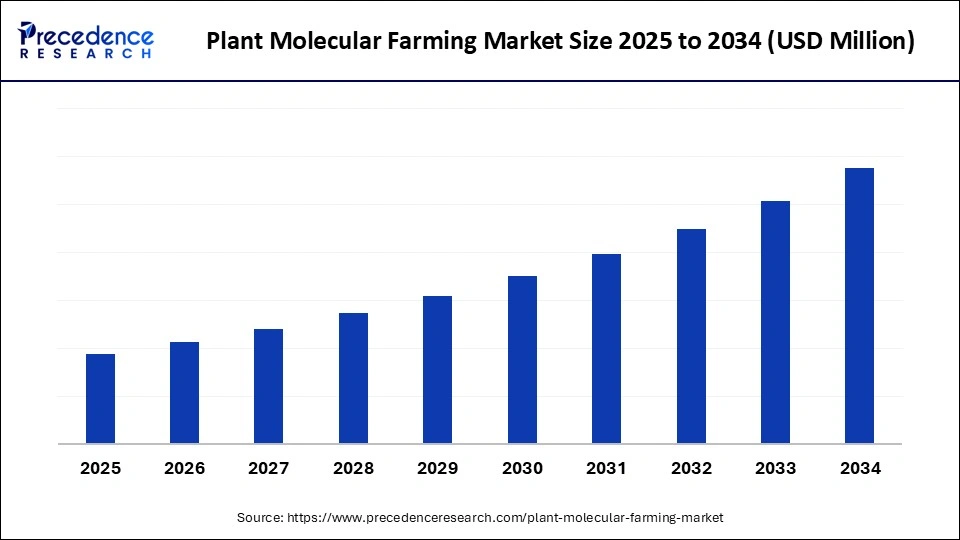

Plant Molecular Farming Market Size and Forecast 2025 to 2034

The plant molecular farming market is expanding as healthcare and agriculture sectors adopt plant-based expression systems for safer and faster drug development. The market is growing due to the rising demand for cost-effective, scalable, and safe production of recombinant proteins, vaccines, and therapeutic biologics using plant-based systems.

Plant Molecular Farming Market Key Takeaways

- North America dominated the molecular farming market with the largest market share of 35% in 2024.

- Asia Pacific is expected to grow at a notable CAGR during the forecast period.

- By product type, the therapeutic proteins segment held the biggest market share of 45% in 2024.

- By product type, the vaccines segment is expected to grow at the fastest rate during the forecast period.

- By plant type/expression, the tobacco-based systems segment captured the highest market share of 40% in 2024.

- By plant type/expression, the leafy crops segment is expected to grow at the fastest CAGR during the forecast period.

- By production method, the transient expression segment contributed the highest market share of 50% in 2024.

- By production method, the stable expression segment is emerging as the fastest-growing during the forecast period.

- By end user, the pharmaceutical and biotechnology companies segment generated the major market share of 55% in 2024.

- By end user, the contract development and manufacturing organization (CDMO) segment is expected to grow at the fastest rate during the forecast period.

Impact of AI on the Plant Molecular Farming Market

The plant molecular farming market is changing because of artificial intelligence (AI), which makes it possible to design, optimize, and produce plant-based proteins and medicines more quickly and efficiently. Genetic alterations that improve plant growth conditions, boost protein yield and stability, and lessen trial-and-error in R&D are found with the aid of AI tools. Plant molecular farming is now more economically feasible and sustainable thanks to this integration, which enables businesses to scale production effectively, reduce costs, and speed up the development of vaccines, therapeutic proteins, and other high-value biomolecules.

- In 2025, Finally Food launched. The CEO of Finally Foods stated that “Our AI-driven platform allows us to cultivate potatoes producing dairy proteins with high efficiency, marking a major step toward commercial plant-based dairy products.”(Source: https://www.greenqueen.com.hk)

Market Overview

The plant molecule farming market is being driven by the growing need for scalable and reasonably priced production of monoclonal antibodies, therapeutic proteins, and vaccines. To decrease their dependency on costly mammalian cell cultures and enhance safety by lowering the risk of contamination, biopharmaceutical companies are implementing plant-based systems. While increasing awareness of pandemic preparedness and the need for rapid vaccine production is speeding up market adoption, technological advancements like transient expression systems and CRISPR-based gene editing are improving yield and efficiency. Furthermore, encouraging regulatory environments and partnerships between academic institutions and biotech companies are speeding up the commercialization of biologics derived from plants.

Plant Molecular Farming Market Growth Factors

- Rising Demand for Biopharmaceuticals: Growing need for vaccines, therapeutic proteins, and monoclonal antibodies drives adoption of plant-based production.

- Advancements in Genetic Engineering: Innovations like CRISPR and transient expression systems improve yield, efficiency, and scalability.

- Cost-Effectiveness and Scalability: Plant systems reduce production costs and enable large-scale manufacturing compared to traditional cell cultures.

- Focus on Pandemic Preparedness: Rapid, flexible production of vaccines and therapeutics is boosting investment in plant molecular farming.

- Regulatory Support and Collaborations: Government support and partnerships with academic and industrial players accelerate commercialization.

- Sustainability and Safety: Plant-based systems lower contamination risks and offer eco-friendly, sustainable production.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Plant Type/Expression System, Plant Type/Expression System, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Biopharmaceuticals

Plant-based production systems are becoming more popular as the demand for monoclonal antibodies, therapeutic proteins, and vaccines rises. High-value biology for use in humans and animals can be produced more quickly and efficiently thanks to plant molecular farming. Complex proteins that are challenging to synthesize in mammalian or microbial cell cultures can also be produced using the platform innovation in biopharmaceuticals, and growing global healthcare demands are driving this demand even more. Furthermore, the demand for customized plant-based biologics is being driven by the rise in chronic disease prevalence and the movement toward personalized medicine. Businesses are also focusing on developing nations where access to reasonably priced biology is crucial.

Sustainability and Safety

Systems based on plants are safer for the environment, provide sustainable alternatives to animal-based production, and lower the risk of contamination. They decrease the amount of waste produced and do away with the need for growth media derived from animals. Furthermore, plants can be grown with little chemical input and renewable energy, which lessens the impact on the environment. Both regulatory and socially conscious consumers find this sustainability appealing, which encourages adoption even more. Ethical issues in the production of biopharmaceuticals are also addressed by the decreased dependence on animal cell lines. Global investors interested in ESG initiatives are drawn to plant molecular farming because of its long-term environmental advantages.

Restraints

Regulatory Challenges

Approval and commercialization of genetically modified plants and biologics derived from plants may be delayed by strict regulations. Complying with several regional regulatory frameworks lengthens development timelines and raises costs. Years may pass before comprehensive safety, efficacy, and environmental impact studies are required for approval procedures. Barriers to international exporting and scaling are also caused by differences in national regulations. Timelines for new product launches are slowed down, and small players may be deterred from joining the market.

High initial Investment

The substantial capital needed to set up greenhouse-controlled cultivation facilities and downstream processing units can be a deterrent for small and medium-sized businesses. The cost of sophisticated equipment for protein extraction, automated cultivation, and gene editing increases. Furthermore, operational costs are raised by the need to train knowledgeable staff to use plant molecular farming technologies. Especially in developing nations, the adoption of molecular farming may be constrained by these high upfront costs.

Opportunities

Expansion in Vaccine Production

Significant prospects for plant molecular farming are presented by the growing demand for vaccines worldwide, particularly for pandemic preparedness. When compared to traditional platforms, plant-based systems can produce vaccines more quickly and cheaply. Additionally, they can be quickly expanded through agricultural means, which makes them extremely flexible in times of medical crisis. This is especially helpful in low- and middle-income nations with limited access to conventional vaccine production facilities. Businesses can investigate developing rapid-response vaccines for zoonotic infections and emerging diseases.

Development of Therapeutic Proteins and Monoclonal Antibodies

Monoclonal antibodies and complex therapeutic proteins are produced through plant molecular farming. By guaranteeing scalability and affordability, this technology can lessen dependency on pricey mammalian cell bioreactors. It also creates opportunities for the development of bio-betters and biosimilars that can compete in the growing biologics market. There are chances to improve protein stability, lower production costs for biologics and treatments for chronic diseases, and replace expensive mammalian cell cultures.

Product Type Insights

Why did the therapeutic proteins segment dominate the plant molecular farming market in 2024?

The therapeutic proteins segment is dominating the plant molecular farming market since it constitutes a dependable, in-demand category that is frequently utilized in the treatment of chronic illnesses like diabetes, cancer, and autoimmune disorders. Plants lower the risk of human pathogen contamination and provide safer, more affordable, and scalable alternatives to conventional cell-based systems. Plant-based systems have an advantage because they can make complex proteins with the right folding and post-translational modifications. The market's need for therapeutic proteins is being further fueled by rising biopharma investment and regulatory backing.

The vaccines segment is the fastest-growing product type in the market, driven by rising global demand for affordable and rapidly scalable vaccine solutions. Plant-based systems enable quick response to emerging infectious diseases, including influenza, COVID-19, and zoonotic outbreaks, making them highly attractive for emergency preparedness. Their low-cost production and potential for oral or edible vaccines enhance accessibility, especially in developing regions. Increasing collaborations between biotech firms and public health organizations are accelerating vaccine development using molecular farming.

Plant Type/ Expression Insights

Why did the tobacco-based systems segment dominate the plant molecular farming market in 2024?

The tobacco-based systems segment dominates because of their short growth cycles, well-established genetic tools, and demonstrated effectiveness in producing large amounts of recombinant proteins. They are the most popular host for production on a commercial scale due to their ability to adapt to controlled environments. Strong technical expertise brought about by decades of research on tobacco-based platforms ensures that therapeutic proteins and vaccines are consistent and scalable. As a result, tobacco is now widely used as the foundation for plant molecular farming applications.

The leafy crops segment is expected to grow at the fastest rate in the market. Leafy crops such as lettuce and spinach are the fastest-growing segment, providing ingestible and safer platforms for therapeutic protein expression and direct vaccine delivery. These crops are becoming more popular because they can be eaten raw, which removes the need for labor-intensive purification processes and drastically lowers production costs. Additionally, the public accepts leafy greens more readily than tobacco-based systems, which supports wider applications in preventive healthcare. As interest in plant-based and oral vaccines grows, leafy crops are being highlighted as a viable substitute method.

Production Method Insights

Why did the transient expression segment dominate the plant molecular farming market?

The transient expression segment dominates because it enables rapid and high-level production of recombinant proteins without the need to create stable genetically modified plants. This method is especially valuable for producing vaccines and therapeutic proteins in response to urgent healthcare needs, such as pandemics. Its flexibility, speed, and ability to produce large volumes in a short time make it the preferred production approach. Pharmaceutical companies increasingly rely on transient expressions to accelerate R&D timelines and market readiness.

The stable expression segment is the fastest-growing production method. Incorporating target genes into the plant genome guarantees steady long-term protein production. Stable expression once developed offers benefits in scalability, cost efficiency, and continuous supply despite being slower to establish than transient approaches. Its uses are growing in the treatment of chronic illnesses and preventative healthcare, where sustained protein synthesis is essential. Stable expression techniques are being adopted at a rapid pace due to growing interest in repeatable, sustainable systems.

End User Insights

Why did pharmaceutical and biotechnology companies dominate the plant molecular farming market in 2024?

The pharmaceutical and biotechnology companies segment dominates the plant molecular farming market as they are primarily responsible for the development and marketing of vaccines and treatments based on plants. These businesses are using plant molecular farming as a disruptive production platform in response to mounting pressure to reduce expenses and spur innovation. They are at the forefront of commercialization because of their substantial R&D infrastructure, strong investment capacity, and regulatory expertise. Their dominance in this field is further reinforced by growing alliances with academic institutions and tech companies.

The contract development and manufacturing organization (CDMO) segment is the fastest-growing end user as biopharma companies increasingly outsource production to reduce costs and enhance flexibility. Plant-based molecular farming offers CDMOs a competitive edge by allowing cost-effective, large-scale production of proteins and vaccines. The growing demand for personalized medicines and small-batch biologics is also fueling CDMO adoption of plant-based systems. With limited in-house capabilities, many pharmaceutical firms are turning to CDMOs for specialized molecular farming expertise, driving their rapid growth.

Regional Insights

What made North America dominate the plant molecular farming market in 2024?

North America dominates the plant molecular farming market because of the presence of top molecular farming firms' robust government funding and sophisticated biotech infrastructure. The area has a well-established regulatory framework that promotes innovation while preserving the safety of products. North America is a leader in commercial adoption due to the high demand for innovative biologics, vaccines, and therapeutic proteins, as well as a highly qualified research ecosystem. Continuous partnerships between academia and business reinforce their supremacy.

Asia Pacific is the fastest-growing region in the market, driven by growing healthcare demands, government funding for biopharmaceutical research, and expanded spending on affordable biologic production techniques. Molecular farming is being actively adopted in the region to address the issue of vaccine and therapeutic affordability. Asia Pacific is a crucial region for future market expansion due to its expanding population, high incidence of infectious diseases, and quick development of biotech companies. Global players are finding it to be a significant location for innovation and outsourcing.

Value Chain Analysis

- Harvesting and Post-Harvest Handling

In plant molecular farming, harvesting must be precise to ensure maximum yield and protein integrity. Plants are typically harvested at specific growth stages when the target biomolecule concentration is highest. Post-harvest handling involves rapid cooling, proper storage, and careful transport to processing facilities to avoid protein degradation. Advanced handling techniques include aseptic harvesting, vacuum cooling, and immediate freezing or stabilization of plant biomass.

Key players: Medicago, Kentucky Bioprocessing, and Fraunhofer Institute for Molecular Biology.

- Distribution to Wholesalers and Retailers

Plant-derived proteins or biopharmaceuticals are packaged and sent to food product manufacturers, biotech firms, or wholesalers following extraction and purification. To ensure product stability during distribution, cold chain logistics are necessary. Businesses frequently offer integrated supply chain solutions that include just-in-time delivery, inventory control, and collaboration with formulation partners or contract manufacturers.

Key players: Bayer Crop Science, Ingredion, Medicago, Moolec Science.

- Export and Trade Compliance

Strict regulatory and trade compliance requirements apply to products derived from plant molecular farming, particularly genetically modified crops or medicines. Plant-derived protein exports require compliance with national GMO approvals, labeling laws, customs requirements, and biosafety regulations. By ensuring market access in areas like the US, Asia-Pacific, and the EU, compliance reduces trade and legal risks.

Key players: Moolec Science, Calyxt, Medicago, Kentucky Bioprocessing.

Plant Molecular Farming Market Companies

- Medicago Inc.

- Kentucky BioProcessing (KBP)

- Protalix Biotherapeutics

- Icon Genetics GmbH

- PlantForm Corporation

- iBio Inc.

- Ventria Bioscience

- Synthon Biopharmaceuticals

- Fraunhofer IME

- ORF Genetics

- Greenovation Biotech GmbH

- Leaf Expression Systems

- PhytoCellTech

- Biolex Therapeutics

- AgroGenesys

- Caliber Biotherapeutics

- Biocentury Plant Systems

- SemBioSys Genetics

- Explant Biotech

- PlantCell Systems

Recent Developments

- In October 2024, Moolec Science announced that it had received USDA approval for the first genetically engineered pea producing bovine myoglobin, paving the way for nutritional, plant-based ingredients that can improve iron content in food products.(Source: https://www.proteinproductiontechnology.com)

- In April 2024, Moolec Science launched a new patent granted in the United States for its SPC2 molecular farming platform using safflower, a milestone that secures exclusive rights until 2041 and solidifies its leadership in plant-based protein production.(Source: https://greenstocknews.com)

- In 2025, PoLoPo announced it had scaled from lab cultivation to field production of genetically engineered potatoes producing functional egg proteins, boosting its output capability to approximately three tons per harvest.(Source: https://www.proteinreport.org)

- In 2025, University of Queensland researchers unveiled a novel nanoparticle-based mRNA delivery method via plant roots, enabling transient gene expression without traditional breeding, an advancement that could significantly shorten crop development times.(Source: https://www.uq.edu.au)

Segments Covered in the Report

By Product Type

- Therapeutic Proteins

- Monoclonal Antibodies

- Cytokines and Interleukins

- Enzymes

- Vaccines

- Viral Vaccines

- Bacterial Vaccines

- Subunit Vaccines

- Industrial Enzymes

- Cellulases and Amylases

- Proteases and Lipases

- Nutraceuticals and Functional Foods

- Others

By Plant Type/Expression System

- Tobacco-based Systems

- Cereals (Rice, Maize, Barley)

- Legumes (Soybean, Pea)

- Leafy Crops (Spinach, Lettuce)

- Other Plant Systems

By Production Method

- Transient Expression

- Stable Expression

- Hairy Root Cultures

- Plant Cell Suspension Cultures

By End User

- Pharmaceutical and Biotechnology Companies

- Contract Development and Manufacturing Organizations (CDMOs)

- Research Institutes and Academic Centers

- Nutraceutical and Food Companies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting