Gate Driver IC Market Size and Forecast 2025 to 2034

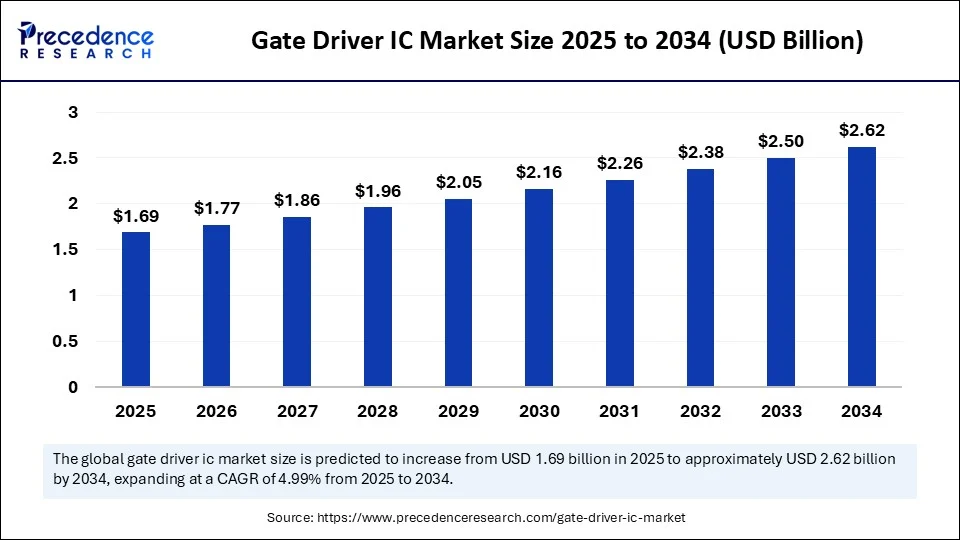

The global gate driver IC market size accounted for USD 1.61 billion in 2024 and is predicted to increase from USD 1.69 billion in 2025 to approximately USD 2.62 billion by 2034, expanding at a CAGR of 4.99% from 2025 to 2034.The market growth is attributed to increasing adoption of wide bandgap semiconductors and rising demand for efficient power management in electric vehicles, industrial automation, and renewable energy systems.

Gate Driver IC MarketKey Takeaways

- In terms of revenue, the global gate driver IC market was valued at USD 1.61 billion in 2024.

- It is projected to reach USD 2.62 billion by 2034.

- The market is expected to grow at a CAGR of 4.99% from 2025 to 2034.

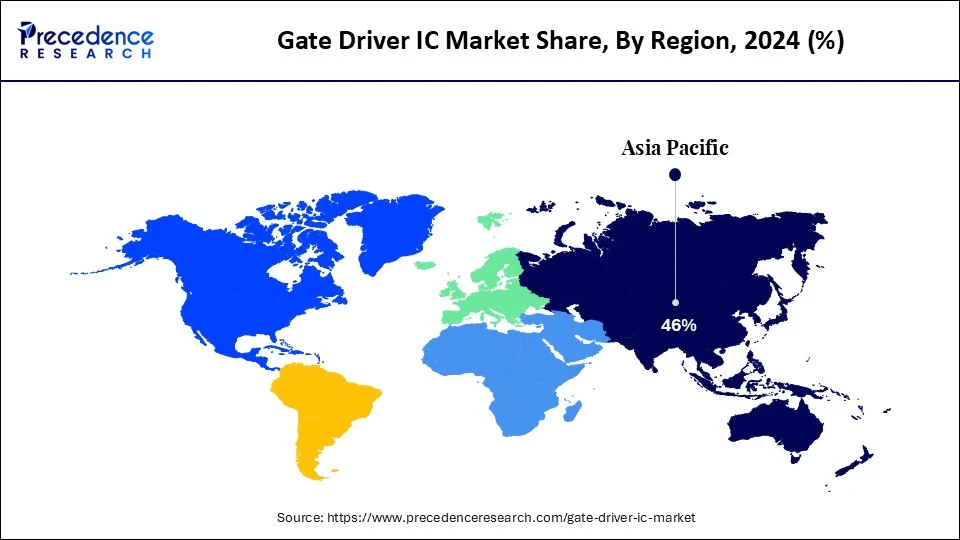

- Asia Pacific dominated the gate driver IC market with the largest market share of 46% in 2024.

- By transistor type, the MOSFET gate driver ICs segment held a major market share of 42% in 2024.

- By transistor type, the GaN gate drivers ICs segment is projected to grow at the highest CAGR between 2025 and 2034.

- By gate driver type, the half-bride gate drivers segment contributed the biggest market share of 35% in 2024.

- By gate driver type, the three-phase gate drivers segment is expanding at a significant CAGR between 2025 and 2034.

- By isolation type, the isolated gate driver ICs segment captured the highest market share of 61% in 2024.

- By semiconductor material, the silicon segment captured the largest market share of 64% in 2024.

- By semiconductor material, the gallium nitride (GaN) segment is expected to grow at a notable CAGR from 2025 to 2034.

- By application, the motor drivers segment held the remarkable market share of 28% share in 2024.

- By application, electric vehicles and charging infrastructure segment is expected to grow at a notable CAGR from 2025 to 2034.

- By end use industry, the industrial segment held the major market share of 33% in 2024.

- By end use industry, the automotive segment is projected to grow at the fastest CAGR between 2025 and 2034.

- By channel type, the dual channel segment accounted for significant market share of 41% share in 2024.

- By channel type, the multi-channel segment is expected to grow at a significant CAGR over the projected period.

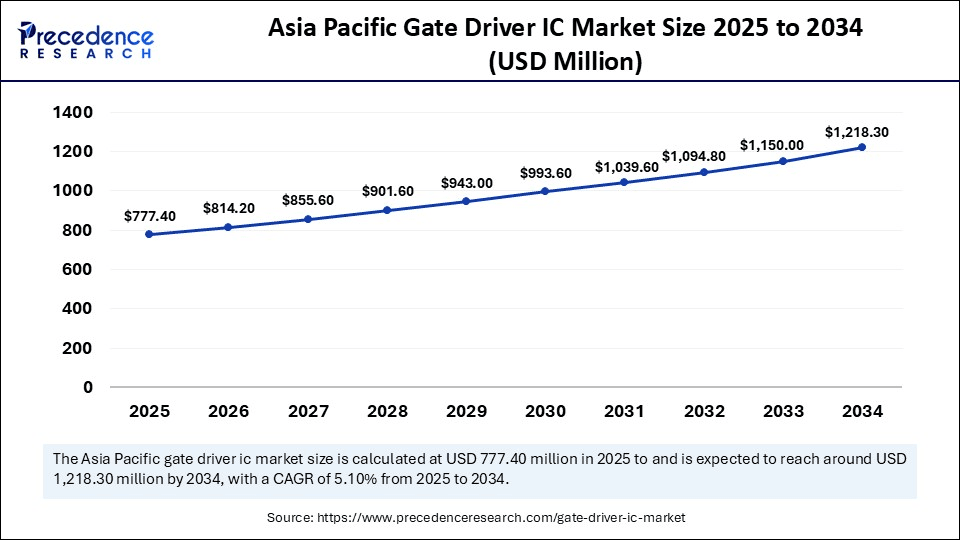

Asia Pacific Gate Driver IC Market Size and Growth 2025 to 2034

The Asia Pacific gate driver IC market size was exhibited at USD 740.60 million in 2024 and is projected to be worth around USD 1,218.30 million by 2034, growing at a CAGR of 5.10% from 2025 to 2034.

What Made Asia Pacific the Dominant Region in the Gate Driver IC Market in 2024?

Asia Pacific dominated the market in 2024 and is expected to sustain its position in the coming years. This is mainly due to the strong manufacturing ecosystems in China, Taiwan, Japan, and South Korea, whose strengths particularly focus on the industrial automation, consumer electronics, and electric mobility sectors. Government investments in high-voltage power electronics and localised semiconductor fabrication capability further increased regional demand. Large-scale manufacturers in the region have expanded their footprints, increasing the use of SiC- and GaN-based devices.

The increased adoption of smart industrial equipment and next-generation HVAC systems also led to an increased need for gate driver integration in 2024, in response to the smart factory adoption initiatives that took place in Japan. The adoption of ICs capable of driving gates is expected to rise within traction inverters, wireless charging modules, and intelligent edge computing systems. KSIA reported that gate driver tape-outs this year reached a record, mostly in high-efficiency switch-mode power supplies and solar inverters. In 2024, the IESA said that local gate driver assembly production had exploded as part of the Make in India and EV-specific production-linked incentive (PLI) schemes. Furthermore, the 5G infrastructure and smart grids powered by portfolios of AI-enabled applications provided a new field of service to gate drivers, thus further boosting the market in this region.

Market Overview

Gate driver ICs (Integrated Circuits) are power electronics components that serve as interfaces between control logic (such as microcontrollers or PWM circuits) and high-power switching devices like MOSFETs or IGBTs. These ICs provide the necessary voltage and current levels to turn these transistors on and off efficiently. Gate driver ICs are crucial in high-speed switching applications such as power supplies, motor drives, inverters, and emerging electric vehicle (EV) systems, enabling precise control, protection features, and enhanced power efficiency.

The increased demand for high-efficiency power conversion systems in electric vehicles, renewable energy, and industrial automation drives the demand for gate driver ICs. They supply the required voltages and current, suppressing the power switches to sustain fast switching speeds, while also providing isolation and protection capabilities to ensure system reliability. The International Energy Agency (IEA) estimates that EV sales topped 14 million vehicles in 2023 and are continuing to increase demand for power-efficient electronics, including gate drivers. Furthermore, the market is likely to be favored by the growing investment in industrial digitalization, facilitated by standards established by global organizations such as IEEE and IEC. (Source:https://www.iea.org)

Impact of Artificial Intelligence on the Gate Driver IC Market

Artificial intelligence (AI) has a significant impact on the gate driver IC market by simplifying the design process and offering high performance and next-generation power electronics applications. Major semiconductor companies utilize AI-driven design automation tools to achieve faster development of gate driver ICs. This advanced technology also enables more precise control over the switching behavior, thermal characteristics, and efficiency of high-voltage systems. Furthermore, the AI enables the engineers to perform simulated optimization on challenging circuit topologies in reduced cycles, decrease design mistakes, and accelerate product release.

Gate Driver IC Market Growth Factors

- Rising Demand for Compact Power Electronics: Growing miniaturization trends in consumer and automotive electronics are fuelling the integration of smaller, high-efficiency gate drivers.

- Boosting the Adoption of GaN and SiC Devices: The increased design migration toward wide-bandgap semiconductors is driving demand for high-performance gate driver ICs across high-voltage applications.

- Growing Emphasis on EV Fast-Charging Infrastructure: The global rollout of high-speed EV chargers is driving the deployment of gate drivers in power conversion and thermal control systems.

- Expanding Deployment of Industrial Robotics: Rising automation in manufacturing is boosting the need for gate drivers in servo drives, motor controllers, and PLCs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.62 Billion |

| Market Size in 2025 | USD 1.69 Billion |

| Market Size in 2024 | USD 1.61 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.99% |

| Dominating Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Transistor Type,Gate Driver Type, Semiconductor Material, Application, End Use Industry, Channel Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is the Increasing Adoption of Electric Vehicles Driving the Growth of the Gate Driver IC Market?

The increasing adoption of electric vehicles (EVs) is expected to drive demand for gate driver ICs. The use of EV powertrains prompts the need for efficient and reliable power conversion systems to handle the high-voltage work of batteries. Gate driver ICs enable the accurate control of power semiconductor components, such as IGBTs or SiC MOSFETs, which are crucial for the efficient transfer of energy in traction inverters, onboard chargers, and battery management systems. With OEMs now attempting to make EVs lighter, more energy-efficient, and faster-charging, designers are incorporating high-power, high-frequency advanced gate drivers to maintain stable high-frequency switching and provide thermal protection.

On January 28, 2025, Infineon Technologies AG introduced new isolated gate driver ICs to enhance its EiceDRIVER family, specifically designed for electric vehicles. These devices support both the latest IGBT and SiC technologies and are compatible with Infineon's new HybridPACK Drive G2 Fusion module the first plug-and-play power module that combines both silicon and silicon carbide (SiC) devices. The third-generation pre-configured EiceDRIVER ICs, 1EDI302xAS (for IGBT) and 1EDI303xAS (for SiC/Fusion), meet AEC standards and are ISO 26262-compliant, making them well-suited for traction inverters in affordable, high-performance xEV systems.

This movement corresponds to the strong emissions standards, electrification ambitions in North America, Europe, and the Asia-Pacific. The Semiconductor Industry Association (SIA) predicts that demand will continue to drive growth at the high-performance semiconductor component level. Furthermore, the growing demand for consumer electronics is expected to drive the adoption of compact gate driver ICs in various end devices. (Source: https://powerelectronicsworld.net)

Restraint

Integration Challenges in High-Power Applications

Complex integration requirements in high-power applications are expected to hinder the market. The integration of gate driver ICs in high-voltage systems, such as electric vehicle inverters and industrial motor drives, may require precise electrical and thermal coordination. The engineers need to meticulously pair the IC using the features specific to wide-bandgap semiconductors, such as SiC or GaN, and this complication makes the design more challenging and prolongs the development period. Furthermore, the high cost associated with wide bandgap-compatible gate drivers further hampers the market in the coming years.

Opportunity

Rising Adoption of Wide Bandgap Semiconductors

The rising adoption of wide-bandgap semiconductors is likely to create immense opportunities for players competing in the market. The extensive use of wide-bandgap semiconductors is poised to transform the technological landscape of gate driver ICs. Silicon carbide (SiC) and gallium nitride (GaN) devices require customized gate drivers that accommodate higher switching rates, improved voltages, and more rapid transient behaviors.

In January 2024, Wolfspeed, Inc., a global leader in silicon carbide technology, announced the expansion of its long-term silicon carbide wafer supply agreement with a major international semiconductor manufacturer. The updated deal, now valued at approximately $275 million, includes the supply of 150mm silicon carbide bare and epitaxial wafers. This agreement strengthens the shared commitment of both companies to accelerate the industry's shift from traditional silicon to silicon carbide-based power semiconductor devices.

Along with electric vehicles, fast-charging stations, and high-power servers, manufacturers are developing tailor-made gate driver solutions that cater to the dynamic needs of WBG devices. The increasing commercial feasibility of SiC and GaN chips is driving research and development in gate driver architectures with low propagation delay and enhanced protection and EMI characteristics. Furthermore, the growing investment in industrial automation is anticipated to support robust growth for gate driver ICs.(Source: https://www.jedec.org)

Transistor Type Insights

Why Did the MOSFET-Based Gate Driver ICs Segment Lead the Market in 2024?

The MOSFET gate driver ICs segment dominated the gate driver IC market, accounting for an estimated 42% share in 2024, due to their wide application in medium-power uses, including industrial automation, power adapters, LED drivers, and consumer electronic products. The prices of MOSFET gate drivers were cost-effective, switching performance was excellent, and they met the requirements of mature silicon systems, thereby making them favorites among designers. The advantages of MOSFET-based solutions motivated manufacturers to focus on these solutions as well.

Texas Instruments, onsemi, and STMicroelectronics have launched extensive lineups of MOSFET drivers to target high-efficiency, low-voltage designs in both commercial and residential applications. They were conferred with dependable thermal characteristics and well-proven design libraries. Thus, they were favored by OEMs that had to operate within strict manufacturing schedules. Furthermore, the Semiconductor Industry Association (SIA) reported stable growth in demand for low-voltage industrial systems in 2024, reaffirming the necessity of applying proven MOSFET-based gate drivers in the coming years.

The GaN gate driver ICs segment is expected to grow at the fastest CAGR in the coming years, as they are more advanced in terms of switching and are better suited for high frequencies and compact power systems. They have found increased application in fast-charging adapters, onboard chargers in electric vehicles, and high-density data center power supply systems. Furthermore, the GaN gate drivers are a very interesting alternative in next-generation power designs, further facilitating their demand in the coming years.

Gate Driver Type Insights

What Made Half-Bridge Gate Drivers the Dominant Segment in the Gate Driver IC Market in 2024?

The half-bridge gate drivers segment dominated the market with the largest revenue share in 2024. This is mainly due to their small architecture, and the effective management of high-side and low-side transistors allowed designers to adopt cost-effective circuit design layouts. Furthermore, manufacturers such as Texas Instruments, ROHM Semiconductor, and STMicroelectronics are increasing the production of half-bridge drivers to meet the rising demand.

The three-phase gate drivers segment is expected to grow at the fastest rate in the upcoming period, due to the increasing need for these drivers in powering high-efficiency and multi-phase motor control systems. They are being used commonly in electric vehicle traction inverters, industrial robotics, and HVAC systems. Three-phase synchronous operation achieves smoother control and lower energy loss.

In October 2024, Infineon Technologies AG introduced the new MOTIX TLE9189 gate driver IC, specifically designed for safety-critical applications involving 12V brushless DC (BLDC) motors. This advanced three-phase gate driver addresses the increasing demand for high-reliability motor control ICs in modern by-wire systems. Engineered for precise, efficient, and secure motor operation, the TLE9189 supports a wide range of automotive functions where safety and performance are paramount, marking a strategic addition to Infineon's expanding portfolio of intelligent motor control solutions.

These drivers are suitable for compact and smart power-control applications, as they offer enhanced thermal performance accompanied by feature support for integrated fault protection capability. Moreover, the use of three-phase control architectures in smart motor-driven systems is increasingly common, and it is predicted that electrification will further boost the segment's growth.(Source: https://www.infineon.com)

Isolation Type Insights

How Does the Isolated Gate Driver ICs Segment Dominate the Gate Driver IC Market in 2024?

The isolated gate driver ICs segment dominated the market, holding about 61% share in 2024, and is expected to sustain its position in the coming years. This is primarily due to their crucial role in high-voltage applications across the automotive, industrial, and renewable energy sectors. The drivers provide a crucial galvanic isolation between the control circuitry and power stages, safely isolating the operators. Their application in traction inverters, solar inverters, and motor drives strengthened their popularity, especially as applications shifted to higher power densities.

These ICs address the rigorous safety and performance requirements in designs utilizing wide-bandgap materials, such as SiC and GaN, which necessitate fast switching and high dv/dt, generating challenging electrical conditions. Companies are presenting new isolated gate drivers with strengthened isolation capabilities and diagnostics to automotive EV systems. Additionally, the growing global interest in the standards of functional safety for electric mobility and industrial control systems further fuels the segment in the coming years.

Semiconductor Material Insights

Why Did the Silicon Segment Maintain Market Leadership in 2024?

The silicon segment held the largest revenue share in the gate driver IC market in 2024. The dominance of silicon stems from its widespread use in legacy systems, low- to medium-voltage systems, and cost-sensitive industrial systems. Silicon gate drivers have the advantage of established manufacturing capabilities and high reliability in consumer electronics, motor drives, and general-purpose inverters. Furthermore, silicon-based solutions remained the preferred alternative in low-end, non-critical power applications due to their reliability, thereby further driving the segment.

The gallium nitride (GaN) segment is expected to grow at the fastest CAGR in the coming years, as it has the performance benefits of high-frequency, high-efficiency power electronics. GaN gate drivers are expected to capture significant momentum in the fields of fast-charging electric vehicles, powertrain systems, 5G base stations, and data center power supply. Additionally, the global drive toward energy efficiency has further facilitated the adoption of GaN technology, advancing rapidly on compact and high-efficiency platforms.

Application Insights

Why Did the Motor Drivers Segment Account for the Largest Revenue Share in the Gate Driver IC Market in 2024?

The motor drivers segment dominated the gate driver IC market in 2024, accounting for about 28% market share. This is primarily due to the high use of motor drivers in industrial automation, the HVAC system, robotics, and home appliances. Leading chipmakers expanded their lineups of motor-control-related drivers in 2024, incorporating built-in protection options and enhanced switching characteristics. Furthermore, the smart motor control, which helps meet energy reduction goals, particularly in industrial pump and compressor activities, further boosts segment growth.

The electric vehicles & charging infrastructure segment is expected to grow at the fastest CAGR in the coming years, owing to the shift toward sustainable mobility and decarbonization. Gate driver ICs are expected to continue gaining high traction in EV onboard chargers, traction inverters, and fast-charging systems, where switching speed, noise immunity, and thermal reliability are of great concern.

Onsemi, ROHM Semiconductor, and STMicroelectronics all announced advanced gate drivers in 2024 aimed at next-gen EV platforms using high-voltage SiC and GaN transistors. IEA reports that electric car sales reached 17 million in 2024, an increase of over 25%, equal to 3.5 million more cars than in 2023. The increase in EV manufacturing around the world and the intensive deployment of rapid chargers are among the factors that lead to the high gate driver usage. Furthermore, the higher demand for high-efficiency powertrain systems further creates a growing demand for gate driver IC technology.

End Use Industry Insights

What Made Industrial the Dominant Segment in the Gate Driver IC Market in 2024?

The industrial segment dominated the market, holding the largest revenue share of approximately 33% in 2024. These ICs are critical in high-reliability motor control, inverters, and power management systems used on factory floors and in process plants, as well as in energy systems. Furthermore, the technological developments in Industrial 4.0, as of 2024, have enhanced the embedded integration of precision gate drivers in edge-based industrial control systems.

The automotive segment is expected to grow at the fastest CAGR in the coming years. It is expected that gate driver ICs will become central in controlling the fast switching and thermal aspects of automotive inverters, on-board chargers, DC-DC converters, and battery management systems. Gate drivers that support both SiC and GaN power devices in the framework of EVs, and ISO 26262 certified, have been introduced by companies such as STMicroelectronics, ROHM Semiconductor, and Renesas Electronics. Moreover, the European Semiconductor Industry Association (ESIA) and China Semiconductor Industry Association (CSIA) gate driver demand from EV and hybrid OEMs increased dramatically, thus facilitating the segment's growth.

Channel Type Insights

How Does the Dual Channel Segment Lead the Market in 2024?

The dual-channel segment dominated the gate driver IC market, accounting for an estimated 41% share in 2024, primarily due to the growing popularity of power management systems, motor control units, and industrial automation equipment, as well as the increasing integration of dual-channel gate drivers. Dual-channel solutions offer an optimal balance of control, size, and thermal efficiency, suitable for use in both isolated and non-isolated environments across the industrial drive, consumer electronics, and energy sectors. Additionally, the retrofitting of traditional motor controllers and UPS systems in the Asia-Pacific continued to justify the prolonged demand for dual-channel ICs.

The multi-channel segment is expected to grow at the fastest CAGR in the coming years, owing to the increased complexity of the systems and scalable power management of electric cars (EVs), data centres, and renewable energy systems. Multi-channel gate drivers facilitate older high-density integration, enabling savings in on-board space and power density, while also simplifying PCB layout. Furthermore, the use of modular UPS systems and smart grid converters installed in 2024 led to an even more widespread adoption of multi-channel designs, thereby fueling the segment.

Gate Driver IC Market Companies

- Analog Devices, Inc.

- Broadcom Inc.

- Dialog Semiconductor (acquired by Renesas)

- Diodes Incorporated

- Infineon Technologies

- MACOM Technology Solutions

- Maxim Integrated (now part of Analog Devices)

- Microchip Technology Inc.

- Monolithic Power Systems (MPS)

- NXP Semiconductors

- ON Semiconductor (onsemi)

- Power Integrations

- Renesas Electronics Corporation

- ROHM Semiconductor

- Semtech Corporation

- Skyworks Solutions

- STMicroelectronics

- Texas Instruments

- Toshiba Electronic Devices & Storage Corporation

- Vishay Intertechnology

Recent Developments

- In September 2024, Toshiba Electronic Devices & Storage Corporation ("Toshiba") has begun supplying engineering samples of its "TB9103FTG" gate driver IC, intended for automotive brushed DC motors such as latch motors[2] and lock motors[3] used in power backdoors and sliding doors, along with drive motors in power windows and seats. As formerly manual automotive components become increasingly electrified, demand for electric motors and their integration into vehicles continues to grow. This trend also leads to a higher number of drivers per motor, increasing the need for downsized and integrated systems. Certain motor applications don't require speed control, creating a market for drivers with simpler functionality and performance.(Source:https://www.businesswire.com)

- In January 20\25, Infineon Technologies AG launched new isolated gate driver ICs to strengthen its EiceDRIVER family, tailored for electric vehicles. These devices support both the latest IGBT and SiC technologies and are compatible with Infineon's new HybridPACK™ Drive G2 Fusion module, the first plug-and-play power module combining both silicon and silicon carbide (SiC) devices. The third-generation pre-configured EiceDRIVER ICs, 1EDI302xAS (for IGBT) and 1EDI303xAS (for SiC/Fusion), meet AEC standards and are ISO 26262-compliant, making them well-suited for traction inverters in affordable, high-performance xEV systems. (Source: https://www.infineon.com)

- In November 2024, Nexperia unveiled a new series of high-efficiency gate driver ICs, optimized for controlling both high-side and low-side N-channel MOSFETs in synchronous buck or half-bridge setups. These ICs offer high output current and superior dynamic response, improving both efficiency and system durability. The automotive-grade NGD4300-Q100 suits applications like electronic power steering and power converters, while the NGD4300 targets DC-DC converters in servers, consumer electronics, and telecom infrastructure, as well as micro-inverters for a range of industrial uses.(Source:https://www.nexperia.com)

Latest Announcement by Industry Leader

- In June 2025, ROHM introduced a gate driver IC tailored for high-voltage GaN applications. The new driver, BM6GD11BFJ-LB, enhances miniaturization and efficiency in high-current systems by supporting stable operation during high-frequency, high-speed switching when used with GaN devices. ROHM Semiconductor, headquartered in Japan, has announced the development of the BM6GD11BFJ-LB, an isolated gate driver IC engineered for 600V-class high-voltage GaN HEMTs. “The BM6GD11BFJ-LB leverages proprietary on-chip isolation technology to reduce parasitic capacitance, enabling operation at frequencies up to 2MHz,” the company said in a press release. “This optimizes the high-speed switching performance of GaN devices, boosting energy efficiency and application performance while also shrinking the mounting area by minimizing peripheral component size.”

(Source: https://www.bisinfotech.com)

Segments Covered in the Report

By Transistor Type

- MOSFET Gate Driver ICs

- IGBT Gate Driver ICs

- GaN Gate Driver ICs

- SiC Gate Driver ICs

- Bipolar Transistor Gate Driver ICs

- Others

By Gate Driver Type

- Half-Bridge Gate Drivers

- Full-Bridge Gate Drivers

- High-Side Gate Drivers

- Low-Side Gate Drivers

- Three-Phase Gate Drivers

- Others

By Isolation Type

- Isolated Gate Driver ICs

- Non-Isolated Gate Driver ICs

By Semiconductor Material

- Silicon (Si)

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

- Others

By Application

- Power Supplies (AC-DC, DC-DC Converters)

- Motor Drivers

- Class D Audio Amplifiers

- Industrial Automation

- Consumer Electronics (TVs, Laptops, etc.)

- Renewable Energy Systems (Solar, Wind)

- Electric Vehicles & Charging Infrastructure

- Data Centers and Servers

- Others

By End Use Industry

- Automotive

- Industrial

- Consumer Electronics

- Telecommunications

- Aerospace & Defense

- Energy & Power

- Healthcare

- Others

By Channel Type

- Single Channel

- Dual Channel

- Multi-Channel

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East &Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting