What is the Metal Manufacturing Waste Heat Recovery System Market Size?

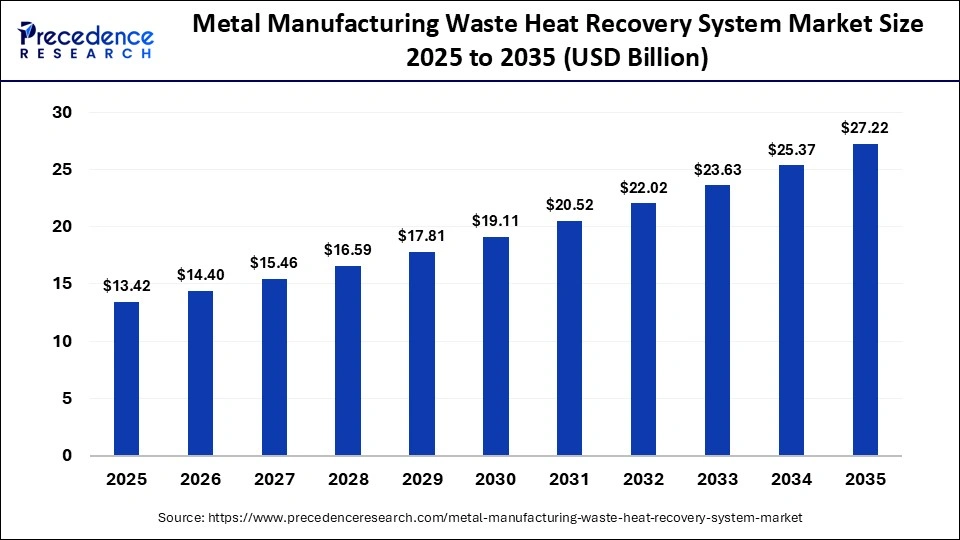

The global metal manufacturing waste heat recovery system market size accounted for USD 13.42 billion in 2025 and is predicted to increase from USD 14.40 billion in 2026 to approximately USD 27.22 billion by 2035, expanding at a CAGR of 7.33% from 2026 to 2035. Rising industrial energy demand, stringent efficiency regulations, and advanced waste heat recovery technologies drive market growth.

Market Highlights

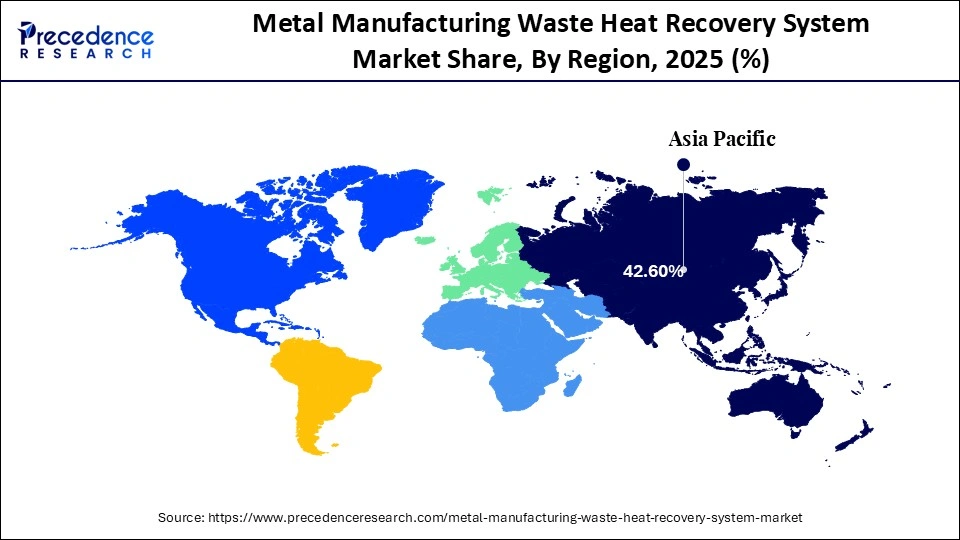

- Asia Pacific held a dominant presence in the market in 2025, accounting for the major market share of 42.6%.

- The Middle East and Africa is expected to grow at the fastest CAGR of 9.6% from 2026 to 2035.

- By technology, the recuperators segment contributed the biggest market share of 29.6% in 2025.

- By technology, the organic rankine cycle (ORC) systems segment is projected to grow at a strong CAGR of 10.9% between 2026 and 2035.

- By heat source, the furnaces segment led the market, holding the largest market share of 33.8% in 2025.

- By heat source, the reheating & annealing process heating segment is growing at a healthy CAGR of 9.4% from 2026 to 2035.

- By application, the power generation segment generated the highest market share of 31.2% in 2025.

- By application, the process heating segment is expected to grow with the highest CAGR of 9.1% from 2026 to 2035.

- By metal type, the iron & steel segment captured the major market share of 58.4% in 2025.

- By metal type, the aluminum segment is projected to expand rapidly of 9.2% of CAGR from 2026 to 2035.

- By end user, the integrated steel plants segment held the major market share of 35.7% in 2025.

- By end user, the secondary metal producers segment is expanding at a solid CAGR of 8.9% between 2026 and 2035.

Metal Manufacturing Waste Heat Recovery System Market Overview

The increasing inefficiency of industrial energy use is a key driver behind the rising adoption of waste heat recovery systems in metal manufacturing. Industrial facilities typically lose a substantial share of input energy as waste heat through exhaust gases, furnaces, and hot equipment surfaces, with estimates indicating losses of roughly 20-50% depending on process type, operating conditions, and local climate. This level of energy loss imposes a direct cost burden on metal producers. It provides a strong economic case for deploying waste heat recovery systems to capture and reuse thermal energy.

In response, major steel and metal manufacturers have begun piloting and scaling waste-heat recovery installations. In 2024, some of the largest global steel manufacturers, including ArcelorMittal, Nucor, and Tata Steel, announced pilot projects to deploy WHR systems, aimed at improving furnace efficiency and reducing overall energy intensity. At the same time, tightening sustainability and emissions regulations across North America and Europe are increasing pressure on manufacturers to improve energy efficiency and lower carbon output. These regulatory and cost-driven factors are accelerating the adoption of waste-heat recovery technologies across energy-intensive metal production facilities.

Impact of Artificial Intelligence on the Metal Manufacturing Waste Heat Recovery System Market

Artificial intelligence is transforming the waste heat recovery systems market in metal manufacturing by improving how thermal energy is captured, managed, and reused across industrial plants. Machine learning algorithms analyze real-time furnace temperatures, exhaust gas profiles, and production schedules to determine the most efficient heat-recovery configurations, helping manufacturers reduce avoidable energy losses during high-temperature processes. These systems continuously adjust operating parameters to align heat recovery performance with changing production conditions.

AI-powered predictive maintenance tools are also used to monitor wear, fouling, and thermal degradation in heat exchangers, boilers, and piping networks. Detecting early signs of performance decline allows these tools to conduct preemptive maintenance, help prevent unplanned shutdowns, lower maintenance costs, and extend equipment life. Manufacturers are also using AI to optimize the integration of recovery technologies such as steam turbines, organic Rankine cycle systems, and thermoelectric modules, ensuring recovered heat is converted into usable energy with higher overall efficiency.

Metal Manufacturing Waste Heat Recovery System Market Growth Factors

- Rising Industrial Electrification: Accelerated electrification in metal plants is driving demand for advanced waste heat recovery solutions to improve overall energy efficiency.

- Growing Adoption of Digital Twin Technology: Digital twin implementation is boosting system design accuracy and real-time optimization of waste heat recovery performance.

- Increasing Use of High-Temperature Heat Pumps: Deployment of high-temperature heat pumps is fueling enhanced heat utilization across industrial processes.

- Propelling Demand for Modular Recovery Systems: Modular and scalable WHR units are propelling uptake in retrofit and brownfield metal facilities.

- Boosting Focus on Operational Reliability: Manufacturers are increasing investments in WHR technologies to enhance reliability and reduce unplanned production downtime.

Global Pulse of Metal Manufacturing Waste Heat Recovery: Trade, Technology, and Transformation

- China produced approximately 1,019 million tonnes of crude steel in 2023, maintaining its position as the world's largest metal producer. This production scale directly drives the greatest global demand for waste heat recovery systems across blast furnaces, sintering plants, and rolling mills.

- India recorded crude steel production of about 141 million tonnes in 2023, ranking second globally. Rising steel capacity additions and energy-efficiency mandates are increasing imports of waste-heat recovery boilers and power-generation systems for Indian metal plants.

- Vietnam produced approximately 19.2 million tonnes of crude steel in 2023, reflecting rapid industrial expansion. Growth in downstream metal fabrication and electronics manufacturing is increasing demand for modular waste heat recovery systems.

- India added more than 15 million tonnes per annum of new steelmaking capacity between 2023 and 2024, with additional capacity under construction across blast furnace and electric arc furnace routes. New greenfield and brownfield projects are driving rising imports of waste-heat recovery systems to improve energy efficiency and meet regulatory requirements.

- Electric arc furnace (EAF) steel production accounted for approximately 28% of global crude steel output in 2023, with an average energy consumption of 400-450 kWh per tonne. The significant electricity usage in EAF operations is driving demand for heat-recovery technologies to improve overall process efficiency.

- United States industrial decarbonization programs, including incentives under the Inflation Reduction Act 2022-2024, have accelerated imports of WHR equipment. Steel and non-ferrous metal plants are leveraging imported ORC systems, turbines, and boilers to meet emission reduction targets and qualify for tax credits.

Metal Manufacturing Waste Heat Recovery System Market Outlook

- Industry Growth Overview: The metal manufacturing waste heat recovery system market is expanding rapidly as industries face mounting energy costs and stricter environmental regulations. Manufacturers are implementing systems to extract heat from flue gases, furnaces, and kilns, to convert the waste energy into electricity, steam, or process heat. The drive to become operationally efficient and increase global production of steel and aluminum is driving its adoption in major industrial centers.

- Technology & Innovation Trends: High-performance materials, corrosion-resistant coatings, and modular designs are enabling seamless installation in existing plants. IoT-based sensors, smart meters, and predictive maintenance software provide real-time data to optimize energy recovery and reduce downtime. Process analytics with AI assistance and digital twin simulation enable operators to maximize heat capture, overcome inefficiencies, and minimize operational risks. Moreover, the companies are exploring combinations of waste heat recovery with renewable energy systems to further reduce dependency on fossil fuels.

- Sustainability Trends: Sustainability initiatives are a critical driver, with companies aiming to lower carbon footprints, improve energy intensity metrics, and comply with ESG frameworks. Waste heat recovery reduces greenhouse gas emissions and fossil fuel use, thereby contributing to corporate sustainability efforts.The incentives that the EU Emission Trading System and the U.S. energy efficiency grants are European and North American regulations that promote the rapid deployment of the system. Additionally, the investment in R&D for higher-efficiency heat exchangers and low-maintenance recovery units is driving both technological and environmental progress.

- Global Expansion: Regional adoption patterns vary, with Europe and North America leading in retrofitted and new installations, driven by mature industrial infrastructure and supportive policies. Asia-Pacific is becoming the most rapidly developing region, driven by industrialization, government incentives, and growing energy demand in China, India, and Southeast Asia. Furthermore, the increased cross-border partnerships and licensing agreements are amplifying access to more sophisticated technologies, thus facilitating the global expansion of the market.

- Major Investors: Private equity and industrial conglomerates are actively funding waste-heat recovery technology providers, as well as acquisitions and retrofitting projects. Startups in thermoelectricity, ORC, and AI-driven optimization are being supported by green technology-oriented venture capital funds. The strategic energy investors are investing in long-term regulatory incentives and the increasing industrial need for low-cost energy management. Global manufacturers and industrial giants are investing in internal energy-efficiency programs as they purchase specialized solutions from solution providers to bolster their technology portfolios.

- Startup Ecosystem: Startups are introducing compact, modular, and high-efficiency recovery units, AI-driven monitoring systems, and next-generation thermoelectric materials. Pilot projects in the steel, aluminum, and foundry sectors show enhanced ROI and reduced energy waste. Research institutions and industry leaders are collaborating with startups to deploy innovative solutions at scale, starting with a prototype. Furthermore, the emerging companies focus on cost-effective retrofits for older plants, enabling wider market adoption in the coming years.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 13.42 Billion |

| Market Size in 2026 | USD 14.40 Billion |

| Market Size by 2035 | USD 27.22 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.33% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East and Africa |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Heat Source, Application, Metal Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Technology Insights

Which Technology Is Driving Maximum Energy Recovery in Metal Manufacturing?

Recuperators: This segment dominated the metal manufacturing waste heat recovery system market in 2025, accounting for an estimated 29.6% market share. Due to their efficiency in returning heat exchanged by the exhaust gases to the industrial processes, this saves a great deal of fuel and operating costs. These systems were used in large quantities in blast furnaces, reheating furnaces, and rolling mills in Asia and Europe for their reliability and performance. Furthermore, the systems were primarily used in steel and non-ferrous metal plants to meet 2025 energy and emissions requirements, thereby fuelling the segment's growth.

Organic Rankine Cycle (ORC) Systems: The organic rankine cycle (ORC) systems segment is expected to grow at the fastest rate in the coming years, with a 10.9% CAGR, as they convert low-grade waste heat into electricity. Increased electricity costs and environmental policies in 2025 drove the uptake of ORC, particularly in developing economies such as India, Vietnam, and Southeast Asia. Moreover, the government incentives and sustainability objectives further accelerated the implementation of ORC systems in the coming years.

Heat Source Insights

Which Heat Sources Are Powering Maximum Efficiency in Metal Manufacturing?

Furnaces: The segment held the largest revenue share in the metal manufacturing waste heat recovery system market in 2025, accounting for 33.8%. The largest amounts of recoverable high-temperature heat were produced by blast, electric arc, and induction furnaces. Thus making them the best choice in a waste heat recovery system implementation.

Furnace-mounted recuperators and ORCs were popular among European, Chinese, and Japanese industrial operators to reduce fuel costs and improve overall energy efficiency. Moreover, the opportunities for retrofit in older plants also increased further adoption, and new steel, aluminum, and copper plants were planned with advanced WHR systems from the design phase.

Reheating & Annealing Processes: The reheating & annealing processes segment is expected to grow at the fastest CAGR in the coming years, accounting for 9.4% market share. These processes generate steady, medium-temperature waste streams suitable for ORC systems and preheating applications, thereby enhancing energy conversion efficiency. Furthermore, these systems were being embraced more by industrial operators in emerging markets, such as India, Vietnam, and the Middle East, thereby propelling segment growth.

Application Insights

How Are Applications Redefining Energy Utilization in Metal Manufacturing?

Power Generation: The segment dominated the metal manufacturing waste heat recovery system market in 2025, accounting for an estimated 31.2% market share, as industrial facilities continued to convert waste heat into electrical power and steam for internal use. Most deployments used Steam Rankine Cycle and ORC-based systems, which enabled the plant to generate power using furnace and exhaust flue gases rather than buying grid power. More than 600 TWh of 2024 was consumed globally, creating growing demand for heat to power systems in the heavy power generation sector. Additionally, the set of energy efficiency requirements introduced in the EU and Asia in 2025, which focused on heat-to-power conversion, reinforced power generation as the dominant application segment.

Process Heating: This segment is expected to grow at the fastest rate in the coming years, with a CAGR of about 9.1%, as operators increasingly repurpose medium-temperature waste heat for preheating furnaces, annealing lines, and rolling mill operations. Heat overflow from heat re-heating and annealing operations provides a constant thermal energy input, enhancing fuel consumption and operational throughput. Furthermore, the process heating heat reuse was identified by industry decarbonization plans in 2025-2026 as an industry compliance measure to reduce national emissions and as an opportunity for increased adoption.

Metal Type Insights

Which Metals Are Driving Maximum Waste Heat Utilization in Manufacturing?

Iron & Steel: The iron & steel segment held the largest revenue share in the metal manufacturing waste heat recovery system market in 2025, accounting for 58.4% of the market, due to blast furnaces and electric arc furnaces, which generate large volumes of high-temperature waste heat that are readily captured and used. In 2023, iron & steel processes globally emitted more than 700 TWh of energy loss, underscoring the need for recovery solutions. Companies had ORC units and high-capacity recuperators installed in plants in China, Germany, and Japan to convert heat into electricity and steam, reducing dependence on grid energy. Moreover, regulatory reductions in carbon and energy efficiency spurred heat-recovery use by iron and steel operators to meet national emissions limits.

Aluminum: This segment is expected to grow at the fastest pace over the coming years, with an estimated 9.2% CAGR. Owing to the electrolysis and reheating of smelters, continuous, steady waste heat at medium temperatures is produced that fits well into modular ORC and economizer systems. The increase in the number of aluminum manufacturing plants in India, Southeast Asia, and the Middle East is likely to accelerate the adoption of heat recovery systems. The rising costs of electricity and incentives to promote sustainability are focusing on energy efficiency, further boosting the market in the coming years.

End User Insights

Which End Users Drive Waste Heat Utilization in Metal Manufacturing?

Integrated Steel Plants: This segment dominated the metal manufacturing waste heat recovery system market in 2025, accounting for an estimated 35.7% market share. Because blast furnaces and electric arc furnaces generate intense high-temperature waste heat, they are prime candidates for recovery systems. The use of ORC units, steam turbines, high-capacity recuperators, and waste heat boilers was popular among operators in integrated mills to utilize exhaust heat for power and steam generation. Furthermore, the expansion of integrated steel production and global decarbonization commitments continued to support high levels of WHR investment.

Secondary Metal Producers: The segment is expected to grow at the fastest CAGR of 8.9% in the coming years, owing to scrap-based and remelting processes that generate medium-temperature heat that suits modular waste heat recovery solutions. Increasing scrap recycling, particularly in Europe and North America, spurred the growth in WHR installed. Additionally, the new capacity developments in India, Southeast Asia, and the Middle East have hastened the demand for waste recovery systems, as operators seek to cut energy costs and minimize environmental impact.

Regional Insights

What is the Asia Pacific Metal Manufacturing Waste Heat Recovery System Market Size?

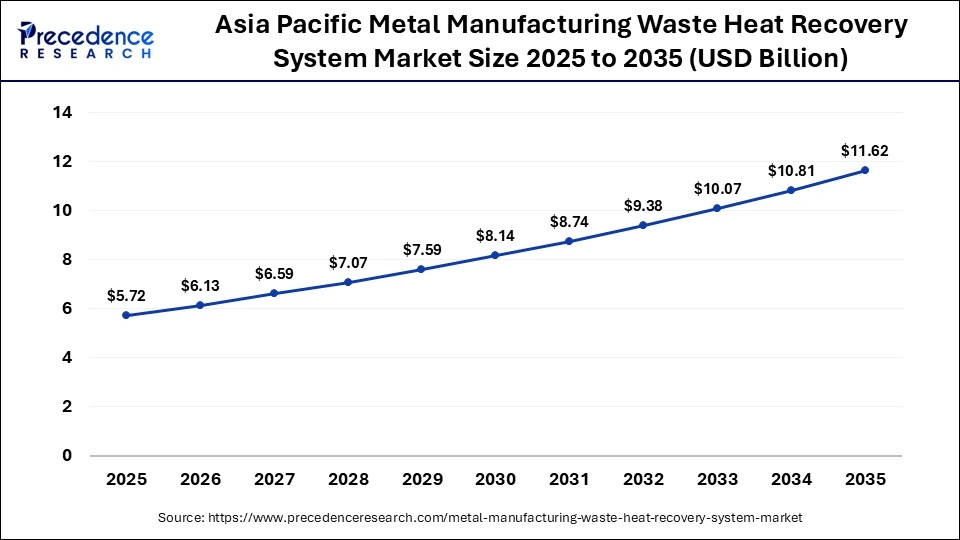

The Asia Pacific metal manufacturing waste heat recovery system market size is expected to be worth USD 11.62 billion by 2035, increasing from USD 5.72 billion by 2025, growing at a CAGR of 7.34% from 2026 to 2035.

Why Is Asia Pacific Leading in the Metal Manufacturing Waste Heat Recovery System Market 2025?

Asia Pacific led the metal manufacturing waste heat recovery system market in 2025, capturing the largest revenue share at approximately 42.6%, driven by the region's high concentration of energy-intensive industrial activity and sustained growth in manufacturing output. Countries across the Asia Pacific accounted for more than 50% of global industrial heat demand projected through 2028, reflecting the scale of steel, aluminum, and non-ferrous metal production concentrated in the region. This structural heat demand creates strong economic incentives for metal producers to deploy waste heat recovery systems to reduce fuel consumption and operating costs.

The region's increasing focus on renewable and low-carbon heat solutions has further supported the adoption of heat reuse technologies in heavy industries. According to the International Energy Agency, industrial renewable heat use is expected to rise toward 2030 as electrification expands across metal processing operations, particularly in scrap-based steelmaking and aluminum production. In parallel, rising investments in energy efficiency upgrades and industrial decarbonization programs have increased awareness of waste heat utilization across major metal manufacturing hubs in the Asia Pacific, reinforcing long-term demand for recovery systems.

China is Leading Asia Pacific's Industrial Heat Recovery Systems Expansion

China is a major player in the waste heat recovery systems market due to the scale of its steel, aluminum, and copper manufacturing industries, which generate large volumes of recoverable industrial heat. According to the Ministry of Industry and Information Technology's 2024 disclosures, more than 3,500 factories participated in national industrial energy efficiency programs, supporting the deployment of waste heat recovery systems across both retrofit projects and newly built greenfield facilities. These programs have targeted high-temperature processes such as blast furnaces, reheating furnaces, and non-ferrous metal smelting operations.

Additional momentum has come from government subsidies and carbon-reduction policies that prioritize energy-efficiency improvements in heavy industry. Policy instruments linked to emissions-reduction targets and industrial decarbonization have encouraged manufacturers to invest in waste-heat recovery as a cost-effective means to reduce fuel consumption and operational emissions. Together, large-scale industrial capacity and sustained policy support continue to consolidate China's leadership in the waste heat recovery market.

How Are the Middle East & Africa Accelerating Growth in the Metal Manufacturing Waste Heat Recovery System Market?

The Middle East and Africa is anticipated to grow at the fastest rate in the market during the forecast period, accounting for an estimated 42% market share, as regional economies diversify their energy portfolios and place greater emphasis on industrial efficiency. Countries within the Gulf Cooperation Council have expanded refinery, petrochemical, and heavy process industries, which generate large volumes of high-grade waste heat suitable for recovery and reuse across steam generation and power applications. In addition, government-led incentive programs introduced in 2024 have encouraged the deployment of waste heat recovery systems in energy-intensive facilities, including refineries, smelters, and chemical plants.

Large-scale industrial zones in Saudi Arabia, the United Arab Emirates, and Qatar are increasingly integrating waste heat recovery with combined heat and power systems to reduce fuel consumption and operational costs. Rising electricity demand from desalination plants and downstream processing facilities further strengthens the case for recovering and reusing excess industrial heat. In Africa, growing investments in cement, metals, and mining operations are also creating new opportunities for waste heat recovery in high-temperature process environments.

Saudi Arabia Metal Manufacturing Waste Heat Recovery System Market Trends

Saudi Arabia is leading adoption in the Middle East and Africa waste heat recovery market, supported by its large base of energy-intensive industries, including petrochemicals, refining, and steel manufacturing. Facilities across these sectors are deploying organic Rankine cycle systems and heat-recovery boilers to convert high-temperature exhaust heat into on-site electricity and process heat, reducing reliance on grid power and fuel consumption. These systems are commonly integrated into furnaces, reformers, and process heaters, where continuous heat output enables stable recovery performance.

National energy diversification policies and industrial efficiency targets have positioned Saudi Arabia as a regional hub for the deployment of industrial heat recovery. Investments aligned with long-term energy transition strategies are encouraging heavy industries to adopt recovery technologies as part of broader cost-reduction and emissions-management initiatives, reinforcing the country's leadership in large-scale waste-heat utilization.

Why Is North America Seeing Notable Growth in Industrial Heat Recovery Systems?

The North America region is expected to hold a notable revenue share of the market, owing to well-developed infrastructure and clean energy policies. IEA reported that U.S. investment in clean technologies neared USD 359 billion in 2024, reflecting strong underlying demand for industrial efficiency solutions.

The policy structures in the U.S. and Canada promoted the use of heat recovery in steel, refining, and chemical plants to meet increasingly stringent energy requirements. The major industrial actors implemented new, highly digitized monitoring and control solutions to achieve the best heat-recovery performance and anticipate maintenance requirements. Additionally, in 2024, higher energy and decarbonization commitments encourage the incremental uptake of ORC and steam cycle technologies.

U.S. Metal Manufacturing Waste Heat Recovery System Market Trends

The U.S. leads the market, supported by a well-developed industrial base and long-standing emphasis on energy efficiency across heavy manufacturing sectors. Steel, aluminum, and chemical plants in the country have implemented organic Rankine cycle and steam turbine systems to convert high-temperature waste heat into on-site electricity, reducing grid dependence and operational energy costs. These systems are commonly deployed alongside furnaces, kilns, and process heaters, where continuous thermal output enables stable power generation. Strong alignment among energy efficiency targets, cost-reduction goals, and industrial modernization efforts continues to support the adoption of waste heat recovery technologies across U.S. manufacturing facilities.

By 2024, the Department of Energy reported more than 1,200 facilities had proposed heat recovery programs, which were projected to save industrial energy usage in the coming years. The retrofit programs and automation-enabled plants further enhanced the adoption in major industrial belts.

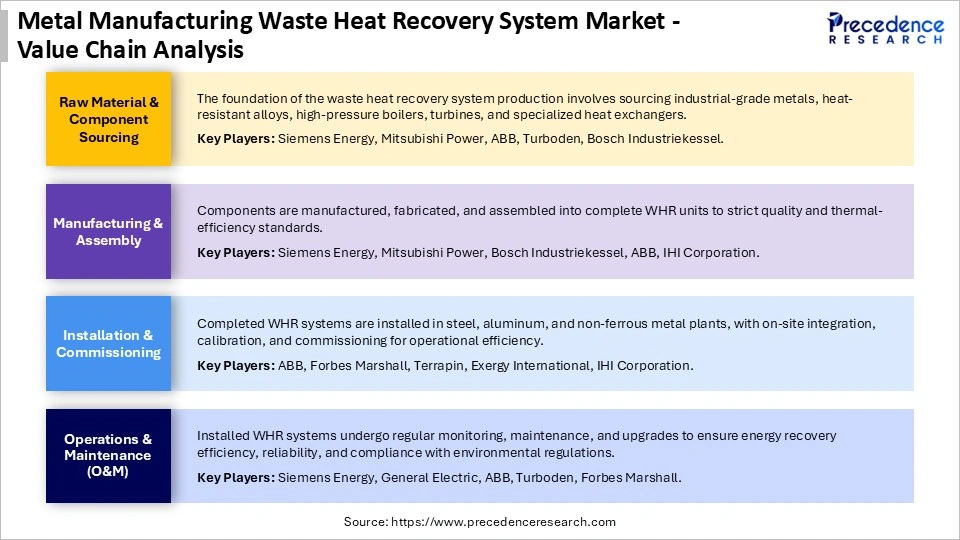

Metal Manufacturing Waste Heat Recovery System Market Value Chain

Top Metal Manufacturing Waste Heat Recovery System Market Companies

- ABB

- Bosch Industriekessel GmbH

- Exergy International Srl

- Forbes Marshall

- General Electric

- IHI Corporation

- Mitsubishi Power, Ltd.

- Siemens Energy

- Terrapin

- Turboden S.p.A.

Recent Developments

- In October 2025, Mitsubishi Heavy Industries Thermal Systems, Ltd. announced the development of the ETI-W, a centrifugal heat pump designed to efficiently utilize waste heat for the Japanese market. The ETI-W leverages heat emitted from factory production processes to heat water, achieving a maximum hot water supply temperature of 90℃ and a capacity of up to 640 kW. This enables applications in high-temperature processes traditionally powered by conventional boilers.

- In December 2025, SWEP, part of Dover and a global leader in brazed plate heat exchangers (BPHEs), announced the launch of two new products, SWEP B327 and SWEP B224. These models have been developed to meet the rising demand in data center cooling and district energy applications, enhancing operational efficiency and thermal management capabilities.

- In September 2025, Ramco Cements commissioned an eight MW waste heat recovery system (WHRS) at its Ramasamy Raja Nagar cement plant in Tamil Nadu. This expansion increased the plant's total WHRS capacity from two MW to 10 MW. At the consolidated level, Ramco Cements' waste heat power generation capacity rose from 45.15 MW to 53.15 MW. The company emphasized that such sustainability-driven initiatives, including WHRS expansion, align with cost optimization, operational efficiency, and India's broader push for greener cement production.

(Source: https://www.mhi.com)

(Source: https://www.prnewswire.com)

(Source: https://poland.arcelormittal.com)

(Source: https://www.projectstoday.com)

Segments Covered in the Report

By Technology

- Recuperators

- Regenerators

- Heat Recovery Steam Generators (HRSG)

- Organic Rankine Cycle (ORC) Systems

- Heat Exchangers

- Others (Thermoelectric, Kalina Cycle)

By Heat Source

- Furnaces

- Kilns

- Boilers

- Reheating & Annealing Processes

- Casting & Smelting Operations

By Application

- Power Generation

- Preheating of Combustion Air

- Process Heating

- Steam Generation

- Space Heating

By Metal Type

- Iron & Steel

- Aluminum

- Copper

- Zinc

- Other Non-ferrous Metals

By End User

- Integrated Steel Plants

- Secondary Metal Producers

- Rolling Mills

- Foundries

- Metal Fabrication Units

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting