What is the Life Science Software Market Size?

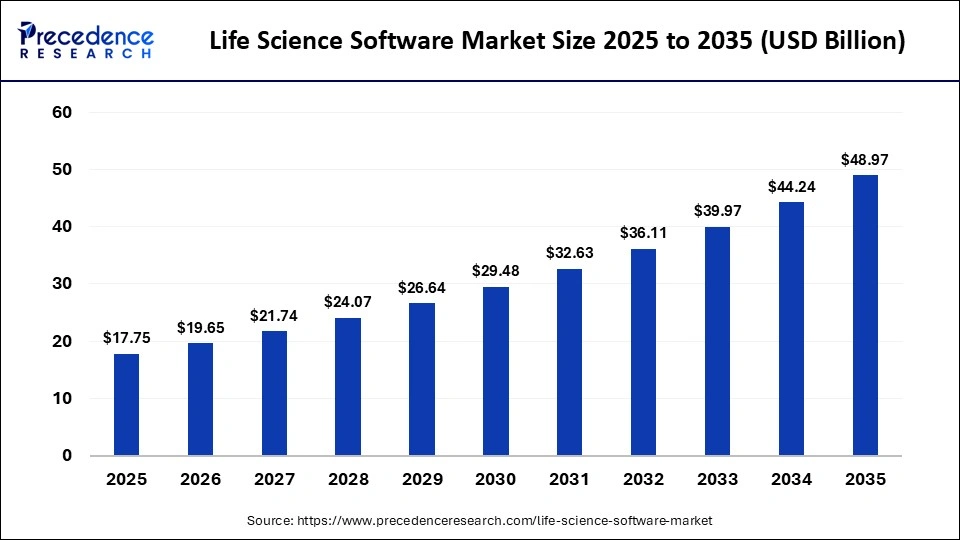

The global life science software market size was calculated at USD 17.75 billion in 2025 and is predicted to increase from USD 19.65 billion in 2026 to approximately USD 48.97 billion by 2035, expanding at a CAGR of 10.68% from 2026 to 2035.This market is growing due to the urgent demand for AI-based automation in drug discovery and even clinical trials to decrease time-to-market and R&D costs.

Market Highlights

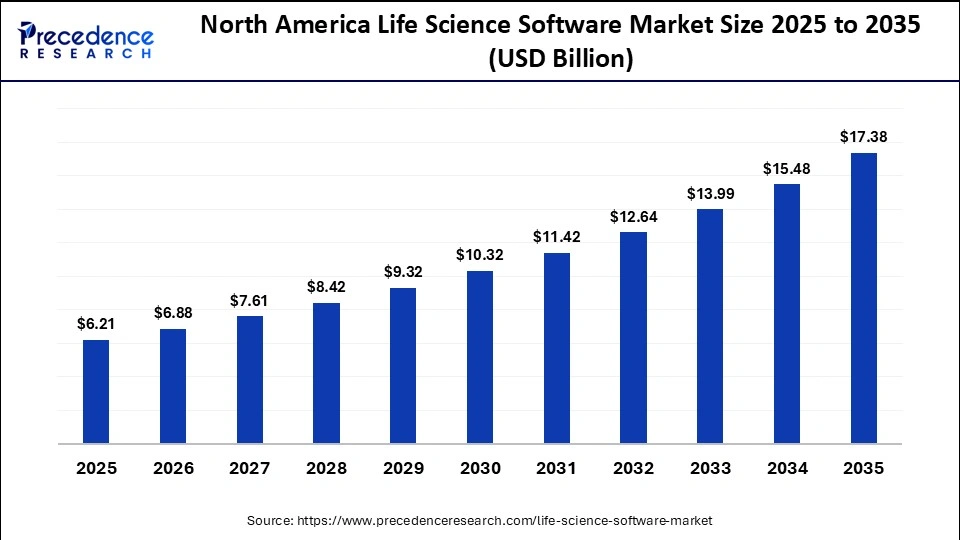

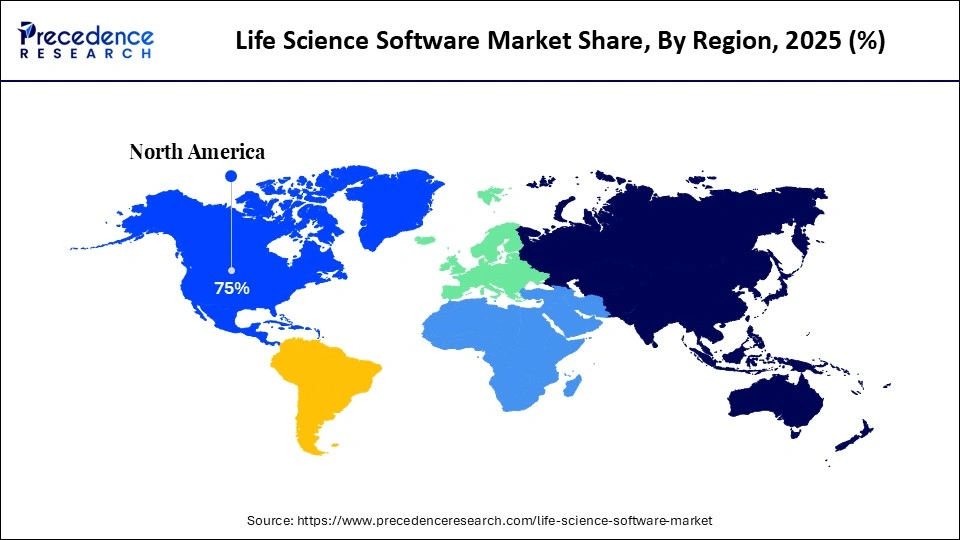

- North America dominated the market with the largest market share of 35% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By deployment, the on-premise segment dominated the market in 2025.

- By deployment, the cloud segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By application, the preclinical and clinical trials segment held the biggest market share of 35% in 2025.

- By application, the research and development segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By end-user, the biotechnology and pharmaceutical companies' segment contributed the highest market share of 41% in 2025.

- By end-user, the medical research centers segment is expected to expand at the fastest CAGR from 2026 to 2035.

What Drives the Life Science Software Market?

The life science software market is mainly driven by the urgent demand for efficient clinical trial management, rising regulatory compliance pressures, and the rapid adoption of AI and cloud-driven solutions to process massive, complex datasets. Additionally, stringent regulatory requirements, growing outsourcing of R&D, and the focus on cost and time efficiency further fuel the adoption of life science software globally.

Life Science Software MarketFuture Market Overview

- Expansion in Emerging Markets: Significant investments in health IT and telemedicine are bolstering the adoption of life science software, mainly in regions such as Latin America and the Middle East, with countries such as Brazil investing in digital health. Rising R&D activities in these regions are also driving demand for software that ensures local regulatory compliance for clinical trials and efficient data management, which is critical for pharmaceutical and biotechnology companies. This combination of infrastructure investment and increasing research activity is expanding the market's growth opportunities.

- Integration of AI & Smart Technologies: The life science companies are shifting quickly from conventional methods to intelligent, AI-driven systems, which not only accelerate time-to-market but also improve patient care. In research and development, AI enables faster and more precise identification of drug targets by analyzing vast biological datasets. Instead of relying on traditional trial-and-error approaches, machine learning models can predict which compounds have the highest likelihood of success, significantly reducing both time and costs in early-stage drug discovery.

- Cloud & SaaS Platforms: The Software-as-a-Service (SaaS) model is gaining immense traction, evolving from basic tools to advanced “intelligent systems” that automate regulatory compliance and document management. To address stringent data privacy and security regulations, organizations are increasingly adopting hybrid cloud environments, combining the control of on-premise infrastructure with the flexibility and scalability of public cloud solutions. This approach ensures compliance while enabling efficient, real-time access to critical data across global operations.

How is AI Influencing the Life Science Software Market?

AI significantly impacts the market by accelerating drug discovery, improving clinical trial efficiency, and enhancing patient care. In R&D, machine learning models analyze vast biological datasets to predict the most promising drug candidates, reducing both time and costs compared to traditional trial-and-error methods. AI also supports clinical trials through patient recruitment, real-time monitoring, and predictive analytics, while enabling personalized medicine by analyzing genomic and health data to recommend targeted therapies. Overall, AI is helping life science companies make faster, more accurate, and data-driven decisions across the entire drug development and healthcare continuum.

What are the Key Trends Influencing the Life Science Software Market?

- Precision and Personalized Medicine: There is an increasing focus on precision and personalized medicine, boosting the demand for software that is needed to analyze genomic data and support targeted therapies.

- Regulatory Compliance and Data Integrity: Rising regulatory scrutiny increases demand for software that ensures compliance with standards like GDPR and HIPAA, maintaining data integrity across research and clinical operations.

- Decentralized and Virtual Clinical Trials: The shift toward decentralized and virtual clinical trials is fueling adoption of digital platforms that enable remote patient monitoring, virtual recruitment, and efficient data management.

Markey Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 17.75Billion |

| Market Size in 2026 | USD 19.65 Billion |

| Market Size by 2035 | USD 48.97Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.68% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Deployment, Application, End-user, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Deployment Insights

What made on-premise the dominant segment in the life science software market?

The on-premise segment dominated the market with a major share in 2025 because it provides organizations with full control over their sensitive data and critical applications, which is crucial in highly regulated environments like pharmaceuticals and biotech. On-premise solutions also allow for deep customization and seamless integration with complex and legacy laboratory systems, which is essential for large-scale pharmaceutical and biotech operations. Many major life sciences companies already have substantial investments in on-premise infrastructure, so they often prefer upgrading existing systems rather than replacing them entirely, ensuring continuity, minimizing disruption, and maximizing the value of their current IT assets.

The cloud segment is expected to grow at the fastest rate during the forecast period. This is because the explosive increase in data generation within life sciences requires scalable storage and computational resources, which the cloud can provide on demand. Additionally, modern drug discovery and clinical research often involve cross-border collaboration, and cloud platforms enable clinicians, researchers, and partners to access, share, and analyze data in real time, accelerating both research workflows and the pace of clinical trials.

Application Insights

Why did the preclinical and clinical trials segment dominate the life science software market?

The preclinical and clinical trials segment dominated the life science software market in 2025. This is because these applications generate vast amounts of complex data that must be collected, managed, and analyzed accurately to ensure successful drug development. Software solutions streamline study design, patient recruitment, protocol management, and regulatory compliance, reducing errors and delays. Moreover, the growing shift toward decentralized and virtual clinical trials has increased the reliance on specialized platforms for real-time data monitoring, remote patient engagement, and efficient decision-making, further driving the segment's dominance.

The research and development segment is expected to grow at a significant CAGR in the upcoming period due to the increasing adoption of advanced digital tools that accelerate drug discovery and development processes. AI and machine learning platforms allow researchers to analyze large biological datasets, predict drug-target interactions, and optimize molecular design, reducing time and costs in early-stage research. Additionally, the rising focus on precision medicine, personalized therapies, and novel biologics is driving demand for software that can manage complex R&D workflows, enhance collaboration across teams, and ensure regulatory compliance, fueling growth in this segment.

End-user Insights

What made the biotechnology and pharmaceutical companies the dominant segment in the market?

The biotechnology and pharmaceutical companies segment dominated the life science software market in 2025. This is because these organizations are heavily involved in drug discovery, development, and commercialization, which require sophisticated digital tools for managing vast amounts of data. They invest significantly in R&D, clinical trials, and regulatory compliance, creating a high demand for software solutions that streamline workflows, ensure data integrity, and accelerate time-to-market. Additionally, the need for collaboration across global teams, integration with laboratory systems, and adherence to strict regulatory standards further strengthens the dominance of this segment in the market.

The medical research centers segment is expected to grow at the fastest CAGR throughout the forecast period. This is due to the increasing emphasis on advanced research, translational medicine, and innovative therapies that rely heavily on data-driven insights. These centers are adopting software solutions for bioinformatics, data management, and clinical trial support to improve research efficiency, collaboration, and reproducibility. Additionally, the growth of academic-industry partnerships and government-funded initiatives in emerging markets is driving demand for specialized software that is able to handle large datasets, ensure regulatory compliance, and accelerate medical discoveries.

Regional Insights

How Big is the North America Life Science Software Market Size?

The North America life science software market size is estimated at USD 6.21 billion in 2025 and is projected to reach approximately USD 17.38 billion by 2035, with a 10.84% CAGR from 2026 to 2035.

What made North America the dominant region in the life science software market?

North America dominated the life science software market by holding the largest share in 2025. The region's dominance in the market is attributed to investments aim on AI-driven drug discovery, cloud-driven data management, and SaaS, with 2023 seeing 745+ deals mainly targeting biotech and pharma operational efficiencies. Healthcare systems and research institutions are placing greater emphasis on securely storing and handling sensitive scientific data, further driving the acceptance of specialized software platforms. Additionally, the region benefits from a strong technology ecosystem in areas like Silicon Valley and Boston, fostering rapid innovation, integration of AI and cloud-based platforms, and early adoption of advanced software solutions across pharmaceutical, biotech, and medical research institutions.

What is the Size of the U.S. Life Science Software Market?

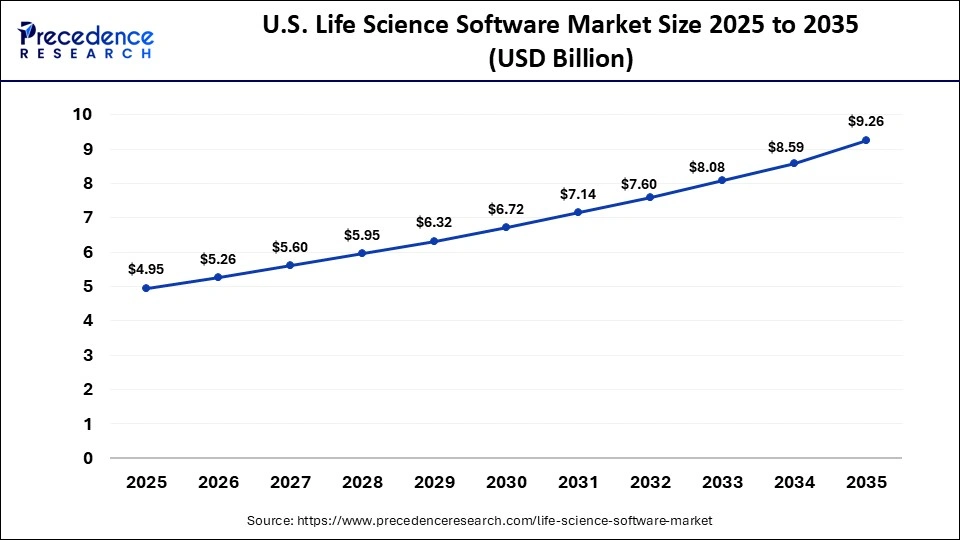

The U.S. life science software market size is calculated at USD 4.66 billion in 2025 and is expected to reach nearly USD 13.13 billion in 2035, accelerating at a strong CAGR of 10.91% between 2026 and 2035.

United States Trends

The U.S. dominates the life science software market due to stringent FDA regulations that require specialized, audit-ready, and validated software solutions. Innovation is further accelerated by the convergence of advanced tech expertise and biological research capabilities in hubs like Silicon Valley and Boston, making the country a global center for compliance-driven life science software development.

Canada: Canada's life sciences sector benefits from a strong research ecosystem and world-class science infrastructure, positioning it as a global contributor to drug discovery and healthcare innovation. This robust environment fuels economic growth, attracts top talent, and supports high-value scientific advancements, strengthening the adoption and development of life science software solutions.

What Makes Asia Pacific the Fastest-Growing Region in the Life Science Software Market?

Asia Pacific is expected to grow at the fastest CAGR throughout the forecast period due to rapid digitalization in healthcare, increasing investment in R&D, and growing adoption of advanced software solutions in the pharmaceutical and biotech sectors. Rising government support, expansion of clinical trial activities, and increasing focus on compliance with local and global regulatory standards are driving demand for specialized life science software. Additionally, rising healthcare infrastructure and talent in IT and life sciences are accelerating the deployment of cloud-based, AI-driven, and data analytics platforms across the region.

China Market Trends

China is a major contributor to the Asia Pacific life science software market due to its rapid expansion of the pharmaceutical, biotechnology, and healthcare sectors. The country is witnessing significant growth in R&D activities, clinical trials, and digital healthcare initiatives, which drives demand for advanced life science software for data management, regulatory compliance, and research analytics. Additionally, strong government support, investment in health IT infrastructure, and the rising adoption of AI, cloud computing, and big data in drug discovery and clinical research further accelerate China's market contribution in the region.

Top Companies Operating in the Market

- SAP SE: SAP SE offers a comprehensive and integrated suite of both cloud-based and on-premise software solutions tailored for the life sciences sector. Powered primarily by SAP S/4HANA and SAP Industry Cloud, these solutions include tools for clinical supply chain management, regulatory compliance such as serialization, and advanced planning with SAP IBP.

- Salesforce, Inc.: Salesforce, Inc. provides a comprehensive, AI-based platform tailored for the life sciences industry, mainly branded as Salesforce Life Sciences Cloud and also funded by Health Cloud. This platform is programmed to unify data, processes, and user engagement across pharmaceutical, biotech, and medical device companies.

- Dassault Systèmes: Dassault Systèmes focuses on virtual twin technology, molecular modeling, and clinical trial management. Its solutions cover the entire lifecycle from drug discovery and development to medical device design. By leveraging AI, the company accelerates research, ensures regulatory compliance, and optimizes manufacturing processes for life science companies.

Who are the Major Players in the Global Life Science Software Market?

The major players in the life science software market include Oracle, IQVIA Inc., Microsoft, Veeva Systems,CEGEDIM GROUP, Optum, Inc., IBM

Recent Developments

- In June 2025, IQVIA unveiled custom AI agents at GTC Paris, powered by NVIDIA technology, to streamline workflows and accelerate insights in life sciences. These applications demonstrate how IQVIA combines AI with deep domain expertise to transform business processes and improve patient outcomes.

- In October 2024, Oracle launched Oracle Analytics Intelligence for Life Sciences, an AI-powered, cloud-scale platform that unifies data to accelerate insights. The solution enables life sciences organizations to answer complex research questions, assess market needs, and optimize therapeutic launch strategies, bridging the gap between clinical research and care.

- In November 2023, Thermo Fisher Scientific and Flagship Pioneering announced a strategic partnership to accelerate the development and commercial scale of multiproduct biotech platforms. The collaboration aims to create new companies focused on innovative tools and capabilities, leveraging both organizations' expertise in life science tools, diagnostics, and services.

Segments Covered in the Report

By Deployment

- Cloud

- On-premise

By Application

- Preclinical and Clinical Trials

- Supply chain management

- Research and Development

- Commercial Engagement and Branding

- Pharmacovigilance

- Regulatory Compliance

By End-user

- Biotechnology and Pharmaceutical Companies

- Medical Research Centers

- Medical Device Companies

- Others (Genomics and others)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting