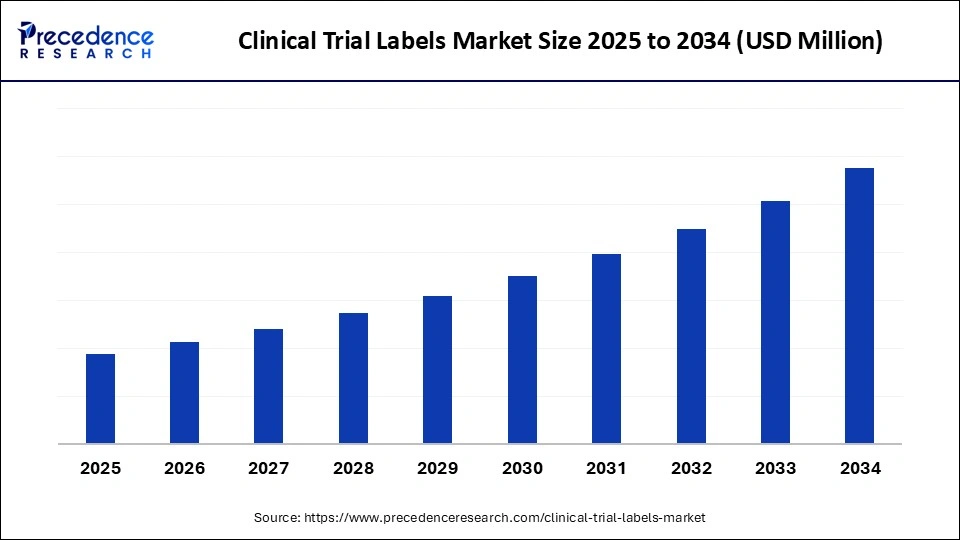

Clinical Trial Labels Market Size and Forecast 2025 to 2034

The clinical trial labels market continues to grow with digital transformation in clinical research. Advanced labeling supports real-time tracking, data integration, and patient-centric approaches. The market is currently experiencing significant growth, driven by an increase in clinical trials and stringent regulatory requirements for drug packaging. Additionally, the rise in personalized medicine and the demand for multilingual variable data labeling solutions are contributing to this growth. Furthermore, advancements in digital printing and smart labeling technologies are expected to further enhance market expansion.

Clinical Trial Labels Market Key Takeaways

- North America dominated the clinical trial labels market in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period.

- By label type, the primary segment held the major market share of 32% in 2024.

- By label type, the security/anti-counterfeit labels segment is projected to grow at a CAGR between 2025 and 2034.

- By material and technology, the paper-based segment led the market in 2024.

- By material and technology, the RFID/NFC-enabled labels segment is expected to witness the fastest CAGR during the foreseeable period.

- By service type, the label printing and artwork services segment captured the biggest market share in 2024.

- By service type, the serialization and aggregation segment is expected to witness the fastest CAGR during the foreseeable period.

- By end-use/product format, the injectables segment contributed the highest market share in 2024.

- By end-use/product format, the biologics and cold-chain product segment is expected to witness the fastest CAGR during the foreseeable period.

- By clinical trial phase, the phase III segment generated the major market share share in 2024.

- By clinical trial phase, the decentralized clinical trials (DCT)/direct-to-patient labeling segment is anticipated to grow at a significant CAGR from 2025 to 2034.

How Can AI Impact the Clinical Trial Labels Market?

Artificial intelligence (AI) further enhances the clinical trial labels market by automating data labeling, improving data quality, and personalizing labeling to create patient-centric approaches, leading to more efficient and accurate trials. Advanced natural language processing (NLP) techniques facilitate patient matching and increase adherence to protocols. AI algorithms, especially those involving deep learning and NLP, can automatically process and label vast amounts of unstructured data, such as medical notes or imaging data, thereby reducing manual effort and minimizing the risk of human error by ensuring higher quality and completeness of labels, which are vital for accurate analysis and decision-making.

Market Overview

The clinical trial labels market includes labels that are crucial for identifying and tracking products throughout the drug development process. These labels provide essential information such as dosage, instructions, and batch numbers. They are applied to investigational medicinal products (IMPs), packaging, patient kits, sample vials, case report forms, and ancillary materials used in clinical trials. These labels ensure regulatory compliance with organizations like the FDA and EMA/ICH, as well as accurate dosing and administration instructions, kit identification and traceability, multilingual patient information (such as booklets and leaflets), tamper-evidence, and features to prevent counterfeiting or ensure proper temperature control throughout all trial phases.

What Are the Key Market Trends in the Clinical Trial Labels Market?

- Increasing Research and Development Investment: Pharmaceutical and biotechnology companies are ramping up their investments in research and development. This surge in investment is driving the demand for clinical trial supplies, which in turn increases the need for specialized labeling solutions.

- Demand for Specialized Packaging: There is a growing requirement for specialized, compliant, and temperature-sensitive packaging. This encompasses labels designed to work seamlessly with these advanced packaging systems, influencing the demand for specialized labels.

- Technological Advancements: The adoption of advanced technologies such as RFID labels and QR codes is propelling the market forward. These innovations improve supply chain efficiency, enhance transparency, and enable effective tracking and management of samples.

- Expansion of Biologics and Personalized Medicine: The shift towards complex biologic drugs and personalized medicine necessitates specialized labels that address unique handling, storage, and tracking needs. This often involves more specific and sensitive labeling solutions, thereby driving demand for advanced labeling technologies.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Label Type, Material and Technology, Service Type, End-Use/Product Format, Clinical Trial Phase, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Number of Clinical Trials

A key driver for the growth of the clinical trial labels market is the increasing number of clinical trials, spurred by rising investments in research and development and the growing prevalence of chronic diseases. This trend necessitates more sophisticated and varied labeling solutions for accurate tracking and regulatory compliance. The rise in lifestyle-related and chronic diseases, such as cancer and diabetes, increases the demand for novel treatments, which in turn leads to a higher number of clinical trials. The shift towards decentralized clinical trials requires labels that support complex, patient-centric logistics and enable real-time tracking of temperature-sensitive and intricate biopharmaceutical products.

Restraint

Complex and Evolving Regulatory Landscape

One primary restraint in the clinical trial label market is the complex and evolving regulatory landscape. Manufacturers must continually adapt to these changing requirements, which can increase operational costs and cause potential delays. Regulatory bodies, such as the U.S. FDA and national authorities like India's CDSCO, regularly update their regulations, forcing companies to modify their labeling systems and processes accordingly. Compounding this issue is the need to comply with diverse regulations across different countries where clinical trials are conducted, adding another layer of complexity to label design and implementation.

Opportunity

Digitalization and the Integration of Advanced Technologies

A significant opportunity in the clinical trial labels market lies in digitalization and the integration of advanced technologies to bolster decentralized clinical trials and enhance efficiency. Electronic label management systems, blockchain technology, and AI-driven forecasting can improve traceability, compliance, and logistics for direct-to-patient (DTP) drug delivery. These innovative systems provide greater flexibility and control over labeling processes, resulting in improved compliance with regulatory standards. Blockchain technology can enhance the security and transparency of clinical trial labels, improving the auditability and integrity of trial data.

Label Type Insights

What Made the Primary Labels Segment Lead the Clinical Trial Labels Market in 2024?

The primary segment dominated the market in 2024. This was primarily due to the increasing preference for pre-filled syringes and vials for drug administration, as they offer improved safety, accuracy, and convenience for both patients and healthcare providers. The rising demand for these pre-filled formats in pharmaceutical products, including biologics and biosimilars, has led to a greater need for specialized labels used on these primary packaging components. Clinical trials aim to collect data on dosage, safety, and efficacy, and precise measurements along with clear identification are essential for accurate data collection and patient compliance during these trials.

The security/anti-counterfeit label segment is the fastest-growing in the market. This growth is largely driven by stringent regulatory requirements for product integrity and traceability, an increasing threat of counterfeit products, and the enhanced transparency provided by technologies such as RFID and serialization. These technologies facilitate unique product identification, secure supply chain tracking, and rapid, real-time authentication, which enhance consumer safety and brand reputation. RFID and serialization enable quick tracking and monitoring, ensuring the safety and effectiveness of investigational products.

Material and Technology Insights

How Did the Paper-Based and Synthetic Film Segment Lead the Clinical Trial Labels Market in 2024?

The paper-based segment led the market in 2024, primarily driven by its superior durability, resistance to harsh conditions, and high-definition print capabilities, which ensure data integrity and patient safety. Thermal transfer technology creates durable, high-quality labels that resist moisture, heat, and chemicals, maintaining the clear, accurate, and tamper-evident identification necessary for tracking samples and patient information during complex clinical trials. The robust nature of these labels is crucial for the accurate tracking of samples, drugs, and patient data throughout the trial process.

The RFID/NFC-enabled labels segment is experiencing the fastest growth in the market. This growth is primarily attributed to enhanced data security, improved supply chain visibility, and increased patient safety through real-time tracking and fraud prevention. Advances in RFID/NFC technology allow for quick data transfer, while 2D barcodes provide high-density data storage and smartphone readability. This combination offers rapid data transfer with a single scan, reducing manual data entry errors and enhancing efficiency in label management and drug dispensing, ensuring that patients receive the correct, untampered medications and treatments, thereby improving the reliability of clinical trial data.

Service Type Insights

How did the Label Printing and Artwork Services Segment Dominate the Clinical Trial Labels Market in 2024?

The label printing and artwork services segment held the dominant position in the market in 2024. This is largely due to the complex regulatory environment, the necessity for precise and high-quality labels, and the increasing complexity of clinical trials. These services specialize in designing and producing labels that meet strict global standards for pharmaceutical products and medical devices. Pharmaceutical companies depend on these services for expert design and printing of labels that are not only informative but also visually appealing, reflecting the brand's professionalism.

The serialization and aggregation segment is the fastest-growing segment in the market, primarily because of its ability to enhance regulatory compliance, supply chain transparency, and drug management through unique identifiers and adaptable printing that caters to varying patient needs and global studies. This allows for the creation of labels with specific patient details, study information, or language variations on-site as required. Serialization and aggregation facilitate the tracking of every package from manufacturing to the patient, helping to prevent counterfeiting and ensuring that the correct drug is administered at the right time, which is critical in clinical trials.

End-Use/Product Format Insights

What Made the Injectables Segment Lead the Clinical Trial Labels Market in 2024?

The injectables segment also dominated the market in 2024, largely due to the increasing use of pre-filled syringes and vials, which provide accuracy, convenience, and a reduced risk of contamination, essential factors in ensuring patient safety and consistent drug delivery during trials. The simplified preparation process, reduced waste, and elimination of mixing steps save time for healthcare professionals, enhancing efficiency in trial operations. This trend is further supported by patient preferences for self-administering chronic disease medications and advantages in manufacturing, such as minimized overfilling and faster preparation times compared to traditional syringes.

The biologics and cold-chain product represent the fastest-growing segment in the market. This growth is primarily driven by the increasing demand for biologics, which are highly temperature-sensitive, as well as the growing stringency of global cold chain regulations that require continuous temperature monitoring, specifically temperature indicators. Additionally, the development of advanced, cost-effective smart labeling technologies has provided real-time data and improved product quality assurance. The rise of decentralized clinical trials (DCTs), which involve home delivery of investigational medical products, necessitates enhanced temperature integrity and contactless protocols to maintain the cold chain in decentralized settings.

Clinical Trial Phase Insights

How Did the Phase III Segment Dominate the Clinical Trial Labels Market in 2024?

The phase III segment dominated the market in 2024. This is attributed to its large patient populations, multi-site global designs, and the extensive and complex labeling data required for regulatory approval. Phase III trials represent the final efficacy and safety validation step, necessitating a substantial volume of data to demonstrate a drug's viability and generate comprehensive package insert information for a diverse patient population worldwide. Managing data from a global, multi-site Phase III trial produces the most complex and voluminous set of labels, requiring significant resources and expertise to support package inserts, medication labeling, and regulatory submissions.

The decentralized clinical trials (DCT)/direct-to-patient labeling segment is anticipated to be the fastest-growing segment in the market. This growth can be attributed to the convenience it offers patients, expedited recruitment, broader access to participants, and reduced costs, all of which accelerate drug development and approval. This patient-centric approach utilizes technology to facilitate participation from home, improving diversity and engagement. Remote data collection via electronic systems, eConsent, and digital patient-reported outcomes streamlines the trial process, resulting in quicker completion times and faster drug approvals, thus encouraging broader adoption of this model.

Regional Insights

How Did North America Dominate the Clinical Trial Labels Market in 2024?

North America led the clinical trial labels market in 2024, primarily due to its robust research infrastructure, high concentration of leading pharmaceutical and biotech companies, significant investment in medical innovation, and an extensive network of academic research centers and hospitals. These elements contribute to a consistently high volume of clinical trials that require specialized labeling solutions. The presence of renowned institutions such as Mayo Clinic, MD Anderson Cancer Center, and Harvard Medical School drives innovation and partnerships in early-stage trials. A well-established regulatory framework, exemplified by the FDA's role in approving new therapies, supports the complex processes associated with clinical trials and their labeling requirements.

The U.S. Clinical Trial Labels Market Trends

The U.S. plays an evolving role in the global market, primarily driven by a thriving pharmaceutical and biotechnology industry, robust regulatory oversight by the FDA, and continuous innovation in clinical trial design and technology. The high volume of clinical trials conducted in the U.S., along with the increasing adoption of decentralized trial models, fuels the demand for specialized labeling and packaging solutions that ensure regulatory compliance, patient safety, and data integrity, thus shaping the market and ensuring the efficient handling of investigational products.

Canada Clinical Trial Labels Market Trends

Canada also has a notable presence in the global market due to its stable and reputable research environment, which attracts a significant number of global clinical trials. Health Canada's efficient and predictable 30-day regulatory review process for clinical trial applications can accelerate early-phase studies. This regulatory stability, combined with tax incentives like the SR&ED program, draws both domestic and international sponsors, creating high demand for labeling solutions that require suppliers to adapt with flexible and technologically advanced options.

Why is Asia Pacific Be Considered the Fastest-Growing Region in the Clinical Trial Labels Market?

Asia-Pacific is the fastest-growing area in the market, driven by a large patient population, lower trial costs, supportive government initiatives, evolving regulatory frameworks, and increasing local manufacturing capabilities for biologics. Countries like China and India are streamlining regulatory processes and offering incentives, such as India's single-window approval system, to attract global sponsors and bolster local operations. The growth of domestic pharmaceutical industries, particularly in India, is leading to increased investment and innovation in biologics, positioning the region as a hub for their production and clinical trials.

Value Chain Analysis

- R&D

The R&D focuses on developing and improving labeling solutions for clinical trial products. It involves creating advanced label materials, digital labeling technologies like QR codes and RFID, and systems for efficient translation and data management to ensure compliance and patient safety during drug development.

Key Players: Almac Group, Catalent, Inc., GA International, PCI Pharma Services, Sharp Services

- Clinical Trials and Regulatory Approvals

This ensures the safety, efficacy, and ethical conduct of research by mandating strict labeling standards for investigational drugs to provide essential, clear information for patients and maintain study blinding, all while adhering to complex, and often multi-country, regulatory guidelines and mitigating risk, ensuring data integrity, and market authorization for new medicines.

Key Players: CCL Industries, Schreiner MediPharm, Thermo Fisher Scientific, Catalent, Inc., ICON plc.

- Formulation and Final Dosage Preparation

Formulation creates the drug product with excipients, while final dosage preparation creates the specific dose and physical form. Both processes are strictly regulated and require precise, clear labeling to ensure patient safety, blinding in trials, and accurate data collection.

Key Players: CCL Healthcare, Thermo Fisher Scientific, PCI Pharma Services, Almac Group, Sharp Services, LLC

- Packaging and Serialization

Packaging involves the containers and labels for investigational drugs, designed for stability, blinded studies, and regulatory compliance. Serialization adds unique, traceable identifiers to each package to track it throughout the supply chain, combating counterfeits and enabling efficient recalls.

Key Players: Almac Group, Thermo Fisher Scientific Inc., IQVIA, Parexel International, Schreiner MediPharm

- Patient Support and Services

The market uses smart, patient-centric labels to enhance the trial experience, improve adherence, and boost retention. Labels act as a hub for providing clear, multilingual instructions and digital reminders, alongside services like travel and logistics support.

Key Players: IQVIA, ICON Plc, Syneos Health, Fortrea, Schreiner MediPharm

Clinical Trial Labels Market Companies

- PCI Pharma Services

- Almac Group

- Piramal Pharma Solutions/Piramal Enterprises

- Sentry BioPharma Services

- WuXi AppTec

- WestRock

- Alcami Corporation

- Caligor Coghlan

- Clinigen/Clinical Supplies Management

- CordenPharma

- Fisher Clinical Services

- Körber Pharma

- Xerimis

- Praxis Packaging Solutions

- Adare Pharma Solutions

Leaders' Announcements

- In July 2025, Aptar Pharma acquired the clinical trial materials manufacturing division of Mod3 Pharma to enhance its capabilities in Phase 1 and 2 clinical trials, especially for orally inhaled and nasal drug products. The acquisition adds an FDA-inspected facility equipped for high-potency APIs and advanced fill-finish technologies, supporting early-stage drug development and innovative therapies.(Source: https://www.pharmaindustrial-india.com)

Recent Developments

- In October 2024, Schreiner MediPharm introduced a new RFID label with a digital first-opening indication at CPHI in Milan. This innovative label enhances product safety and medication tracking in healthcare by providing clear digital identification of medicine containers and indicating their integrity upon first opening. (Source:https://manufacturingchemist.com)

- In June 2024, IQVIA launched One Home for Sites™, a platform that consolidates multiple software applications for clinical research sites, simplifying tasks and improving efficiency. This reduces the burden of managing numerous usernames and passwords and helps sites conduct more research and patient care.

(Source: https://www.iqvia.com)

Segments Covered in the Report

By Label Type

- Primary

- Secondary

- Booklet/Patient Instruction Labels

- Blister/Unit-dose Labels

- Adhesive/Non-adhesive labels

- Security/Anti-counterfeit Labels

- Temperature-sensitive/Cold-chain Indicator Labels

By Material and Technology

- Paper-based labels

- Film/Synthetic labels

- Tamper-evident materials

- RFID/NFC-enabled labels

- QR/Datamatrix/2D barcode labels

- Thermal transfer/direct thermal printed labels

By Service Type

- Label design and artwork services

- Label printing and reprographics

- Serialization and aggregation services

- On-demand/digital printing

- Label application/automated labeling

- Inspection, quality control and verification

- Warehousing and kit assembly

By End-Use/Product Format

- Solid oral dosage

- Injectable

- Biologics and Cold-chain products

- Medical devices/companion diagnostics

- Combination products/device-drug kits

By Clinical Trial Phase

- Phase I

- Phase II

- Phase III (large-scale, multicenter)

- Phase IV/post-marketing studies

- Decentralized Clinical Trials (DCT)/Direct-to-Patient labeling

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting