What is the Advanced Technical Ceramics Market Size?

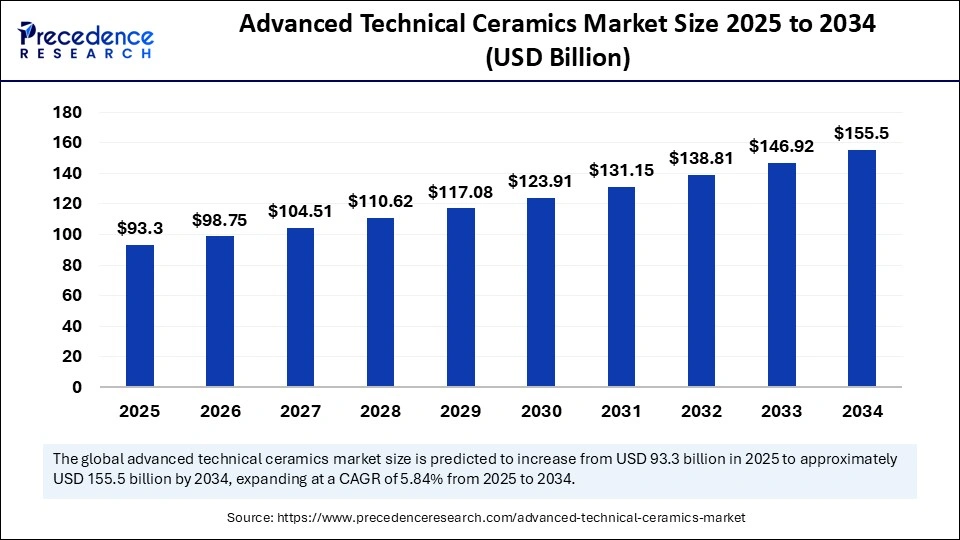

The global advanced technical ceramics market size is accounted at USD 93.30 billion in 2025 and predicted to increase from USD 98.75 billion in 2026 to approximately USD 155.50 billion by 2034, expanding at a CAGR of 5.84% from 2025 to 2034. The demand for advanced technical ceramics has been increasing in industries like aerospace & defense, healthcare, consumer electronics, and automotives, driving the global advanced technical ceramics market. The growing adoption of clean energy technologies is further contributing to the market growth.

Advanced Technical Ceramics Market Key Takeaways

- In terms of revenue, the global advanced technical ceramics market was valued at USD 88.15 billion in 2024.

- It is projected to reach USD 155.50 billion by 2034.

- The market is expected to grow at a CAGR of 5.84 % from 2025 to 2034.

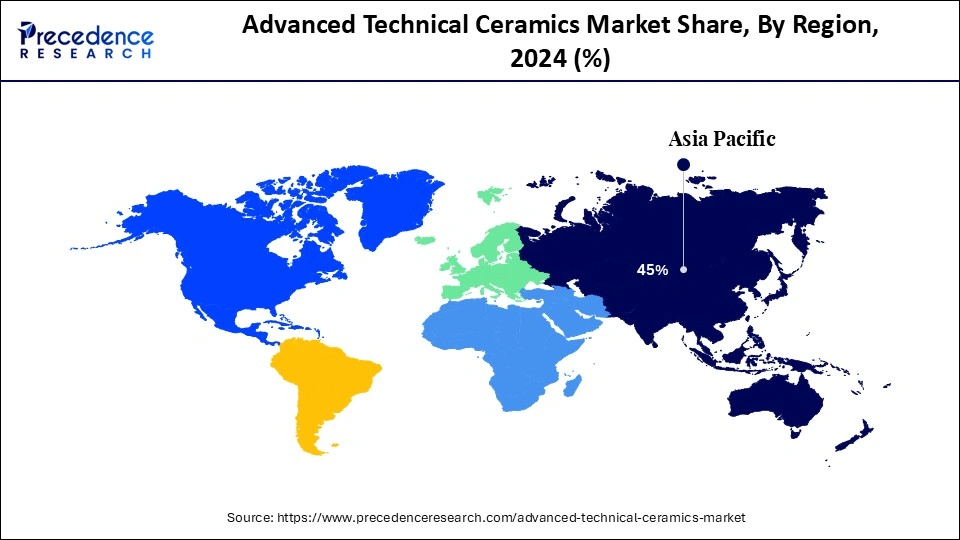

- Asia Pacific dominated the advanced technical ceramics market with the largest share of 45% in 2024.

- North America is expected to grow at the fastest CAGR from 2025 to 2034.

- By material type, the oxide ceramics segment contributed the biggest market share of 40% in 2024.

- By material type, the non-oxide ceramics segment is expected to grow at a notable CAGR between 2025 and 2034.

- By product type, the structural ceramics segment captured the highest market share of 45% in 2024.

- By product type, the functional ceramics segment is expected to grow at the highest CAGR between 2025 and 2034.

- By application, the aerospace & defense segment generated the major market share of 35% in 2024.

- By application, the electronics segment will grow at a significant CAGR between 2025 and 2034.

- By form, the ceramic components segment held the highest market share of 50% in 2024.

- By form, the ceramic coatings segment is expected to grow at a notable CAGR between 2025 and 2034.

- By functionality, the wear resistance segment accounted for the biggest market share of 25% in 2024.

- By functionality, the thermal insulation segment will expand at a significant CAGR between 2025 and 2034.

Artificial Intelligence: The Next Growth Catalyst in Advanced Technical Ceramics

Artificial intelligence is transforming the advanced technical ceramics from design and manufacturing to quality control and simulation. An AI algorithm simulates and provides predictions over ceramic material properties for the design of novel materials, specifically. The optimization of the manufacturing process enables to enhancement of efficiency and reduces defects in materials. AI is a significant tool in material selection according to its properties and performance. The AI-enabled inspection systems detect defects and anomalies in materials to ensure high-quality.

The ongoing innovations in AI-powered ceramic 3D printing are realizing the advanced technical ceramic materials. 3DCeram USHERS is an emerging era for the AI-enabled ceramic 3D printing. Manufacturers have increased AI adoption in technical ceramics to enhance quality, efficiency, innovations, and reduce the cost burden.

- In June 2025, Kyocera participated in the World of Quantum trade fair to demonstrate its cutting-edge material solutions for quantum technologies, including a range of ceramic packaging solutions and assembly options to provide superior thermal management and hermetic solutions. (Source:https://spain.kyocera.com)

Strategic Overview of the Global Advanced Technical Ceramics Industry

Advanced technical ceramics, also known as engineering ceramics or high-performance ceramics, are materials specifically engineered for various applications in industries that require materials with superior properties, such as high hardness, thermal resistance, electrical insulation, and chemical stability. These ceramics are used in applications such as electronics, aerospace, automotive, and healthcare due to their unique combination of mechanical, electrical, and thermal properties. They are commonly made from oxides, nitrides, and carbides and can withstand harsh environments, making them ideal for advanced technological applications.

The market is experiencing a rapid surge toward eco-friendly alternatives and renewable energy demands. The increasing research & development activities and stringent regulations for material performance and environmental impacts are driving innovations in technical ceramics. The growing emphasis on the development of high-performance components for emerging technologies is bringing significant investments and advanced manufacturing practices in the industry.

Major Advanced Technical Ceramics Exhibitions in 2025

| Date | Event | Agenda |

| October 2025 | 10th Edition of AM Ceramics | The event will be held in Vienna, hosted by TU Wien, to bring several experts in ceramic additive manufacturing together to demonstrate the latest innovations and advancements, from industrial use to material research. (Source:https://www.pim-international.com) |

| July 2025 | The Advanced Materials Show and The Advanced Ceramics Show | The show was held to demonstrate the latest material and technical ceramics innovations, aligning with providing sophisticated insights in the UK's industry. The exhibition welcomed more than 300 companies to unveil their most advanced innovations and technologies. (Source:https://advancedmaterialsshow.com) |

| June 2025 | Ceramics China 2025 | The event was conducted in Guangzhou, achieved remarkable scale and reach by attracting 786 exhibitors from 21 countries. The event held solidified its position as a global marketplace for innovation, collaborations, and networking across the global ceramics value chain. (Source:https://ceramicworldweb.com) |

| May 2025 | PCIM Europe 2025 | The exhibition was conducted at Nuremberg Exhibition Center, Nuremberg, Bayern, Germany, featuring more than 1,200 exhibitors from more than 50 countries and a conference with more than 500 speakers to leverage understanding about the latest trends in power electronics. (Source:https://www.ceramtec-group.com) |

What are the Key Trends in the Advanced Technical Ceramics Market?

- Industrial Demands: Industries like automotives, aerospace & defense, healthcare, and electronics have increased demand for high-performance components to enhance thermal resistance, hardness, hip replacements, and other prosthetics, driving the need for advanced technical ceramics.

- Celan Energy Technology Demands: The demand for clean energy technologies has increased, driving the adoption of advanced ceramics like solar, fuel cells, sensors, and panels.

- Growing Adoption of Electric Vehicles: The increased adoption of electric vehicles has fostered demand for advanced technical ceramics for superior thermal and electrical properties.

- Government Investments: The government worldwide is investing heavily in research and development for sectors like energy, defense, and aerospace, driving the adoption of high-performance ceramics.

- Technological Advancements: The technological advancements lie integration of nanotechnology in high-performance ceramic materials, driving innovations in high-technological applications.

Market Outlook:

- Market Growth Overview: The Advanced Technical Ceramics market is expected to grow significantly between 2025 and 2034, driven by rapid growth in end-use industries, innovation in nanotechnology integration, and 3D printing are expanding the application possibilities for advanced ceramics.

- Sustainability Trends: Sustainability trends involve enabling clean energy and E-mobility, the adoption of sustainable manufacturing processes, and the circular economy and waste recycling.

- Major Investors: Major investors in the market include 3M Company, Kyocera Corporation, Morgan Advanced Materials, Coors Tek Inc., Saint-Gobain, and BC Partners.

- Startup Economy: The startup economy is focused on additive manufacturing, novel material developments, and niche applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 155.50 Billion |

| Market Size in 2025 | USD 93.30 Billion |

| Market Size in 2026 | USD 98.75 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.84% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Product Type, Application, End-Use Industry, Form, Functionality, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Focus on Sustainable Manufacturing

The increased focus on sustainable manufacturing has boosted companies' innovations and developments of sustainable materials and efficient production methods to minimize environmental emissions. The adoption of renewable energy has increased, growing demand for energy-efficient products is further driving the adoption of advanced technical ceramics to enable higher efficiency and reduce waste in industrial settings. Additionally, the increased consumer awareness has driven demand for sustainable products, prompting companies to leverage advanced ceramics. The ongoing research and development approaches in enhancing the recyclability of advanced ceramic components and materials are further adding to their adoption.

Restraint

High Production Cost

Advanced technical ceramics have a complex manufacturing process that requires sophisticated equipment and skilled professionals. The complex manufacturing process, like high-temperature sintering, specialized treatments, and precision machining, require skilled labor, adding to the production cost. Additionally, the high cost of raw materials like silicon carbide, zirconia, and alumina is subject to price volatility. The high production cost of advanced technical ceramics limits its scalability and limits the adoption among cost-conscious companies.

Opportunity

Integration of Nanotechnology

Companies are integrating nanotechnology with their ceramic offering to develop advanced ceramics with improved properties like improved strength, electrical conductivity, and thermal stability. Nanostructured ceramics lead to new high-tech applications like biomedical devices, energy storage systems, and electronics. Nanotechnology-based ceramics offer efficient products like fast, small, and more efficient components in telecommunications and consumer electronics. The integration of nanotechnology with existing ceramics is leading to the demand for high-performance materials and enhancing innovations to expand the potential application of advanced technical ceramics.

Material Type Insights

Which Material Dominated the Advanced Technical Ceramics Market in 2024?

The oxide ceramics segment dominated the market with the largest share in 2024 due to their superior properties, such as extreme strength, wear resistance, high thermal stability, and hardness. The demand for oxide ceramics is high in industries like automotives, aerospace & defense, electronics, and the healthcare sector. The rapid innovations and advancements in material science and manufacturing processes for oxide ceramics ensure high quality and properties of the materials.

The non-oxide ceramics segment is expected to grow at the fastest CAGR during the projection period, driven by increased adoption of non-oxide ceramics in industrial applications due to their superior properties. Non-oxide ceramics such as silicon nitride and silicon carbide provide exceptional thermal stability, chemical resistance, and hardness, making them suitable for various industrial applications. The adoption of non-oxide ceramics has increased in harsh industrial settings, driven by their superior resistance to chemical corrosion.

Product Type Insights

Why Did the Structural Ceramics Segment Dominate the Advanced Technical Ceramics Market?

The structural ceramics segment dominated the market in 2024 due to their unique properties and applications. The structural ceramics offer high strength, durability, thermal stability, and corrosion resistance, making them ideal for applications like automotive and aerospace. The increased use of structural ceramics in aerospace & defense applications like missile defense systems, protective gear, and turbine engines is contributing to the segment's growth.

The functional ceramics segment is expected to grow at the fastest rate over the forecast period, due to their unique properties like high temperature resistance, mechanical strength, high thermal stability, electrical conductivity, and chemical inertness. The use of functional ceramics is high in industries like energy, electronics, medical, and automotive. The expanding industrial progress and increasing complexity of engineered systems drive the need for advanced materials like functional ceramics.

Application Insights

What Made Aerospace & Defense the Dominant Segment in the Advanced Technical Ceramics Market in 2024?

The aerospace & defense segment dominated the market in 2024 due to increased demand for high-performance materials in various aerospace & defense applications. Advanced technical ceramics are widely used in missile systems, protective gear, and turbine engines due to their high strength and temperature resistance. The aerospace & defense sector drives the adoption of ceramic materials like silicon carbide and boron carbide for ballistic protection. The growing use of advanced technical ceramics in radar & communication systems and hypersonic vehicles is contributing to the growth of the segment.

The electronics segment is likely to grow at the fastest pace in the coming years due to the increasing need for high-performance and miniaturized components in electronics. The advanced technical ceramics are widely used in various electronics applications such as 5G infrastructure, semiconductor manufacturing, and electronic components. Advanced technical ceramics are crucial in various electronics applications due to their low signal loss, thermal stability, and high electrical insulation properties.

The automotive segment is expected to grow at a significant CAGR due to increased adoption of advanced technical ceramics in vehicles, particularly electric vehicles. Strict emission regulations are fostering the adoption of sustainable materials and technologies in the automotive sector, including advanced ceramic technologies. The high-performance properties of advanced technical ceramics, such as high thermal stability, high-temperature resistance, and electrical insulation, make them ideal for various automotive applications.

The healthcare segment is expected to expand at a notable rate in the upcoming period, driven by the increasing demand for biocompatible materials in orthopedic and dental implants. Medical ceramics, like alumina and zirconia, are highly used in implants and prosthetics. The expanding healthcare infrastructure and advancements in 3D printing technologies are driving the adoption of advanced technical ceramics in the healthcare industry.

Form Insights

Why Did the Ceramic Components Segment Lead the Advanced Technical Ceramics Market?

The ceramic components segment led the market in 2024, due to increased use of ceramic components in the automotive and electronics industry. The ceramic components offer exceptional mechanical strength, thermal stability, and wear resistance. The growing demand for high-performance materials in consumer electronics and telecommunications is fostering the segment's growth.

The ceramic coatings segment is expected to grow at the fastest rate over the forecast period, due to increased adoption of ceramic coatings in various industries like aerospace, automotive, and manufacturing. Ceramic coatings are often composed of materials like titanium nitride, alumina, or zirconia, making them highly durable, wear-resistant, and providing thermal stability. The demand for high-performance and lightweight materials has increased, driving the adoption of ceramic coatings in material forms.

Functionality Insights

How Does the Wear Resistance Functionality Lead the Advanced Technical Ceramics Market in 2024?

The wear resistance segment led the market in 2024 due to the crucial role of advanced technical ceramics with wear resistance properties to enhance the lifespan of equipment and reduce operational costs. Ceramics with wear resistance functionality improve efficiency in high-wear applications. The automotive, manufacturing, aerospace, and defense industries are major adopters of ceramics with wear resistance functionality due to the high need for durable and reliable components in these industries.

The thermal insulation segment is expected to grow at the highest CAGR over the projection period due to increased demand for high-temperature insulation components in various industrial applications. Advanced technical ceramics with thermal insulation functionality withstand high temperatures and offer excellent insulation. The industries, such as aerospace, automotive, and manufacturing, are the major adopters of thermal insulation-based ceramics to improve energy efficiency, conserve energy, and comply with environmental regulations.

Regional Insights

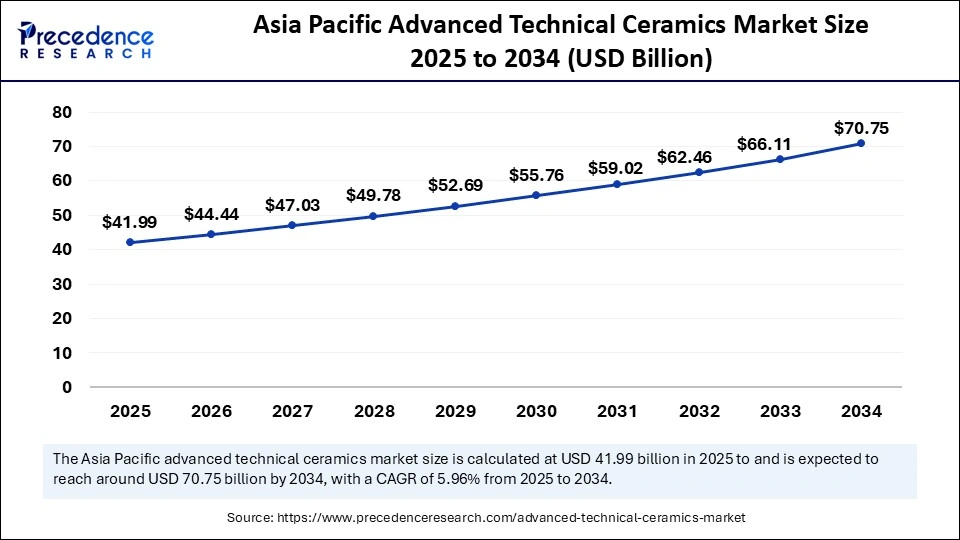

Asia Pacific Advanced Technical Ceramics Market Size and Growth 2025 to 2034

The Asia Pacific advanced technical ceramics market size is exhibited at USD 41.99 billion in 2025 and is projected to be worth around USD 70.75 billion by 2034, growing at a CAGR of 5.96% from 2025 to 2034.

Asia Pacific Advanced Technical Ceramic Market Trends

Asia Pacific dominated the global advanced technical ceramics market in 2024 due to its well-established supply chain, presence of major electronics manufacturers, and government initiatives. Asia Pacific has a robust availability of raw materials and components. Government incentives like tax credits and grant funding for high-value materials enable research and development of advanced technical ceramics in the region. Strong manufacturing sector, large consumer base, and high-tech technological developments are contributing to the market growth.

Asia Pacific: China Advanced Technical Ceramics Market Trends

China is a major player in the regional market, contributing to growth due to a continuous large consumer population, a strong electronic manufacturing sector, growing R&D activities, government support to local manufacturing giants, and increased demand for titanate ceramics in the automotive industry. China's 14th Five-Year Plan segment dominates the market.

Japan, South Korea, India, and Thailand are significant players in the regional market due to their advanced manufacturing capabilities in semiconductors and electronics. Thailand is an emerging manufacturing leader hub in Southeast Asia, offering significant support through the country's robust infrastructure and government initiatives, including Thailand 4.0 initiatives, driving demand for cutting-edge and technical ceramics.

- From 15-17 October 2025, the ASEAN Ceramics event will be conducted in Bangkok, Thailand. The event will host a 5,000 sq ft exhibition space, featuring more than 200 companies and brands, with more than 4,000 trade visitors and buyers, to create significant collaborative opportunities for these companies and brands. (Source:https://www.pim-international.com)

North America Advanced Technical Ceramics Market Trends

North America is the fastest-growing region in the market, due to the region's robust industrial base, strong R&D investments, stringent manufacturing standards, and high focus on leading market players. North America is concentrating on the development of advanced technical ceramics with improved properties. The shift to sustainable and high-performance ceramics contributes to the market growth. The increasing demand for advanced technical ceramics in well-established industries like automotives, healthcare, and aerospace is transforming the regional market.

North America: U.S. Advanced Technical Ceramics Market Trends

The U.S. is a major player in the market, contributing to the growth due to increased demand for advanced technical ceramics in various industries and ongoing advancements in material science. The strong focus on integrating cutting-edge technologies like AI and IoT, and expanding emerging applications like quantum computing and energy-efficient materials, is bringing significant innovative approaches in the U.S. market.

- In January 2025, the 49th International Conference & Exposition on Advanced Ceramics & Composites (ICACC 2025) was organized by the American Ceramic Society's Engineering Ceramics Division (EDC) in Daytona Beach, Florida. The conference showcases extreme international meetings on advanced structural and functional ceramics, composites, and other upcoming ceramic materials and technologies. (Source: https://ceramics.org/past-event)

Europe Advanced Technical Ceramics Market Trends

Europe is a notable player in the market, contributing to market growth due to increased adoption of advanced technical ceramics in various applications like aerospace & defense, renewable energy, medical devices & implants, and automotives. The existence of key market players like Morgan Advanced Materials, Kyocera Corporation, Ceram Tech, 3M, and Saint-Gobi Ceramic Materials is contributing to significant innovations and developments of advanced technical ceramics. Additionally, strong evidence of strict environmental regulations and growing R&D activities is fostering the market.

Europe: Germany Advanced Technical Ceramics Market Trends

Germany is leading the regional market with its robust industrial base, advanced engineering & manufacturing capabilities, and strong export-oriented economy. Germany is a hub for major manufacturing giants. The growing academic collaboration with research institutions and government initiatives for promoting digitalization and Industry 4.0 is leading to market expansion.

Value Chain Analysis of the Advanced Technical Ceramics Market

- Raw Material Sourcing and Preparation

This initial stage involves the extraction and processing of high-purity raw materials such as alumina, zirconia, silicon carbide, and silicon nitride.

Key Players: Alcoa, Rio Tinto, and Hydro provide essential ceramic oxides, carbides, and nitrides. - Manufacturing/Operations

This core stage involves converting the prepared raw materials into finished advanced ceramic components through specialized processes like pressing, sintering (high-temperature firing), and advanced machining.

Key Players: KYOCERA Corporation, CeramTec, CoorsTek, Morgan Advanced Materials, 3M, and Saint-Gobain. - Outbound Logistics and Distribution

Activities in this stage focus on storage, inventory management, and ensuring the finished products are delivered efficiently to various end-use industries globally.

Key Players: Distribution is often managed internally by vertically integrated manufacturers like Kyocera and CoorsTek, or through specialized distributors such as Applied Ceramics Inc. and Technocera. - Marketing and Sales

This stage involves strategies to attract and retain customers across diverse sectors by highlighting the unique performance benefits of advanced ceramics.

Key Players: Global players such as 3M, Kyocera, and Morgan Advanced Materials - Service and Post-Sale Support

The final stage includes post-purchase support, maintenance, and handling customer complaints to ensure product performance and enhance customer satisfaction.

Key Players: CoorsTek and CeramTec - End-use Application

While not a traditional "stage" within a single company's value chain, the ultimate use by the customer is where the value is realized.

Key Customers (End Users): Samsung (electronics), Toyota (automotive), Siemens Energy (energy & power), and Pfizer (medical).

Top Companies in the Advanced Technical Ceramics Market & Their Offerings:

- CeramTec GmbH: This company develops and manufactures high-performance ceramic components used across diverse industries, from medical technology like biocompatible implants to automotive applications.

- Morgan Advanced Materials: A prominent manufacturer of advanced carbon and ceramic products, Morgan develops materials for demanding applications in aerospace, automotive, energy, and semiconductor industries.

- Kyocera Corporation: As a major manufacturer, Kyocera contributes significantly with its broad portfolio of fine ceramic components for electronics, automotive, and industrial applications. The company's strong R&D, vertical integration, and global manufacturing footprint allow it to meet growing demand in key markets.

- CoorsTek Inc.: One of the largest manufacturers of technical ceramics, CoorsTek produces components and engineered solutions for harsh environments in industries like aerospace, automotive, and medical. The company offers over 400 proprietary ceramic formulations and emphasizes customized solutions to meet specific client needs.

- Rauschert GmbH: A German company specializing in technical ceramics, Rauschert is recognized for its expertise in manufacturing customized, high-performance, and sustainable ceramic solutions. The company plays a key role in producing advanced ceramic components for energy-efficient industrial and other applications.

- Saint-Gobain Ceramics: This company offers high-performance ceramic and refractory materials, such as its Hexoloy silicon carbide material, which is used in applications requiring superior hardness, strength, and high-temperature resistance. Its products are critical for industries like aerospace, energy, and refractories operating in extreme environments.

- 3M Company: An industrial giant with a diverse portfolio, 3M integrates advanced ceramics into a variety of products, including ceramic abrasives and components for automotive, electronics, and aerospace. The company leverages its materials science expertise to develop innovative ceramic solutions that support key industrial and sustainability trends.

- Schott AG: A technology group producing advanced materials, Schott contributes to the ceramics market through its development of glass-ceramics and other specialty materials for high-tech applications. Its ceramic-based innovations are used in semiconductors, medical devices, optics, and aerospace.

- H.C. Starck Inc.: Specializing in high-performance metal and ceramic powders, H.C. Starck provides essential raw materials for the advanced materials industry. The company's products are critical for niche markets that demand precision-engineered materials for applications like electronics, aerospace, and medical devices.

- NGK Insulators Ltd.: As a manufacturer of insulators and other components, NGK is involved in the technical ceramics market, particularly in applications related to power generation and electronics. The company utilizes its ceramic expertise for various industrial uses, including its namesake insulators.

- Denso Corporation: Though shifting focus, Denso has been a significant contributor to the market through its advanced ceramic products used in automotive applications, such as spark plugs and sensors. The company's technologies for ceramic-based engine components have been widely adopted across the automotive industry.

- GE Aviation: As a major end-user, GE Aviation has been instrumental in driving innovation in advanced ceramics, specifically ceramic matrix composites (CMCs). The company's use of CMCs in its jet engines for static parts has significantly advanced aerospace applications by improving heat resistance and fuel efficiency.

- Mitsubishi Materials Corporation: This company has contributed to the market by developing innovative composite materials, such as a high-heat-resistant carbon fiber-based ceramic matrix composite. This research is aimed at advanced aerospace applications, including heat shields for reusable space transportation systems.

- Toyota Tsusho Corporation: As a trading company, Toyota Tsusho contributes to the market through its role in the global supply chain, sourcing and distributing various industrial materials, including advanced ceramics. Its involvement likely supports a wide range of industries, particularly the automotive sector, where ceramics are increasingly used for lightweighting and heat management.

- Murata Manufacturing Co., Ltd.: This global electronics leader is a major contributor to the advanced ceramics market through its multilayer ceramic capacitors (MLCCs) and other ceramic-based electronic components. Its strong focus on R&D for miniaturization and energy efficiency drives innovation in materials technology for smartphones, automotive, and industrial equipment.

- Solvay Group: Solvay, a global specialty chemicals and advanced materials company, contributes to the market by supplying specialized polymers and high-performance materials used in conjunction with or as precursors for advanced ceramics.

- American Elements: This company supplies a wide array of high-purity raw materials, including ceramic oxides and advanced materials essential for producing advanced technical ceramics.

- Ceradyne Inc.: Acquired by 3M, Ceradyne is known for producing high-performance ceramic materials, particularly advanced ceramics for defense applications like ceramic armor and other specialized products. The company's technology has been integrated into 3M's offerings, further strengthening its market position in advanced materials.

- Henkel AG & Co. KGaA: Henkel provides advanced adhesives, sealants, and functional coatings that are used in manufacturing processes involving advanced ceramics. While not a ceramics producer, its Adhesive Technologies business unit is a vital part of the value chain, supporting industrial customers who integrate ceramic components into their products.

- Isolite Insulating Products Co., Ltd.: This company specializes in the development and manufacturing of insulation products, which can include advanced ceramic fiber-based materials for high-temperature applications. It contributes to the market by providing thermal management solutions critical for various industrial and energy sectors.

Advanced Technical Ceramics Market Companies

- CeramTec GmbH

- Morgan Advanced Materials

- Kyocera Corporation

- CoorsTek Inc.

- Rauschert GmbH

- Saint-Gobain Ceramics

- 3M Company

- Schott AG

- H.C. Starck Inc.

- NGK Insulators Ltd.

- Denso Corporation

- GE Aviation

- Mitsubishi Materials Corporation

- Toyota Tsusho Corporation

- Murata Manufacturing Co., Ltd.

- Solvay Group

- American Elements

- Ceradyne Inc.

- Henkel AG & Co. KGaA

- Isolite Insulating Products Co., Ltd.

Recent Developments

- In July 2025, Kyocera launched its portfolio of semiconductors, automotive components, and fine ceramics at the Advanced Ceramics Show 2025 in Birmingham, UK. The company achieved its goal of offering innovative products and technologies to improve everyday convenience and efficiency. (Source:https://norway.kyocera.com)

- In May 2025, Samsung launched the Galaxy S25 Edge featuring new Corning Gorilla Glass Ceramics 2 to improve durability. The product was hyped in the market due to its slim design and top-tier hardware, measuring just 5.85 mm in thickness and weighing about 163 grams. (Source: https://www.indiatoday.in)

Segment Covered in the Report

By Material Type

- Oxide Ceramics

- Alumina (Al2O3)

- Zirconia (ZrO2)

- Mullite (Al6Si2O13)

- Non-Oxide Ceramics

- Silicon Carbide (SiC)

- Silicon Nitride (Si3N4)

- Boron Carbide (B4C)

- Composite Ceramics

- Carbon-Carbon Composites

- Ceramic Matrix Composites (CMC)

By Product Type

- Structural Ceramics

- Mechanical components (e.g., bearings, seals)

- Aerospace components (e.g., turbine blades)

- Functional Ceramics

- Sensors and actuators

- Electronic components (e.g., capacitors, resistors)

- Bioceramics

- Bone implants

- Dental implants

By Application

- Aerospace & Defense

- Jet engines and propulsion systems

- Radomes and thermal protection systems

- Automotive

- Engine components (e.g., pistons, brake systems)

- Exhaust systems

- Electronics

- Capacitors, resistors, and insulators

- Semiconductor components

- Healthcare

- Implants (orthopedic and dental)

- Prosthetics

- Energy

- Nuclear reactors and power plants

- Solar cells

- Industrial

- Wear-resistant components

- Furnace linings and thermal insulation

By End-Use Industry

- Aerospace & Defense

- Automotive

- Electronics

- Healthcare

- Energy

- Industrial Manufacturing

- Consumer Goods

- Others

By Form

- Ceramic Powder

- Ceramic Components (e.g., tubes, sheets, rods)

- Ceramic Coatings

- Ceramic Films

By Functionality

- Thermal Insulation

- Electrical Insulation

- Wear Resistance

- Chemical Resistance

- Magnetic Properties

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting