cGMP Manufacturing Market Revenue and Forecast by 2035

cGMP Manufacturing Market Revenue and Trends 2026 to 2035

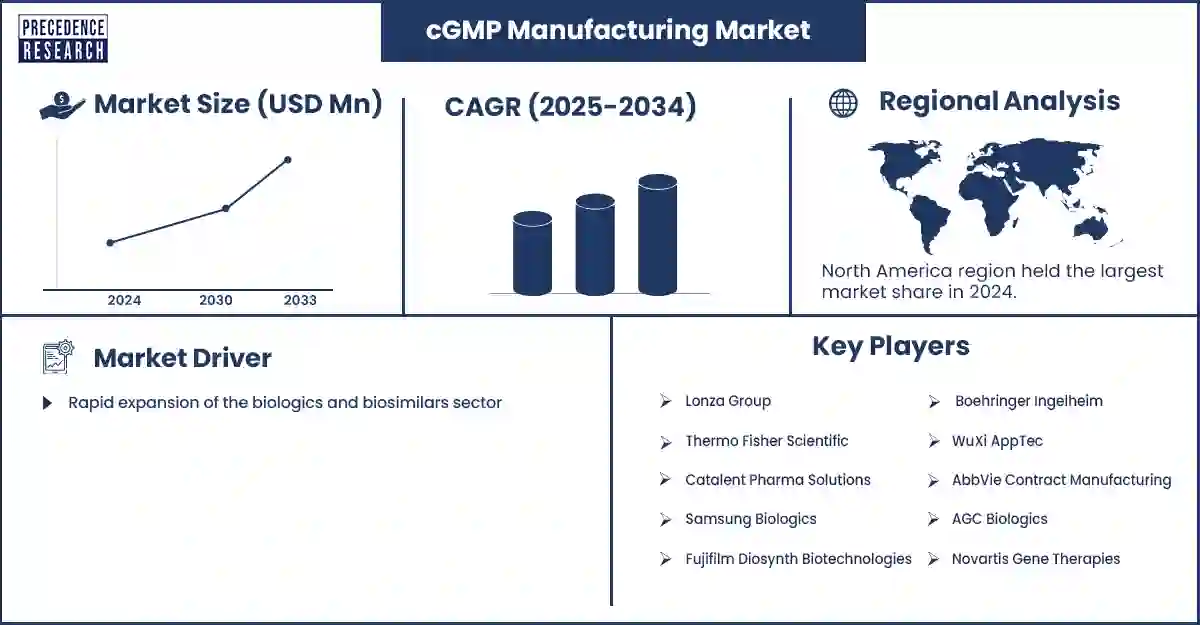

The global cGMP manufacturing market sees strong growth as CDMOs and manufacturers adopt advanced systems to improve efficiency, compliance, and product integrity. Evolving safety standards significantly drive the market to comply with regulations, the rapid expansion of the biologics and biosimilars sector, and the increasing shift towards outsourcing.

What Factors Are Fueling the cGMP Manufacturing Market?

The market is primarily expanding due to evolving and stringent safety regulations, updated regulatory frameworks, and a growing shift toward advanced therapies and biopharmaceuticals. These factors require manufacturers to adopt more sophisticated systems for production, purification, and quality control. Increased outsourcing to CDMOs and CMOs also contributes to market growth, as biopharmaceutical companies rely on external partners with specialized facilities, scalable capacity, and technical expertise. The integration of automation and digital technologies further strengthens this expansion. Automated workflows, real-time monitoring tools, and advanced analytics improve efficiency, reduce human error, and support consistent compliance with regulatory expectations.

Many governments are investing heavily in healthcare R&D, thereby accelerating the development of new pharmaceutical products. These investments support biotechnology clusters, research institutions, and national innovation programmes that explore next-generation therapeutic platforms. The increasing demand for advanced therapies, including gene and cell therapies, is a leading driver of the market. Personalized medicine initiatives are growing as well, supported by genomic sequencing, molecular diagnostics, and targeted treatment approaches.

Segment Insights

- By product type, the biologics segment held the largest market share in 2025 due to the special requirements for GMP facilities, as these are delicate, complex molecules that require highly advanced bioprocessing facilities and proper conditions.

- By process type, the upstream processing segment held the largest market share in 2025, owing to its ability to offer robust productivity and increased efficiency of biomanufacturing.

- By scale of operation, the clinical segment held the largest market share in 2025, as clinical manufacturing requires a compact, highly regulated, and flexible production environment to fulfill evolving regulatory needs.

- By service type, the manufacturing service segment held the largest market share in 2025, as many businesses continue to leverage GMP-qualified facilities to conduct aseptic and upstream/downstream operations.

- By therapeutic area, the oncology segment held the largest market share in 2025, driven by the growing use of monoclonal antibodies, checkpoint inhibitors, and targeted therapies to curb the global cancer burden.

- By end-user, the pharmaceutical & biotechnology segment led the market in 2025, as these domains continue to be major contributors to drug discovery, biologics development, and commercialization.

Regional Insights

North America held the largest market share in 2025. The region’s growth can be attributed to the rapid expansion of the CDMO sector, supported by strong pharmaceutical and biotechnology industries, widespread outsourcing preferences, and rising demand for complex biologics. Companies in the region continue to advance pipelines in monoclonal antibodies, cell therapies, gene therapies, and other high-value modalities, which require specialized manufacturing capacity and stringent regulatory compliance. As a result, CDMOs play a critical role in supporting both early development and commercial scale production.

The market is thriving due to ongoing innovation in complex medicines, evolving regulatory standards, and increasing demand for cGMP testing to ensure safety, purity, and efficacy. Continuous improvement in analytical methods and quality systems further strengthens this trend. Country-wise, the United States leads the region. Its well-established biomanufacturing infrastructure, advanced technology adoption, and strong emphasis on core processing activities make it a central hub for outsourced production. The outsourcing trend encourages companies to prioritize efficiency and scalability, which aligns closely with the capabilities of the region’s experienced CDMOs.

Asia Pacific is projected to grow at the fastest CAGR during the foreseeable period. Growth is driven by an ageing population, rising prevalence of chronic diseases, and a growing preference for biologics and advanced therapies, such as mRNA platforms and cell- or gene-based treatments. These demographic and clinical factors encourage regional investment in biomanufacturing capacity and advanced therapeutic development.

Supply chain resilience is another key driver. Many countries in the Asia-Pacific region are strengthening domestic production capabilities to reduce dependence on external suppliers. Supportive government policies, including infrastructure development, tax incentives, and national biotechnology strategies, further accelerate regional growth. These initiatives translate into rapid expansion across sectors such as medical devices, biopharmaceuticals, and specialized manufacturing services. As a result, Asia Pacific is emerging as a significant growth engine for the global market.

cGMP Manufacturing Market Coverage

| Report Attribute | Key Statistics |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2025 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Recent development

- In September 2025, a Siegfried company, Dinamiqs, launched its cGMP manufacturing facility developed for viral vectors, which enables end-to-end manufacturing of viral vector gene therapies.(Source: https://chemanager-online.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/7187

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344