What is the IoT Integration Market Size?

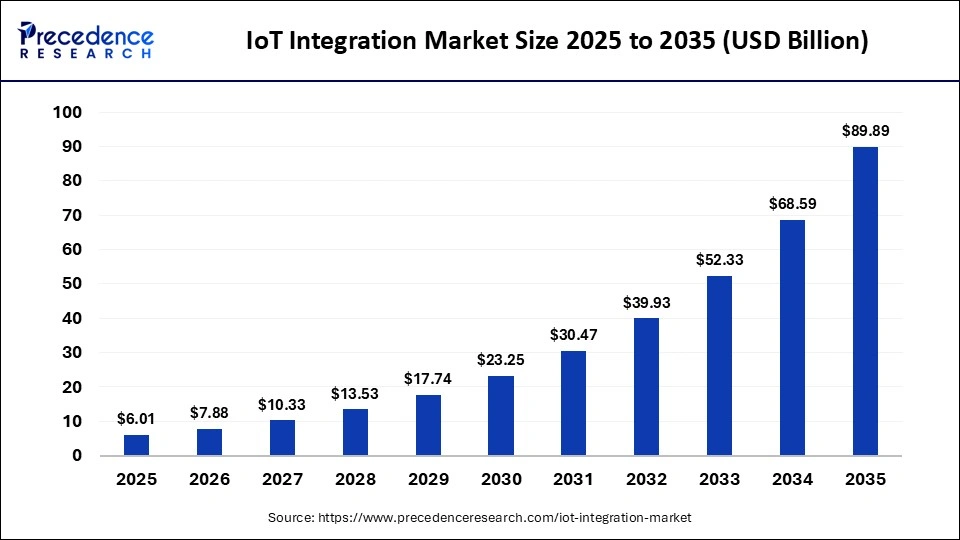

The global IoT integration market size accounted for USD 6.01 billion in 2025 and is predicted to increase from USD 7.88 billion in 2026 to approximately USD 89.89 billion by 2035, expanding at a CAGR of 31.06% from 2026 to 2035. The IoT integration market is driven by the rapid adoption of connected devices and the growing need to streamline digital transformation across industries.

Market Highlights

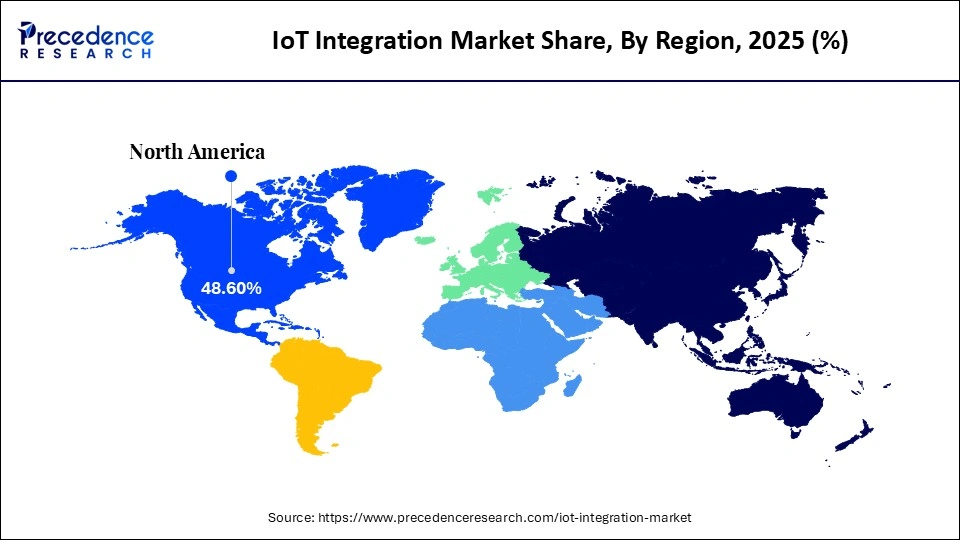

- North America dominated the market by holding the largest market share of 48.6% in 2025.

- The Asia Pacific is expected to expand at the fastest CAGR of 24.5% between 2026 and 2035.

- By service type, the device integration segment contributed the highest market share of 27.5% in 2025.

- By service type, the cloud integration segment is growing at a strong CAGR of 22.6% between 2026 and 2035.

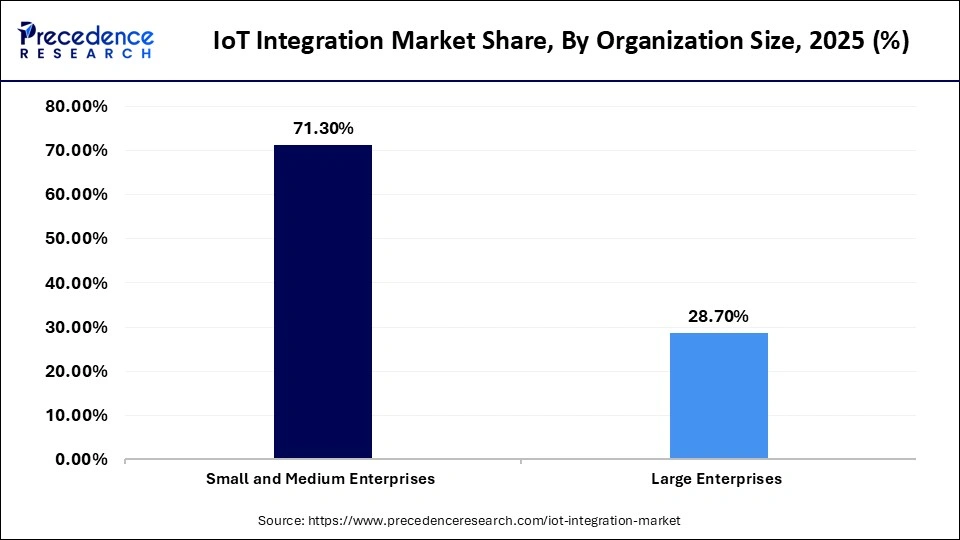

- By organization size, the large enterprises segment held the major market share of 71.3% in 2025.

- By organization size, the SMEs segment is growing at a notable CAGR of 23.0% between 2026 and 2035.

- By enterprise application, the smart manufacturing segment captured the biggest market share of 28.6% in 2025.

- By enterprise application, the smart healthcare segment is poised to grow at a solid CAGR of 21.9% between 2026 and 2035.

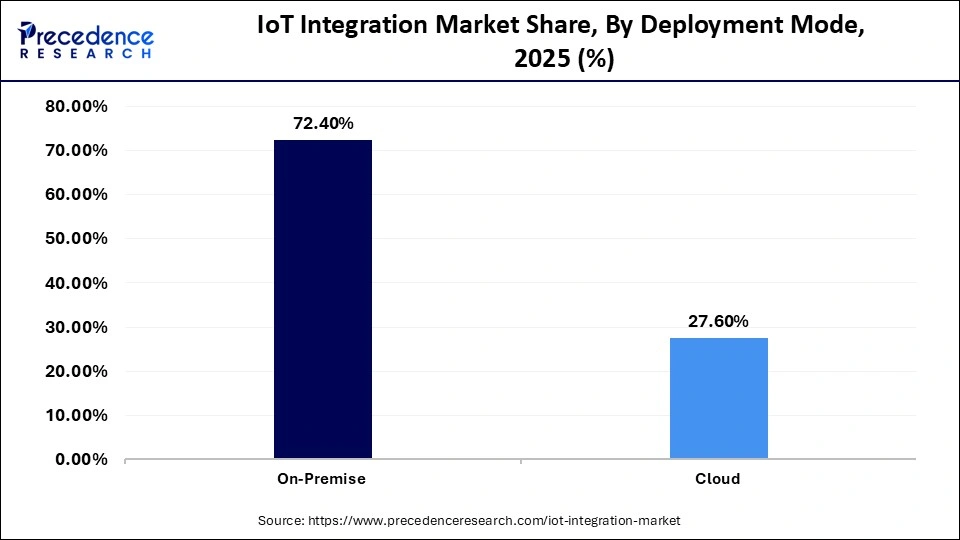

- By deployment mode, the cloud segment generated the biggest market share of 72.4% in the market during 2025.

- By vertical, the manufacturing segment accounted for the biggest market share of 34.8% in 2025.

- By vertical, the healthcare segment is expanding at a strong CAGR of 22.4% between 2026 and 2035.

Market Overview

The IoT integration market is rapidly evolving as organizations rely on connected ecosystems to enhance automation, data-driven insights, and operational efficiency. IoT integration involves seamlessly connecting devices, platforms, applications, and backend systems through cloud services, middleware, data orchestration, API management, and device lifecycle management. IoT integration is crucial for ensuring interoperability, real-time communication, and scalability across diverse IoT frameworks, benefiting industries such as manufacturing, healthcare, energy, retail, transportation, and smart cities.

The driving force behind this market is the exponential growth of connected devices, Industry 4.0 initiatives, and the increased use of predictive analytics and automation. The growing adoption of cloud computing and edge computing further enhances the scalability and flexibility of IoT architectures. Additionally, businesses are investing in IoT implementation to streamline workflows, improve customer experience, lower operational costs, and enable remote monitoring and maintenance. IoT is particularly being adopted in healthcare and smart city projects, where it facilitates real-time diagnostics, asset tracking, and service delivery. With ongoing innovation, the integration of IoT is transforming businesses, making ecosystems smarter and more interconnected.

Key Technological Shifts in the IoT Integration Market Driven by AI

Artificial Intelligence (AI) in IoT integration significantly enhances automation, intelligence, and decision-making across interconnected ecosystems. By combining AI with IoT platforms, organizations process large volumes of real-time data, identify trends, predict malfunctions, and enable automatic responses without human intervention. Applications like predictive maintenance, anomaly detection, and adaptive optimization are transforming industries such as manufacturing, healthcare, smart energy, and transportation. Additionally, AI-driven digital twins are revolutionizing system monitoring and simulation, allowing for precise modeling and optimization of scenarios. As IoT implementations scale, AI boosts operational efficiency, reduces costs, improves security intelligence, and enhances the overall user experience.

IoT Integration Market Outlook

- Industry Growth Overview: The IoT integration market is expected to grow at a rapid pace between 2026 and 2035 because of the growing application of smart devices, automation systems, and connected infrastructure in industries. With the growth of IoT ecosystems, organizations are now focusing on integration to improve performance and decision-making and to minimize complexity.

- Global Expansion: The market is expanding worldwide due to the development of connectivity technologies and extensive smart infrastructure initiatives. Emerging regions offer significant opportunities for market expansion, driven by government investments in smart cities and growing industrial automation.

- Major Investors: Major firms like IBM, Cisco, Microsoft, Accenture, and AWS are allocating hefty funds to enhance IoT integration infrastructures, AI, and security systems. They are focused on end-to-end integration services, scalable architecture, and theory ecosystems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.01 Billion |

| Market Size in 2026 | USD 7.88 Billion |

| Market Size by 2035 | USD 89.89 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 31.06% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Organization Size, Enterprise Application, Deployment Mode, Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

IoT Integration Market Segment Insights

Service Type Insights

The device integration segment dominated the market with a major market share of 27.5% in 2025. This is mainly due to the growing adoption of smart devices and sensors across industrial, commercial, and consumer sectors. As IoT ecosystems expand, businesses are prioritizing seamless device connectivity to enable real-time communication, interoperability, and compatibility across diverse hardware setups. The increased number of interconnected devices, such as smart meters, wearables, and industrial sensors, has highlighted the need for specialized integration services to manage communication protocols, firmware, and security layers. Additionally, investments in digital transformation and Industry 4.0 have accelerated the integration of legacy systems with next-generation IoT devices, emphasizing the importance of device-level connectivity in creating scalable, secure, and intelligent IoT systems.

The cloud integration segment is expected to grow at a CAGR of 22.6% during the forecast period. Organizations are focusing on cloud platforms to enable more scalability, simplify deployments, and provide access to remote data in globally distributed IoT environments. Additionally, cloud-native IoT platforms offer rapid analytics, AI-based automation, and support economic growth, which is especially attractive to enterprises undergoing digital transformation. The rising smart city initiatives, industrial automation, and connected healthcare also drive the adoption of cloud computing, as real-time intelligence and remote infrastructure management become essential. As security measures, data encryption, and cloud orchestration solutions advance, cloud integration has become a key facilitator of flexible, robust, and future-ready IoT ecosystems.

Organization Size Insights

The large enterprises segment dominated the IoT integration market with a 71.3% share in 2025, as large organizations actively adopted IoT on a large scale to streamline operations and minimize downtime, thereby boosting capabilities. Their robust financial resources enabled them to invest in premium integration services, AI-enabled automation systems, and advanced cybersecurity measures. Additionally, these enterprises employed IoT to create digital twins, support predictive maintenance and smart assets, and optimize workflows and efficiency. Due to rising competition, large organizations have become more focused on comprehensive digital transformation, which increases the influence of large corporations in the IoT integration market.

The SME segment is expected to grow at the highest CAGR of 23.0% during the forecast period as small and medium-sized enterprises recognize the potential of IoT as a strategic investment to improve efficiency, reduce workforce dependence, and enhance business intelligence. These scalable solutions enable smaller organizations to adopt IoT gradually, based on their specific needs. Increased focus on automation benefits, government incentives for digital transformation, and industry-specific IoT solutions, such as smart farming, retail automation, and asset tracking, have further driven adoption. For SMEs, IoT use cases mainly include remote monitoring, energy optimization, safety compliance, and workflow visibility. This growing adoption trend signals a faster move toward digital maturity and greater competitiveness for SMEs in the global market.

Enterprise Application Insights

In 2025, the smart manufacturing segment led the market with a 28.6% share, driven by advanced Industry 4.0 technologies, automation systems, and AI-based production optimization tools. Manufacturers adopted IoT integration to connect machines, robotics, inventory systems, and production facilities, enabling predictive maintenance, machine optimization, and real-time quality control. Connected factories facilitated communication between factories, digital twins, autonomous manufacturing processes, and data-driven decision-making, resulting in measurable performance improvements and cost reductions. The adoption of IoT became essential for mass automation and operational intelligence, and as smart factories became a key competitive advantage, automation and intelligence solutions scaled accordingly.

The smart healthcare segment is expected to grow at a 21.9% CAGR in the coming years, driven by the increasing use of connected medical devices, remote patient monitoring, and digital diagnostics platforms. Rising demand for telehealth, AI-friendly analytics, and real-time health data delivery has boosted the adoption of IoT in hospitals, clinics, and homes. Healthcare organizations leverage IoT to enable better treatment personalization, robotic workflows, and improved patient safety through continuous monitoring and smart notifications. The rise in chronic diseases has also contributed to the increased use of IoT-enabled wearable health devices and biometric tracking systems. Market growth has been further supported by regulatory standards that promote interoperability, electronic health records, and secure data communication. As healthcare providers shift toward preventive and value-based care models, integrating IoT becomes crucial for maintaining continuous data awareness and improving service efficiency.

Deployment Mode Insights

The cloud segment dominated the market, holding a 72.4% share in 2025 and is expected to grow at the fastest rate in the coming years, as it is the most scalable, flexible, and cost-effective deployment model for IoT. Cloud-based integration is preferred by organizations because it enables centralized data management, remote access without issues, and faster deployment cycles, especially in distributed operational models. Cloud platforms also offer real-time analytics, AI workloads, and cross-platform interoperability, making them well-suited for rapidly evolving IoT ecosystems. Additionally, cloud architecture facilitates efficient onboarding of devices, configuration, and updates to cybersecurity without requiring physical infrastructure investments. As IoT ecosystems expand globally, cloud infrastructure becomes essential to manage large quantities of devices and provide unlimited connectivity and intelligence.

The on-premise segment is expected to grow at a notable rate during the forecast period due to increasing demand for high data privacy, low-latency processing, and strict regulatory compliance. Industries such as defense, manufacturing, banking, and healthcare are adopting on-premise IoT integration solutions to maintain full control over sensitive operational and customer data. Furthermore, on-premise integration technologies and closed-loop automation have become quicker and more secure due to advancements in on-premise computing architectures and private edges. Many businesses favor on-premise models to reduce cybersecurity risks, minimize downtime, and establish trusted local processing environments for mission-critical tasks. The demand for on-premise deployment remains consistent among organizations that prioritize data sovereignty, business continuity, and the ability to manage their infrastructure independently.

Vertical Insights

The manufacturing segment held the largest market share of 34.8% in 2025 due to the industry's ongoing digital transformation and the increasing adoption of smart manufacturing technologies. IoT integration allows manufacturers to optimize production processes, enhance supply chain visibility, and improve equipment maintenance through real-time data and predictive analytics. With the rise of Industry 4.0, manufacturers are investing heavily in connected devices, sensors, and automation systems to drive operational efficiency and reduce downtime. Additionally, IoT integration enables manufacturers to streamline workflows, ensure better asset management, and achieve higher levels of productivity, making it a key driver of the market in this sector.

The healthcare segment is expected to expand at a 22.4% CAGR over the projection period due to the accelerated digital transformation in medical infrastructure, diagnostics, and patient care delivery. IoT integration enables real-time patient monitoring, connected medical devices, intelligent hospital systems, and automatic emergency alerts, improving clinical outcomes and operational efficiency. As remote care, telemedicine, and wearable devices become essential, ensuring secure interoperability of medical systems and devices is crucial. Additionally, IoT is facilitating precision medicine, data-driven care, and seamless integration of clinical data with electronic health records, while compliance standards like HIPAA and GDPR further drive the adoption of systematic integration solutions in healthcare.

IoT Integration MarketRegion Insights

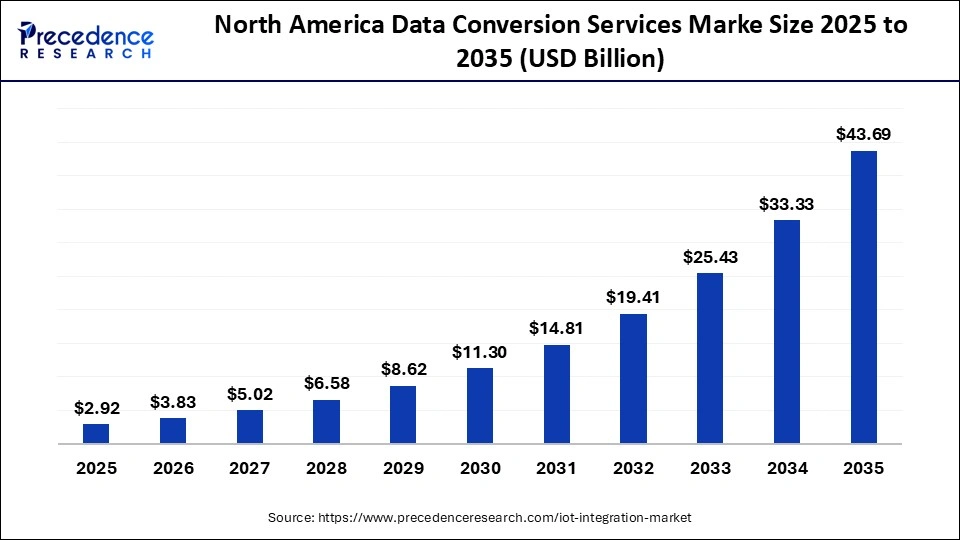

The North America IoT integration market size is estimated at USD 2.92 billion in 2025 and is projected to reach approximately USD 43.69 billion by 2035, with a 31.07% CAGR from 2026 to 2035.

Why Did North America Lead the Global IoT Integration Market in 2025?

North America led the IoT integration market, capturing the largest share of 48.6 % in 2025. This is mainly due to its high level of digital transformation maturity, advanced technology preparedness, and early integration of connected systems across industries. The region benefits from the presence of technological giants, cloud service providers, and system integrators that consistently invest in innovation. The integration of cutting-edge technologies like 5G, AI, machine learning, and edge computing accelerates the deployment of large-scale IoT solutions, enabling real-time insights and automation. Key industries such as healthcare, smart cities, manufacturing, logistics, and defense have significantly boosted their integration projects, supported by government initiatives on smart infrastructure, cybersecurity compliance, and R&D funding.

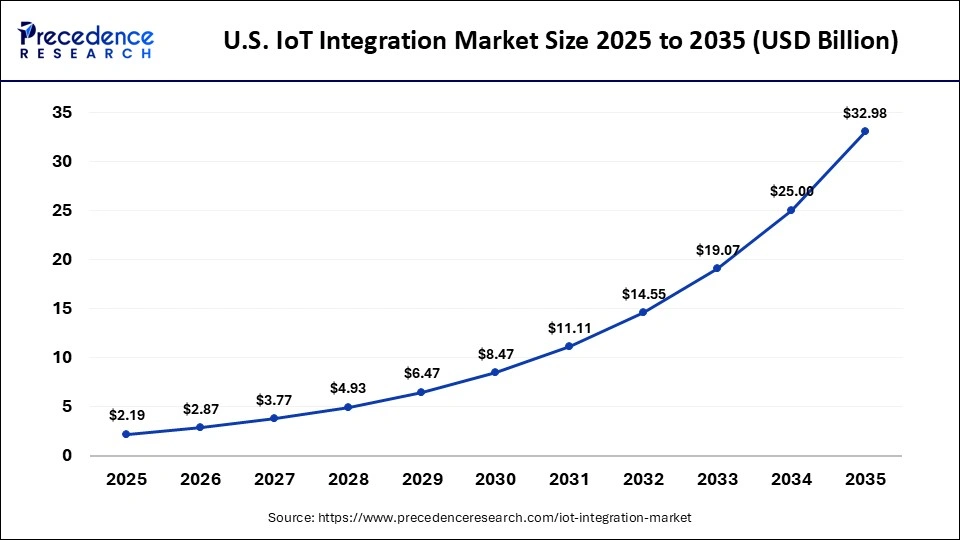

The U.S. IoT integration market size is calculated at USD 2.19 billion in 2025 and is expected to reach nearly USD 32.98 billion in 2035, accelerating at a strong CAGR of 31.15% between 2026 and 2035.

U.S. IoT Integration Market Analysis

The U.S. leads the market in North America due to substantial investments in automation, cloud platforms, and digital upgrades across various sectors. Innovation leadership, driven by tech giants like Amazon, Google, IBM, Cisco, and Microsoft, has been key to enhancing the ecosystem. IoT integration is particularly strong in smart manufacturing, energy, healthcare, retail, and logistics, where real-time monitoring and predictive insights are essential for creating value. Government initiatives supporting intelligent infrastructure, cybersecurity systems, and industrial modernization, along with the U.S. leading the 5G rollout, have further accelerated the adoption of IoT projects and the deployment of low-latency intelligent edge solutions on a large scale.

Asia Pacific is expected to grow at the fastest CAGR of 24.5% over the upcoming period, driven by rapid industrialization, mass-scale digitalization, and increased government spending on smart infrastructure. Countries like China, India, Japan, and South Korea are rapidly adopting IoT technologies across industries, transportation, agriculture, and public safety to boost productivity and address structural challenges. This trend is supported by the widespread rollout of 5G and a strong local IoT hardware manufacturing base, with large-scale smart city projects driving further adoption in the APAC region. Integration platforms are becoming increasingly crucial as businesses in the region navigate multi-vendor environments and diverse device networks. Additionally, the growing demand for cloud computing, AI-based automation, and integrated consumer electronics is fueling the continued expansion of IoT services across industries.

China IoT Integration Market Trends

China is a global pioneer in IoT integration, driven by strong government support, extensive industrial automation, and rapid development of connected infrastructure. Initiatives like Made in China 2025 and large-scale smart city projects have accelerated the adoption of IoT across manufacturing, retail, energy, and transportation sectors. Countries such as China, India, Japan, and South Korea are embracing IoT in industries, transport, agriculture, and public safety to enhance productivity and address structural challenges, supported by the rollout of 5G and local IoT hardware production. The growing demand for linked healthcare and smart mobility solutions further drives IoT integration, with China, backed by its manufacturing capacity and technological scalability, emerging as one of the most rapidly evolving IoT markets worldwide.

Europe is expected to grow at a notable rate over the projection period, driven by robust policy frameworks, regulatory compliance requirements, and standardization initiatives that promote secure, interoperable IoT environments. The region's shift toward smart manufacturing, sustainability-focused automation, and intelligent mobility is accelerating IoT adoption across various industries. Countries like Germany, France, Italy, and the Nordic nations are early adopters of industrial IoT, while the automotive and energy sectors are helping scale IoT applications. The increasing investments in smart transport, digital utilities, and public healthcare digitalization, along with a growing focus on cybersecurity and ecosystem collaboration, position Europe as a highly regulated market for IoT integration.

UK IoT Integration Market Trends

In the UK, the market is expanding as industries are adopting automation, analytics, and artificial intelligence to enhance visibility and productivity. The country's focus on smart public infrastructure, digital government projects, and the development of smart healthcare and transportation initiatives further accelerates IoT adoption. A strong IT services ecosystem, cybersecurity expertise, and active innovation centers boost the integration of IoT technologies into businesses. Key sectors such as logistics, finance, retail, utilities, and critical infrastructure are driving demand for IoT integration, where interoperability and real-time data are essential for optimized operations.

The Middle East & Africa (MEA) is experiencing an opportunistic rise in the market due to increased investments in smart city development, digital transformation strategies, and automation across major sectors. Countries like Saudi Arabia, UAE, Qatar, and South Africa are implementing IoT to improve service quality, infrastructure efficiency, and economic modernization. Projects such as Saudi Vision 2030 and Dubai Smart Nation are widely embraced and require advanced integration solutions. With the expansion of 5G and cloud infrastructure, businesses are increasingly using IoT for real-time analytics, smart monitoring, and predictive insights. Additionally, greater cooperation among governments, telecom operators, and international technology vendors is further driving adoption.

What Potentiates the Growth of the Latin American IoT Integration Market?

The market in Latin America is driven by the growing digital infrastructure, increasing efforts by enterprises to modernize, and proactive interest in smart services by the public sector. Countries like Brazil, Mexico, and Chile are using IoT to automate industries, upgrade the energy grid, connect agriculture, and optimize logistics. The adoption of cloud technology and telecom development has reduced connectivity barriers and lowered IoT implementation costs. The region also benefits from increased automation, real-time data, and predictive analytics in manufacturing, retail, transportation, and healthcare. Additionally, government-led digital transformation initiatives and smart city projects are creating more demand. As awareness, affordability, and maturity levels grow, Latin America is moving toward a scalable IoT integration system, positioning itself as a major emerging market with strong potential for long-term growth.

Top Companies in the IoT Integration Market & Their Offerings

- Accenture: Accenture offers end-to-end IoT integration services such as strategy, cloud migration, digital twins, and platform orchestration of large-scale enterprise applications.

- IBM: It provides Watson IoT and hybrid cloud integrations that help companies achieve real-time analytics, AI-driven automation, and secure connections among devices in any industry.

- TCS (Tata Consultancy Services): It provides scalable IoT integration with their IoT framework, consulting, as well as connected platforms of digital manufacturing and enterprise transformation.

- Wipro: A corporation engaged in the incorporation of IoT, supervision and control of devices, and integrating edges and clouds to allow intelligent functioning and predictive upkeep.

- Capgemini: It provides the services of IoT integration, interoperability, and digital engineering with a great focus on the application of smart infrastructure and Industry 4.0.

Other Major Companies

- Infosys

- Cognizant

- Capgemini

- Deloitte

- HCL Technologies

- Tech Mahindra

- Cisco Systems

- SAP SE

- Oracle Corporation

- Microsoft

- ATOS

Recent Developments

- In January 2025, Accenture acquired a digital twin technology system platform at Percipient as part of its banking modernization solutions. It is estimated that this acquisition will help financial institutions to easily transform to a core system and accelerate innovation without disrupting operations.(Source: https://newsroom.accenture.com)

- In April 2024, Microsoft declared a strategic alliance with the leading companies in the industrial sector to build AI-driven industrial data integration. Its collaboration aims at using AI to get actionable insights on complex industrial data that enhance predictive maintenance, automation, and operational efficiency.(Source: https://theaiinsider.tech)

- In October 2023, Amazon Web Services released the general availability of its new Software Package Catalog, a fully managed cloud service feature that is intended to be used by large-scale orchestrating IoT devices. This service enables companies to quickly and cost-effectively increase, view, and control software deployments through a single dashboard of interconnected device ecosystems.(Source: https://aws.amazon.com)

IoT Integration MarketSegments Covered in the Report

By Service Type

- Device Integration

- Platform Integration

- Application Integration

- Data Integration

- API Integration

- Network Integration

- Cloud Integration

- System Design & Architecture

By Organization Size

- Small & Medium Enterprises

- Large Enterprises

By Enterprise Application

- Smart Manufacturing

- Smart Energy & Utilities

- Smart Healthcare

- Smart Retail

- Smart Transportation & Logistics

- Smart Agriculture

- Smart Buildings

By Deployment Mode

- On-Premise

- Cloud

By Vertical

- Manufacturing

- Healthcare

- Retail

- BFSI

- IT & Telecom

- Transportation & Logistics

- Energy & Utilities

- Government

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting