What is the Liquid Filtration for Pharmaceutical Market Size?

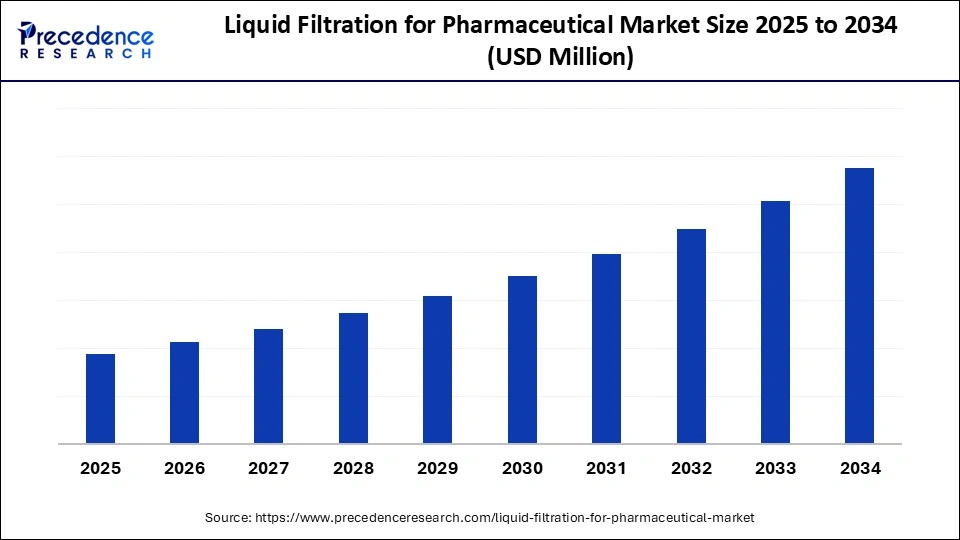

The global liquid filtration for pharmaceutical market is witnessing strong growth as the industry prioritizes sterile processing, purity assurance, and contamination control.This market is growing due to increasingly stringent regulatory guidelines for product safety and purity.

Liquid Filtration for Pharmaceutical Market Key Takeaways

- By region, North America dominated the market, holding the largest market share of 40% in 2024.

- By region, Asia Pacific is expected to grow at a notable rate in liquid filtration for pharmaceutical market share.

- By filtration type, the membrane filtration segment held the largest share of the market at 50% in 2024.

- By filtration type, the sterile filtration segment is expected to grow at the fastest rate during the forecast period.

- By filtration material, the polyethersulfone segment held the largest market share of 40% in 2024.

- By filtration material, the polyvinylidene fluoride segment is expected to grow at the fastest rate during the forecast period.

- By application, the biopharmaceutical production segment held the largest share at 45% in 2024.

- By application, the vaccine manufacturing segment is expected to grow at the fastest rate during the forecast period

- By end user, the pharmaceutical manufacturers segment is expected to grow at the fastest rate of 42% in the liquid filtration for pharmaceutical market.

- By end user, the biopharmaceutical companies segment held the largest share in the market in 2024.

Market Overview

What Is Encompassed in the Liquid Filtration for Pharmaceutical Market?

The liquid filtration for the pharmaceutical market is experiencing significant growth, driven by increased demand for biologics and more stringent sterility and purity regulations. The use of single-use systems and improvements in filtration technologies are further supporting this expansion. Since pharmaceutical companies prioritize efficiency, safety, and compliance, the market continues to grow.

- In August 2025, Cytiva launched a new filter designed to enhance the filtration of high-concentration biologics, aiming to improve efficiency and reduce contamination risks in biopharmaceutical manufacturing.

AI Shift in Liquid Filtration for Pharmaceutical Market

To analyze sensor data from MEEs and anticipate failures before they happen, artificial intelligence is being used. This optimizes maintenance plans, cuts expenses, and lessens unscheduled downtime. Algorithms that utilize machine learning can detect mechanical wear, scaling, and fouling early on. AI is increasing the overall reliability of equipment by automating maintenance scheduling and alerts.

- In September 2024, GE Aerospace launched a companywide generative AI platform, AI Wingmate, to enhance employee productivity in specialized functions like predictive engine maintenance. (Source: https://www.geaerospace.com)

Liquid Filtration for Pharmaceutical Market Outlook

- Industry Growth Overview: The liquid filtration market in pharmaceuticals is steadily expanding due to the increasing demand for high-purity drugs, biologics, and vaccines. Innovations in membrane technology, depth filtration, and single-use systems are improving process efficiency, product yield, and contamination control.

- Sustainability trends: To minimize environmental impact and comply with stringent regulatory standards, companies are focusing on solvent recovery, reusable filtration systems, and eco-friendly filter materials. Efforts toward reducing water and energy consumption in filtration processes are also gaining momentum.

- Global Expansion: Growth is driven by emerging pharmaceutical hubs in North America, Europe, and the Asia Pacific, with governments supporting advanced manufacturing facilities, regulatory compliance, and adoption of continuous processing technologies.

- Major Investors: Private equity firms, venture capital, and leading pharmaceutical filtration solution providers are investing in advanced membrane systems, high-throughput filtration technologies, and pilot to commercial scale facilities to meet rising global demand and maintain competitive advantage.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Filtration Type, Filtration Material, Application / Use Case, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Restraint

High Capital Investment

The high initial setup costs make MEE adoption challenging for small and medium-sized businesses. The cost barrier hinders adoption, particularly in developing nations. Notwithstanding the long-term advantages of MEEs, many businesses still favor less expensive alternatives. For investors, the large upfront cost and high frequency of postponing returns can hinder their investment returns. In sectors where profit margins are narrow, this becomes a crucial limitation.

Opportunity

Sustainable Solutions in Water Management

The demand for sustainable solutions, such as MEE, is being driven by increasingly stringent environmental regulations. Industries are increasingly using ZLD to reduce water waste and comply with stringent discharge regulations. This encourages adoption in industries such as food processing, chemicals, and textiles. Before final treatment, MEEs are essential in concentrating effluents. The growing movement toward circular economic practices further strengthens this opportunity.

Segmental Insights

Filtration Type Insights

What Made the Membrane Filtration Segment Dominate the Liquid Filtration for Pharmaceutical Market in 2024?

The membrane filtration segment dominated the liquid filtration for pharmaceutical market in 2024 with a 50% share, due to its vital function in guaranteeing the sterile filtration and purification of injectable medications, vaccines, and biologics. Pharmaceutical manufacturers prefer it because of its effectiveness in eliminating microorganisms and particulates, as well as its compliance with regulatory requirements.

Meanwhile, the sterile filtration segment is growing, driven by the rising demand for injectable drugs and vaccines that require stringent sterility standards. The increased focus on patient safety and the growing biopharmaceutical sector are fueling the adoption of advanced sterile filtration technologies. The expansion of single-use systems in production facilities further accelerates this growth.

Filtration Material Insights

Why Did the Polyethersulfone Segment Dominate the Liquid Filtration for Pharmaceutical Market in 2024?

The polyethersulfone segment is dominating the liquid filtration for pharmaceuticals with a 40% share in 2024, owing to its perfect vital applications like cell culture media and biologics filtration, due to its high chemical and thermal stability. Its robustness guarantees steady performance even in the most demanding pharmaceutical processing environments. Additionally, PES membranes have low protein-binding qualities, which are critical for drug formulations.

The polyvinylidene fluoride segment is experiencing rapid growth due to its high mechanical strength, broad chemical compatibility, and low protein-binding properties. These features make it increasingly attractive for high-purity filtration processes in biopharmaceutical production. Rising adoption of vaccines and monoclonal antibody production further drives this segment.

Application Insights

Why Did the Biopharmaceutical Production Segment Dominate the Market for Liquid Filtration for Pharmaceuticals in 2024?

The biopharmaceutical production segment led the liquid filtration for pharmaceutical market with a 40% share in 2024 because of the increased demand for vaccines and biologics. To guarantee product safety, purity, and compliance, filtration is a crucial step in the production of biopharmaceuticals. The industry's demand for filtration technologies has increased due to the ongoing advancements in downstream processing.

Vaccine manufacturing is the fastest-growing application segment, driven by global vaccination programs and the ongoing development of next-generation vaccines, which require advanced filtration to meet sterility and regulatory standards. Public health initiatives and government funding also accelerate the expansion of this segment.

End User Insights

What Made Pharmaceutical Manufacturers Dominate the Market for Liquid Filtration in Pharmaceuticals in 2024?

The pharmaceutical manufacturers segment is dominating the liquid filtration for pharmaceutical market with a share of 42% in 2024, as they use cutting-edge filtration systems to guarantee high-quality production and safety, due to the growing complexity of drug formulations. These businesses can quickly implement new filtration technologies thanks to established R&D infrastructure.

Biopharmaceutical companies are the fastest-growing end-user segment, expanding rapidly due to the surge in biological drug development and the need for specialized filtration solutions in research and production facilities. Collaborations and partnerships with filtration technology providers also fuel their growth.

Regional Insights

What Made North America Dominate the Liquid Filtration for Pharmaceutical Market in 2024?

North America dominated the liquid filtration for pharmaceutical market in 2024, with a 40% share, due to its robust pharmaceutical manufacturing base, advanced biopharmaceutical infrastructure, and stringent regulatory guidelines that encourage the adoption of high-performance filtration technologies. The presence of leading filtration equipment manufacturers in the region further strengthens its position.

U.S. Liquid Filtration for Pharmaceutical Market Trends

In the U.S., the market is being driven by strong demand from biopharmaceutical manufacturing, especially for sterile and ultrafiltration applications, as biologic drugs and vaccines grow in prominence. The various programs enhance domestic pharmaceutical manufacturing and supply chain resilience, focusing on filtration technology. Major initiatives include the U.S. FDA's PreCheck program, which aims to strengthen the domestic pharmaceutical supply chain. The U.S. FDA's generic drug pilot program was created to speed up the review process for abbreviated new drug applications (ANDAs) for generic drugs that are produced and tested in the U.S.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is the fastest-growing region, driven by rising pharmaceutical production, expanding biotech hubs, and increasing investments in biologics and vaccine manufacturing. Government initiatives and favorable policies are also attracting new players to the region.

China Liquid Filtration for Pharmaceutical Market Trends

China is a major contributor to the market in Asia Pacific due to the rapid expansion in biologics, vaccines, and biosimilars production. Local manufacturers are increasingly embracing single-use membrane filtration systems to reduce contamination risk and improve process flexibility. Stricter NMPA (National Medical Products Administration) regulations and GMP standards are pushing the adoption of sterile filtration integrated with automated fill-finish lines. In May 2024, the Chinese Pharmacopoeia Committee (CPC) planned to include Pharmaceutical Water in the Chinese Pharmacopoeia.

Why is Europe Considered a Notably Growing Region in the Liquid Filtration for Pharmaceutical Market?

Europe is expected to grow at a notable rate in the market in the upcoming period due to ongoing pharmaceutical reforms, sustainability initiatives, the EU Green Deal, and strong national programs that encourage innovation. Market-driven developments and technological advancements are also accelerating the adoption of high-performance filtration solutions. Additionally, stringent EU regulations on product validation, sterility, and water quality are key factors pushing pharmaceutical manufacturers toward more advanced liquid filtration systems. The region's rigorous regulatory framework under the EMA and EU Pharmacopeia further accelerates the adoption of validated filtration systems to ensure product quality and patient safety.

UK Liquid Filtration for Pharmaceutical Market Trends

The market in the UK is largely driven by rising biopharmaceutical R&D and production of biologics and complex drug formulations, which demand high-performance sterile and membrane filtration. In July 2025, the UK government launched a plan to drive growth of the life sciences sector that also enables faster access to treatments. This, in turn, fosters innovations in medical technology and supports market growth. Moreover, there is a rapid shift toward single-use filtration systems to reduce contamination risk and validation burden, driving the market.

What Potentiates the Growth of the Latin America Liquid Filtration for Pharmaceutical Market?

The market in Latin America is expected to grow at a steady rate during the forecast period. This is mainly due to the increasing biopharmaceutical and sterile drug manufacturing, including vaccines and injectables, which is pushing the adoption of membrane filters and high-precision sterile filtration systems. The primary government initiatives concentrate on enhancing manufacturing standards and public health in this area. The government's efforts to boost pharmaceutical production and enforce quality control also contribute to the expansion of the regional market.

Brazil Liquid Filtration for Pharmaceutical Market Trends

In Brazil, the market is being driven by rapid growth in biopharmaceutical manufacturing, particularly vaccines, biologics, and biosimilars, which is necessitating more sterile filtration systems. In October 2024, Brazil's government announced plans to boost the pharmaceutical sector through increased domestic investments. The growth of vaccine, generic, and biologic manufacturers is driving demand for advanced pharmaceutical filtration systems in the country. Companies are investing in these filtration technologies to comply with regulatory standards and address rising market requirements.

What Opportunities Exist in the Middle East and Africa?

The Middle East and Africa (MEA) offer significant opportunities in the liquid filtration for pharmaceutical market. Increased government investment in healthcare infrastructure and local drug manufacturing, especially through initiatives such as Saudi Vision 2030, is promoting self-reliance and boosting demand for high-quality filtration systems. The legislative and manufacturing initiatives are driving demand for advanced filtration solutions across the industry. Government efforts to localize drug manufacturing, increasing healthcare spending, and a growing pharmaceutical sector are supporting market growth. A strong focus on purity standards and the rapidly growing pharmaceutical industry are the main drivers boosting the adoption of advanced liquid filtration solutions in the region.

Country-Level Investments/ Funding Trends for Liquid Filtration for Pharmaceutical Market

| Country | Investment Focus | Funding Objectives |

| India | Strengthening pharmaceutical manufacturing via Make in India and PLI (Production Linked Incentive) schemes, promoting cleanroom and GMP compliance. |

Support investments in high-purity filtration systems to ensure product safety and regulatory compliance in pharmaceutical manufacturing. |

| Canada | Focus on GMP-compliant biopharma production, with government backing through the Strategic Innovation Fund and Life Sciences programs. |

Encourage adoption of advanced filtration technologies to improve product sterility and enable production of biologics and vaccines. |

| United States | Investments through BARDA, NIH, and DoD to support pharma manufacturing resilience, with an emphasis on pandemic preparedness. | Develop domestic capacity for sterile filtration, especially for injectable drugs and biologics, reducing dependency on foreign suppliers. |

Top Companies in Liquid Filtration for Pharmaceutical Market & their Offerings

- Pall Corporation: Supplies filtration, separation, and purification technologies for biopharmaceuticals, microelectronics, and industrial applications.

- Sartorius AG: Provides bioprocessing tools and laboratory equipment for the biopharmaceutical industry.

- Merck KGaA (Millipore): Sells lab supplies, chemicals, and biopharma manufacturing products under its life science business, MilliporeSigma.

- 3M Company: Offers a diversified range of industrial products, including filtration solutions.

- Donaldson Company, Inc.: Manufacturers of filtration systems for engines and industrial applications.

Liquid Filtration for Pharmaceutical Market Companies

- Parker Hannifin Corporation

- Eaton Corporation

- GE Healthcare Life Sciences

- Filtration Group Corporation

- Thermo Fisher Scientific

- Advantec MFS, Inc.

- Ahlstrom-Munksjö

- Meissner Filtration Products

- Nitto Denko Corporation

- Toray Industries, Inc.

- Hengst SE

- Koch Membrane Systems

- Spectrum Laboratories, Inc.

- Porex Corporation

- Porvair Filtration Group

Recent Developments

- In October 2025, Avalara introduced Agentic Tax and Compliance, a new class of AI agents that initiate and execute compliance workflows from start to finish. Powered by the ALFA framework, these intelligent agents deliver accuracy, scale, and speed across the entire compliance lifecycle. (Source: https://www.prnewswire.com)

- In October 2025, Target announced plans to open seven new stores across the United States during the month. These new locations are part of the company's strategy to expand its footprint and enhance customer accessibility. (Source: https://www.usatoday.com)

Segments Covered in the Report

By Filtration Type

- Membrane Filtration

- Microfiltration

- Ultrafiltration

- Nanofiltration

- Depth Filtration

- Sheet Filters

- Cartridge Filters

- Sterile Filtration

- Others

By Filtration Material

- Polyethersulfone (PES)

- Polyvinylidene Fluoride (PVDF)

- Cellulose Acetate

- Nylon

- Polypropylene

- Stainless Steel

- Others

By Application / Use Case

- Biopharmaceutical Production

- Vaccine Manufacturing

- Injectable Drugs

- Bulk Drug Intermediates

- Research & Laboratory Use

- Others

By End User

- Pharmaceutical Manufacturers

- Biopharmaceutical Companies

- Contract Manufacturing Organizations (CMOs)

- Research & Academic Institutes

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting