What is the Sugar-Based Excipients Market Size?

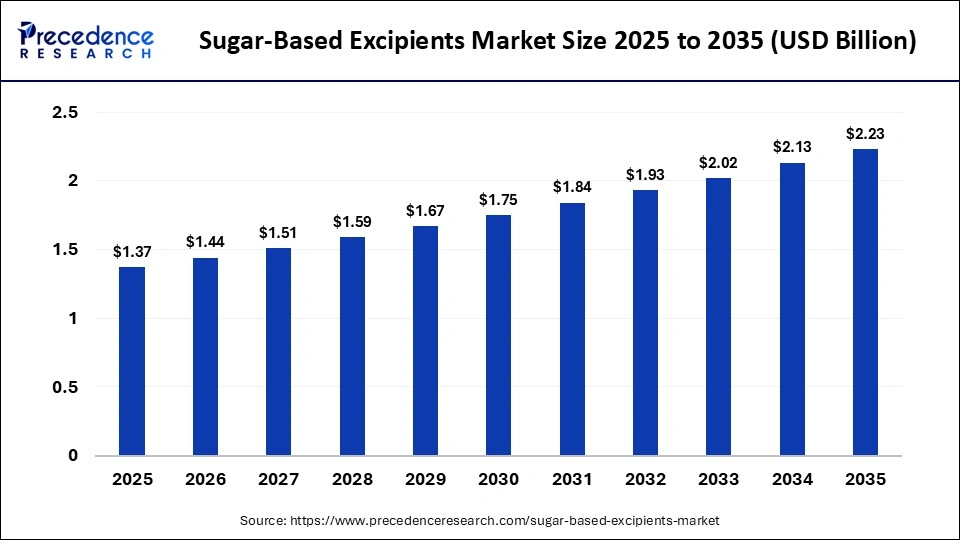

The global sugar-based excipients market size accounted for USD 1.37 billion in 2025 and is predicted to increase from USD 1.44 billion in 2026 to approximately USD 2.23 billion by 2035, expanding at a CAGR of 5.00% from 2026 to 2035. The market is rapidly expanding due to the rising demand for pharmaceutical, nutraceutical, and food products that offer improved taste and low side effects. Increasing geriatric population, growing healthcare awareness, and the expanding production of generic drugs are further supporting the market growth.

Market Highlights

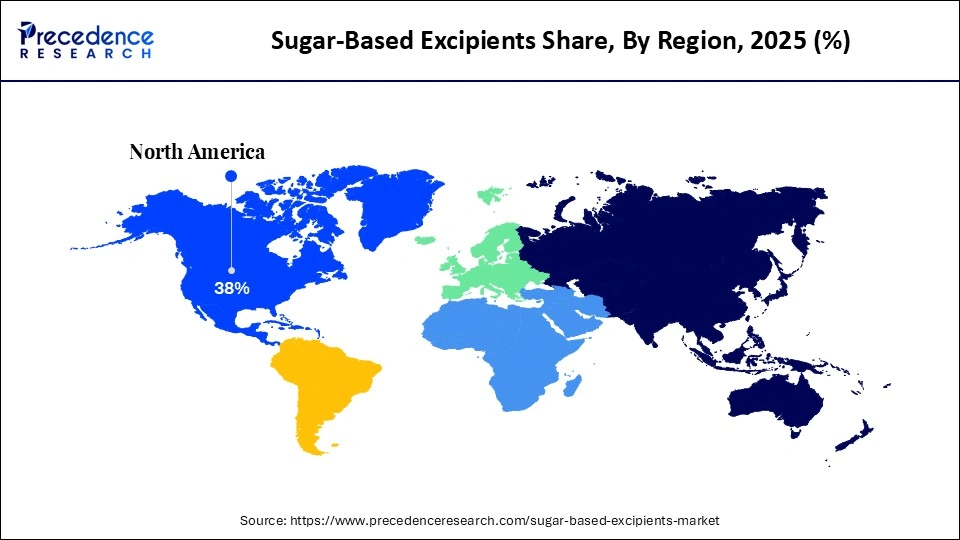

- North America held the largest market share of 38% in 2025.

- The Asia Pacific is projected to grow at the fastest CAGR during the foreseeable period.

- By product type, the sugar alcohols segment held the largest market share of nearly 45% in 2025.

- By product type, the artificial sweeteners segment is projected to grow at the fastest CAGR during the foreseeable period.

- By form, the powders/granules segment held the largest market share of 40% in 2025.

- By form, the direct compression sugar segment is projected to grow at the fastest CAGR during the foreseeable period.

- By application/functionality, the fillers & diluents segment held the largest market share of nearly 54% in 2025.

- By application/functionality, the flavoring & taste-making agents segment is projected to grow at the fastest CAGR during the foreseeable period.

- By end user, the pharmaceutical companies segment held the largest market share of nearly 62% in 2025.

- By end user, the CDMOs segment is projected to grow at the fastest CAGR during the foreseeable period.

Market Overview

The sugar-based excipients market deals with the production and sale of inactive, sugar-derived substances like sucrose, mannitol, and others, which are used as fillers, binders, and flavor maskers in various sectors like pharmaceutical, food, and nutraceutical. They are widely used in oral solid dosages like tablets, capsules, and pediatric formulations. The market is gaining momentum due to advancements in drug formulation technologies and the increasing use of patient-friendly dosage forms such as chewable tablets, syrups, and orally disintegrating tablets. Additionally, the growing preference for natural, biodegradable, and clean-label excipients in pharmaceutical and food applications is further accelerating market expansion.

Sugar-Based Excipients Market Trends

- The market is witnessing a strong trend toward compressible sugar excipients, as they simplify manufacturing processes while reducing processing time and energy consumption.

- Manufacturers are increasingly combining two or more excipients to create single, high-performance ingredients with improved flowability and dilution capacity.

- Rising demand for palatable formulations that aid swallowing and improve patient compliance, especially among pediatric and geriatric populations, is supporting market growth.

- A growing preference for plant-derived, natural, and toxin-free ingredients over synthetic alternatives is further boosting demand for sugar-based excipients.

How is AI Impacting the Sugar-Based Excipients Market?

The integration of artificial intelligence in sugar-based excipients manufacturing is optimizing formulation development through machine learning (ML)–driven prediction of excipient–API compatibility, real-time quality monitoring, and process optimization. AI algorithms can analyze large chemical and formulation datasets to predict interactions between sugar excipients and active pharmaceutical ingredients, significantly reducing reliance on time-consuming empirical testing. ML models and neural networks show strong potential in modeling complex formulations, guiding product development decisions, and improving performance consistency. Case studies involving tablet formulations, lipid-based carriers, and nanotechnology enabled systems highlight AI's practical success in enhancing formulation efficiency, reproducibility, and overall product quality.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.37 Billion |

| Market Size in 2026 | USD 1.44 Billion |

| Market Size by 2035 | USD 2.23 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Form, Application/Functionality, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

Why Does the Sugar Alcohols Segment Lead the Sugar-Based Excipients Market?

The sugar alcohols segment led the market while holding the largest share of nearly 45% in 2025, as they offer a sweet and pleasant sugary taste without significant changes in blood sugar levels. They are commonly used as binders and fillers for oral tablet development due to their properties, such as non-browning and non-crystallization. They are highly safe for diabetes patients as they do not cause a sharp rise in sugar levels. Also, they are highly versatile in both food and pharmaceutical applications, fueling their demand on a large scale.

The artificial sweeteners segment is projected to grow at the fastest CAGR during the foreseeable period as they offer high-intensity sweetness and fewer calories. These sweeteners do not impact blood sugar levels and do not cause tooth decay or cavities, making them the preferred choice in various applications. These sweeteners are used to mask the bitter taste of active pharmaceutical ingredients, especially in tablets and syrup, and are mainly used by pediatricians due to their enhanced properties and safety.

Form Insights

Why Did the Powders/Granules Segment Dominate the Sugar-Based Excipients Market?

The powders/granules segment held the largest market share of 40% in 2025, owing to their extensive use in high-volume pharmaceutical formulations such as tablets and capsules. These forms are preferred for their excellent flowability, compressibility, and ability to enhance manufacturing efficiency, while also supporting patient-friendly and natural formulations. Additionally, the pharmaceutical industry's heavy reliance on tablet and capsule dosage forms sustains strong demand for high-volume fillers and diluents, reinforcing this segment's market leadership.

The direct compression sugar segment is projected to grow at the fastest CAGR during the foreseeable period due to its suitability for high-speed tablet production and its ability to handle heat- and moisture-sensitive active pharmaceutical ingredients. These excipients offer excellent compressibility and flow, ensuring a strong tablet structure and consistent weight without the need for complex granulation processes. Their efficiency in simplifying manufacturing and reducing production time makes them highly attractive to pharmaceutical manufacturers. Additionally, the increasing demand for patient-friendly, natural, and reliable formulations is further driving the adoption of direct compression sugar excipients.

Application/Functionality Insights

Why Does the Fillers & Diluents Segment Lead the Sugar-Based Excipients Market?

The fillers & diluents segment led the market while holding the largest market share of nearly 54% in 2025, owing to their critical role in providing bulk, enhanced powder flow, and content uniformity in the rapidly growing solid dosage of oral medicines. Fillers and diluents are fundamental to creating proper tablet size and weight that increases flowability with mass production and supports drug compressibility. Modern sugar-based fillers like sorbitol often serve dual purposes of filler and binder, making them an ideal option for tablet formation safely.

The flavoring & taste-making agents segment is expected to grow at the fastest CAGR during the forecast period. This is mainly due to the rising demand for palatable pharmaceutical, nutraceutical, and food products. Sugar-based excipients help mask the bitterness of active ingredients, improving patient compliance, especially among children and the geriatric population. Their natural origin and safety profile make them increasingly preferred over synthetic alternatives. Additionally, the growth of functional foods, dietary supplements, and chewable or orally disintegrating formulations is further driving the adoption of sugar-based flavoring agents.

End User Insights

How do Pharmaceutical Companies Hold the Largest Market Share?

The pharmaceutical companies segment held the largest market share of nearly 62% in 2025 due to their extensive use in high-volume formulations such as tablets, capsules, and orally disintegrating tablets (ODTs). These companies prioritize natural, non-GMO, and patient-friendly excipients to enhance taste, stability, and overall formulation quality. Additionally, pharmaceutical manufacturers' focus on improving patient compliance and product performance continues to drive the segment's market leadership.

The CDMOs segment is projected to grow at the fastest CAGR during the foreseeable period, driven by their specialized offerings and integrated services for advanced oral solid dosage formulations. They leverage technologies such as hot melt extrusion and spray drying to enhance drug stability, which is particularly important for pediatric and geriatric formulations. Rapid adoption of sugar-based binders and fillers by CDMOs is further fueling the segment's growth.

Regional Insights

How Big is the North America Sugar-Based Excipients Market Size?

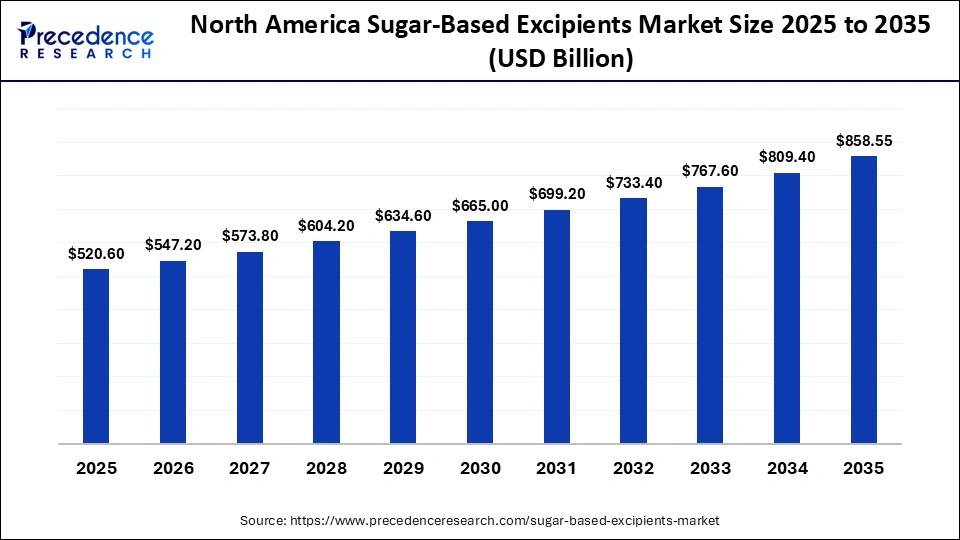

The North America sugar-based excipients market size is estimated at USD 520.60 million in 2025 and is projected to reach approximately USD 858.55 million by 2035, with a 5.13% CAGR from 2026 to 2035.

What Factors Contribute to North America's Dominance in the Sugar-Based Excipients Market?

North America dominated the sugar-based excipients market by holding a major share of 38% in 2025 due to a combination of factors like its well-established pharmaceutical and biotech industries, strict safety regulations, and growing use of oral medicines. The rapid expansion of biologics relies heavily on advanced sugar-based stabilizers like sucrose and trehalose to prevent protein aggregation and degradation during storage and transport. Additionally, rising consumer preference for plant-based, clean-label, and non-toxic ingredients in medicines is further fueling market growth in the region.

What is the Size of the U.S. Sugar-Based Excipients Market?

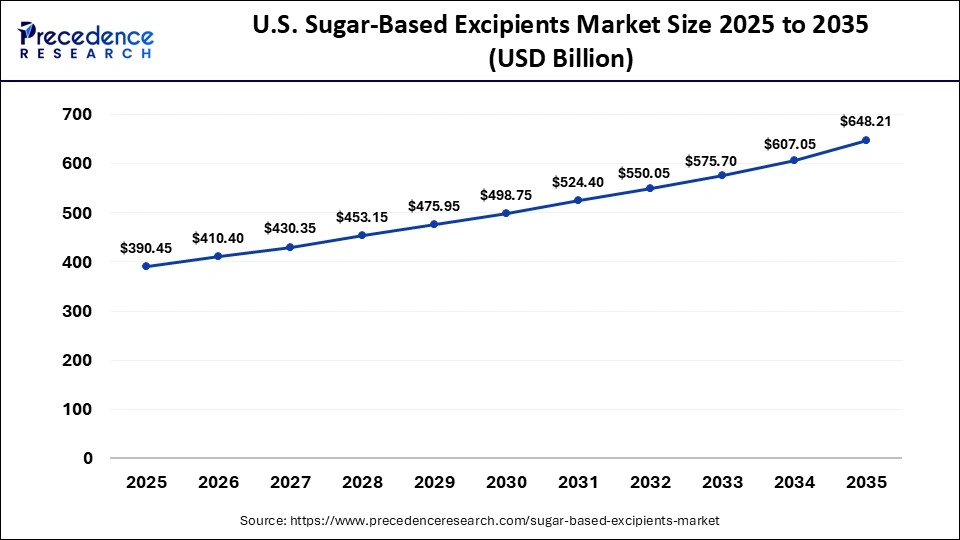

The U.S. sugar-based excipients market size is calculated at USD 390.45 million in 2025 and is expected to reach nearly USD 648.21 million in 2035, accelerating at a strong CAGR of 5.20% between 2026 and 2035.

U.S. Sugar-Based Excipients Market Trends

The U.S. sugar-based excipients market is experiencing strong growth driven by the rising demand for orally disintegrating and chewable formulations with enhanced taste. There is a high adoption of sugar alcohols, such as mannitol and sorbitol, due to their high stability and suitability for direct compression. The country's position as a market leader is further supported by its advanced, research-driven pharmaceutical manufacturing sector and well-developed infrastructure.

What Makes Asia Pacific the Fastest-Growing Region in the Sugar-Based Excipients Market?

Asia Pacific is expected to grow at the fastest CAGR during the foreseeable period, driven by the rapid expansion of pharmaceutical manufacturing in countries like China, India, and Japan, and rising demand for generic drugs and high-volume production amid increasing chronic diseases. The region serves as a major pharma manufacturing hub, requiring large quantities of sugar-based excipients for tablet formulations. Additionally, low labor and manufacturing costs, along with strategic partnerships and joint ventures between global leaders like Corlon and Roquette, are boosting R&D investments and further fueling market demand in the region.

China Sugar-based Excipients Market Trends

China is a major contributor to the Asia Pacific sugar-based excipients market due to its expanding pharmaceutical manufacturing for biologics and over-the-counter drugs, supported by a large aging population and rising healthcare spending. The country's strength lies in its massive manufacturing capacity, with around 400 specialized excipient manufacturers bolstering a robust pharmaceutical industry.

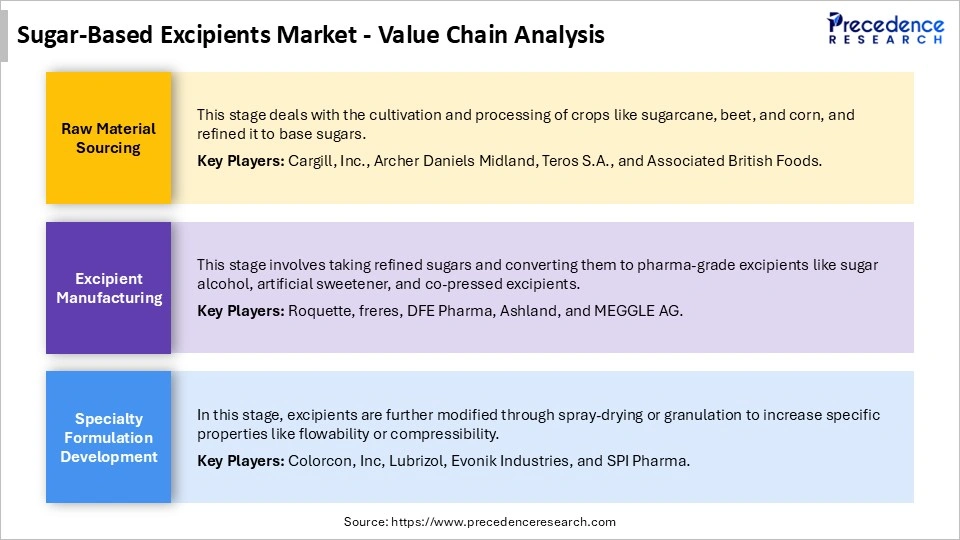

Sugar-Based Excipients Market Value Chain Analysis

Who are the Major Players in the Global Sugar-Based Excipients Market?

The major players in the sugar-based excipients market include Roquette Freres, DFE Pharma, Ashland Global Holdings Inc, BASF SE, Cargill, Incorporated, Archer Daniels Midland Company (ADM), Associated British Foods (SPI Pharma), Ingredion Incorporated, JRS Pharma GmbH & Co. KG, Colorcon, Inc., MEGGLE Group, Südzucker AG (BENEO), Tereos S.A., Kerry Group plc, and Merck KGaA.

Recent Developments

- In October 2025, Roquette, a popular pharma leader for plant-based ingredients and excipients for health and nutrition, launched its novel pharmaceutical excipient, KLEPSTONE Crysmeb methyl-beta-cyclodextrin, aiming to enhance the solubility and stability of a wide range of APIs.(Source: https://www.pharmaexcipients.com)

- In October 2025, Ashland is enhancing its portfolio by focusing on high-purity excipients for injectables and low-nitrate offerings for oral solid dosage, along with lifesaving medicines.(Source: https://www.pharmtech.com)

Segments Covered in the Report

By Product Type

- Sugar Alcohols (Polyols)

- Actual Sugars

- Artificial Sweeteners

By Form

- Powders/Granule

- Direct Compression Sugars

- Syrups & Liquid Solutions

By Application/Functionality

- Fillers & Diluents

- Flavoring & Taste-Masking Agents

- Tonicity Agents

By End-User

- Pharmaceutical Companies

- CDMOs (Contract Manufacturers)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting