What is the Automated Bio-banking Market Size?

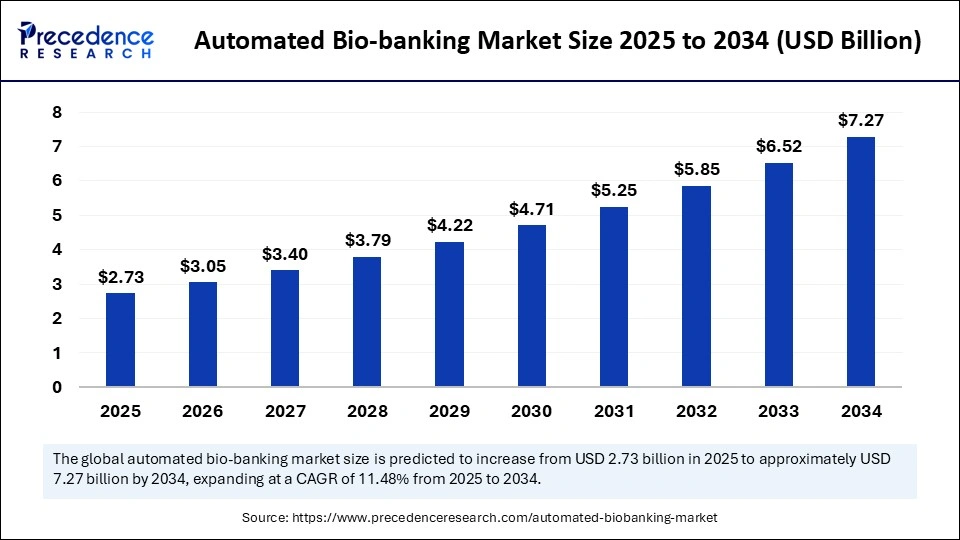

The global automated bio-banking market size accounted for USD 2.45 billion in 2024 and is predicted to increase from USD 2.73 billion in 2025 to approximately USD 7.27 billion by 2034, expanding at a CAGR of 11.48% from 2025 to 2034. The growth of the automated bio-banking market is driven by rising demand for efficient sample management, digital integration, and advancements in automation and storage technologies.

Market Highlights

- North America dominated the automated bio-banking market with the highest share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR in the market between 2025 and 2034.

- By product type, the automated sample storage systems segment held the largest market share in 2024.

- By product type, the software & informatics solutions segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By sample type, the blood products segment captured the biggest market share in 2024.

- By sample type, the DNA/RNA samples segment is expected to expand at a notable CAGR over the projected period.

- By application, the drug discovery & development segment dominated the market in 2024.

- By application, the genomics & proteomics research segment is expected to expand at a notable CAGR over the projected period.

- By automation level, the fully automated bio-banking systems segment held a dominating market share in 2024.

- By automation level, the semi-automated bio-banking systems segment is expected to expand at a notable CAGR over the projected period.

- By end-user, the biopharmaceutical & pharmaceutical companies segment captured the largest market share in 2024.

- By end-user, the academic & research institutes segment is expected to expand at a notable CAGR over the projected period.

- By storage capacity, the medium-scale automated bio-banks (1M-10M samples) segment dominated the market in 2024.

Market Size and Forecast

- Market Size in 2024: USD 2.45 Billion

- Market Size in 2025: USD 2.73 Billion

- Forecasted Market Size by 2034: USD 7.27 Billion

- CAGR (2025-2034): 11.48%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is Automated Bio-Banking?

The automated bio-banking market is evolving due to an increasing need for biomedical research for a better and more efficient way to store, manage, and retrieve samples. Automation enables the reduction of human error and enhances data accuracy, supporting various high-volume genomic and clinical research studies. Automated bio-banking refers to more advanced bio-banking systems that manage biological samples using robotics and data storage technology. The growth of the market is also supported by the maturity of AI-enabled sample tracking, increased funding for biotechnology facilities, and an increased focus on precision and personalized medicine.

Key Technological Shifts in the Automated Bio-Banking Market Driven by AI:

Artificial intelligence is driving the transformation of automated biobanking by enabling advanced sample tracking, predictive maintenance, and intelligent data utilization. Vendors like Thermo Fisher are integrating AI-powered upgrades, including real-time sample tracking and predictive analytics, into retrieval workflows. Large-scale AI initiatives, such as those by the UK Biobank, are utilizing machine learning to analyze vast participant datasets and predict early-onset diseases, demonstrating the power of linking samples with data to drive discovery. Additionally, peer-reviewed studies highlight AI's role in harmonizing omics data, enhancing quality control, and managing consent, signaling a shift from passive biobank repositories to dynamic, active data platforms.

Automated Bio-Banking Market Outlook

- Market Growth Overview: The market is expected to experience rapid growth during the forecast period from 2025 to 2034, driven by increasing demand for high-quality biospecimens and stringent regulatory compliance requirements. Automation is set to formalize quality systems for bio-specimens in line with ISO 20387 standards, enhancing quality management system (QMS) compliance and traceability. BBMRI-ERIC is actively accelerating the implementation of this ISO guidance to better regulate, improve specimen quality, and facilitate access.

- Trend: Rising use of robotic workflows to reduce variability and errors is a major trend in the industry. A recent study on a robotic biobanking project demonstrated that the median coefficient of variation (%CV) decreased from approximately 4.63 in manual operations to about 1.80 with robotic automation, significantly enhancing the reproducibility of high-throughput assays and subsequent omics analyses.

- Global Expansion: Public biobanks operating at a population scale are rapidly increasing specimen volumes and the depth of multi-omics data. Examples include the UK Biobank, with nearly 500,000 participants, and the NIH All of Us program, which currently has hundreds of thousands of participants enrolled. Continued investment in these initiatives is driving growing demand for automated storage, retrieval, and federated access solutions.

- Start-up Ecosystem: Public programs and infrastructures, such as NIH All of Us and BBMRI-ERIC, are funding the development of scalable biobanking platforms and establishing biobanking standards. Grants and federated data tools are reducing the risks associated with automation investments, fueling the emergence of a vibrant start-up ecosystem focused on robotics, laboratory information management systems (LIMS), and federated search services.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 2.45 Billion |

| Market Size in 2025 | USD 2.73 Billion |

| Market Size by 2034 | USD 7.27 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.48% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Sample Type, Application, Automation Level, End-User, Storage Capacity, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Need to Increase Sample Throughput

One of the key drivers of growth in the automated bio-banking market is the need to increase sample throughput while maintaining integrity and traceability. Precision medicine initiatives and large cohort studies generate millions of specimens. For example, the U.S. "All of Us" biobank plans to sample and manage over 35 million biospecimens, relying on automation to ensure specimen quality and maintain a secure chain of custody. Automation reduces the risk of human error in critical processes, such as freezing, decapping, sorting, and retrieval, especially for specimens stored at ultra-low temperatures. Additionally, the integration of robotics and intelligent workflows streamlines the cataloging and access of biospecimens in high-volume laboratory settings.

Restraint

High Cost and Integration Challenges

High costs of automated systems and complexities in integration are among the main factors limiting the adoption of automated biobanking. Advanced robot-freezers, automated sample retrieval systems, and data management systems require expensive infrastructure, which can deter small biobanks or academic institutions from adopting automation. For example, in July 2024, the UK Biobank invested £50 million in upgrading its automated storage and retrieval systems to meet the scale of genomic projects, raising the question of whether smaller labs could afford to match those upgrades. (Source: https://www.ukbiobank.ac.uk)

Similarly, hospitals and universities find the integration of automation with existing IT systems to be even more complicated, causing delays and reduced adoption. While automation helps ensure sample and data integrity over time and accuracy across multiple uses, the institutional costs and technical issues are usually too great for the broader adoption of automated biobanking.

Opportunity

Could “Data-Driven Biospecimen Intelligence” Be the Killer Application for Automated Biobanking?

A major opportunity lies in transforming biobanks from passive "cold storage warehouses" into intelligent, data-driven platforms that seamlessly link each specimen to multi-omics, clinical, and imaging datasets. This evolution, often referred to as Biobanking 4.0, is set to digitally anchor biospecimens in rich data ecosystems, enabling real-time analytics, predictive modeling, and AI-assisted sample triage.

For example, Vanderbilt University recently deployed a fully automated biobank with a 10 million sample capacity, designed to support sophisticated cohort queries at scale. The automated sample storage market is projected to triple by 2034, driven in part by rising demand for smart, interoperable systems.

With digital metadata and analytics at the core of automation, biobanks are evolving beyond specimen storage to become active contributors to research, integrated into workflows, and enabling the discovery of valuable biological insights.

Segment Insights

Product Type Insights

Which Product Hold the Largest Share of the Automated Bio-Banking Market?

The automated sample storage systems segment held the largest share of the market in 2024, as they provide reliable storage, greatly reduce human errors, and manage samples with high throughput. Their implementation is crucial, as they provide controlled environments for sensitive biological materials. The adoption of these essential systems by global biobanks is heavily dependent upon pharmaceutical, clinical, and research studies.

The software & informatics solutions segment is expected to grow at the fastest CAGR over the projection period, driven by the rising demand for AI sample tracking, big data analytics, and real-time monitoring. Software solutions are crucial for aiding accuracy, interoperability, and compliance, thereby facilitating and supporting the development of precision medicine and collaborative research, making them an essential component of next-generation biobanking systems.

Sample Type Insights

What Made Blood Products the Dominant Segment in the Market?

The blood products segment dominated the automated bio-banking market in 2024, as they are the most widely collected and used specimens in clinical diagnostics, therapeutic research, and large biobanking population health studies. Their significance in the identification of disease biomarkers, vaccine development, and transfusion medicine underscores their importance, as they are the most used and requested biological resource within automated biobanks.

The DNA/RNA samples segment is likely to expand at the fastest rate in the upcoming period due to the rising demand for genomic and transcriptomic research, particularly in precision medicine and personalized therapies. These samples are crucial for genetic sequencing, biomarker discovery, and multi-omics studies, which are becoming increasingly central to large-scale cohort projects, such as the UK Biobank and NIH's All of Us. Automation offers significant advantages in handling DNA/RNA, such as reducing degradation risk, improving sample traceability, and enabling high-throughput processing with minimal human error.

Application Insights

Why Did the Drug Discovery & Development Segment Dominate the Automated Bio-Banking Market?

The drug discovery & development segment dominated the market in 2024, as biobanked samples are the mainstay of pharmaceutical companies conducting drug efficacy, safety, and biomarker validation studies. Automated systems facilitate efficiency through the standardized storage and retrieval of biobanked samples, allowing preclinical and clinical studies, essential in an R&D context, to be conducted more rapidly. Thus, drug discovery and development drive the overall segment.

The genomics & proteomics research segment is likely to grow at the fastest rate during the forecast period due to its central role in advancing precision medicine, biomarker discovery, and large-scale population studies. These research areas require the storage and management of vast quantities of high-quality biological samples, particularly DNA, RNA, and proteins, which demand strict environmental control, traceability, and consistency. Advancements in next-generation sequencing and proteomic profiling further support segmental growth. The research community is increasingly reliant on high-quality biobanked samples to investigate genetic variations and protein functions, which align with precision medicine and disease-specific research initiatives.

Automation Level Insights

How Do Fully Automated Bio-Banking Systems Hold the Largest Market Share in 2024?

The fully automated bio-banking systems segment remains dominant, holding the largest share in 2024, as the high level of accuracy, efficiency, and minimal manual intervention they provide is unmatched by semi- or manual options. The standardized sample handling, reliable sample storage, and greater retrieval response times they provide are a major reason why large pharmaceutical companies and research organizations favor these systems in the pursuit of reducing errors and optimizing sample management for long-term use.

The semi-automated bio-banking systems segment is expected to expand at the fastest CAGR over the forecast period, mainly due to the balance between automation and cost-effectiveness. Flexibility, scalability, affordability, and ease of access are essential components in biobanking, as an increasing number of smaller labs and research institutes prefer semi-automated systems over fully automated solutions due to cost, uncertainty, or other factors. As organizations transition from manual to fully automated biobanking systems, these factors become even more crucial.

End-User Insights

Which End-User Lead the Automated Bio-Banking Market in 2024?

The biopharmaceutical & pharmaceutical companies segment led the automated bio-banking market in 2024 because they rely heavily on large volumes of biological samples for drug discovery, clinical experimentation, and biomarker research. Automated biobanks are ideal for these companies, as they require highly standardized processes for both storage and retrieval of biological samples in order to ensure sample integrity and accelerate product development cycles.

The academic & research institutes segment is expected to grow at the highest CAGR in the coming years, as they are increasingly employing automated biobanking to advance studies in genomics, proteomics, and personalized medicine. Academic and research institutes are rapidly expanding their biobanking capabilities in response to increased funding through collaborations, government support, and data-driven research.

Storage Capacity Insights

Why Did the Medium-Scale Automated Bio-Banks Segment Dominate the Market in 2024?

The medium-scale automated bio-banks (1M-10M samples) segment dominated the automated bio-banking market in 2024, as they achieve the best of cost, capacity, and usability. They are being used by hospitals, pharmaceutical companies, and research centers seeking an easy storage solution without the high capital investment required for a large-scale facility.

The largest-scale automated bio-banks segment is likely to expand at the fastest rate in the market, driven by an increase in population-based studies, advancements in genomics, and international research collaborations. They are capable of storing millions of unique biological samples while maintaining quality assurance, interoperability, and digital sample registration for later use in precision medicine and biomedical research worldwide.

Regional Insights

Why Did North America Dominate the Automated Bio-Banking Market in 2024?

North America maintained its leadership position in the automated bio-banking market by holding the largest share in 2024. This is due to its mature healthcare infrastructure, well-established genomic research pipeline, and early adoption of advanced automation technologies for specimen storage. Academic and research institutions are rapidly implementing automation to enhance sample traceability and minimize human error. For instance, in 2025, Azenta Life Sciences expanded its automated storage capabilities to support large-scale clinical research collections. Similarly, the Mayo Clinic upgraded its robotic cryostorage systems to accelerate genomic clinical trials and oncology research, further strengthening the region's leadership in the market.

The U.S. is a major contributor to the market due to its strong network of both public and private biobanks and its leadership in integrating biobanks into national health initiatives. The ongoing "All of Us Research Program" exemplifies this, rapidly expanding bio-specimen collection with integrated automated systems that enable long-term tracking and efficient retrieval. Additionally, the U.S. has placed strong emphasis on precision healthcare, supporting the development of AI-integrated inventory and automated storage systems. These innovations allow for dynamic resizing of freezer space and improved management of research-use inventories, significantly enhancing operational efficiency.

What Makes Asia Pacific the Fastest-Growing Market?

Asia Pacific is expected to experience the fastest growth, driven by large-scale genomic initiatives, government-funded research, and the expanding scope of clinical trials. Countries like China, Japan, and India are making significant investments in biobank infrastructure to support precision medicine and national health data programs. For instance, Japan's National Center for Global Health and Medicine recently upgraded its automation platform to manage temperature-sensitive biospecimens, while Indian research institutions are partnering with global automation firms to develop integrated biorepositories.

China leads the region, propelled by strategic national policies that promote genomic research and biobank standardization. The government's "Healthy China 2030" initiative, along with a rapidly growing biopharmaceutical sector, has spurred investment in large-scale automated research facilities. Organizations like BGI Group and several provincial health centers have implemented robotics-based cryogenic storage systems to support the largest genetic study of human health in history. Additionally, China's growing domestic capabilities in automated biobanking are enabling localized equipment production and cost reduction, further accelerating regional market growth.

Key Investments and Funding Activities in Biobanking and Genomics Sector (2024–2025)

| Company / Entity | Date | Funding / Amount | Description / Use of Funds |

| Galatea Bio | March 2025 | US$ 25 million | To build a global biobank and sequence genomes of 10 million people, focusing on diverse ancestries to advance precision medicine and AI-driven genomics |

| Colossal Biosciences | January 2025 | US$ 200 million (Series C) | To expand de-extinction and conservation genomics programs, scale CRISPR tools, and develop artificial womb technology for species restoration |

| AminoChain | September 2024 | US$ 7 million (Pre-seed + Seed) | To develop a decentralized biobank marketplace using blockchain for transparent biosample sharing and interoperable biobank data systems |

| Roswell Park Biobank | October 2024 | US$ 7.73 million (Federal grant) | To modernize Roswell Park's biobank facility with advanced freezers, automation, and improved infrastructure for cancer research support |

| Czech Biobank Network (BBMRI.cz) | August 2024 | €184 million (Government funding) | To modernize Czech national biobanks with automation, robotics, and advanced bioinformatics infrastructure under the BBMRInv project (2024–2026) |

Top Companies in the Automated Bio-Banking Market

Tier I – Major Players

These are the dominant companies in the automated biobanking market. Each holds a substantial share individually, and together, they account for approximately 40–50% of total market revenue.

- Thermo Fisher Scientific Inc.

- Azenta Life Sciences (formerly Brooks Life Sciences)

- Hamilton Company

- Tecan Group Ltd.

These players lead due to their global presence, comprehensive automation solutions, strong R&D capabilities, and strategic partnerships in genomics and precision medicine.

Tier II – Mid-Level Contributors

These companies maintain strong market presence and are key solution providers but are not as dominant as Tier I players. Collectively, they contribute about 30–35% of the total market.

- Qiagen N.V.

- Greiner Bio-One International GmbH

- LiCONiC AG

- ASKION GmbH

- PHC Holdings Corporation (Panasonic Healthcare)

They often serve mid-sized and regional biobanks and research institutions with reliable and customizable automation solutions.

Tier III – Niche and Regional Players

These are smaller or regionally focused companies with limited global outreach. Individually, their contributions are modest, but together they hold around 15–20% of the market.

- BioCision, LLC

- Micronic Holding B.V.

- Biobank AS

- Ziath Ltd.

- Promega Corporation

- Other local automation providers and emerging start-ups

These companies typically focus on specialized equipment, sample tracking, consumables, or niche biobanking services and are increasingly contributing through innovation in robotic systems, software integration, or regional projects.

Recent Developments

- In May 2024, Cellipont Bioservices, and Adva Biotechnology, announced its collaboration with Adva Biotechnology marking the launch of the groundbreaking ADVA X3, an advanced, fully automated platform for manufacturing cell therapies, streamlining processes and reducing costs.

- In November 2024, NAYO proudly Announce the Launch of Fully Automated Biobanking Solutions in the 12th Analytica China & Labtech China Congress 2024, the international trade fair for laboratory technology, analysis and biotechnology in China.

Segments Covered in the Report

By Product Type

- Automated Sample Storage Systems

- Automated Sample Processing Systems

- Sample Retrieval & Tracking Systems

- Software & Informatics Solutions

By Sample Type

- Blood Products (Plasma, Serum, Whole Blood)

- Human Tissues

- DNA/RNA Samples

- Cell Lines

- Other Bio-specimens

By Application

- Clinical Diagnostics

- Drug Discovery & Development

- Genomics & Proteomics Research

- Regenerative Medicine & Cell Therapy

- Population-based Biobanking / Epidemiology Studies

By Automation Level

- Fully Automated Bio-banking Systems

- Semi-automated Bio-banking Systems

By End-User

- Biopharmaceutical & Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals & Clinical Laboratories

- Contract Research Organizations (CROs)

- Government & Public Biobanks

By Storage Capacity

- Small-scale Automated Bio-banks (<1M samples)

- Medium-scale Automated Bio-banks (1M–10M samples)

- Large-scale Automated Bio-banks (>10M samples)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting