Industrial Valves and Actuators Market Size and Forecast 2025 to 2034

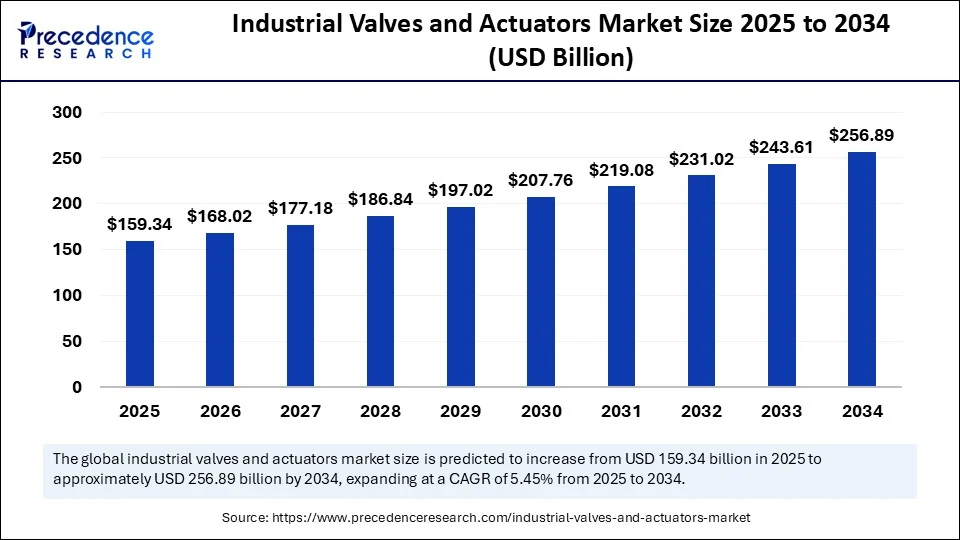

The global industrial valves and actuators market size accounted for USD 151.11 billion in 2024 and is predicted to increase from USD 159.34 billion in 2025 to approximately USD 256.89 billion by 2034, expanding at a CAGR of 5.45% from 2025 to 2034. The industrial valves and actuators market is driven by the rising automation, infrastructure expansion, and increasing demand for precise flow control across key industries.

Industrial Valves and Actuators MarketKey Takeaways

- In terms of revenue, the global industrial valves and actuators market was valued at USD 151.11 billion in 2024.

- It is projected to reach USD 256.89 billion by 2034.

- The market is expected to grow at a CAGR of 5.45% from 2025 to 2034.

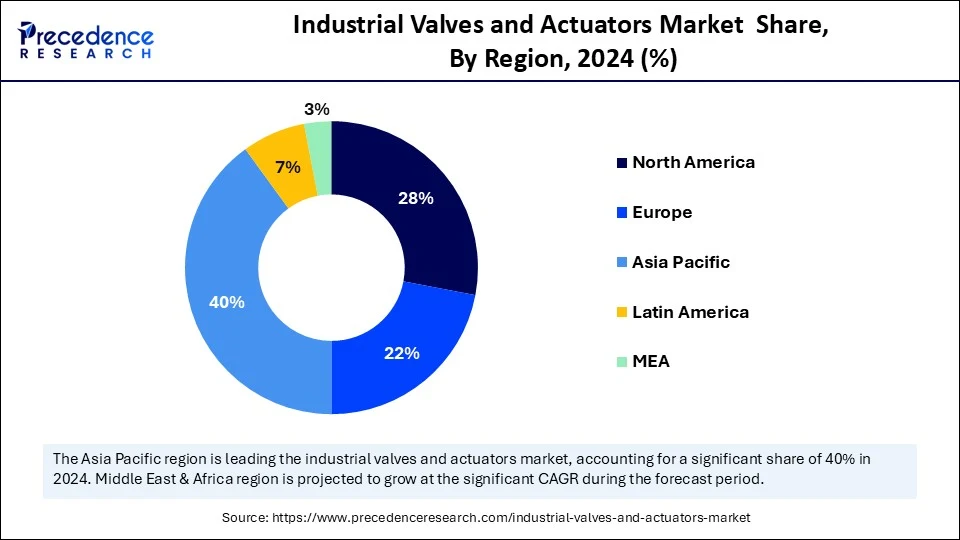

- Asia Pacific accounted for the largest share of the industrial valves and actuators market of 40% in 2024.

- The Middle East and Africa is anticipated to witness the fastest growth during the forecasted years.

- By valve type, the ball valves segment held a significant market share in 2024.

- By valve type, the globe valves segment is anticipated to show considerable growth over the forecast period.

- By actuator type, the pneumatic actuators segment contributed the biggest market share in 2024.

- By actuator type, the electric actuators segment is anticipated to show considerable growth over the forecast period.

- By material, the steel (carbon + stainless) segment captured the highest market share 2024.

- By material, the alloys (hastelloy, inconel) segment is anticipated to show considerable growth over the forecast period.

- By function, the on/off control segment held the largest share in 2024.

- By function, the modulating control segment is anticipated to show considerable growth over the forecast period.

- By end-use industry, the oil and gas segment generated the major market share 2024.

- By end-use industry, the water and wastewater segment is anticipated to show considerable growth over the forecast period.

- By valve size, the 1”–6” segment generated the highest market share in 2024.

- By valve size, the >25” segment is anticipated to show considerable growth over the forecast period.

- By sales channel, the direct (OEM/epc) segment accounted for the biggest market share in 2024.

- By sales channel, the indirect (digital distributor models) segment is anticipated to show considerable growth over the forecast period.

How is AI Integration Transforming the Industrial Valves and Actuators Market?

The integration of Artificial Intelligence in industrial valves and actuators is optimizing the efficiency of operations and system reliability. Predictive maintenance can be achieved with the aid of AI-based systems, which help predict potential failures using real-time data. It also increases safety by identifying abnormalities and warning operators of potential risks in a timely manner. The incorporation of AI facilitates the implementation of Industry 4.0, enabling connectivity with other intelligent devices to facilitate remote tracking and operation.

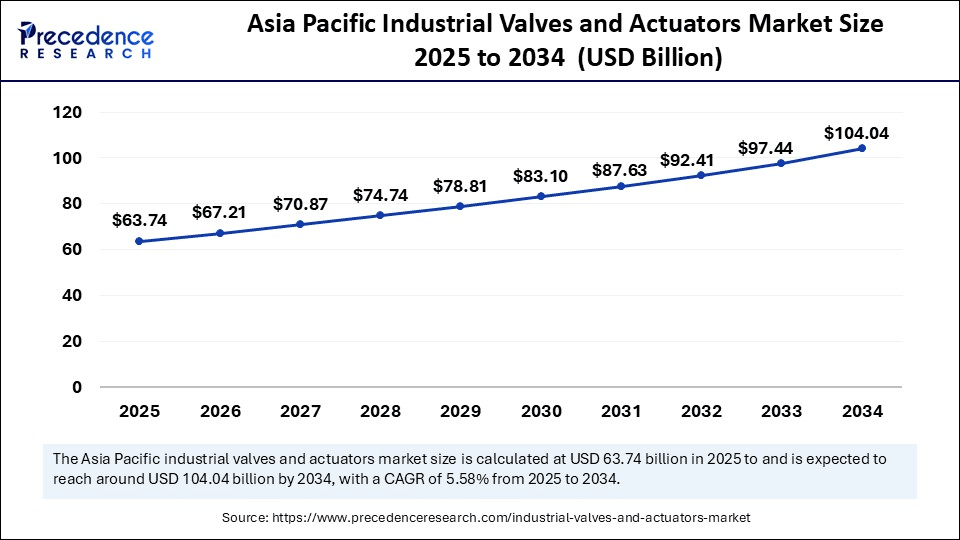

Asia Pacific Industrial Valves and Actuators Market Size and Growth 2025 to 2034

Asia Pacific industrial valves and actuators market size is exhibited at USD 63.74 billion in 2025 and is projected to be worth around USD 104.04 billion by 2034, growing at a CAGR of 5.58% from 2025 to 2034.

What Made Asia Pacific the Dominant Region in the Industrial Valves and Actuators Market in 2024?

Asia Pacific registered dominance in the industrial valves and actuators market by capturing the largest share in 2024. This dominance is fueled by rapid industrial and infrastructure development in key economies such as China and India. These nations are investing heavily in water and wastewater treatment, food and beverage processing, and electric power generation, all of which depend on flow control systems. With a rising population, there is a high demand for clean water and energy, which is fueling investment in valve and actuator manufacturing technologies. Both governments and the private sector are investing in valve manufacturing and advanced automation technologies, contributing to market growth.The region's market leadership is further supported by advantages such as affordable labor, favorable policies, and expanding industrial bases. China is a major contributor to the market. This is mainly due to the expanding oil and gas, chemicals, and pharmaceuticals industries, which further leads to higher demand for valves and actuators.

Why is the Middle East & Africa to Grow at the Fastest Rate?

The Middle East & Africa is expected to grow at the fastest CAGR during the forecast period. This is primarily due to the rising construction of pipelines, oil and gas infrastructure, and petrochemical plants, all needing precise fluid control. Rising investments in water, wastewater, and power plants also boost the demand for valves and actuators. The region's vast oil and gas reserves drive substantial investments in exploration, production, and refining infrastructure, creating a high demand for valves and actuators. Rapid industrialization and infrastructure development further boost market growth. Additionally, the government's focus on energy diversification and infrastructure modernization creates the need for these components.

What Factors are Influencing the Growth of the European Industrial Valves and Actuators Market?

The European industrial valves and actuators market is expected to grow at a notable rate in the coming years, driven by its strong industrial base, focus on technological advancement, and strict environmental regulations. Manufacturing and engineering companies in Germany, the UK, France, and Italy fuel consistent demand for high-quality valves and actuators. Industries like chemicals, pharmaceuticals, food and beverage, and power generation emphasize precision, efficiency, and safety, leading to strong demand for advanced valve systems and smart actuation technologies. New opportunities for valves and actuators are also emerging in clean energy applications due to the rising adoption of wind, solar, and biomass power. Additionally, investments in water and wastewater treatment plants, power plants, and pipelines boost demand for valves and actuators.

Market Overview

The industrial valves and actuators market comprises mechanical and electromechanical devices used to control the flow of liquids, gases, and slurries across industrial applications. Valves are used to start, stop, or regulate flow, while actuators are mechanisms that automatically operate the valve (manual, pneumatic, hydraulic, or electric). These solutions are critical in industries such as oil & gas, power generation, water & wastewater treatment, chemicals, food & beverage, mining, and pharmaceuticals.

The market is driven by automation trends, process safety regulations, energy efficiency demands, and escalating global infrastructure investments. There is a rising need for intelligently controlled and automated valve systems as manufacturing, energy, and water management sectors strive for enhanced efficiency, safety, and real-time process control. This market growth is also fueled by increased government investments in industry modernization and infrastructure development, particularly in emerging economies, making valves and actuators crucial components in next-generation industrial systems.

What Factors Are Fueling the Rapid Expansion of the Industrial Valves and Actuators Market?

- Rising Need of Automation: The valves and the actuator are the main elements of flow control and pressure within the automated system. The safety and efficiency of operations, along with productivity, are gaining more attention, leading to a greater demand for enhanced automated flow control solutions.

- Growth in Oil and Gas as well as Energy Sectors: Valves and actuators play a very significant role in the oil, gas, and power generation in the flow of fluids. There is a higher demand for energy, and new infrastructure systems are being built, especially in developing economies. Hence, the need to utilize reliable flow control equipment is increasing.

- Water and Wastewater Management Expansion: Actuators and valves play an important role in the control of water infrastructure. Sustainability objectives and governmental enthusiasm are becoming the driving force behind the introduction of smart valve solutions to desalination, sewage treatment, and water recycling systems around the world.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 256.89 Billion |

| Market Size in 2025 | USD 159.34 Billion |

| Market Size in 2024 | USD 151.11 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.45% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East and Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Authentication, Component,Deployment, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Investments in Modernizing Industrial Facilities

The industrial valves and actuators market is experiencing a surge in growth due to the increasing number of investments in the modernization of industrial facilities. Worldwide, manufacturers are keen on streamlining their operational efficiency, reducing the time to repair, and ensuring that their products are of high quality through affirmative control and automation technology. Manufacturers are allocating a greater proportion of their capital expenditures to modern infrastructure to replace outdated systems. The increasing focus on modernizing industries is also serving as a significant driver of the need for high-performance and automated valves and actuators, making them key elements of the future of smart manufacturing.

Restraint

Fluctuating Raw Material Prices

Volatile prices of raw materials are a limitation in the market for industrial valves and actuators. The main materials used to produce these parts include steel, aluminum, brass, and polymers, whose prices fluctuate due to global economic and political circumstances. These could include geopolitical tensions, trade barriers, supply chain disruptions, and other pandemics or conflicts in key supply areas. This variation has a direct result on the manufacturing cost and profit margin, particularly for small and medium-sized enterprises. Additionally, the trend of fluctuating input costs may interfere with budgeting and planning activities, eroding confidence in market investments.

Opportunity

Renewable Energy Transition

The shift to renewable energy worldwide creates immense opportunities in the industrial valves and actuators market. Countries are attempting to phase out carbon emissions and the use of fossil fuels, which is leading to increased investment in renewable sources such as hydropower, solar power, wind energy, and biomass. Such energy systems also require sophisticated and dependable fluid, steam, and gas management systems, generating a strong need and desire for high-performance valves and actuators.

The smart valve technologies enhance their performance by making them real-time, automated, and predictive, facilitating maintenance. The growing demand for efficient, scalable, and intelligent flow control solution products, coupled with the surge in renewable energy use, further fuels market growth.

Valve Type Insights

How Does the Ball Valves Segment Dominate the Industrial Valves and Actuators Market in 2024?

The ball valves segment led the market, accounting for the largest revenue share in 2024. Ball valves are widely favored across diverse industries due to their straightforward design, swift shut-off capabilities, and ability to handle high-pressure environments. They are engineered to endure high-pressure and high-temperature conditions, making them suitable for oil and gas, petrochemical, power generation, and water treatment sectors. These valves offer a reliable seal with minimal torque, leading to reduced energy consumption and maintenance expenses. Furthermore, advancements in material science and sealing technologies enable the use of ball valves in more corrosive media and across a wider temperature spectrum, broadening their application range.

The globe valves segment is expected to grow at a significant CAGR over the forecast period. Globe valves are extensively utilized in applications requiring flow regulation, such as steam services, cooling water systems, and fuel oil systems. Their design allows for fine control of flow rates through a combination of linear and perpendicular movement of the plug, enabling precise pressure and flow control in complex industrial processes. Industries like power generation, chemical manufacturing, and pharmaceuticals frequently employ globe valves when precise process parameters are critical. As industries increasingly prioritize operational efficiency, accuracy, and safety, the demand for high-performance globe valves will continue to grow.

Actuator Type Insights

Why Did the Pneumatic Actuators Segment Contribute the Most Revenue in 2024?

The pneumatic actuators segment contributed the largest revenue share in 2024 due to their heightened adoption across various industries. These actuators use compressed air to generate mechanical movement, providing rapid response times and predictable performance in various challenging conditions. Pneumatic actuators are particularly well-suited for hazardous and explosion-prone environments because they lack electrical components that could trigger ignition. The growing automation in process industries and the need for safe, efficient valve control mechanisms continue to drive the demand for pneumatic actuators.

The electric actuators segment is expected to grow at the fastest CAGR in the upcoming period. This growth is fueled by their precision, automation capabilities, and seamless integration with digital systems. These actuators convert electrical energy into mechanical motion, enabling remote actuation, high-precision positioning, and programmability. They are increasingly utilized in industries such as water treatment, pharmaceuticals, and food processing, where clean operation, intelligent diagnostics, and efficiency are highly valued. The global trend towards sustainability and industrial electrification further accelerates their adoption.

Material Insights

What Made Steel the Dominant Segment in the Industrial Valves and Actuators market in 2024?

The steel (carbon + stainless) segment led the industrial valves and actuators market in 2024, holding the largest revenue share due to its broad applicability, durability, and cost-effectiveness. Stainless steel, with its superior corrosion resistance, is highly sought after in environments where corrosion is a concern, including the chemical processing, food and beverage, water treatment, and oil and gas industries. Carbon steel is favored for its affordability and good strength in low to moderate pressure and temperature applications where corrosion resistance is not a primary requirement.

The alloys (hastelloy, inconel) segment is expected to grow at a significant CAGR over the forecast period. This is mainly due to the increasing preference for hastelloy (a nickel-molybdenum alloy) due to its exceptional corrosion resistance, even in highly acidic and chemically aggressive environments, making it ideal for chemical production and marine applications. Inconel, another nickel-based alloy, is known for maintaining its strength and resisting oxidation at extremely high temperatures. It is used in applications involving high heat and pressure, such as aerospace, power generation, and petrochemical refining. As industries face increasingly stringent regulatory performance and safety demands, advanced alloys will see greater use in critical systems.

Function Insights

Why Did the On/Off Control Segment Dominate the Market in 2024?

The on/off control segment held the largest share of the industrial valves and actuators market in 2024. This is largely because of their critical function in industrial applications where the flow of a substance needs to be either fully open or fully closed. Electric, pneumatic, or hydraulic-actuated on/off control valves are essential for starting or stopping process streams, directing fluid flow, and performing emergency shutdowns. They are easy to maintain and operate, especially in the oil and gas, water treatment, manufacturing, and power generation industries. Furthermore, on/off valves typically require less sophisticated control infrastructure for installation, operation, and maintenance.

The modulating control segment is expected to experience the fastest growth in the market, fueled by the rising need for precision and efficiency in industrial processes. Modulating control valves are continuously adjusted to maintain process variables like flow, pressure, or temperature in real-time. The integration of Internet of Things and AI, along with advanced automation and digital control technologies, is also driving the adoption of modulating systems, which can be readily optimized for energy efficiency and high-quality product output.

End-Use Industry Insights

Why Did the Oil & Gas Segment Contribute the Most Revenue in 2024?

The oil & gas segment dominated the industrial valves and actuators market with the most revenue in 2024. This is due to the critical need for reliable, accurate, and durable control systems in the complex and often hazardous operating conditions of the industry. Valve actuators are essential for automating valve operations in drilling, extraction, refining, pipeline transport, and emergency shutdowns. Actuator designs that offer better sealing, corrosion resistance, and real-time monitoring have also increased their importance in maintaining safe and efficient oil and gas operations. Furthermore, the industry prioritizes asset optimization, operational safety, and minimizing downtime.

The water & wastewater segment is expected to experience substantial growth in the coming years. Increased urbanization, industrialization, and environmental awareness are driving investment in new water infrastructure and wastewater regulations. Valves are essential for controlling the direction, pressure, and flow of water and chemicals throughout treatment facilities, distribution systems, and sewage plants. They are used in filtration units, pumping stations, disinfection processes, and sludge management to ensure safe operation.

Valve Size Insights

Why Made 1”–6” the Dominant Segment in the Industrial Valves and Actuators Market in 2024?

The 1”–6” segment led the market while capturing the largest revenue share in 2024. Valves of this size are versatile and used to regulate fluid and gas flow in pipelines, common in industries such as oil and gas, chemical processing, pharmaceuticals, food and beverage, and water treatment. Their ease of installation, maintenance, and automation compared to other valves makes them popular in systems where reliability and frequent use are important. Additionally, many industries with centralized automation systems include 1”-6” valves for precision and control in processes like bottling, refining, cooling, and heating.

The >25” segment is expected to grow at a significant CAGR during the forecast period. These valves are used in applications with large commodity volumes, such as water distribution networks, water treatment plants, power generation stations, and large oil and gas pipelines. They are essential for mainline isolation and emergency shutdowns due to their ability to control large fluid volumes. The demand for >25” valves is also driven by the modernization of aging infrastructure and urban development of water systems, which is accelerating the growth of this segment.

Sales Channel Insights

How Does the Direct (OEM/EPC) Segment Dominate the Market in 2024?

The direct (OEM/EPC) segment dominated the market with the most revenue share in 2024. The dominance of this segment stems from its ability to meet the demand for specialized services. The direct distribution channel involves supplying valves and actuators directly to manufacturers, Original Equipment Manufacturers (OEMs), and engineering, procurement, and construction (EPC) companies. These clients typically require large quantities of high-quality, customized products for complex industrial applications, including oil & gas refineries, power stations, chemical plants, and large infrastructure projects. Direct cooperation with manufacturers ensures product compatibility, enhances quality control, reduces lead times, and streamlines communication. Furthermore, direct channels often provide OEMs and EPC contractors with technical support, installation services, and after-sales support.

The indirect (digital distributor models) segment is expected to grow substantially in the industrial valves and actuators market. This growth is driven by the increasing digitization of industrial product procurement and distribution. Digital distributor models offer benefits such as faster quote generation, direct inventory visibility, easier order management, and simplified logistics. These platforms often include product configuration tools, automated reordering, customer reviews, and integration with procurement systems, improving the overall purchasing experience. The shift towards Industry 4.0 and smart manufacturing also necessitates digital interfaces for transactions in the supply chain.

Industrial Valves and Actuators Market Companies

- Emerson Electric Co.

- Flowserve Corporation

- Schneider Electric SE

- IMI plc

- Rotork plc

- Honeywell International Inc.

- Crane Co.

- Bray International

- SAMSON AG

- Metso Corporation (now Valmet)

- KITZ Corporation

- Velan Inc.

- Pentair plc

- AVK Holding A/S

- GEA Group AG

- Auma Riester GmbH

- Bonney Forge

- Burkert Fluid Control Systems

- Curtiss-Wright Corporation

- Festo Group

Recent Developments

- In July 2024, Metso decided to acquire the privately owned Australian company, Jindex Pty Ltd, a valves and process flow control provider. The experience of Metso in providing slurry handling, hydrocyclones, and minerals equipment processing, combined with the product portfolio of Jindex in the provision of valve solutions, will also bring increased capability to Metso to provide more complete slurry handling solutions in the mining sector.

- In May 2024, Emerson launched a series of AVENTICS high-power, high-precision pressure regulator valves, which are used to increase effectiveness, versatility, and precision of the manufacturing systems, where pneumatic power is applied. The new AVENTICS Series 625 Sentronic proportional pressure control valves, together with an appropriate data acquisition software, set a new standard of precision and quality.

- In May 2023, Dante Valve Company collaborated with W&O Supply. This alliance seeks to significantly enhance access and the better customer service of the Dante Valve Danco brand across various regions. Through this partnership, the company W&O Supply is the sole factory sales and service agent of Dante Valve Co., Danco pressure relief valves.

Market Segment Covered in the Report

By Valve Type

- Ball Valves

- Butterfly Valves

- Gate Valves

- Globe Valves

- Check Valves

- Plug Valves

- Diaphragm Valves

- Pressure Relief/Safety Valves

- Others (Needle, Pinch, Control Valves)

By Actuator Type

- Manual Actuators

- Pneumatic Actuators

- Hydraulic Actuators

- Electric Actuators

- Electro-Hydraulic Actuators

- Smart/Intelligent Actuators

By Material

- Cast Iron

- Steel (Carbon, Stainless)

- Alloys (Brass, Bronze, Inconel, Hastelloy)

- Plastic (PVC, PTFE, Others)

- Others (Ceramics, Titanium)

By Function

- On/Off Control

- Modulating Control

- Isolation

- Safety Relief

By End-Use Industry

- Oil & Gas

- Power Generation (Thermal, Nuclear, Renewable)

- Water & Wastewater

- Chemical

- Food & Beverage

- Pharmaceutical

- Mining & Metals

- Pulp & Paper

- Marine

- Others (Textile, HVAC, etc.)

By Valve Size

- <1”

- 1”–6”

- 6”–25”

- >25”

By Sales Channel

Direct (OEMs, EPCs)

Indirect (Distributors, Integrators)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting