What is the Desiccant Dehumidifier Market Size?

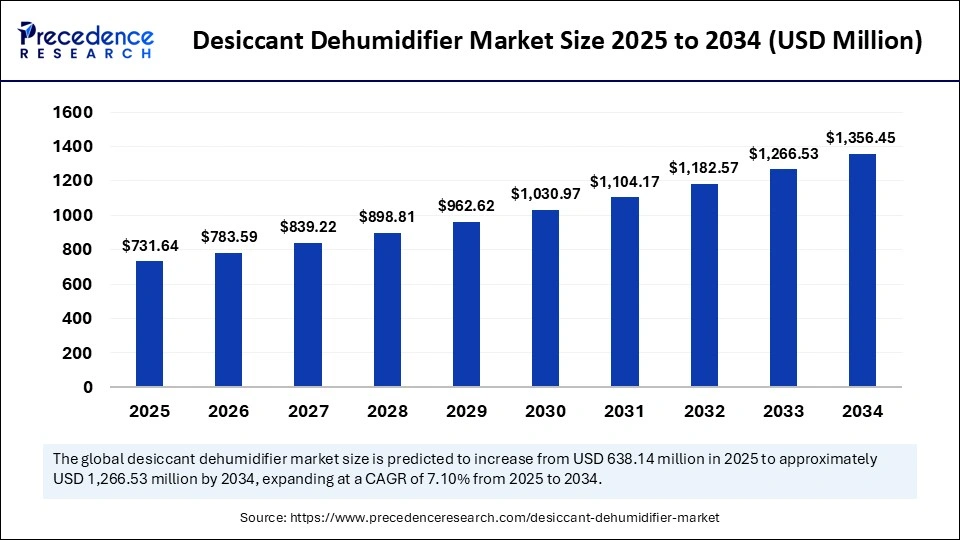

The global desiccant dehumidifier market size accounted for USD 731.64 million in 2025 and is predicted to increase from USD 783.59 million in 2026 to approximately USD 1,356.45 million by 2034, expanding at a CAGR of 7.10% from 2025 to 2034. The market is driven by the rising demand for precise humidity control and energy-efficient air treatment solutions.

Market Highlights

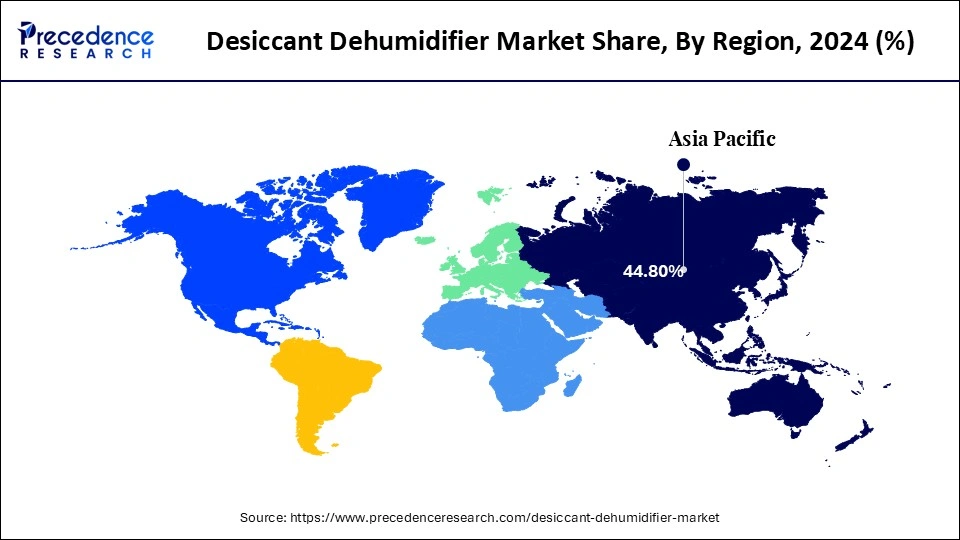

- The Asia Pacific dominated the global market with the largest market share of 44.8% in 2024.

- The North America is expected to expand at a significant CAGR from 2025 to 2034.

- By type, the portable desiccant dehumidifiers segment led the market while holding a 47.4% share in 2024.

- By type, the industrial / fixed desiccant dehumidifiers segment is expected to grow at a 6.0% CAGR from 2025 to 2034.

- By capacity, the low capacity (<500 cfm) segment captured a 52.4% revenue share in 2024.

- By capacity, the high capacity (>2000 cfm) segment is expected to expand at a 6.4% CAGR from 2025 to 2034.

- By component, the rotor segment led the market while holding a 43.4% share in 2024.

- By component, the heater segment is expected to grow at a 6.2% CAGR from 2025 to 2034.

- By end-use industry, the pharmaceuticals segment contributed the highest market share of 34.5% in 2024.

- By end-user industry, the food & beverage processing segment is expected to grow at a 6.3% CAGR from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 731.64 Billion

- Market Size in 2026: USD 783.59 Billion

- Forecasted Market Size by 2034: USD 1,356.45 Billion

- CAGR (2025-2034): 7.10%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

What is a Desiccant Dehumidifier?

A desiccant dehumidifier is a special pump meant to dry down the air by using desiccant substances like silica gel, molecular sieves, or activated alumina. Compared to conventional refrigerant-based dehumidifiers that use the condensation process, desiccant dehumidifiers are able to take in and adsorb water vapor onto a desiccant surface; thus, they are especially useful in low-temperature or low-humidity surroundings. The system usually has a rotating desiccant wheel, which repeatedly collects the moisture present in the air stream, and then it regenerates the desiccant by a heating process to allow continuity.

The desiccant dehumidifier market is a category of devices that find extensive application in a wide variety of processes such as pharmaceutical production, food processing, cold warehousing, electronics production, and HVAC services. Such industries are subject to the need to have a consistent humidity level to safeguard goods, preserve quality, as well as to deter microbial contamination or corrosion. The market is experiencing high growth rates because of the increasing need to control humidity in the sensitive environment, the growing awareness of the necessity of the quality of the air, and the technological progress that supports better performance without consuming much energy.

Impact of AI on the Desiccant Dehumidifier Market

The desiccant dehumidifier market is undergoing a significant transformation driven by the integration of Artificial Intelligence (AI), enabling smarter, more efficient, and predictive humidity control. AI-powered sensors and algorithms facilitate real-time monitoring of temperature, moisture, and airflow, allowing systems to automatically optimize dehumidification performance while reducing energy consumption. Predictive maintenance capabilities, enabled by advanced data analytics, allow for early detection of component wear, minimizing downtime and operational costs. Manufacturers are increasingly adopting AI-controlled systems to enhance energy efficiency, maintain precise moisture regulation, and align with sustainability goals.

These technological advancements are reshaping the competitive landscape, pushing the industry toward a more interconnected, intelligent, and energy-efficient future. As AI innovations accelerate, the desiccant dehumidifier sector is evolving into a high-performance segment within the broader climate control and industrial automation ecosystem.

Desiccant Dehumidifier Market Outlook

The desiccant dehumidifier market is poised for substantial growth between 2025 and 2034, driven by accelerating industrialization, the increasing need for precise humidity control, and the rising demand for energy-efficient air treatment systems. Expanding applications across the pharmaceutical, food processing, and electronics manufacturing sectors are key contributors to this upward trajectory.

The market is experiencing global momentum, particularly in Asia-Pacific, North America, and Europe. Rapid infrastructural development, growth in cold chain logistics, and the expansion of manufacturing hubs in emerging economies are creating lucrative opportunities for both established players and new entrants in the desiccant dehumidifier space.

Leading companies such as Munters, Bry-Air, Condair Group, and DehuTech are making significant investments in R&D, smart technology integration, and product innovation. Strategic mergers and acquisitions continue to shape the competitive landscape, strengthening global production capabilities and market presence.

A vibrant startup ecosystem is contributing to innovation in compact, energy-efficient, and IoT-enabled dehumidifier designs. Emerging technologies, such as smart sensors, regenerative desiccant systems, and hybrid models, are gaining traction, fostering collaboration between technology-driven startups and established HVAC and climate control companies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 731.64 Million |

| Market Size in 2026 | USD 783.59 Million |

| Market Size by 2034 | USD 1,356.45 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.10% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Capacity, Component, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Desiccant Dehumidifier MarketSegment Insights

Type Insights

The portable desiccant dehumidifiers segment led the market while holding a 47.4% share in 2024 due to their flexibility, ease of deployment, and compact design, which make portable units ideal for use in confined spaces such as small offices, rental properties, storage areas, and temporary construction sites. Their mobility makes them highly suitable for short-term applications and varying environmental conditions.

The adoption of these dehumidifiers is rising across sectors like pharmaceuticals, food processing, and construction, where localized or on-demand humidity control is critical. Additionally, their cost-effectiveness makes them attractive for small businesses and residential users. With the growing global emphasis on indoor air quality, comfort, and mold prevention, demand for portable desiccant dehumidifiers is projected to maintain a strong growth trajectory over the forecast period.

The industrial / fixed desiccant dehumidifiers segment is expected to grow at a significant CAGR of 6.0% over the forecast period. These units are designed for high-capacity, continuous operation, making them essential in mission-critical environments such as pharmaceutical manufacturing, food processing, cold storage, and electronics production. Their integration with centralized HVAC systems enables precise, large-scale humidity control while optimizing energy consumption and reducing maintenance costs.

Fixed systems are particularly valuable in facilities where humidity fluctuations can cause equipment degradation, corrosion, or product spoilage. As industrial infrastructure expands and automation becomes more prevalent, demand for robust, energy-efficient, fixed desiccant dehumidifiers is expected to continue to rise, reinforcing their importance in large-scale environmental control strategies.

Capacity Insights

The low capacity (<500 CFM) segment dominated the desiccant dehumidifier market, holding about 52.4% share in 2024. This dominance is primarily driven by its extensive use in small-scale commercial, residential, and mobile applications. These units are ideal for environments with space constraints or sensitivity to moisture, such as offices, retail stores, laboratories, and storage facilities, where effective humidity control is critical but installation of large-scale systems is impractical.

Low capacity units are highly portable, energy-efficient, and cost-effective, making them suitable for temporary or localized usage. Their growing adoption is also fueled by increasing consumer awareness regarding indoor air quality and the need to prevent mold, corrosion, and material degradation. Furthermore, demand is rising for smart, IoT-enabled units featuring automatic humidity control and remote monitoring capabilities, which enhance usability and performance.

The high capacity (>2000 CFM) segment is projected to grow at a 6.4% CAGR during the forecast period. These large-scale systems are engineered for industrial and commercial environments requiring continuous, high-volume moisture removal, such as food processing plants, pharmaceutical manufacturing facilities, electronics factories, and cold storage warehouses.

High capacity dehumidifiers ensure precise humidity regulation in expansive areas while optimizing energy consumption and minimizing operational downtime. Their efficiency and reliability are further enhanced through integration with advanced HVAC systems and automated control technologies. With heightened industrial focus on product quality, regulatory compliance, and sustainability, high capacity desiccant dehumidifiers are increasingly becoming an industry standard. Additionally, ongoing innovations aimed at improving energy efficiency and environmental performance are expected to sustain robust growth in this segment.

Component Insights

The rotor segment led the market while holding a 43.4% share in 2024 due to its critical role in the desiccant system, which is the vital moisture-absorbing element. Rotors are major elements in the honeycomb structure with silica gel or molecular sieves, which are loaded and through which dehumidification can be successfully and stably achieved by continuous adsorption and regeneration. They have a high surface area and are thermally stable, which is the key to improving the overall performance of a system in a low-humidity environment as well as a high-humidity environment.

Increased utilization of lightweight and energy-saving composite rotors has also enhanced the moisture absorption capacity and cost of operation. Pharmaceuticals, food processing, and electronic industries are also very much dependent on dehumidifiers of rotor type that need to have accuracy in humidity regulation. Furthermore, the technologies of rotor coating and modularity are increasing their efficiency and flexibility for a wide range of industrial purposes.

The heater segment is expected to grow at a significant CAGR of 6.2% in the coming years. Desiccant dehumidifiers require heaters that help to regenerate the desiccating substance by extracting the absorbed moisture throughout the drying process. Recent proliferation of more energy and intelligence-based heating, such as PTC (Positive Temperature Coefficient) and electric resistance heaters, has been found to improve the work and efficiency of dehumidifiers. Pharmaceutical, logistics, and cold-storage industries are the industrial sectors that have been moving towards the adoption of high-performance heaters to attain shorter regeneration periods and nonstop working. Also, advances in waste-heat recovery and renewable-powered heater systems are going downwards in the cost of operating energy, which is in line with the global sustainability programs. Due to the increase in productivity, optimization of energy, and reliability of operations in the industries, the demand for new, durable, and low-maintenance heater components is also increasing.

End-Use Industry Insights

The pharmaceuticals segment held a 34.5% share in the desiccant dehumidifier market in 2024, since the stability of drugs, their effectiveness, and shelf life heavily depend on the appropriate humidity levels. The pharmaceutical production, storage, and packaging require controlled environmental conditions to avoid degradation or contamination of the products due to moisture. Desiccant-type dehumidifiers are very common in cleanrooms, laboratories, and storage warehouses whose slightest changes in humidity can interfere with delicate formulations and biological products.

The rising demand for vaccines, biologics, and temperature-sensitive drugs has also ensured the demand for advanced dehumidification solutions. As the production of pharmaceuticals in various parts of the world continues to grow, the use of high-performance desiccant dehumidifiers will therefore be crucial to the quality of the products, operational efficiency, and compliance with the rules and regulations.

The food & beverage processing segment is expected to grow at a 6.3% CAGR over the projection period, since the precision of the humidity regulation defines the quality, safety, and shelf life of food products. Moisture build-up may cause growth of microbial, spoilage, and changes in texture and flavor of processed foods, and hence desiccant dehumidifiers would be critical in processing plants, cold storage, and wrapping facilities. The systems are also essential in ensuring that there are uniform production conditions in the bakeries, beverage plants, and freezers. Combined with increasing production of packaged and processed foods and efficient food safety regulations, the growing demand for dehumidification at a global scale is motivating manufacturers to invest in high-performance dehumidification technologies. Compact, portable, and hybrid systems can be flexibly applied as different lines of processing, which are useful in achieving the quality control and hygienic standards.

Desiccant Dehumidifier MarketRegion Insights

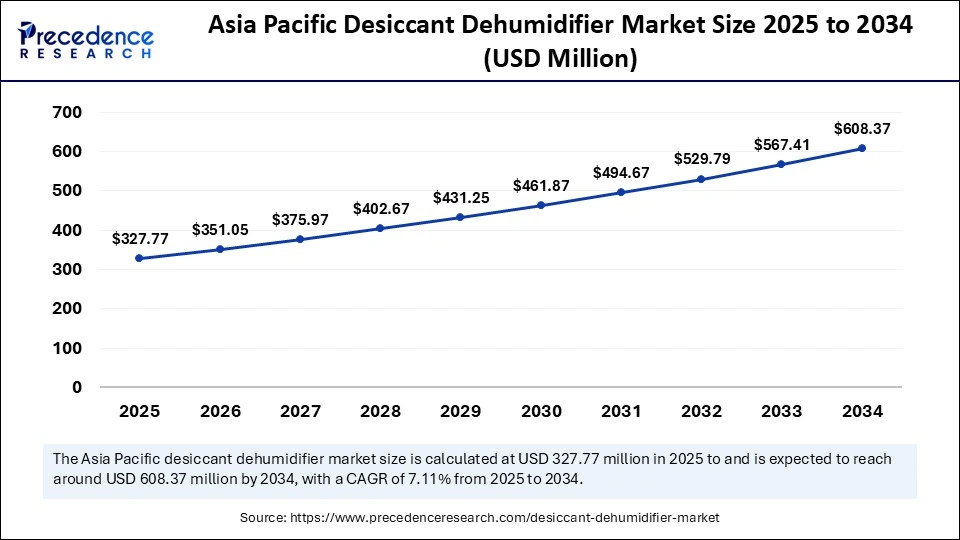

The Asia Pacific desiccant dehumidifier market size is exhibited at USD 327.77 million in 2025 and is projected to be worth around USD 608.37 million by 2034, growing at a CAGR of 7.11% from 2025 to 2034.

Why Did Asia Pacific Lead the Global Desiccant Dehumidifier Market in 2024?

Asia Pacific led the global market with the highest market share of 44.8% in 2024 and is expected to grow at a 6.5% CAGR throughout the forecast period. This leadership is driven by rapid industrialization, urbanization, and the growth of manufacturing sectors in countries such as China, India, and Japan. Increasing demands for energy-efficient and sustainable dehumidification solutions across industries like pharmaceuticals, electronics, and food processing, where precise humidity control is essential for product quality and operational efficiency, are key growth factors. Furthermore, urban expansion and infrastructure development are driving the need for reliable air treatment systems in commercial buildings, warehouses, and cold storage facilities. Government initiatives promoting energy efficiency and sustainability, especially in China, are also strongly advocating for the adoption of advanced desiccant dehumidification technologies.

China Desiccant Dehumidifier Market Trends

China is a major contributor to the market, as it has been witnessing a rapid rise in industrial and commercial activities. The tendency of the country toward energy-efficient and sustainable technologies stimulates investments in highly developed dehumidification systems in pharmaceuticals, electronics manufacturing, food processing, and logistics. The high rates of urbanization and development of cold storage and warehousing systems are raising the demand for accurate humidity control systems. To optimize the use of energy to keep the environmental conditions steady, manufacturers are implementing smart, IoT-enabled, and hybrid desiccant dehumidifiers. The high level of electronics and pharmaceutical manufacturing in China and the rising export with the strict environmental requirement guarantee the constant use of high-performance dehumidifiers.

North America is expected to grow at a significant CAGR throughout the forecast period, driven primarily by the increasing demand for precise humidity control across various industrial sectors such as pharmaceuticals, food processing, electronics, and healthcare. Maintaining consistent environmental conditions is critical in these industries to ensure product quality, regulatory compliance, and operational efficiency.

Additionally, stringent regulations enforced by government agencies such as the U.S. FDA, USDA, and EPA are compelling manufacturers and facility operators to adopt advanced desiccant dehumidification technologies that deliver reliable and consistent moisture control. Furthermore, the region's growing emphasis on energy efficiency and sustainability is encouraging companies to invest in high-performance, low-energy, and smart humidity control systems.

U.S. Desiccant Dehumidifier Market Trends

The U.S. is a major contributor to North America's rapid growth in the desiccant dehumidifier market. The adoption of these systems is increasingly prevalent across industrial, commercial, and institutional settings. Expansion in large-scale food processing plants, pharmaceutical manufacturing facilities, electronics production units, and cold storage warehouses is driving robust demand for high-capacity, precise dehumidification solutions. Moreover, advancements in technology, such as IoT-enabled sensors, automated humidity control, and hybrid dehumidifier designs, are enhancing energy efficiency and operational reliability. These innovations are rapidly gaining traction across a diverse range of industries, further fueling market growth.

The market within Europe is witnessing notable growth because of the rising demand across industrial, commercial, and residential sectors. Increasing awareness of indoor air quality, energy efficiency, and environmental sustainability is encouraging the adoption of advanced dehumidification systems. Key markets such as Germany, the UK, France, and Italy are witnessing growth in industrial manufacturing, food processing, pharmaceuticals, and cold storage facilities—sectors that require precise humidity control to maintain product quality and operational reliability. This demand is propelling investments in high-performance, energy-efficient desiccant dehumidifiers throughout the region. Technological advancements in smart sensors, IoT integration, hybrid dehumidifier designs, and automated controls are further enhancing system efficiency, reducing operational costs, and improving reliability, thereby accelerating market expansion in Europe.

Germany Desiccant Dehumidifier Market Trends

Germany is a major player in the regional market. The pharmaceutical, automotive, electronics, and food processing industries in the country depend much on humidity control to ensure product quality, as well as to ensure that sensitive materials are not damaged during the processes. The regulation compliance and quality assurance are high in standards, and thus promote the use of advanced desiccant dehumidifiers, such as energy-efficient and smart-controlled systems. In the German market, more use of digital solutions and predictive maintenance technologies is also being integrated, which enables the facilities to optimize the operation, minimize downtime, and lower the operation costs. The expanding level of environmental awareness and the incentives of government policies to use sustainable and efficient energy technologies further stimulate the growth of market.

Desiccant Dehumidifier MarketValue Chain

The value chain begins with sourcing critical raw materials such as desiccants (silica gel, activated alumina, molecular sieves), metals, plastics, and electronic components. Ensuring high-quality, cost-effective, and sustainable material supply is essential to maintain product performance and reliability, while also optimizing manufacturing costs.

This stage involves the fabrication of core components including desiccant wheels, compressors, fans, heating elements, and control systems. Precision manufacturing is key to achieving efficient moisture absorption, durability, and integration of smart technology for enhanced product functionality.

Here, components are assembled into finished desiccant dehumidifier units. This process includes quality control, system testing, and calibration to ensure optimal humidity control performance and energy efficiency. The integration of IoT and automation systems during assembly further adds value by enabling smart operation and predictive maintenance.

Efficient distribution networks facilitate the timely delivery of finished products to wholesalers, retailers, and end-users globally. Effective logistics management minimizes transportation costs and delivery times, which is crucial for maintaining product integrity and meeting market demand across diverse geographies.

Desiccant Dehumidifier Market Companies

These companies dominate the desiccant dehumidifier market with significant global reach, broad product portfolios, and strong technological capabilities. Collectively, they account for nearly half of the total market revenue.

- Munters: A global leader in air treatment solutions, Munters offers advanced desiccant dehumidifiers with a strong focus on energy efficiency and smart controls, serving diverse industries including pharmaceuticals, food processing, and electronics.

- Desiccant Technologies Group: Specializes in innovative desiccant rotor and dehumidification technologies, providing highly efficient, customizable systems for industrial and commercial humidity control applications worldwide.

- Bry-Air: Known for its comprehensive range of desiccant dehumidifiers and drying equipment, Bry-Air emphasizes sustainable, energy-saving technologies tailored for manufacturing and storage environments.

- Condair Group: A major player offering integrated humidity control solutions, including desiccant dehumidifiers, with expertise in IoT-enabled smart systems to optimize industrial and commercial air quality.

- Seibu Giken DST: Focuses on cutting-edge desiccant rotor technology and large-scale industrial dehumidification solutions, supporting sectors such as automotive, pharmaceuticals, and electronics with precision humidity control.

These firms hold strong market positions, often regional leaders or specialists, and contribute a sizable portion of market revenue, though not as dominant as Tier I players. Together, they cover around one-third of the market.

- Atlas Copco AB: Renowned for its industrial equipment, Atlas Copco provides high-performance desiccant air dryers and dehumidifiers integrated with compressed air systems, enhancing energy efficiency and reliability across manufacturing sectors.

- Kaeser Kompressoren: Specializes in compressed air systems and desiccant dryers, offering robust and energy-efficient dehumidification solutions tailored for industrial applications requiring precise moisture control.

- Trotec Laser GmbH: While primarily known for laser technology, Trotec also supplies portable and fixed desiccant dehumidifiers targeting commercial and industrial sectors, focusing on innovation and user-friendly designs.

- DehuTech AB: Focused exclusively on advanced desiccant dehumidification technologies, DehuTech delivers customizable, energy-saving solutions primarily for industrial drying and environmental control applications.

- Fisen Corporation: Provides a range of desiccant dehumidifiers and air treatment products emphasizing energy efficiency and smart control systems, serving diverse industries including pharmaceuticals and food processing.

Smaller, emerging, or regionally-focused companies with limited but growing market presence. Individually, they have modest shares, but collectively contribute about 15–20% of the overall market.

- SPX FLOW

- Quincy Compressor

- Sullair, LLC

- Rotorcomp

- Parker Hannifin Corp

Recent Developments

- In May 2024, Nature Miracle released two smart dehumidifier models under its Efinity brand, which are used for indoor agriculture and controlled environment devices. The products will enhance precision climate control and energy conservation in the horticultural activities.

- In September 2023, Munters Group (MTRS) signed an agreement to acquire ZECO, an Indian air treatment solutions manufacturer, for an estimated enterprise value of MSEK 790. This acquisition strengthens Munters' dehumidification presence and growth platform in the Indian market.

Exclusive Analysis on the Desiccant Dehumidifier Market

The desiccant dehumidifier market is poised for robust expansion over the forecast horizon, underpinned by a confluence of macroeconomic, regulatory, and technological catalysts. With heightened awareness surrounding indoor air quality, and the criticality of precision humidity control across sectors such as pharmaceutical manufacturing, food processing, cold chain logistics, and semiconductor fabrication, the market is transitioning from a supplementary utility to an operational imperative. Regulatory bodies like the FDA, EPA, and EU environmental standards are further accelerating adoption by enforcing stringent compliance thresholds, particularly within cleanroom and controlled-environment applications.

On the demand side, emerging economies in Asia Pacific, particularly India and Southeast Asia, are presenting scalable opportunities due to rapid industrialization, infrastructure growth, and public-private investments in manufacturing and healthcare facilities. Simultaneously, North America and Europe continue to drive value through high-capacity installations integrated with smart building systems and sustainability-aligned HVAC infrastructure. This dual-engine growth is transforming desiccant dehumidification into a critical enabler of decarbonization and energy optimization strategies.

Technology infusion remains a key differentiator. Innovations such as AI-based humidity control, IoT-enabled monitoring, hybrid desiccant-refrigerant systems, and regenerative wheel technologies are redefining operational efficiency while minimizing lifecycle costs. Manufacturers that leverage smart automation and modular configurations will be best positioned to capture enterprise-scale retrofit and greenfield deployment opportunities.

From an investment standpoint, the market is exhibiting favorable conditions for strategic consolidation, vertical integration, and R&D-driven competitive differentiation, particularly as ESG benchmarks tighten globally. In conclusion, the desiccant dehumidifier market is evolving into a mission-critical utility across industrial value chains, with long-term growth potential embedded in its ability to deliver sustainable, intelligent, and scalable climate control solutions.

Desiccant Dehumidifier MarketSegments Covered in the Report

By Type

- Portable Desiccant Dehumidifiers

- Industrial / Fixed Desiccant Dehumidifiers

- Commercial Desiccant Dehumidifiers

By Capacity

- Low Capacity (<500 CFM)

- Medium Capacity (500–2000 CFM)

- High Capacity (>2000 CFM)

By Component

- Rotor

- Heater

- Fans & Motors

- Control Systems

By End-Use Industry

- Pharmaceuticals

- Food & Beverage Processing

- Cold Storage & Warehousing

- Electronics & Semiconductors

- HVAC Systems

- Chemical & Petrochemical

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting