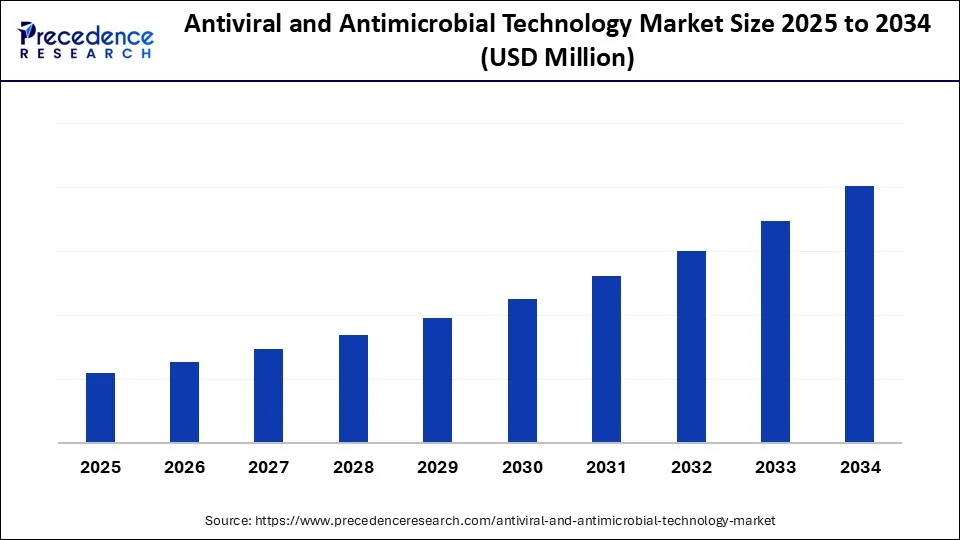

Antiviral and Antimicrobial Technology Market Size and Forecast 2025 to 2034

The antiviral and antimicrobial technology market continues to grow with applications in healthcare, construction, packaging, and consumer products. These technologies enhance safety, durability, and sustainability. The market is growing rapidly due to awareness of infectious disease threats, with increased focus on healthcare-associated infections and a global demand for protective impurity solutions.

Antiviral and Antimicrobial Technology Market Key Takeaways

- North America dominated the global antiviral and antimicrobial technology market with the largest market share of 42% in 2024.

- Asia Pacific is estimated to expand at the fastest CAGR between 2025 and 2034.

- By technology/mechanism, the metallic ion/oxide-based (Ag, Cu, ZnO) segment held the biggest market share of 35% in 2024.

- By technology/mechanism, the graphene/nanocarbon-based actives segment is anticipated to grow at fastest CAGR between 2025 and 2034.

- By form factor/delivery, the coatings and paints (solvent/waterborne, powder) segment captured the highest market share of 58% in 2024.

- By form factor/delivery, the additives and masterbatches for polymers segment will expand at a notable CAGR over the projected period.

- By substrate/base material, the plastics and polymers (PP, PE, PVC, PU, epoxy) segment contributed the maximum market share of 18% in 2024.

- By substrate/base material, the textiles and nonwovens segment is expected to grow at a notable CAGR over the projected period.

- By end-use industry, the healthcare and life sciences (hospitals, clinics, labs) segment held the largest market share of 42% in 2024.

- By end-use industry, the water and wastewater treatment segment is expected to grow at a notable CAGR over the projected period.

- By distribution/go-to-market, the direct B2B/OEM integration segment generated the major market share of 20% in 2024.

- By distribution/go-to-market, the online B2B marketplaces and e-procurement segment is expected to expand at a notable CAGR over the projected period.

Is artificial intelligence redefining the future of antiviral and antimicrobial innovation?

Artificial intelligence is gaining traction as a research accelerator in the antiviral and antimicrobial technology market, tackling the historic hurdles of time, cost, and drug resistance. Recent work has highlighted the benefits of AI-based predictive modeling, which allows for faster screening of molecular structures, reducing millions of compounds to a handful of feasible candidates.

For example, deep-learning algorithms have identified new antimicrobial peptides and optimized drug formulations against resistant pathogens. AI-enabled platforms are also being adopted into clinical microbiology laboratories to improve rapid infection detection and identification of resistance genes. This dual application of AI in discovery and diagnostics is positioning it as a key enabler of next-generation anti-infective technologies.

Market Overview

Antiviral and antimicrobial technology comprises materials, chemistries, surface treatments, and engineered systems designed to inactivate or inhibit viruses, bacteria, and fungi on contact or within a defined exposure window. Core modalities include active-ingredient-based–based approaches (e.g., metal ions, organic biocides), photocatalytic and UV-C germicidal mechanisms, and passive microtopographies that reduce microbial adhesion. Solutions are delivered as coatings, additives/masterbatches, laminates/films, filters, and device-integrated modules for continuous or intermittent protection. The antiviral and antimicrobial technology market spans healthcare, consumer, and industrial environments, built infrastructure, transportation, and food systems, with performance governed by efficacy spectrum, durability, regulatory compliance, safety, and total cost of ownership.

Antiviral and Antimicrobial Technology Market Growth Factors

- Increase in Healthcare-Associated Infections:The rise in hospital-acquired infections has increased the need for antimicrobial coatings, surfaces, and devices as healthcare providers look to prevent infections and therefore increase patient safety through innovative antiviral and antibacterial technologies.

- Increased Consumer Hygiene Awareness:Post-pandemic, consumers have shifted to higher standards of hygiene, and as a result, there is a demand for antimicrobial textiles, packaging, and personal products in an effort to add an extra layer of protection from harmful pathogens in our everyday environments.

- Supportive Regulatory Frameworks:Government programs and regulatory frameworks are encouraging antimicrobial compliance in healthcare environments, construction, and packaging products, resulting in the faster uptake of certified antiviral and antimicrobial technologies in all areas of the world.

- Advances in Materials and Nanotechnologies:Advances in the understanding of innovative nanomaterials, smart coatings, and surface-modification technologies are ensuring that antimicrobial protection lasts longer. This will, in turn, drive innovation in all sectors and offer additional commercial opportunities with strong growth potential.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology/Mechanism, Form Factor/Delivery, Substrate/Base Material, End-Use Industry, Distribution/Go-to-Market, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Are rapid diagnostic technologies potentially the biggest disruptor to superbugs?

In the larger battle against antimicrobial resistance (AMR), a further important opportunity is presented in both the global development of ultra-fast, point-of-care diagnostics that can rapidly decrease antibiotic misuse. In June 2024, Sysmex Astrego is an inspiring example as its rapid test won the £8 million Longitude Prize. This rapid test detects urinary tract infections and helps identify the right antibiotic, all in less than one hour, from an old model of 2-3 days. (Source:https://pharmaceutical-journal.com)

By providing the basis for the right treatment decision quickly, these rapid tests can help limit inappropriate antibiotic prescriptions, which are a significant contributor to AMR. As health systems around the world enter an era of recognized need for more rapid and accurate early diagnosis, the pace of change reflects the increased investment and adoption of rapid diagnostics as a core part of our antimicrobial future.

Restraint

Is high development cost slowing down innovation in antiviral and antimicrobial technologies?

A key restraining factor for the market for antiviral and antimicrobial technology is the high cost of R&D and commercialization. The process of developing a new novel antimicrobial or advanced coating is complex and involves regulatory approval, clinical testing, and trialling that may take up to 10 years. Low return on investment has led many pharmaceutical companies to cut antibiotic pipelines and redirect their focus to areas of urgent global need.

Several recently funded biotech start-ups focused on antimicrobials have recently filed for bankruptcy because of unsustainable funding models. Funding and regulatory challenges often make it impossible for innovators to get new and novel products to market quickly, reducing their rate of adoption and global access.

Opportunity

Are stricter infection-control measures creating new opportunities for antimicrobial innovation?

A significant opportunity is being created out of the growing regulation of hygiene and infection control measures in health care, transportation, and public spaces. The Centers for Disease Control and Prevention (CDC) estimates that 1 in 31 hospital patients has at least one healthcare-associated infection (HAI). Also, the CDC updated the infection-prevention guidelines by encouraging antimicrobial coatings to prevent healthcare-associated infections in hospitals and clinics.

(Source:https://www.cdc.gov)

Airlines and schools throughout the world are using antimicrobial-treated surfaces to limit the airborne transmission of viruses. As more regulations exist supporting restrictions on public and commercial activities, along with increased public demand for safer public environments, there are opportunities for companies to create more sustainable, effective antiviral technologies. Companies developing antimicrobial products may have greater leverage regarding a shift toward safer, germ-resistant environments for people.

Technology/Mechanism Insight

Why are metallic ion/oxide-based components dominant in the antiviral and antimicrobial technology market?

The metallic ion/oxide-based (Ag, Cu, ZnO) segment dominated the antiviral and antimicrobial technology market in 2024 because these technologies are heavily utilized across healthcare, consumer products, and water treatment segments. Silver, copper, and zinc oxide are known for their strong anti-microbial activity, lasting protection, and compatibility with coatings, plastics, and textiles. The regulatory acceptances of these metallic ions are established, and their safety is proven.

The graphene/nanocarbon-based technology segment is anticipated to have the highest growth rate during the forecast period. These nanomaterials are new in their forms of antimicrobial mechanisms, enabling high durable solutions with multi-functional characteristics, including electrical conductivity or barrier protection. Their anticipated use and expansion in the advanced medical device market, smart textiles, and next-generation packaging markets of the future are supported by ongoing research and development and large-scale commercial pilot projects that bring speed to commercialization and wide-scale adoption in an emerging area of innovative applications.

Form Factor/Delivery Insights

Why do coatings and paints dominate the antiviral and antimicrobial market?

The coatings and paints (solvent/waterborne, powder) segment dominated market in 2024, as it can be used across a variety of settings including, healthcare facilities, consumer electronics, packaging of products, and construction materials. Waterborne, solvent-based, and powder coatings with antimicrobial properties provide lasting and continuous protection from bacteria and viruses while being the least likely to compromise the surface and provide the versatility for temporary or permanent applications. Coatings provide long-term protection and offer variety for many different applications. It is no surprise that coatings and paints are the most readily and widely used form of antimicrobial products across different industries.

The additives and masterbatches for the polymers segment is expected to experience the fastest growth. These masterbatches are being used more frequently in plastics, packaging films, and consumer products to provide antimicrobial properties throughout the polymeric materials. The rise of the hygiene-conscious consumer of packaging, personal care products, and medical devices has contributed to the rapid adoption of polymer masterbatches, taking advantage of their efficiency, scalability, and ease of integration with existing manufacturing processes.

Substrate/Base Material Insights

Why are plastics and polymers dominant in the antiviral and antimicrobial technology market?

The plastics and polymers segment is presently the leading the market, and is supported by applications in packaging, medical devices, consumer goods, and industrial products. The common use of materials such as polyethylene, polypropylene, PVC, and epoxy all incorporate antimicrobial additives to provide long-term protection.

The textiles and nonwovens segment is expected to experience the fastest growth in the forecast period. Nonwoven textiles are particularly popular in masks, gowns, and hygiene products, all of which provide more options for antimicrobial textiles and contribute to the growth in the textiles and nonwovens segment. As consumers increasingly choose textiles that reinforce hygienic and sustainable fabrics and materials, investment and innovation grow, which renders this segment highly favorable.

End-Use Industry Insights

Why are human-supervised agents leading the antiviral and antimicrobial technology market?

The healthcare and life sciences lead the antiviral and antimicrobial technology market in 2024, as there is an immediate need for infection prevention in hospitals, clinics, and laboratories. This segment has strong political support, awareness of hospital-acquired infections, and innovation in protective medical equipment, which makes it the most advanced application for these technologies.

The water and wastewater treatment segment is expected to grow the fastest in the period ahead. The growing global awareness of microbial contamination in water supplies, safe drinking water, and sustainable sanitation practices will drive demand in this segment. Antimicrobial technologies are being offered as standalone membranes or filters and are being manufactured into treatment chemicals in order to make the water safer. With a growing commitment to infrastructure and tighter hygiene regulations, this segment is a growth driver.

Distribution/Go-to-Market Insights

Which distribution/go-to-market segment dominated the antiviral and antimicrobial technology market?

The direct B2B/OEM integration segment held the highest shares of the antiviral and antimicrobial technology market, as more and more manufacturers are choosing direct relationships with original equipment makers to embed antimicrobial technologies into their products in the design phase. Doing this allows for quality control, quicker time to market, and instilling customer confidence, especially in the healthcare, packaging, and consumer goods spaces, where regulatory approval and uniformity are consistently important.

The online B2B marketplaces and e-procurement segment is expected to grow at the fastest CAGR. Increasingly, digital procurement platforms offer antimicrobial solutions to small/medium enterprises and cut down on distribution costs. As industries continue moving away from traditional, paper-based supply chains and realizing their opacity, digital sourcing and intact supply chains will become major contributors to growth for online platforms. Furthermore, these online mediums provide more transparency, allow for quicker purchases, and offer more flexibility to providers of antimicrobial technology that have a global reach.

Regional Insights

How will North America remain the strategic origin of the antiviral and antimicrobial technology market?

North America is currently in the lead, as its established data and cloud infrastructure, significant enterprise R&D budgets, and rich space of platform providers enhance production deployments. US-based cloud providers and enterprise software providers are embedding agentic workflows into CRM, data platforms, and public-sector use-cases seamlessly creating reusable frameworks, security baselines, and procurement pathways that minimize time-to-value for large customers.

Due to concentrated workforce talent, the amount of product innovation in hyperscalers, and a regulatory-compliant product delivery to market, the U.S. leads North America as it relates to enterprise proofs-of-concept and large-scale rollouts. With a vision to foster strategic acquisitions or product go-lives, US firms are cautiously reducing integration periods between real-time data planes and agent runtimes, lowering reliance on implementing services, and positively impacting ROI predictability for operations, service desks, and automation teams. These factors produce a landscape in which buyers can pilot to learn with measurable KPIs (MTTR, FTE-hours saved, SLA uplift) prior to deploying agents across global estates.

Why is the Middle East and Africa the fastest-growing region for the antiviral and antimicrobial technology market?

The Middle East and Africa (MEA) is recognized as a booming market mainly due to increased public health investments, public infection-control mandates, and an increase in healthcare infrastructure development. The Gulf states are investing large amounts of money into sophisticated hospitals, laboratories, and hospitality facilities that embrace antimicrobials in surfaces and devices. The pandemic-driven infection-prevention upgrades sped up the rate of implementation across hospital sites and airports, while recent food safety legislative changes are increasing demand for antimicrobial surfaces to be included in packaging. Multinational suppliers are aligning themselves with local distributors observed within a fast-changing regional market that now acknowledges that antimicrobial stewardship programs and AMR [antimicrobial resistance] strategies are priority programs for healthcare policymakers.

The UAE is the regional leader, establishing a national healthcare hub with world-class hospital systems, maintaining strict infection-control protocols. The regional AMR summits in Abu Dhabi in 2025 focused on antimicrobial stewardship and further validated demand for advanced technologies within hospitals and clinics.Mega-projects ongoing within the medical tourism and hospitality industries in Dubai include the published United Nations Sustainable Development Goals, distributed to all developers, that address protentional subsequent hygiene failures should antimicrobial finishes not be considered. Growing government policies and increased visibility of health and safety tech procurement set the UAE as a developing market. (Source: https://icamr-uae.com)

Antiviral and Antimicrobial Technology Market Companies

- Microban International

- Sanitized AG

- BioCote Ltd

- Sciessent LLC

- Polygiene Group (incl. Addmaster/BIOMASTER)

- Arxada (formerly Lonza Specialty Ingredients)

- BASF SE

- Dow Inc.

- AkzoNobel N.V.

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Nippon Paint Holdings Co., Ltd.

- Cupron Inc.

- Wieland (CuVerro copper alloys)

- Signify (UV-C disinfection systems)

Recent Developments

- In January 2025, Onkos Surgical's first-in-human applications of NanoCept, its antibacterial coating for orthopaedic implants, are a valuable step forward in reducing intraoperative bacterial contamination during complex surgical procedures. Onkos received De Novo market authorization from the Food and Drug Administration (FDA) in April of 2024 for its NanoCept Antibacterial Technology.(Source: https://www.prnewswire.com)

- In March 2025, Microban, global leader in antimicrobial and odor control technologies, introduced its AkoTech multifunctional coating platform, safe for people and customizable, and easy to apply and use. It provides hardness, adhesion, water/oil repellency on surfaces like flooring, countertops, expert touchscreens, and furniture.(Source: https://www.fcnews.net)

Segments Covered in the Report

By Technology/Mechanism

- Metallic ion/oxide-based (Ag, Cu, ZnO)

- Organic biocides (QACs, PHMB, isothiazolinones)

- Photocatalytic (TiOâ‚‚, doped oxides)

- UV-C germicidal modules (254 nm and UV-C LED)

- Antiviral/antimicrobial peptides and enzymes

- Superhydrophobic/microtextured anti-adhesion surfaces

- Graphene/nanocarbon-based actives

By Form Factor/Delivery

- Coatings and paints (solvent/waterborne, powder)

- Additives and masterbatches for polymers

- Laminates, protective films, and wraps

- Embedded filters and membranes (air/water)

- Sprays, wipes, curing/impregnation treatments

- Device modules (UV-C, plasma, photocatalytic units)

By Substrate/Base Material

- Plastics and polymers (PP, PE, PVC, PU, epoxy)

- Textiles and nonwovens

- Paints and architectural coatings

- Glass and ceramics

- Metals and copper alloys

- Paper and paperboard

By End-Use Industry

- Healthcare and life sciences (hospitals, clinics, labs)

- Building and construction (commercial, institutional)

- Consumer goods and apparel

- Transportation (aviation, rail, automotive, marine)

- Food and beverage processing and packaging

- Electronics and appliances

- Water and wastewater treatment

By Distribution/Go-to-Market

- Direct B2B/OEM integration

- Industrial distributors and channel partners

- Private-label/ingredient-brand licensing

- Online B2B marketplaces and e-procurement

By Region

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting