Fibroblast Growth Factors (FGFs) Market Size and Forecast 2025 to 2034

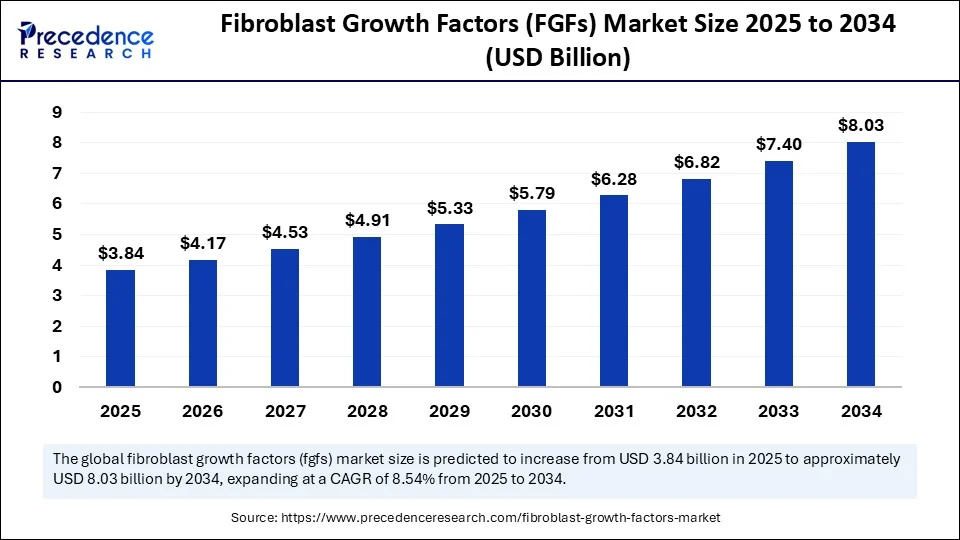

The global fibroblast growth factors (FGFs) market size accounted for USD 3.54 billion in 2024 and is predicted to increase from USD 3.84 billion in 2025 to approximately USD 8.03 billion by 2034, expanding at a CAGR of 8.54% from 2025 to 2034.The market is experiencing significant growth, driven by increasing research in regenerative medicine and tissue repair. This growth is further supported by expanding applications in wound healing, stem cell therapy, and cancer research. Additionally, advancements in biologics and an increase in clinical studies are anticipated to accelerate market expansion.

Fibroblast Growth Factors (FGFs) MarketKey Takeaways

- In terms of revenue, the global fibroblast growth factors (FGFs) market was valued at USD 3.54 billion in 2024.

- It is projected to reach USD 8.03 billion by 2034.

- The market is expected to grow at a CAGR of 8.54% from 2025 to 2034.

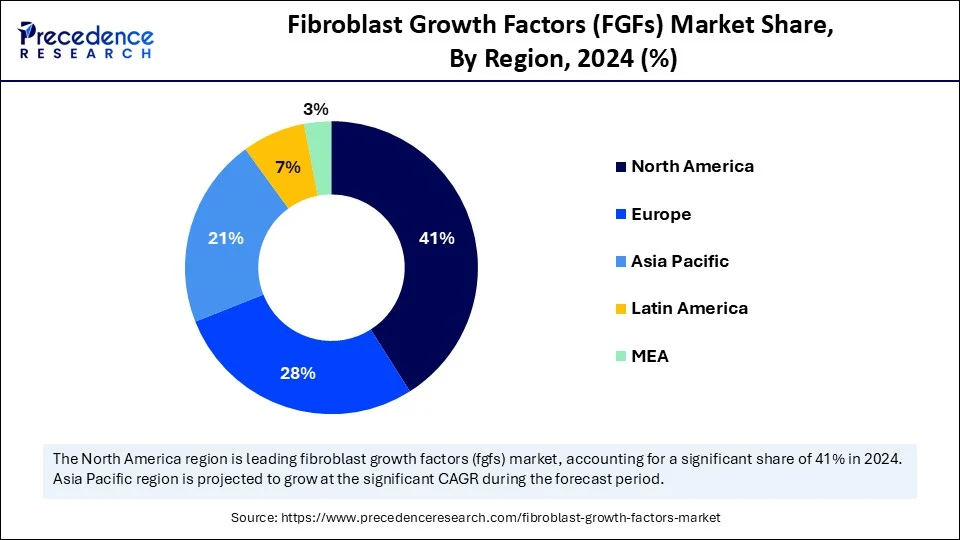

- North America dominated the global fibroblast growth factors (FGFs) market with the largest share of 41% in 2024.

- Asia Pacific is anticipated to grow at a significant CAGR from 2025 to 2034.

- By grade, the FGF type and derivatives segment led the market in 2024 and is expected to grow further in the coming years.

- By product format/grade, the research-grade (≥95% purity) segment captured the market biggest market share in 2024.

- By product format/grade, the GMP-grade and formulated clinical kits segment is expected to grow at a significant CAGR over the projected period.

- By application/therapeutic use case, the cell culture and research segment contributed the biggest market share of 30% in 2024.

- By application/therapeutic use case, the regenerative medicine and aesthetics segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By end-user/buyer, the pharmaceutical and biotech companies segment held the highest market share in 2024.

- By end-user/buyer, the contract development and manufacturing organizations (CDMOs) segment is expanding at a significant CAGR from 2025 to 2034.

- By business model/service offering, the off-the-shelf catalog products segment led the market in 2024.

- By business model/service offering, the custom-engineered FGF development segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By regulation/clinical stage, the preclinical use segment held the major market share in 2024.

- By regulation/clinical stage, the phase I/II clinical trials is projected to grow at a notable CAGR between 2025 and 2034.

How AI Can Impact the Fibroblast Growth Factors (FGFs) Market?

Artificial intelligence (AI) is transforming the fibroblast growth factors (FGFs) market, especially in drug discovery and development. AI algorithms analyze large datasets to accelerate the identification of drug candidates and optimize development processes, making research more efficient and cost-effective. AI tools can analyze complex biological data to discover new targets for FGF treatments and speed up repurposing existing drugs for FGF-related conditions. Generative AI can create synthetic datasets, enabling faster, more comprehensive testing of therapies without ethical or practical issues associated with human data. Overall, AI influences market growth.

U.S. Fibroblast Growth Factors (FGFs) Market Size and Growth 2025 to 2034

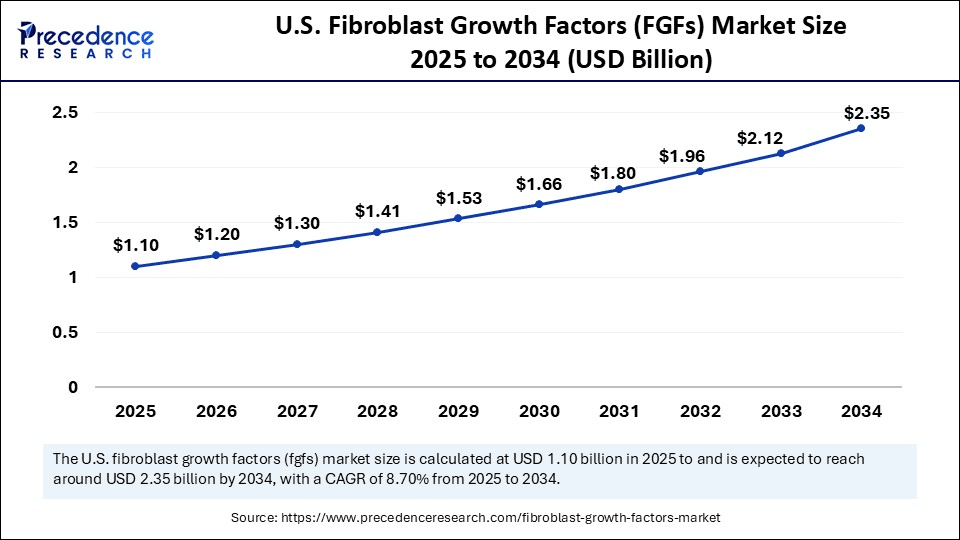

The U.S. fibroblast growth factors (FGFs) market size was exhibited at USD 1.02 billion in 2024 and is projected to be worth around USD 2.35 billion by 2034, growing at a CAGR of 8.70% from 2025 to 2034.

How did North America Dominate the Fibroblast Growth Factors (FGFs) Market in 2024?

North America dominates the Fibroblast Growth Factors (FGFs) market due to its robust healthcare infrastructure, a strong biotechnology sector, substantial investments in research and development, and the presence of leading pharmaceutical companies. The region's focus on personalized medicine and precision therapies, including the application of FGFs in regenerative medicine, along with the regulatory framework in the U.S., particularly facilitates the faster approval of novel biologics. This contributes to market expansion and a thriving biotechnology industry, with numerous companies dedicated to developing and commercializing FGF-based products. The presence of prominent key players like Thermo Fisher Scientific, PeproTech, R&D Systems, Abcam Limited, Cell Signaling Technology, Inc., and Novus Biologicals further contributes to this market growth.

The U.S. Fibroblast Growth Factors (FGFs) Market Trends

The U.S. is playing an evolving role in the global market, primarily due to the rising prevalence of carcinomas and a robust healthcare system that fosters research and development in regenerative medicine, wound healing, and cancer therapies. Leading U.S.-based pharmaceutical and biotechnology companies, such as Thermo Fisher Scientific, Sigma-Aldrich, and PeproTech, are driving innovation through advancements like smart delivery systems and synthetic FGF analogs, further contributing to market growth.

What Made Asia Pacific the Fastest-Growing Region in the Fibroblast Growth Factors (FGFs) Market in 2024?

Asia Pacific is expected to experience the fastest market growth, primarily due to rapid industrialization, a burgeoning middle class, and increased investment in emerging economies. Strong government support for research and development, particularly in countries like China, Japan, India, and South Korea, is driving this growth. The region is witnessing rising domestic demand and manufacturing capabilities, actively promoting advancements in biotechnology and pharmaceuticals, including FGF-related technologies. Additionally, the ongoing digital transformation is accelerating the adoption of new technologies and research methodologies involving FGFs. A growing middle class with increased purchasing power is further driving demand for healthcare services and advanced therapies related to FGFs.

India Fibroblast Growth Factors (FGFs) Market Trends

India holds a unique position in the global market, driven by its large and aging population and the increasing prevalence of lifestyle diseases. This creates a demand for treatments in areas such as wound healing, regenerative medicine, and oncology. Additionally, India's growing economy, focus on healthcare improvement, and rising awareness of advanced treatments present significant opportunities for the market's growth and advancement in the coming years.

Why was Europe Considered a Notable Region in the Fibroblast Growth Factors (FGFs) Market in 2024?

Europe is also experiencing noteworthy growth in the market in 2024, owing to strong regulatory support, increasing adoption in key sectors such as biotechnology and regenerative medicine, and advancements in related technologies. The European market is observing a surge in the utilization of FGFs, spurred by their potential to promote tissue repair and regeneration. Both the public and private sectors are fuelling innovation and market expansion, with green initiatives and strategic investments in research and development further benefiting the region.

How Will Latin America Surge in the Fibroblast Growth Factors (FGFs) Market?

Latin America is witnessing notable market growth in 2024, primarily due to improving healthcare infrastructure, rising disease prevalence, and increasing awareness of regenerative medicine solutions. However, the market faces challenges such as regulatory hurdles and limited reimbursement frameworks. To overcome these challenges, strategic partnerships and a focus on localizing products and services are essential. Latin American countries are investing in enhancing and expanding their healthcare infrastructure, leading to greater access to advanced therapies, including those involving FGFs, particularly in regenerative medicine and advanced therapies.

How Will the Middle East and Africa Emerge in the Fibroblast Growth Factors (FGFs) Market?

The Middle East and Africa is experiencing notable market growth due to increasing healthcare expenditures and the rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases. This growth drives the demand for advanced diagnostic and therapeutic solutions, along with expanding research and development activities. Governments in the region are investing more in healthcare infrastructure and services, including diagnostics and treatment options for chronic diseases, which fuels the demand for FGF-related products and technologies. The growing burden of chronic conditions is propelling the need for advanced diagnostic and therapeutic solutions, including FGF-based therapies for tissue regeneration, wound healing, and cancer treatment.

Market Overview

The fibroblast growth factors (FGFs) market consists of naturally occurring or recombinant proteins, such as FGF1, FGF2, FGF3, FGF7, FGF10, and others, along with their engineered derivatives. These are used to promote cell proliferation, angiogenesis, tissue regeneration, and wound healing. These growth factors are essential in research, drug development, regenerative therapies, and biomanufacturing, especially for applications like wound healing, oncology, dermatology, stem cell culture, and metabolic disorders. The market is driven by the diverse roles FGFs play in various biological processes and the increasing interest in their therapeutic potential for diseases related to development, tissue repair, metabolism, and neurological disorders.

What Are the Key Trends in the Fibroblast Growth Factors (FGFs) Market?

- Research and Development: Fibroblast Growth Factors (FGFs) are extensively used in research to investigate cellular processes, disease mechanisms, and potential therapeutic targets. They also play a crucial role in tissue engineering and stem cell research, contributing to market growth.

- Therapeutic Applications:FGFs are being studied for their potential in regenerative medicine, wound healing, and the treatment of various diseases. Ongoing research continues to reveal new applications for FGFs across different disease areas, prompting heightened interest and investment in this field.

- Aging-Related Diseases:Research indicates that FGFs play a role in age-related diseases, highlighting their potential for therapeutic interventions. The increasing prevalence of diabetes, obesity, and cardiovascular diseases is driving the demand for FGF-based therapies.

- Technological Advancements:Progress in recombinant protein production and drug delivery systems is making FGFs more accessible and effective as therapeutics. Additionally, FGFs and their receptors are being explored as biomarkers for disease diagnosis and prognosis.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.03 Billion |

| Market Size in 2025 | USD 3.84 Billion |

| Market Size in 2024 | USD 3.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | FGF Type and Derivatives, Product Format/Grade, Application/Therapeutic Use Case, Business Model/Service Offering, End-User/Buyer, Regulation/Clinical Stage, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Regenerative Medicine and Wound Healing Therapies

The primary driver of the fibroblast growth factors (FGFs) market is the rising demand for regenerative medicine and wound healing therapies. This demand is further fueled by a rise in chronic diseases, an aging population, and advancements in biotechnology. FGFs are key to tissue repair and regeneration, making them vital for therapies targeting chronic wounds, burns, and musculoskeletal injuries. Additionally, the growing prevalence of diseases like diabetes and cardiovascular conditions, which can cause chronic wounds and other complications, contributes to the demand for FGF-based treatments. Innovations in drug delivery and protein engineering are enhancing the efficacy and safety of FGF therapies, further boosting market growth.

Restraint

High Cost and Complexity

The main challenge in the fibroblast growth factors (FGFs) market is the high cost and complexity involved in their development and production, coupled with lengthy regulatory approval processes, especially for therapeutic uses that require substantial financial investment. Developing FGF-based therapies involves intricate processes that are costly and time-consuming. Concerns about the long-term safety and effectiveness of these therapies can also delay or hinder approval. Producing FGFs in a scalable, cost-effective way is difficult, which adds to the overall cost and complexity, potentially discouraging investment in FGF research and development.

Opportunity

Expanding FGF-Based Therapies Beyond Traditional Uses

A key future opportunity in the fibroblast growth factors (FGFs) market is expanding FGF-based therapies beyond traditional uses, particularly into areas such as oncology, metabolic disease treatment, and regenerative medicine. This includes exploring new FGF-related drug targets and creating combination therapies with other treatments. FGFs are showing promise beyond wound healing and tissue repair, with research indicating potential in fighting cancers and metabolic disorders. Developments like stabilized FGF variants, long-acting injectables, and biomaterial-scaffold conjugates are broadening FGF applications. Integrating FGF therapies with other treatment modalities is gaining momentum as a personalized approach to cancer and other diseases.

FGF Type and Derivatives Insights

What Made the Native Isoforms Dominate the Fibroblast Growth Factors (FGFs) Market in 2024?

The FGF1 and FGF2 sub-segment of the native isoforms segment dominated the market in 2024. This dominance is mainly due to their overlapping functions, which have long been recognized for their potent effects on cell growth, angiogenesis, and tissue repair, crucial for wound healing and tissue regeneration. Their early discovery and well-established role in various biological processes contribute to their market strength. While other FGFs have specific functions, the combined ability of FGF1 and FGF2 to promote cell growth and blood vessel formation has made them central to research and therapeutic development.

The FGF3, FGF10, and FGF21 sub-segment of the native isoforms segment is anticipated to have the fastest growth. This growth is driven by their diverse roles in biological processes and disease treatment. FGF21 is of particular interest due to its potential in managing metabolic and cardiovascular conditions. FGF10 is essential in lung development and morphogenesis, relevant for lung regeneration and respiratory disorders. These FGFs are involved in many cellular functions like growth, differentiation, migration, and survival. They interact with different FGFRs and co-factors such as α-klotho and β-klotho, leading to specific cellular responses. This specificity enables targeted therapies with potentially fewer side effects.

Product Format/Grade Insights

How did the Research-Grade (≥95% Purity) Segment Lead the Fibroblast Growth Factors (FGFs) Market in 2024?

The research-grade (≥95% purity) segment led the market in 2024. This is mainly because of the strict requirements in research areas like regenerative medicine, cancer, and drug discovery. High-purity FGFs produce more reliable, consistent results, which are crucial for advancing scientific knowledge and developing new therapies. FGFs and their receptors (FGFRs) are involved in many cancers, and targeting FGFRs with inhibitors is a promising treatment strategy. FGFs with ≥95% purity meet strict standards, ensuring the validity of research findings. High-purity FGFs are vital for in vitro and in vivo studies aimed at identifying potential drugs and understanding their mechanisms, avoiding off-target effects, and ensuring precise targeting.

The GMP-grade and formulated clinical kits segment is experiencing the fastest growth, driven mainly by the rising demand for these growth factors in regenerative medicine and new therapy development. GMP-grade FGFs are produced under stringent quality controls, making them suitable for human use in clinical trials. FGFs are being explored for their potential to treat diseases like diabetes, cardiovascular conditions, and skeletal disorders, which further fuels demand. The focus on high-quality, clinically applicable FGFs is essential for regulatory approval and widespread adoption, making them valuable in regenerative medicine.

Application/Therapeutic Use Case Insights

Why did the Cell Culture and Research Segment Lead the Fibroblast Growth Factors (FGFs) Market in 2024?

The cell culture and research segment led the market in 2024. This is largely due to the essential role that FGFs (fibroblast growth factors) play in fundamental biological processes such as cell growth, differentiation, and tissue repair, which are widely studied in research settings. FGFs are crucial for maintaining cell cultures, allowing researchers to explore their functions and develop potential therapies. They are applied across various research areas, including drug development, cancer research, diagnostics, gene therapy, and stem cell research. Consequently, the cell culture market, which significantly relies on FGFs, is experiencing rapid growth, particularly within the pharmaceutical and biotechnology industries.

The regenerative medicine and aesthetics segment is expected to experience the fastest growth in the market. This increase can be attributed to its capacity to promote tissue regeneration and repair, which is highly desirable in aesthetic procedures. FGFs, especially basic FGF (bFGF), are vital for wound healing, angiogenesis, and collagen synthesis, all essential components for skin rejuvenation and repair. Regenerative approaches often utilize minimally invasive techniques, which attract individuals seeking aesthetic improvements with reduced downtime and less scarring, enhancing their value for anti-aging treatments. They address a range of aesthetic concerns, including wrinkles, scars, and skin damage from aging or sun exposure.

End-User/Buyer Insights

How did Pharmaceutical and Biotech Companies' Segment Become Dominant in the Fibroblast Growth Factors (FGFs) Market in 2024?

The pharmaceutical and biotech companies segment dominated the market in 2024. This dominance stems from the significant role FGFs play in various biological processes relevant to drug development, particularly in regenerative medicine, cancer research, wound healing, and preclinical/clinical development. The pharmaceutical industry invests heavily in preclinical and clinical development to assess the safety and efficacy of potential FGF-based drugs. This process includes evaluating the effects of FGFs on different cell types, such as fibroblasts, endothelial cells, and stem cells, in both in vitro and in vivo models. Numerous advancements and collaborations emphasize this trend, focusing on FGF-based therapies for conditions like cancer and cardiovascular diseases.

The contract development and manufacturing organizations (CDMOs/CMOs) segment is the fastest-growing in the market. This growth is primarily due to cost-effectiveness, specialized expertise, and quicker time-to-market. CDMOs provide cost-efficient solutions for pharmaceutical and biotech companies that are increasingly outsourcing their development and manufacturing to CDMOs, thus reducing operational costs. These organizations possess specialized knowledge in areas such as biologics, gene therapies, and personalized medicine, which are critical for FGF development. Furthermore, CDMOs can hasten the development timeline and assist in global market entry, due to their established supply chains and regulatory expertise.

Business Model/Service Offering Insights

How did the Off-The-Shelf Catalog Products Segment Lead the Fibroblast Growth Factors (FGFs) Market in 2024?

The off-the-shelf catalog products segment led the market in 2024. This predominance is attributed to the accessibility, convenience, and cost-effectiveness of these products compared to custom or research-specific reagents. The high demand for FGFs in research and development drives this trend, as reagents are manufactured, ensuring lot-to-lot consistency and simplifying the experimental process for researchers. In-house or commissioning custom synthesis can be both expensive and time-consuming. These reagents provide a more affordable option, especially for research labs with limited budgets, and standardized reagents contribute to the reproducibility of research findings, which is vital for scientific advancement.

The custom-engineered FGF development segment is expected to experience rapid growth, driven by the increasing demand for personalized therapies and targeted drug delivery. Custom-engineered FGFs enable the development of therapies tailored to specific patient needs, optimizing treatment outcomes and minimizing side effects. By modifying FGFs, researchers can enhance their delivery to target tissues and cells, improving therapeutic efficacy and accelerating healing processes in wound healing and bone regeneration. This growth is further propelled by advancements in understanding FGF signaling pathways, critical for various biological processes, including cell growth, tissue repair, and angiogenesis.

Fibroblast Growth Factors (FGFs) Market Companies

- Thermo Fisher Scientific

- PeproTech

- R&D Systems (Bio-Techne)

- Merck KGaA (Sigma-Aldrich)

- Abcam

- Cell Signaling Technology

- GenScript Biotech

- Lonza Group

- Miltenyi Biotec

- FUJIFILM Wako Pure Chemical

- 89bio Inc.

- Akero Therapeutics

- MedChemExpress

- Proteintech Group

- Novartis (FGF-targeted oncology pipelines)

- Bristol-Myers Squibb (FGF-linked therapies)

- Elabscience Biotech

- ACROBiosystems

- Genscript's custom CDMO FGF services

- Stem-cell culture suppliers integrating FGFs (e.g., STEMCELL Technologies)

Leaders' Announcements

- In February 2024, HUTCHMED announced that Inmagene Biopharmaceuticals licensed two drug candidates for immunological diseases, enabling their further development, manufacture, and worldwide commercialization. HUTCHMED's CEO, Dr. Weiguo Su, highlighted this as validation of their research and development efforts and a testament to their collaborative approach in advancing innovative drug candidates.(Source: https://www.hutch-med.com)

- In September 2023, Kriya Therapeutics acquired Tramontane Therapeutics, gaining a portfolio of Fibroblast Growth Factor 21 (FGF21) assets aimed at treating metabolic and neurodegenerative diseases. Kriya views the one-time adeno-associated virus (AAV) gene therapy for FGF21 as a promising treatment approach for non-alcoholic steatohepatitis (NASH), demonstrating strong efficacy in animal models, including a single-dose gene therapy candidate for insulin.

(Source: https://kriyatherapeutics.com)

Recent Developments

- In November 2024, Eisai Co., Ltd. launched TASFYGO Tablets 35 mg (tasurgratinib succinate) in Japan for patients with unresectable biliary tract cancer possessing FGFR2 gene fusions who have progressed after chemotherapy. TASFYGO is an orally available tyrosine kinase inhibitor that selectively targets FGFR1, FGFR2, and FGFR3. A companion diagnostic test, the AmoyDx FGFR2 Break-apart FISH Probe Kit, was approved in August 2024.(Source: https://www.eisai.com)

- In August 2024, Taiho Oncology Europe GmbH introduced Lytgobi (futibatinib) in France for adult patients with locally advanced or metastatic cholangiocarcinoma with FGFR2 fusions who have not responded to previous therapies. Dr. Antoine Hollebecque described it as a meaningful advancement in treating this difficult condition, as the medication targets one of the most common underlying genomic alterations observed in cholangiocarcinoma. (Source:https://taiho-europe-website.s3.eu-central-1.amazonaws.com)

Segments Covered in the Report

By FGF Type and Derivatives

- Native isoforms

- FGFGF1 and FGF2

- FGF3, FGF10 and FGF21

- Others

- Engineered Growth Factors

- Fusion Proteins for half-life extension

- Biosynthetic or synthetic FGF

By Product Format/Grade

- Research-grade (≥95% purity)

- GMP-grade and Formulated Clinical Kits

- GMP-plus/Clinical manufacturing grade

- Bioprocess reagents

By Application/Therapeutic Use Case

- Regenerative Medicine/Aesthetics

- Dermatology/Aesthetics

- Orthopedics/Bone Repair

- Cardiovascular

- Metabolic and Liver Disease

- Oncology

- Cell Culture and ResearchOrphan Diseases and Rare Tissue Disorders: tissue-targeted FGF therapies

By End-User/Buyer

- Pharma and Biotech companies

- Bioprocessing firms

- Academic and Contract Research Organizations (CROs)

- Contract Development and Manufacturing Organizations (CDMOs)

- Aesthetic/Regenerative Clinics (commercial therapies)

By Business Model/Service Offering

- Off-the-shelf catalog products

- Custom protein/variant development (CDMO services)

- Custom-engineered FGF development

- Formulated products

By Regulation/Clinical Stage

Preclinical Use

Phase I/II Clinical Trials

Advanced Clinical Trial/Marketed Use

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting