Circular Packaging Market Size and Forecast 2025 to 2034

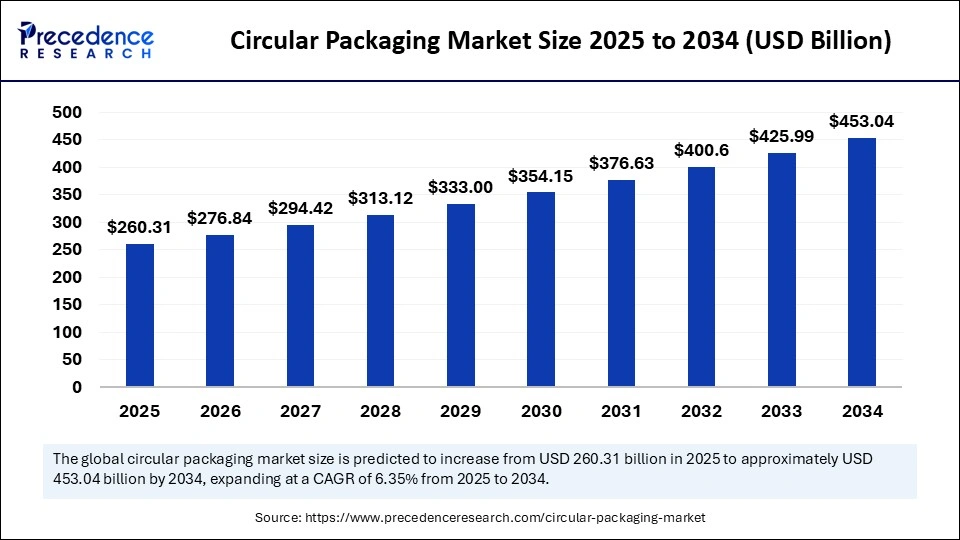

The global circular packaging market size was calculated at USD 244.77 billion in 2024 and is predicted to increase from USD 260.31 billion in 2025 to approximately USD 453.04 billion by 2034, expanding at a CAGR of 6.35% from 2025 to 2034. The market is growing due to growing regulatory support for circular economy initiatives.

Circular Packaging Market Key Takeaways

- In terms of revenue, the global circular packaging market was valued at USD 244.77 billion in 2024.

- It is projected to reach USD 453.04 billion by 2034.

- The market is expected to grow at a CAGR of 6.35% from 2025 to 2034.

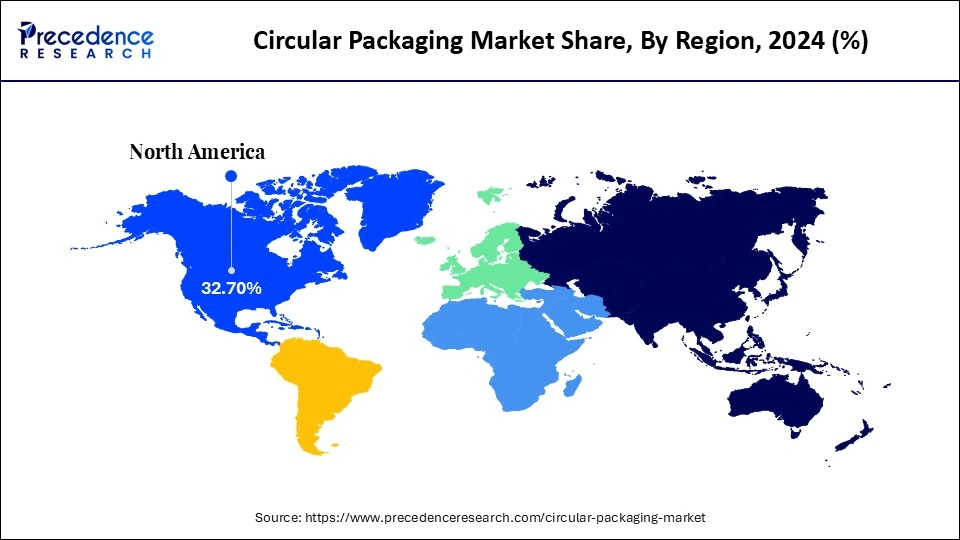

- Europe dominated the circular packaging market with the largest share of 32.70% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 9.80% during the forecast period.

- By material type, the paper & cardboard segment held the biggest market share of 34.60% in 2024.

- By material type, the bioplastics segment is projected to grow at the fastest CAGR of 10.10% during the forecast period.

- By packaging format, the flexible packaging segment captured the highest market share of 38.90% in 2024.

- By packaging format, the refillable/reusable packaging systems segment is projected to grow at the fastest CAGR of 10.50% during the forecast period.

- By end-use industry, the food & beverage segment contributed the maximum market share of 42.70% in 2024.

- By end-use industry, the e-commerce & retail segment is expected to grow at the fastest CAGR of 9.80% during the forecast period.

- By circularity model, the recyclable packaging segment accounted for the significant market share of 52.30% in 2024.

- By circularity model, the reusable/refillable packaging segment is expected to grow at the fastest CAGR of 10.40% during the forecast period.

- By technology/innovation, the advanced recycling technologies segment held the largest share of 36.40% in 2024.

- By technology/innovation, the smart packaging for reusability segment is expected to grow at the fastest CAGR of 11.20% during the forecast period.

- By distribution channel, the retail (offline) segment generated the major market share of 61.20% in 2024.

- By distribution channel, the e-commerce segment is expected to grow at the fastest CAGR of 9.90% during the forecast period.

Market overview

The significance of the circular packaging market depends on its shift from a linear "take-make-dispose" model to a sustainable one aimed at waste reduction, resource conservation, and environmental protection. It decreases the reliance on finite natural resources by prioritizing the usage of recycled materials together with reusable materials, conserving water, energy, and raw materials such as paper and plastic. The circular economy can unlock remarkable global economic expansion, with the packaging sector playing a crucial role in this transformation.Brands are under pressure to meet user expectations and environmental goals by accepting circular packaging models, improving their brand reputation, and aligning with global sustainability initiatives.

Impact of AI on the Circular Packaging Market

Artificial intelligence is significantly boosting the circular packaging market by optimizing design, enhancing supply chain efficiency, improving waste management, and permitting smarter materials and tracking. AI algorithms determine structural requirements as well as environmental data to create lightweight, right-sized packaging that utilizes less material, decreasing waste and shipping costs. AI powers computer vision along with robotic systems for accurate sorting of waste, raising the quality of recycled materials. AI-driven automation in manufacturing as well as waste sorting lowers labor expenses and increases consistency and accuracy, making circular processes more efficient. By using less material, enhancing logistics, and improving recyclability, AI assists in reducing overall costs and carbon emissions linked with packaging.

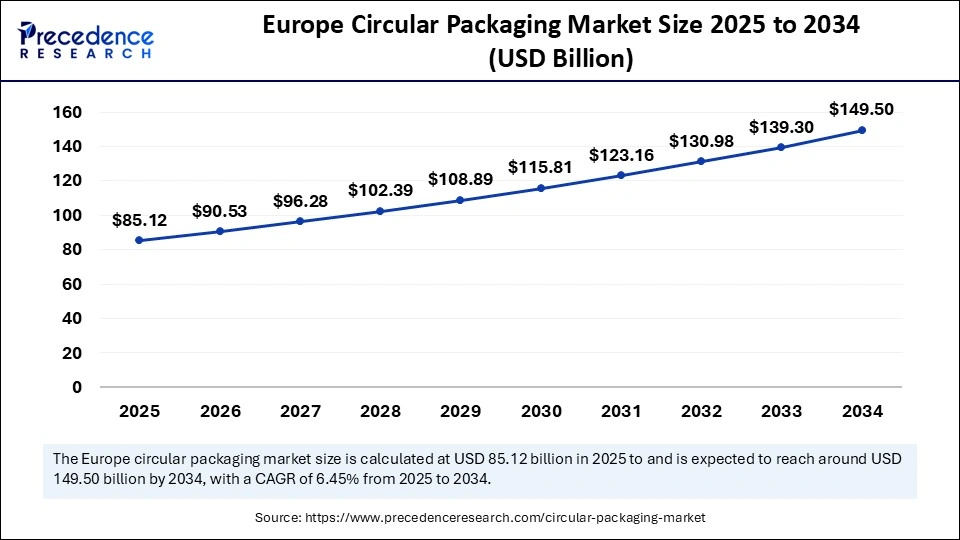

Europe Circular Packaging Market Size and Growth 2025 to 2034

The Europe circular packaging market size is evaluated at USD 85.12 billion in 2025 and is projected to be worth around USD 149.50 billion by 2034, growing at a CAGR of 6.45% from 2025 to 2034.

Why Did Europe Dominate the Circular Packaging Market in 2024?

Europe has a well-known and advanced ecosystem for waste management, which includes significant investments in modern recycling facilities. High consumer knowledge and demand for eco-friendly as well as sustainable products create a solid market incentive for firms to adopt circular packaging. Many major retailers, as well as fast-moving consumer goods (FMCG) brands in Europe, have committed to utilizing 100% recyclable or compostable packaging, thus solidifying the market's leadership.

- In June 2025, Mondi declared its partnership with Saga Nutrition, a French pet food producer, to create a recyclable packaging solution for Saga's dry pet food range. Utilising mono-material to replace non-recyclable multi-material plastics, Saga can ensure pet food freshness while improving the brand's sustainability efforts. (Source: https://interplasinsights.com)

Asia Pacific

Rapid industrialization, urbanization, as well as a burgeoning middle class in countries like China and India are driving consumption, which in turn fuels the need for packaging solutions, including circular ones. The significant expansion in e-commerce and retail industries is a major reason, as these sectors need substantial amounts of packaging and are increasingly adopting sustainable practices because of consumer demand and corporate sustainability goals. The region is seeing expansion in innovative, eco-friendly technologies, mainly in advanced materials and processing, and significant investment from major key players in improving production processes for circular packaging.

Circular Packaging Market Growth Factors

- Consumers are increasingly concerned about the environmental impact of packaging waste and are actively seeking out products from firms committed to sustainable practices.

- Improvements in sorting methods, chemical recycling, as well as processing technologies are making it possible to recycle a broader range of materials more efficiently.

- Circular packaging aids companies in decreasing waste disposal expenses and managing resources more efficiently, aligning with both economic as well as environmental goals.

- Governments globally are incorporating strict regulations, which include bans on single-use plastics as well as mandates for Extended Producer Responsibility (EPR), which compel firms to adopt sustainable and circular packaging solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 453.04 Billion |

| Market Size in 2025 | USD 260.31 Billion |

| Market Size in 2024 | USD 244.77 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.35% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Packaging Format, End-Use Industry, Circularity Model, Technology/Innovation, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Why Is Increasing Consumer Demand for Sustainable Products the Driving Force for the Circular Packaging Market?

Increasing consumer demand is a primary driver of the circular packaging market because consumers prioritize brands working with their environmental values, which in turn boosts brand loyalty and improves market competitiveness. Eco-friendly packaging solutions offer a competitive edge, making goods more attractive to consumers who are increasingly making buying decisions based on environmental impact.

Restraint

Why Is the Complexity of Sorting Multi-material Packaging a Restraint for the Circular Packaging Market?

The complexity of sorting multi-material packaging restrains the circular packaging market because separating mixed materials for recycling is technically challenging and expensive, requiring advanced, specialized systems, which current waste management infrastructure usually lacks. Current sorting technologies, such as Near-Infrared (NIR) identification, mainly detect surface properties, not multiple layers, and are not sophisticated enough to manage the wide variety of combinations of materials as well as thicknesses found in multi-material packaging.

Opportunity

Why Is the Rapidly Expanding E-commerce Sector an Opportunity for the Circular Packaging Market?

The rapidly expanding e-commerce sector is a major opportunity for the circular packaging market because increased online shopping generates substantial packaging waste, contributing to a surge in consumer demand for sustainable alternatives. Governments are implementing stricter regulations as well as policies to reduce single-use plastic waste and encourage circular economy principles. The vast and global nature of e-commerce offers a massive platform for deploying and scaling circular packaging models.

Material Type Insights

Why Did the Paper & Cardboard Segment Dominate the Circular Packaging Market in 2024?

The paper & cardboard segment dominates the circular packaging market due to its inherent recyclability, biodegradability, as well as the established infrastructure for paper recovery. It is a sustainable, cost-effective, and versatile alternative to other materials. Paper and cardboard are highly recyclable, as well as well-established global recycling infrastructures, along with collection systems, facilitate efficient recovery and reuse. Paper and cardboard provide a cost-effective solution for many packaging needs. They are used across diverse sectors, which include retail, e-commerce, food & beverage, and healthcare.

The bioplastics segment is witnessing the fastest growth because of increasing user environmental awareness, corporate sustainability initiatives, and stringent government regulations on single-use plastics. Policies such as bans on disposable plastics and regulations encouraging sustainable packaging push firms to adopt bioplastics. Bioplastics provide advantages like a reduced carbon footprint as well as the potential for faster decomposition compared to traditional plastics.

Packaging Format Insights

Why Did the Flexible Packaging Segment Dominate the Circular Packaging Market in 2024?

The flexible packaging segment dominated the market due to high need in the food and beverage sector for its cost-effectiveness as well as convenience, coupled with innovations such as recyclable and compostable alternatives and advanced recycling technologies for plastic. Flexible packaging, mainly plastic-based, is usually more cost-effective than alternatives such as glass or metal. Ongoing innovations are also introducing more sustainable alternatives, including compostable food bags and biodegradable films, which are gaining traction as well as fostering a circular economy.

The refillable/reusable packaging systems segment is witnessing the fastest growth due to strong consumer need for sustainability, rising government regulations as well as mandates, significant operational expenses savings for businesses, as well as technological advancements that permit robust and traceable systems.Governments globally are implementing stricter mandates, like single-use plastic bans as well as extended producer responsibility (EPR) laws, to decrease waste and encourage circular economy models. Many businesses are adopting refillable packaging as part of their corporate sustainability goals and to improve their brand image by demonstrating environmental leadership.

End-Use Industry Insights

Why Did the Food & Beverage Segment Dominate the Circular Packaging Market in 2024?

The food & beverage segment dominates the market due to increasing regulatory pressure for sustainable packaging, strong user need for eco-friendly options, and the inherent demand for packaging to ensure product safety and shelf life. Governments globally are implementing stricter regulations as well as mandates against single-use plastics and waste, compelling food and beverage firms to adopt recyclable and compostable packaging. Packaging in the F&B industry is vital for maintaining product quality, safety, and hygiene. Circular packaging solutions, like sterile processed recycled paper as well as high-quality recycled resins, can meet these stringent requirements.

The e-commerce & retail segment is growing rapidly because of increased user need for sustainable practices, the rapid growth of online shopping, and advancements in eco-friendly packaging materials. The rapid expansion of online shopping and direct-to-consumer (DTC) sales creates a massive need for effective as well as sustainable packaging to deliver products safely and efficiently. Innovations in materials, like compostable films, bio-based plastics, and recyclable alternatives, offer practical and cost-effective sustainable options for e-commerce packaging.

Circularity Model Insights

Why Did the Recyclable Packaging Segment Dominate the Circular Packaging Market in 2024?

Due to a combination of consumer need for sustainability, solid government regulations, and the well-known infrastructure for materials such as paper and cardboard, which are broadly recognized for their eco-friendly as well as cost-effective properties. Materials such as paper and cardboard benefit from well-known collection and recycling systems, making them easily processed and a preferred choice for producers. Advancements in material science have contributed to the development of high-performance recyclable options for a wide range of products, including those in the food and beverage industry, meeting both sustainability and product integrity needs.

Technology/Innovation Insights

Why Did the Advanced Recycling Technologies Segment Dominate the Circular Packaging Market in 2024?

As they overcome the limitations of conventional methods by converting complex plastic waste into high-quality, virgin-like raw materials, which is vital for achieving ambitious recycled content targets and fostering genuine circularity for items such as multi-material films and pouches previously considered non-recyclable.

The smart packaging for reusability segment is growing rapidly, because it combines strong environmental benefits with cost efficiencies, driven by escalating consumer need for sustainability and supportive government policies such as single-use packaging bans. Reusable packaging directly addresses waste reduction by eliminating the demand for single-use packaging, which is a primary driver of landfill waste and pollution. Data gathered from smart packaging helps firms optimize their reuse systems, reducing expenses and improving operational efficiency.

Distribution Channel Insights

Why Did the Retail (Offline) Segment Dominate the Circular Packaging Market in 2024?

Consumers prefer to physically inspect sustainable as well as eco-friendly packaging before purchase, benefiting from the tactile along visual experience offered by specialty stores and supermarkets. Offline retail environments permit better consumer education through direct interaction and demonstrations, which is crucial for explaining the advantages of zero-waste and circular packaging solutions. Many eco-friendly along sustainable products are sold in specialty organic stores, supermarkets with dedicated sustainable sections, as well as local markets, which naturally drive offline purchases.

The e-commerce segment is growing rapidly, due to the increase in online shopping, which necessitates more packaging for individual shipments, combined with increasing consumer and regulatory pressure for sustainability. Consumers are increasingly knowledge of the environmental impact of packaging waste and are actively choosing brands that use eco-friendly materials and decrease their environmental footprint. Packaging is the first physical interaction a consumer has with an online brand, making it a vital element for customer experience and brand loyalty. Sustainable packaging assists in building trust and reflects positive corporate values.

Value Chain Analysis

- Raw Material Sourcing

Raw material sourcing for the circular packaging market aims to secure materials from renewable, recycled, as well as sustainable sources to decrease waste and create closed-loop systems.

Key Players: SABIC and Covestro

- Recycling and Waste Management

In the circular packaging market, recycling is the process of collecting as well as repurposing used packaging materials into new products, while waste management covers the entire system for handling and processing this packaging waste, targeting to keep materials in a continuous loop.

Key Players: TerraCycle, Veolia, and SUEZ

Circular Packaging Market Companies

Recent Developments

- In February 2025, Amcor plc and Berry Global Group, Inc. declared that at their respective shareholder meetings, shareholders of both firms overwhelmingly voted to accept the combination of these two companies. (Source: https://www.amcor.com)

Segments Covered in the Report

By Material Type

- Paper & Cardboard

- Recycled Paperboard

- Corrugated Board

- Molded Pulp

- Bioplastics

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch Blends

- Cellulose-Based Plastics

- Metal

- Recycled Aluminum

- Recycled Steel

- Glass

- Recycled Glass

- Recycled Plastics

- PET (rPET)

- HDPE

- LDPE

- Polypropylene (PP)

- Compostable/Biodegradable Materials

- Bagasse

- Palm Leaves

- Seaweed-Based Packaging

- Mushroom-Based Materials

By Packaging Format

- Flexible Packaging

- Pouches

- Sachets

- Wrappers

- Rigid Packaging

- Boxes

- Bottles & Jars

- Cans

- Trays

- Clamshells

- Secondary & Tertiary Packaging

- Cartons

- Crates

- Pallets

- Stretch & Shrink Wrap

- Returnable Packaging

- Reusable Containers

- Kegs & Drums

- Pallet Boxes

- Refillable/Reusable Packaging Systems

- In-store Refill Packs

- Home Refill Solutions

By End-Use Industry

- Food & Beverage

- Fresh Produce

- Ready Meals

- Snacks & Confectionery

- Dairy

- Beverages (Alcoholic & Non-alcoholic)

- Personal Care & Cosmetics

- Skincare

- Haircare

- Cosmetics

- Healthcare & Pharmaceuticals

- OTC Drugs

- Medical Devices Packaging

- E-commerce & Retail

- Apparel & Footwear

- Consumer Electronics

- Industrial & Chemicals

- Lubricants

- Construction Materials

- Household Products

- Cleaning Products

- Detergents

- Agriculture

- Seed Packaging

- Fertilizer Bags

By Circularity Model

- Recyclable Packaging

- Reusable/Refillable Packaging

- Compostable/Biodegradable Packaging

- Upcycled Packaging

- Packaging-as-a-Service Models

- Deposit Return Systems (DRS)

- Subscription Models (e.g., Loop by TerraCycle)

By Technology/Innovation

- Advanced Recycling Technologies

- Chemical Recycling

- Enzymatic Recycling

- Smart Packaging for Reusability

- QR Codes for Returns

- NFC/IoT-enabled Trackable Packaging

- 3D Printed Packaging

- From recycled polymers or biodegradable filaments

- Design for Disassembly/Modularity

By Distribution Channel

- Retail (Offline)

- Supermarkets & Hypermarkets

- Specialty Stores

- E-commerce

- D2C Brands

- Online Marketplaces

- Institutional/B2B

- Contract Packaging

- Foodservice & Catering Supplies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting