Semi-flexible Solar Panels Market Size and Forecast 2025 to 2034

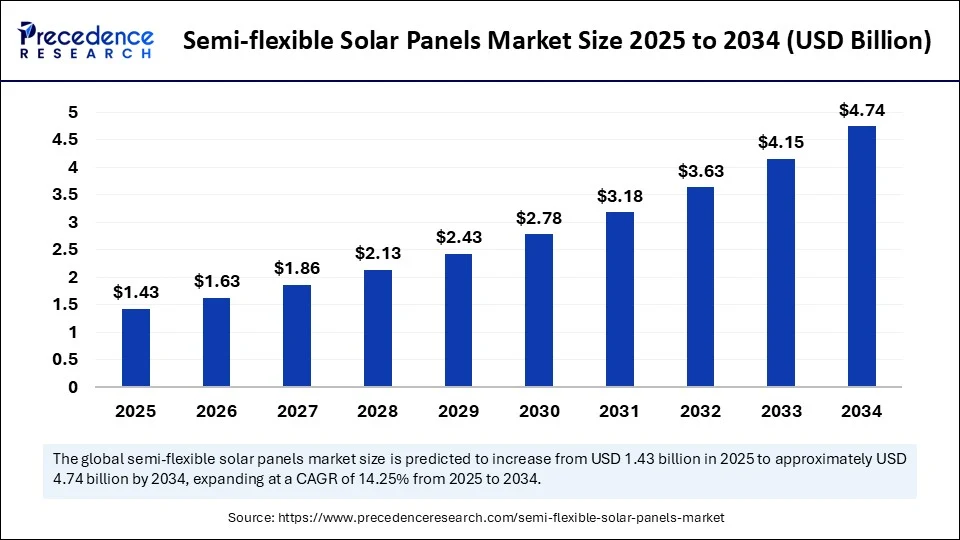

The global semi-flexible solar panels market size was calculated at USD 1.25 billion in 2024 and is predicted to increase from USD 1.43 billion in 2025 to approximately USD 4.74 billion by 2034, expanding at a CAGR of 14.25% from 2025 to 2034. The market is growing due to rising demand for lightweight, portable, and adaptable solar solutions across residential, commercial, and off-grid applications.

Semi-flexible Solar Panels Market Key Takeaways

- In terms of revenue, the global semi-flexible solar market was valued at USD 1.25 billion in 2024.

- It is projected to reach USD 4.74 billion by 2034.

- The market is expected to grow at a CAGR of 14.25% from 2025 to 2034.

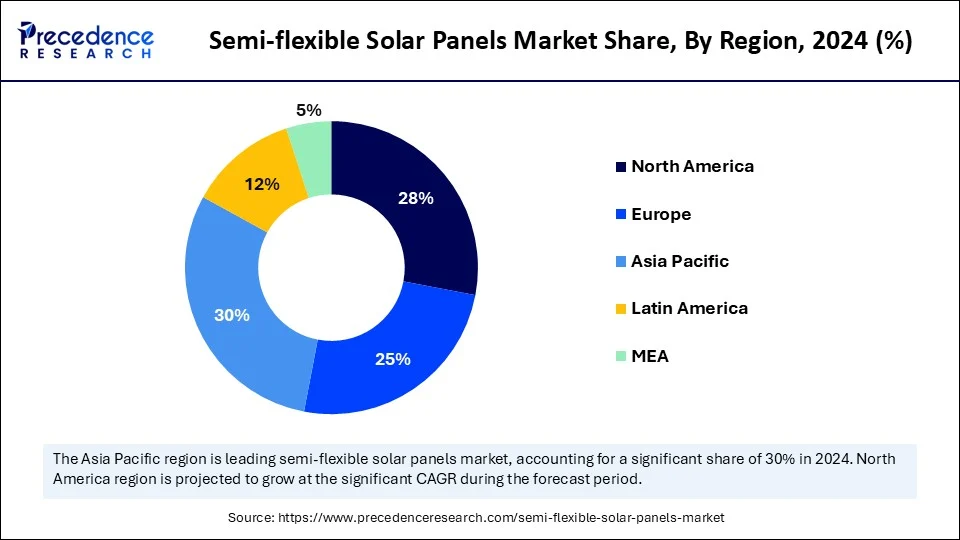

- Asia Pacific dominated the market with the largest market share of 30% in 2024.

- Middle East & Africa is expected to grow at the fastest rate during the forecast period.

- By technology, the thin film (CIGS) held the biggest share of 45% in 2024.

- By technology, the ultra-thin crystalline silicon segments are expected to grow at the fastest CAGR during the forecast period.

- By application, the portable/consumer segment captured the largest share at 35% in 2024.

- By application, the marine & RV segment is projected to grow at the fastest CAGR during the forecast period.

- By power output, the 50W to 200W segment contributed the highest market share of 50% in 2024.

- By power output, the above 500 W segment is emerging as the fastest-growing in the semi-flexible solar panels market.

- By mounting type, the frame-mounted flexible kits segment held the maximum market share of 40% in 2024.

- By mounting type, the adhesive-backed peel-and-stick segment is expected to grow at the fastest CAGR during the forecast period.

- By end user sector, the commercial segment generated the major market share of 40% in 2024.

- By end user sector, the government/institutional segment is expected to grow at the fastest CAGR during the forecast period.

How Is Artificial Intelligence (AI) Optimizing Production and Efficiency in the Semi-flexible Solar Panels Market?

Artificial intelligence is optimizing production and efficiency in the semi-flexible solar panels market by streamlining design, automating quality control, and reducing defects during manufacturing. Machine learning reduces costs and speeds up production by predicting durability and testing material combinations. To forecast performance and facilitate predictive maintenance, artificial intelligence examines data on temperature, sunlight, and panel wear. Because of these developments semi semi-flexible panels are now more dependable, affordable, and appropriate for uses such as building-integrated solar systems, EVs, and portable power.

Asia Pacific Semi-flexible Solar Panels Market Size and Growth 2025 to 2034

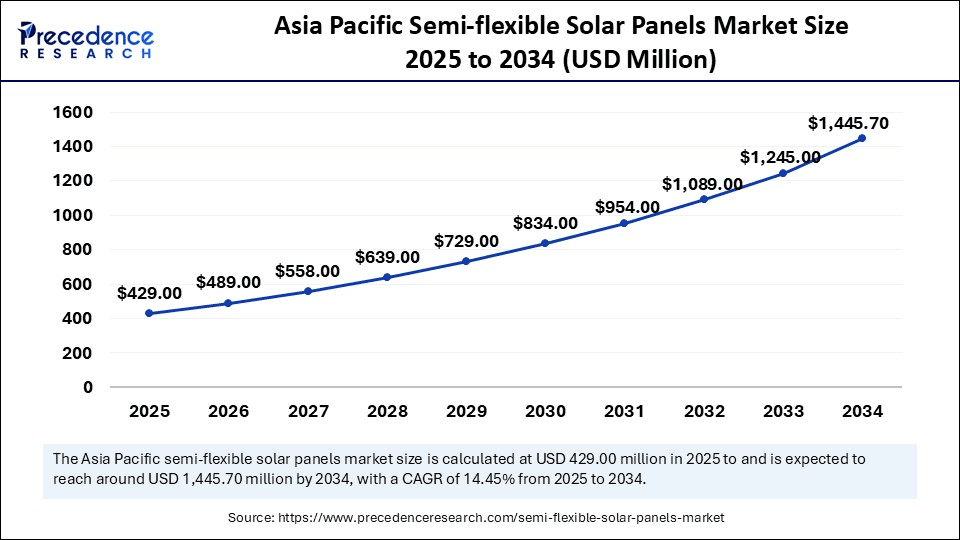

The Asia Pacific semi-flexible solar panels market size is exhibited at USD 429.00 million in 2025 and is projected to be worth around USD 1,445.70 million by 2034, growing at a CAGR of 14.45% from 2025 to 2034.

Why Did Asia Pacific Dominate the Semi-flexible Solar Panels Market?

Asia Pacific segment dominated the market, driven by rapid urbanization, government incentives for solar adoption and improvements in solar panel manufacturing technology are the main drivers of this trend. Leading producers in several nations throughout the region guarantee robust supply capabilities, and rising consumer awareness of sustainable energy options encourages adoption. Furthermore, semi-flexible solar panels are now more reasonably priced due to mass-scale manufacturing in the Asia Pacific and falling production costs, which has strengthened their dominance in both the consumer and business sectors. The region's leadership is further cemented by this robust production scale, policy support, and innovation ecosystem.

The Middle East & Africa segment is the fastest growing, driven by rising off-grid solar adoption and expanded investments in renewable energy infrastructure. Solar deployment is naturally favored by the region's plentiful sunshine and growing demand for dependable energy in isolated locations. Governments are actively promoting renewable energy policies to diversify the production of electricity, and semi-flexible panels provide a low-maintenance, lightweight option that can be used in both urban and rural settings. Adoption is also happening at a never-before-seen rate due to the increase in portable power demand for mining, oil and gas camps, and rural electrification initiatives.

Market Overview

Semi-flexible solar panels are a new innovation in photovoltaic modules featuring a light with slightly flexible substrates, typically made of thin-film materials (such as amorphous silicon or CIGS) or ultra-thin crystalline cells, bonded to polymer or metalized backings. They offer enhanced adaptability for curved surfaces, portability, and low-profile installations compared to rigid panels.

The semi-flexible solar panels market is experiencing steady growth fueled by the growing need for solar solutions that are robust, lightweight, and portable for off-grid commercial and residential use. Since they are made of flexible materials, these panels and frequently used for outdoor activities, boats, recreational vehicles, and building integrated photovoltaics applications where conventional rigid panels are less appropriate. They are becoming increasingly appealing for contemporary energy needs due to their simplicity of installation, increased efficiency, and adaptability to curved surfaces. Government incentives for technological developments in thin film and flexible photovoltaic materials and an increasing focus on the use of renewable energy sources are all contributing to the market's rapid growth.

Semi-flexible Solar Panels Market Growth Factors

- Rising Demand for Portable & Lightweight Energy Solutions: Semi-flexible panels are popular for RVs, boats, and outdoor use because they are lightweight, portable, and easy to install, driving demand for mobile renewable energy.

- Increasing Adoption in Residential & Commercial Use: Their ability to fit curved or uneven surfaces makes them ideal for rooftops, vehicles, and building facades, boosting adoption across sectors.

- Growth of Off-Grid & Remote Applications: Semi-flexible panels provide reliable power in rural, remote, and disaster-hit areas without heavy infrastructure, supporting off-grid energy needs.

- Advancements in Solar Technology: Improved thin film materials like CIGS have enhanced panel efficiency and durability, making semi-flexible solutions more attractive.

- Supportive Government Policies: Subsidies and green energy programs worldwide are encouraging renewable adoption, benefiting semi-flexible solar panel deployment.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.74 Billion |

| Market Size in 2025 | USD 1.43 Billion |

| Market Size in 2024 | USD 1.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.25% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology / Substrate, Application, Power Output Range, Mounting Type, End-User Sector, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Adoption of Renewable Energy

Semi-flexible solar panels are in a good position to gain from the global trend toward sustainable power generation, which is increasing demand for more flexible solar solutions. Infrastructure for renewable energy is being invested in the governments and businesses to lessen carbon footprints. Customers are looking for cost-effective solar solutions that work in a variety of settings as regulations and sustainability goals become more stringent. By satisfying these demands through portability and adaptability to nontraditional installations semi semi-flexible designs increase their allure in the clean energy transitions.

- On 19 June 2024, DuPont and Desun Energy officially launched flexible solar panels featuring DuPont Tedlar front sheet at Intersolar Europe 2024, highlighting better outdoor stability and durability.(Source: https://www.dupont.com)

Supportive Government Policies and Incentives

The semi-flexible solar panels market is benefiting from policies that promote wider solar adoption, such as tax breaks, subsidies, and renewable energy requirements. Green building standards are rebate programs that are being used in many regions to encourage the use of clean energy. To encourage consumer adoption, educational initiatives about renewable power frequently incorporate applications that are appropriate for portable and flexible formats. Semi-flexible technologies are becoming more widely used in residential, commercial, and niche energy sectors thanks to these systemic supports that are reducing purchase barriers.

Restraints

Higher Cost Compared to the Conventional Panels Market

Generally speaking, semi-flexible solar panels are more expensive per watt than conventional rigid crystalline silicon modules. The specialized materials, protective coatings, and flexible substrates that raise production costs are the reasons behind their premium pricing. For large-scale or cost-conscious installations where buyers frequently choose more economical rigid options, this pricing disparity reduces their appeal. In emerging economies where upfront affordability is crucial, the high upfront investment particularly discourages growth in the semi-flexible solar panels market.

- On 21 February 2025, Polyshine Solar unveiled ultralight, flexible rooftop solar models with a power conversion efficiency of up to 20.1% but their advanced manufacturing likely comes at a premium cost.(Source: https://www.pv-magazine.com)

Limited Consumer Awareness

Despite their growing presence in outdoor and recreational markets, many potential end users remain unaware of semi-flexible solar panel use cases and benefits. Their niche positioning and the absence of mainstream marketing have resulted in low public visibility. Without aggressive consumer education or retail exposure, adoption outside enthusiast groups remains limited.

- In 2025, Japan's renewed push into ultra-thin, flexible solar technologies highlights advancing tech but also underscores a broader awareness lag.(Source:https://m.economictimes.com)

Opportunities

Integration with Electric Vehicles (EVs)

As electric vehicle adoption rises, integrating semi-flexible solar panels onto vehicles' roofs offers a promising opportunity for auxiliary power generation, extending range, and reducing grid dependency. Flexible panels can conform to curved surfaces, providing continuous trickle charging for HVAC infotainment or on-board electronics. This creates value by enhancing EV efficiency with minimal aesthetic or structural compromise.

- On 19 June 2025, Polyshine Solar unveiled lightweight flexible rooftop modules at World Smart Energy Week 2025, emphasizing their potential for curved surfaces and ease of installation, ideal for future EV applications.(Source: https://www.polyshinesolar.com)

Advanced Tandem & Perovskite Flexible Technologies

Once niche flexible solutions are becoming more widely available, as breakthroughs in flexible perovskite/silicon tandem solar cells are pushing efficiencies towards 30 percent. New lightweight high-power solar application types are made possible by these high-efficiency formats, opening markets that were previously restricted by low power capabilities.

- On 29 April 2025, Researchers demonstrated flexible perovskite/c-silicon tandem solar cells with a certified 29.88% efficiency, making a major leap toward the commercialization of high-performing flexible PV.(Source: https://www.polyshinesolar.com)

Technology Insights

Why Is the Thin Film (CIGS) Segment Dominating the Semi-flexible Solar Panels Market in 2024?

The thin film (CIGS) segment dominated the semi-flexible solar panels market, propelled by its graded flexibility, low weight, and high energy conversion efficiency in comparison to conventional materials. Because these panels are simpler to install on curved or uneven surfaces, they are perfect for portable electronics transport applications and building-integrated photovoltaics. Their superior performance in low light and durability further solidifies their market dominance.

Ultra-thin crystalline silicon segment is the fastest growing, propelled by ongoing developments that blend the lightweight and pliable properties of flexible substrates with the high efficiency of crystalline silicon. Applications requiring both portability and increased power output are increasingly using these panels. Ultra-thin crystalline silicon is now a competitive option in the flexible solar market thanks to manufacturing advancements that are bringing down costs.

Application Insights

Why Did the Portable/Consumer Segment Dominate the Semi-flexible Solar Panels Market in 2024?

The portable/consumer segment dominated the semi-flexible solar panels market, driven by rising demand for lightweight, easy-to-carry solar solutions for outdoor activities, camping, and personal gadgets. Consumers are increasingly preferring semi-flexible panels for charging smartphones, laptops, and other portable devices. Their versatility and adaptability have positioned this segment at the forefront of market adoption.

The marine & RV segment is the fastest growing, driven by the rise in caravan travel, recreational boating, and the need for off-grid power sources. Semi-flexible panels are perfect for marine and RV applications because they can fit on curved surfaces without adding a lot of weight. Rapid adoption in this market is being driven by the trend toward energy independence and sustainable tourism.

Power Output Insights

Why Did the 50W to 200W Segment Dominate the Semi-flexible Solar Panels Market in 2024?

The 50W to 200W segment dominated the market for semi-flexible solar panels, driven by its adaptability to a variety of consumer and small-scale business applications. These panels are the most widely used type for small appliances, camping equipment, and personal electronics because they provide the best possible balance of portability, affordability, and efficiency. Their widespread demand is further supported by their ease of installation.

The above 500 W segment is the fastest growing, driven by the growing demand for larger capacity solar solutions in heavy-duty off-grid commercial and industrial settings. Semi-flexible panels can now produce higher wattages while still being lightweight, thanks to technological advancements. This is creating new possibilities for power-hungry applications and large-scale projects.

Mounting Type Insights

Why Did Frame-Mounted Flexible Kits Segment Dominate the Semi-flexible Solar Panels Market in 2024?

Frame-mounted flexible kits segment dominated the semi-flexible solar panels market, driven by the fact that they are more resilient to severe weather, more structurally stable, and more durable than adhesive-based panels. They are favored in long-term and commercial installations where dependability is essential. Their dominant position is a result of their longer lifespan and high level of market acceptance.

Adhesive adhesive-backed peel and stick segment is the fastest growing because of its lightweight design and ease of installation. Users can quickly mount panels without an expert's assistance. These panels are perfect for curved surfaces, short-term setups, and convenience-seeking do-it-yourselfers. Adoption is speeding up due to the rising demand for cars, portable electronics, and residential rooftops.

End User Sector Insights

Why Did the Commercial Segment Dominate the Semi-flexible Solar Panels Market in 2024?

The commercial segment dominated the market, driven by the growing use of semi-flexible panels in offices, retail stores, and industrial facilities, looking for environmentally friendly energy sources. They are appropriate for rooftops where conventional panels are impractical due to their versatility and light weight. The emphasis on green energy adoption by businesses has strengthened this segment's dominance.

The government/ institutional segment is the fastest growing, driven by increased funding for public infrastructure defense applications and renewable energy projects. Because of their portability and speed of deployment semi semi-flexible panels are being used in military camps, remote installations, and disaster relief efforts. Government initiatives that are encouraging this industry are increasing demand even more.

Semi-flexible Solar Panels Market Companies

- SunPower (Maxeon)

- NexPower

- PowerFilm Solar

- Oxford Photovoltaics

- Amorphous Energy Solutions

- Alta Devices

- SolarBorn

- Heliatek

- Flisom

- Solbian (Solbian R&D)

- Innovation Solar

- AltaGlass

- Flexcell Solar

- Voltaic Systems

- SolarFlexPower (Zhejiang)

- Pophypower (FlexCell)

- Rollbond

- LIM Group

- Sunflare

- Tigo Energy (FlexModule)

Recent Developments

- On 9 January 2025, Anker introduced the Solix Solar Beach Umbrella at CES 2025, integrating perovskite solar cells capable of up to 100 W output via USB-C and XT-60 ports, offering significant performance improvements over conventional silicon cells.(Source: https://pv-magazine-usa.com)

- On 10 July 2025, during Amazon Prime Day 2025, brands like ECO-WORTHY, Renogy, and DOKIO offered semi-flexible, waterproof solar panels at 15–30% discounts—making lightweight, DIY-friendly solar solutions more accessible for balconies and outdoor setups.(Source: https://www.homebuilding.co.uk)

- On 14 June 2025, at SNEC 2025, Polyshine Solar unveiled the JG-Series: double-sided, translucent, ultra-thin (1.1 mm glass) flexible PV modules with up to 23.3% efficiency and a weight under 5.5 kg/m², optimized for applications on curved, high-load, or architectural surfaces.

(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Technology / Substrate

- Thin film (amorphous silicon)

- Thin film (CIGS)

- Ultra-thin crystalline silicon

By Application

- Portable / Consumer (e.g., backpacks, chargers)

- Building-integrated (roofing materials, facades)

- Industrial / Commercial (ground-mounted arrays, warehouses)

- Marine & RV (boats, recreational vehicles, off-grid mobility)

- Specialized (drones, aerospace, military)

By Power Output Range

- Below 50 W

- 50 W to 200 W

- 201 W to 500 W

- Above 500 W

By Mounting Type

- Adhesive-backed peel-and-stick

- Frame-mounted flexible kits

- Rollable / Sheet formats

- Custom-contour laminates

By End-User Sector

- Residential end-use

- Commercial end-use

- Industrial end-use

- Government / Institutional end-use

By Region

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting