What is the EV Battery Testing Market Size?

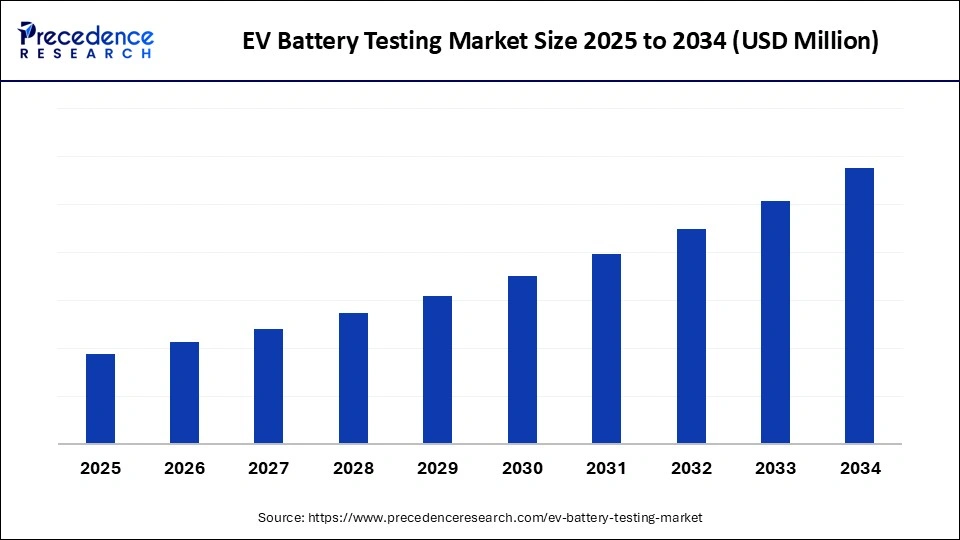

The global EV battery testing market is witnessing rapid growth as manufacturers and service providers ensure electric vehicle batteries meet performance, safety, and reliability standards.The market growth is attributed to the increasing global adoption of electric vehicles and rising investments in advanced battery technologies, which demand rigorous testing for safety, performance, and longevity.

EV Battery Testing Market Key Takeaways

- Asia Pacific held a dominant presence in the market in 2024.

- North America/ Europe is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By test type, the performance and electrical testing segment accounted for a considerable share of the EV battery testing market in 2024.

- By test type, the safety and abuse segment is projected to experience the highest growth rate in the market between 2025 and 2034.

- By test stage, the validation and type approval testing segment led the market.

- By test stage, the end-of-life/second-use/recycling qualification segment is set to experience the fastest rate of market growth from 2025 to 2034.

- By end-use/application, the passenger EVs segment registered its dominance over the EV battery testing marketin 2024.

- By end-use/application, the commercial vehicles segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By vehicle type/OEM customer, the battery manufacturers/ cell makers segment dominated the market.

- By vehicle type/OEM customer, the tier-1 suppliers segment is projected to expand rapidly in the market in the coming years.

- By test equipment/solution type, the battery test systems/cycle segment maintained a leading position in the EV battery testing market in 2024.

- By test equipment/solution type, the software (data acquisition, analytics, simulation & digital twins) segment is predicted to witness significant growth in the market over the forecast period.

What Is Encompassed in the EV Battery Testing Market?

The global EV battery testing market is projected to expand significantly, driven by the increasing adoption of electric cars and advancements in battery technologies. According to the International Energy Agency (IEA), the sales-weighted average range of battery electric cars grew by 50% from 2018 to 2023, highlighting the rapid improvements in battery performance. This surge in EV adoption necessitates robust testing to ensure battery safety, efficiency, and longevity. (Source: https://www.iea.org)

Governments worldwide are investing in EV infrastructure and setting stringent regulations to promote EV adoption and battery safety. The U.S. Department of Energy's 2025 Battery Energy Storage Systems Report emphasises the importance of advanced battery testing to support the growing demand for EVs and energy storage solutions. Furthermore, as the market continues to grow, the demand for sophisticated testing solutions is expected to rise, further driving innovation and investment in the EV battery testing sector.(Source:https://www.energy.gov)

Impact of Artificial Intelligence on the EV Battery Testing Market

Artificial intelligence (AI) is transforming the EV battery testing market by enhancing efficiency, accuracy, and innovation in testing procedures. The market leaders implement AI-powered solutions to process large volumes of battery cell and pack data, predicting a decrease in performance, safety concerns, and capacity in real-time. Furthermore, the application of AI-based predictive intelligence enables manufacturers to accelerate product testing, improve battery life, and meet stringent safety requirements.

Key Technological Shifts in the EV Battery Testing Market

The market for EV battery testing is undergoing a technological revolution driven by the quest for efficiency, accuracy, and sustainability in testing processes. The introduction of artificial intelligence (AI) and machine learning is one of the most influential changes. It has enabled the conduct of predictive diagnostics and the identification of possible cell failures more quickly. Indicatively, the National Renewable Energy Laboratory (NREL) developed AI-assisted battery lifetime predictive models in 2024, which can assist testing labs in enhancing their precision and reducing cycle time.

Firms such as Keysight Technologies and AVL list GmbH have been building automated and AI-based test platforms to improve accuracy and minimise the cost of operation. Simultaneously, high-throughput testing systems have enabled the simultaneous testing of multiple chemistries, including solid-state and lithium-metal batteries. This enhances scalability and accelerates commercialisation schedules. Additionally, there is the emergence of portable and wireless testing solutions that can provide on-site testing of EV fleets and EV charging networks.

Battery Technology Trade & Production Shifts: Launches and Capacity Trends

- China leads global battery cell manufacturing, reaching over 3 TWh of installed capacity in 2024 after nearly a 30 % expansion, reinforcing its dominance in upstream production.

- In 2024, global gigafactories produced 867.8 gigawatt-hours (GWh) of EV battery cells, underscoring the scale of industrial output and the growing need for testing services.

- Established battery makers such as CATL, BYD, and LG Energy Solution accounted for just over 60 % of global cell deployments in 2024, reinforcing concentration in top-tier firms.

- The U.S. Department of Energy committed US$43 million in 2024 to projects aimed at enhancing battery safety, reducing failure risk, and boosting domestic innovation in pack manufacturing.

- CATL unveiled a new sodium-ion battery brand, “Naxtra,” in 2025, with planned mass production by the end of the year, offering ~175 Wh/kg energy density as a lower-cost alternative to lithium-ion.

- Over 864 GWh of battery capacity was deployed into the passenger EV fleet in 2024, a 25% increase over 2023, signaling an accelerating demand for validated, safe battery systems.

- Governments are injecting major capital: the U.S. DOE selected over 11 high-impact battery projects worth billions in late 2024 to expand domestic cell, component, and recycling capacity.

(Source: https://www.electrive.com)

(Source: https://autovista24.autovistagroup.com)

(Source: https://rhomotion.com)

(Source: https://www.energy.gov)

(Source: https://www.reuters.com)

(Source: https://www.adamasintel.com)

(Source: https://www.energy.gov)

(Source: https://www.energy.gov)

EV Battery Testing Market Growth Factors

- Growing Adoption of Wireless and Automated Testing Systems: Rising integration of wireless diagnostics and automation is driving efficiency, reducing testing time, and enhancing accuracy in battery validation processes.

- Driving the Development of Second-Life Battery Testing: An increasing focus on repurposing EV batteries for energy storage applications is fueling demand for specialized second-life battery testing solutions.

- Rising Demand for Ultra-Fast Charging Batteries: Growing investment in ultra-fast charging infrastructure is propelling the need for advanced testing to ensure battery stability and safety under high-speed charging conditions.

- Boosting Integration of IoT in Battery Diagnostics: Expanding IoT applications in battery performance monitoring are driving innovation in real-time testing and predictive maintenance solutions.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Test Type, Test Stage, End-Use / Application, Vehicle Type / OEM Customer, Test Equipment / Solution Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Increasing Adoption of Electric Vehicles Driving Demand in the EV Battery Testing Market?

Increasing adoption of electric vehicles is expected to significantly boost the market in the coming years. According to the IEA 2024 report, over 17 million electric car sales were recorded worldwide in 2024. This influx necessitates a thorough battery validation process to ensure adherence to rigorous safety and performance regulations.

The increasing use of EVs in passenger/commercial/public transportation brings increased demands on the testability of battery lifetime and high-speed charging features. Strict government and safety agency regulations compel manufacturers to adopt a rigorous testing methodology. Furthermore, the growing regulatory frameworks and safety standards are expected to drive the global expansion of testing services.(Source: http://www.iea.org)

Restraint

How Are High Capital and Operational Costs Hindering Growth in the Market for EV Battery Testing?

High capital investment in advanced battery testing facilities is expected to restrain market growth, as the infrastructure required for precise performance, safety, and lifecycle assessments often involves highly specialized equipment and sophisticated laboratories. These expenses can create significant entry barriers, particularly for smaller or emerging manufacturers, who may struggle to access or afford such services. Additionally, the rapid pace of technological progress in battery chemistries, including lithium-ion, solid-state, and other next-generation cells, introduces another layer of complexity.

Opportunity

How Are Surging Investments in Battery Technology R&D Impacting the EV Battery Testing Market?

Surging investments in battery technology R&D are projected to create immense opportunities for the players competing in the EV battery testing market. Manufacturers are investing substantial funds in the production of high-energy-density batteries, solid-state cells, and new-generation chemistries. Battery performance testing is a crucial component of R&D, as it enables companies to assess the safety and durability of batteries before mass production.

In 2024, the global capacity for battery manufacturing was three terawatt-hours (TWh), and the forecast is to increase three times within five years. This indicator of the rapid development of the industry and the necessity of new testing solutions. With such developments, the role of specialized testing is sharpened in providing competitive battery solutions. Moreover, the high demand for battery reliability and safety is likely to intensify focus on advanced testing solutions.

(Source: https://www.iea.org)

Segment Insights

Test Type Insights

Why is the Performance/Electrical Test Type Dominating the EV Battery Testing Market?

The performance and electrical testing segment dominated the EV battery testing market in 2024, driven by manufacturers' interest in range, efficiency, and system integration validation. Cell makers and automakers test electrical performance more to ensure state-of-charge algorithms and pack-level energy throughput. Furthermore, the increasing volumes of cell-to-pack electrical qualifications are further fuelling the invest over the long term in precision electrical test equipment and automated data pipelines.

The safety and abuse segment is expected to grow at the fastest rate in the coming years, owing to the advancement of more rigorous safety requirements by regulators and research labs, as well as stricter abuse testing measures. Moreover, the EU Battery Regulation and national amendments introduced stricter safety and traceability regulations, further boosting the segment growth.

Test Stage Insights

What Factors Have Made Validation/Type Approval Testing the Leading Segment in the EV Battery Testing Market?

The validation and type approval testing segment held the largest revenue share in the EV battery testing market in 2024, due to the ongoing rise in regulatory requirements and rigorous homologation processes. Additionally, the investment in certified validation services and automated data processes provides support for regulatory dossiers and submissions for homologation.

The end-of-life / second-use / recycling qualification segment is expected to grow at the fastest rate in the coming years, owing to the increasing policy focus on circularity. The EU Batteries Regulation would require disclosures of durability, reparability, and the percentage of recycled content.

That raises the testing requirements of used packs, creating a need to move towards standard EoL assessment protocols. Furthermore, the Recyclers and reuse projects in the industry resulted in expanded pilot deployments that necessitated intensive state-of-the-art testing for health, safety, and residual life.

End-Use / Application Insights

Why Are Passenger EVs Leading the EV Battery Testing Market?

The passenger EVs segment dominated the EV battery testing market in 2024, as manufacturers were competing to comply with regulatory requirements and match consumer expectations. The IEA estimates that the total sales of EVs worldwide increased by almost a quarter annually in the first half of 2024. This indicates the amount of testing required to make them compliant and reliable. Furthermore, the high rate of EV passenger uptake accelerated the emphasis on stringent battery testing regimes, thus further fuelling the market.(Source: http://www.iea.org)

The commercial vehicles segment is expected to grow at the fastest CAGR in the coming years, owing to the interest in decarbonization and the economic efficiency of the electrification of the logistics sphere. Moreover, as the world becomes increasingly focused on electrifying transportation, logistics is expected to drive the demand for commercial EV battery testing technology.

Vehicle Type / OEM Customer Insights

How Are Battery Manufacturers and Cell Makers Driving Dominance in the EV Battery Testing Market?

Battery manufacturers/cell makers & OEMs segment held the largest revenue share in the EV battery testing market in 2024, as they played a central role in ensuring compliance, safety, and performance before commercial introduction. These players have the role of authenticating the electrochemical characteristics and efficiency of energy to satisfy the requirements of the international standards.

- The International Energy Agency (IEA) estimates that in 2023, the global EV battery requirement exceeded 750 GWh, underscoring the significant demand for testing needs. Additionally, the increased vertical integration of automakers into cell production continued to increase their share of tester activity.(Source: https://www.iea.org)

The tier-1 suppliers segment is expected to grow at the fastest rate in the coming years, driven by the increasing complexity of incorporating batteries into vehicle platforms. Furthermore, the Tier-1s' demand is expected to increase because OEMs will outsource key sub-system design and leave their testing to suppliers to guarantee interoperability and reliability.

Test Equipment / Solution Type Insights

Why Are Battery Test Systems/Cyclers the Key Segment in the EV Battery Testing Market?

The battery test systems/cyclers segment dominated the EV battery testing market in 2024, as they are essential in ensuring charge-discharge performance, efficiency, and cycle life across a variety of chemistries.

Manufacturers use these systems to benchmark energy density, thermal behavior, and degradation during actual driving conditions. Moreover, the increased use of fast-charging networks also contributed to the demand to use high-precision cyclers, which measure rapid changes in current.

The software (data acquisition, analytics, simulation & digital twins) segment is expected to grow at the fastest rate in the coming years, as the industry shifts to predictive validation and faster development cycles. Additionally, the segment is expected to grow at a rapid pace due to the increasing interest of OEMs and cell manufacturers in predictive software, which aims to improve cost optimization and lifecycle management.

Regional Insights

What Makes Asia-Pacific the Dominating Region in the EV Battery Testing Market?

Asia Pacific led the EV battery testing market, capturing the largest revenue share in 2024, due to its superior battery production capacity, strong EV production, and support of government policies. In 2023, China manufactured more than 75% of global lithium-ion batteries and more than 60% of all global EV sales.

This generates massive demand for battery testing on large scales, according to the International Energy Agency (IEA). These programs put the Asia-Pacific in the centre of the global EV battery testing ecosystem. Furthermore, the Asia Pacific EV battery testing market is expected to expand significantly due to the rapid development of EV manufacturing hubs.(Source: https://www.orfonline.org)

North America / Europe is anticipated to grow at the fastest rate in the market during the forecast period, owing to the high rate of EV adoption and strict testing laws. According to the projections of the U.S. Department of Energy (DOE), North American battery manufacturing capacity is expected to grow to over 1,200 GWh by 2030. (Source: https://www.energy.gov)

This creates a need for sophisticated testing facilities to validate cells and new chemistries. The Battery Regulation 2023/1542, which is being applied in Europe starting in 2024 is requires full lifecycle testing of batteries, including carbon footprint, recyclability, and safety compliance. Additionally, it is estimated that North America and Europe will grow at the same pace, which is further attributed to government incentives and tightening regulations.(Source:https://certifycomply.com)

Top Vendors in EV Battery Testing Market & Their Offerings

- AVL List GmbH (Austria): AVL is a global leader in automotive testing solutions, offering advanced battery test systems for performance, durability, and safety evaluation.

- Keysight Technologies (USA): Keysight provides precision battery testing and emulation solutions that enable automakers and battery developers to validate high-voltage systems and ensure compliance with international standards.

- Chroma ATE Inc. (Taiwan): Chroma specializes in automated test equipment for EV batteries, including regenerative battery cyclers, high-power testing systems, and environmental simulation setups for safety validation.

- HORIBA MIRA (UK): HORIBA delivers comprehensive battery safety and performance testing services, covering crash simulation and regulatory compliance checks for global markets.

- Maccor Inc. (USA): Maccor is widely recognised for its high-precision battery test equipment used in R&D and quality control. The company's systems are capable of conducting long-duration cycling tests, which are essential for next-generation solid-state and high-energy-density chemistries.

Top EV Battery Testing Market Companies

- UL Solutions – Provides safety certification, compliance, and testing services, including battery and EV system evaluations.

- TÜV SÜD – German TIC (testing, inspection, certification) company offering EV battery safety, performance, and compliance testing.

- Intertek Group – Global testing and certification provider specializing in product safety, quality, and performance testing.

- SGS SA – Swiss-based leader in inspection and verification services, including battery testing and sustainability assessments.

- Bureau Veritas – Provides conformity assessment and testing services for automotive, energy storage, and consumer products.

- DNV – Offers testing, advisory, and certification services with expertise in renewable energy and battery storage systems.

- DEKRA – German TIC provider focused on product safety, EV battery validation, and automotive testing.

- Element Materials Technology – Specializes in materials testing and battery performance/safety evaluations for EV and aerospace.

- AVL List GmbH – Austrian company known for advanced simulation and testing systems for powertrains and EV batteries.

- Horiba / HORIBA MIRA – Provides automotive R&D, battery testing, and emissions measurement systems.

- Chroma ATE Inc. – Taiwanese company producing electronic test and measurement systems, including EV battery testers.

- Arbin Instruments – U.S. manufacturer of precision battery test equipment for research and commercial applications.

- Maccor (AMETEK Battery Test Systems) – Industry leader in automated battery test equipment for R&D and production.

- Bio-Logic (Horiba-BioLogic) – French company offering electrochemical and battery testing instruments for laboratories.

- Keysight Technologies – Global provider of electronic design and test solutions, including advanced battery and EV test systems.

Recent Developments

- In May 2025, UL Solutions Inc. (NYSE: ULS) inaugurated its Europe Advanced Battery Testing Laboratory in Aachen, Germany. The facility is dedicated to testing batteries for electric vehicles and large-scale energy storage systems, significantly enhancing UL Solutions' testing capabilities and strengthening its presence in the European market.

- In June 2025, GÖPEL electronic introduced a modular high-voltage battery test bench specifically designed for safety and functional evaluation of EV battery packs. Engineered for automotive development and production environments, this system aims to support fast, efficient, and cost effective quality assurance of battery cells and packs.

- In September 2025, Battery OK Technologies launched EV DOCTOR AIR, the world's first subscription-based EV battery tester. This AI-powered solution delivers the fastest, most affordable, and universally compatible battery diagnostics for electric vehicles, establishing a new standard for battery health checks.

(Source: https://www.henkel.com)

(Source: https://group.mercedes-benz.com)

(Source: https://ir.ul.com)

(Source: https://chargedevs.com)

(Source: https://www.tribuneindia.com)

Segments Covered in the Report

By Test Type

- Performance / Electrical (capacity, energy, power, internal resistance, C-rate)

- Cycle Life / Durability (calendar life, cycle aging, capacity fade)

- Safety / Abuse (thermal runaway, overcharge/overdischarge, short circuit, mechanical abuse, nail penetration)

- Environmental / Climatic (temperature, humidity, salt spray, vibration, shock)

- Thermal / Thermal Management (thermal mapping, thermal runaway propagation, thermal soak/soak-back)

- Electrochemical Characterization (impedance spectroscopy, coulombic efficiency, half-cell tests)

- Charge/Discharge & Fast-Charging Tests

- Battery Management System (BMS) Validation & HIL (Hardware-in-the-Loop)

- Safety Certification & Regulatory Compliance Testing (UN 38.3, IEC 62660, ISO 26262 related checks)

By Test Stage

- R&D / Prototype Testing

- Validation / Type Approval Testing

- Pre-Production / Pilot Line Testing

- Production / End-of-Line (EOL) Testing

- Field / In-service Diagnostics & Warranty Testing

- End-of-Life / Second-Use / Recycling Qualification

By End-Use / Application

- Passenger EVs

- Commercial Vehicles (buses, trucks, delivery vans)

- Two-wheelers / E-bikes / Scooters

- Specialty Vehicles (off-road, mining, marine)

- Stationary Storage / V2G (if same packs reused)

By Vehicle Type / OEM Customer

- OEMs (Automakers)

- Tier-1 Suppliers

- Battery Manufacturers / Cell Makers

- Contract Manufacturers / EMS

- Independent Test Labs & Research Institutes

By Test Equipment / Solution Type

- Battery Test Systems / Cyclers (hardware)

- Environmental Chambers & Safety Rigs

- BMS Test HIL Systems & Emulators

- Thermal Imaging & Sensors

- Software (data acquisition, analytics, simulation & digital twins)

- Automated Handling & Robotic Test Cells

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting