What is the Pharmaceutical Lipid-Based Excipients Market Size?

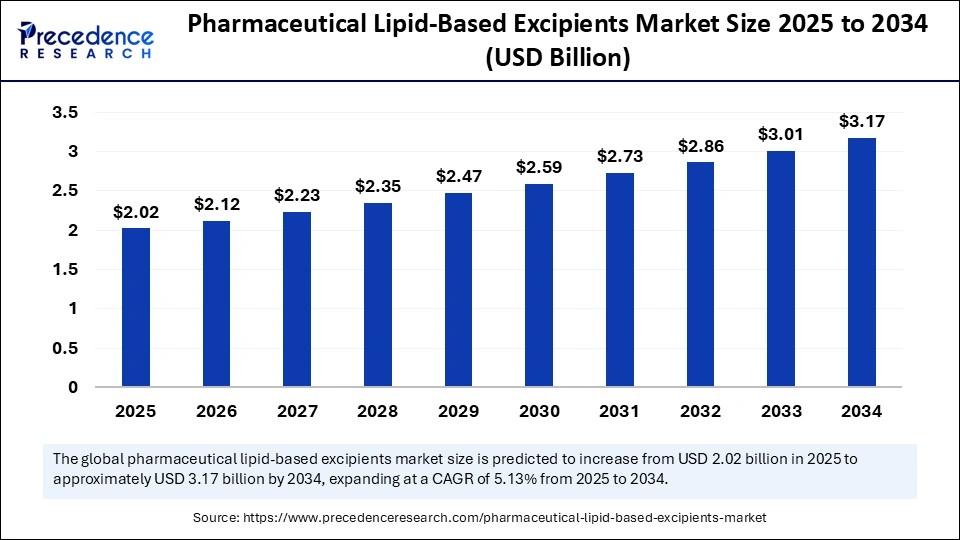

The global pharmaceutical lipid-based excipients market size is calculated at USD 2.02 billion in 2025 and is predicted to increase from USD 2.12 billion in 2026 to approximately USD 3.17 billion by 2034, expanding at a CAGR of 5.13% from 2025 to 2034. The rising demand for liquid formulations and advances in drug delivery technologies are fueling the growth of the global pharmaceutical lipid-based excipients market.

Market Highlights

- North America dominated the global pharmaceutical lipid-based excipients market, with the largest share of 40% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

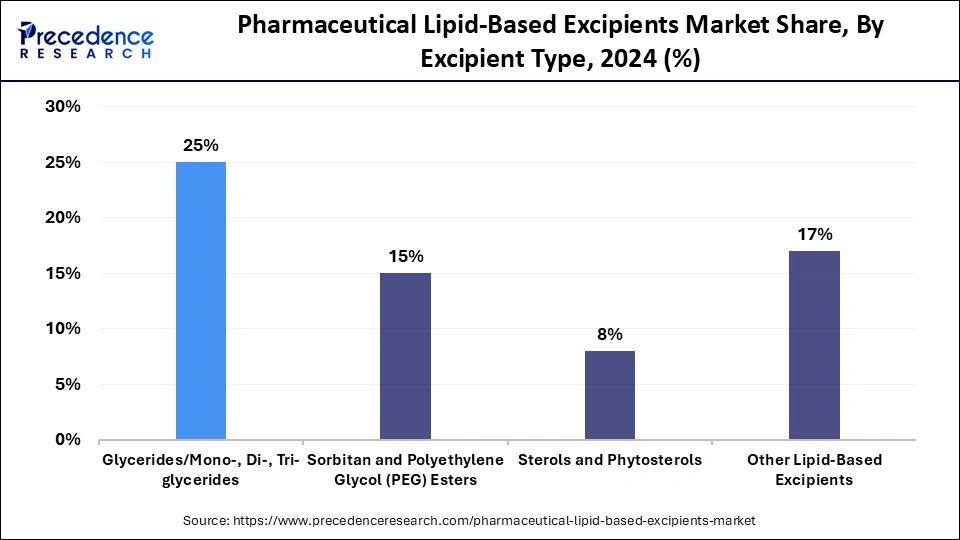

- By excipient type, the phospholipids segment contributed the largest market share of 35% in 2024.

- By excipient type, the sorbitan & polyethylene glycol (PEG) esters segment is expected to grow at a significant CAGR from 2025 to 2034.

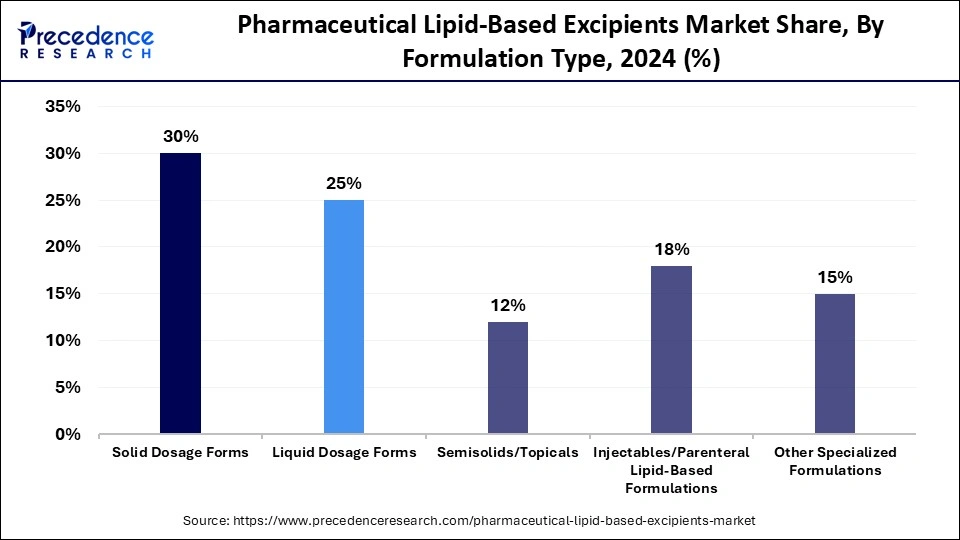

- By formulation type, the solid dosage forms segment led the market while holding the largest share of 30% in 2024.

- By formulation type, the injectables / parenteral lipid-based formulations segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By application/therapeutic area, the oncology segment held the largest market share of 28% in 2024.

- By application/therapeutic area, the infectious diseases segment is expected to grow at a significant CAGR between 2025 and 2034.

- By end-user/customer, the pharmaceutical manufacturers segment accounted for the biggest market share of 50% in 2024.

- By end-user/customer, the biopharmaceutical companies segment is growing at a significant CAGR between 2025 and 2034.

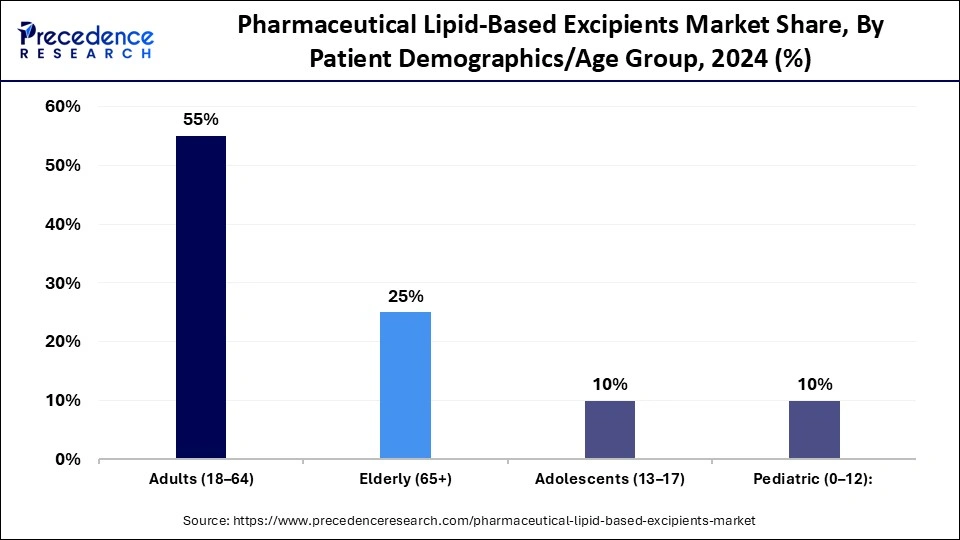

- By patient demographic/age group, the adults (18–64) segment captured the highest market shar of 55% in 2024.

- By patient demographic/age group, the pediatric (0–12) segment is expected to grow at the fastest rate between 2025 and 2034.

Understanding Lipid-Based Excipients in Drug Formulation: Definitions, Roles & Mechanisms

Pharmaceutical lipid-based excipients are specialized lipid materials used in drug formulation to improve the solubility, stability, and bioavailability of active pharmaceutical ingredients (APIs). These excipients include oils, fats, phospholipids, surfactants, and other lipid derivatives, which are essential in developing oral, topical, and parenteral drug delivery systems. They are commonly used in solid lipid nanoparticles, liposomes, self-emulsifying drug delivery systems (SEDDS), and other advanced drug delivery technologies to boost therapeutic effectiveness and patient adherence.

Pharmaceutical lipid-based excipients are produced to meet strict regulatory standards, ensuring safety, quality, and consistency in pharmaceutical use. Healthcare professionals focused on delivering personalized medicine create significant opportunities for specialized excipients. Major advances in drug delivery systems, such as nanotechnology and lipid-based excipients, are enhancing bioavailability and targeted delivery.

Technological Transitions in Lipid-Based Excipients: Nanoparticles, Liposomes and Beyond

The pharmaceutical lipid-based excipients industry is experiencing rapid technological changes due to advances in digitalization and automation. Manufacturing companies are focusing on improving lipid nanoparticles to enhance drug delivery systems, targeting therapies, and solubility. The focus on sustainable, natural, and bridgeable lipid excipients is driving innovation in natural and biodegradable options because of regulatory pressures and consumer demands. Additionally, the adoption of advanced technologies like AI, 3D printing, and smart excipients supports personalized medicine, increases patient compliance, and enables customized dosage forms.

BASF, Gattefosse, and ABITEC Corporation are the leading companies investing heavily in the technological shift in the pharmaceutical lipid-based excipients industry. BASF offers digital formulation tools like MyProductWorld and ZoomLab, utilizing predictive models to streamline formulation processes. Gattefosse enhances the oral bioavailability of poorly water-soluble drugs. Additionally, ABITEC Corporation provides specialty lipids and a co-processed excipient system for direct compression and sustained-release applications.

Pharmaceutical Lipid-Based Excipients MarketOutlook

The pharmaceutical lipid-based excipients market is experiencing significant growth due to rising demand for advanced drug delivery systems and biologic formulations. Factors such as increased adoption of mRNA, demand for gene therapies, and expanding portfolios of poorly water-soluble drugs are driving this growth. Innovations in advanced technologies like nanoparticle delivery systems and a focus on providing personalized medicine, supported by regulatory bodies, are strengthening the industry position.

There is significant potential for market growth in emerging regions such as Latin America, Southeast Asia, and the Middle East & Africa, driven by increased healthcare demand and a rising population. The growth of pharmaceutical manufacturing, expanding gene-based drug production, and the need for advanced drug delivery systems support this development.

Pharmaceutical companies like Evonik Industries AG are the primary investors in lipid excipients, with a $220 million facility dedicated to mRNA-based therapy lipids. ABITEC Corporation, BASF, CordenPharma, Lipoid, Corda International, and Ashland are also making significant investments in this industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.02 Billion |

| Market Size in 2026 | USD 2.12 Billion |

| Market Size by 2034 | USD 3.17 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.13% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Excipient Type, Formulation Type, Application / Therapeutic Area, End-User / Customer Segment, Patient Demographics / Age Group, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pharmaceutical Lipid-Based Excipients Market Segment Insights

Excipient Type Insights

In 2024, the phospholipids segment led the market with about 35% share due to its ability to enable advanced drug delivery systems. The phospholipid excipients offer versatile building blocks for cutting-edge drug delivery methods, including liposomes and lipid nanoparticles. These excipients improve drug solubility, stability, and bioavailability. Phospholipids can be used in both topical and ophthalmic formulations, especially for oncology applications, leading to increased demand for natural and synthetic phospholipids in various pharmaceutical products.

The sorbitan & polyethylene glycol (PEG) esters segment is expected to grow at the fastest rate in the upcoming period due to high solubility and bioavailability. The sorbitan and polyethylene glycol esters have superior performance as emulsifiers, solubilizers, and surfactants. The challenges of improving the stability and bioavailability of poorly water-soluble drugs can be addressed by using sorbitan and polyethylene glycol (PEG) esters as excipients. Advances in drug delivery systems, mRNA-based therapies, and biopharmaceuticals contribute to this growth.

Formulation Type Insights

The solid dosage forms segment dominated the market with a 30% share in 2024 due to its high solubility and bioavailability. Oral dosage forms are the most preferred methods for drug administration because of their convenience, ease of production, and stability, which is driving the demand for oral medications and promoting innovations and developments in solid dosage forms. Solid formulations overcome the challenges posed by a large proportion of active pharmaceutical ingredients (APIs), such as limited availability and water solubility. With a strong patient preference for oral medication, the need for innovative solid dosage forms continues to grow.

The injectables / parenteral lipid-based formulations segment is expected to grow at a significant CAGR over the forecast period, driven by its improved bioavailability. The strong control of lipid formulations on drug release, along with increased patient preference for injectables / parenteral lipid-based formulations, especially for chronic diseases like cancer, neurological disorders, and pain management, contribute to this growth. These formulations, including lipid emulsions, lipid nanoparticles (LNPs), and liposomes, help enhance patient compliance and therapeutic effectiveness for chronic conditions. Rapid advancements in gene therapies and mRNA vaccines are further fueling innovations in injectables / parenteral lipid-based formulations.

Application/Therapeutic Area Insights

The oncology segment led the market with the largest share of 28% in 2024, driven by increasing pipelines for targeted therapies and immunotherapies. Lipid nanoparticles and liposomes facilitate targeted drug delivery for cancer. Lipid-based excipients improve the solubility, bioavailability, and stability of anti-cancer drugs, making them suitable for delivering hydrophobic cancer drugs and boosting therapeutic effectiveness. These lipid excipients are extensively used in liposomes and self-emulsifying drug delivery systems to reduce toxicity and enhance treatment outcomes. The segment is rapidly expanding, supported by the growing pipelines of anti-cancer drugs such as gene therapies and immunotherapies for cancer.

The infectious diseases segment is expected to grow at a notable CAGR during the forecast period, driven by the capability of lipid-based excipients to improve solubility, bioavailability, and stability of anti-infective drugs. These excipients are extensively used in treatments such as antivirals and antibiotics. They are also vital in formulations like vaccines, especially mRNA vaccines. Lipid nanoparticles and liposomes are key in delivering poorly soluble drugs, increasing bioavailability, and stabilizing sensitive therapeutic molecules.

End-User/Customer Insights

The pharmaceutical manufacturers segment dominated the market with a 50% share in 2024 due to increased demand for novel drug formulations and advanced delivery systems. Pharmaceutical manufacturers play a crucial role in fueling innovations and the adoption of cutting-edge lipid-based excipients. The demand for biologics, biosimilars, and mRNA vaccines has increased, leading to robust adoption of lipid-based excipients to improve the stability, solubility, and bioavailability of APIs. Increased investments in R&D by pharmaceutical manufacturers enable strong innovations and development of lipid-based excipients.

The biopharmaceutical companies segment is expected to grow at the fastest rate during the forecast period, driven by its role as the primary consumer of lipid-based excipients. The increasing pharmaceutical manufacturing capabilities and demand for advanced drug delivery systems are fueling this growth. These companies use these ingredients in large-scale drug production. The significant investments in biologics, biosimilars, and advanced therapies like mRNA vaccines by biopharmaceutical companies contribute to the segment's growth.

Patient Demographic/Age Group Insights

In 2024, the adults (18–64) segment dominated the market with the largest share of 55%, due to the high prevalence of chronic and lifestyle diseases among adults. Adults face challenges in drug administration because of a high proportion of poorly water-soluble drug candidates. The demand for advanced drug delivery systems has increased in this age group. Adults also have a rising demand for targeted therapies, leading to the adoption of lipid-based formulations in various therapeutic areas because of their ability to improve drug delivery and reduce drug toxicity.

The pediatric (0–12) segment is likely to grow at the fastest CAGR between 2025 and 2034, driven by the increasing prevalence of chronic diseases in the pediatric age group. The need for specialized drug delivery systems has grown for children. The demand for oral formulations for ease of administration has also increased. Lipid-based excipients enhance the solubility, stability, and bioavailability of drugs intended for the pediatric population.

Pharmaceutical Lipid-Based Excipients Market Regional Inisghts

The North America Pharmaceutical Lipid-Based Excipients market size is estimated at USD 810 million in 2025 and is projected to reach approximately USD 1,276 million by 2034, with a 5.18% CAGR from 2025 to 2034.

What Made North America the Dominant Region in the Pharmaceutical Lipid-Based Excipients Market?

North America led the global market with the largest share of 40% in 2024, thanks to the region's high healthcare spending and advanced pharmaceutical manufacturing capabilities. North America serves as a hub for a strong research and development base and a well-established pharmaceutical industry. The demand for advanced drug formulations has grown in North American healthcare, driven by increased investments in local manufacturing industries. The rising popularity of patient-friendly and centric oral and topical delivery systems also contributes to this growth. A strong focus on innovations in drug delivery, including mRNA vaccines, and government incentives for local manufacturing, are fueling this expansion.

The U.S. Pharmaceutical Lipid-Based Excipients market size is calculated at USD 615.60 million in 2025 and is expected to reach nearly USD 976.14 million in 2034, accelerating at a strong CAGR of 5.25% between 2025 and 2034.

U.S. Pharmaceutical Lipid-Based Excipients Market Analysis

The U.S. is a major player in the regional market due to its strong investments in R&D and a focused approach to innovative drug delivery systems. It has experienced rapid growth in demand for new therapies such as mRNA vaccines, cell therapies, and gene editing. As consumer preference shifts toward oral and topical drug delivery, innovations are emerging. Manufacturing companies are noticing the impact of AI technology in speeding up formulation development. The presence of strict regulatory frameworks and their emphasis on the safety and sustainability of new medicines are fueling this growth.

In June 2025, BASF opened its new Good Manufacturing Practice (GMP) solution center in Wyandotte, Michigan. These investments showcase BASF's ongoing dedication to providing innovative solutions in the biopharma and pharmaceutical ingredients sectors, including a reliable supply of bioprocessing ingredients and excipients.

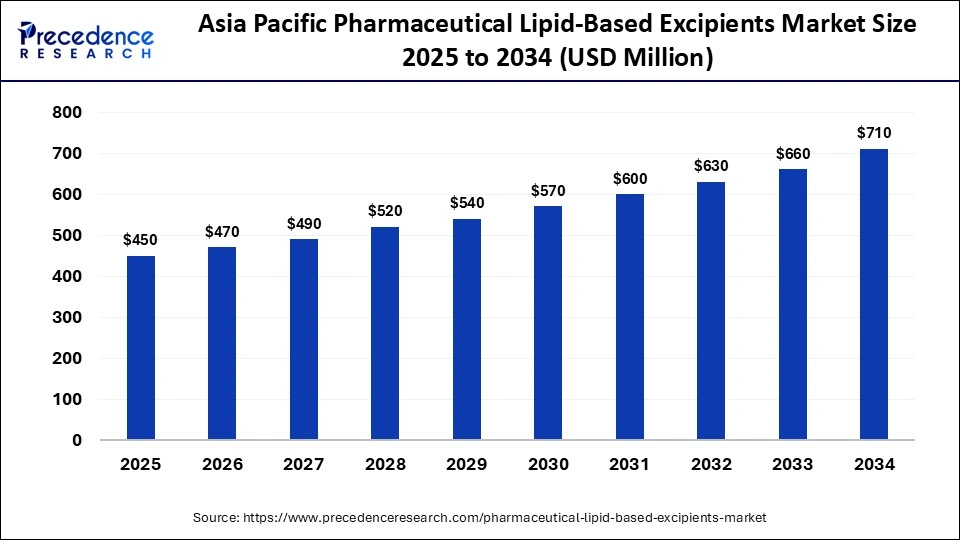

The Asia Pacific Pharmaceutical Lipid-Based Excipients market size is expected to be worth USD 710 million by 2034, increasing from USD 450 million by 2025, growing at a CAGR of 5.39% from 2025 to 2034.

What Makes Asia Pacific the Fastest-Growing Market for Pharmaceutical Lipid-Based Excipients?

Asia Pacific is expected to experience the fastest growth in the coming years due to increasing focus on novel technologies and increased demand for new formulations. The demand for advanced drug delivery systems has risen in Asian pharmaceutical companies. The Government of Asia is investing heavily in local manufacturing capabilities and establishing various incentives to support local pharmaceutical infrastructure. Asian pharmaceutical lipid excipients supply is focusing on leveraging palm oil derivatives for affordable tablet coatings and emulsifiers. With growing healthcare expenditures, strong access to cutting-edge therapeutics, and government support, industry growth is fueled in countries like China, India, and Japan.

China Pharmaceutical Lipid-Based Excipients Market Trends

China dominates the regional market due to its well-established pharmaceutical industry and strong manufacturing capabilities. The country has focused on innovations in drug delivery, utilizing technologies like the self-emulsifying drug delivery system and solid lipid nanoparticles. Its government is investing heavily in the local pharmaceutical sector to enhance manufacturing capabilities and expand research and development efforts. The growing emphasis on integrating advanced technologies like AI for faster formulation development has further contributed to this growth.

For instance, in May 2025, the 2025 China International Natural Health & Nutrition Expo (NHNE) and the 92nd API China, 90th PHARMACHINA, were held at the China Import and Export Fair Complex in Guangzhou, showcasing innovation, industrial collaboration, and global partnerships. These events are recognized as Asia's most important gathering for the health and pharmaceutical industries, illustrating China's rapidly evolving role in manufacturing.

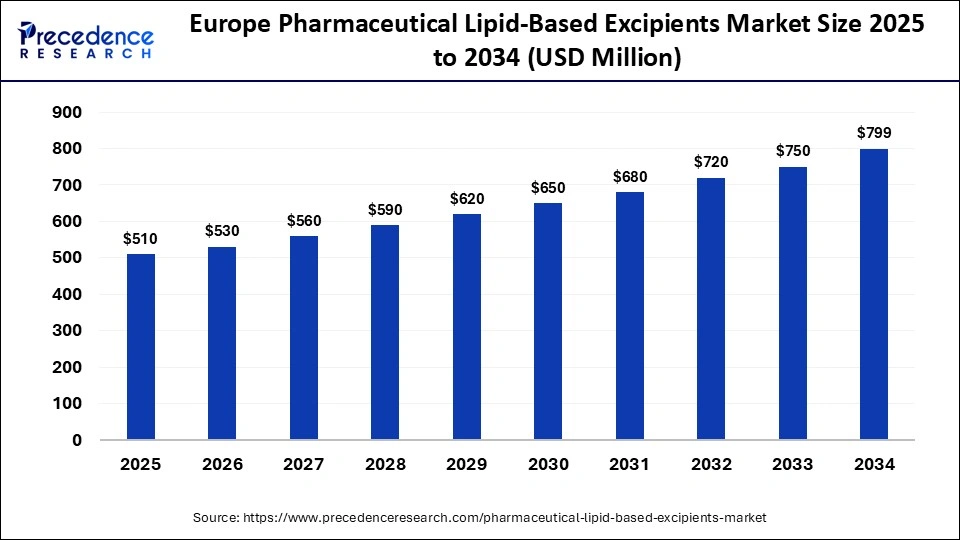

The Europe Pharmaceutical Lipid-Based Excipients market size has grown strongly in recent years. It will grow from USD 510 million in 2025 to USD 799 million in 2034, expanding at a compound annual growth rate (CAGR) of 5.39% between 2025 and 2034.

What Factors Support the Growth of the European Pharmaceutical Lipid-Based Excipients Market?

Europe is expected to grow at a significant rate during the forecast period, driven by the region's advanced pharmaceutical manufacturing capabilities. Europe serves as a hub for advanced and robust R&D infrastructure. The demand for innovative and sophisticated drug delivery systems has increased across Europe. The rise in chronic disease prevalence and the growing need for lipid-based excipients in oral, topical, and parenteral formulations are fueling innovations and developments of new pharmaceutical lipid-based excipients. The presence of strict regulations and standards to ensure high-quality excipients further encourages innovation and the adoption of lipid excipients in European drug formulations.

From October 28th to 30th, 2025, CPHI Europe will open its doors in Frankfurt at Messe Frankfurt for exhibitors. InnoPack, P-MEC, MedTech, ICSE, and Bioproduction will be held together with CPHI. Various excipient suppliers, their booths, and key topics and products will be showcased at this event.

Germany Pharmaceutical Lipid-Based Excipients Market Trends

Germany is a key player in the regional market due to its strong and well-established pharmaceutical companies and their manufacturing capabilities. It leads in pharmaceutical innovation and regulatory alignment. Germany is at the forefront of R&D in lipid nanoparticles for biopharmaceutics, such as vaccines, RNA-based drugs, and gene therapy applications. With a strong focus on innovation and quality, Germany has become the hub for lipid-based excipients.

What Made Latin America a Notable Region of Growth in the Pharmaceutical Lipid-Based Excipients Market in 2024?

Latin America emerged as a notable growth region for the pharmaceutical lipid-based excipients market in 2024, driven by a combination of expanding drug-manufacturing capacity, the rise of complex formulation needs, and increasing regulatory alignment with global standards. In particular, the growing number of generic and biosimilar drug launches in countries like Brazil and Mexico has heightened demand for lipid-based excipients that enhance the solubility and bioavailability of poorly soluble actives. Meanwhile, local pharmaceutical companies in the region have increasingly sought to partner with global suppliers for advanced excipient technologies, prompting knowledge transfer and infrastructure investment.

Also noteworthy is the trend towards patient-friendly dosage forms (e.g., lipid-based oral and topical formulations) in the Latin American market, which positions lipid-based excipients favorably. Finally, regional healthcare spend growth and increasing vertical integration of pharma production have further underlined Latin America as a key frontier for excipient innovation and supply-chain development.

Brazil Market Analysis

In Brazil, the pharmaceutical lipid-based excipients market in 2024 was shaped by the country's mature generics industry, growing biologics/complex formulation activity, and increasing local manufacturing. Brazilian drug manufacturers have been actively reformulating existing products and introducing lipid-based delivery forms to stay competitive in both domestic and export markets, thereby elevating demand for high-quality lipid-based excipients.

Regulatory and quality-compliance upgrades among Brazilian contract-manufacturing and development organizations (CMOs/CDMOs) have encouraged greater use of premium excipients rather than commodity excipients, thereby supporting the lipid-based segment. With Brazil positioning itself as a hub for Latin American pharmaceutical production, and global excipient firms showing interest in partnerships or local distribution channels, the country presents a compelling market for lipid-based excipient suppliers seeking growth beyond traditional regions.

Pharmaceutical Lipid-Based Excipients Market Value Chain

Pharmaceutical Lipid-Based Excipients Market Companies

- Headquarters: Ludwigshafen, Germany

- Year Founded: 1865

- Ownership Type: Publicly Traded (Frankfurt Stock Exchange: BAS, OTC: BASFY)

History and Background

BASF SE, originally founded in 1865 as Badische Anilin- und Soda-Fabrik, began as a producer of synthetic dyes and chemicals. Over more than 150 years, BASF has evolved into the world’s largest chemical company, supplying a wide range of products including chemicals, materials, industrial solutions, surface technologies, nutrition, and agricultural solutions. The company has played a foundational role in developing the global chemical industry and continues to lead in sustainable chemistry, advanced materials, and life science applications.

In recent decades, BASF has strengthened its focus on biotechnology, renewable feedstocks, and green chemistry. Its Nutrition & Care division includes production of pharmaceutical and personal care ingredients such as excipients, lipids, surfactants, and specialty oleochemicals used in drug delivery and formulation technologies.

Key Milestones / Timeline

- 1865: Founded in Mannheim, Germany, as Badische Anilin- und Soda-Fabrik

- 1913: Commenced production of ammonia via the Haber-Bosch process

- 1952: Reestablished after World War II as BASF AG

- 2001: Reorganized into a global group of operating divisions and subsidiaries

- 2017: Expansion into biotechnology and nutrition with enhanced lipid excipient capabilities

- 2023: Announced new strategic framework focusing on sustainability and circular economy

Business Overview

BASF operates as a global leader in chemicals and materials science, supplying key products for industries ranging from automotive and construction to pharmaceuticals, food, and agriculture. The company’s Nutrition & Care segment delivers high-quality excipients, lipids, and surfactants to pharmaceutical and healthcare customers worldwide. BASF’s integrated production system, known as the “Verbund” model, allows for efficient material and energy use across its global manufacturing network.

Business Segments / Divisions

- Chemicals

- Materials

- Industrial Solutions

- Surface Technologies

- Nutrition & Care

- Agricultural Solutions

Geographic Presence

BASF operates in more than 90 countries with over 350 production sites worldwide. Major R&D and manufacturing hubs are located in Germany, the United States, China, Belgium, and Brazil.

Key Offerings

- Pharmaceutical excipients and lipids

- Personal care and nutrition ingredients

- High-performance plastics and composites

- Catalysts and coatings for automotive and industrial applications

- Agricultural solutions including crop protection and seeds

Financial Overview

BASF reports annual revenues of approximately €70–80 million, maintaining its position as the largest chemical producer globally. While economic cycles impact performance, the company continues to achieve stable margins through its diversified portfolio and focus on innovation, sustainability, and operational efficiency.

Key Developments and Strategic Initiatives

- March 2023: Launched new sustainability framework emphasizing circular economy and carbon neutrality

- October 2023: Opened new biotechnology and lipid innovation center in Ludwigshafen

- February 2024: Expanded collaboration with pharmaceutical manufacturers for lipid-based drug delivery systems

- June 2025: Announced investment in next-generation biobased surfactants for life science applications

Partnerships & Collaborations

- Partnerships with global pharmaceutical companies for excipient and lipid development

- Collaborations with universities and research institutes for green chemistry and bioprocess engineering

- Alliances with agricultural and nutrition technology firms for sustainable ingredient sourcing

Product Launches / Innovations

- New lipid excipient series for advanced drug delivery (2024)

- Biobased surfactant platform for personal and healthcare applications (2025)

- Renewable chemical feedstocks integrated into existing production processes (2023)

Technological Capabilities / R&D Focus

- Core technologies: Advanced materials, catalysis, biotechnology, process engineering, green chemistry

- Research Infrastructure: Global R&D network with over 70 sites and approximately 11,000 scientists

- Innovation focus: Sustainable chemistry, biobased materials, excipient and lipid formulation technologies

Competitive Positioning

Strengths: Scale, integrated production system, global brand reputation, broad portfolio

Differentiators: Strong R&D investment, sustainability leadership, and vertically integrated manufacturing model

SWOT Analysis

- Strengths: Global scale, diversified portfolio, innovation capacity

- Weaknesses: Exposure to energy and raw material cost fluctuations

- Opportunities: Expansion in sustainable chemistry, biobased materials, and life sciences

- Threats: Economic volatility, regulatory pressures, and environmental compliance challenges

Recent News and Updates

- July 2024: BASF introduced a new global initiative to achieve net-zero COâ‚‚ emissions by 2050

- December 2024: BASF Nutrition & Care division expanded its lipid excipient portfolio for pharmaceutical applications

- April 2025: BASF announced partnership with major biopharma firms to scale sustainable lipid manufacturing for drug delivery systems

Other Companies in the Market

- ABITEC Corporation: ABITEC Corporation is a leading manufacturer of specialty lipids used in drug delivery systems, including emulsifiers, solubilizers, and bioavailability enhancers. The company's products such as Capmul and Captex are widely applied in oral, topical, and parenteral formulations. ABITEC's focus on custom lipid chemistry and pharmaceutical-grade purity supports innovation in lipid-based drug delivery.

- BASF SE: BASF SE is a global supplier of pharmaceutical excipients, including a wide range of functional lipids like phospholipids, triglycerides, and fatty acid esters. Its Kollicream and Kollisolv product lines enhance solubility and stability in complex formulations. BASF's strong R&D and sustainable manufacturing practices make it a key player in lipid-based drug formulation solutions.

- Chemaris S.A.: Chemaris S.A. specializes in the production of high-purity phospholipids and lecithins for pharmaceutical and nutraceutical applications. Its lipids are used in liposomal drug delivery and parenteral nutrition, emphasizing biocompatibility and traceability.

- CordenPharma: CordenPharma provides contract manufacturing services for high-purity lipids used in mRNA vaccines, lipid nanoparticles (LNPs), and other drug delivery systems. Its capabilities include GMP-grade synthesis and scalable lipid production for pharmaceutical and biotech industries.

- Croda International plc: Croda International is a major producer of bio-based pharmaceutical lipids and excipients, including emulsifiers and surfactants. Through its Avanti Polar Lipids subsidiary, Croda leads in supplying high-purity lipids for mRNA therapeutics and vaccine delivery systems. The company's expertise in sustainable lipid chemistry strengthens its presence in biopharmaceutical applications.

- Evonik Industries AG: Evonik develops functional lipids and excipients for drug delivery, including those used in mRNA and nanoparticle-based therapies. Its lipid portfolio supports formulation stability, controlled release, and targeted delivery. Evonik's Health Care division focuses on innovation in lipid nanoparticle technologies and scalable manufacturing for advanced therapies.

- Gattefossé: Gattefossé is a recognized specialist in lipid-based excipients and drug delivery systems, offering products such as Labrasol, Gelucire, and Capryol. Its lipid technologies enhance solubility and bioavailability of poorly water-soluble drugs. The company's expertise in formulation science supports both pharmaceutical and cosmetic industries.

- IOI Loders Croklaan: IOI Loders Croklaan supplies specialty lipids and emulsifiers derived from sustainable vegetable oils. Its products are used in oral and topical formulations, focusing on purity, functionality, and biocompatibility. The company's innovation supports the development of excipient-grade lipid systems for pharma applications.

- IOI Oleo GmbH: A division of the IOI Group, IOI Oleo manufactures oleochemical-based lipids and esters for pharmaceutical use. Its high-purity lipid excipients provide stability and performance in drug delivery and topical formulations.

- Lipoid GmbH: Lipoid GmbH is a global leader in the production of natural and synthetic phospholipids for parenteral nutrition, liposomes, and mRNA-based drug delivery. The company's GMP-compliant manufacturing and deep expertise in lipid chemistry make it a critical supplier for vaccines and biotherapeutics.

- Merck KGaA: Merck KGaA offers a wide portfolio of lipid excipients for pharmaceutical formulations, including those for liposomal and nanoparticle systems. Its lipid technologies support advanced drug delivery, controlled release, and stability enhancement.

- Sasol: Sasol produces fatty acids, alcohols, and esters that serve as key building blocks for pharmaceutical lipids. Its high-purity oleochemicals are used in topical and oral dosage formulations, supporting consistent quality and performance.

- Stepan Company: Stepan Company manufactures specialty surfactants and lipid-based excipients used in drug solubilization and emulsification. Its focus on sustainability and formulation flexibility enables its products to meet stringent pharmaceutical standards.

- Wilmar BioEthanol: Wilmar BioEthanol, part of Wilmar International, produces bio-based alcohols and oleochemicals that serve as raw materials for lipid synthesis. The company emphasizes renewable sourcing and large-scale production capabilities for pharmaceutical and cosmetic lipid intermediates.

Recent Developments

- In September 2025, Evonik launched MaxiPure Ploysorbate 80, a highly pure surfactant designed for injectable and biopharmaceutical applications. This MaxiPure Polysorbate 80 excipient is developed to meet the rigorous demands of modern drug development. It addresses critical challenges such as viral inactivation, protein stability, and the consistent solubilization of hydrophobic active pharmaceutical ingredients (APIs).(Source: https://chemxplore.com)

- In February 2024, a license agreement for commercializing randomized polyethylene glycols (rPEGs), a new class of PEGs, was made by Evonik and its partner, the Johannes Gutenberg University Mainz (JGU) in Germany. Evonik intends to use rPEGs, which were first developed at JGU for its specialized lipid platforms, to expand the company's toolbox of technologies for nucleic acid-based medicines.(Source: https://chemanager-online.com)

Exclusive Analysis on the Pharmaceutical Lipid-Based Excipients Market

The pharmaceutical lipid-based excipients market is undergoing a phase of strategic recalibration and accelerated innovation, driven by the confluence of advanced drug delivery paradigms, bioavailability enhancement imperatives, and a shifting regulatory environment favoring biocompatible, multifunctional excipient systems. The industry has evolved beyond its conventional role as a passive formulation component, transforming into a value-accretive enabler of differentiated therapeutics.

From a market potential standpoint, lipid-based excipients represent one of the most compelling sub-segments within the broader pharmaceutical excipients landscape. Their ability to modulate solubility, permeability, and pharmacokinetic profiles positions them at the epicenter of formulation science, particularly for poorly water-soluble APIs and emerging biologics. The growth trajectory is being further reinforced by the expanding adoption of lipid nanoparticle (LNP) technologies in mRNA and gene-based therapeutics, a trend catalyzed by recent vaccine successes and ongoing clinical pipeline expansion.

From an investment and competitive perspective, Tier I players (Gattefossé, BASF, Croda) continue to consolidate their dominance through vertical integration and technology licensing, while Tier II and Tier III firms are finding whitespace opportunities in high-margin niches such as nutraceutical excipients, customized lipid carriers, and region-specific supply chains.

Overall, the market demonstrates a high elasticity of innovation-to-demand translation, implying that firms capable of combining formulation science with regulatory foresight and sustainable production will command a disproportionate share of future value creation. With global revenues projected to expand at a CAGR exceeding XX% through the end of the decade, the sector is poised to remain a strategic growth conduit within the evolving pharmaceutical manufacturing ecosystem.

Pharmaceutical Lipid-Based Excipients MarketSegment Covered in the Report

By Excipient Type

- Phospholipids

- Lecithin (Soy, Egg, Sunflower)

- Phosphatidylcholine

- Phosphatidylserine

- Glycerides / Mono-, Di-, Tri-glyceride

- Medium-chain triglycerides (MCT)

- Caprylic/Capric triglycerides

- Glycerol monostearate

- Sorbitan & Polyethylene Glycol (PEG) Esters

- Sorbitan monostearate

- Polysorbates

- PEGylated lipids

- Sterols & Phytosterols

- Cholesterol

- Plant sterols

- Other Lipid-Based Excipients

- Liposomes / Lipid nanoparticles

- Self-emulsifying lipid systems

- Nanoemulsion carriers

By Formulation Type

- Solid Dosage Form

- Tablet coatings

- Granules / powders

- Controlled-release matrices

- Liquid Dosage Forms

- Suspensions

- Solutions

- Emulsions

- Semisolids / Topicals

- Creams & gels

- Ointments

- Injectables / Parenteral Lipid-Based Formulation

- Lipid nanoparticles (LNPs)

- Micellar formulations

- Lipid emulsions

- Other Specialized Formulations

- Self-emulsifying drug delivery systems (SEDDS)

- Lipid-drug conjugates

By Application / Therapeutic Area

- Oncology

- Cancer therapeutics

- Targeted drug delivery

- CNS Disorder

- Neurological & psychiatric drugs

- Cardiovascular Diseases

- Anti-hypertensives, lipid-lowering drugs

- Infectious Diseases

- Antiviral formulations

- Antibacterial lipid-based carriers

- Gastrointestinal & Hepatic Disorder

- Lipid-based oral formulations for liver-targeted delivery

- Vaccines / Biologics

- mRNA vaccines

- Lipid nanoparticle carriers

- Other Therapeutic

- Rare disease & orphan drugs

- Nutraceuticals

By End User / Customer Segment

- Pharmaceutical Manufacturers

- Branded generics manufacturers

- Generic drug manufacturers

- Biopharmaceutical Companie

- Vaccine & biologics developers

- Gene therapy & cell therapy developers

- Contract Development & Manufacturing Organizations (CDMOs)

- Research Institutes / Academia

- Drug formulation research

- Nanomedicine R&D

By Patient Demographics / Age Group

- Adults (18–64)

- Elderly (65+)

- Adolescents (13–17)

- Pediatric (0–12)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting