What is the Motor Lamination Market Size?

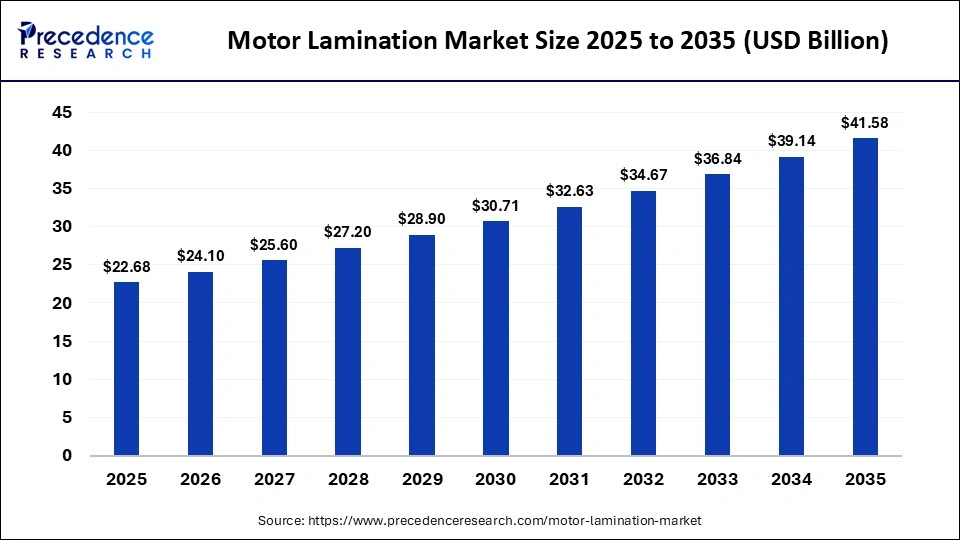

The global motor lamination market size accounted for USD 22.68 billion in 2025 and is predicted to increase from USD 24.10 billion in 2026 to approximately USD 41.58 billion by 2035, expanding at a CAGR of 6.25% from 2026 to 2035. This market is growing due to rising demand for energy-efficient electric motors across electric vehicles, industrial automation, and renewable energy applications.

Market Highlights

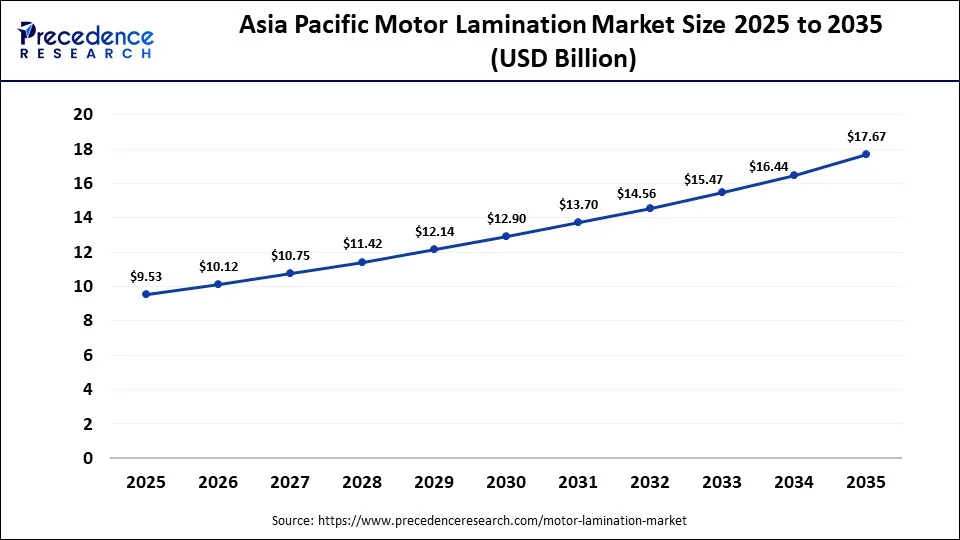

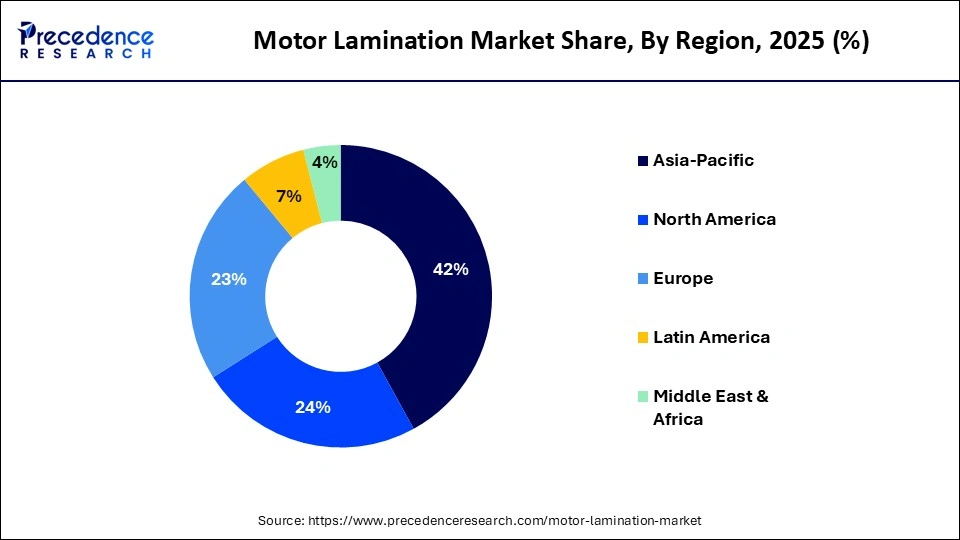

- Asia Pacific dominated the global market with a major revenue share of approximately 42% in 2025.

- Latin America is expected to grow at the fastest CAGR between 2026 and 2035.

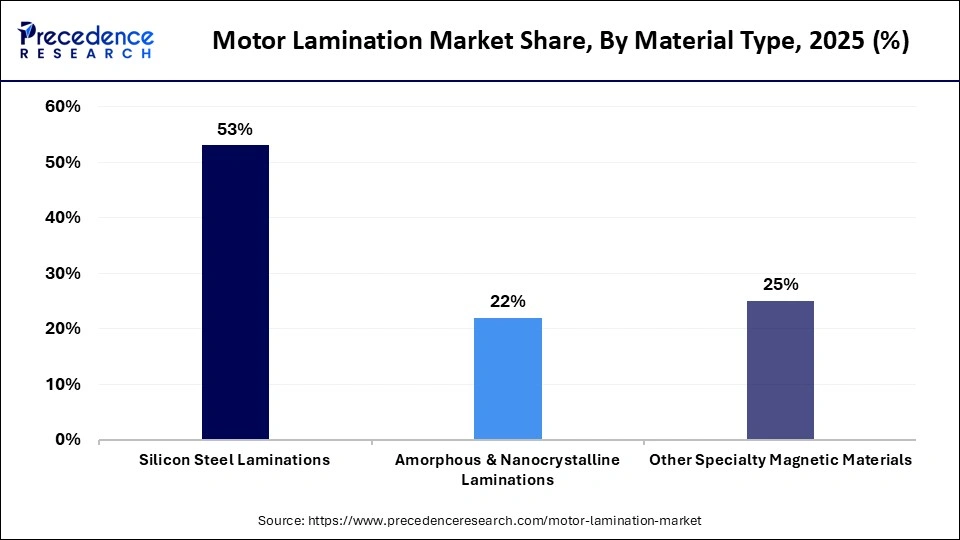

- By material type, the silicon steel lamination segment generated the biggest market share of approximately 53% in 2025.

- By material type, the amorphous & nanocrystalline laminations segment is expanding at the fastest CAGR between 2026 and 2035.

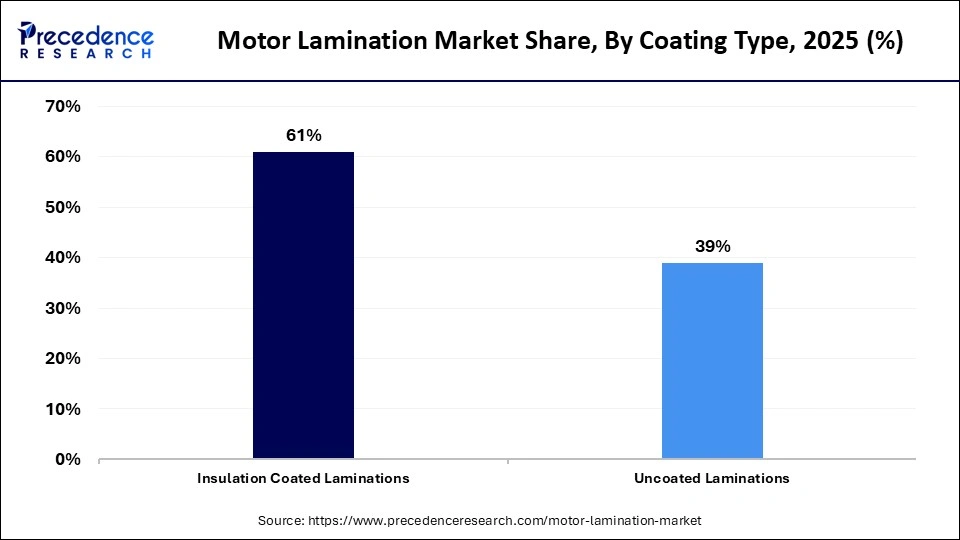

- By coating type, the insulation-coated lamination segment contributed the highest market share of approximately 61% in 2025.

- By coating type, the uncoated laminations segment is growing at a strong CAGR between 2026 and 2035.

- By motor type application, the industrial motors segment held a major market share of approximately 41% in 2025.

- By motor type application, the automotive traction motors segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By end-use industry, the automotive segment generated the biggest market share of approximately 31% in 2025.

- By end-use industry, the industrial machinery segment is expanding at the fastest CAGR between 2026 and 2035.

Market Overview

The global motor lamination market includes thin, precision-cut steel sheets (laminations) used to build stator and rotor cores in electric motors and generators to reduce eddy current losses and improve energy efficiency. Motor laminations are critical in industrial motors, automotive traction motors, HVAC systems, appliances, and renewable energy generators. The market is witnessing steady growth, driven by the growing use of energy-efficient motors in HVAC systems, industrial equipment, electric cars, and renewable energy applications.

The demand for premium electric steel laminations has been increasing due to a growing global emphasis on lowering energy losses and increasing motor efficiency. Further propelling market expansion are growing manufacturing operations, quick industrial automation, and encouraging government policies that encourage energy efficiency. Better performance, durability, and cost effectiveness are also made possible by technological developments in materials and precision manufacturing techniques, which are improving the motor lamination market's overall prospects.

How is AI Transforming the Motor Lamination Market?

Artificial intelligence is playing a crucial role in transforming the motor lamination market by maximizing design precision, cutting down on material waste, and boosting production effectiveness. While machine learning based quality inspection guarantees real-time defect detection, AI-driven simulations assist manufacturers in creating laminations with reduced core losses and enhanced magnetic performance. Furthermore, AI-enabled predictive maintenance in production lines reduces downtime and increases throughput, which eventually supports lower costs and quicker scalability across high-volume motor applications like industrial automation and electric vehicles.

Major Market Trends

- Growing adoption of high-grade electrical steel to reduce core losses and improve motor efficiency.

- Rising demand for motor laminations from electric vehicles and hybrid mobility solutions.

- Increased use of thin-gauge laminations to enhance performance in high-speed motors.

- Integration of AI and automation in lamination manufacturing for precision and quality control.

- Shift toward sustainable and recyclable materials in response to environmental regulations.

- Expansion of industrial automation and robotics is boosting demand for efficient motors.

- Technological advancements in stamping and laser-cutting processes for complex motor designs.

Future Market Outlook

- Rising production of electric vehicles worldwide is expected to create long-term demand for advanced motor laminations.

- Growing investments in renewable energy projects are expected to increase demand for efficient generators and motors.

- Rising focus on energy-efficient appliances is opening new application areas for motor laminations.

- Emerging markets offer opportunities due to rapid industrialization and infrastructure growth.

- Development of lightweight and high-performance lamination materials to improve motor power density is likely to open new opportunities.

- Increasing adoption of smart factories is enabling demand for AI-optimized motor components.

- Strategic collaborations between material suppliers and motor manufacturers to drive innovation and cost optimization.

Government Initiatives Supporting the Motor Lamination Market

Government initiatives are playing a key role in driving the motor lamination market by promoting electric vehicles, industrial modernization, and energy efficiency. Policies supporting EV adoption, such as incentives for vehicle production and charging infrastructure, are increasing demand for high-efficiency motors and advanced laminations. In addition, energy-efficiency regulations for industrial motors are encouraging manufacturers to adopt low-loss lamination materials, while investments in smart manufacturing, renewable energy, and domestic production are further accelerating market growth across automotive and industrial sectors.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 22.68 Billion |

| Market Size in 2026 | USD 24.10 Billion |

| Market Size by 2035 | USD 41.58 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.25% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Latin America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material Type, Coating Type, Motor Type Application, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Material Type Insights

What made silicon steel laminations the dominant segment in the motor lamination market?

The silicon steel laminations segment dominated the market with the largest share of 53% in 2025. This is because of their crucial role in minimizing energy losses while maintaining dependable performance. They are widely used in industrial and automotive motors due to their superior magnetic qualities, affordability, and widespread availability. The dominance of the segment is further reinforced by their well-established manufacturing ecosystem and suitability for large-scale motor production. Furthermore, ongoing advancements in silicon steel grades, both grain-oriented and non-grain-oriented, have improved durability and efficiency, supporting widespread use.

The amorphous and nanocrystalline laminations segment is expected to grow at the fastest CAGR in the coming years, driven by a growing need for motors with extremely high efficiency. These materials are perfect for high-performance industrial applications, renewable energy systems, and electric vehicles because they have substantially lower core losses than traditional steel. The adoption of energy efficiency standards is accelerating due to increased attention. Furthermore, improvements in production methods are progressively lowering expenses, facilitating wider commercialization.

Coating Type Insights

Why did the insulation coated laminations segment dominate the motor lamination market?

The insulation coated laminations segment dominated the market while holding the highest share of 61% in 2025, as coatings improve electric insulation between laminations and reduce eddy current losses. In high-speed, high-efficiency motors, especially those used in industrial and automotive applications, these laminations are frequently chosen. Their leading position in the market is reinforced by their capacity to enhance durability and thermal performance. The demand for coated laminations has also increased because of the increased regulatory focus on motor efficiency.

The uncoated laminations segment is expected to grow at the fastest CAGR in the coming years because of their cost-effectiveness and easy manufacturing. For motors with low to medium efficiency, uncoated laminations are appealing due to their simpler manufacturing procedures and reduced production costs. The adoption of uncoated laminations is being aided by growing industrialization. Segment expansion is also driven by the growing need for basic motors in applications related to agriculture and infrastructure.

Motor Type Application Insights

Why did the industrial motors segment dominate the motor lamination market?

The industrial motors segment dominated the market in 2025 because industrial motors are widely used in automation, HVAC, power generation, and manufacturing systems. Strong demand for long-lasting and effective motor laminations was maintained by ongoing operating requirements and growing investments in industrial infrastructure. Their large-scale applications drive consistent demand for both coated and uncoated laminations. Additionally, ongoing industrialization and infrastructure development globally continue to support the dominance of this segment.

The automotive traction motors segment is expected to grow at the fastest CAGR in the coming years, fueled by the rising development of hybrid and electric cars, which rely heavily on high-efficiency traction motors. Increasing government incentives, stricter emission regulations, and consumer demand for sustainable transportation are driving this growth. Additionally, advancements in lightweight and high-performance laminations are enabling manufacturers to improve motor efficiency, further boosting market expansion in the automotive sector.

End-Use Industry Insights

Why did the automotive segment dominate the motor lamination market?

The automotive segment dominated the market by holding a 31% share in 2025, backed by extensive manufacturing of both electric and conventional automobiles. The industry is greatly focusing on developing electric and hybrid models, which require a large number of high-performance motor laminations to enhance efficiency and reduce energy losses. Strong demand from automakers worldwide, supported by government incentives for cleaner transportation, drives consistent consumption of both coated and uncoated laminations. Additionally, ongoing innovations in lightweight and high-efficiency motors for the automotive sector further reinforce this segment's market dominance.

The industrial machinery segment is expected to grow at the fastest CAGR in the coming years, driven by increasing demand for efficient and reliable motors in manufacturing, processing, and automation equipment. Expansion of industrialization and infrastructure projects in developing regions is boosting the need for motors in heavy machinery. The adoption of energy-efficient and high-performance laminations to reduce power losses is driving growth in this segment. Furthermore, Industry 4.0 programs are hastening the installation of cutting-edge motors throughout manufacturing facilities.

Regional Insights

What is the Asia Pacific Motor Lamination Market Size?

The Asia Pacific motor lamination market size is expected to be worth USD 17.67 billion by 2035, increasing from USD 9.53 billion by 2025, growing at a CAGR of 6.37% from 2026 to 2035.

Why did Asia Pacific dominate the motor lamination market?

Asia Pacific dominated the market by capturing a 42% share in 2025. This is mainly due to its strong manufacturing base and large-scale production of motors across industries such as automotive, industrial machinery, consumer appliances, and electronics. Rapid industrialization, urbanization, and infrastructure development in countries like China, India, Japan, and South Korea have driven sustained demand for electric motors and related components. Additionally, the region benefits from cost-effective manufacturing, abundant raw materials, and growing adoption of electric vehicles, further reinforcing its market leadership.

India Motor Lamination Market Trends

India's motor lamination market is witnessing steady growth, propelled by the nation's growing manufacturing sector, increasing use of electric vehicles, and quick industrialization. The demand for energy-efficient motors in the automotive, industrial machinery, and power sectors is rising due to government programs like Make in India and significant investments in infrastructure and renewable energy. Sustained market expansion is also supported by the rise in domestic motor manufacturers and the growing emphasis on lowering energy losses.

How is the opportunistic rise of Latin America in the motor lamination market?

Latin America is expected to grow at the fastest CAGR in the coming years, driven by growing investments in energy-efficient technologies, a growing industrial base, and an increase in automobile production. Growing investments in electric mobility, renewable energy, and industrial automation are boosting demand for efficient electric motors and motor laminations. In addition, favorable government policies, lower manufacturing costs, and rising foreign direct investment are creating new growth opportunities, positioning Latin America as an emerging and attractive market for motor lamination manufacturers.

Mexico Motor Lamination Market Trends

The market in Mexico is growing due to rising automobile manufacturing and increasing industrial automation. The country's strong position as a key automotive production hub, supported by international trade agreements and foreign investments, is driving demand for motor laminations used in traction motors and industrial machinery. Additionally, the modernization of industrial facilities and the growing adoption of energy-efficient motor technologies are further boosting market growth.

Who are the Major Players in the Global Motor Lamination Market?

The major players in the motor lamination market include EuroGroup Laminations, Feintool, Tempel Steel, Pitti Engineering, R. Bourgeois, LCS Company, Kumar Precision Stampings, Sitem Group, Godrej & Boyce, Precision Micro Ltd, Thyssenkrupp Steel, Nippon Steel Corporation, ArcelorMittal, POSCO, Worthington Steel, and United States Steel Corporation.

Recent Developments

- On January 30, 2025, thyssenkrupp Steel commissioned a new high-tech annealing and insulating line in Bochum. This facility can produce ultra-thin electrical steel sheets as thin as 0.2 mm with an annual capacity of 200,000 metric tons. (Source: https://www.wiretradefair.com)

- In June 2025, thyssenkrupp Steel announced the launch of its Bluemint Powercore innovations at the CWIEME trade fair. This new range features grain-oriented electrical steel and high-efficiency thin sheets designed for sustainable energy and electric mobility. The company highlighted its commitment to CO2-reduced production and advanced electrical steel solutions from its Bochum facility.(Source: https://www.thyssenkrupp-steel.com)

Segments Covered in the Report

By Material Type

- Silicon Steel Laminations

- Non-oriented electrical steel (NOES)

- Grain-oriented electrical steel (GOES)

- Amorphous & Nanocrystalline Laminations

- Other Specialty Magnetic Materials

By Coating Type

- Insulation Coated Laminations

- Uncoated Laminations

By Motor Type Application

- Industrial Motors

- Automotive Traction Motors

- HVAC & Air Compressors

- Appliances & Consumer Motors

- Renewable Energy Generators (Wind, etc.)

- Other Motor Types

By End-Use Industry

- Automotive

- Industrial Machinery

- Consumer Appliances

- Energy & Power Generation

- Construction & Infrastructure

- Other End-Uses

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting