What is Pharmaceutical Quality Management Software Market Size?

The global pharmaceutical quality management software market size is calculated at USD 2.35 billion in 2025 and is predicted to increase from USD 2.66 billion in 2026 to approximately USD 8.03 billion by 2034, expanding at a CAGR of 13.07% from 2026 to 2035. The market is witnessing market expansion is primarily driven by rising research & development investments, increasing healthcare demands from an aging population, pressure to meet stringent regulatory standards, and the incorporation of advanced technologies like AI, ML, and robotics.

Market Highlights

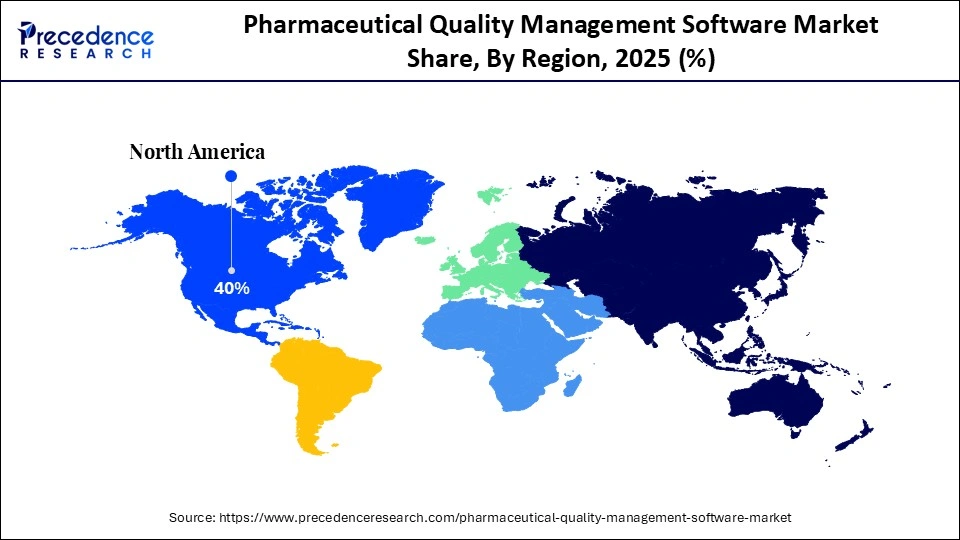

- North America accounted for the largest market share of 40% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR 18% between 2026 to 2036.

- By solution/module type, the CAPA (corrective & preventive action) management segment contributed the biggest market share of 30% in 2025.

- By solution/module type, the supplier quality management segment is growing at strong CAGR of 16% between 2026 to 2036.

- By deployment mode, the cloud/web-based segment captured the biggest market share of 60% in 2025 and is projected to maintain growth with a CAGR of 18% between 2026 to 2036.

- By enterprise size, the large enterprises segment accounted for the highest market share of 62% in 2025.

- By enterprise size, the medium enterprises segment is expanding at a healthy CAGR of 15% between 2026 to 2036.

- By end-user/application sector, the pharmaceutical & biotechnology manufacturers segment led with around 45% of market share in 2025.

- By end-user/application sector, the contract development and manufacturing organizations (CDMOs/CMOs) segment is growing at a notable CAGR of 17% between 2026 to 2036.

What is Pharmaceutical Quality Management Software?

The global pharmaceutical quality management software market comprises enterprise software solutions and services designed specifically to manage, monitor, automate, and improve quality-management processes in pharmaceutical and biotech manufacturing, R&D, and supply chain operations. These systems include modules such as document control, audit management, corrective and preventive actions, change control, non-conformance/deviation management, supplier quality management, training management, risk & compliance management, and quality analytics. They may be deployed on-premises or via cloud platforms, and they are critical for ensuring regulatory compliance and product quality.

How Can AI Impact the Pharmaceutical Quality Management Software Market?

Artificial intelligence (AI) is transforming the pharmaceutical quality management software market and enhancing efficiency and compliance through predictive analytics, automated documentation, real-time monitoring, and smart audit trails. AI tools can automatically analyze audit trails to find compliance issues faster, aiding in regulatory inspections. Also, AI provides risk scores for processes, products, and suppliers, helping companies focus on the most critical risks. Thus, AI-powered systems perform real-time visual inspections of products, ensuring consistency and catching defects.

Pharmaceutical Quality Management Software Market Outlook

The market is set for strong growth from 2026 to 2035. This expansion is primarily driven by the increasing need for stringent regulatory compliance, the complexities of modern supply chains, and the ongoing digital transformation within the pharmaceutical and life sciences industries.

This major trend due to their cost-effectiveness and scalability, driven by the increasing adoption of AI and ML for advanced data analysis, automation, and predictive quality control to meet strict regulatory pressures, improve operational efficiency, and ensure real-time traceability and audit readiness.

The worldwide market is expanding rapidly with increasing regulatory pressures, a focus on product safety, and digital transformation within the pharmaceutical industry. Furthermore, this expansion fostered by demand for integrated systems to manage quality processes from research to manufacturing, the adoption of cloud-based solutions, and the integration of advanced technologies.

Many companies such as Veeva Systems, MasterControl, Honeywell International, IQVIA, and Dassault Syst�mes are investing heavily in R&D and strategic acquisitions to expand their offerings and integrate advanced technologies.

Startups like Qualio are developing cloud quality management systems tailored for the entire life sciences ecosystem, assisting quality professionals in adopting the latest regulatory updates. Others focus on AI assistants to enhance efficiency and reduce errors in quality and safety operations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.35 Billion |

| Market Size in 2026 | USD 2.66 Billion |

| Market Size by 2035 | USD 8.03 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.07% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Solution / Module Type, Deployment Mode, Enterprise Size, End-User / Application Sector, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pharmaceutical Quality Management Software MarketSegment Insights

Solution/Module Type Insights

The CAPA (corrective & preventive action) management segment dominated the market with around 30% share in 2025. This is mainly because it is crucial for regulatory compliance, product quality, and risk mitigation. It serves as the backbone of quality management software, helping companies systematically address deviations and prevent issues from recurring, which reduces product recalls and protects patient safety. The integration of CAPA with other modules, the demand for automated processes, and its ability to support data-driven decisions all contribute to its market leadership.

The supplier quality management segment is expected to be the fastest-growing, with a CAGR of approximately 16%. This growth is driven by increasing complexity in global supply chains, strict regulatory oversight, and the rising need to mitigate risks to ensure patient safety. The incorporation of advanced technologies like AI, ML, and cloud computing into quality management software is a key growth factor. Since a single quality failure from a supplier can affect an entire batch of medication, leading to serious health risks for patients, ensuring product integrity and safety remains a top priority.

Deployment Mode Insights

The cloud/web-based segment led with about 60% market share and is projected to maintain growth with a CAGR of around 18% during the forecast period. This is mainly due to its cost-effectiveness, as it eliminates the need for expensive hardware, ongoing maintenance, and allows for scalability and accessibility. It enables real-time data analysis and lessens the IT infrastructure burden for pharmaceutical companies, as the provider manages software maintenance and updates. This model offers flexibility to adapt to changing regulatory and operational needs, supports remote work, and facilitates global operations, functioning as an on-premise solution for most users.

Enterprise Size Insights

Large enterprises held about 62% of the market share, primarily because of their extensive production, complex operations, and strict global regulatory compliance requirements, which demand robust and scalable quality management software. They have the financial resources to invest heavily in comprehensive systems that integrate with other enterprise solutions, adopt advanced technologies like AI and machine learning, and tailor solutions to their complex needs. Their focus on digital transformation helps maintain consistency, reduce errors, and boost efficiency at scale.

The medium enterprises segment is expected to grow fastest with a CAGR of around 17%. This growth is mainly due to the adoption of affordable, cloud-based solutions that enable smaller organizations to stay competitive. Cloud solutions eliminate large IT infrastructure and maintenance costs, which is a significant benefit for smaller firms. Medium enterprises rely on QMS to meet increasingly complex regulatory requirements, especially for gaining and maintaining market access in global markets. This growth is further driven by the need for greater efficiency, economic competitiveness, and access to international markets.

End-User/Application Sector Insights

The pharmaceutical & biotechnology manufacturers segment held about 45% of the market in 2025. This is due to the higher need for complex quality control in manufacturing, rising pharmaceutical demand, and the necessity for efficiency and speed to streamline processes like documentation, approvals, and audits. Companies depend on quality management software to manage everything from drug development to production, ensure compliance with regulations such as the FDA's, and improve operational efficiency through automation and integrated systems. This, in turn, increases demand for sophisticated software to manage quality at scale.

The contract development and manufacturing organizations (CDMOs/CMOs) segment is experiencing the fastest growth with a CAGR of 16%. This is due to the rising trend of outsourcing, the growing complexity of advanced therapies, the need to accelerate time-to-market, and the demand for specialized regulatory compliance and data management. By outsourcing manufacturing to CDMOs, pharmaceutical companies can concentrate on core activities likedrug discovery and marketing. Overall, quality management software helps these companies mitigate risks related to clinical trial failures, supply chain disruptions, and manufacturing issues.

Pharmaceutical Quality Management Software MarketRegional Insights

The North America pharmaceutical quality management software market size is estimated at USD 940 million in 2025 and is projected to reach approximately USD 3,252 million by 2035, with a 13.21% CAGR from 2026 to 2035

North America led the pharmaceutical quality management software market with around 38-40% in 2025. This dominance is driven by its strict regulatory environment, high R&D investment, and a strong presence of major pharmaceutical companies. The region's focus on research and development fuels a higher demand for advanced quality management tools that support innovation and new product development. Companies in North America are heavily investing in digital transformation, adopting integrated, cloud-based, and AI-enabled solutions to improve efficiency, compliance, and product safety, as well as to support risk mitigation.

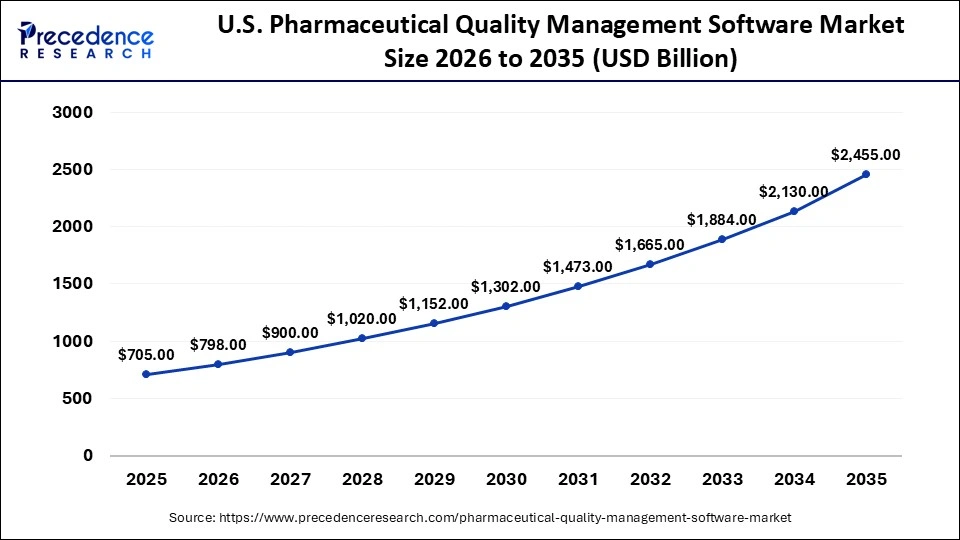

The U.S. pharmaceutical quality management software market size is calculated at USD 705 million in 2025 and is expected to reach nearly USD 2,455 million in 2035, accelerating at a strong CAGR of 13.29% between 2026 and 2035.

U.S. is a key contributor in this region, mainly because regulations such as FDA 21 CFR Part 11 and cGMP standards require robust, automated QMS solutions to ensure compliance, traceability, and patient safety. It is also home to many global pharmaceutical giants and leading QMS vendors like Veeva Systems, MasterControl, IQVIA, Honeywell, which drive innovation, especially in cloud-based and AI-enabled platforms.

Asia Pacific region is expected to experience the fastest growth, with a CAGR of around 18-20% during the forecast period. This rapid growth is primarily driven by countries like China and India, which are emerging as major global hubs for pharmaceutical and generic drug manufacturing, supplying both domestic and international markets while maintaining quality and consistency. Additionally, the region is increasingly aligning its local regulations with international standards from the FDA, EMA, and the International Council for Harmonisation. This push for regulatory compliance, including mandates for digital quality systems and data integrity, is driving widespread adoption of advanced, automated quality management software adoption.

India Pharmaceutical Quality Management Software Market Trends

India is the fastest-growing regional market in the Asia-Pacific and serves as a key hub for pharmaceutical manufacturing. The country's significant industrialization in the pharmaceutical sector, along with a focus on meeting global regulatory standards to boost exports, is driving the demand for quality management software. India is also a center for developing cost-effective quality management software solutions, with local companies like AmpleLogic contributing to the market.

Europe region is expected to accelerate considerably in the coming period. This is primarily due to its stringent and evolving regulatory framework, a strong emphasis on quality assurance, and significant investments in digital transformation and R&D. The European Medicines Agency, along with national authorities, enforces rigorous guidelines such as Good Manufacturing Practices and the EU Medical Device Regulation, which mandate robust and traceable quality management systems. The region is home to major pharmaceutical companies like Sanofi, AstraZeneca, and Novartis, as well as key software providers like SAP SE, Dassault Syst�mes, and Siemens AG, all of which support market expansion.

Germany Pharmaceutical Quality Management Software Market Trends

Germany is the largest market for quality management software within Europe, known for its emphasis on industrial standards. This market growth is further driven by a strong manufacturing sector and the Industry 4.0 initiative, which promotes the integration of quality management software with IoT and real-time monitoring to enhance efficient, high-quality production. Germany serves as a base for major global software players like SAP and Siemens, offering integrated quality management software solutions across various industries.

In Latin America, there has been significant growth in the global market, primarily driven by the increasing need for operational efficiency and stricter regulatory compliance as the pharmaceutical sector evolves. Urbanization and rising income levels are boosting consumer consumption and increasing demand for higher-quality products. Both multinational corporations and local companies are key players, with strategies often focused on technological innovation, regulatory compliance, and customer satisfaction.

Brazil Pharmaceutical Quality Management Software Market Trends

Brazil represents a significant market in Latin America. The National Health Surveillance Agency of Brazil is aligning its Good Manufacturing Practices standards with international requirements, which is pushing local pharmaceutical companies to adopt advanced quality management systems for compliance and access to global markets. Additionally, a push for economic self-reliance and increased investments in local R&D incentivizes the adoption of automated software to improve efficiency and quality control.

The Middle East and Africa are key contributors to the global market, driven mainly by the expanding pharmaceutical industry and the demand for robust quality management systems. This growth is supported by factors such as population growth and increasing access to healthcare, which necessitate higher quality standards. Investments in digital infrastructure and the modernization of healthcare systems further facilitate this growth.

UAE Pharmaceutical Quality Management Software Market Trends

The UAE is a developing market with significant growth potential in the Middle East, primarily due to its focus on healthcare advancement and digital transformation. Significant investments in advanced medical facilities and a growing awareness of quality management certifications are primary drivers for the adoption of quality management software in the region's healthcare and pharmaceutical sectors. Stringent government regulations demand high-quality and safety standards, which encourage the enterprises to comply.

Pharmaceutical Quality Management Software Market Value Chain

This involves identifying the evolving regulatory requirements and developing the software modules that meet these standards.

Key Players: MasterControl, Veeva Systems, Honeywell, Dassault Systemes, Qualio, ComplianceQuest, AmpleLogic, and Oracle.

This focuses on promoting these software to pharmaceutical, life sciences, and biotechnology companies, with enhanced compliance, operational efficiency, and reduced risk of recalls.

Key Players: Veeva Systems, MasterControl, and IQVIA.

This involves installing and configuring the software to meet a client's specific workflows and validating the system to ensure it is GxP-compliant and audit-ready.

Key Players: Honeywell for TrackWise Digital, Veeva, and MasterControl.

This ensures end-users can effectively use the system and providing ongoing technical assistance and updates to accommodate evolving regulations.

Key Players: MasterControl, Qualio, and Veeva.

This focuses ongoing use of the software within the pharmaceutical company to manage quality operations day-to-day and drive continuous improvement.

Key Players: Pharmaceutical company's QA/QC departments, production and supply chain teams, and regulatory affairs teams.

Pharmaceutical Quality Management Software Market Companies

Offers the Veeva Quality Cloud, a suite of cloud-based QMS solutions on the Vault platform, including Vault QMS, QualityDocs, LIMS, and Station Manager.

Provides a cloud-based QMS that integrates processes like document control, training, quality events, audits, and supplier and risk management.

Offers solutions like TrackWise Digital for enterprise QMS and Honeywell Forge Life Sciences for IoT-enabled optimization.

Provides quality and compliance solutions leveraging its data and analytics capabilities, often bundling software with data services.

Offers the ETQ Reliance cloud-based QMS with customizable features to automate quality processes.

Leaders' Announcements

- In March 2025, MasterControl announced acquisition of Qualer. This acquisition accelerates our vision of helping customers reduce complexity, increase efficiency, and speed time-to-market for life-changing products. Qualer will help us address a critical need in the industry by reducing costs, increasing productivity, and ensuring compliance for physical assets. (Source:https://www.prnewswire.com)

Recent Developments

- In February 2025, Yokogawa Electric Corporation launched the OpreX Quality Management System, a cutting-edge, cloud-based solution designed to accelerate digital transformation (DX) in quality assurance processes for pharmaceutical and food & beverage manufacturing industries. Ensures efficient, flexible, and error-free quality management by centralizing the management of deviations, CAPA (Corrective and Preventive Actions), changes in manufacturing procedures, and document revisions. (Source: https://www.biospectrumasia.com)

- In July 2024, Antares Vision Group launched DIAMIND Sentry, a solution allowing pharma companies to efficiently manage the substantial uptick in exceptions stemming from traceability mandates. The sophisticated system was developed by Rfxcel, a business unit of Antares Vision Group, providing supply chain visibility solutions. (Source: https://www.packagingtechtoday.com)

Pharmaceutical Quality Management Software MarketSegments Covered in the Report

By Solution / Module Type

- Document Management

- Audit Management

- CAPA (Corrective & Preventive Action) Management

- Change Management

- Supplier Quality Management

- Non-Conformance / Deviation Management

- Training Management

- Risk & Compliance Management

- Inspection Management

- Other Quality Modules

By Deployment Mode

- On-Premises Deployment

- Cloud / Web-Based Deployment

- Hybrid Deployment

By Enterprise Size

- Large Enterprises

- Medium Enterprises

- Small & Emerging Pharma / Biotech

By End-User / Application Sector

- Pharmaceutical & Biotechnology Manufacturers

- Contract Development & Manufacturing Organizations (CDMOs) / CMOs

- Research & Development (R&D) Organizations

- Generic Drug Manufacturers

- Regulatory / Compliance Authorities

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content