What is the Biochar Gasification Market Size?

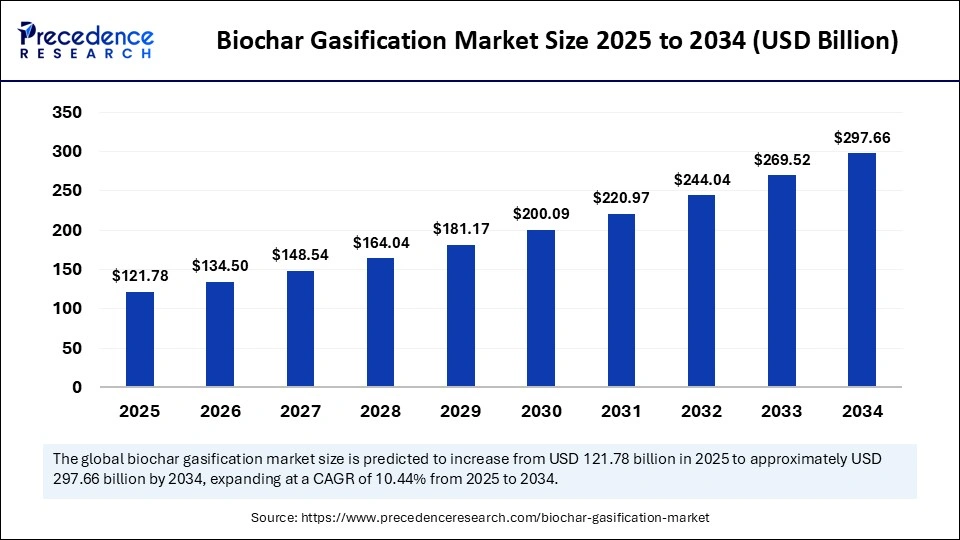

The global biochar gasification market size is calculated at USD 121.78 billion in 2025 and is predicted to increase from USD 134.50 billion in 2026 to approximately USD 297.66 billion by 2034, expanding at a CAGR of 10.44% from 2025 to 2034. The market is experiencing substantial growth, driven by the integration of AI and IoT technologies that enhance process efficiency, consistency, and regulatory compliance. Smart sensors and AI systems analyze real-time operational data to optimize reactor performance and improve product quality. This enables continuous process verification, which is critical for meeting regulatory standards and securing carbon credit certifications. As a result, biochar gasification is gaining traction as a sustainable solution for both waste-to-energy applications and regenerative agriculture.

Market Highlights

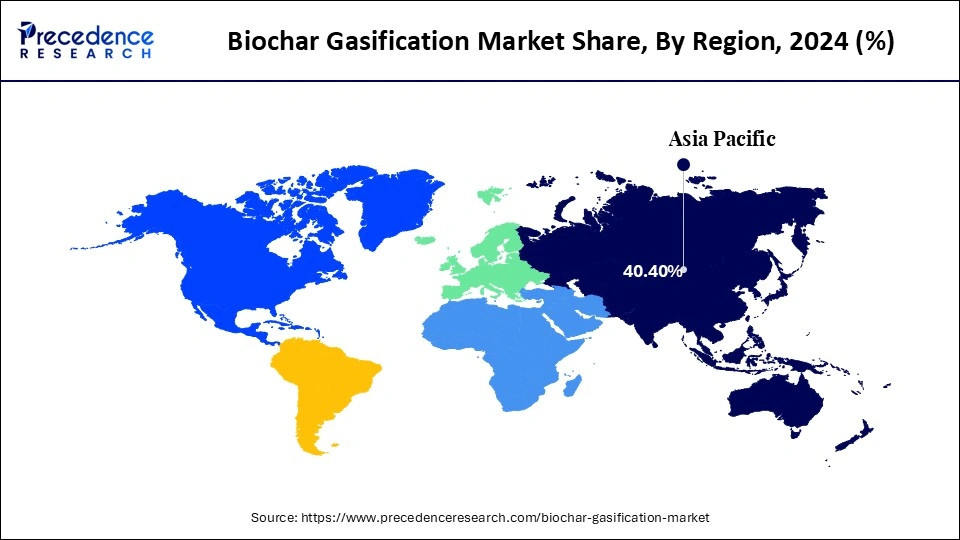

- Asia Pacific dominated the market with a 40.40% share in 2024 and is expected to register the highest CAGR of 11.5% from 2025 to 2034.

- By feedstock type, the agricultural waste segment contributed the largest market share of 49.4% in 2024.

- By feedstock type, the forestry waste segment is expected to grow at the fastest CAGR of 10.4% from 2025 to 2034.

- By gasification technology, the fixed bed gasification segment dominated the market with a 50.4% share in 2024.

- By gasification technology, the fluidized bed gasification segment is expected to grow at a 10.6% CAGR from 2025 to 2034.

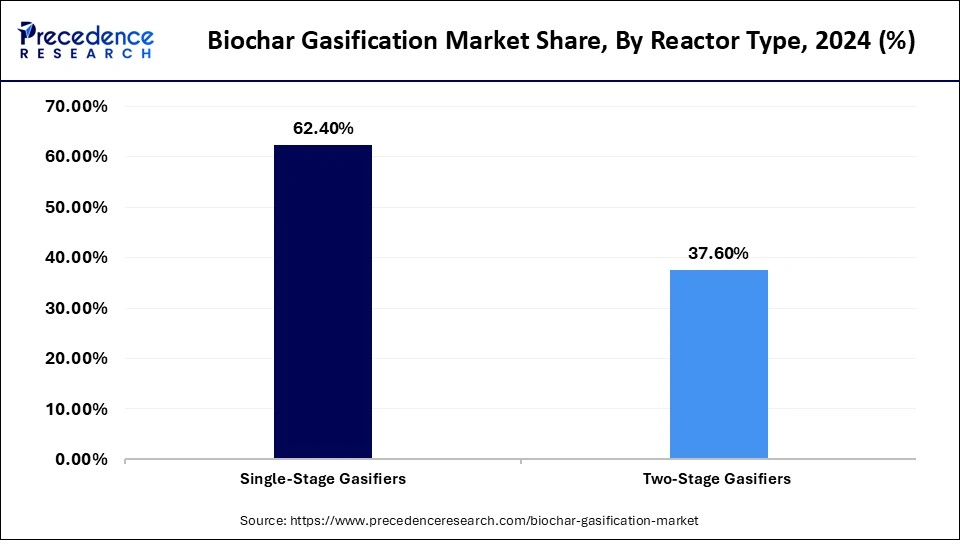

- By reactor type, the single-stage gasifiers segment led the market with a 62.4% share in 2024.

- By reactor type, the two-stage gasifiers segment is expected to expand at a 10.7% CAGR from 2025 to 2034.

- By application, the energy production segment held the major market share of 44.5% in 2024.

- By application, the soil amendment segment is expected to register the fastest CAGR of 10.6% during the foreseeable period.

- By end-user industry, the agriculture segment dominated the market with a share of 46.4% in 2024.

- By end-user industry, the power & energy segment is expected to grow at a 10.9% CAGR from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 121.78 Billion

- Market Size in 2026: USD 134.50 Billion

- Forecasted Market Size by 2034: USD 297.66 Billion

- CAGR (2025-2034): 10.44%

- Largest Market in 2024: Asia Pacific

What is Biochar Gasification?

The biochar gasification market involves the production of biochar through the gasification process, converting biomass into biochar, syngas, and heat under controlled oxygen conditions. This technology offers renewable energy generation, carbon sequestration, and soil fertility enhancement. The market is driven by the increasing focus on sustainable waste management, renewable energy adoption, and climate change mitigation. Biochar gasification is gaining attention across agriculture, energy, and industrial sectors due to its environmental benefits and circular economy applications.

How is AI Impacting the Biochar Gasification Market?

Artificial intelligence (AI) is transforming the biochar gasification market by enhancing the efficiency, sustainability, and scalability of converting biomass into energy and carbon-rich biochar. Through advanced data analytics and machine learning (ML) models, AI enables predictive process control, real-time optimization, and efficient resource management. By continuously adjusting operating parameters, AI reduces fuel consumption, minimizes operational costs, and enhances process sustainability. Additionally, AI supports logistical planning and provides insights into both the economic and environmental impacts, positioning it as a critical enabler in the evolution of intelligent, low-carbon biochar production systems.

Biochar Gasification Market Outlook

The biochar gasification market is projected to grow significantly between 2025 and 2034. This growth is driven by the growing demand for biochar in sustainable agriculture, a rising focus on waste management and the circular economy and increasing government incentives for carbon capture and climate mitigation strategies.

Sustainability is central to this market, including the use of agricultural and forestry residues as feedstock, reducing landfill waste, and promoting a circular economy. Biochar is increasingly valued for its long-term carbon sequestration potential, positioning gasification projects for revenue from carbon credit markets.

While Asia-Pacific dominates the market, there is strong potential for market expansion in North America and Europe due to their large agricultural industry and supportive policies, along with strong incentives for waste-to-energy and carbon capture. Latin America and Africa are emerging as long-term growth opportunities.

Significant investment from corporations and funds is flowing into the sector. Microsoft, for instance, has committed to large-volume, long-term carbon removal credit purchases from biochar projects. Additionally, private investment is funding large-scale biochar production facilities.

The startup ecosystem is thriving, with companies innovating in biochar production technology and commercial applications. Emerging firms focus on developing portable or on-site gasification units to reduce logistics costs, advanced reactors for better efficiency, and integrated systems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 121.78 Billion |

| Market Size in 2026 | USD 134.50 Billion |

| Market Size by 2034 | USD 297.66 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.44% |

| Dominating Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Feedstock Type, Gasification Technology, Reactor Type, Application, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Biochar Gasification MarketSegment Insights

Feedstock Type Insights

The agricultural waste segment dominated the market, accounting for a 49.4% share in 2024. This is due to its abundant availability, cost-effectiveness, and potential for sustainable waste management. Converting crop residues like corn stalks, wheat straw, and rice husks into biochar and syngas through gasification provides a dual solution for managing agricultural waste and producing renewable energy. Gasifying agricultural waste for biochar creates a circular economic model. This is especially relevant in farming regions like the Asia-Pacific, where agricultural residues are plentiful.

The forestry waste segment is expected to grow at the fastest CAGR of 10.4% over the projection period. This growth is mainly due to its abundant availability, favorable properties for gasification, and alignment with modern circular economy principles. Valuing this waste addresses environmental and economic challenges, including waste management, greenhouse gas emissions, and soil health. Turning forest waste into biochar and energy supports circular economy goals by transforming low-value waste into valuable products, preventing its release into the atmosphere.

Gasification Technology Insights

The fixed bed gasification segment led the market with a 50.4% share in 2024. This is due to its simplicity, cost-effectiveness, and suitability for small-to-medium-scale operations. Fixed-bed gasifiers are relatively easy to design and require less investment compared to more complex technologies, making them a practical choice for smaller projects, including decentralized rural electrification. Fixed-bed gasification naturally produces both a combustible gas and biochar, boosting economic viability for agricultural and environmental applications.

The fluidized bed gasification segment is expected to register the highest CAGR of 10.6% throughout the forecast period. This is mainly because of its superior fuel flexibility, high heat and mass transfer, and efficient temperature control. These features allow processing a wide range of biomass feedstock, including materials with varying moisture and ash content common in biochar production, leading to high thermal efficiency and better syngas quality compared to other gasifier types. Uniform temperature distribution also helps prevent ash sintering and agglomeration.

Reactor Type Insights

The single-stage gasifiers segment led the market, holding a 62.4% share in 2024. This is primarily because of their simplicity, lower cost, and ability to produce high-quality, low-tar biochar suitable for various uses. Operating at low load conditions, downdraft gasifiers can be optimized to generate high yields of stable, carbon-rich biochar, making them effective for long-term carbon sequestration. Single-stage gasifiers perform well with specific biomass types, such as wood chips and pellets, making them a commercially solid option.

The two-stage gasifiers segment is expected to grow at a CAGR of 10.7% in the coming years, largely because it produces cleaner, higher-quality syngas with significantly lower tar levels, improving efficiency and reducing downstream equipment issues. This reliability and efficiency drive increased commercial adoption and investment. The process can be fine-tuned to produce syngas with higher heating value and greater hydrogen content when using steam or carbon dioxide as gasification agents, with precise control over the process.

Application Insights

The energy production segment dominated the market by holding a 44.5% share in 2024. This is mainly due to the high efficiency and revenue potential of converting biomass into syngas for power generation. The versatility of this process allows it to support multiple market drivers, including renewable energy mandates, waste management, and the expanding carbon credit market. While farming is a major application for biochar, energy production is a primary driver of the gasification technology. Additionally, ongoing improvements in gasifier design and syngas cleaning technologies have increased efficiency and economic viability.

The soil amendment segment is expected to grow at the fastest CAGR of 10.6%, primarily because of its proven ability to improve soil health, boost crop yields, and sequester carbon to combat climate change. Biochar enhances soil health by increasing organic carbon, nutrient retention, and water-holding capacity, leading to long-term environmental benefits and cost savings for farmers. Improving soil structure and nutrient availability supports better crop growth and higher yields. Advances in biochar production and supportive government policies are driving this growth.

End-User Industry Insights

The agriculture segment led the market with a 46.4% share in 2024. This is primarily due to the significant benefits that gasification-derived biochar offers for soil health, crop yield, and long-term sustainability. As a valuable co-product of the gasification process, biochar enhances soil structure, retains nutrients, and supports carbon sequestration, delivering benefits to both farmers and the environment. Additionally, growing government support through subsidies, incentives, and regulatory frameworks promoting sustainable agriculture and organic waste utilization is accelerating adoption across the sector.

The power and energy segment is expected to expand at a CAGR of around 10.9% over the projection period, mainly due to rising demand for sustainable and renewable energy sources and the sector's need for advanced waste-to-energy solutions. Biochar gasification provides a clean, efficient method for converting organic waste into valuable energy products, aligning with global efforts to reduce carbon emissions. Integrating bioenergy with carbon capture and storage is a key factor driving investments in biochar technology.

Biochar Gasification MarketRegional Insights

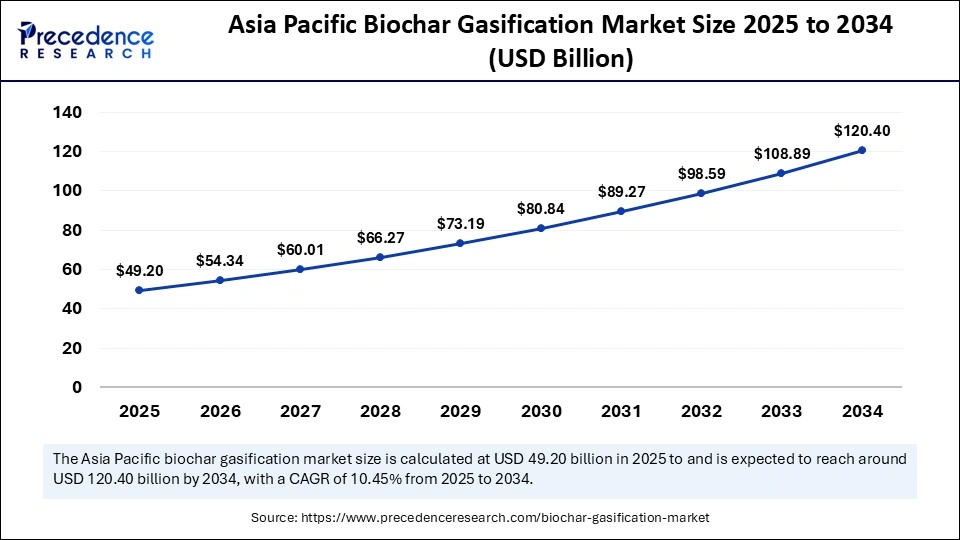

The Asia Pacific biochar gasification market size is exhibited at USD 49.20 billion in 2025 and is projected to be worth around USD 120.40 billion by 2034, growing at a CAGR of 10.45% from 2025 to 2034.

How Does Asia Pacific Dominate the Biochar Gasification Market in 2024?

Asia Pacific dominated the market with a 40.4% share in 2024 and is expected to expand at an 11.5% CAGR in the coming years. The region's dominance stems from a strong combination of agricultural, environmental, and governmental factors. Countries with large farming sectors, such as China and India, produce vast quantities of agricultural waste like crop residue, rice straw, and coconut shells. This provides an abundant and inexpensive biomass source for biochar gasification, making the process more economically feasible region. The region's large agricultural sector provides a massive, consistent source of biomass feedstock, while increasing environmental awareness and supportive government initiatives, accelerated the adoption of biochar for sustainable farming and waste management.

India Biochar Gasification Market Trends

India is a major contributor to the market, primarily leveraging the immense biomass from agricultural residue and municipal waste. India views biochar gasification as a powerful tool for sustainable waste management, carbon sequestration. Additionally, initiatives include government-backed biomass programs, local projects utilizing waste for biochar fertilizer, and growing interest from startups and research institutions to improve technology and awareness.

China Biochar Gasification Market Trends

China plays a major role in the global market, primarily due to robust state policies, immense biomass resources, and the world's largest carbon market, yet its progress is complicated by high costs and regional disparities. China is aggressively leveraging biochar gasification to mitigate environmental pollution from open burning and pursue ambitious carbon neutrality goals. The central government, through supportive policies and significant investment, is scaling up biomass gasification plants for combined heat and power generation.

Europe is expected to grow at a notable rate in the foreseeable period. This is due to robust government initiatives, stringent environmental regulations, a strong focus on circular economies, and increasing demand from the agricultural and industrial sectors. European nations are actively turning organic waste, including agricultural residues and forestry byproducts, into value-added products like biochar and bio-energy through gasification. European farming increasingly favors organic and regenerative methods to improve soil health, retain moisture, and enhance nutrient availability.

Germany Biochar Gasification Market Trends

Germany plays a distinctive role in the market, distinguishing itself through technological advancements, strong government policy support, and a high-value, circular economy approach, despite relying on limited domestic biomass resources. This technology is backed by a robust policy framework, the Renewable Energy Sources Act, which provides incentives and favorable conditions for biomass projects, offers financial motivation, and expands its use beyond agriculture to applications in construction, and specialized industrial fillers.

Regulatory Landscape for the Biochar Gasification

| Country | Regulatory Bodies | Key Regulations | Voluntary Standards |

| EU | European Commission | Biochar approved as a fertilizer component under Regulation (EU) 2019/1009. | EU Carbon Removal Certification Framework (CRCF) certifies biochar projects. European Biochar Certificate (EBC) |

| U.S. | Environmental Protection Agency (EPA) and State Agencies | Emissions are regulated under the Clean Air Act (CAA). Permits are required at the state level. | Climate Action Reserve (CAR) Biochar Protocol |

| China | Provincial and Local Governments | Controls on biomass energy, feedstock, and plant emissions. | Focus on mandatory government oversight rather than voluntary standards. |

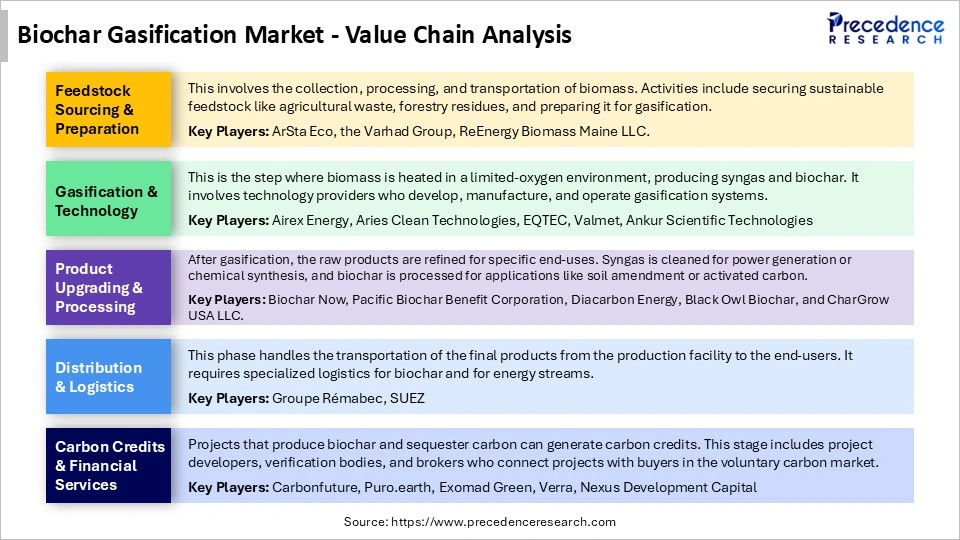

Biochar Gasification MarketValue Chain

Biochar Gasification Market Companies

| Tier | Companies | Rationale / Role | Estimated Cumulative Share |

| Tier I – Major Players |

|

These firms are leading developers of large scale biochar/gasification systems, with technology leadership, high output capacity and strong international presence. | 45% |

| Tier II – Established Players |

|

These companies are scaling up, regional or technology specialist players, contributing meaningful volume and innovation though not as dominant globally as Tier I firms. | 25% |

| Tier III – Emerging / Niche Players |

|

These smaller and regional players focus on niche feedstock models, early stage scale, specialized applications or local markets, and thus hold smaller share collectively. | 18% |

Recent Developments

- In May 2025, Airex Energy, Groupe Rémabec, and SUEZ inaugurated Carbonity, Canada's first industrial-scale biochar plant in Port-Cartier. This partnership aims for an initial production capacity of 10,000 tonnes of biochar per year, expected to triple by 2026, making it North America's largest biochar facility.

(Source: https://www.suez.com) - In November 2024, Myno Carbon received US$20.4 million from the USDA to build a large-scale biochar carbon removal facility in Port Angeles, Washington. This facility is set to convert sustainably sourced biomass into 20,000 dry tonnes of renewable carbon products for agriculture, improving crop yields and promoting climate-smart farming.(Source: https://www.worldfertilizer.com)

- In July 2023, SUEZ, Airex Energy, and Groupe Rémabec formed Carbonity, a joint venture to build Canada's first biochar plant in Port-Cartier, Quebec. Using forestry and agricultural biomass, the facility will produce biochar, recognized by the IPCC as one of the top five negative-emission solutions, for carbon sequestration, improved soil health, and sustainable land use.(Source: https://www.suez.com)

Exclusive Analysis on the Biochar Gasification Market

The global biochar gasification market is poised for substantial long-term expansion, catalyzed by the convergence of climate-driven policy frameworks, circular economy imperatives, and rapid technological innovation. As decarbonization mandates intensify across industrial and agricultural sectors, biochar, derived via thermochemical gasification of biomass, has emerged as a high-impact, negative-emission solution, validated by its inclusion in IPCC carbon mitigation strategies. The market's trajectory is increasingly shaped by the dual utility of gasification systems: not only do they deliver stable, carbon-rich biochar suitable for soil amendment, carbon sequestration, and waste valorization, but they also generate clean syngas, unlocking decentralized energy applications.

From an investment analyst's perspective, the sector is evolving from pilot-scale deployments to scalable, modular units that leverage AI-driven process optimization, IoT-based diagnostics, and data-integrated carbon credit frameworks, aligning biochar gasification with ESG-aligned capital flows and green bond eligibility. This is fostering strong interest from public-private consortia, sustainability-focused venture capital, and carbon credit aggregators seeking verifiable and tradeable offsets. The market's forward potential is amplified by regulatory support for regenerative agriculture, renewable energy generation from agri-waste, and rising monetization of soil carbon projects.

Opportunities abound in the development of regionally adaptive gasification platforms, the creation of standardized MRV (Monitoring, Reporting, and Verification) protocols for carbon markets, and integration with bioenergy with carbon capture and storage (BECCS). While market fragmentation and feedstock variability remain near-term challenges, ongoing vertical integration by major players and emerging alliances across the biomass-to-energy value chain point to a structurally consolidating market with multi-dimensional revenue streams, spanning clean energy, soil health, and carbon finance.

Biochar Gasification MarketSegments Covered in the Report

By Feedstock Type

- Agricultural Waste

- Forestry Waste

- Animal Manure

- Urban Biomass

- Industrial Biomass Residues

By Gasification Technology

- Fixed Bed Gasification

- Fluidized Bed Gasification

- Entrained Flow Gasification

- Downdraft Gasification

By Reactor Type

- Single-Stage Gasifiers

- Two-Stage Gasifiers

By Application

- Energy Production

- Soil Amendment

- Waste Management

- Carbon Sequestration

- Industrial Processing

By End-User Industry

- Agriculture

- Power & Energy

- Waste Management Companies

- Chemical Industry

- Construction & Cement

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting