Long-Acting Injectables (LAIs) Market Size and Forecast 2025 to 2034

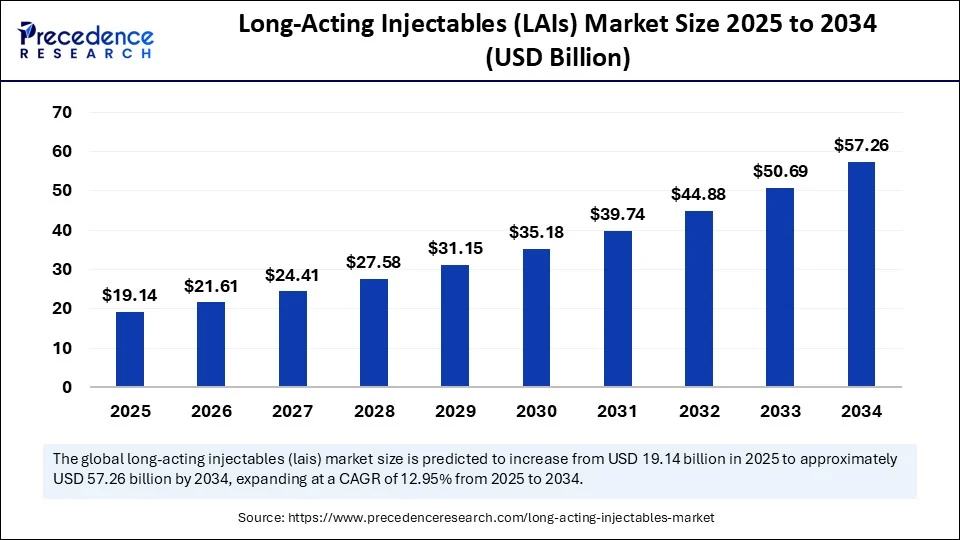

The global long-acting injectables (LAIs) market size accounted for USD 16.94 billion in 2024 and is predicted to increase from USD 19.14 billion in 2025 to approximately USD 57.26 billion by 2034, expanding at a CAGR of 12.95% from 2025 to 2034. The market is gaining traction due to improved adherence, reduced dosing frequency, and providing stable pharmacokinetics for chronic and specialty conditions. Also, an obvious reason for this rise is the advancement in drug delivery systems.

Long-Acting Injectables (LAIs) Market Key Takeaways

- In terms of revenue, the global long-acting injectables (LAIs) market was valued at USD 16.94 billion in 2024.

- It is projected to reach USD 57.26 billion by 2034.

- The market is expected to grow at a CAGR of 12.95% from 2025 to 2034.

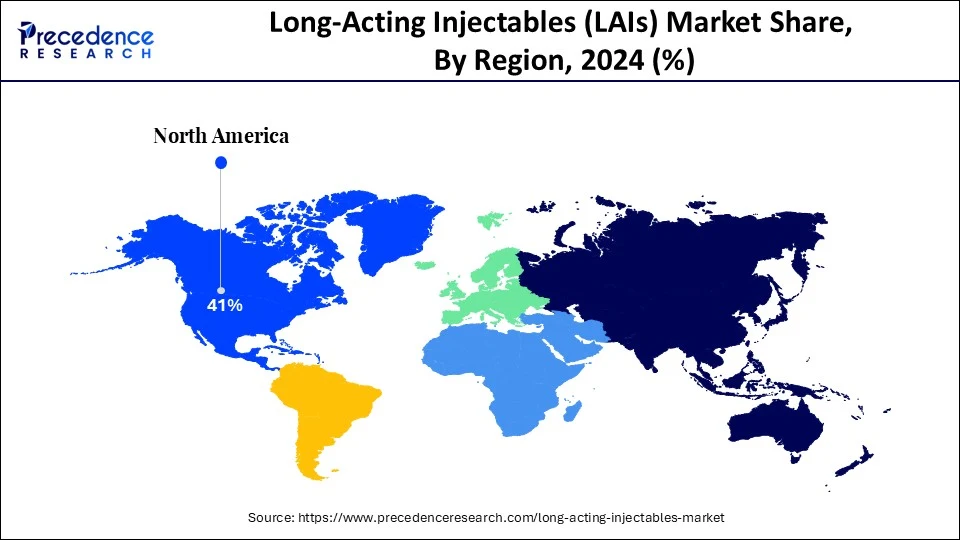

- North America held a major market share of 41% in the long-acting injectables (LAIs) market in 2024.

- Asia Pacific is expected to be the fastest-growing region in the upcoming years.

- By drug type, the antipsychotics segment held the maximum revenue share of 38% in the long-acting injectables (LAIs) market in 2024.

- By drug type, the anti-infectives segment is expected to witness the fastest growth in the market over the forecast period.

- By delivery technology type, the microsphere-based systems segment held the maximum revenue share of 34% in the long-acting injectables (LAIs) market in 2024.

- By delivery technology type, the nanoparticle-based Systems segment is expected to witness the fastest growth in the market over the forecast period.

- By route of administration, the Intramuscular segment held the maximum market share of 55% in the market in 2024.

- By route of administration, the Subcutaneous segment is expected to witness the fastest growth in the market over the forecast period.

- By indication, the schizophrenia segment held the maximum revenue share of approximately 30% in the market in 2024.

- By indication, the HIV/AIDS segment is expected to witness the fastest growth in the market over the forecast period.

- By patient group, the adults segment held the maximum revenue share of approximately 70% in the long-acting injectables (LAIs) market in 2024.

- By patient group, the Geriatrics segment is expected to witness the fastest growth in the market over the forecast period.

- By distribution channel group, the hospital pharmacies segment contributed the biggest market share of 48% in 2024.

- By distribution channel group, the online pharmacies segment is expected to witness the fastest growth in the market over the forecast period.

How AI is Changing the Long-Acting Injectables (LAIs) Market?

Artificial intelligence is changing the long-acting injectables (LAIs) market R&D and commercialization in several practical ways, like predictive modeling for controlled kinetics, formulation optimization via in silico screening of excipient drug interactions, virtual patient simulations to forecast adherence/outcomes, and AI-driven pharmacovigilance to detect safety signals sooner. On the commercial side, AI helps identify ideal patient cohorts, optimizes supply chain forecasting for temperature-sensitive depots, and supports value-based contracting by linking real-world outcomes to dosing strategies. The market is shaped by the interplay between clinical need, which is improving adherence, technological capability, formulation platforms, and regulatory pathways. The important AI uses include a shift from oral to injectable options in poorly adherent populations, a growing CRO/CDMO role in formulation scale-up and sterile manufacturing, and cold chain and clinical administration logistics that favor integrated provider programs.

- In July 2025, at the Google for India event held in Bengaluru on Wednesday, Google announced a series of initiatives aimed at accelerating India's AI capabilities and empowering developers. The highlight of the event was the introduction of onshore processing for Gemini 2.5, delivering low-latency AI performance tailored for Indian developers, particularly in regulated sectors such as healthcare, finance, and governance.

(Source: https://economictimes.indiatimes.com)

U.S. Long-Acting Injectables (LAIs) Market Size and Growth 2025 to 2034

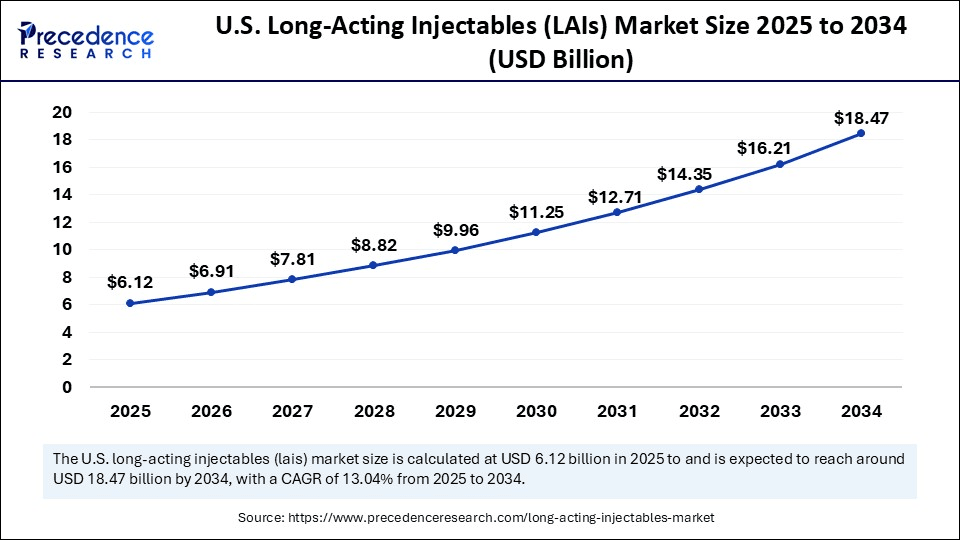

The U.S. long-acting injectables (LAIs) market size was exhibited at USD 5.42 billion in 2024 and is projected to be worth around USD 18.47 billion by 2034, growing at a CAGR of 13.04% from 2025 to 2034.

Why Does North America Lead the long-acting injectables (LAIs) market?

North America continues to dominate the long-acting injectables (LAIs) market, due to a mature specialty care ecosystem, strong private and public payer structures willing to reimburse innovations with clear outcome benefits, and a concentration of biotech and CDMO capacity for sterile injectable development. Provider networks and higher per-capita healthcare spending accelerate the adoption of LAI products. Regulatory frameworks are supportive of evidence-based adoption, and payers are increasingly incorporating long-acting injectables into value-based care models. Technological integrations, including AI-assisted patient selection and monitoring, are more prevalent in North America than in most other markets. Collectively, these factors make the region a lucrative base for LAI commercialization.

The U.S. dominated in North America, driven by its high prevalence of chronic conditions that benefit from adherence-focused interventions. Mental health treatment, HIV prevention, hormonal therapies, and oncology supportive care are among the leading LAI application areas. The country's well-established specialty pharmacy networks facilitate distribution and administration in both hospital and outpatient settings. Competitive dynamics are shaped by rapid biosimilar entry alongside premium-priced innovator products. Public and private insurers are actively piloting reimbursement models tied to patient outcomes, which aligns well with LAI benefits. These conditions ensure that the U.S. remains a focal point for global LAI launch strategies.

Can Asia Pacific Outpace the Rest of the Regions in the Long-Acting Injectables (LAIs) Market?

Asia Pacific continues to dominate the long-acting injectables (LAIs) market, driven by large and diverse patient populations, increasing healthcare spending, and rapid expansion of specialty medical facilities. Governments in the region are prioritizing chronic disease management and preventive care, both of which align with LAI advantages. Urbanization and rising middle-class income levels are improving access to clinic-based treatments. Pharmaceutical companies are partnering with local CDMOs to establish cost-effective manufacturing and reduce reliance on imports. The region's growing expertise in sterile manufacturing also positions it as a competitive exporter of LAI products. As regulatory environments mature, market entry timelines are expected to shorten, further accelerating adoption.

China is the fastest-growing economy in the Asia Pacific. China stands out as a key growth driver within Asia-Pacific, supported by robust investments in biotech, pharmaceutical R&D, and healthcare infrastructure. The country's healthcare reforms are improving patient access to specialty care while promoting the adoption of innovative therapies. Domestic manufacturers are increasingly capable of producing high-quality products, both for local use and export. With a large target population for psychiatric, infectious disease, and hormone-related therapies, the market potential is significant. The government's focus on self-sufficiency in pharmaceuticals aligns with the development of locally made products. As patient awareness grows, China is expected to become one of the largest single-country markets for the long-acting injectables (LAIs) market in the next decade.

Market Snapshot- Slow Release, Fast Impact

The long-acting injectables (LAIs) market encompasses pharmaceutical formulations designed to release active ingredients over extended periods following a single administration, typically ranging from weeks to months. These formulations are primarily developed for chronic conditions where patient adherence is critical, such as psychiatric disorders, hormone replacement therapy, contraception, and certain infectious diseases. LAIs are administered via intramuscular, subcutaneous, or other injectable routes, using advanced delivery systems like microspheres, liposomes, and polymer-based depots to ensure controlled release and sustained plasma drug levels.

The long-acting injectables (LAIs) market is a convergence of formulation science, patient care, and biopharma commercial strategy. Growth is being driven by expanding therapeutic uses, advances in delivery platforms, sustained-release polymers, injectable suspensions, in situ gelling systems, and increasing adoption by payors and providers seeking adherence and outcome improvements. Key commercial models include originator-provided clinics, hospital outpatient administration, and partner-based manufacturing for novel platforms.

Market Key Trends

- Expanding indications in oncology supportive care, long-acting antinociceptives and antivirals, contraception, and metabolic disease.

- Platform licensing and partnerships pharma companies licensing deport platforms to extend product lifecycles or enable biologic long-acting forms.

- Emerging-market adoption as clinic networks expand.

- Biosimilar and follow-on long-acting injectables, where originator patents expire opportunities for cost-competitive formulations and CDMO specialization.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 57.26 Billion |

| Market Size in 2025 | USD 19.14 Billion |

| Market Size in 2024 | USD 16.94 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.95% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Delivery Technology, Route of Administration, Indication, Patient Group, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Improving adherence and outcomes

A primary driver is improving adherence and outcomes for chronic conditions where daily dosing fails, the long-acting injectables (LAIs) market reduces missed doses, cuts relapse/hospitalization risk, and delivers predictable exposures that can improve efficacy and safety profiles. Secondary drivers include technological advances in depot chemistry and strong interest from specialty pharma to differentiate products through delivery. However, market dynamics are also influenced by several structural and operational realities. The administration of the long-acting injectables (LAIs) market requires clinical settings, trained personnel, and, in some cases, cold-chain handling factors that can limit accessibility in certain geographies. Pharmaceutical companies are increasingly collaborating with contract development and manufacturing organizations to meet demand while managing complex sterile production requirements.

Opportunity

Expanding Indications

The market for LAIs presents vast expansion potential across therapeutic areas and geographies. Beyond psychiatry and infectious diseases, the developers are exploring LAIs for oncology supportive care, chronic pain, metabolic disorders, and autoimmune conditions. Pharmaceuticals' lifecycle management strategies are increasingly turning to LAI formulations to extend product value beyond initial patent protection. There is also growing interest from governments and NGOs in developing LAIs for public health programs targeting HIV, TB, and contraception in underserved regions. Biotech firms specializing in delivery technology stand to benefit from platform licensing, as large pharma companies look to partner rather than build in-house expertise. These factors collectively open multiple high-value entry points for both innovators and service providers.

Market Restraint

Significant barriers remain

While the long-acting injectables (LAIs) market has strong growth potential, significant barriers remain. The high upfront cost of developing and manufacturing sterile, long-duration injectables can deter smaller companies from entering the space. Clinical trials for LAIs require longer follow-up periods to establish sustained efficacy and safety, adding time and expense to commercialization. Adverse events, even when rare, can have prolonged consequences due to the extended presence of the drug in the body, making risk mitigation critical. Infrastructure requirements such as trained healthcare professionals, cold storage, and proper administration facilities can limit uptake in low-resource settings. Reimbursement challenges also persist in markets where cost-effectiveness data is lacking or payer policies are slow to adapt. Together, these factors create a high barrier-to-entry environment for market entrants.

Drug Type Insights

Why Do Antipsychotics Dominate the Long-Acting Injectables (LAIs) Market?

The antipsychotics segment has become a dominant force in the long-acting injectables (LAIs) market, driven by their critical role in managing chronic psychiatric conditions such as schizophrenia and bipolar disorder. Long-acting formulations offer consistent plasma levels, reducing relapse risk and improving patient adherence compared to daily oral dosing. Psychiatric care providers increasingly favor LAIs due to reduced hospitalization rates and improved treatment continuity. Pharmaceutical companies have also invested heavily in large-acting injectable versions of leading antipsychotic brands to maintain market leadership. This strong clinical and commercial foundation positions antipsychotics as the cornerstone of the long-acting injectable segment.

Favourable reimbursement frameworks in many markets further bolster the adoption of large-action injectable antipsychotics. Healthcare systems recognize the cost benefits of avoiding acute psychiatric crises through better adherence. Patient acceptance is also increasing as awareness grows around the benefits of reduced dosing frequency. In addition, ongoing innovation in injection delivery and patient support programs enhances overall uptake. While competition from generics exists, brand loyalty remains strong due to the critical nature of psychiatric treatment outcomes. As mental health awareness continues to rise globally, the dominance of antipsychotic LAIs is expected to remain firmly intact.

The anti-infectives segment is expected to experience the fastest growth in the long-acting injectables (LAIs) market during the forecast period, driven by the increasing adoption of long-acting antibiotics and antivirals to improve treatment compliance, particularly in complex or prolonged regimens. In infectious diseases like HIV and TB, missing doses can have severe consequences, making LAIs a valuable solution. Healthcare providers view these therapies as a way to reduce disease transmission, improve patient outcomes, and ease the burden on healthcare facilities. Governments and NGOs are actively supporting initiatives that deploy long-acting injectable anti-infectives in community health programs. This alignment of public health goals with clinical innovation is accelerating demand.

Further growth in this segment is expected from ongoing R&D into next-generation anti-infectives with extended dosing intervals. Pharmaceutical companies are exploring novel formulations that can provide protection or treatment coverage for weeks or even months. The convenience factor for patients, combined with improved therapeutic consistency, is a strong market driver. Moreover, long-action injectables reduce the need for strict daily adherence, which can be challenging in remote or resource-limited settings. Partnerships between pharma companies and global health organizations are likely to expand access to these treatments. This combination of clinical necessity and market support makes anti-infectives the standout growth opportunity within Long-action injectables.

Delivery Technology Insights

Why Micro-Sphere-Based System Dominating the Market?

The microsphere-based segment has become a dominant force in the long-acting injectables (LAIs) market, as these delivery systems have a well-established track record of safety, stability, and controlled drug release. They are widely used in both small-molecule and peptide-based Large-acting injectables, making them versatile across therapeutic categories. Pharmaceutical manufacturers favor microsphere systems due to their scalability and compatibility with various active ingredients. The predictability of drug release profiles also supports favourable regulatory outcomes. As a result, microsphere-based remains the go-to choice for many developers.

The segment's strength also lies in the extensive manufacturing infrastructure already in place. Many contract manufacturing organizations (CMOs) have the expertise and equipment to produce microsphere-based products efficiently. This lowers the barrier for companies to bring such products to market. Clinicians are familiar with these systems, further easing adoption. Despite emerging technologies, the reliability of microsphere-based delivery maintains its market leadership. As new LAIs enter the pipeline, microsphere platforms are expected to capture a significant portion of formulation contracts.

The nanoparticle-based systems segment is expected to experience the fastest growth in the market during the forecast period, as systems offer enhanced drug solubility, targeted delivery, and the potential for reduced side effects. Their precision in controlling release rates makes them ideal for complex biologics and high-value specialty drugs. Pharmaceutical companies are increasingly investing in nanoparticle R&D to unlock new therapeutic possibilities. The appeal also extends to patient-centric benefits, including smaller injection volumes and potentially less frequent dosing. These attributes make nanoparticle systems a key area of innovation.

Advancements in nanofabrication and characterization techniques further support the segment's rapid growth. Collaborations between biotech firms and drug delivery specialists are accelerating product development timelines. Regulatory agencies are becoming more familiar with nanoparticle-based products, paving the way for faster approvals. The potential for personalized medicine applications also drives market interest. While manufacturing complexity remains a challenge, the clinical advantages are too significant to ignore. This positions nanoparticle-based systems as a major force in the future of LAIs.

Route of Administration Insights

The intramuscular segment has become a dominant force in the long-acting injectables (LAIs) market since this route allows for large-volume depot injections, enabling prolonged release of active ingredients. Clinicians trust IM delivery for its consistent pharmacokinetics and broad applicability across therapeutic areas. IM administration is especially preferred in psychiatric, infectious disease, and hormonal therapies. The established procedural familiarity among healthcare providers supports its ongoing dominance. For many existing and pipeline LAIs, IM remains the default delivery route.

The infrastructure for IM delivery is already embedded in healthcare systems worldwide. From hospital settings to community clinics, trained personnel are readily available to administer these injections. Patients often perceive IM delivery as more serious or effective, which can reinforce adherence. Pharmaceutical companies continue to optimize IM formulations for comfort and reduced injection-site reactions. While alternative routes are emerging, IM's clinical reliability and market presence make it hard to displace. As new therapies launch, IM delivery is expected to retain a substantial market share.

The subcutaneous segment is expected to experience the fastest growth in the long-acting injectables (LAIs) market during the forecast period. Patients appreciate the less invasive nature of SC injections compared to IM delivery. Smaller needle sizes, reduced pain, and the possibility for self-administration enhance patient acceptance. Pharmaceutical developers are increasingly designing LAIs with SC compatibility to cater to these preferences. SC delivery also opens doors for home-based treatment models, which can lower healthcare costs. This aligns with the broader shift toward patient-centric care.

Innovations in device technology, such as auto-injectors and wearable pumps accelerate the segment's growth. These advancements make it easier for patients to receive treatment without frequent clinic visits. SC delivery is particularly attractive for chronic disease management, where convenience is key to adherence. Healthcare providers also value the reduced need for specialized administration training. As formulation science continues to evolve, more LAIs are expected to transition to SC delivery. This trajectory positions the segment as a major disruptor in traditional injection practices.

Indication Insights

Why Is Schizophrenia Dominating The Long-Acting Injectables (LAIs) Market?

The schizophrenia segment has become a dominant force in the market, due to the severe consequences of non-adherence. They provide stable plasma levels, reducing the risk of relapse and hospitalization. Mental health practitioners increasingly recommend LAIs for long-term management. The segment benefits from strong clinical evidence supporting LAI efficacy in schizophrenia. This entrenched role ensures its continued market leadership.

Reimbursement policies in many regions favor long-acting injectable use in schizophrenia, recognizing the cost savings from reduced acute care needs. Patient and caregiver awareness of the benefits of adherence is also growing. The introduction of new long-acting injectable formulations with improved tolerability further supports adoption. Pharmaceutical companies maintain a robust pipeline of long-acting injectable antipsychotics targeted at schizophrenia. Despite emerging uses in other conditions, schizophrenia remains the foundational driver for LAI demand. This dominance is unlikely to diminish shortly.

The HIV/AIDS segment is expected to experience the fastest growth in the market during the forecast period. The shift from daily oral therapy to monthly or bimonthly injections represents a major advancement in patient convenience. Long-acting injectable injections improve adherence, reduce pill fatigue, and help mitigate stigma. Public health organizations view LAIs as a strategic tool for controlling HIV transmission. Clinical trials have demonstrated strong efficacy and patient satisfaction. These factors combine to drive rapid adoption.

Governments and NGOs are actively funding programs to expand access to long-acting injectable HIV treatments. Partnerships with community health centres are ensuring availability in both urban and rural areas. The potential for combination long-acting injectable therapies could further boost uptake. Patients are increasingly willing to switch from oral regimens once they understand the benefits. Pharmaceutical companies are prioritizing HIV/AIDS in their long-acting injectable pipelines due to the large and sustained market potential. This positions the segment as one of the most transformative in the long-acting injectable landscape.

Patient Group Insights

Why Adult Sector dominating the Long-Acting Injectables Market?

The adult segment has become a dominant force in the long-acting injectables (LAIs) market, due to the high prevalence of chronic diseases requiring long-term medication in the adult population. LAIs offer the convenience and adherence support that busy adults often need. Therapeutic areas like psychiatry, infectious disease, and hormone therapy see particularly strong adult uptake. Employers and insurers are also supportive of LAIs for their potential to improve productivity by reducing illness-related disruptions. The segment benefits from a large, stable demand base.

The geriatrics segment is expected to experience the fastest growth in the market for long-acting injectables (LAIs) during the forecast period, due to aging populations facing a higher burden of chronic diseases, making them prime candidates for adherence-focused therapies. LAIs reduce the complexity of medication schedules, which can be challenging for elderly patients managing multiple prescriptions. Caregivers and healthcare providers value the reduced monitoring burden associated with less frequent dosing. The segment is also benefiting from targeted pharmaceutical development for age-related conditions. This creates a strong clinical and commercial growth trajectory.

Distribution Channel Insights

Why Are Hospital Pharmacies Dominating the Long-Acting Injectables (LAIs) Market?

The hospital pharmacies segment has become a dominant force in the market, as it benefits from advancements in biotechnology and a rising focus on antimicrobial resistance. Lysozymes are increasingly incorporated into topical creams, wound dressings, and medical devices to prevent infections. Their natural antimicrobial action, coupled with low toxicity, makes them ideal for sensitive applications in hospitals and clinics.

The online pharmacies segment is expected to experience the fastest growth in the market during the forecast period, due to their central role in administering complex injectables, making them the primary distribution point for many therapies. Hospital settings provide the trained personnel and infrastructure necessary for safe LAI delivery. The ability to coordinate patient follow-up within the same facility enhances treatment adherence. Hospital pharmacies also handle cold-chain management, essential for many LAI formulations. This integration of clinical and logistical capabilities secures their market leadership.

Long-Acting Injectables (LAIs) Market Companies

- Johnson & Johnson (Janssen Pharmaceuticals)

- Pfizer Inc.

- Eli Lilly and Company

- Teva Pharmaceutical Industries Ltd.

- AstraZeneca PLC

- Novartis AG

- Alkermes plc

- Sanofi S.A.

- ViiV Healthcare

- GSK plc

- AbbVie Inc.

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

- Bayer AG

- Gilead Sciences, Inc.

- Sun Pharmaceutical Industries Ltd.

- Lupin Limited

- Dr. Reddy's Laboratories Ltd.

- Cipla Ltd.

- Viatris Inc.

Recent Developments

- In July 2025, GSK plc announced that ViiV Healthcare, a global specialist HIV company majority-owned by GSK, with Pfizer and Shionogi as shareholders, will present abstracts from its innovative HIV treatment and prevention portfolio at the International AIDS Society (IAS) 2025 Conference in Kigali, Rwanda. The presentations will showcase key data on the long-term effectiveness of Vocabria & Rekambys (marketed as Cabenuva in the US, Canada, and Australia), the company's complete long-acting injectable regimen for HIV treatment. The data will also explore patient preferences for long-acting injectables over daily oral therapy and highlight the benefits these injectables offer in overcoming common challenges associated with daily pills, such as stigma and adherence issues.

(Source: https://www.pharmabiz.com)

Segments Covered in the Report

By Drug Type

- Antipsychotics

- First-Generation (Typical) Antipsychotics

- Second-Generation (Atypical) Antipsychotics

- Hormonal Agents

- Contraceptives

- Hormone Replacement Therapy (HRT) Agents

- Anti-Infectives

- Antiretrovirals (ARVs)

- Antibiotics

- Antifungals

- Pain Management Drugs

- Opioid-Based Formulations

- Non-Opioid Analgesics

- Others

- Anti-addiction Drugs

- Immunomodulators

- Oncology Agents

By Delivery Technology

- Microsphere-Based Systems

- Liposome-Based Systems

- Polymer-Based Depots

- In-Situ Forming Gels

- nanoparticle-based systems

- Others (e.g., crystalline suspensions, oil-based depots)

By Route of Administration

- Intramuscular (IM)

- Subcutaneous (SC)

- Intradermal (ID)

- Others (e.g., intra-articular, intravitreal)

By Indication

- Schizophrenia

- Bipolar Disorder

- Major Depressive Disorder (MDD)

- Contraception

- Hormone Deficiency Disorders

- HIV/AIDS

- Pain Management

- Oncology

- Others (e.g., opioid addiction, chronic inflammatory diseases)

By Patient Group

- Adults

- Pediatrics

- Geriatrics

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others (e.g., specialty clinics)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting