LNP CDMO Market Size and Forecast 2025 to 2034

The global LNP CDMO market size was calculated at USD 205.47 million in 2024 and is predicted to increase from USD 235.98 million in 2025 to approximately USD 820.46 million by 2034, expanding at a CAGR of 14.85% from 2025 to 2034. The market is experiencing substantial growth due to the increasing demand for delivery systems, especially in the development of mRNA-based vaccines and therapeutics. This growth is further supported by the rising trend of biopharma companies outsourcing formulation and manufacturing services. Additionally, ongoing advancements in nanotechnology and the expanding applications of LNPs in gene therapy and oncology are expected to accelerate market expansion.

LNP CDMO Market Key Takeaways

- In terms of revenue, the global LNP CDMO market was valued at USD 205.47 million in 2024.

- It is projected to reach USD 820.46 million by 2034.

- The market is expected to grow at a CAGR of 14.85% from 2025 to 2034.

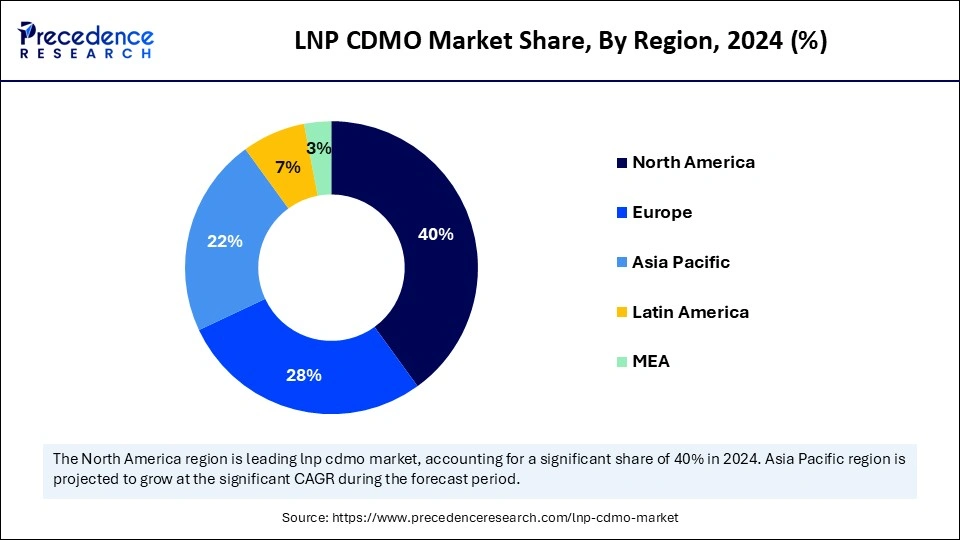

- North America dominated the global LNP CDMO market with the largest share of 40% in 2024.

- Asia Pacific is anticipated to grow at a significant CAGR from 2025 to 2034.

- By type of lipid nanoparticle, the cationic lipid nanoparticles (CLNP) segment captured the largest market share of 40% in 2024.

- By type of lipid nanoparticle, the anionic lipid nanoparticles (ALNP) segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By service type, the drug development segment contributed the highest market share of 45% in 2024.

- By service type, the analytical and testing services segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By end-use industry, the pharmaceutical segment held the maximum market share of 60% in 2024.

- By end-use industry, the biotechnology segment is expected to grow at a significant CAGR from 2025 to 2034.

- By application, the mRNA delivery segment accounted for the significant market share of 50% in 2024.

- By application, the gene therapy segment is expected to witness the fastest CAGR during the forecast period.

- By manufacturing scale, the clinical-stage manufacturing segment generated the major market share of 35% in 2024.

- By manufacturing scale, the commercial-scale manufacturing segment is expected to witness the fastest CAGR during the foreseeable period.

Market Overview

The LNP CDMO market consists of specialized organizations that provide services for developing and producing lipid nanoparticles (LNPs) for drug delivery. This market is rapidly expanding, spurred by the success of mRNA therapies, the growth of LNP-based genetic therapies, increasing R&D investments, and the need for specialized manufacturing expertise. The urgent requirement for specialized infrastructure and expertise for complex LNP production, combined with a rising number of LNP-related pipeline drugs, has prompted pharmaceutical companies to outsource development and manufacturing to CDMOs. This strategy helps accelerate drug development and manage costs effectively.

How Can AI Impact the LNP CDMO Market?

Artificial intelligence (AI) is revolutionizing the LNP CDMO market by optimizing LNP formulation design, improving process efficiency, ensuring quality control, and streamlining manufacturing operations, ultimately reducing time and costs. AI algorithms identify optimal process conditions and key variables for increased manufacturing efficiency and scalability, reducing the number of experimental runs needed and saving resources. AI-enabled systems monitor and control manufacturing processes in real-time, predict maintenance needs, optimize batch scheduling, and automate process adjustments to reduce variability and improve consistency.

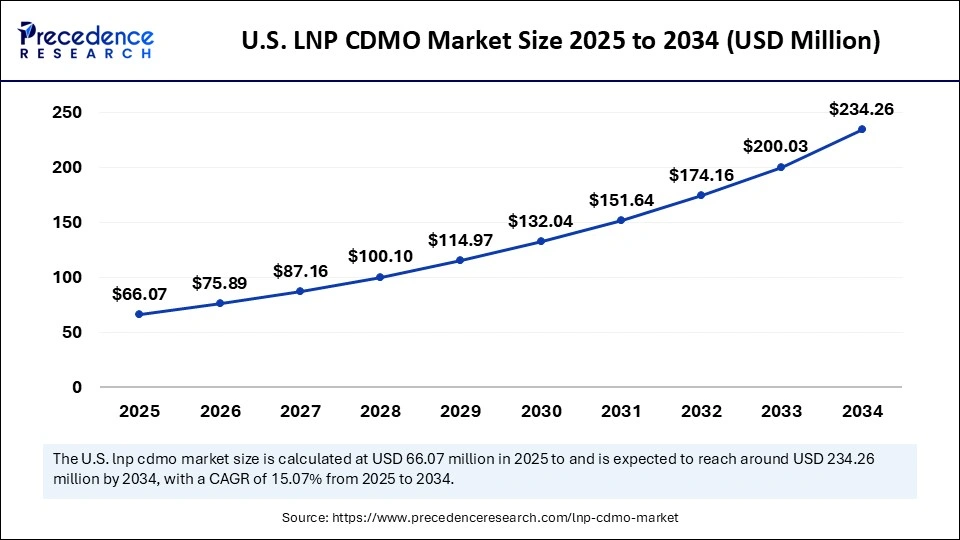

U.S. LNP CDMO Market Size and Growth 2025 to 2034

The U.S. LNP CDMO market size was exhibited at USD 57.53 million in 2024 and is projected to be worth around USD 234.26 million by 2034, growing at a CAGR of 15.07% from 2025 to 2034.

How Did North America Lead the LNP CDMO Market in 2024?

North America led the market in 2024, primarily due to significant investments in research and development, strong government funding for mRNA technology, a high concentration of biopharmaceutical companies and research institutions, and a well-established healthcare infrastructure. The region conducts numerous clinical trials for LNP-based therapeutics, particularly RNA-based medicines, reinforcing its leadership in the market. North America boasts a robust network of biopharmaceutical companies, CDMOs, and academic research clusters, creating a synergistic environment for LNP development. The U.S. National Institutes of Health provides substantial funding for nanomedicine research and development, directly supporting innovation in LNP technology.

The U.S. LNP CDMO Market Trends

The U.S. plays a dominant role in the global market due to a robust ecosystem of biopharmaceutical firms, significant public and private investment, and a supportive regulatory environment. The country leads in technological advancements, including microfluidics and artificial intelligence (AI) for LNP formulation and scaling, along with a strong clinical pipeline for LNP-based therapies targeting infectious diseases and cancer. Initiatives and regulatory guidance from agencies like the FDA help ensure quality and accelerate the development of next-generation mRNA and gene therapies.

Canada LNP CDMO Market Trends

Canada is evolving its role in the global market, primarily because of its foundational research contributions and targeted government investments. This technological heritage has fostered a strong domestic biopharmaceutical ecosystem, supported by national strategies to enhance biomanufacturing capacity and a skilled workforce concentrated in key metropolitan areas like Vancouver, Toronto, and Montreal. Canada's LNP sector leverages specialized CDMOs, such as Evonik Vancouver Laboratories and BIOVECTRA, to provide expertise from early-stage development to commercial supply for complex nanomedicines.

Why Did the Asia Pacific Consider the Fastest-Growing Region in the LNP CDMO Market in 2024?

Asia-Pacific is the fastest-growing segment of the LNP CDMO market. This growth is driven by a combination of cost-effective manufacturing, a surge in local pharmaceutical research and development, strong government initiatives and funding in countries like China and India, and a large, skilled workforce. Many governments in the Asia-Pacific region actively support the biotech and pharmaceutical sectors through funding, incentives, and policies that encourage innovation and outsourcing to CDMOs. Major hubs like China and India are benefiting from significant biotech investments, while countries like Japan and South Korea contribute through advanced research facilities.

What Are the Key Trends in the LNP CDMO Market?

- Demand for Targeted and Personalized Medicine: LNPs play a crucial role in personalized medicine by enabling the precise delivery of drugs to targeted cells and tissues. Their ability to enhance drug delivery efficiency and minimize side effects is driving innovation in targeted therapies for oncology and other complex diseases.

- Complexity and Cost of LNP Manufacturing: The production of LNPs is a technically challenging process that requires significant investment in specialized equipment, high-quality raw materials, and expertise. Many pharmaceutical and biotech companies, particularly startups, choose to outsource production to contract development and manufacturing organizations (CDMOs) to manage costs and complexities.

- Technological Advancements in LNP Formulation: Continuous innovations in formulation and manufacturing technologies, such as microfluidics, are improving LNP stability, encapsulation efficiency, and targeting capabilities. These advancements are increasing the demand for advanced CDMO services.

- Growth of the Biotech Sector: Small and mid-sized biotech firms with robust research pipelines but limited internal manufacturing capabilities are major contributors to the market. These firms heavily rely on CDMOs to scale up and produce therapies for clinical trials and commercialization, stimulating research and development activities.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 820.46 Million |

| Market Size in 2025 | USD 235.98 Million |

| Market Size in 2024 | USD 205.47 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.85% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type of Lipid Nanoparticle (LNP), Service Type, End Use Industry, Application, Manufacturing Scale, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand For RNA-Based Therapies

The primary driver of the LNP CDMO market is the increasing demand for RNA-based therapies, particularly mRNA vaccines, which rely on LNPs for effective delivery. This trend is further supported by a robust pipeline of LNP-related drugs, growing research and development investments, and the proven success of LNPs in combating COVID-19. The number of LNP-related drugs in various stages of clinical development is growing, creating significant demand for CDMOs with specialized manufacturing capabilities. Pharmaceutical and biotech companies are making substantial investments in research and development for LNP-based therapies, further accelerating the market's growth.

Restraint

High Costs and Complexities

The main challenges facing this market are the high costs and complexities associated with LNP manufacturing, which require specialized equipment and high-purity lipids. The production process demands specialized infrastructure, expertise, and expensive, pure-grade lipids, making it costly. LNP-based therapies must also meet stringent safety, efficacy, and pharmacokinetic requirements, resulting in time-consuming and expensive regulatory approval processes. Additionally, a shortage of skilled scientists and technicians presents a bottleneck to meeting the growing demand for LNP services.

Opportunity

Increasing Demand for Specialized Manufacturing of RNA-Based Therapeutics and Gene Therapies

A significant opportunity for the LNP CDMO market lies in the increasing demand for specialized manufacturing of RNA-based therapeutics and gene therapies, as LNPs are essential for their delivery. The versatility of LNPs extends beyond vaccines to new applications in oncology, gene editing, and the treatment of rare diseases. The expanding pipeline of LNP-related drugs presents substantial opportunities for CDMOs. This growth is further propelled by the success of mRNA vaccines, an increasing number of LNP-based drugs for oncology and rare diseases, and the necessity for specialized expertise and scalable, high-quality manufacturing.

Type of Lipid Nanoparticle Insights

What Made the Cationic Lipid Nanoparticles (CLNP) Segment Dominate the LNP CDMO Market in 2024?

The cationic lipid nanoparticles (CLNP) segment dominated the market in 2024. This is primarily due to their superior ability to encapsulate and deliver nucleic acids for gene therapies, mRNA vaccines, and RNA interference drugs. The positively charged nature of cationic lipids allows them to effectively interact with negatively charged genetic material. Additionally, the manufacturing of LNP, including CLNPs, can be rapidly scaled up for large-scale demands of vaccine and therapeutic production. This capability was significant during the COVID-19 pandemic. Their unique properties facilitate the successful escape of their genetic payload from endosomes into the nucleus, essential for gene expression and therapeutic efficacy.

The anionic lipid nanoparticles (ALNP) segment is expected to be the fastest-growing during the forecast period. This growth is primarily attributed to the critical role of ionizable lipids in encapsulating nucleic acids in RNA-based therapies and vaccines. There has been a significant increase in demand following the success of mRNA COVID-19 vaccines. Ionizable lipids become positively charged at the low pH of the endosome, allowing effective interaction with negatively charged nucleic acid payloads for efficient encapsulation. At physiological pH, they transition to neutral or less positive charges, enhancing biocompatibility and preventing off-target binding.

Service Type Insights

How Did the Drug Development Segment Lead the LNP CDMO Market in 2024?

The drug development segment led the market in 2024. This is largely due to the explosion in mRNA therapeutics, the complexity of LNP formulation, and the growing demand for specialized end-to-end LNP development and manufacturing services. The formulation of LNPs requires specialized knowledge and advanced equipment, which many biotech and pharmaceutical companies may lack in-house. Consequently, CDMOs provide the necessary expertise, infrastructure, and regulatory support to help these companies focus on core research, development, and commercialization, enabling faster innovation and cost-efficiency.

The analytical and testing services segment is projected to be the fastest-growing market. This growth is driven by the high complexity of LNP-based therapies, necessitating specialized analytical methods to ensure safety and efficacy. Increasing demand for RNA-based drugs, stricter regulatory guidelines, and a growing trend of outsourcing testing by pharmaceutical companies further contribute to this surge. Pharmaceutical and medical device companies are increasingly outsourcing analytical testing to specialized CDMOs to access advanced equipment, expertise, and capacity without the need for significant capital investment in drug development, thus reducing costs.

End Use Industry Insights

How Did the Pharmaceutical Segment Dominate the LNP CDMO Market in 2024?

The pharmaceutical segment maintained a dominant market position in 2024. This is primarily due to the rising demand for LNPs in advanced drug delivery systems for mRNA vaccines and gene therapies. The need for specialized development and manufacturing expertise provided by CDMOs, as well as strategic outsourcing by pharmaceutical companies aiming to accelerate time-to-market and reduce costs, also play a significant role. Pharmaceutical companies rely on CDMOs for their technical capabilities, regulatory compliance, and integrated end-to-end services, which significantly shorten development timelines.

The biotechnology segment is experiencing the fastest growth in the market. This growth is largely due to the essential role of LNPs in delivering fragile genetic material in innovative therapies like mRNA vaccines and gene editing. The success of mRNA vaccines has sparked a surge in the development of new mRNA vaccines, gene therapies, and RNA interference drugs, all of which depend on LNP delivery systems and demand specialized CDMO expertise.

Application Insights

How Did the mRNA Delivery Segment Lead the LNP CDMO Market in 2024?

The mRNA delivery segment captured a dominant position in the market in 2024. This is driven by the proven success of mRNA vaccines, the inherent need for LNPs to protect and deliver mRNA, and ongoing research and development into new LNP formulations and applications. The rapid development and global deployment of mRNA vaccines during the COVID-19 pandemic showcased the potential of LNP technology as an effective delivery system for mRNA. Beyond vaccines, there is an increasing focus on mRNA-based treatments for various conditions, including genetic diseases, cancers, and gene editing therapies, which necessitates expertise in LNP formulation and manufacturing from CDMOs.

The gene therapy segment is anticipated to be the fastest-growing segment in the market. This is heightened by the rising prevalence of genetic disorders, advancements in gene editing technologies such as CRISPR, and the demand for personalized and novel treatments, all of which present unique manufacturing challenges. Many biopharmaceutical companies, including large corporations and emerging biotechs, lack the internal infrastructure and technical expertise required for these complex therapies. This gap leads to an increased demand for outsourced services from CDMOs, which provide flexible and adaptable LNP platforms to meet these needs.

Manufacturing Scale Insights

What Made the Clinical-Stage Manufacturing Segment Lead the LNP CDMO Market in 2024?

The clinical-stage manufacturing segment dominated the market in 2024. This dominance is due to the increasing need for rapid and scalable production of lipid nanoparticle (LNP)-based therapeutics, such as mRNA vaccines and gene therapies, during critical phases of drug development. The complex, capital-intensive, and highly regulated nature of LNP manufacturing drives pharmaceutical companies to depend on specialized CDMOs. For flexible, Good Manufacturing Practice (GMP)-compliant services. This reliance ensures consistent, high-quality production from early clinical phases and supports the growing demand for these therapies.

The commercial-scale manufacturing segment is the fastest-growing in the market. This growth results from the increasing success of LNP-based drugs, like mRNA vaccines and gene therapies, which create a need for specialized, scaled-up manufacturing expertise and infrastructure. Additionally, the global demand for cost-efficiency, speed to market, and robust supply chains from CDMOs makes outsourcing more appealing for both emerging biotech firms and established pharmaceutical companies looking to quickly bring new LNP-based therapies to market, further driving the preference for outsourced services.

Value Chain Analysis

- R&D

The R&D market consists of companies that provide outsourced research, development, and manufacturing services for therapeutics using LNP. LNPs are protective carriers for genetic material like mRNA, for advanced drug delivery systems, and demand for these contract services is rising due to complex manufacturing and the growth of mRNA therapeutics.

Key Players: Lonza, Thermo Fisher Scientific, Evonik, FUJIFILM Diosynth Biotechnologies, Catalent, Inc.

- Clinical Trials and Regulatory Approvals

This market involves organizations providing comprehensive services for LNP-based drug delivery systems used in products like mRNA vaccines, assisting clients from early development through large-scale manufacturing for clinical trials and commercial supply, in navigating complex regulatory pathways.

Key Players: Lonza Group, Catalent, Inc., FUJIFILM Corporation, Samsung Biologics, WuXi STA

- Formulation and Final Dosage Preparation

This involves developing a specific mix of lipids that will self-assemble into nanoparticles and effectively encapsulate the payload. The manufacturing step where the formulated drug is processed into its final, patient-ready form, such as a sterile injectable liquid in a vial or syringe. This involves processes like sterile filtration and aseptic filling.

Key Players: Evonik Health Care, Merck KGaA, CordenPharma, Phosphorex, Thermo Fisher Scientific

- Packaging and Serialization

This is the packaging and serialization of LNP-based drugs, which includes specialized ultracold and cryogenic packaging to ensure the drug's stability. Serialization involves assigning each package a unique, traceable ID, such as a 2D barcode, to combat counterfeiting and enable supply chain tracking.

Key Players: Lonza Group AG, Thermo Fisher Scientific, Evonik, CordenPharma, BIOVECTRA

- Distribution to Hospitals, Pharmacies

For outpatient care, the market uses a specialized, controlled supply chain to deliver packaged LNP products to retail pharmacies. These pharmacies then dispense the medication to patients according to a doctor's prescription. The process requires strict adherence to cold-chain logistics to ensure product integrity and patient safety.

Key Players: Merck KGaA, Samsung Biologics, CordenPharma GmbH, FUJIFILM Corporation

LNP CDMO Market Companies

- Lonza Group

- WuXi AppTec

- Samsung Biologics

- Catalent

- Moderna

- Evonik Industries

- CordenPharma

- BioNTech

- Albemarle Corporation

- Kuehne + Nagel

- Northway Biotechpharma

- Cryoport, Inc.

- AMRI

- Pharmaron

- Genevant Sciences

- Miltenyi Biotec

- SynBioTech

- JHL Biotech

- Particle Sciences, Inc.

- Acell Technologie

Leaders' Announcements

- In July 2024, Agilent Technologies announced its acquisition of BIOVECTRA, a Canadian company specializing in biologics and active pharmaceutical ingredients. This acquisition expands Agilent's services in oligonucleotides and CRISPR therapeutics, incorporating BIOVECTRA's expertise in sterile fill-finish, pDNA, mRNA, and lipid nanoparticle formulation, enhancing support for gene editing technologies.(Source: https://www.agilent.com)

Recent Developments

- In March 2023, Evonik opened a GMP facility in Hanau, Germany, to manufacture lipids for pharmaceutical drug delivery, supporting clinical and small-scale commercial needs. This facility enhances Evonik's capabilities for RNA and gene therapies, such as those for infectious diseases and cancer immunotherapy. It can produce a variety of custom lipids, ensuring high-quality GMP material for seamless scale-up, as noted by Thomas Riermeier and Paul Spencer from Evonik's Health Care business.(Source: https://www.evonik.com)

Segments Covered in the Report

By Type of Lipid Nanoparticle (LNP)

- Cationic Lipid Nanoparticles (CLNP)

- Anionic Lipid Nanoparticles (ALNP)

- Neutral Lipid Nanoparticles (NLNP)

By Service Type

- Drug Development

- Preclinical

- Clinical Development

- Commercial Manufacturing

- Analytical and Testing Services

- Quality Control Testing

- Stability Testing

- Release Testing

- Formulation Development

- Lipid Nanoparticle Formulation

- Pre-formulation Studies

- Fill and Finish Services

- Primary Packaging

- Secondary Packaging

- Final Drug Product Filling

By End Use Industry

- Pharmaceutical

- Gene Therapy

- mRNA-based Vaccines

- Small Molecule Drug Delivery

- Biotechnology

- Protein Therapeutics

- Cell Therapy

- Cosmetics

- Skin Care

- Hair Care

- Agriculture

- Pesticide Delivery

- Fertilizer Delivery

By Application

- mRNA Delivery

- Gene Therapy

- Cancer Therapy

- Vaccine Delivery

- RNA-based Drugs

By Manufacturing Scale

- Preclinical and Early-Stage Manufacturing

- Clinical-Stage Manufacturing

- Commercial-Scale Manufacturing

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting