Life Science Logistics Market Size and Forecast 2025 to 2034

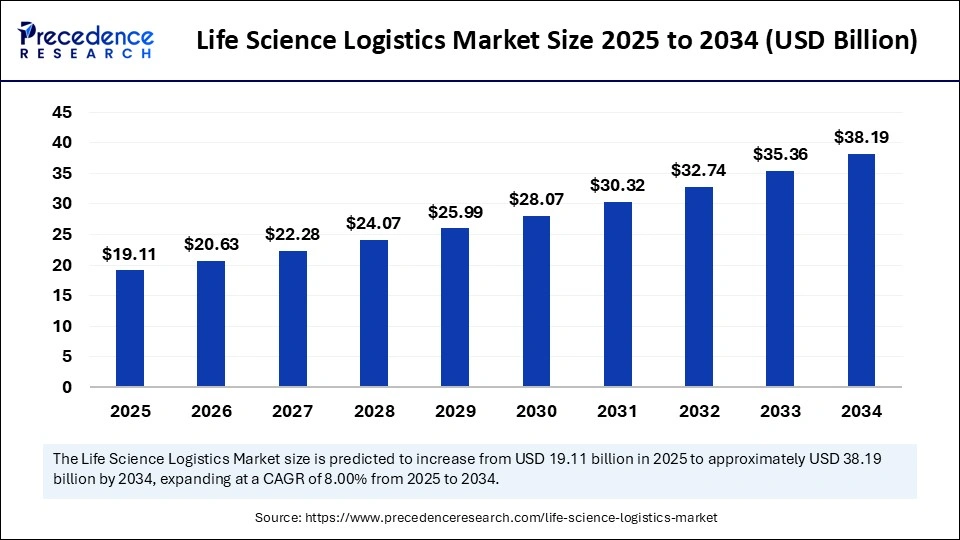

The global life science logistics market size accounted for USD 17.69 billion in 2024 and is predicted to increase from USD 19.11 billion in 2025 to approximately USD 38.19 billion by 2034, expanding at a CAGR of 8.00% from 2025 to 2034. Growing demand for temperature-sensitive biologics, advances in cold chain technologies, increasing clinical trials globally, and growing investment in healthcare are driving the growth of the life science logistics market.

Life Science Logistics MarketKey Takeaways

- In terms of revenue, the life science logistics market is valued at $19.11 billion in 2025.

- It is projected to reach $38.19 billion by 2034.

- The market is expected to grow at a CAGR of 8.00% from 2025 to 2034.

- North America dominated the life science logistics market in 2024.

- Asia Pacific is expected to expand the fastest CAGR between 2025 and 2034.

- By service type, the warehousing and storage segment held the largest market share in 2024.

- By service type, the transportation segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By application, the pharmaceuticals segment captured the biggest market share in 2024.

- By application, the medical devices segment is expected to expand to a significant CAGR over the projection period.

- By end-user, the pharmaceutical companies segment contributed the major market share in 2024.

- By end-user, the hospitals and clinics segment is expected to expand to the highest CAGR in the upcoming period.

How is AI Reshaping the Future of Life Science Logistics?

Artificial intelligence is transforming the life science logistics industry. The life sciences sector is looking to AI to enhance logistics efficiency. AI reduces delivery times, minimizes waste and spoilage, and tracks temperature-sensitive products in transit. It also optimizes supply chain planning and management. AI algorithms analyze demand, eliminate delays by optimizing route planning, and optimize costs. Machine learning models also have the ability to analyze vast datasets to predict inventory needs, reducing waste and improving responsiveness. Overall, AI is crucial for managing complex logistics, ultimately saving lives by ensuring timely delivery of therapies and diagnostics.

Market Overview

The life sciences logistic market is a very specific area of logistics that involves the management of transport, storage, and distribution of pharmaceutical products, medical devices, biotechnology products, and all other materials in the healthcare sector. These logistics functions can often come with regulatory requirements need for temperature control, and time limitations to ensure that there is correct product integrity for patient use.

The market is rapidly changing, fueled by the expanding demand for biologics, personalized medicine, and clinical trials. There are advancements in cold chain, real-time tracking and automation that improve efficiency and reliability in the process. Furthermore, increased health-care expenditure, globalization of pharmaceutical trade, and regulatory requirements for product safety and traceability increase the market opportunity for life sciences logistics.

Life Science Logistics MarketGrowth Factors

- Higher Demand for Biologics and Specialty Drugs: The use of temperature-sensitive biologics, vaccines, and personalized medicines has increased, requiring specialized handling and sophisticated cold chain logistics, which are more dependent on specialized logistics solutions.

- Growth of Clinical Trials: As clinical research grows (especially in emerging markets), there is a heightened demand for efficient transportation and storage of clinical trials, revealing a gap in the logistics market for reliable transport and logistics infrastructure.

- Increased Regulatory Demands: Ongoing global regulatory evolution, such as GDP (Good Distribution Practices), are putting pressure on life science companies to use specialized logistics providers that have established logistics precedent and regulatory experiential in managing complexities and meeting regulations.

- Infrastructure Growth in Healthcare: The health systems' global growth and investment in developing economies is increasing the supply chain requirement for pharmaceuticals and medical equipment.

- Advancements in Technology: Advances in cold chain monitoring, real-time tracking, and automation are driving improvements in efficiency and reducing risks and encouraging greater adoption of specialized logistics services.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 38.19 Billion |

| Market Size in 2025 | USD 19.11 Billion |

| Market Size in 2024 | USD 17.69 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expansion of Cold-Chain Network and High Adoption of Biologics

The rapid expansion of the cold chain network, driven by advanced technologies, is driving the growth of the market. Technologies like artificial intelligence (AI), internet of things (IoT), Blockchain, and automation are transforming the market by improving efficiency of cold-chain infrastructure. As there is high adoption ofbiologics, cell therapies, and temperature-sensitive drugs, logistics providers are making sizable investments in advance cold-chain networks. These specialized capabilities are no longer niche; they are core infrastructure to ensure drug efficacy and compliance with regulatory authorities. Recognizing this evolution and the surge in demand from the clinician and drug manufacturers, global logistics companies are expanding their capacity.

For instance, in March 2025, DHL announced that it had acquired Cryopdp, a US-based specialist in courier providing logistics services for clinical trials, biopharma, and cell & gene therapies. This partnership enables both the companies to strengthen their supply chain services offerings for the global life sciences and healthcare sector.

(Source: https://ir.cryoportinc.com)

Restraint

Escalating Fuel and Air Freight Charges

The life science logistics sector faces extreme cost pressure due to high fuel prices and constrained air freight capacity. As observed by IATA, global cargo costs increased by over 10% in 2024, with spot charter rates were almost 50% higher than pre-COVID-19 levels. This cost increases is attributed to abrupt rise in fuel price, increased labor costs, and aircraft maintenance backlogs.

(Source: https://www.worldcourier.com)

These rising costs directly relate to pharmaceutical companies' and other industry stakeholders' ability to generate profits and maintain reliable operations for time- and temperature-sensitive shipments, which are especially relevant for biologics and clinical trial materials. Air cargo shortages force companies to pay excessive premiums for guaranteed transport space and incur disruption to their scheduled rates. Even small increases in transportation costs can lead to severe price reductions on low-volume, high-value medical products, limits on the scalability and flexibility of the supply chain, and increased logistical complexity.

Opportunity

Rising Demand for Personalized Medicine

The rising demand for personalized medicine creates immense opportunities in the life science logistics market. These new therapies employ innovative, complex designs and require precise temperature control and handling. Since personalized medicines are manufactured to the specifications of an individual patient, their use increases the frequency of smaller, time-sensitive shipments and likely leads to a need for a highly specialized logistics service provider.

As innovation in biotech accelerates and more biologics produces, logistics providers need to increase cold chain capacity, identify and implement real-time tracking systems, and maintain strict regulatory compliance in order to accommodate demand. This scenario creates a strong opportunity for companies committed to developing tailored, reliable, and secure transportation solutions. The growing prevalence of chronic diseases and a continued focus on innovative therapies further legitimizes this opportunity for specialized logistics to be a key enable of the growing life sciences sector.

Service Type Insights

Why did the Warehousing & Storage Segment Dominate the Market in 2024?

The warehousing & storage segment dominated the market, capturing the largest revenue share in 2024. This is mainly due to their critical role in maintaining the integrity of temperature-sensitive and high-value life science products. Warehousing and storage services provide the necessary infrastructure, including cold chains, advanced technology like inventory management tools, and real-time monitoring to ensure safety, integrity, and regulatory compliance of these products. With the growth of biologics and personalized medicine, life science companies can no longer overlook warehousing and storage. In fact, it is recommended that high-value assets be warehouse-stored whenever possible to guarantee continuity and reduce risk.

Meanwhile, the transportation segment is expected to grow at a remarkable CAGR in the upcoming period. The expansion of the global pharmaceutical and medical devices trade agenda is creating a heightened demand for transportation services capable of delivering secure, timely deliveries throughout the life cycle. Innovation in refrigerated transport, GPS tracking, and real-time temperature monitoring efficiencies are essential for the effective delivery of life science products. These innovations enhance efficiency and ensure the integrity of goods throughout the transit.

Application Insights

What Made Pharmaceuticals the Dominant Segment in 2024?

The pharmaceuticals segment dominated the life science logistics market with the largest revenue share in 2024. This is mainly due to the increased distribution and logistics activities needed to complete the drug development and commercialization process. The huge increase in the volume of drugs being produced, clinical trials, and global studies has increased the need for logistics services for compliant and safe delivery. Pharmaceutical companies also operate in a very highly regulated market that needs specific systems for inventory management, warehousing, and transportation.

On the other hand, the medical devices segment is expected to expand at a significant rate over the projection period due to innovation and increased complexity of medical technologies. The logistics requirements of medical devices are diverse. Products like implants, surgical tools, and diagnostic instruments have specific storage and transportation requirements, including a controlled environment and unique packaging. The rising production of medical devices and increasing numbers of minimally invasive procedures are increasing the demand for responsive, compliant, and agile logistics.

End-User Insights

How Does the Pharmaceutical Companies Segment Dominate the Life Science Logistics Market?

The pharmaceutical companies segment dominated the market with the maximum revenue share in 2024. This is mainly due to the increased participation of these companies in R&D and clinical trials. These companies heavily rely on logistics partners for cold chain storage, temperature-controlled transport, and supply chain transparency. The operational scale and complexity of all large pharmaceutical firms require very high levels of logistical coordination to meet stringent regulatory compliance. With the increased production volume of pharmaceuticals, these companies demand logistics services that include warehousing, storage, and transportation.

On the other hand, hospitals and clinics segment is expected to expand at the highest CAGR in the upcoming period since they actively engaged in clinical trials, point-of-care diagnostics, and decentralized healthcare delivery. Hospitals and clinics must have fast and reliable, traceable logistics solutions for pharmaceuticals, medical devices, and biological samples. The growing trend of personalized medicine and the expansion of direct-to-patient treatments are further increasing their reliance on logistics for quick and accurate product delivery. As a result of the new role being taken on by hospitals and clinics as actively responsible for patient-related therapies, demand for specialized logistics will continue to rise.

Regional Insights

What Factors Contributed to North America's Dominance in the Life Science Logistics Market?

North America registered dominance in the market by holding the largest revenue share in 2024, driven by its well-established cold chain infrastructure. The region benefits from well-established infrastructure and standardized cold chain practices. The region is also home to some of the leading life science companies. There is high investment in advanced temperature controlled refrigerated and ambient warehousing. All these factors contributed to the region's dominance in the market.

The U.S. is a major player in the North American life science logistics market. This is mainly due to its robust infrastructure, comprehensive regulatory framework, and the presence of major biotech and pharmaceutical companies. The expansion of production capacity, particularly in areas like drugs and medical devices, is likely to increase the demand for specialized temperature-controlled distribution networks.

In April 2025, UPS announced that it had acquired the healthcare logistics company Andlauer Healthcare Group (AHG) in Canada for $1.6 billion to expand its operations in healthcare logistics. With nine distribution centers and 22 branches across Canada, AHG specializes in offering third-party logistics and temperature-sensitive transportation services to the healthcare industry. The acquisition of AHG shows UPS's strategy to expand its global cold chain capabilities to meet the needs of the healthcare sector.

(Source: https://www.reuters.com)

Asia Pacific Life Science Logistics Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the coming years due to significant investments in healthcare, a rise in clinical trials, and the expanding pharmaceutical manufacturing capabilities. Countries like China, India, Japan, and South Korea are investing heavily in cold chain infrastructure to meet both domestic and global demands. Logistics providers are responding too: FedEx is now operating four Life Science Centers, in Japan, South Korea, Singapore, and Mumbai, while also hiring senior leaders to respond to the growing demand in the region. India plays a major role in the market due to its expanding pharmaceutical manufacturing base and improved regulatory system.

- In October 2024, UPS introduced a new cross?docking facility in India designed for healthcare logistics that can operate in all temperature zones.

- In February 2024, FedEx introduced a Life Science Center focused on clinical trials and high value pharmaceuticals in Mumbai. (Source: https://www.healthcareradius.in)

Life Science Logistics Market Companies

- DHL

- World Courier

- Quick STAT

- CEVA Logistics

- Marken

- Agility

- Rhenus Group

- MNX Global Logistics

- CRYOPDP

- Langham Logistics

- Life Science Logistics

- Biocair

- Others

Recent Developments

- In May 2025, Azenta Life Sciences launched sub -150°C Cryo Carrier. The liquid nitrogen vapour-based CryoPod Carrier from Azenta Life Sciences is designed to provide a safe, portable, and trackable solution for hand carrying temperature-sensitive materials between labs, providing protection below -150°C for over 3 hours.

(Source:https://pharmaceuticalmanufacturer.media)

- In April 2024, Cardinal Health announced that construction has begun for a new 350,000 square-foot logistics center in Columbus, Ohio, that will serve as a centralized replenishment center for the distribution of over-the-counter consumer health products in support of its core pharmaceutical business.

(Source:https://newsroom.cardinalhealth.com)

Segments Covered in the Report

By Service Type

- Warehousing & Storage

- Transportation

- Value-added Services

By Application

- Pharmaceuticals

- Medical Devices

- Biologicals

- Clinical Trial Materials

By End-User

- Pharmaceutical Companies

- Hospitals and Clinics

- Contract Research Organizations (CROs)

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content