What is the Energy Storage Consulting & Deployment Services Market Size?

The global energy storage consulting & deployment services market is expanding as industries adopt advanced storage solutions to improve grid stability and energy efficiency.The market for energy storage consulting & deployment services is driven by growing renewable integration, grid modernization, and rising demand for optimized storage solutions.

Market Highlights

- Asia Pacific accounted for the largest market share in 2024.

- North America is expected to grow at the fastest CAGR between 2025 and 2034.

- By service type, the customer energy management services segment held a dominant share in 2024.

- By service type, the ancillary services segment is growing at a notable CAGR from 2025 to 2034.

- By end user, the industrial segment held the major market share in 2024.

- By end user, the utility segment is expanding at a strong CAGR from 2025 to 2034.

- By technology/storage type, the battery storage segment contributed the highest market share in 2024.

- By technology/storage type, the thermal storage segment is projected to grow at a considerable CAGR between 2025 and 2034.

- By application/use case, the grid services segment captured the a significant market share in 2024.

- By application/use case, the behind-the-meter solutions segment is growing at a notable CAGR from 2025 to 2034.

Reinventing Grid Resilience: How Energy Storage Consulting & Deployment Services Are Transforming the Power Sector

The energy storage consulting & deployment services market has become a vital cornerstone of the global energy transition, contributing to cleaner, more resilient, and decentralized power systems. The demand to adopt renewable energy across utilities, industries, and governments has increased the need for advanced storage solutions, driving rapid growth in consulting, engineering, design, deployment, and operational support services. BESS, Energy storage as a service (ESaaS), microgrid development, and hybrid renewable storage deployments are segments that deserve special focus, and each needs professional guidance to be cost-effective, safe, and efficient for long-term operations.

The catalysts for the market expansion of energy storage consulting and deployment services include the integration of renewable energy, the growing sentiment of grid instability, and the worldwide need for decarbonization. As solar and wind capacity increases, the consulting services will assist stakeholders in navigating intermittency and in unlocking the optimal storage configuration in the best interest of peak shaving, load shifting, frequency regulation, and backup power. Incentives, clean energy standards, and reduction targets are policy frameworks that promote project viability and encourage private investment.

Key AI Integration in the Energy Storage Consulting & Deployment Services Market

AI is an emerging central facilitator in the energy storage consulting & deployment services market, and it has changed the way systems are designed, optimized, and operated throughout their lifespans. There are AI-based analytics that can better predict load demand at specific times, the fluctuations in renewable energy sources, and the dynamics of battery degradation with much greater accuracy, enabling consultants to provide more precise feasibility research and financial projections.

Digital twins enabled by machine learning enable providers to mimic the grids behavior, detect risk conditions, and optimize system architecture before installation. Such corporations as Fluence, Wartsila, Stem Inc., Tesla, and Powin integrate AI into control platforms that enable autonomous grid support, real-time balancing, and seamless integration with distributed energy resources (DERs).

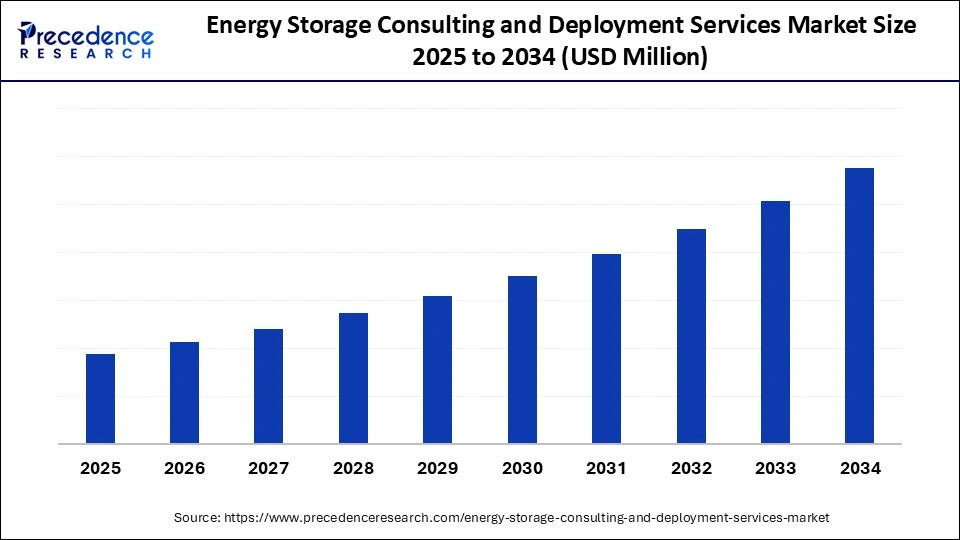

Energy Storage Consulting & Deployment Services Market Outlook

The growth of service offerings is increasing with the growing need for Battery Energy Storage Systems (BESS), decarbonization requirements, and the modernization of old transmission systems. This growth is enabled by complete-stack consulting, system design, and implementation solutions from ABB, Siemens, Schneider Electric, Hitachi Energy, and Burns & McDonnell.

North America and Europe lead the installations, although Asia-Pacific, particularly China, India, Japan, and South Korea, has been registering the highest rate of scale-up in utility-scale and C&I installations. The foreign players, including LG Energy Solution, SMA Solar Technology, Eaton, and Engie, continue to invest in new markets through partnerships and long-term service contracts.

The venture capital and sovereign funds are providing support to major Investors who are interested in the energy transition to accelerate grid-scale deployments. The key investment leaders eager to collaborate with consulting and deployment companies with strategic funding include Brookfield, BlackRock, Macquarie, Goldman Sachs Renewable Power, and KKR.

New software companies are changing the market by offering AI-based optimization of storage, digital twins, and modular microgrids. The new companies Stem Inc., the AI company of Fluence, Powin, Form Energy, Ambri, and Energy Vault are also disruptors with new designs of consulting, analytics, and turnkey deployment.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, End User, Technology/Storage Type, Application/Use Case, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Energy Storage Consulting & Deployment Services Market Segment Insights

Service Type Insights

Customer Energy Management Services: The Customer energy management services segment led the energy storage consulting & deployment services market and accounted for the largest revenue share in 2024, as commercial, industrial, and utility customers are turning to enhanced analytics, optimization software, and storage control platforms to save energy expenses and enhance the efficiency of their operations. This group of services enables customers to control peak loads, participate in demand response, and better integrate distributed energy resources. As the use of behind-the-meter (BTM) storage and AI-based energy management solutions grows, consultants are of utmost importance for system sizing, financial modeling, and deployment approaches.

Ancillary Services: The ancillary services segment is expected to expand dramatically as grid operators seek greater flexibility, faster response capabilities, and improved grid stability to handle changing renewable energy inputs to the grid. The nature of energy storage to provide frequency regulation, spinning reserve, voltage support, and black-start capabilities renders energy storage invaluable to the current grids. Consulting firms are beginning to implement systems tailored to participation in ancillary markets, and AI platforms are beginning to determine the optimal revenue stacking across a range of grid services.

Bulk Energy Services: Bulk energy services are also gaining traction as large-scale renewables, especially solar and wind, require storage to reduce intermittency and facilitate long-term energy shifting. The segment targets utility-scale storage applications that provide load leveling, peak shaving, and arbitrage across wholesale markets. As high-capacity, multi-hour systems are implemented by developers, consultants assist utilities in evaluating TCO, integration requirements, and grid effects. This segment is being reinforced by increased investment in long-duration technologies, from flow batteries to gravity storage, with major players including Form Energy, Energy Vault, and EDF Renewables, leading to the proliferation of this technology in regional transmission networks.

End User Insights

Industrial: The industrial segment captured the largest share of the market for energy storage consulting & deployment services in 2024, driven by increased demand for energy cost optimization, enhanced power reliability, and support for behind-the-meter (BTM) storage systems in manufacturing, mining, data centers, and heavy-processing companies. These plants have a peak demand fee, which is a major constraint, leading to storage and energy consulting services that help these facilities minimize operating costs and avoid downtime. Industrial users are also becoming more involved in demand response programs and adopting renewable-plus-storage systems to achieve sustainability goals.

Utility: The utility sector is set to see considerable growth as grid operators switch to predominantly renewable systems, requiring firm, balancing, and long-duration energy storage. Consulting services are important to the utility for planning the system, determining grid impact, adhering to regulatory requirements, and conducting cost-benefit analyses of storage assets. Growing investments in gigawatt-sized storage, hybrid plants, and transmission-scale stabilization are further strains on demand.

Commercial: The commercial market is steadily growing as energy companies move towards energy storage to address high charges for peak demand, build resilience, and integrate rooftop solar with smart control systems. Retail centers, hospitals, educational facilities, office buildings, and logistics centers rely on consulting partners to assess ROI, design modular deployments, and optimize energy consumption across multiple sites using AI-based platforms. Storage is becoming more attractive because it allows commercial customers to continue operating when the grid is unavailable and reduces reliance on the grid.

Technology/Storage Type Insights

Battery Storage: The battery storage segment led the energy storage consulting & deployment services market in 2024, demonstrating unmatched scalability, the ability to deliver almost immediate responses, and declining prices driven by the development of lithium-ion and solid-state technologies. It is used in commercial, industrial, and utility-scale applications, where batteries are favored for supporting peak shaving, frequency regulation, renewable integration, and behind-the-meter optimization. Modularity enables consultants to create multi-purpose systems that can be used in many ways, and AI-based battery management systems enhance lifecycle performance and safety.

Thermal Storage: The thermal storage market will continue to experience a high CAGR as industries and utility firms seek affordable, long-term storage solutions to maintain heating, cooling, and grid load balancing. Some thermal technologies have been proposed for commercial buildings, district energy systems, and concentrated solar power (CdTe) plants: molten salt, ice storage, and phase-change materials. Consulting services are becoming more advisory, assisting clients in combining thermal storage with renewable systems, analyzing lifecycle economics, and designing hybrid energy configurations.

Hybrid Storage: Hybrid storage systems, combining batteries with other technologies such as thermal, mechanical, or hydrogen storage, are on the rise due to attributes like greater flexibility, redundancy, and multi-duration energy. These systems enable operators to add services on top of each other, achieve greater economy of peaks and off-peak periods, and provide both fast-response and long-duration storage from a single integrated solution. The current renewable-plus-hybrid storage projects are gaining greater interest as they are being rolled out more rapidly in both industrial microgrids and utility-scale plants.

Application/Use Case Insights

Grid Services: This segment saw the highest turnover in 2024, as utilities and grid operators increasingly relied on storage to stabilize networks, manage peak loads, and accommodate high levels of renewable penetration. Frequency regulation, voltage support, spinning reserve, and congestion management services required a high level of consulting expertise and mass deployments. With increasing age and reliability issues with grids, storage systems were required to support resilience planning and grid modernization. The consultants play a crucial role in the design of service-stacking models, regulatory review, and optimisation using AI-controlled tools.

Renewable Integration: The renewable integration segment will grow significantly as countries accelerate the deployment of solar-plus-storage and wind-plus-storage systems to achieve decarbonization objectives. Storage can improve reliability by smoothing output variations, shifting energy to peak demand periods, and reducing curtailment, making consulting highly important for system design, interconnection research, and financial analysis. Developers are moving towards hybrid power plants that use AI-based storage systems to optimize dispatch and maximize revenue across markets.

Microgrids: Microgrids are also on the rise as communities, industries, campuses, and remote locations find they need to be energy-independent, resilient, and able to operate independently during grid failures. Storage is the backbone of microgrids, enabling easy islanding, load control, and renewable injection. The consulting services facilitate microgrid feasibility studies, system sizing, resilience modelling, and controller selection, which are important because they ensure the system operates stably. Recent developments in AI-driven microgrid energy management systems (EMS) enable real-time optimization, demand forecasting, and load prioritization.

Energy Storage Consulting & Deployment Services Market Region Insights

In 2024, Asia Pacific became the industry leader in the global energy storage consulting & deployment services market due to significant additions of renewable energy, a favorable policy framework, and massive investments in projects related to battery and grid modernization. China was at the heart of it, and it is growing utility-scale storage, increasing lithium-ion production potential, and accelerating grid upgrades through digitalization, which is highly dependent on consulting, engineering, and integration skills.

The pace of urbanization, rising electricity demand, and decarbonization initiatives across India, Japan, South Korea, and Southeast Asia further underscore the need for more advanced feasibility studies, AI-driven planning, and deployment of optimization models. The popularity of energy storage technologies, which offer specialized consulting services, is supported by a robust manufacturing ecosystem in the region and government-funded pilot programs.

China Energy Storage Consulting & Deployment Services Market Trends

China was characterized by distinct tendencies towards aggressive utility-scale rollouts, a powerful incentive for frequency-regulation storage, and rapid expansion of long-duration technologies such as flow batteries. The number of state-owned utilities and private developers increased their investments and enhanced demand for consulting related to grid-connected storage planning, lifecycle assessment, and digital EMS integration. There was also a strong manufacturing capacity that reduced battery prices and made storage widely used in EV charging infrastructure, commercial premises, and industrial microgrids, since each of them required specialized engineering and integration services.

North America became the most rapidly expanding market, driven by federal incentives, faster implementation of clean-energy requirements, and the blistering development of utility-scale renewable projects. The motivation for growth is large-scale deployments in the United States, the development of larger hybrid solar-plus-storage systems, and corporate demand for resilient power solutions.

Greater degrees of grid digitalization programs, greater interest in long-duration storage, and the need for asset performance modelling through the aid of AI also supported the consulting business. The increased demand for expertise in engineering, system design, and deployment was further driven by the advanced age of the grid infrastructure in the area, frequent outages due to the climate, and the strong investor interest in the storage-based power market.

The U.S. is currently experiencing swift market growth, driven by robust federal incentives, state-based clean energy requirements, and the faster implementation of grid-based and behind-the-meter storage systems. The utilities, independent power producers, and commercial facilities are increasingly entrusting their system modelling and interconnection studies, regulatory compliance, and energy management optimisation to AI consulting partners.

Increasing grid congestion, frequent weather-related outages, and the need for resilience solutions continue to drive the adoption of battery storage and hybrid renewable systems, both of which require end-to-end design, engineering, and deployment expertise. There is also a growing ecosystem of technology vendors, financing partners, and energy service companies in the U.S., which also contributes to the increased demand for consulting-led implementation frameworks.

The European energy storage consulting & deployment services market is witnessing sustainable growth, driven by strict decarbonisation goals, the fast integration of renewable energy sources, and grid stability and energy independence in the region. The solar and wind penetration in Germany, Spain, the Nordics, and Eastern Europe necessitates high-level planning, techno-economic modelling, and compliance-focused consulting to facilitate a seamless integration.

The increased focus on flexibility markets, cross-border energy trading, long-term storage pilots, etc., also contributes to the demand for professional services from engineers and implementation partners. Also, regulatory developments in Europe, including capacity market reforms and incentives for distributed energy sources, create a need to engage specialised consulting firms to structure and optimise the project.

UK Energy Storage Consulting & Deployment Services Market Trends

The UK energy storage consulting & deployment services industry is growing rapidly as the nation gains momentum in transitioning its power system to a flexible, resilient system based on renewable sources. The demand for expert advisory services to support project planning, revenue modelling, and technology selection is being driven by strong policy support and increasing grid stability requirements. The deployment activity is shifting from short-term battery deployment to long-term and hybrid storage systems to enable frequency response, peak shaving, and grid balancing. With investor confidence growing and storage emerging as a central part of decarbonisation strategies in the UK, the market is evolving towards a more sophisticated approach to projects and a more intensive integration with technical aspects.

Energy Storage Consulting & Deployment ServicesMarket Companies

A global leader in energy storage technology and services, offering turnkey deployment, digital optimization software, and lifecycle services. The company supports utilities and developers with grid-scale and commercial storage projects.

Provides engineering, procurement, consulting, and construction services for battery and hybrid storage systems. The company delivers feasibility studies, interconnection planning, and full project execution for large-scale deployments.

Offers technical advisory, safety assessments, due diligence, and validation services for energy storage projects. DNV supports investors, utilities, and OEMs with battery performance testing and grid-integration analysis.

Specializes in storage system engineering, analytics, and commissioning support for stand-alone and renewable-paired battery projects. The company assists clients with regulatory compliance and project optimization.

Provides IT and operational consulting for integrating energy storage assets into utility systems. The firm focuses on enterprise architecture, system configuration, and digital transformation for power-sector clients.

Offers digital engineering, analytics, and asset management solutions for battery and hybrid storage deployments. Infosys supports energy companies with predictive maintenance, grid modeling, and operational optimization.

A global engineering consultancy providing feasibility studies, EPC support, and bankability assessments for battery and hydrogen-based storage systems. Fichtner works with utilities, financiers, and governments on large projects.

Provides testing, inspection, and certification services for battery systems across stationary and mobile applications. The company supports project safety validation, performance assessment, and quality assurance.

Develops large-scale battery storage installations integrated with renewable energy projects. The company focuses on grid services such as peak shaving, balancing, and system reliability enhancement.

Specializes in underground energy storage solutions, including compressed air, hydrogen, and thermal storage. The company provides engineering, construction, and geotechnical expertise for subsurface storage projects.

Recent Developments

- In November 2024, Hydrostor signed a Crown Lands agreement with the New South Wales government in Australia to build the Silver City Energy Storage Centre. The project will enhance energy stability in the region by offering a mini-grid system with the potential to supply 200 MW of power and long-term storage capability.(Source: https://hydrostor.ca)

- In December 2023, Customized Energy Solutions collaborated with Peninsula Clean Energy to optimize the latters renewable energy and storage resources in California within ISO markets. This partnership will advance Peninsula Clean Energy in developing fully renewable power to serve the needs of customers in the City of Los Banos and San Mateo County.(Source:https://www.globenewswire.com)

Energy Storage Consulting & Deployment Services MarketSegments Covered in the Report

By Service Type

- Bulk energy services

- Ancillary services

- Transmission infrastructure services

- Distribution infrastructure services

- Customer energy management services

- Other services

By End User

- Utility

- Industrial

- Commercial

- Residential

By Technology/Storage Type

- Battery storage

- Thermal storage

- Mechanical storage (flywheel, compressed air, pumped hydro)

- Hybrid storage

By Application/Use Case

- Grid services (frequency regulation, peak shaving, arbitrage)

- Renewable integration (solar + storage, wind + storage)

- Microgrids

- Behind-the-meter solutions (backup power, demand-charge management)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting