Automotive Secure Element Chip Market Revenue to Attain USD 2,131.13 Mn by 2035

Automotive Secure Element Chip Market Revenue and Trends 2026 to 2035

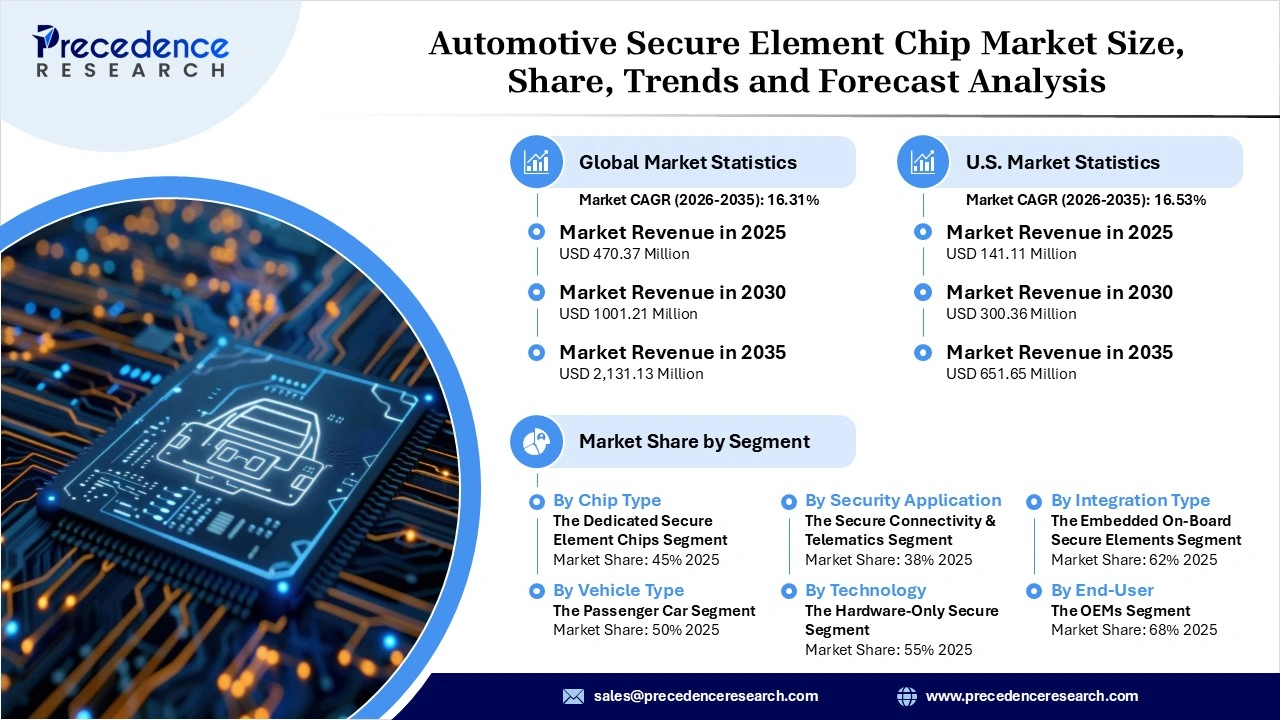

The global automotive secure element chip market revenue surpassed USD 470.37 million in 2025 and is predicted to attain around USD 2,131.13 million by 2035, growing at a CAGR of 16.31%. This market is experiencing unprecedented growth, driven by the strict cybersecurity regulations and rapid advancements in autonomous driving technologies (ADAS).

What are the Factors That Have a Significant Contribution to the Growth of the Automotive Secure Element Chip Market?

The rising adoption of connected, autonomous, and electric vehicles is a major driver of growth in the automotive secure element chip market during the forecast period. As vehicles become increasingly software defined and connected, secure element chips are being embedded to safeguard in-vehicle communications, digital identities, and data exchanges between vehicle systems and external networks. The rapid surge in electric vehicle adoption is further increasing demand for secure chips used in battery management systems, motor control units, and secure charging infrastructure, where authentication and encrypted communication are critical.

Market expansion is also strongly supported by stringent government regulations related to vehicle safety and cybersecurity, alongside the rising incidence of cyber threats targeting connected vehicles. Automakers are under growing pressure to deploy hardware-based security solutions to protect sensitive user data, critical vehicle functions, and over-the-air software updates from unauthorized access and tampering. As cybersecurity risks escalate in parallel with vehicle connectivity and automation, secure element chips are becoming a foundational component in ensuring trust, compliance, and resilience across next-generation automotive platforms.

Segment Insights

- By component/chip type, the dedicated secure element chips segment led the market while holding the largest share of 45% in 2025. Several automotive OEMs are increasingly adopting dedicated secure elements for the most crucial mission applications, such as secure boot and identity authentication. These chips assist in securely storing cryptographic keys, sensitive vehicle credentials, and digital certificates.

- By vehicle type, the passenger car segment led the automotive secure element chip market while holding the largest share of 50% in 2025, owing to the rising use of connected features such as infotainment, telematics, and digital keys in passenger cars.

- By security application, the secure connectivity & telematics segment led the market while holding the largest share of 38% in 2025, owing to the rapid advancement in connected vehicle technology and strict regulations regarding securely handling data.

- By technology, the hardware-only secure elements segment led the market while holding the largest share of 55% in 2025, due to the increasing need for robust security in connected and autonomous vehicles. Hardware-based components are designed to manage cryptographic keys and secure functions.

- By integration type, the embedded on-board secure elements segment led the automotive secure element chip market while holding the largest share of 62% in 2025. Automakers are widely adopting centralized security control. They deliver reliable and low-latency security.

- By end-user, the OEMs segment led the market while holding the largest share of 68% in 2025. Original Equipment Manufacturers (OEMs) embed advanced security features into vehicles to meet strict security standards and regulations. With control over the whole vehicle architecture, OEMs can enhance security deployment.

- By secure feature type, the encryption & authentication services segment led the market while holding the largest share of 42% in 2025, owing to growing awareness of cybersecurity regulations. These features keep out unauthorized users and prevent data breaches. Strict vehicle safety regulations enhance encryption standards.

- By sales/distribution type, the direct OEM contracts segment led the automotive secure element chip market while holding the largest share of 60% in 2025. Automakers generally prefer tighter control over cybersecurity. This distribution channel involves direct and long-term relationships between chip manufacturers (semiconductor companies) and vehicle OEMs. Several manufacturers supply customized electronic components directly to the OEMs for smooth integration into the vehicle's control systems.

Regional Insights

Asia Pacific dominated the global automotive secure element chip market in 2025, holding a share of 40%, supported by its strong semiconductor ecosystem and large-scale automotive manufacturing base. The region hosts major technology and chip suppliers such as Qualcomm, Samsung, Infineon Technologies, STMicroelectronics, Texas Instruments, and Renesas Electronics, which actively supply secure elements for automotive applications. Strong vehicle production volumes, combined with government-backed initiatives promoting smart mobility and intelligent transport systems, are reinforcing adoption of hardware-based security solutions. Growth is primarily driven by rising deployment of connected and electric vehicles, increasing regulatory focus on vehicle cybersecurity, and the need to secure sensitive data, digital keys, and over-the-air software updates.

North America, on the other hand, is emerging as a rapidly growing region and is projected to expand at a significant CAGR of approximately 18-22% between 2026 and 2035. Market growth is fueled by accelerating electric vehicle adoption, rising vehicle connectivity, and rapid advancements in advanced driver-assistance systems and autonomous driving technologies. Stringent cybersecurity regulations and increasing awareness of cyber threats targeting in-vehicle networks are pushing automakers and mobility service providers to integrate secure element chips for authentication, encryption, and data protection. The growing reliance on software-defined vehicles and connected mobility platforms is further strengthening demand for automotive-grade secure hardware across the North American market.

Automotive Secure Element Chip Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 470.37 Million |

| Market Revenue by 2035 | USD 2,131.13 Million |

| CAGR from 2026 to 2035 | 16.31% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2025 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Recent Developments

- In March 2025, the Car Connectivity Consortium (CCC) announced a significant expansion of its CCC Digital Key Certification Program, now covering Bluetooth Low Energy (LE) and Ultra-Wideband (UWB) technologies. This update marks a transformative step in the evolution of digital key standards, reinforcing CCC’s commitment to enabling universal, secure, and interoperable access between vehicles and smart devices. The Car Connectivity Consortium (CCC) is a cross-industry organization dedicated to defining how vehicles interact with devices and the world to create a more seamless and secure consumer experience.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/7278

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344