What is the Organic Peroxide Market Size?

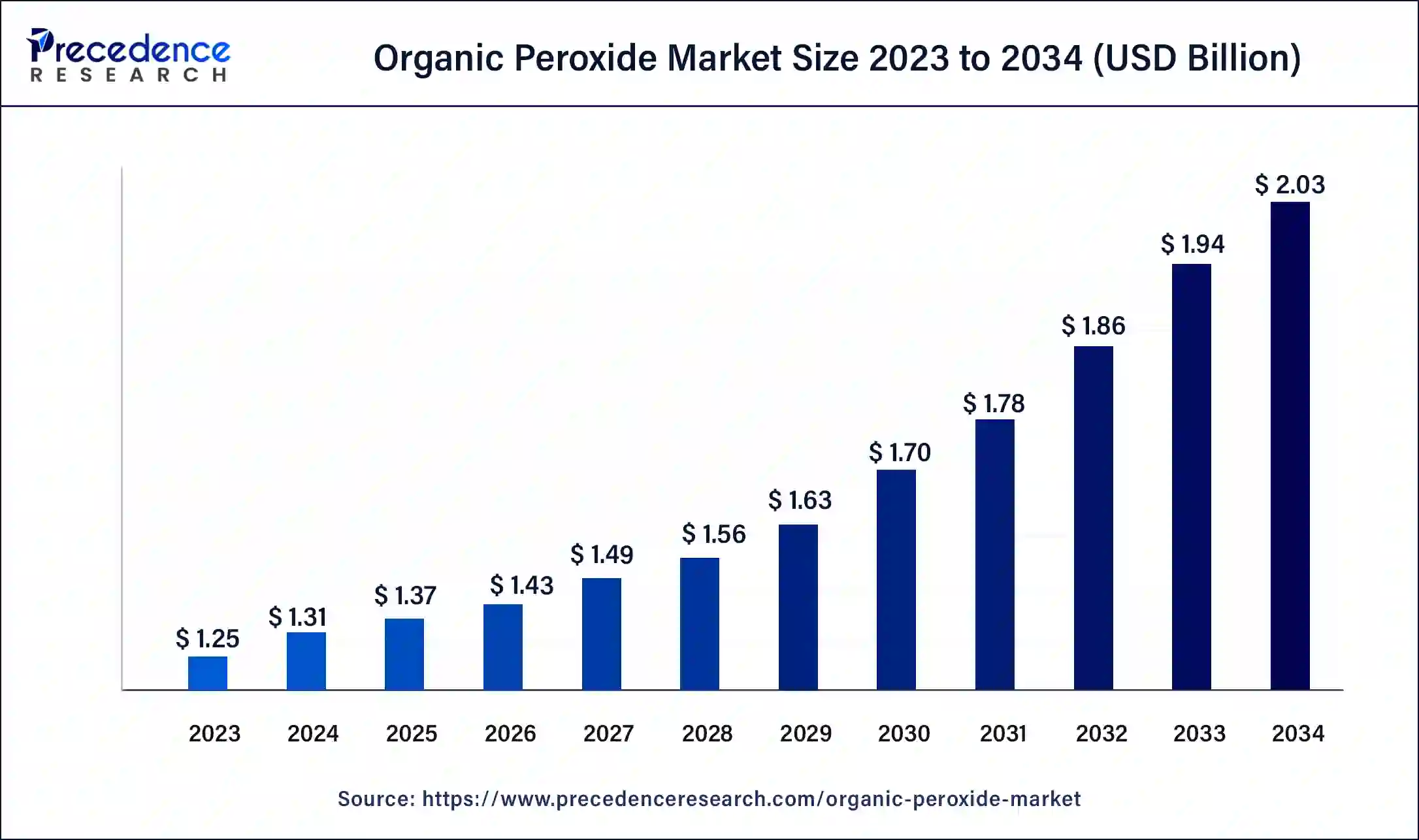

The global organic peroxide market size accounted for USD 1.37 billion in 2025 and is predicted to increase from USD 1.43 billion in 2026 to approximately USD 2.11 billion by 2035, expanding at a CAGR of 4.41% from 2026 to 2035.

Market Highlights

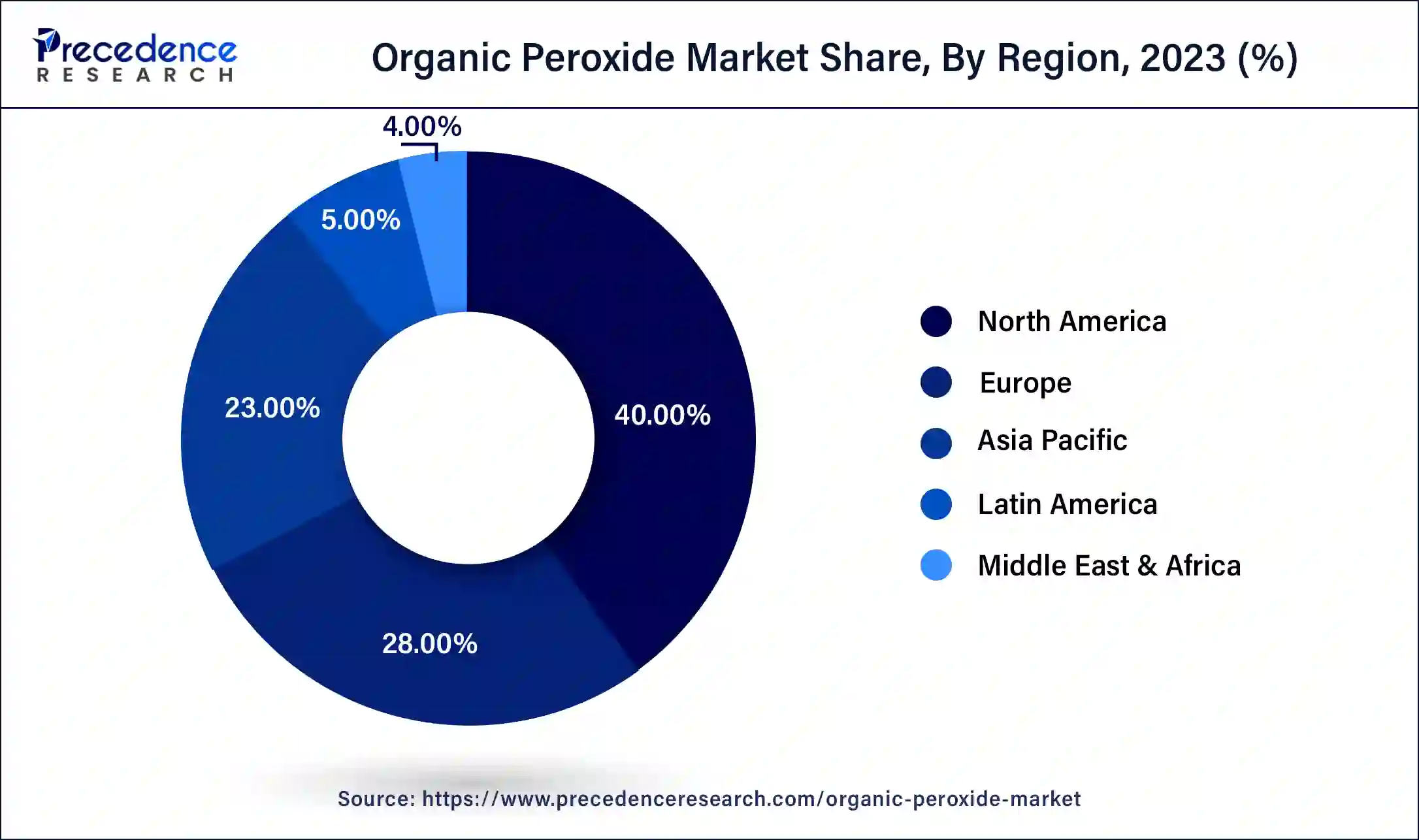

- North America dominated the organic peroxide market with a 40% share in 2025.

- Asia-Pacific is expected to witness growth at a CAGR of 7.8% during the forecast period.

- By product, the diacetyl peroxide segment held the largest share of 41% in the market in 2025.

- By product, the ketone peroxide segment is expected to grow at a significant rate of 6.7% during the forecast period.

- By application, the paper and textiles segment held the largest share of 36% in the market.

- By application, the polymer segment is expected to grow at a notable rate of 7.3% during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 1.37 Billion

- Market Size in 2026: USD 1.43 Billion

- Forecasted Market Size by 20354: USD 2.11 Billion

- CAGR (2026 to 2035): 4.41%

- Largest Market in 2025: North America

- Fastest Growing Market: Asia Pacific

What is Organic Peroxide?

Organic peroxides are chemicals characterized by the presence of the peroxide functional group (-O-O-), and they find applications in a wide range of industries, primarily serving as initiators for polymerization reactions in the production of plastics, rubbers, resins, and other polymer-based materials. Organic peroxide market offers materials that are utilized in the manufacturing of adhesives and sealants. As construction and automotive industries grow, there is an increased demand for adhesives and sealants, further driving the demand for organic peroxides.

The continual growth of the plastics and rubber industries, driven by consumer goods, packaging, and automotive sectors, contributes significantly to the demand for organic peroxides for cross-linking and curing purposes. They are used in the bleaching process in the pulp and paper industry. Growth in this industry, driven by factors such as increased demand for packaging materials, can contribute to the demand for organic peroxides. Ongoing research and development efforts in the field of chemistry may lead to the discovery of new applications for organic peroxides, expanding their market potential.

How is AI contributing to the Organic Peroxide Industry?

The use of artificial intelligence in the production of organic peroxides is extensive. In fact, it is applied in several ways, such as health and safety monitoring, process control, research in molecular chemistry, and even automating practices. AI is also able to cleanse the environment, minimize waste, use less energy, and keep the quality of the product steady through real-time data-driven control systems.

Organic Peroxide Market Data and Statistics

- In July 2022, United Initiators achieved a significant milestone by completing its new TBHP-TBA facility with an annual capacity of 25 ktons in Huaibei, Anhui Province, China. This marks the company's initial venture into downstream organic peroxides production, reinforcing its product portfolio and expanding its presence through strategic expansion efforts.

- In 2020, synthetic rubber production in China saw a modest increase of 0.99%, reaching 7,513.2 kilo metric tons compared to the 7,439.6 kilo metric tons produced in 2019. The upward trend continued in 2021, with China's synthetic rubber production reaching 8,117 kilo metric tons, marking a significant growth of 9.1% compared to the previous year. According to the China Rubber Industry Association, the country imported a total of 775 kilo metric tons of synthetic rubber from January to August 2021, representing a notable increase of 10% compared to the same period in 2020. Furthermore, in the first eight months of 2021, China exported approximately 190 kilo metric tons of synthetic rubber, reflecting a substantial surge of 89% compared to the corresponding period in 2020. These production and trade figures underscore the dynamic nature of the synthetic rubber industry in China.

What are the Growth Factors in the Organic Peroxide Market?

- Organic peroxides are vital in the production of composite materials, especially in industries such as aerospace and automotive. The demand for lightweight and durable composite materials contributes to the growth of the organic peroxide market.

- Organic peroxides are utilized in the bleaching process in the pulp and paper industry. The growing demand for paper and packaging materials globally contributes to the increased use of organic peroxides.

- Organic peroxides find applications in the pharmaceutical and cosmetic industries. The growth of these industries, along with increasing consumer demand for related products, contributes to the organic peroxide market's expansion.

Trade Analysis of Organic Peroxide Market

- The overall global import volume amounted to 1,676 total shipments between July 2024 and June 2025 (TTM), representing approximately 50% growth, composed of 343 export suppliers and 390 buyers.

- During July 2025, the whole import input was registered with a significant year-on-year growth of % when compared to July 2024.

- The major countries of suppliers throughout the world were China, Italy, and Ukraine.

- On the other hand, the leading countries of the world in terms of imports were Vietnam, India, and the United States.

- Vietnam took the first place with a total of 2,223 shipments, followed by India with 255 and the United States with 227 shipments.

Organic Peroxide Market Outlook

- Industry Growth Overview: The organic peroxide market will continue to expand steadily between 2025 and 2030, as there is a growing need for organic peroxides to supply the plastics, composite, and rubber processing sectors. This increase in demand has been fueled by the extensive use of organic peroxides in the construction, automotive, and electronics industries throughout Asia-Pacific and North America.

- Sustainability Trends: With manufacturers moving to safer and cleaner peroxide formulations, manufacturers are focusing on developing eco-friendlier synthetic curing agents and producing green or sustainable synthetic intermediates to comply with the growing international regulations regarding workplace and environmental health and safety.

- Global Expansion: The primary players in the organic peroxide market are aggressively expanding into the Southeast Asian, Eastern Europe, and LATAM regions to be close to polymer manufacturing facilities. In addition to this, capital investments to increase capacity in the Asia-Pacific region will support the growth of plastics and composites in this area.

- Major Investors: Big private equity and strategic investors have realized that investing in the organic peroxide market can produce very good profits because of regulations protecting companies from producing at a certain cost. There have been many new investments made recently in high-performance organic peroxide for specialty polymer production and advanced composites fabrication.

- Startup Ecosystem: With the growth of the startup landscape, more entrepreneurs are creating companies that provide new alternative and safe processed organic peroxide formulations, with sustainable methods of production and via digitalized process control.

Market Scope

| Report Coverage | Details |

| Global Market Size in 2025 | USD 1.37 Billion |

| Global Market Size in 2026 | USD 1.43 Billion |

| Global Market Size by 2035 | USD 2.11 Billion |

| Global Market Growth Rate from 2026 to 2035 | CAGR of 4.41% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing manufacturing of synthetic rubber and elastomers

The increasing manufacturing of synthetic rubber and elastomers serves as a significant catalyst for the expansion of the organic peroxide market.

- According to The International Rubber Study Group (IRSG), global natural rubber production witnessed a notable rise of 5.4%, escalating from 13.065 million tons in 2020 to 13.770 million tons in 2021.

- Similarly, data from the National Bureau of Statistics China reveals that tire production surged by 22.1%, reaching 596.04 million units from January to August 2021 compared to the previous year.

The demand for organic peroxides is closely tied to the growth of the plastics and rubber industries. These chemicals are crucial for cross-linking and curing processes in the production of plastic and rubber products. This surge in rubber and thermoplastics manufacturing, where organic peroxides are utilized, is anticipated to propel the revenue growth of the organic peroxide market.

Restraint

Safety concerns

The safety concerns associated with organic peroxides, stemming from their highly reactive nature, constitute a significant restraint for the global organic peroxide market. These safety challenges manifest during manufacturing, transportation, and usage, presenting risks of fire, explosions, and the release of hazardous byproducts. Factors contributing to safety concerns include the chemical reactivity, thermal instability, handling complexities, and transportation risks associated with organic peroxides. Mitigation strategies involve rigorous process design, employee training, compliance with regulations, and the development of emergency response plans to ensure safe production, storage, and transportation of these chemicals. Despite their critical role in industrial processes, the need for comprehensive safety measures underscores the potential risks associated with organic peroxides.

Opportunity

Innovative greenfield development

Establishing an innovative Greenfield project for the production of environment-friendly organic peroxides is a key driver of opportunities in the organic peroxide market.

- In December 2021, Nouryon has commenced full-scale production at its cutting-edge organic peroxide greenfield facility in Tianjin, China, in response to the increasing demand from Packaging, Paints and Coatings, and Construction consumers in the region. The site comprises three manufacturing facilities that are outfitted with state-of-the-art safety, energy efficiency, and environmental protection technologies.

This entails incorporating green chemistry principles, utilizing renewable feedstocks, implementing energy-efficient production methods, minimizing waste, prioritizing advanced safety measures, collaborating with environmental agencies, innovating in packaging, and positioning the project as a sustainable supplier. The focus is on creating a state-of-the-art facility that not only meets current market demands for organic peroxides but also aligns with sustainability goals and positions the project as a leader in environmentally responsible chemical production.

Segments Insights

Product Insights

The diacetyl peroxide segment held the dominating share of 41%. The escalating need for hardened polymers in the construction and manufacturing sectors, coupled with a growing demand for resins to enhance flooring solutions, is anticipated to be a pivotal factor influencing the market for diacetyl peroxide in the projected period. platforms, reflecting a commitment to driving the overall improvement of sequencing technologies in genomics research and diagnostics.

The ketone peroxide segment is anticipated to be the fastest-growing segment at a CAGR of 6.7% during the forecast period. This upsurge is attributed to the increasing demand for plastic-reinforced glass, commonly known as fiberglass. This heightened demand is particularly driven by the production of watercraft in marine parts, substituting traditional wood and steel structures, and the rising demand for automobiles in emerging economies. The aviation sector's robust growth, fueled by an increasing demand for cost-effective air travel, is expected to boost the need for high-end fiberglass, thereby amplifying the consumption of ketone peroxide in various crosslinking applications.

Application Insights

The paper and textiles segment emerged as the leader in terms of market share while holding a market share of 36% in 2024. The rising demand for ready-made clothing, driven by the preferences of the emerging middle-class population for trends like western fashion, designer apparel, and brand choices, is expected to significantly boost the need for organic peroxides in the coming eight years. Additionally, the ongoing remodeling of interior architecture for enhanced and creative decoration purposes is anticipated to contribute to the increased demand in the carpet and curtain industry, thereby further amplifying the overall requirement for the mentioned products in the future.

The polymer segment is expected to witness the fastest rate of 7.3% in the organic peroxide market during the forecast period. The escalating demand for robust plastics, including polyvinyl chloride, thermosetting plastics, and plastic-reinforced glasses, driven by the increasing needs in residential construction and profile applications, is projected to result in heightened production rates. This surge in production is expected to drive the demand for the market significantly over the next eight years. Additionally, the paper and pulp segment is anticipated to be the third-largest application segment, propelled by the adoption of smart packaging materials, which is expected to experience growth.

Regional Insights

What is the U.S. Organic Peroxide Market Size?

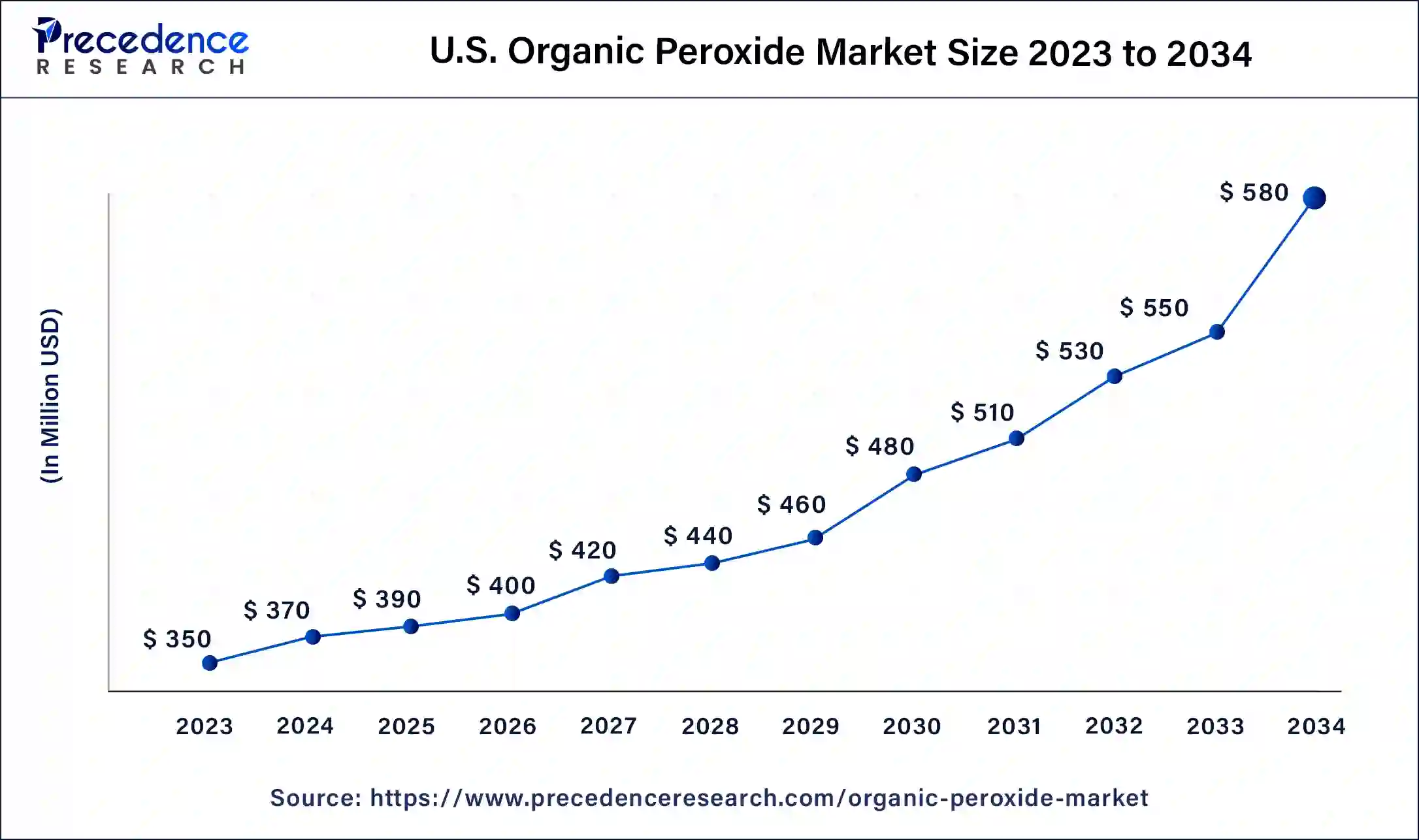

The U.S. organic peroxide market size is estimated at USD 390 million in 2025 and is predicted to be worth around USD 603 million by 2035, at a CAGR of 4.45% from 2026 to 2035.

North America, in 2023 dominated the organic peroxide market while holding 40% of the market share, mainly driven by manufacturers' increasing focus on competitive regions with abundant raw materials and cost-effective labor. The rising investments in establishing new product lines, influenced by factors such as plastic type, manufacturing process, and application, are expected to fuel demand in this region as a catalyst. Notably, the Canadian organic peroxide market has secured the largest market share, with the US organic peroxide market emerging as the fastest-growing segment within the North American region.

Formosa Plastics Corporation is currently executing a Polyvinyl chloride (PVC) expansion project at its 513,000 metric tons per year unit in Baton Rouge, Louisiana. This expansion aims to augment the output by an additional 130,077 metric tons per year and is scheduled to be operational by the end of 2021. In July 2021, the company disclosed its substantial investment of USD 332 million to enhance polyvinyl chloride (PVC) production at the Baton Rouge site. However, due to the disruptions caused by the COVID-19 outbreak, the PVC expansion project has been deferred, and the new anticipated timeline for completion is in the fourth quarter of 2022. The increased utilization of polymers is expected to drive a substantial rise in the demand for organic peroxides, particularly in polymerization applications. This surge in consumption is anticipated to significantly contribute to the overall growth of the market.

The Asia-Pacific organic peroxide market is projected to witness the fastest CAGR of 7.8% during the forecast period. This growth is attributed to the rising production of synthetic rubber in the region. According to the National Bureau of Statistics in China, the country manufactured 807.47 million tires in 2020, slightly declining from the 844.45 million units produced in 2019. Notably, the Chinese organic peroxide market has secured the largest market share in the Asia-Pacific region, while the Indian organic peroxide market stands out as the fastest-growing market. These trends highlight the significant role of synthetic rubber production in propelling the organic peroxide market in the Asia-Pacific region.

Along with that, The Asia-Pacific region has emerged as one of the largest consumers of plastic products, representing over 42% of the global demand. This demand is projected to continue over the next eight years. The rise of China and India as key destinations for product manufacturing, combined with increased exports and domestic demand, is anticipated to further stimulate the usage of plastic products in the region during the projected period.

Tthe Europe organic peroxide market holds the second-largest market share, primarily attributed to the surge in construction activities in the region, which has bolstered the demand for paints and coatings. Notably, the German organic peroxide market has secured the largest market share within Europe, while the UK organic peroxide market stands out as the fastest-growing market in the region. These trends underscore the significance of the construction sector and the expanding demand for organic peroxides in the European market.

Why did Latin America grow at a steady rate in the Organic Peroxide Market?

Growth in Latin America was primarily driven by increasing levels of construction activity, as well as growth in both automotive manufacturing and plastic production. In addition, investments by Latin American countries for the upgrade of their industrial sectors led to the increased use of peroxide-based applications. The country continued to benefit from improvements made to trade routes and increased access to raw materials.

Brazil Organic Peroxide Market Trends

Brazil led the region due to the strong presence of manufacturing activities, with a major focus on construction materials, packaging, and automotive products, and benefited from the increased use of organic peroxides in plastics, composites, and rubber products through the expansion of its chemical industry. Increased levels of industrialization and government support for local production have created increased demand in Brazil.

Why did the Middle East and Africa grow at a steady rate in the Organic Peroxide Market?

The Middle East and Africa grew rapidly due to growth, including increasing use of construction equipment, increasing production of plastics and other industrial products, and other industrial activities. As the region develops new manufacturing facilities, the use of Peroxides will also be supported for making plasticized products, as well as for making fiberglass and other building materials.

As a result, as the region continues to develop its infrastructure and diversify its economy, many opportunities exist for the use of Peroxides in packaging, automotive components, and systems for use with renewable energy sources.

Saudi Arabia Organic Peroxide Market Trends

Due to its strong petrochemical industry and abundance of available plastic production capacity, Saudi Arabia leads this region of the world in terms of peroxide production. Investing in expanding Saudi Arabia's industrial base created an increased demand for Peroxides used for making polymer products, resulting in the creation of new uses for Peroxides in the construction and packaging industries.

Value Chain Analysis of the Organic Peroxide Market

- Feedstock Procurement: Finding and buying the raw materials that are used to make the organic peroxides.

Key players: ExxonMobil, Shell, SABIC, Sinopec - Chemical Synthesis and Processing: Carrying out chemical reactions, changing the raw materials into peroxide products of the company.

Key Players: Nouryon, United Initiators, Arkema, Kawaguchi Chemical - Compound Formulation and Blending: Mixing the synthesized materials exactly to get the needed performance characteristics.

Key players: Nouryon, United Initiators, Arkema - Quality Testing and Certification: Checking the products against safety, quality, and regulatory standards for compliance.

Key players: SGS, Bureau Veritas, Intertek, OSHA, REACH - Packaging and Labelling of Organic Peroxide: Providing necessary containers, labels, and safety information for storage and transportation.

Key players: Greif, Mauser Packaging Solutions

Organic Peroxide Market Companies

- Akzo Nobel N.V. (Netherlands): The company has no more specialty chemicals business, as all the operations are now under Nouryon, but it has always played a part in organic peroxides, while AkzoNobel keeps focusing on paints, coatings, and performance materials globally.

- Arkema S.A. (France): Develops organic peroxides and advanced materials supporting polymerization, crosslinking, and high-performance industrial applications worldwide.

- United Initiators (Germany): Produces high-purity organic peroxides for plastics, rubber, and specialty chemicals, emphasizing strong technical expertise.

Other Major Key Players

- Nouryon (Netherlands)

- NOF Corporation (Japan)

- Pergan GmbH (Germany)

- Lanzhou Auxiliary Agent Plant Co., Ltd. (China)

- Solvay SA (Belgium)

- Chinasun Specialty Products Co., Ltd. (China)

- Hansoo Chemical Co., Ltd. (South Korea)

- Shaoxing Shangyu Shaofeng Chem Co., Ltd. (China)

- Jiangsu Yuanyang Pharmaceutical Co., Ltd. (China)

- MEGA S.p.A. (Italy)

- Plasti Pigments Pvt. Ltd. (India)

- NOF Europe GmbH (Germany)

Recent Developments

- In October 2025, Arkema launched Luperox NeatCure, a new organic peroxide granule for faster, safer curing of elastomers and polymers. This innovation highlights responsible development, enhancing efficiency while supporting customers in achieving productivity and sustainability goals. (Source: https://www.arkema.com )

- In March 2025, Nouryon launched Eka HP Puroxide™, a low-carbon hydrogen peroxide product. This launch has become the first Nordic company to offer a sustainable solution for pulp and paper, mining, and water treatment industries. (Source: https://chemindigest.com )

- In October 2022, Arkema (France) expanded its partnership with Univar Solutions, Weber & Schaer, and Dolder for the distribution of its organic peroxides. Arkema intended to expand its business in the European plastics cross-linking and rubber markets, and meet customer needs globally.

- In October 2022, Arkema (France) declared that the company would reorganize the distribution of its Luperox and Retic organic peroxide, with Weber and Schaer, The Dolder firm, and Univar Solutions, for the crosslinking market in several European countries as of January 1st, 2023.

- In June 2020, Nouryon (Netherlands) completed the expansion of organic peroxide in Brazil. The expansion has doubled the capacity of the manufacturing facility.

Segments Covered in the Report

By Product

- Diacyl peroxide

- Ketone peroxide

- Percarbonates

- Dialkyl peroxide

- Hydro-peroxide

- Peroxy ketals

- Peroxyesters

By Application

- Polymer

- Chemicals & plastics

- Coatings, adhesives & elastomers

- Paper & textiles

- Detergents

- Personal care

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting