What is the Patient Registry Software Market Size?

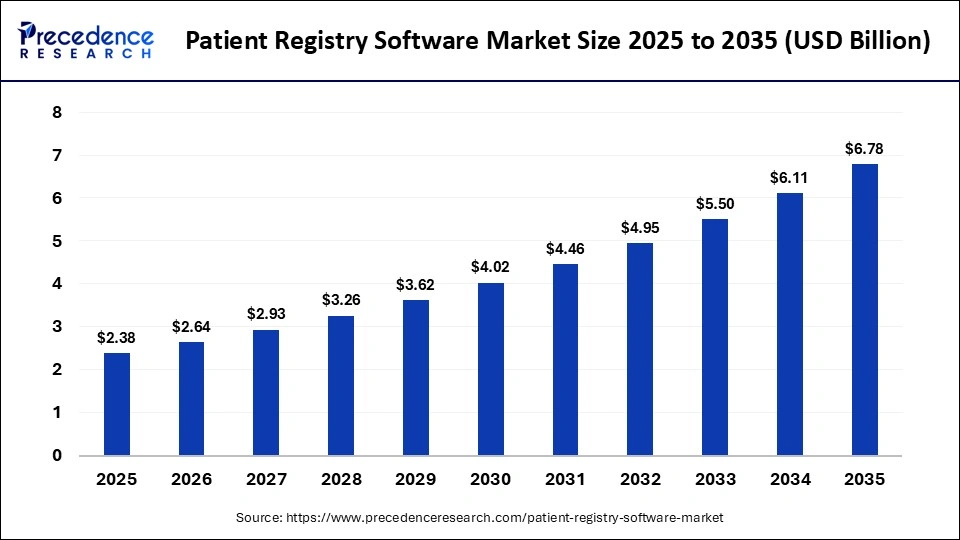

The global patient registry software market size accounted for USD 2.38 billion in 2025 and is predicted to increase from USD 2.64 billion in 2026 to approximately USD 6.78 billion by 2035, expanding at a CAGR of 11.04% from 2026 to 2035. The market for patient registry software is primarily driven by the rapid digitization of healthcare records in the healthcare industry.

Market Highlights

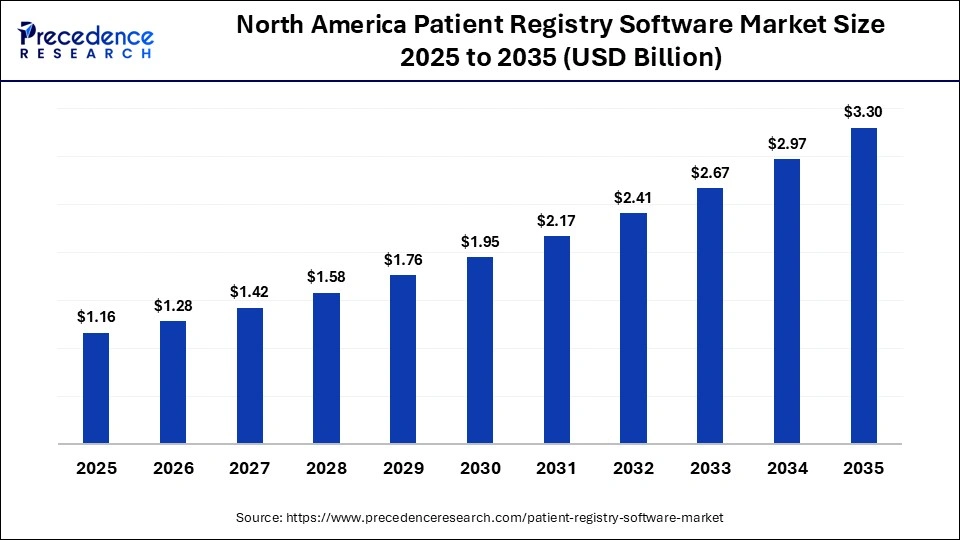

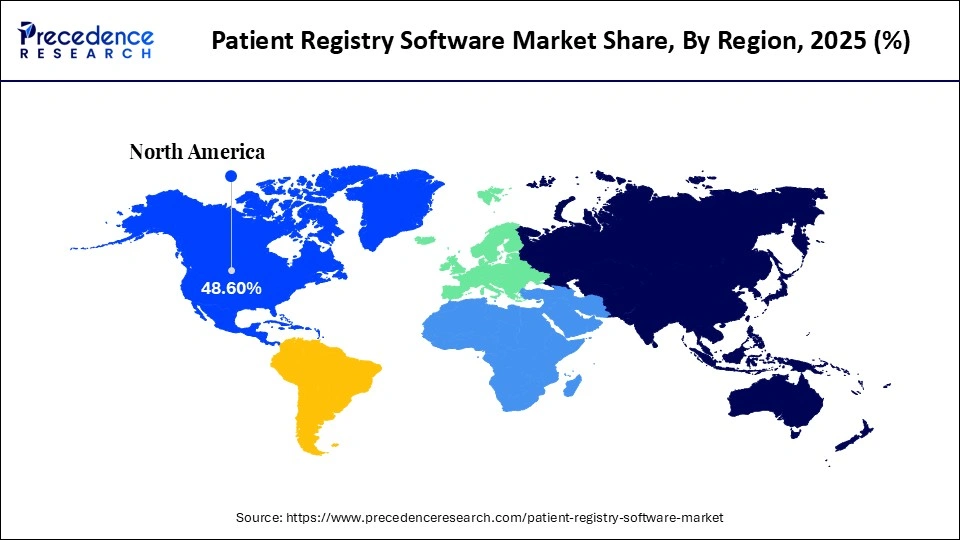

- North America dominated the market, holding the largest market share of 48.6% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 10.6% between 2026 to 2035.

- By registry type, the disease registries segment captured the biggest market share of 52.4% in 2025.

- By registry type, the product registries segment is growing at a remarkable CAGR of 9.0% between 2026 to 2035.

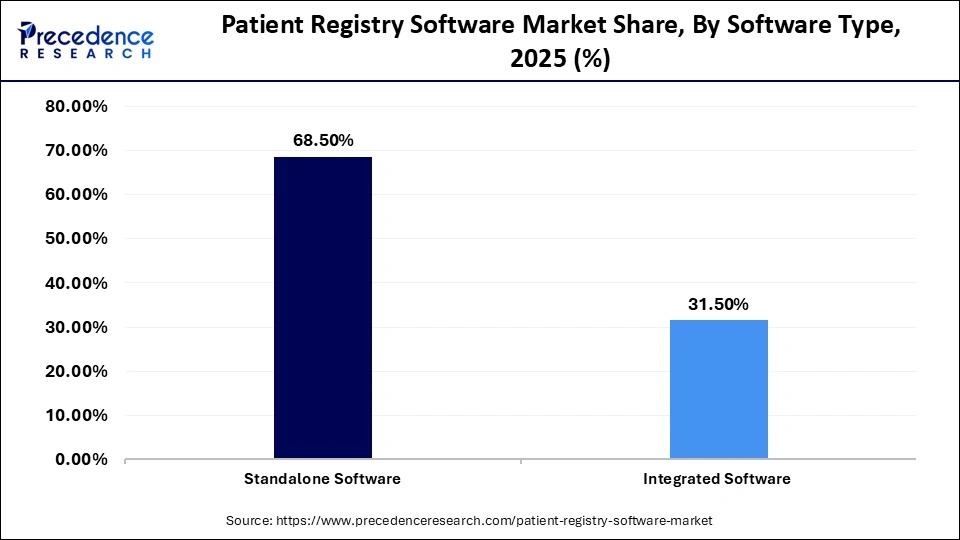

- By software type, the standalone software segment generated the highest market share of 68.5% in 2025.

- By software type, the integrated software segment is poised to grow at a solid CAGR of 8.7% between 2026 to 2035.

- By end user industry, the government agencies & TPAs segment contributed the largest market share of 44.2% in 2025.

- By end user, the pharmaceutical, biotechnology & medical device companies segment is expected to expand at a remarkable CAGR of 9.2% CAGR between 2026 to 2035.

- By functionality, the population health management segment held the largest market share of 37.6% in 2025.

- By functionality, the medical research & clinical studies segment is set to grow at a healthy CAGR of 9.1% between 2026 and 2035.

Patient Registry Software Market Overview

Patient registry software is a healthcare IT solution designed to systematically collect, store, and manage longitudinal patient data related to specific diseases, treatments, procedures, or defined populations. These platforms support clinical research, real-world evidence generation, quality benchmarking, and long-term health outcomes tracking by consolidating structured and unstructured clinical data across care settings.

Hospitals, academic research institutions, life sciences companies, payers, and public health authorities use patient registries to monitor disease prevalence, evaluate treatment effectiveness, track safety outcomes, and support value-based care initiatives. Registry data is also increasingly used to meet post-market surveillance, regulatory reporting, and population health management requirements.

Patient registry software is deployed through cloud-based and on-premise models, enabling scalability, data security, and integration with electronic health records, laboratory systems, and analytics tools. These capabilities enhance interoperability, improve data quality, and support evidence-based clinical and administrative decision-making across healthcare ecosystems.

How Are AI-Driven Innovations Reshaping the Patient Registry Software Market?

As healthcare IT capabilities advance, integration of Artificial Intelligence is driving innovation and accelerating growth in the patient registry software market by transforming registries into intelligent, data-driven platforms. AI enables automated data ingestion, real-time validation, predictive analytics, and continuous insight generation, allowing registries to move beyond passive data storage toward active clinical and operational decision support.

Natural Language Processing and machine learning play a central role by extracting structured information from unstructured clinical notes, discharge summaries, pathology reports, and imaging narratives. This significantly reduces manual data entry, improves data completeness, and supports the creation of accurate longitudinal patient profiles that are suitable for research, regulatory reporting, and outcomes analysis.

AI-driven automation also streamlines administrative workflows linked to registry operations, including appointment coordination, billing alignment, eligibility checks, and insurance verification. By reducing repetitive administrative effort and minimizing data inconsistencies, AI allows clinical and research staff to focus more directly on patient care, protocol adherence, and study oversight.

Machine learning models enhance registry value by identifying patient cohorts, predicting disease progression, flagging data anomalies, and supporting real-world evidence generation with higher precision. These capabilities are strengthening the role of patient registry software as a core infrastructure for population health management, clinical research, and value-based care programs.

Patient Registry Software Market Outlook

- Industry Growth Overview: Between 2025 and 2030, the industry is expected to experience accelerated growth. The growth of the market is driven by rapid digital transformation, increasing adoption of Electronic Health Records (EHRs), rising burden of chronic and rare diseases, supportive government initiatives and funding, and increasing integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and cloud-based platforms.

- Global Expansion: Several leading players in the patient registry software market, including IBM, Dacima Software Inc., IQVIA, Oracle, and Health Catalyst, are actively expanding their geographical presence through strategic initiatives such as acquisitions, key partnerships, supportive government initiatives, and new product launches. For instance, in May 2025, Registry Partners, a national leader in data abstraction, registry management, and consulting services, announced the launch of RegiHealth, a groundbreaking program designed to help hospitals and healthcare systems maximize the return on their patient registry investments. The RegiHealth program offers a four-step process to guide healthcare systems through patient registry optimization, which includes Client Survey, Response Analysis, RegiHealth Score, and RegiHealth Action Plan.

- Major Investors: Major investors and key players in the patient registry software market include large technology corporations/specialized health data giants like IQVIA, IBM, Optum, Oracle, and McKesson. These investments are advancing data-driven healthcare to enhance data analysis and improve patient outcomes.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.38 Billion |

| Market Size in 2026 | USD 2.64 Billion |

| Market Size by 2035 | USD 6.78 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Registry Type, Software Type, Functionality, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Registry Type Insights

What Causes the Disease Registries Segment to Dominate the Patient Registry Software Market?

Disease Registries: The segment held the largest market share of 52.4% in 2025. The growth of the segment is mainly driven by the increasing burden of chronic and rare diseases, which creates a significant demand for efficiently tracking and managing patient populations. Disease registries play a crucial role in managing and analyzing patient data related to specific diseases.

Product Registries: This segment is expected to grow at a remarkable CAGR of 9.0% between 2026 and 2035. Product registries efficiently identify suitable patients for clinical trials, which accelerates the development of new drugs. Product registries provide valuable insight into drugs or medical devices in clinical research. Several regulatory agencies adopt product registries to support regulatory decision-making regarding the drug's safety and effectiveness.

Software Type Insights

Which Segment Is Dominated by the Software Type in the Patient Registry Software Market?

Standalone Software: The segment dominates the patient registry software market, holding a 68.5% share. Standalone software provides solutions for managing chronic diseases, healthcare services, and product tracking and is widely used by hospitals, the pharmaceutical industry, government bodies, and research centers to evaluate outcomes and conduct clinical studies.

Integrated Software: The segment is the fastest-growing in the patient registry software market, with a CAGR of 8.7%. Integrated software embeds into EHRs and other systems for real-time insights. Integrated patient registry solutions are widely preferred due to their data-driven insights, improved coordination across departments and institutions, and compliance & security with regulatory requirements.

End-user industry Insights

What Causes the Government Agencies & Public Health Authorities Segment to Dominate the Patient Registry Software Market?

Government Organizations & TPAs: The segment dominates the patient registry software market, holding a 44.2% share. This is driven by the rise in government-backed health programs, increasing patient volume, and rising adoption of Electronic Health Records (EHRs). Patient registry software helps government agencies in disease surveillance, managing population health, and public health initiatives. Additionally, favorable government policies and initiatives for digital health records have significantly increased the adoption of patient registry software.

Pharmaceutical, Biotechnology & Medical Device Companies: This segment is the fastest-growing in the patient registry software market, with a CAGR of 9.2%. Patient registry software facilitates data collection, analysis, and reporting, which assists in providing crucial information to pharma/biotech/medical device companies for developing novel drugs, biologics, and advanced medical devices.

Functionality Insights

Why Is Population Health Management Dominating the Patient Registry Software Market?

Population Health Management: The segment dominates the patient registry software market, holding a 37.6% share. The growth of the segment is driven by the rising shift toward value-based care, rising cases of infectious & chronic diseases, rising need to reduce patient readmissions, and increasing integration of advanced technology like Artificial Intelligence (AI) and Machine Learning (ML) AI in population health management. Healthcare systems are increasingly moving towards value-based care, which enables providers to improve patient outcomes and reduce costs.

Medical Research & Clinical Studies: This segment is expected to show the fastest growth over the forecast period, supported by the growing demand for real-world evidence in drug development, post-market surveillance, and regulatory decision-making processes. Patient registry software is extensively used to systematically collect, store, and manage longitudinal health status data of patients undergoing specific treatments. Several researchers monitor how a patient's health status evolves after a specific intervention or treatment. These factors are expected to boost the medical research and clinical studies segment in the patient registry software market.

Regional Insights

How Big is the North America Patient Registry Software Market Size?

The North America patient registry software market size is estimated at USD 1.16 billion in 2025 and is projected to reach approximately USD 3.30 billion by 2035, with a 11.02% CAGR from 2026 to 2035.

How Can North America Dominate the Patient Registry Software Market?

North America dominates the patient registry software market, holding a 48.6% share, supported by mature healthcare IT infrastructure and very high adoption of electronic health records across provider networks. The United States and Canada have established large-scale digital health ecosystems where registries are routinely integrated with EHRs, claims systems, laboratory platforms, and analytics tools to support clinical research and population health programs.

Regional growth is reinforced by the strong presence of leading health IT and registry software vendors, sustained R&D investment, and a strict emphasis on data security, interoperability, and regulatory compliance. Frameworks governing patient privacy and data exchange have encouraged adoption of secure, enterprise-grade registry platforms capable of handling longitudinal and multi-source datasets at scale.

Government-backed digitization initiatives and reimbursement models focused on outcomes-based care are further accelerating adoption. In the U.S., programs overseen by the Centers for Medicare & Medicaid Services emphasize quality reporting, real-world evidence generation, and chronic disease management, all of which rely heavily on registry data. The rising prevalence of chronic conditions such as cardiovascular disease, diabetes, and oncology indications is increasing demand for integrated and cloud-based patient registries to support population health management, clinical research, and improved patient outcomes across the region.

What is the Size of the U.S. Patient Registry Software Market?

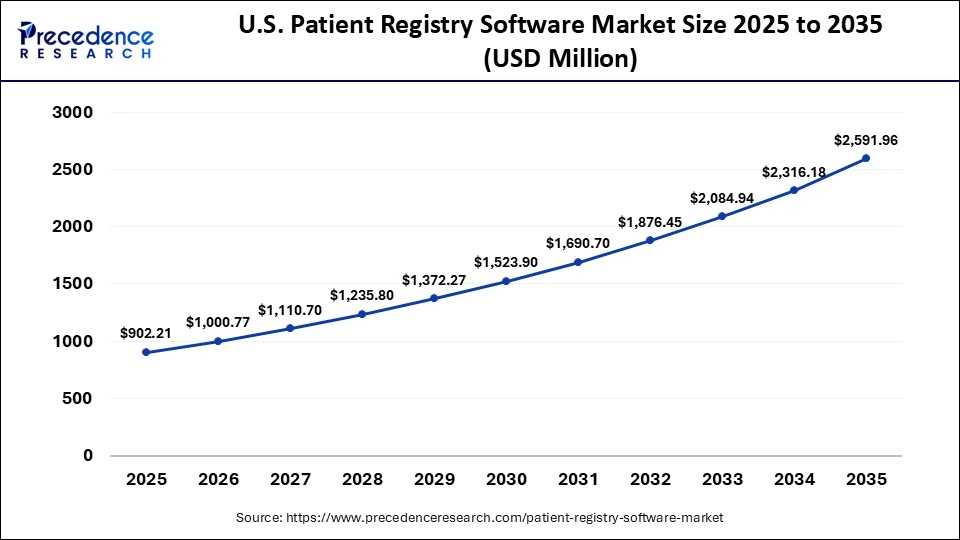

The U.S. patient registry software market size is calculated at USD 902.21 million in 2025 and is expected to reach nearly USD 2,591.96 million in 2035, accelerating at a strong CAGR of 11.13% between 2026 and 2035.

How Is the United States Transforming the Patient Registry Software Market?

The United States leads the patient registry software market and represents the largest contributor to regional and global adoption. The country hosts a concentration of leading market participants, including IBM Corporation, IQVIA Holdings Inc., Health Catalyst Inc., Oracle Corporation, Conduent Inc., Elekta, and Dacima Software Inc., all of which actively support large-scale registry deployments across clinical and research environments.

Market growth in the U.S. is driven by a highly advanced healthcare IT infrastructure, rapid digital transformation across provider networks, and strong alignment with value-based care models. Supportive government initiatives, expanding use of real-world evidence in regulatory and reimbursement decisions, and a rising burden of chronic diseases are reinforcing demand for longitudinal patient data platforms. In parallel, integration of AI-driven analytics and cloud-based architectures is enhancing scalability, interoperability, and real-time insight generation, further strengthening the country's leadership in patient registry software adoption.

In August 2025, Oracle brought Electronic Health Records (EHRs) into the 21st century. Now available for ambulatory providers in the U.S., the all-new, modern Oracle Health EHR helps clinicians enhance care quality with AI-fueled intelligence that is contextual and conversational. Instead of drowning in a sea of screens and clicks, clinicians can simply use voice commands to ask for the information they need, such as a patient's recent lab results and current medications. Designed in partnership with providers on the front lines, this secure, voice-first solution is reimagining care by empowering clinicians with personalized, streamlined workflows. This helps keep them informed and in control while cutting administrative busywork so they can focus on what matters most, their patients.

How Is the Asia Pacific Region the Fastest-Growing in the Patient Registry Software Market?

Asia Pacific is the fastest-growing region in the patient registry software market, recording a CAGR of 9%, driven by accelerated digital transformation across healthcare systems and rising emphasis on structured health data management. Governments across the region are investing in national digital health programs, disease surveillance platforms, and outcomes tracking initiatives, which are increasing demand for scalable and interoperable patient registry solutions.

Countries such as China, India, Japan, and South Korea are expanding electronic health record adoption and strengthening regulatory frameworks around data standardization, reporting, and compliance. These developments are creating a favorable environment for registry platforms that can integrate EHR, claims, and laboratory data at scale.

The region also faces a high and growing patient population burdened by chronic conditions such as cancer, cardiovascular diseases, diabetes, and rare diseases, which necessitates long-term disease tracking and real-world evidence generation. Patient registries are increasingly used to support national screening programs, post-market surveillance, and population-based research in these therapeutic areas.

Rising adoption of advanced technologies, including artificial intelligence, machine learning, and cloud-based systems, is enhancing registry functionality by enabling automated data capture, predictive analytics, and real-time reporting. This convergence of regulatory push, healthcare digitization, epidemiological pressure, and technology adoption is expected to sustain strong growth of the patient registry software market across Asia Pacific in the coming years.

India's Patient Registry Software Market Analysis

India's patient registry software market is experiencing steady growth, supported by accelerating adoption of electronic health records, rising healthcare R&D investment, and increasing emphasis on data-driven clinical and policy decision-making. The growing burden of infectious diseases and long-term chronic conditions such as diabetes, cardiovascular disorders, and oncology is increasing demand for longitudinal patient data platforms that can support disease tracking, outcomes measurement, and real-world evidence generation.

Supportive government initiatives play a central role in market expansion. Programs such as the Ayushman Bharat Digital Mission are driving nationwide EHR adoption, standardized health identifiers, and interoperability across healthcare systems. This digital foundation is creating a unified ecosystem where patient registries can seamlessly integrate clinical, claims, and diagnostic data, accelerating uptake across public health programs, clinical research, and population health management initiatives.

Is the European Region Responsible for Growth in the Patient Registry Software Market?

The European patient registry software market is experiencing notable growth, driven by increasing use of real-world evidence in clinical decision-making, reimbursement assessments, and regulatory submissions. Health authorities and payers across the region increasingly rely on registry-based RWE to evaluate treatment effectiveness, safety outcomes, and long-term population health trends, which is strengthening demand for structured and interoperable registry platforms.

Strong regulatory frameworks across the European Union support this growth by encouraging standardized data collection, traceability, and post-market surveillance. The rising prevalence of chronic diseases such as cardiovascular disorders, cancer, and autoimmune conditions is further increasing the need for longitudinal disease registries that can support outcomes tracking and quality benchmarking at national and cross-border levels.

Europe is also rapidly adopting advanced technologies, including artificial intelligence and machine learning, to enhance registry functionality. These tools are used for predictive analytics, automated cohort identification, data quality validation, and personalized care pathway analysis, improving the value of registries for clinicians, researchers, and policymakers.

In parallel, government-backed digital health initiatives and multi-stakeholder partnerships between public authorities, academic research institutions, and technology providers are accelerating deployment. This collaborative ecosystem, combined with a strong focus on evidence-based care and regulatory compliance, continues to fuel sustained growth of the patient registry software market across Europe.

Germany Patient Registry Software Market Analysis

Germany is experiencing significant growth in the patient registry software market, driven by rapid technological advancement in cloud-based, interoperable health IT systems and increasing demand for value-based care delivery models. Healthcare providers and payers are placing greater emphasis on outcomes measurement, care coordination, and longitudinal data tracking, which is accelerating adoption of advanced registry platforms.

Regulatory compliance requirements related to data protection, reporting, and quality benchmarking are also strengthening demand for secure and standardized registry solutions. Germany's strong policy focus on digital health, supported by sustained government funding and national digitalization strategies, is encouraging hospitals and research institutions to modernize data infrastructure and improve interoperability across care settings.

The rising prevalence of chronic conditions such as cardiovascular disease and diabetes, along with increasing recognition and diagnosis of rare diseases, is prompting development of specialized disease-specific registries. These registries support long-term outcomes tracking, real-world evidence generation, and research collaboration, positioning Germany as a key growth market for patient registry software during the forecast period.

Patient Registry Software Market Companies

- IBM Corporation

- IQVIA Holdings Inc.

- Health Catalyst Inc.

- Oracle Corporation

- UnitedHealth Group/Optum

- Conduent Inc.

- Elekta

- Dacima Software Inc.

- ImageTrend Inc.

- Global Vision Technologies Inc.

- Syneos Health Inc.

- Medidata Solutions (Dassault Systemes)

- Phoenix Health/Veradigm

- ESO Solutions

- MRO/FIGmd Inc.

Recent Developments

- In August 2025, Galvanize Therapeutics announced the enrollment of the first patient in the PROPEL Registry, a multicenter observational study designed to evaluate the clinical application, safety, and outcomes of the Aliya Pulsed Electric Field (PEF) ablation system for soft tissue lesions, including primary and metastatic lesions in the lung, liver, and other organs.(Source: https://www.prnewswire.com)

- In May 2024, Rymedi and Precision Genetics, two leading pioneers in healthcare technology solutions, announced their strategic partnership aimed at transforming health outcomes and efficiencies through precision medicine. The collaboration will combine Precision Genetics' PrecisionOp, a personalized means to reduce adverse drug reactions and reliance on post-operative opioids for patients undergoing surgery, and Rymedi's blockchain-enabled clinical trial and registry platform.(Source: https://www.accessnewswire.com)

Segments Covered in the Report

By Registry Type

- Disease Registries

- Health Service Registries

- Population Registries

- Product Registries

By Software Type

- Standalone Software

- Integrated Software

By Functionality

- Population Health Management

- Patient Care Management

- Medical Research & Clinical Studies

- Health Information Exchange

- Point of Care

Product Outcome Evaluation

By End User

- Government agencies & public health authorities

- Hospitals & Medical Practices

- Private Payers

- Pharmaceutical, Biotechnology & Medical Device Companies

- Research Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting