Butter Packaging Market Size and Forecast 2025 to 2034

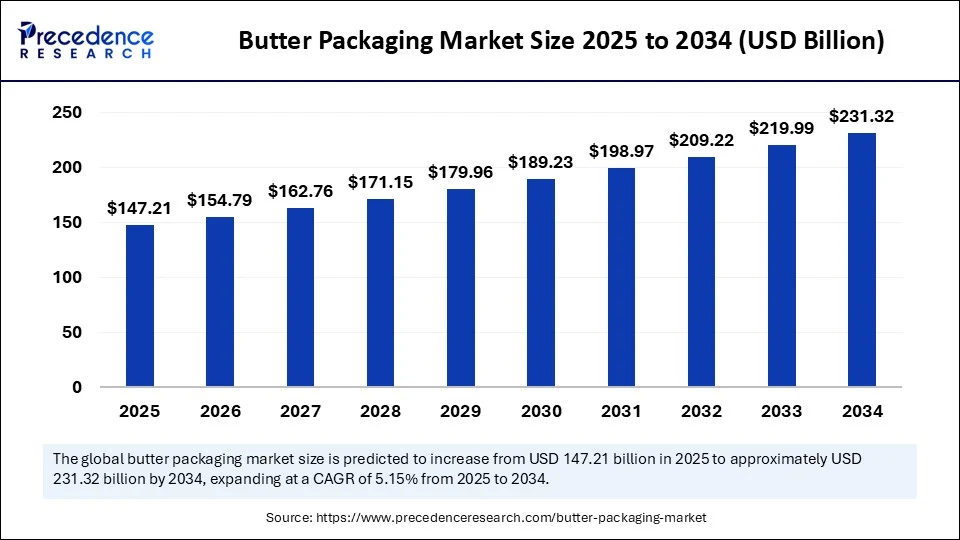

The global butter packaging market size was calculated at USD 140 billion in 2024 and is predicted to increase from USD 147.21 billion in 2025 to approximately USD 231.32 billion by 2034, expanding at a CAGR of 5.15% from 2025 to 2034. The demand for packaged butter has increased from food services and the retail sector, driving the global butter packaging market. The growing innovations in resealable tubes and environmentally-friendly wrappers are further contributing to the market growth.

Butter Packaging Market Key Takeaways

- In terms of revenue, the global butter packaging market was valued at USD 140 billion in 2024.

- It is projected to reach USD 231.32 billion by 2034.

- The market is expected to grow at a CAGR of 5.15% from 2025 to 2034.

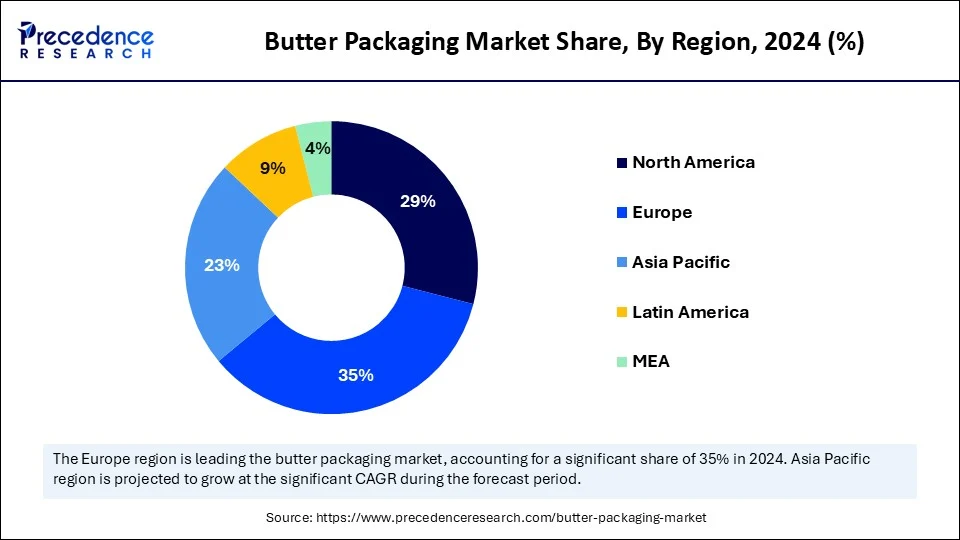

- Europe dominated the butter packaging market with the largest share of 35% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By packaging type, the foil/paper-wrapped blocks segment captured the market biggest market share of 32% in 2024.

- By packaging type, the resealable tubs and pouches segment will grow at a CAGR between 2025 and 2034.

- By product type, the salted butter segment contributed the highest market share of 38% in 2024.

- By product type, the organic & plant-based butter segment will grow at a significant CAGR between 2025 and 2034.

- By distribution channel, the supermarkets/hypermarkets segment generated the major market share of 54% in 2024.

- By distribution channel, the online retail segment will expand at a significant CAGR between 2025 and 2034.

- By end-use, the household/retail segment held the largest market share of 47% in 2024.

- By end-use, the bakery & confectionery industry segment is expected to grow at a CAGR between 2025 and 2034.

How is AI Impacting the Butter Packaging Industry?

Artificial intelligence is reshaping the butter packaging industry by enabling efficient packaging solutions, enhancing customer experiences, and reducing environmental impact. The packaging industry has increased the adoption of AI to enhance productivity and reduce the cost burden. The ongoing surge for innovative, aesthetic, and sustainable packaging practices is making AI more crucial in the packaging industry. AI is helping to reduce the environmental impact of packaging by enabling sustainable packaging solutions that align with waste reduction. Additionally, the integration of AI in advanced technologies, such as materials science and manufacturing processes, is transforming the butter packaging industry. AI algorithms offering efficient packaging design optimization, predictive maintenance, automated quality control, and sustainable packaging solutions to support the emerging butter packaging market.

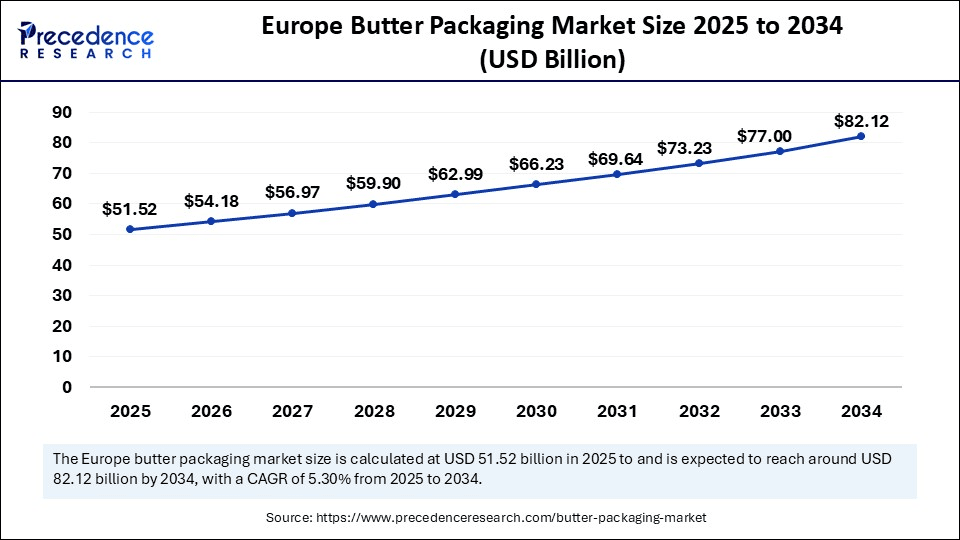

Europe Butter Packaging Market Size and Growth 2025 to 2034

The Europe butter packaging market size is exhibited at USD 51.52 billion in 2025 and is projected to be worth around USD 82.12 billion by 2034, growing at a CAGR of 5.30% from 2025 to 2034.

What Made Europe the Dominant Region in the Butter Packaging Market?

Europe dominated the global butter packaging market with the largest revenue share of 35% in 2024. This is mainly due to the increased exports of butter products and the strong presence of packaging manufacturing giants. According to the Food & Agriculture Organization, more than 70% of the world's dairy product exports come from Europe. Europe is well-known for its focus on sustainable packaging solutions. The rising trends, including the use of paper packaging, demand for recyclable and compostable material-based packaging, and growing innovations in smart packaging solutions, are fueling the market.

The European Union (EU) is the strongest governing body that has implemented various regulations for packaging in recent decades. The new regulations, such as those related to packaging and packaging waste, are further contributing to the transformation of a circular economy, including for the butter industry. The regulations unveil several key changes, including the reduction of harmful substances such as PFAS, and set a target for local manufacturers to use reusable and recyclable packaging.

- For instance, in January 2025, Denmark launched its EPR system for packaging, in line with EU Directive 94/62/EC, the current EU packaging Directive for registration and quantity report of packaging materials. The register is similar to the Dansk Producentansvar, a German-produced register, LUCID.

(Source: https://www.lizenzero.eu)

Countries like Germany, France, and the Netherlands are leading the European butter packaging market. Germany is a major player in the market, contributing to growth due to the country's strong infrastructure for production and distribution, as well as its well-established dairy processing industry. The German government has implemented several regulations to mandatory the sustainable packaging of food & beverage solutions mandatory, including butter. The broad manufacturing base and technological advancements are contributing to the market growth.

Asia Pacific Butter Packaging Market Trends

Asia Pacific is the fastest-growing region in the global market, contributing significantly to market growth due to its large population, rapid urbanization, expanding food service industry, and innovations in packaging technologies and materials. Asia has increased its focus on sustainable and eco-friendly packaging solutions by increasing the use of recyclable and biodegradable materials. The strict regulations regarding food safety and hygiene are supporting the market growth.

China is a major player in the market due to its large population, expanding food service industry, strong manufacturing base, and rapid growth of the e-commerce sector. The growing availability of disposable income and awareness of health & food safety regulations have increased demand for convenient and sustainable packaging solutions in the country. China is well-known for its cost-effective manufacturing practices, which have made it a dominant force in the Asian market.

India is the second-largest country in the market within Asia Pacific. The country's rapid urbanization, large consumer pool, and increasing disposable income support market growth. India has experienced demand for premium and high-quality butter, driven by countries in the food service industry. Government initiatives, including investments in local manufacturing for novel innovations and regulations that promote sustainable practices, are contributing to market growth.

- In March 2025, the Food Safety and Standards (Packaging) First Amendment Regulations 2025 were issued by India's Food Safety and Standards Authority (FSSAI). The regulation mandates that local manufacturers use only recycled polyethylene terephthalate (PET) materials in food packaging solutions.

(Source: https://enviliance.com)

North America Butter Packaging Market Trends

North America is expected to grow at a notable rate during the projection period, driven by the strong presence of key market players, the expansion of e-commerce, the robust food service industry, and growing consumer demand for sustainable and eco-friendly packaging solutions. Countries like the U.S. and Canada are playing a leading role in the regional market due to the large demand for flexible, convenient, and sustainable packaging solutions for butters. The growing trend of home cooking and changing lifestyles is driving technological innovations in butter packaging solutions in these countries.

Additionally, the strict regulations for food safety and health are contributing to the market growth. The new tariffs have caused significant challenges to local manufacturing companies in the U.S. and Canada. However, the growing innovations in flexible and sustainable packaging solutions are expected to drive market growth.

- The Extended Producer Responsibility (EPR) is gaining traction across the U.S., with a focus on redefining the packaging process and material selections. The regulations are shifting business practices of packaging from design to disposal.

Market Overview

The butter packaging market involves the production and use of packaging solutions specifically designed to protect, preserve, and present butter across retail, food service, and industrial distribution channels. These packaging types must maintain the product's shelf life, protect it from contamination, enable brand differentiation, and facilitate efficient transportation and storage. Growing health trends, sustainability goals, and increasing demand for premium and plant-based butter have led to evolving packaging needs such as resealable, recyclable, and single-serve formats.

As butter consumption increases, so does the need for safe and high-quality packaging solutions. Stringent regulations regarding food safety and labeling are further contributing to market growth. With changing consumer preferences for convenient and sustainable packaging, the market witnessed rapid growth. Additionally, companies are investing heavily in the production of cost-effective and efficient packaging solutions for food products, including those that better shape market growth.

What are the Key Factors for the Butter Packaging Market?

- Increased Butter Consumption: The increased consumption of butter has driven up demand for packaged butter from industries such as retail and food services, contributing to market growth.

- Sustainability Concerns: The rapid demand for sustainable and eco-friendly packaging solutions, including those in the butter industry, is a major factor contributing to the development of production practices and packaging solutions.

- Western Food Culture Influence: The growing influence of Western food culture, driven by social media and influencers, is fuelling the consumption of butter, driving demand for innovative butter packaging solutions.

- Conventional and Innovative: The ongoing search for convenient packaging formats, such as bottles, single-serve portions, and boxes, is bringing innovative approaches to the better packaging industry.

- Digitalization and E-commerce: The expanding digitalization and e-commerce channels are increasing the sale of butter products, driving the need for innovative packaging solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 231.32 Billion |

| Market Size in 2025 | USD 147.21 Billion |

| Market Size in 2024 | USD 140 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.15% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Packaging Type, Product Type, Distribution Channel, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Advancements in Packaging

Ongoing innovations in packaging technologies, such as smart packaging, advanced materials, and sustainable packaging solutions, are the major drivers of the global butter packaging market. The adoption of automation and digital systems is increasing for innovative packaging solutions, offering greater efficiency, flexibility, durability, and precision. The trend of resealable tubs for butter packaging is on the rise, driven by growing demand for sustainable packaging solutions. Additionally, there is a growing demand for aesthetically pleasing packaging for food products and increasing innovations in packaging visual appearance. Moreover, the focus on the use of advanced packaging materials, including bioplastics, paperboards, and aluminum foil, with their unique properties, is contributing to market growth.

Restraint

Fluctuation of Raw Material Cost

The fluctuation in raw material costs, including paper, plastic, and aluminum, is the major hindrance for butter packaging companies. This fluctuation leads to a reduction in profit margin and an increase in the price of solutions to consumers. The cost fluctuations also lead to supply chain distribution, having an impact on the efficiency and reliability of the packaging supply chain. The increased demand for sustainable packaging poses a major challenge to the butter packaging industry, making it difficult to maintain the price of packaging solutions due to frequent fluctuations in sustainable raw materials.

Opportunity

Rising Demand for Convenient and Sustainable Packaging Solutions

The rising demand for convenient and sustainable packaging solutions among consumers creates immense opportunities in the butter packaging market. Consumers are favoring easy-to-use, easy-to-open, single-serve packs, resealable containers, and eco-friendly solutions. Packaging with sustainable practices, such as reducing waste and minimizing environmental impacts, is gaining significant traction in the market, driven by growing sustainability concerns and government environmental regulations. These demands have caused challenges for manufacturing companies to bring innovative approaches to butter packaging solutions. Companies are showcasing the FSC-certified paper wrappers to meet regulatory requirements and maintain their image.

- In 2025, Amco Technology launched biodegradable butter packaging films to comply with strict environmental regulations. The packaging film is designed from PLA and other compostable materials to provide high durability, flexibility, and antioxidant properties.

- In 2025, Amai LLC developed an eco-friendly, edible, and compostable butter packaging film that replaces traditional parchment and aluminum foil. This film combines a composite paper layer with a biodegradable polylactic acid (PLA) and polyhydroxy butyrate layer.

(Source: https://www.greyb.com)

Packaging Type Insights

Which Packaging Type Segment Dominate the Butter Packaging Market in 2024?

The foil/paper-wrapped blocks segment dominated the market with the share of 32% in 2024 due to the high use of foil/paper-wrapped blocks in butter packaging, thanks to their excellent barrier properties. They are easy to use and cost-effective compared to the other packaging options, making them suitable for cost-conscious consumers. The foil- or paper-wrapped blocks are highly barrier-resistant to oxygen, moisture, and light, helping butter maintain its quality. This block provides efficient space and storage for a large amount of products. The wrapping often comes with essential information, such as the expiration date and nutritional facts of the products, making them user-friendly and more convenient.

The resealable tubs & pouches segment is expected to grow at the fastest rate over the forecast period due to their convenience, versatility, cost-effectiveness, and user-friendly nature. The resealable tubs & pouches help to preserve the freshness of the products. The growing consumer demand for convenient and easy-to-use packaging is driving the adoption of resealable tubs & pouches. The pouches are available in various formats like stand-up pouches, spout pouches, and flat pouches, making them flexible, highly functional, and quick to appeal. Additionally, the growing demand for eco-friendly options is further driving the adoption of resealable tubs & pouches.

Product Type Insights

Why Did the Salted Butter Segment Dominate the Butter Packaging Market in 2024?

The salted butter segment led the market with share of 38% in 2024 due to its wide use in enhancing flavor and extending the product's shelf life. The widespread use of salted butter in various applications leads to high demand in both the household and foodservice sectors. Salted butter plays a crucial role in enhancing taste and convenience, making it popular in commercial kitchens. Health-conscious and premium consumers are the major adopters of salted butter products. The demand for recyclable wraps and portioned blocks is high for salted butter products.

The organic & plant-based butter segment is expected to grow at the fastest CAGR in the coming years, driven by increased consumer preference for organic and plant-based products. The rising awareness about the health benefits of organic & plant-based butter compared to conventional dairy butter has attracted health-conscious consumers. Additionally, the growing number of environmentally conscious consumers has increased the adoption of organic & plant-based butter due to its lower carbon footprint and reduced water requirements. The rising popularity of organic & plant-based butter is driving demand for sustainable and eco-friendly packaging solutions to complement with organic nature of this butter. The growing trend of vegan and vegetarian lifestyles is further contributing to the segment's growth.

Distribution Channel Insights

How Does the Supermarkets/Hypermarkets Segment Dominate the Butter Packaging Market in 2024?

The supermarkets/hypermarkets segment dominated the market with share of 54% in 2024, holding the largest share due to the wide reach and accessibility of these retail outlets. The convenient locations of these stores, in both urban and rural areas, make them highly accessible to a broad range of consumers. This store offers a diverse product range of dairy products, including butter, with various flavors, brands, and packaging types, making them convenient for consumers. Additionally, the availability of comprehensive discounts and promotional offers on products attracts a large consumer base. Consumers with a high preference for one-stop shopping experiences are shaping the segment growth.

The online retail segment is expected to expand at the highest CAGR over the forecast period due to the increasing consumer preference for convenient shopping experiences. Online retail stores provide doorstep deliveries of products, making them highly convenient for busy lifestyles. The expansion of e-commerce platforms is driving an increase in online shopping activities. Consumers are increasingly preferring online platforms for competitive pricing, honest product reviews, and access to a wide range of options. The growing urbanization, digitalization, and use of online platforms are fostering the segment's growth.

End-use Insights

Why Did the Household/Retail Segment Dominate the Butter Packaging Market?

The household/retail segment contributed the major share of 47% in 2024. Households are the largest end-users of butter due to the extensive use of butter in cooking and baking. The retail industry is the second-largest adopter of butter products, largely due to its large consumer base that prefers shopping through retail stores. The demand for packaged butter and convent packaging formats has increased. The demand for diverse packaging options, particularly in urban areas, through retail and e-commerce, is driving growth in this segment. The growing demand for easy-to-use, convenient, resealable, and extended-life packaging has increased in the household and retail sectors.

The bakery & confectionery industry segment is expected to grow at the fastest CAGR over the forecast period due to the high demand for butter in the bakery & confectionery industry for various applications, including cakes, pastries, and cookies. These products require butter with consistent quality, making demand for specialized packaging solutions to maintain product quality, freshness, and appealing preference. The expanding food services industry and e-commerce platform are contributing to the segment's growth. Additionally, the rising demand for sustainable packaging is driving significant innovations in butter packaging for the bakery & confectionery industries.

Butter Packaging Market Companies

- Arla Foods

- Fonterra Co-operative Group

- Lactalis Group

- Land O'Lakes

- Amul (GCMMF)

- Dairy Farmers of America

- Ornua (Kerrygold)

- Saputo Inc.

- Kerry Group

- Organic Valley

- Danone

- Unilever (Flora, Becel)

- Nestlé S.A.

- President (under Lactalis)

- Anchor (under Fonterra)

- Horizon Organic

- Vermont Creamery

- Huhtamäki (packaging provider)

- Amcor Plc (packaging materials)

- Tetra Pak (carton-based packaging)

Recent Developments

- In April 2025, ProAmpac launched its Butter Fresh Parchment and foil-paper-based options, designed for the protection of butter, margarine, and oil-based solid products. This packaging is excellent to maintain dead-fold properties, freshness, and reduce air exposure to the products.

(Source: https://www.businesswire.com)

- In April 2025, Lecta launched a novel grease-resistant paper, Creaset HGP, for flexible packaging for pet food bags and butter wraps. The product is designed to provide a strong barrier to grease and is free from per- and polyfluoroalkyl substances (PFAS).

(Source: https://thepackman.in)

Segment Covered in the Report

By Packaging Type

- Foil/Paper-Wrapped Blocks

- Butter Sticks (wrapped or unwrapped)

- Tubs (plastic, compostable, biodegradable)

- Resealable Pouches

- Cartons/Boxes

- Jars (glass/plastic)

- Squeeze Tubes

- Others (e.g., Bag-in-box systems, single-serve pods)

By Product Type

- Salted Butter

- Unsalted Butter

- Cultured Butter

- Clarified Butter (Ghee)

- Flavored/Herb Butter

- Organic Butter

- Plant-Based Butter

- Reduced-Fat/Lite Butter

- Others (e.g., Whey Butter, Spreadable Blends)

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail/E-commerce

- Foodservice Distributors

- Specialty/Deli Stores

- Others (e.g., Institutional/Bulk Purchase Programs, Direct-to-Consumer Subscriptions)

By End Use

- Household/Retail

- Foodservice (Restaurants, Cafés, Hotels)

- Bakery & Confectionery Industry

- Dairy Processing Facilities

- Meal Kit Services

- Others (e.g., Airline Catering, Institutional Kitchens)

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting