What is the Density Gradient Media Market Size?

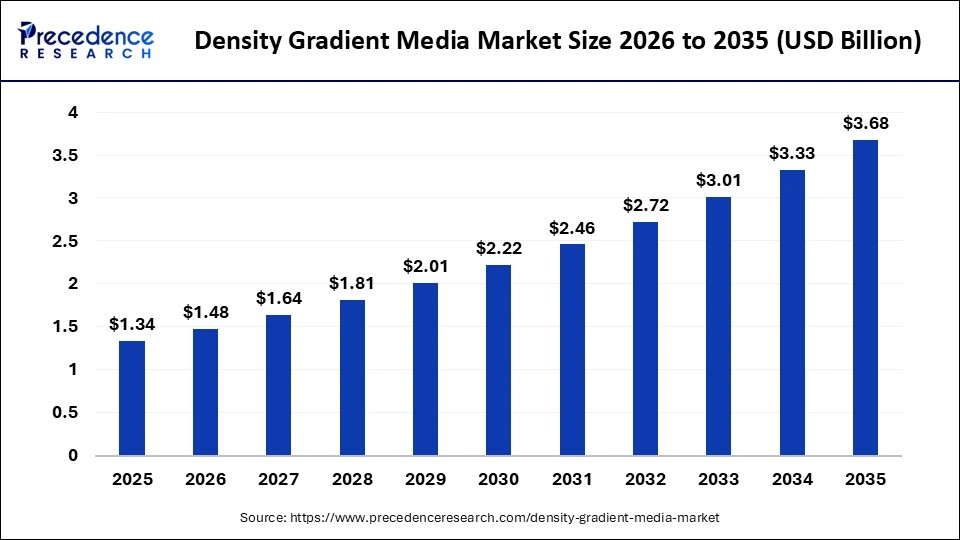

The global density gradient media market size is calculated at USD 1.34 billion in 2025 and is predicted to increase from USD 1.48 billion in 2026 to approximately USD 3.68 billion by 2035, expanding at a CAGR of 10.63% from 2026 to 2035. The market is primarily driven by the growing applications in cell and gene therapy, the increasing demand for accurate cell separation in life science research, and the surging investment in the life sciences industry.

Market Highlights

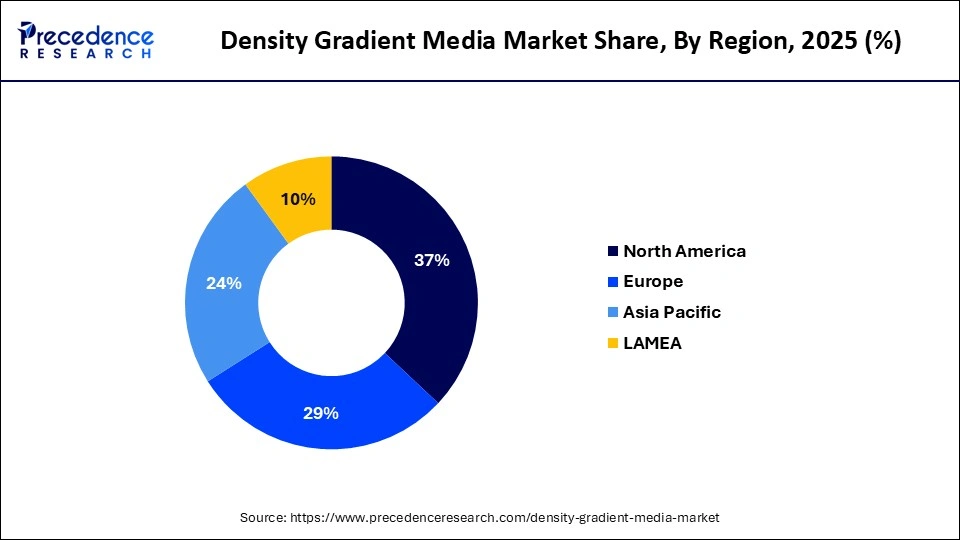

- North America dominated the market, holding the largest market share of 37% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR of 13% between 2026 and 2035.

- By product, the ficoll segment held the largest market share of 34% in 2025.

- By product, the sucrose segment is expected to grow at the fastest CAGR between 2026 and 2035.

- By formulation, the liquid media segment contributed the largest market share of 56% in 2025.

- By formulation, the custom gradient solutions segment is projected to grow at the fastest CAGR of 12% between 2026 and 2035.

- By application, the cell isolation segment generated the highest market share of 38% in 2025.

- By application, the viral purification segment is expanding at a strong CAGR of 10.50% between 2026 and 2035.

- By end-use industry, the biotechnology & pharmaceutical research segment captured more than 43% of market share in 2025.

- By end-use industry, the biomanufacturing / cell & gene therapy manufacturing segment is growing at a healthy 13% CAGR between 2026 and 2035.

- By distribution channel, the direct sales segment accounted for the largest market share of 60% in 2025.

- By distribution channel, the online/lab-supplies marketplaces segment is expected to grow at the highest CAGR of 14% between 2026 and 2035.

Market Overview

The global density gradient media market includes specialized reagents and consumables used to create density gradients in centrifugation or separation processes. These media enable the isolation, purification, and separation of cells, subcellular organelles, viral vectors, nucleic acids, and other biomolecules. They consist of products like ficoll, sucrose, sodium iodide, or custom gradient solutions, which are available in liquid or powder form. These products are used in life sciences research, cell and gene therapy, diagnostics, and biopharma manufacturing.

How are AI-Driven Innovations Reshaping the Density Gradient Media Market?

As technology continues to advance, Artificial Intelligence (AI) integration is driving innovation and significantly boosting the growth of the density gradient media market. AI integration in cell separation and microfluidics, including the use of density gradient media, leverages data analysis, automation, and process optimization. An AI-powered solution is commonly used to control and automate microfluidic systems, allowing for precise, real-time adjustments of flow rates and other parameters to improve efficiency and reduce the need for manual intervention. Machine learning can effectively analyze large datasets from experiments to predict the best separation conditions for various applications.

Density Gradient Media MarketOutlook

Between 2026 and 2035, the market for density gradient media is expected to experience rapid growth. The market is driven by expansion of cell and gene therapy pipelines, increased research in molecular biology and translational medicine, and rising demand for high-purity separation technologies.

Leading companies are broadening their geographic reach. For example, in June 2025, Cytiva, a Danaher company and a global leader in life sciences, finalized major expansion projects across various locations in the U.S., Europe, and Asia as part of its ongoing effort to improve service for customers developing and manufacturing advanced therapeutics.

Major investors in the market include biotechnology companies, life science research institutes, pharmaceutical manufacturers, and venture-backed firms specializing in cell separation and purification technologies. They contribute by funding advanced R&D, expanding production of high-purity media, and supporting innovation that enhances applications in genomics, proteomics, vaccine development, and clinical diagnostics.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.34 Billion |

| Market Size in 2026 | USD 1.48 Billion |

| Market Size by 2035 | USD 3.68 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.63% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Formulation, Application, End-Use Industry, Distribution, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Density Gradient Media Market Segment Insights

Product Type Insights

The ficoll segment dominated the market with the largest share of 34% in 2025. This is because ficoll-based media is a reliable and standard method for separating specific cell populations. Ficoll solutions are generally non-ionic and have low osmotic pressure, which helps reduce cell damage during separation. Ficoll-based media is a standard method in immunology, clinical research, and diagnostic testing, owing to the low cytotoxicity and ability to preserve cell viability.

On the other hand, the sucrose segment is expected to grow at the fastest CAGR between 2026 and 2035. The segments growth is driven primarily by its cost-effectiveness and increasing use in fundamental cell biology and virology research. Sucrose is significantly more economical than Ficoll or Percoll, making it an attractive option for high-throughput sample preparation and for laboratories with limited budgets.

The cesium chloride segment is expected to grow at a notable rate over the coming years, driven by its critical role in specialized applications, such as the high-purity isolation of nucleic acids and viral vectors for gene therapy. In addition, rising R&D spending in biotechnology and pharmaceuticals is driving demand for cesium chloride (CsCl).

Formulation Insights

The liquid media segment dominated the market by holding a 56% share in 2025. The segments dominance is primarily due to the increasing need for high reproducibility in research and clinical settings, as well as rising regulatory compliance requirements for biopharmaceutical manufacturing. Additionally, rising investment in life science R&D, especially in cell and gene therapy and regenerative medicine, is driving demand for liquid density gradient media to improve accuracy and efficiency.

The custom gradient solutions segment is expected to grow at the fastest CAGR of 12% in the upcoming period. This is mainly due to the rising need for application-specific formulations and the presence of stringent requirements of cell and gene therapies. Custom gradients allow fine-tuning of the separation process, leading to improved resolution and higher recovery rates of target materials.

The powdered media segment is expected to grow significantly due to its cost-effectiveness, longer shelf life, and the need for on-demand preparation in large-scale biopharmaceutical operations. Powdered media are generally cheaper to produce. For labs and manufacturers requiring large volumes, this offers cost savings, especially in academic research institutes where budgets are often limited.

Application Insights

The cell isolation segment dominated the density gradient media market by holding a share of 38% in 2025. The segments dominance is primarily attribute to its critical role in cancer research, the increasing adoption of regenerative medicine and stem cell therapies, and the growing demand for high-purity cell samples for diagnostics. Cell isolation techniques allow researchers to study tumor biology, identify biomarkers, and develop targeted treatments.

On the other hand, the viral purification segment is expected to expand at a CAGR of 10.50%, driven by the rapid growth of cell and gene therapy and increasing R&D investment in novel therapeutics and vaccines. As more cell and gene therapies for cancers, genetic disorders, and infectious diseases advance through clinical trials and gain FDA approval for AAV-based therapies, thereby driving the segments growth.

The protein purification segment is expected to grow significantly during the forecast period. This growth is driven by increased R&D investment in pharmaceuticals and biotechnology, greater demand for protein-based therapeutics, and the rising need for highly purified protein samples in various studies. The expansion of the biopharmaceutical industry further supports research activities that require high-quality, purified proteins.

End-Use Industry Insights

The biotechnology & pharmaceutical research segment dominated the density gradient media market, holding a 43% share in 2025. This is mainly due to the increasing need for high-purity components in biomanufacturing. The biotechnology and pharmaceutical research sector is the largest end-user in the market, as density gradient media play a vital role in the development and manufacturing of advanced therapeutics such as CAR-T therapies and stem cell treatments.

On the other hand, the cell & gene therapy manufacturing segment is the fastest-growing segment in the market, growing at a CAGR of 13%. This is primarily due to the increasing demand for cell and gene therapies, the surge in infectious diseases, and substantial private and public investments. Moreover, the rising demand for high-purity, clinical-grade cell isolation and viral vector purification is expected to drive the segments growth over the forecast period.

The diagnostics & clinical laboratories segment is expected to expand at a considerable growth rate over the forecast period. The segments growth is supported by rising demand for high-purity cell separation in diagnostic testing, rapid advancements in reproductive technologies, and increasing cases of chronic and infectious diseases. These media are widely used to isolate specific cell populations, such as circulating tumor cells (CTCs) and cancer stem cells (CSCs), from patient samples.

Distribution Channel Insights

The direct sales segment led the market by holding a share of 60% in 2025. Manufacturers often have their own skilled sales teams that work directly with hospitals and research institutions. Direct sales streamline the supply chain, reducing intermediate handling points and lowering the risk of contamination. This channel allows manufacturers to build strong, long-term relationships with research labs, biotech firms, and pharmaceutical companies that require high-purity, specialized media. Through direct engagement, suppliers offer tailored technical support, product customization, and reliable supply for critical applications.

The online lab supplies marketplace segment is growing the fastest, with a growth rate of 14%. Several companies are actively selling their density gradient media directly through dedicated e-commerce platforms and their own websites. Online lab supply marketplaces connect manufacturers with hospitals, research institutions, and biotech firms. These platforms offer convenience and a wide variety of products such as Percoll, Ficoll-Paque, sucrose, and cesium chloride.

The distributors & resellers segment is expected to grow at a considerable rate in the coming years. Distributors and resellers play a crucial role in connecting manufacturers with a vast network of global research institutions, biotechnology companies, hospitals, and labs. Distributors & resellers have established networks, allowing manufacturers to penetrate diverse and niche markets without the extensive direct sales infrastructure.

Density Gradient Media Market Regional Insights

The North America density gradient media market size is estimated at USD 495.80 million in 2025 and is projected to reach approximately USD 1,380.00 million by 2035, with a 10.78% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Density Gradient Media Market?

North America dominated the density gradient media market, holding a 37% share in 2025, owing to its advanced healthcare infrastructure, increasing application of cell and gene therapy, and rising investment in the life science industry. The region is home to the worlds most well-established biopharmaceutical sector that drives demand for high-purity, reproducible media solutions and accelerates innovation towards advanced formulations. The regions biopharmaceutical sector requires scalable methods for isolating and processing cells and biomaterials during drug development and manufacturing. Such factors are expected to drive the media market in the coming years.

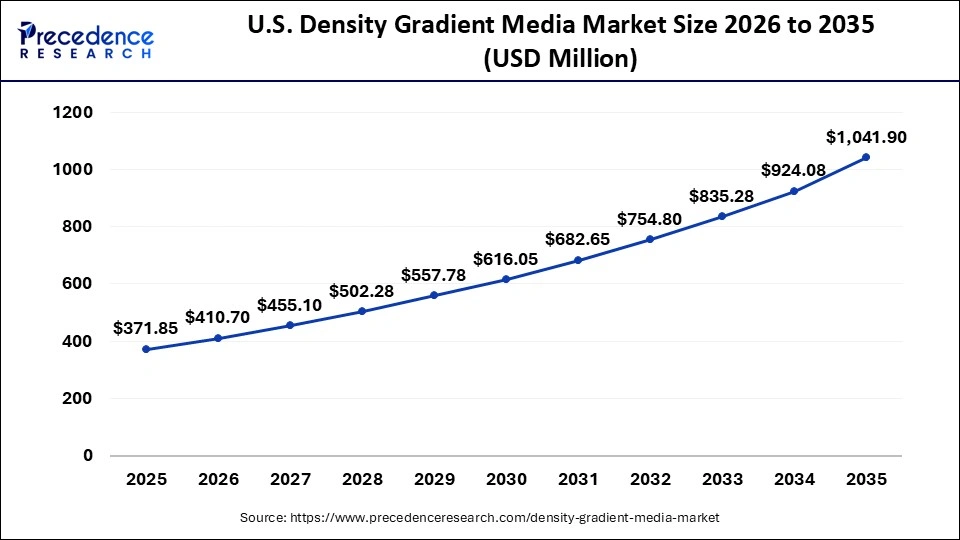

The U.S. density gradient media market size is calculated at USD 371.85 million in 2025 and is expected to reach nearly USD 1,041.90 million in 2035, accelerating at a strong CAGR of 10.85% between 2026 and 2035.

U.S. Market Trends

The U.S. leads the market in North America. The country heavily emphasizes quality, innovation, and clinical applications, which drives demand for density gradient media across various fields, including immunology, oncology, and stem cell biology. Factors such as the growing number of established academic and biopharma research efforts, increased investment in viral vector production, rising research in molecular biology and translational medicine, expanding applications in cell therapy and gene therapy, and the increasing need for high-purity separation technologies are expected to propel the markets growth in the coming years.

The Asia Pacific density gradient media market size is expected to be worth USD 901.60 million by 2035, increasing from USD 321.60 million by 2025, growing at a CAGR of 10.86% from 2026 to 2035.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the fastest CAGR of 13% in the coming years, driven by the thriving biopharmaceutical industry, increased government support for life sciences research, and the expanding diagnostics sector. The regions growth is mainly due to the rising demand for accurate cell separation in life science research, the growing need for cell and gene therapy, higher R&D expenditure from both the private biopharmaceutical sector and public institutions, and increased investment in the life science industry.

Major Market Trends in India

Indias density gradient media market is growing. The countrys biopharmaceutical sector is expanding quickly, driven by increasing investments in biologics and biosimilars, especially in oncology, which relies heavily on density gradient media for cell separation. Government-supported innovation funding and initiatives promoting academic-industry collaboration play a key role in encouraging the use of density gradient media across the country.

The Europe density gradient media market size has grown strongly in recent years. It will grow from USD 388.60 million in 2025 to USD 1,085.60 million in 2035, expanding at a compound annual growth rate (CAGR) of 10.82% between 2026 and 2035.

Europe: A Notably Growing Region

Europe is expected to experience significant growth in the market. The regions expansion is driven by the increased use of in-vitro diagnostics, supportive government policies,higher demand for regenerative medicine and cell therapy, a shift toward precision medicine, and ongoing innovation in media formulations to improve cell viability, reproducibility, and recovery. Europe has many academic and biopharma companies that use density gradient media for various applications, including viral purification, cell separation, and nucleic acid extraction.

Major Market Trends in Germany

Germany is experiencing notable growth, driven by its leadership in diagnostics, biotechnology, and a vibrant life sciences research ecosystem. The countrys strong biotechnology sector, high R&D investment, and government-supported innovation funding are expected to boost its development.

Regulatory Landscape Influencing the Density Gradient Media Market

| Country/Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

| U.S. | U.S. Food and Drug Administration (FDA) | FDAs Quality System Regulation (QSR), found in 21 CFR Part 820 | Regulatory transition, Pre-market submissions, Manufacturing and quality control, and post-market surveillance. | The FDA focuses on ensuring that the manufacturing processes for density gradient media adhere to Current Good Manufacturing Practices (CGMP), as outlined in the QSR/QMSR. This includes robust controls for production, labeling, and contamination. |

| European Union | European Commission, National Competent Authorities (NCAs), and European Medicines Agency (EMA) | IVDR (Regulation (EU) 2017/746) | Transition to IVDR, EUDAMED implementation, increased post-market surveillance (PMS), and justification for in-house tests. | The regulatory bodies have an advisory and supporting role, particularly for high-risk IVDs that serve as companion diagnostics for medicinal products. |

| India | Central Drugs Standard Control Organisation (CDSCO) | Medical Devices Rules, 2017 | Product registration, Manufacturing standards, Performance evaluation, Stability studies, Labeling requirements, and Unique Device Identifier (UDI). | This regulatory framework ensures that density gradient media and other IVDs meet stringent quality and safety standards before being made available for clinical or diagnostic use in India. |

Density Gradient Media Market Companies

MP Biomedicals supports the market by providing high-quality separation media widely used in molecular biology, cell isolation, and clinical research.

STEMCELL Technologies strengthens the market through its advanced cell separation products and specialized media designed for precise and reproducible research workflows.

REPROCELL contributes by supplying gradient media and related cell culture solutions that support stem cell research, regenerative medicine, and drug discovery applications.

Kitazato enhances the market by offering gradient media and reproductive biotechnologies used for oocyte and embryo handling in fertility and clinical laboratories.

FUJIFILM drives market growth by leveraging its life science division to produce high-purity separation media and innovative tools for bioprocessing, diagnostics, and advanced research.

Other Major Players

- pluriSelect Life Science

- Lonza

- Danaher Corporation

- Avantor, Inc.

- Merck KGaA

Recent Developments

- In May 2025, Beckman Coulter Life Sciences introduced the OptiMATE Gradient Maker, a device created to automate density gradient ultracentrifugation (DGUC). The new system speeds up purification processes by as much as 75% while enhancing consistency and reproducibility. Current upstream workflows can take up to three days, involving time-consuming steps such as preparing stocks, mixing and dispensing, sealing tubes, and spinning for up to 48 hours. The OptiMATE Gradient Maker reduces this time to as little as six hours, with four main steps: creating the method, connecting consumables, executing the method, and spinning. (Source: https://lifesciences.danaher.com)

- In August 2025, EDM Resources Inc. announced the final results of the dense media separation study on all zinc and lead composite samples from its Scotia Mine. The final tests suggest that it might be possible to pre-concentrate crushed run-of-mine material using Dense Media Separation (DMS) before flotation, potentially lowering the overall mineral processing costs at the Scotia Mine.(Source: https://www.marketscreener.com)

Density Gradient Media MarketSegments Covered in the Report

By Product

- Sodium Iodide

- Cesium Chloride

- Ficoll

- Sucrose

- Other Density Gradient Media

By Formulation

- Liquid Media

- Powdered Media

- Custom Gradient Solution

By Application

- Cell Isolation

- Viral Purification

- Protein Purification

- Nucleic Acid Extraction

- Other Applications

By End-Use Industry

- Biotechnology & Pharmaceutical Research

- Academic & Government Research Institutes

- Diagnostics & Clinical Laboratories

- Cell & Gene Therapy Manufacturing

- Others

By Distribution

- Direct Sales

- Distributors & Resellers

- Online/Lab-Supplies Marketplaces

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting