Data Center Monitoring Market Size and Forecast 2025 to 2034

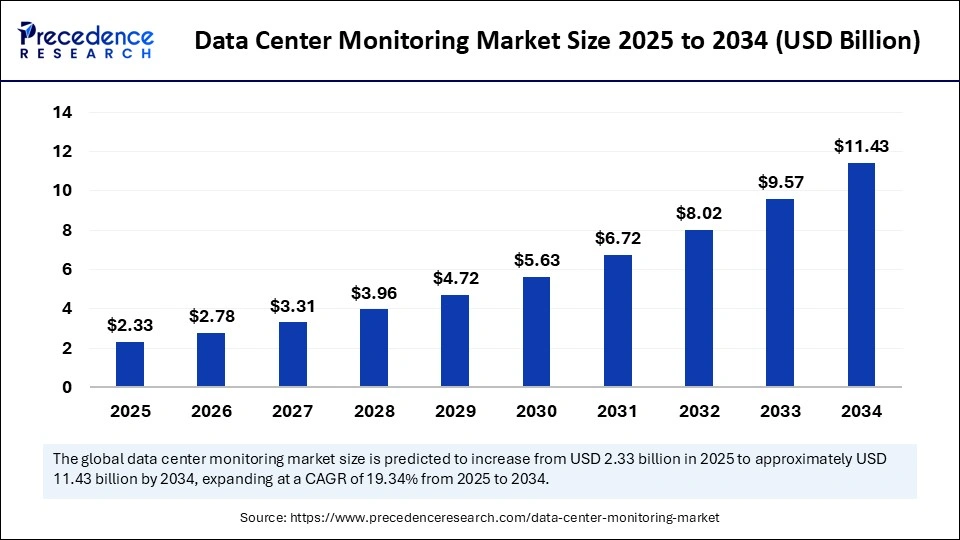

The global data center monitoring market size accounted for USD 1.95 billion in 2024 and is predicted to increase from USD 2.33 billion in 2025 to approximately USD 11.43 billion by 2034, expanding at a CAGR of 19.34% from 2025 to 2034. The market growth is attributed to increasing demand for real-time infrastructure visibility, energy-efficient operations, and AI-enabled predictive monitoring solutions.

Data Center Monitoring Market Key Takeaways

- In terms of revenue, the global data center monitoring market was valued at USD 1.95 billion in 2024.

- It is projected to reach USD 11.43 billion by 2034.

- The market is expected to grow at a CAGR of 19.34% from 2025 to 2034

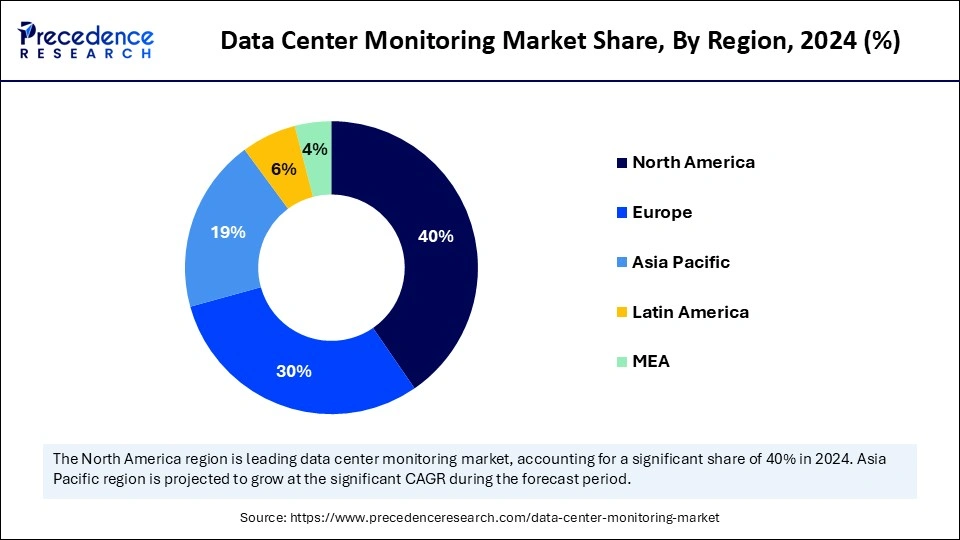

- North America dominated the global data center monitoring market with the largest share of 40% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By component, the hardware segment held the major market share of 45% in 2024.

- By component, the software segment is projected to grow at a CAGR between 2025 and 2034.

- By solution, the DCIM segment contributed the biggest market share of 35% in 2024.

- By solution, the power monitoring segment is expanding at a significant CAGR between 2025 and 2034.

- By end-user, the hyperscale data centers segment captured the highest market share of 50% in 2024.

- By end-user, the colocation data centers segment is expected to grow at a significant CAGR over the projected period.

- By deployment type, on-premises generated the maximum market share of 60% in 2024.

- By deployment type, the cloud-based segment is expected to grow at a notable CAGR from 2025 to 2034.

- By industry vertical, IT & telecom segment accounted for the significant market share of 50% in 2024.

- By industry vertical, healthcare is expected to grow at a notable CAGR from 2024 to 2034.

- By offering type, the continuous monitoring segment held the largest market share of 55% in 2024.

- By offering type, the on-demand monitoring segment is projected to grow at a CAGR between 2025 and 2034.

Market Overview

The increasing pace of artificial intelligence (AI) integration has turned out to be one of the key factors that are contributing to the development of the data center monitoring market. The introduction of AI into monitoring systems in 2024 facilitated real-time anomaly detection, predictive maintenance. This improves operational efficiency to deal with the complications of managing large-scale data infrastructures. The International Roadmap to Devices and Systems (IRDS) emphasized that AI workloads in data centers require high-bandwidth and low-latency interconnects to support machine learning workloads.

The increasing energy efficiency demands have led to the adoption of the latest monitoring systems. The Lawrence Berkeley National Laboratory (LBNL) of the U.S. Department of Energy has introduced AI-enabled monitoring to its data centers. This results in tremendous energy savings, which is a conventional sustainability requirement. Furthermore, the hyperscale data center deployments are already soaring in countries such as India, Singapore, and Indonesia due to investments in regional infrastructural work by local and international technology giants.

Impact of Artificial Intelligence on the Data Center Monitoring Market

Artificial intelligence (AI) has become the key to transforming the data center monitoring market through smarter decision-making, quicker response time, and more efficient work. Moreover, the increasing need for sustainability, cost-efficiency, and continuous digital services encourages businesses to integrate AI-enhanced monitoring, which makes it an impetus for innovations and future market growth.

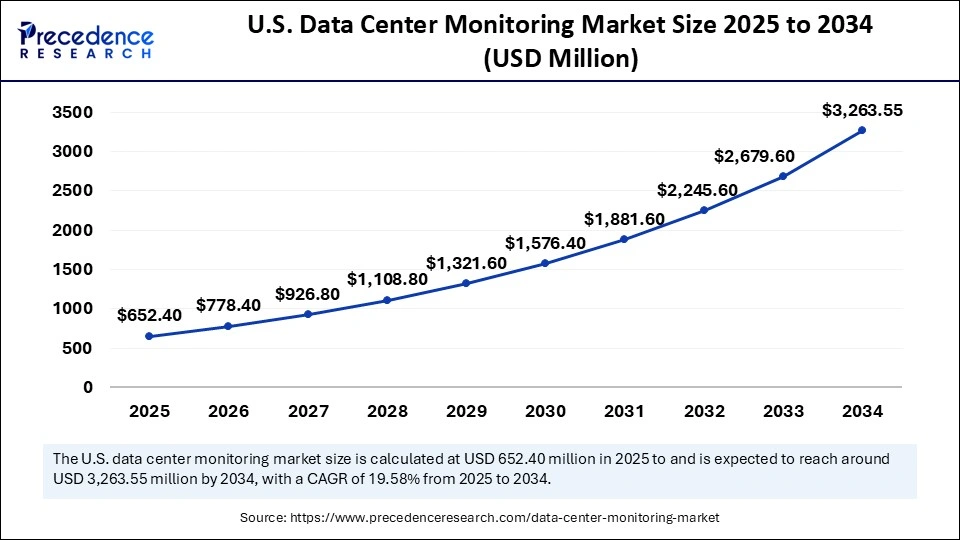

U.S. Data Center Monitoring Market Size and Growth 2025 to 2034

The U.S. data center monitoring market size was exhibited at USD 546.00 million in 2024 and is projected to be worth around USD 3,263.55 million by 2034, growing at a CAGR of 19.58% from 2025 to 2034.

What Factors Contributed to North America Leading the Data Center Monitoring Market, and Why Is the Asia Pacific Projected to Grow at the Fastest Rate?

North America led the data center monitoring market, capturing the largest revenue share in 2024, due to the high level of investment in digital infrastructure and the development of cloud-based services. United States, in the first place, in the list of large technology companies that are expanding their data centers to handle the growing demand of artificial intelligence (AI), machine learning, and cloud-native workloads, were Amazon Web Services (AWS), Microsoft, Google, Meta, and IBM.

In 2024, the Lawrence Berkeley National Laboratory (LBNL) mentioned that with the implementation of AI-based monitoring, the amount of wasted energy was decreased by 18%. This is a major contributor to overall cost savings and corporate sustainability efforts. Partnerships with companies such as Schneider Electric, Cisco Systems, and Vertiv also enhanced the reliability of the infrastructure; therefore, constant monitoring is an essential investment in this area. Additionally, the North American operators also continued to implement predictive analytics and automated alerts, and technologies of digital twins into monitoring systems, thus boosting the market in this region.(Source: https://energyanalysis.lbl.gov)

The Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, driven by rising internet penetration, smart city projects, and the rapid adoption of cloud computing services. Among these nations, India, Singapore, Indonesia, and Malaysia experienced hyper-scale and edge data center growth in 2024, driven by both local and global technology giants such as Oracle, AWS, Microsoft, and Google investing in the nations.

In 2024, the strategic relevance of the region to the global data center ecosystem was found in a USD 6.5 billion cloud investment by Oracle in Malaysia. The increased uptake of 5G networks and edge computing in the Asia Pacific only added to the pressure of seeking intelligent monitoring solutions that can guarantee uptime and security of distributed infrastructures. Moreover, the partnership with Dell Technologies, HPE, and VMware enabled scalable, cloud-ready monitoring platforms that could support the fast increase of workloads and sophisticated analytics needs in 2024, making the region a key engine of next-generation data center performance.(Source: https://www.oracle.com)

Data Center Monitoring Market Growth Factors

- Rising Demand for Edge Computing Integration: Growing adoption of edge data centers is driving the need for advanced monitoring systems to ensure real-time performance and reliability.

- Boosting AI-Driven Operational Insights: Increasing use of artificial intelligence in monitoring platforms propels predictive maintenance and intelligent resource management.

- Growing Emphasis on Regulatory Compliance: Rising global standards for data security and environmental reporting fuel investments in robust monitoring solutions.

- Propelling Adoption of Hybrid Cloud Environments: Expansion of hybrid and multi-cloud infrastructures is driving the deployment of scalable and integrated monitoring platforms.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 11.43 Billion |

| Market Size in 2025 | USD 2.33 Billion |

| Market Size in 2024 | USD 1.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 19.34% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Solution, End-User, Deployment Type, Industry Vertical, Offering Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Why Is Growing Emphasis on Energy Efficiency Anticipated to Accelerate Advancements in the Data Center Monitoring Market?

Increasing demand for real-time infrastructure visibility is expected to drive the market. The operators use a constant tracking of servers, power units, and cooling systems to maintain constant operations and minimize the mean-time-to-repair. High-frequency telemetry and log streams ingested by monitoring teams of IT and facility equipment are used to identify anomalies immediately. New industry data indicates that outages are still costly-the 2024 survey by Uptime indicates that outages continue to have a significant impact, despite the frequency decreasing.

The need to evoke fears of cybersecurity risks is bound to increase monitoring investments. The increasing threats to data centers are ransomware and distributed denial-of-service (DDoS) attacks, and insider threats, and require constant attention. Organizations are increasingly interested in solutions that enhance security analytics and integrate them with infrastructure monitoring to form a unified layer of defense. Moreover, the high demand for automation and predictive maintenance is estimated to fuel market expansion.(Source: https://cloudsecurityalliance.org)

Restraint

High Implementation Costs Expected to Challenge Adoption

High implementation costs are expected to hinder the market in the coming years. Businesses need immense capital to install complex monitoring platforms, which incorporate AI, machine learning, and IoT-enabled sensors throughout the infrastructure. Smaller organizations face the challenge of making investments when there is a limited budget to justify them, especially in emerging economies where cost sensitivity is high. Additionally, the restrained development because of reliability concerns in AI-driven monitoring is estimated to slow adoption.

Opportunity

Why Is Growing Emphasis on Energy Efficiency Anticipated to Accelerate Advancements in the Data Center Monitoring Market?

Growing emphasis on energy efficiency is anticipated to accelerate market growth and further create an immense opportunity in the market. Data centers can also use large quantities of electricity, and as a result, operators are adopting measures that maximize energy consumption and minimize costs of operation. Analytics-driven monitoring platforms assess the efficiency of using power to achieve power utilization effectiveness (PUE) and are useful to dynamically operate cooling systems.

Energy pressures intensify urgency; the IEA estimates that data centres consumed 460 TWh of energy in 2022 and will consume more than 1,000 TWh by 2026. Hence, engineers are combining performance monitoring with energy telemetry in a bid to balance reliability and efficiency. The 2024 U.S. DOE/Lawrence Berkeley National Laboratory evaluation reports that data center loads have tripled over the last decade and are expected to continue to rise, possibly two to three times in the U.S. By 2028, requiring operators to rely on monitoring to manage capacity planning and grid-interaction strategies. Furthermore, the engines use predictive models based on historical sensor traces to enable the technicians to get actionable alerts that focus on the root causes rather than the generic ones.

(Source: https://journal.uptimeinstitute.com)

(Source: https://www.iea.org)

(Source: https://www.energy.gov)

Component Insights

Which Segment of the Data Center Monitoring Market Dominated in Recent Years, and What Factors Contributed to Its Leadership?

The hardware segment dominated the data center monitoring market in 2024 with an estimated share of 45%, as enterprises used physical infrastructure in the form of sensors, power distribution units (PDUs), racks, and cooling monitors. They guarantee uninterrupted operations in the data centers. The operators emphasized hardware investments, as these tools offered real-time telemetry, including temperature, energy consumption, and equipment status, which were the pillars of smart monitoring.

- In 2024, the European Data Centre Association (EUDCA) said that mega-facilities in Europe were heavily invested in high-tech PDUs and liquid cooling sensors to comply with more stringent energy-efficiency standards. Furthermore, the operators keep replacing the old systems with modern monitoring hardware to reach new levels of resilience and efficiency, further facilitating the segment.(Source: https://www.eudca.org)

The software segment is expected to grow at the fastest rate in the coming years, as the need to use advanced analytics, automation, and AI-based capabilities increases. The number of enterprises implementing monitoring platforms that combine the results of hardware sensors into a single dashboard to perform predictive analysis and decisions is on the rise. Additionally, the vendors add real-time anomaly detection, security analytics, and workflow automation to these platforms, helping cut downtime and improve operational agility.

Solution Insights

How Did DCIM Solutions Lead the Market in Recent Years, and What Drives Their Dominance in Monitoring Complex Data Center Operations?

The DCIM segment held the largest revenue share in the data center monitoring market in 2024, accounting for 35% of the market share, due to its ability to provide end-to-end visibility for power, cooling, space, and asset utilization. This helps enterprises optimize operations in an increasingly complex environment. Furthermore, the increasing use of real-time analytics and predictive maintenance will also enhance the dominance of DCIM in the years to come.

The power monitoring segment is expected to grow at the fastest CAGR in the coming years, owing to the increase in efficiency, reliability, and resilience in energy-intensive data center operations. Additionally, the real-time monitoring of energy consumption, detection of inefficiencies, and avoidance of unplanned downtime due to electrical malfunctions further fuel the segment's growth.

End-User Insights

Why Do Hyperscale Data Centers Account for the Largest Share of the Market, and How Are They Influencing Demand for Advanced Monitoring Solutions?

The hyperscale data centers segment dominated the data center monitoring market in 2024 that holding a market share of about 50%, due to the increasing demand for cloud services, AI workloads, and high-performance computing, including Amazon Web Services (AWS), Microsoft, Google, Meta, and Alibaba.

The operators in this market focused on monitoring platforms to operate complex infrastructures that involve thousands of interconnected servers, which have megawatts of IT load. Additionally, this segment is expected to continue to be on top in the short term with sustained investment in automation, AI-driven insights, and digital twin-based monitoring strategies.(Source: https://journal.uptimeinstitute.com)

The colocation data centers segment is expected to grow at the fastest rate in the coming years, owing to more enterprises seeking scalable and cost-efficient infrastructure. Furthermore, the colocation monitoring platforms vendors added AI-based predictive analytics and automatic alerts, enabling operators to optimize multi-tenant environments and minimize the risks posed by unplanned outages.

Deployment Type Insights

What Makes On-Premise Deployment the Leading Type in Data Center Monitoring, and How Are Enterprises Leveraging It for Operational Efficiency?

On-premise segment held the largest revenue share in the data center monitoring market in 2024, with an estimated share of 60%, as it ensures complete control over infrastructure critical to the business, such as servers, cooling, and power distribution units. Additionally, the vendors increased on-premise solutions with AI-based dashboards and predictive analytics to help facilitate proactive maintenance and reduce risk.

Cloud-based segment is expected to grow at the fastest CAGR in the coming years, owing to the increased use of hybrid and multi-cloud structures. Businesses are progressively turning to cloud implementation to obtain scalability, focused analytics, and real-time monitoring across all distributed facilities.

Cloud-based systems enable operators to aggregate data across multiple locations into a single interface, so the operators can predictively maintain, plan capacity, and optimize energy. In 2024, the Cloud Security Alliance (CSA) emphasized that mid-sized and enterprise IT organizations have sharply turned to cloud monitoring due to the need to achieve agility and operational efficiency. Furthermore, this market is expected to grow quickly as cloud-based solutions become key drivers of resilient, agile, and scalable data center monitoring.(Source: https://cloudsecurityalliance.org)

Industry Vertical Insights

Why Does the IT & Telecom Vertical Dominate the Market, and What Factors Are Driving Its Reliance on Advanced Monitoring Platforms?

The IT & telecom segment dominated the data center monitoring market in 2024 that holding a market share of about 50%, as global hyperscalers and telecom operators have spent large sums to implement sophisticated monitoring solutions to protect the continuous operation of their service delivery.

These organizations have utilized real-time monitoring to manage high-density server racks, network switches, and power and cooling systems in geographically dispersed data centers. In 2024, the International Telecommunication Union (ITU) highlighted that telecom operators who deployed edge data centers had thirty times faster incident identification and mitigation of incidents when they had integrated monitoring platforms, further facilitating the market growth.(Source: https://www.itu.int)

The healthcare segment is expected to grow at the fastest rate in the coming years, owing to the further digitization of patient data, telehealth services, and linked medical technology. Monitoring solutions are being implemented in hospitals, research facilities, and pharmaceutical organizations in a bid to maintain 24/7 uptime, protect sensitive patient information, and adhere to stringent laws and regulations, including HIPAA and GDPR.

- In 2024, IBM, Microsoft, and Dell Technologies developed AI-assisted systems to monitor healthcare facilities in real-time, enhancing operational resilience and enabling real-time decision-making. Furthermore, this upward trend is expected to gain momentum, making healthcare a vital new area in next-generation data center monitoring solutions.(Source: https://blogs.microsoft.com)

Offering Type Insights

Why Is Continuous Monitoring the Leading Type of Offering, and How Is On-Demand Monitoring Shaping the Future of Data Center Operations?

The continuous monitoring segment held the largest revenue share in the data center monitoring market in 2024, accounting for an estimated 55% market share. The growing complexity of IT infrastructures and the urgent need for real-time information about data center operations were the reasons behind this dominance. Additionally, the continuous monitoring compliance is aligned with industry and regulatory standards compliance, making sure about compliance and improving the security posture.

On-demand segment is expected to grow at the fastest CAGR in the coming years, owing to the growing use of cloud services, and the opportunity to implement scalable and flexible monitoring solutions, which can be adjusted to fit certain operational needs, is on the rise. On-demand monitoring enables organizations to monitor capabilities.

These are cost-effective solutions to dynamic and fluctuating workloads. Moreover, as companies increasingly adopt agile processes and cloud-native infrastructure, on-demand monitoring is expected to gain significant momentum, providing a scalable and effective data center management solution.

Data Center Monitoring Market Companies

- ABB Ltd.

- AEG Power Solutions

- Delta Electronics, Inc.

- Digital Realty

- Eaton Corporation

- Emerson Electric Co.

- Fujitsu Ltd.

- Hewlett Packard Enterprise

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Network Equipment Technologies, Inc.

- Nlyte Software

- Panduit Corporation

- Rittal GmbH & Co. KG

- Schneider Electric

- Siemens AG

- Sunbird Software

- Tripp Lite

- Vertiv Co.

Recent Development

- In June 2025, Ecolab Inc., a global leader in water, hygiene, and infection prevention solutions, launched its 3D TRASAR Technology for Direct-to-Chip Liquid Cooling. The solution monitors critical coolant health indicators in real time, including temperature, pH, and flow rates, protecting servers and optimizing performance. Leveraging AI-powered analytics, Ecolab's offering spans the entire data center cooling landscape, enabling operators to enhance efficiency while reducing environmental impact and conserving vital natural resources.

- In April 2025, ST Telemedia Global Data Centres (India) inaugurated a state-of-the-art data center campus in New Town, Kolkata, covering 5.59 acres. Engineered for AI workloads, the facility features high-density racks, advanced cooling systems, and a modular design for scalable expansion. The project supports India's national objectives to expand digital infrastructure, promote sustainable technology adoption, and enable high-performance computing across Eastern India.

- In May 2025, NTT DATA announced the accelerated growth of its Global Data Centers division, securing land across North America, Europe, and Asia to support nearly a gigawatt of planned capacity. This initiative forms part of NTT DATA's $10 billion investment strategy through 2027, aimed at scaling digital infrastructure, supporting AI workloads, and enhancing enterprise connectivity worldwide.

- In January 2025, DayOne officially launched as an independent entity, following the completion of Series B funding led by major global investment institutions. Formerly operating as GDS International (GDSI), DayOne, founded in 2022 and headquartered in Singapore, has established a reputation for scaling data center markets across the Asia-Pacific region, driving digital transformation, and enhancing regional connectivity through innovative infrastructure solutions.

(Source: https://en-in.ecolab.com)

(Source: https://www.sttelemediagdc.com)

(Source: https://services.global.ntt)

(Source: https://www.datacenterdynamics.com)

(Source: https://www.prnewswire.com)

(Source: https://www.vertiv.com)

(Source: https://www.eaton.com)

Segments Covered in the Report

By Component

- Hardware

- Sensors

- Controllers

- Power Monitoring Devices

- Environmental Monitoring Devices

- Networking Hardware

- Software

- Monitoring Software

- Data Analytics Software

- Asset Management Software

- Automation Software

- Services

- Managed Services

- Professional Services

By Solution

- DCIM (Data Center Infrastructure Management)

- Environmental Monitoring

- Power Monitoring

- Network Monitoring

- Security Monitoring

- Cooling Monitoring

By End-User

- Hyperscale Data Centers

- Colocation Data Centers

- Enterprise Data Centers

- Cloud Providers

- Telecom Providers

By Deployment Type

- On-premise

- Cloud-based

By Industry Vertical

- IT & Telecom

- BFSI (Banking, Financial Services & Insurance)

- Healthcare

- Retail

- Government

- Manufacturing

- Energy

- Media & Entertainment

By Offering Type

- Continuous Monitoring

- On-demand Monitoring

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East &Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content