What is the Plastic Contract Manufacturing Market Size?

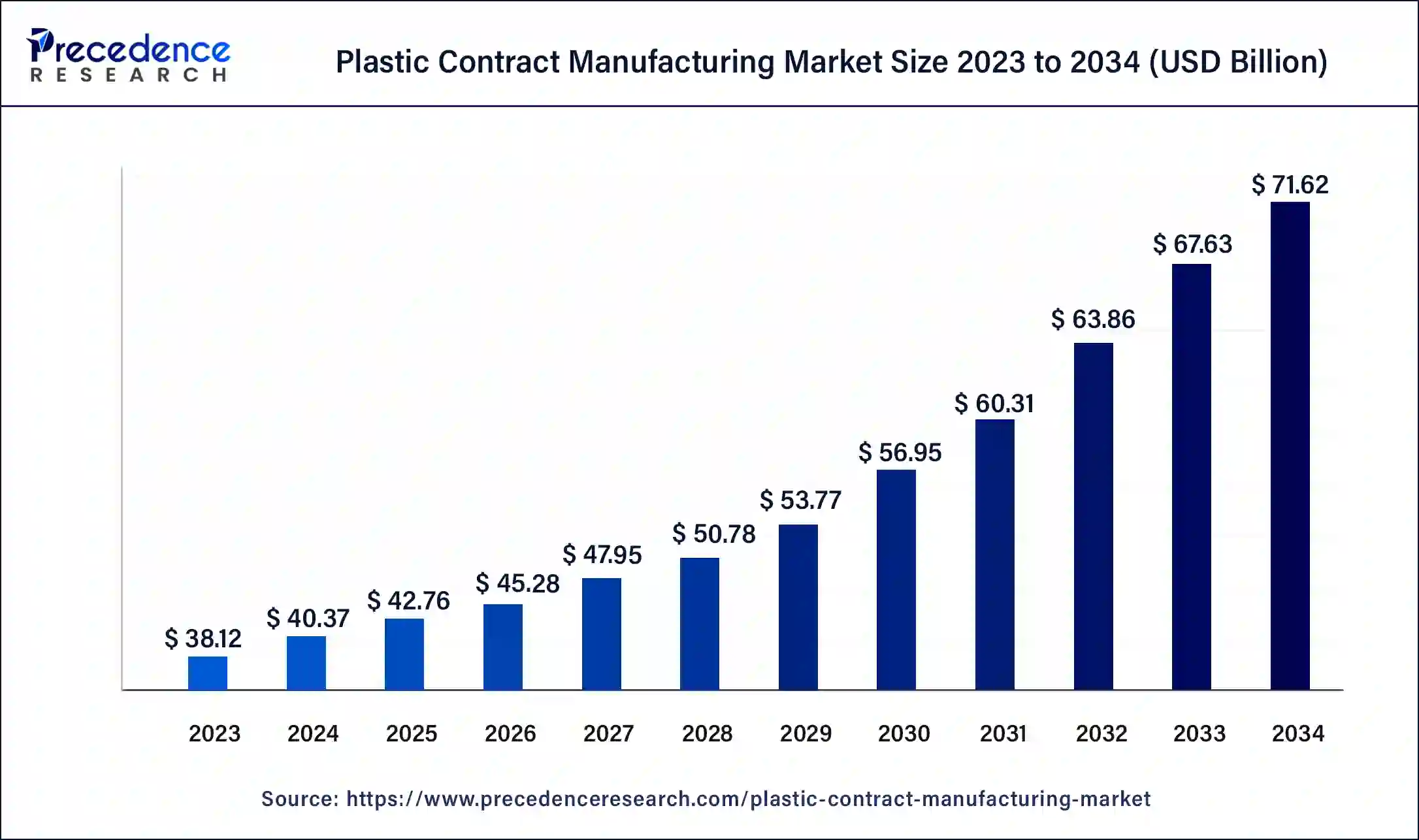

The global plastic contract manufacturing market size is calculated at USD 42.76 billion in 2025 and is predicted to increase from USD 45.28 billion in 2026 to approximately USD 75.46 billion by 2035, expanding at a CAGR of 5.84% from 2026 to 2035

Market Highlights

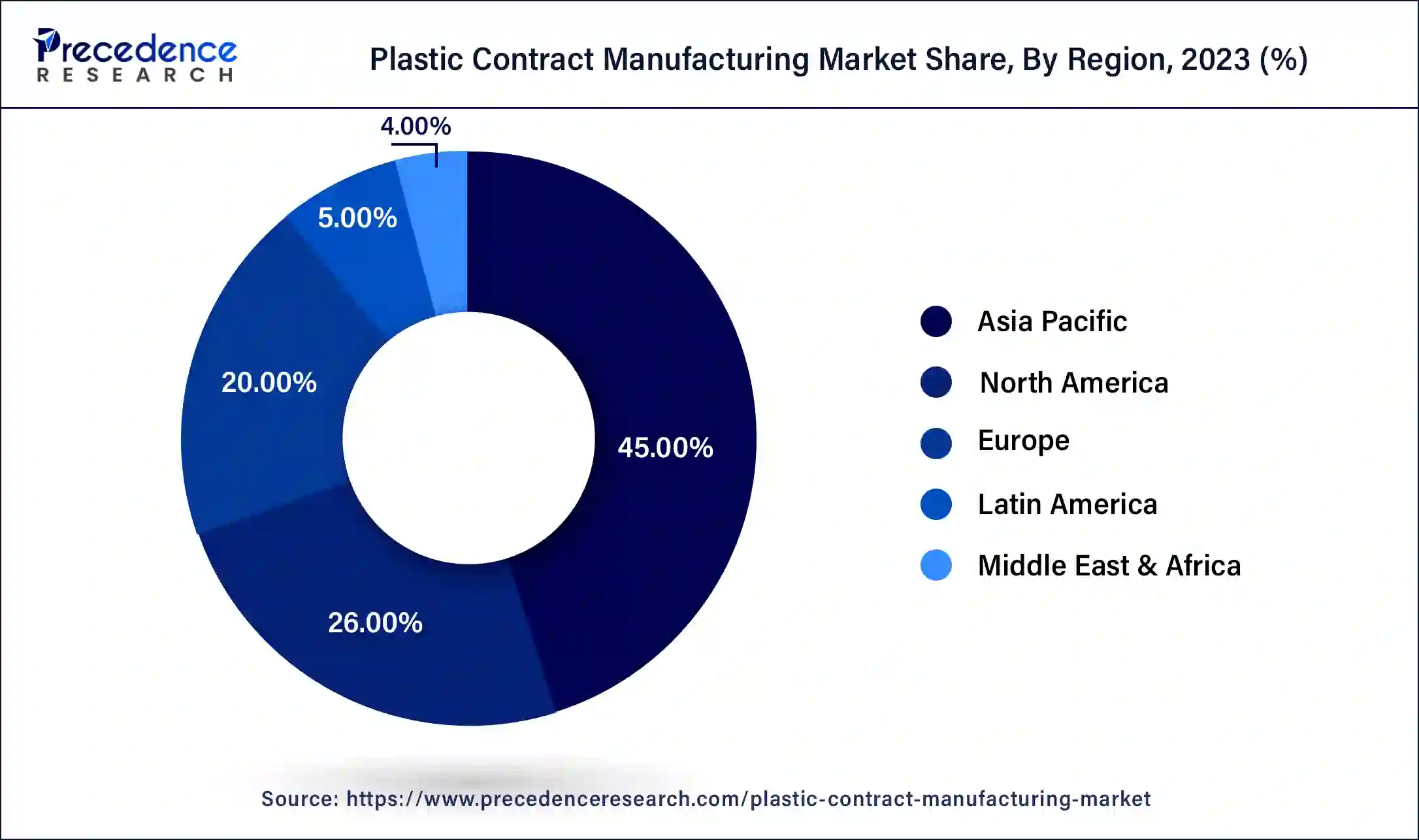

- Asia Pacific led the global market with the highest market share of 45% in 2025.

- By products, the polypropylene segment segment has held the largest market share of 35% in 2025.

- By application, the consumer goods and appliances segment captured the biggest revenue share of 27% in 2025.

The Polymer Powerhouse: Unveiling the Future of Plastic Contract Manufacturing

The plastic contract manufacturing market is experiencing a renaissance, driven by precise engineering, cost-effective production, and the global trend toward product customization. As industries such as healthcare, consumer electronics, automotive, and packaging demand flexible, scalable, and high-quality manufacturing, contract manufacturers are becoming essential. The market is shaped by rapid tooling innovations, advanced polymers, and the integration of automation with digital design systems. With OEMs increasingly outsourcing to improve efficiency and flexibility, the market is shifting toward a high-value, innovation-driven sector.

Market Outlook

- Industry Growth Overview: The plastic contract manufacturing market is growing as brands outsource production to reduce costs and streamline supply chains. Rising demand for customized, high-precision plastic components across automotive, medical, and consumer goods is also driving the growth of the market.

- Sustainability Trend: Sustainability is becoming the core of competitive strategy. Manufacturers are focusing on recyclable materials, energy-efficient molding, and waste-reducing production methods. Circular manufacturing models like take-back programs and polymer reprocessing are gaining popularity. Bio-based plastics and green additives are being explored to balance performance with environmental responsibility.

- Major Investors: Major investors in the market include private equity firms, large packaging and plastics corporations, and diversified manufacturing groups that fund capacity expansion, automation, and global facility growth. Their investments enable contract manufacturers to adopt advanced molding technologies, enhance production scalability, and meet increasing demand from industries such as medical devices, automotive, and consumer goods.

Plastic Contract Manufacturing Market Growth Factors

The plastic contract manufacturing is a safe and healthy way of manufacturing plastic on large scale. The plastic contract manufacturer offers to provide a few plastic production services based on the customer's needs in this process. In most cases, the brands from whom plastic products are purchased are not the same as the companies that produce full products. The plastic contract manufacturers are used by product brands and companies to outsource their plastic production. The multiple plastic contract manufacturers could be involved in the full process of plastic contract manufacturing at times.

An original equipment manufacturers capacity to find and purchase required materials and components, mold and assemble plastic components, package, and transport the finished product is known as contract manufacturing. The original equipment manufacturers collaborate with molders to complete projects, allowing them to concentrate more on strategy, sales, and other key capabilities in order to grow their businesses.

The contract manufacturing is a cost-effective outsourcing method that keeps overhead and operating costs low. The contracting with outside manufacturers allows businesses to attain high levels of efficiency and production. The businesses can concentrate on what they do best rather than bothering about manufacturing. Due to the specialized workforce, bulk purchasing, and reduced errors, plastic contract manufacturing lowers the cost of final products. In the end, this will cut the price for clients, resulting in increased sales.

The manufacturing companies specialize in designing certain items so that they can launch a high-volume manufacturing line and adopt cost cutting strategies for a corporation. This frees firms on more vital tasks without fear of making mistakes for which they lack the necessary training and experience. The major manufacturing companies have the abilities and equipment to improve and change the product, if necessary, without making costly mistakes at a pivotal point.

The aerospace, telecommunications, defense, automotive, medical, electronics, pharmaceuticals, and industrial utilize services and solutions in the global plastic contract manufacturing market. In order to improve their user experience and acquire a wider customer base, the key market players in the global plastic contract manufacturing market are providing a variety of services.

The expansion of the global plastic contract manufacturing market is being driven by the surge in the demand for electronic products such as wearables, smartphones, and smartwatches as well as an increase in disposable income. Furthermore, increased complexities in engineering and layout of items as well as rise in surgeries have resulted in increased demand for medical equipment. During the forecast period, this factor is expected to play a significant role in boosting the growth of the plastic contract manufacturing market.

Clinical device production is expensive, and there is fierce competition among plastic contract manufacturing market players. Thus, there is a rise in a adoption of methods that can lower manufacturing costs, boosting the growth of the plastic contract manufacturing market. In addition, the plastic contract manufacturing market is expected to benefit from increased demand for consumer electronics such as computers, video recorders, smartphones, cameras, and televisions over the projected period.

The increased need for better healthcare services, technological improvements, and infrastructure development are expected to enhance the medical equipment industry, which will surge the demand for plastic contract manufacturing. The plastic contract manufacturing provides benefits such as expertise, job shifting, and costs savings. The plastic contract manufacturers collaborate with customers to choose raw materials, design parameters, timelines, and certification requirements. The producers can customize and expand products to meet specific requirements. The end users save money by outsourcing a portion of the manufacturing process. As a result, all these factors contribute to the growth of the global plastic contract manufacturing market during the forecast period.

The high capital investments and higher requirements for establishing solid relationships with raw material suppliers, on the other hand, are projected to limit the new entrants to the plastic contract manufacturing market. As a result, the risk of new entrants is predicted to be low. One of the options available to major market players is in-house manufacturing. The high capital required to establish plastic molding facilities as well as continuously changing manufacturing technology, are projected to boost the expansion of the global plastic contract manufacturing market over the projected period.

Notable Developments in the Plastic Contract Manufacturing Market:

- Manufacturers Increasingly Collaborating to Provide Full Service: OEMs (original equipment manufacturers) are moving away from traditional transactional outsourcing arrangements with their suppliers towards long-term service provision that encompasses product development, including design optimization, material selection, and tooling, manufacturing, and post-processing of the finished product.

- Increase in Demand for Low Volume High Complexity Plastic Parts: The demand from industries such as the medical device and electronic industries is for smaller production runs and greater precision in manufacturing due to higher standards of tolerance and finish than existing operations can provide. as a result of this demand, contract manufacturers are investing in advanced injection moulding, micro-moulding, and precision tooling technologies.

- Demand for Sustainable Processes: Contract manufacturers are increasingly using recycled polymers, bio-based plastics, and closed-loop material reuse to meet their global OEM clients' requirements regarding ESG commitments. Additionally, contract manufacturers are also investing in energy-efficient moulding processes as a result of their commitment to ESG initiatives.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 42.76 Billion |

| Market Size in 2026 | USD 45.28 billion |

| Market Size by 2035 | USD 75.46 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.84% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Products Insights

In 2025, the polypropylene segment accounted revenue share of 35%. The polypropylene is mostly utilized in the automotive and medical industries to manufacture components. The polypropylene's qualities including as sterilization and impact resistance are projected to boost its use in the medical business.

The polyethylene segment, on the other hand, is predicted to develop at the quickest rate in the future years. The polyethylene is utilized in medical and equipment devices and components packing bags. The increased use of plastic in pouches is likely to boost demand for the product during the forecast period.

Application Insights

The consumer goods and appliances segment dominated the market in 2025 with a revenue share of 27%. Increasing reliance on household appliances as a result of the growing working population, combined with rising disposable income levels, is predicted to fuel demand for this equipment and propel the plastic contract manufacturing market.

The automotive segment is fastest growing segment of the plastic contract manufacturing market in 2025. The plastics are used in electrical components, chassis, powertrains, interior and exterior furnishings in the automobile and automotive industries.

Regional Insights

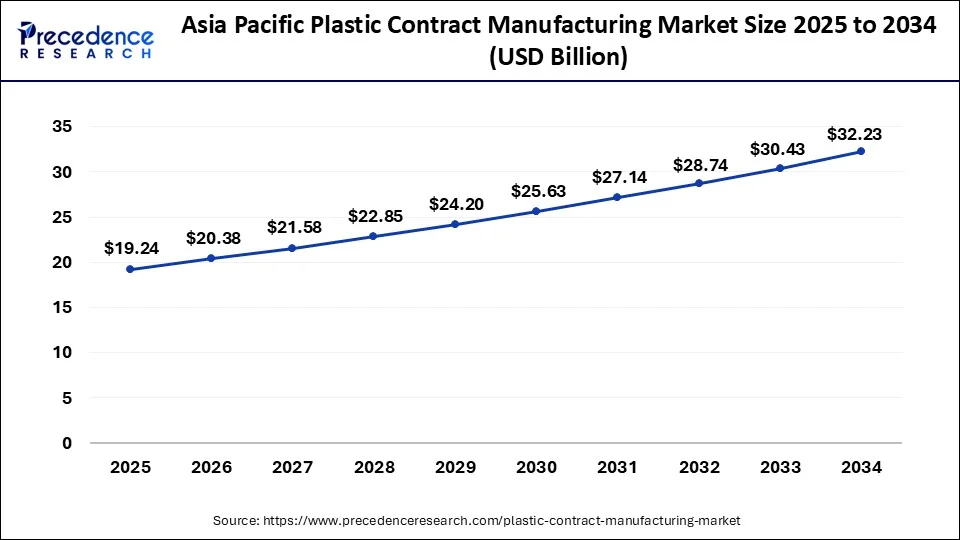

Asia Pacific Plastic Contract Manufacturing Market Size and Growth 2026 to 2035

The Asia Pacific plastic contract manufacturing market size is estimated at USD 19.24 billion in 2025 and is predicted to be worth around USD 33.95 billion by 2035, at a CAGR of 5.84% from 2026 to 2035

Asia-Pacific region dominated the market and accounted with a revenue share of 45% in 2025. The Asia-Pacific region stands as the formidable leader in the plastic contract manufacturing market, characterized by being the largest global hub for both plastic production and consumption. This dominance can be attributed to a thriving manufacturing sector, where cost-effective labor and abundant raw materials play crucial roles.

As disposable incomes rise along with population growth in this region, the demand for consumer goods, particularly electronic appliances, is surging. Major players like China dominate the market, and the country's status as the leading plastic producer further cements its pivotal role.

The combination of lower labor costs and an efficient supply chain of raw materials makes the Asia-Pacific an exceptionally competitive landscape for plastic contract manufacturing.

Asia-Pacific remains the epicenter of large-scale polymer production and contract manufacturing, driven by the expanding manufacturing footprints of China, India, Vietnam, and Malaysia, which provide strong cost competitiveness and rapid production cycles. The region's adoption of advanced technologies, such as automation, high-cavity molds, and hybrid materials, is accelerating quickly, further solidifying its global dominance.

The region's diversification into medical molding, industrial machinery components, and electronics casings, supported by upgrades to meet global regulatory standards, is strengthening its long-term resilience. Rising investment in precision tool-making, along with India's emergence as a competitive molding hub, is further reinforcing Asia-Pacific's leadership in the market.

Europe Plastic Contract Manufacturing Market Trends:

Meanwhile, Europe is experiencing significant growth in its plastic contract manufacturing sector, driven by its dual status as both a major producer and consumer of plastics. The region's highly industrialized economies support a robust demand for electronic goods, medical devices, and other products reliant on plastic components. With a significant population experiencing rising disposable incomes, Europe is seeing increased demand for consumer electronics like smartphones and smartwatches. The advanced infrastructure, skilled workforce, and adherence to high manufacturing standards make Europe a formidable player in global plastic contract manufacturing.

What Makes North America the Fastest-Growing Region in the Market?

North America is expected to grow at the fastest rate in the upcoming period, supported by a strong industrial base, advanced technologies, and rising demand for medical devices, automotive components, and precision consumer goods. Integration of automation, additive manufacturing, and cleanroom molding, combined with reshoring trends that push OEMs to seek dependable local partners, is further enhancing the region's competitive edge.

The U.S. leads the regional market due to its strong molding capabilities, advanced R&D infrastructure, and a vibrant automotive supply chain. Widespread adoption of Industry 4.0 practices ensures higher throughput, lower defect rates, and more agile production cycles. Growing demand for biocompatible plastics in healthcare further boosts market growth. A strong focus on sustainability is accelerating efforts in recyclate integration and bio-based polymers.

What Potentiates the Growth of the Middle East & Africa Plastic Contract Manufacturing Market?

The market in the Middle East & Africa is gradually emerging. This is mainly due to increasing industrialization, expanding FMCG sectors, and infrastructure development, all of which boost demand for molded plastic components. Countries in the GCC are increasingly investing in polymer downstream industries to reduce economic dependence on oil. The market is slowly aligning with global standards, driven by the adoption of modern machinery.

The UAE stands out with its strategic industrial diversification policies, significant investments in advanced molding technologies, and access to high-purity locally produced polymer feedstock. Consistent demand from packaging, construction, and automotive aftermarket segments, combined with free-trade zones and world-class logistics, continues to strengthen its position as a preferred contract manufacturing hub.

Plastic Contract Manufacturing Market Value Chain Analysis:

- Sourcing & Engineering of Raw Materials: This section of the value chain emphasizes the procurement of both engineered and commodity resins to be used in producing products designed for longevity, flexibility, and compliance with regulatory requirements. To manage fluctuations in prices for these types of products and to ensure consistent quality, strategic sourcing agreements are utilized.

Key Players: BASF SE, SABIC, LyondellBasell - Molding Tool Design and Process Engineering: Molding tool design, as well as process engineering and product quality assurance, is an essential consideration when attempting to manufacture high-quality and cost-efficient products

Key Players: Berry Global, Jabil Inc., EVCO Plastics - Manufacturing, Assembly & Quality Management: This section of the value chain includes the injection molding/plastic extrusion processes used to produce an item, as well as secondary finishing operations associated with these processes, and assembly, including extensive quality testing. Many customers in the medical and automotive sectors require certification of products manufactured under their respective industry standards (ISO 13485 and IATF 16949) as a means to differentiate between potential suppliers.

Key Players: Flex Ltd., Celestica Inc., Nypro (Jabil)

Plastic Contract Manufacturing Market Companies

- McClarin Plastics LLC

- EVCO Plastics

- C&J Industries

- Genesis Plastics Welding

- Plastikon Industries Inc.

- PTI Engineered Plastics Inc.

- Mack Molding

- Natech Plastics Inc.

- Rosti Group AB Inc.

- Baytech Plastics

Recent Developments

- In July 2024, Hansgrohe Group, known for its premium bathroom and kitchen products, launched a recycling initiative for plastic at its Offenburg/Elgersweier production site. The company collaborated with ImplusTec to contribute to sustainable manufacturing practices.

- In February 2025, Arterex, a leading global medical device developer and contract manufacturer, took hold of Adroit USA Inc. The company has expanded its medical manufacturing and metal fabrication.

- In January 2025, Zeus, a global leader in advanced polymer solutions and catheter manufacturing, announced and introduced StreamLiner NG, an addition to the company's ultra-thin-walled catheter liners.

- On June 17, 2024, Hansgrohe Group Launches an industrial plastic recycling process. The Hansgrohe Group commissioned a world-first plastic recycling system at its Offenburg/Elgersweier production site, developed with ImpulsTec GmbH, that recovers and reuses production waste from chrome-plated ABS components directly onsite, advancing circular manufacturing efficiency.

(https://www.hansgrohe-group.com)

Segments Covered in the Report

By Product

- Polypropylene

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene

- Polystyrene

- Others

By Application

- Medical

- Aerospace & Defense

- Automotive

- Consumer Goods & Appliances

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting