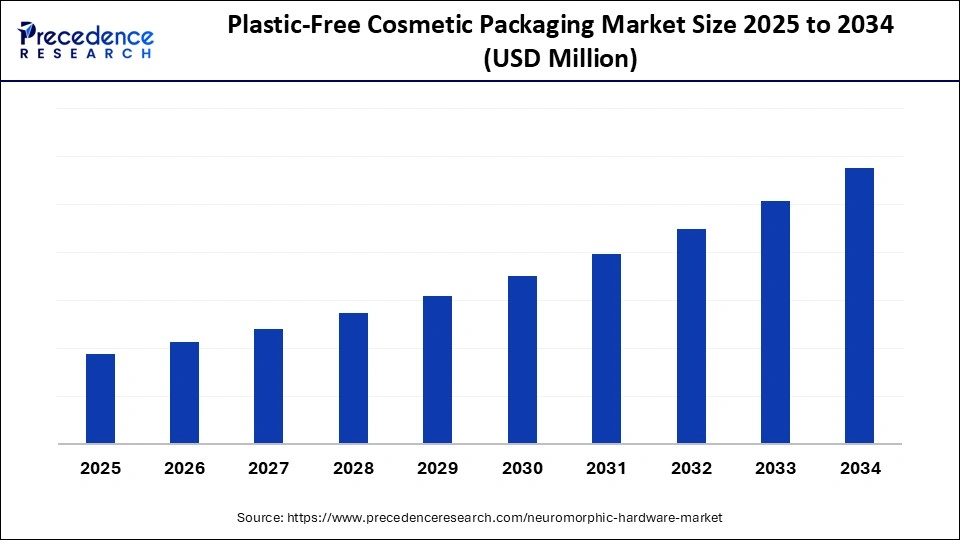

What is the Plastic-Free Cosmetic Packaging Market Size?

The global plastic-free cosmetic packaging market is witnessing strong growth as brands adopt biodegradable, refillable, and recyclable solutions to meet rising consumer demand for sustainable beauty products.The plastic-free cosmetic packaging market is growing due to rising environmental awareness.

Plastic-Free Cosmetic Packaging Market Key Takeaways

- Europe dominated the plastic-free cosmetic packaging market with the largest market share of 34.20% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 10.40% during the forecast period.

- By packaging type, the bottles segment held the biggest market share of 27.6% in the market.

- By packaging type, the sticks segment is projected to grow at the fastest CAGR of 10.2% during the forecast period.

- By material type, the glass segment captured the highest market share of 33.4% in 2024.

- By material type, the plant-based fibers segment is projected to grow at the fastest CAGR of 11.4% during the forecast period.

- By application, the skincare products segment contributed the maximum market share of 38.2% in 2024.

- By application, the makeup segment is expected to grow at the fastest CAGR of 10.5% during the forecast period.

- By end-user, the mass market cosmetic brands segment accounted for the significant market share of 42.7% in 2024.

- By end-user, the organic/natural/clean beauty brands segment is expected to grow at the fastest CAGR of 11.3% during the forecast period.

- By distribution channel, the offline retail segment generated the major market share of 68.1% in 2024.

- By distribution channel, the online retail segment is expected to grow at the fastest CAGR of 10% during the forecast period.

Market overview

The plastic-free cosmetic packaging market is significant because it addresses increasing concerns about plastic pollution as well as the environmental impact of the beauty industry, which generates huge amounts of waste. There is a rising consumer choice for eco-friendly products and even sustainable packaging, prompting beauty brands to accept plastic-free solutions to meet these ethical expectations. Brands are using sustainable materials such as glass, bamboo, aluminum, and paper-based products as alternatives to plastic. Increasingly strict government regulations and even policies targeted at curbing single-use plastics and encouraging circular economy principles are captivating the market to shift away from conventional plastics.

Impact of AI on the Plastic-Free Cosmetic Packaging Market

Artificial intelligence is crucial in the plastic-free cosmetic packaging market for optimizing material usage, accelerating the design as well as production of sustainable packaging, improving quality control and efficiency, and enhancing supply chain and recycling operations. AI algorithms determine product requirements as well as environmental data to design lightweight, appropriately sized packaging, further reducing material usage and expenses, and carbon emissions.

AI assists in selecting and optimizing the usage of sustainable materials such as recycled, compostable, or biodegradable alternatives by analyzing life cycle assessment data and even aligning with circular economy principles. By optimizing packaging dimensions along with streamlining production workflows, AI assists in minimizing overall waste, leading to a greener planet.

Plastic-Free Cosmetic Packaging Market Growth Factors

- Consumers are increasingly aware of the environmental influence of packaging waste, creating a need for sustainable and even plastic-free alternatives.

- Increased online shopping has shown the requirement for sustainable as well as lightweight shipping materials, thus increasing the need for eco-friendly solutions.

- A rise in the consumption of luxury cosmetics fuels the demand for high-end, sustainable packaging that works with premium aesthetics.

- Advances in materials science have contributed to the advancement of new biodegradable as well as plant-based packaging materials, like PLA (polylactic acid), mushroom-based materials, and even sugarcane, making plastic-free alternatives more viable.

Market Scope

| Report Coverage | Details |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Packaging Type, Material Type, Application, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How are environmental consciousness and ethical consumerism the driving forces for the plastic-free cosmetic packaging market?

Environmental consciousness and ethical consumerism are primary drivers of the plastic-free cosmetic packaging market because consumers are increasingly seeking sustainable options for plastic. This shift is boosted by growing knowledge of plastic pollution's environmental impact, leading users to prioritize brands with eco-friendly packaging such as paper, glass, or bamboo. Consumers are increasingly aligning their buying choices with their personal ethical values, which include environmental responsibility as well as a desire to support firms that demonstrate ethical practices.

Restraint

How is the limited availability of sustainable raw materials the driving force for the plastic-free cosmetic packaging market?

Manufacturers face challenges in planning and fulfilling orders because of the inconsistent and limited supplies of suitable, eco-friendly materials. The lack of readily available sustainable materials at scale limits the capacity for firms to offer plastic-free packaging in large quantities. Inadequate infrastructure for the proper processing of some eco-friendly materials, such as specialized recycling or industrial composting, decreases their actual environmental advantages and can make them less viable.

Opportunity

How is implementing refillable systems to promote reuse the driving force for the plastic-free cosmetic packaging market?

Refillable systems are a driving force for the plastic-free cosmetic packaging market because they address rising consumer concern over plastic waste, work with corporate sustainability goals, and provide significant environmental benefits such as reduced waste and even carbon emissions. By reducing the manufacturing together with transportation of new packaging materials, refillable systems significantly decrease carbon emissions compared to single-use alternatives. Brands that accept refillable systems can improve their image as environmentally responsible, fostering user loyalty and creating a positive brand perception. Implementing innovative refillable solutions can offer brands a competitive advantage, permitting them to carve out a unique position in the crowded cosmetic market.

Segments Insights

Packaging Type Insights

Why did the bottles segment dominate the plastic-free cosmetic packaging market in 2024?

The bottle segment dominates the plastic-free cosmetic packaging market due to its inherent protective qualities, suitability for diverse cosmetic products such as serums and creams, and the extensive range of dispensing mechanisms available, like pumps and droppers that improve user convenience and hygiene. Bottles can be equipped with numerous dispensing mechanisms, like sprayers, pumps, and droppers, to ensure precise, controlled, and hygienic application of cosmetic products. Plastic-free glass bottles are usually seen as a more premium and even eco-conscious choice, appealing to users' preference for sustainable beauty solutions.

The sticks segment is witnessing the fastest growth because of its eco-friendly materials such as paper and compostable alternatives, its portability and convenience for users, and the strong market trend towards sustainable beauty and even on-the-go lifestyles. Manufacturers are using paper, compostable materials, and plant-based alternatives to create stick packaging that appeals to ecologically conscious consumers. A broader range of cosmetic and even personal care products, like sun care and brow laminators, are being generated in stick formats, creating new opportunities for plastic-free packaging solutions.

Material Type Insights

Why did the glass segment dominate the plastic-free cosmetic packaging market in 2024?

The glass segment dominates the plastic-free cosmetic packaging market due to its premium perception, excellent product preservation qualities, as well as high recyclability, which aligns with increasing consumer need for sustainable and non-toxic options. A significant global shift toward sustainability, along with environmental consciousness, fuels the need for plastic-free options. Glass is a 100% recyclable and even non-toxic material, making it a perfect fit for eco-conscious users and brands aiming to decrease their environmental footprint. Brands leverage glass to create a high-end image and also differentiate their products in a competitive market, appealing to users who prioritize quality and sustainability.

The plant-based fibers segment is witnessing the fastest growth due to its increasing consumer need for sustainable products, driven by increasing environmental knowledge and concerns over plastic pollution. Plant-based fibers are usually renewable, biodegradable, as well as compostable, providing a lower environmental impact compared to conventional plastics. The growth of online retail has increased the requirement for packaging that is both protective as well as environmentally responsible, with fiber-based options such as corrugated boxes being ideal.

Application Insights

Why did the skincare products segment dominate the plastic-free cosmetic packaging market in 2024?

The skincare products segment dominates the plastic-free cosmetic packaging market due to the growing consumer need for sustainable, health-focused, and even premium products. Skincare products need diverse packaging (bottles, jars, tubes) and feature eco-friendly formats such as glass, aluminum, and refillable systems that work with consumer trends for minimal waste and even ingredient awareness. Brands target innovative packaging that protects product quality, improves the user experience, and provides a premium, aesthetically appealing appearance, which is an important driver for sustainable materials such as glass and aluminum. Packaging serves as a vital tool for brands to differentiate themselves, with sustainability as well as premiumization playing important roles in the competitive skincare market.

The makeup segment is growing rapidly because it combines high consumer need for sustainable beauty products with the repeated repurchase cycle of color cosmetics, driving innovation in materials such as metal, cardboard, and bamboo. Unlike some other cosmetic segments, makeup products such as eyeshadows, lipsticks, and foundations are frequently purchased. This rapid turnover means more packaging is utilized and discarded, making the sustainability of the packaging a remarkable concern for both consumers and brands. Cosmetics brands are setting their own sustainability goals, which include reducing plastic waste and even adopting greener alternatives. This is supported by rising regulatory mandates as well as global initiatives that encourage sustainable practices in the beauty industry.

End-User Insights

Why did the mass-market cosmetic brands segment dominate the plastic-free cosmetic packaging market in 2024?

The mass market cosmetic brands segment held the largest share. It is driven by consumer requirements for sustainability, governmental regulations, and eco-conscious branding. Consumers are more conscious of the environmental influence of packaging and are even actively seeking out brands that provide sustainable and eco-friendly solutions. Adopting plastic-free packaging assists brands in standing out, appealing to younger demographics (such as Gen Z and millennials), and aligning with ethical consumerism, which improves brand image and even customer loyalty. Brands are exploring smart and interactive packaging to build brand storytelling, improve customer engagement, and ensure product authenticity.

The organic/natural/clean beauty brands segment is growing rapidly, because of strong consumer need for eco-friendly products, driven by environmental concerns together with ethical considerations, which works perfectly with these brands' core messaging. For brands inherently targeted on natural, clean ingredients, accepting plastic-free packaging is a consistent and authentic way to display their commitment to environmental responsibility, which eventually resonates with their target audience.

Distribution Channel Insights

Why did the offline retail segment dominate the plastic-free cosmetic packaging market in 2024?

The offline retail segment held the largest share. Due to consumer choices for physically inspecting eco-friendly products, mainly in specialty stores, where product quality as well as tactile appeal are essential. Offline channels offer a space for users to assess the quality as well as sustainability credentials of plastic-free packaging firsthand, which includes its visual appeal, texture, and durability. Plastic-free and zero-waste products are usually sold in specialty organic stores as well as supermarkets with dedicated sustainable sections, which act as a significant driver for offline sales.

The online retail segment is growing rapidly, due to the convenience of e-commerce, and raised consumer environmental knowledge is driving the requirement for sustainable solutions, the ability of online platforms to attract eco-conscious consumers, as well as the direct-to-consumer (DTC) model's effectiveness in encouraging plastic-free products. Online marketplaces, along with DTC brand websites, permit brands to easily showcase their sustainability efforts, which include plastic-free packaging, to a wider audience of environmentally aware consumers.

Regional Insights

Why did Europe dominate the plastic-free cosmetic packaging market in 2024?

Europe leads the plastic-free cosmetic packaging market due to strict government regulations, high consumer need for sustainable products, bans on single-use plastics, and even extensive investment in green packaging innovation. Public, along with private sectors in Europe, actively engage in sustainability initiatives, with governmental funds for green packaging and circular economy principles. Investments in green packaging technologies, along with the promotion of circular economy principles, are accelerating the acceptance of sustainable solutions.

Asia Pacific

Asia Pacific is a popular region for the plastic-free cosmetic packaging market due to a combination of factors, including rising disposable incomes, rapidurbanization, and growing consumer knowledge of environmental issues and sustainability. Several governments are implementing policies to decrease plastic waste, like bans on single-use plastics (e.g., in India) and new recycling regulations, which promote the adoption of sustainable packaging. Cosmetic brands are eco-friendly, actively developing innovative and biodegradable packaging solutions, including refillable options, to cater to the increasing need for sustainable beauty products.

Value Chain Analysis

- Raw Material Sourcing

Raw material sourcing for the plastic-free cosmetic packaging market includes recycled materials such as post-consumer recycled (PCR) plastic, and renewable bio-based resources like cornstarch, sugarcane, bamboo, and mushroom-based materials, and also infinitely recyclable materials such as glass and metals (aluminum, tin, stainless steel).

Key Players: Pangea, EcoPack Innovations, Tetra Pak, Amcor

- Logistics and Distribution

Logistics and distribution for the plastic-free cosmetic packaging market include eco-friendly materials such as glass, paper, and bioplastics, optimized supply chains to protect from damage, as well as technology integration for efficiency, all while adapting to user demand for sustainable products via channels such as DTC and e-commerce.

Key Players: Mondi, Quadpack, Libo Cosmetics

Plastic-Free Cosmetic Packaging Market Companies

- Quadpack

- WWP Beauty

- Albéa Group

- Berry Global Inc.

- Libo Cosmetics

- Amcor

- AptarGroup

Recent Developments

- In November 2023, Amcor declared the start of the next generation of its Medical Laminates solutions. The new solution decreases the carbon footprint of the final package while maintaining the performance demands of device applications, assisting medical firms to progress their sustainability goals without compromising patient safety. (Source: https://pharmaceuticalmanufacturer.media)

- In June 2022, WWP Beauty, a full-service supplier to the worldwide beauty industry, established two new packaging collections in partnership with Eastman as part of its commitment to offering customers sustainable technologies along materials: Eastman's Cristal One Renew and Cristal Renew. (Source: https://www.beautypackaging.com)

Segments Covered in the Report

By Packaging Type

- Jars

- Glass Jars

- Metal Jars (Aluminum, Tin)

- Paper-based Jars (compressed paper, molded pulp)

- Bottles

- Glass Bottles

- Aluminum Bottles

- Bamboo Bottles

- Tubes

- Aluminum Tubes

- Paper-Based Tubes

- Plant Fiber-Based Tubes

- Compacts and Cases

- Bamboo Compacts

- Paperboard Cases

- Metal Compacts

- Pouches and Sachets

- Paper-based Pouches

- Cellulose Film Pouches

- Sticks

- Paperboard Push-up Sticks (e.g., deodorants, balms)

- Droppers and Dispensers

- Glass Droppers

- Wooden Caps

- Aluminum Dispensers

By Material Type

- Glass

- Aluminum

- Paper and Cardboard

- Wood

- Bamboo

- Birch

- Plant-Based Fibers

- Sugarcane Bagasse

- Wheat Straw

- Coconut Husk

- Biodegradable Films (non-plastic)

- Cellulose

- Polylactic Acid (PLA – if not counted as "plastic")

- Ceramic

By Application

- Skincare Products

- Creams and Lotions

- Serums

- Face Masks

- Haircare Products

- Shampoo

- Conditioners

- Hair Oils

- Makeup

- Foundations

- Lipsticks and Lip Balms

- Blush and Powders

- Fragrances and Perfume

- Deodorants and Antiperspirants

- Bath and Body

- Soaps

- Body Scrubs

- Body Butters

By End User

- Mass Market Cosmetic Brands

- Premium/Luxury Brands

- Organic/Natural/Clean Beauty Brands

- Private Label Brands

- DTC (Direct-to-Consumer) Indie Brands

By Distribution Channel

- Online Retail

- Brand-Owned Websites

- E-commerce Platforms (Amazon, Etsy, etc.)

- Offline Retail

- Specialty Beauty Retailers (Sephora, Ulta, etc.)

- Department Stores

- Health and Organic Stores

- Supermarkets and Hypermarkets

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting