Polymer Filler Market Size and Forecast 2025 to 2034

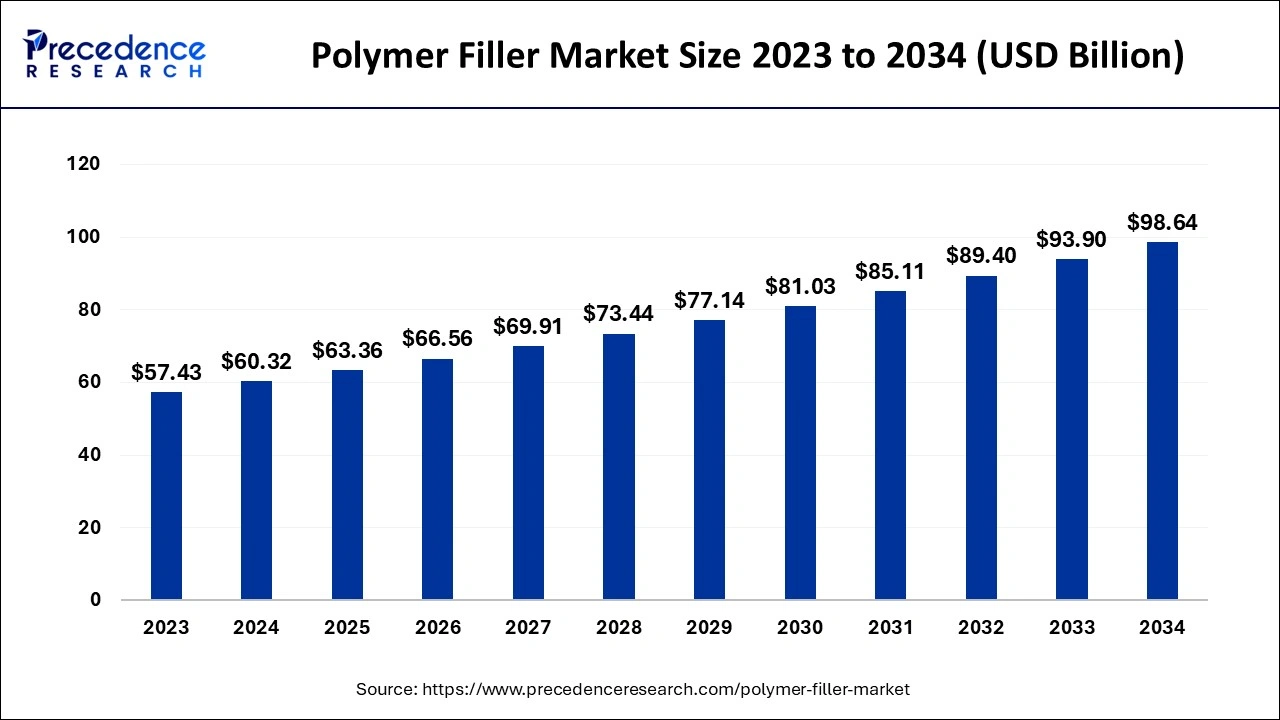

The global polymer filler market size was accounted at USD 60.32 billion in 2024 and is predicted to hit around USD 98.64 billion by 2034, growing at a CAGR of 5.04% from 2025 to 2034. Rising demand for high-strength and lightweight materials in various industries is the key factor driving the market growth. Also, the easy availability of natural fibers like cellulose and wood, coupled with the increasing demand for sustainable materials, can propel market growth shortly.

Polymer Filler Market Key Takeaways

- The global polymer filler market was valued at USD 60.32 billion in 2024.

- It is projected to reach USD 98.64 billion by 2034.

- The polymer filler market is expected to grow at a CAGR of 5.04% from 2025 to 2034.

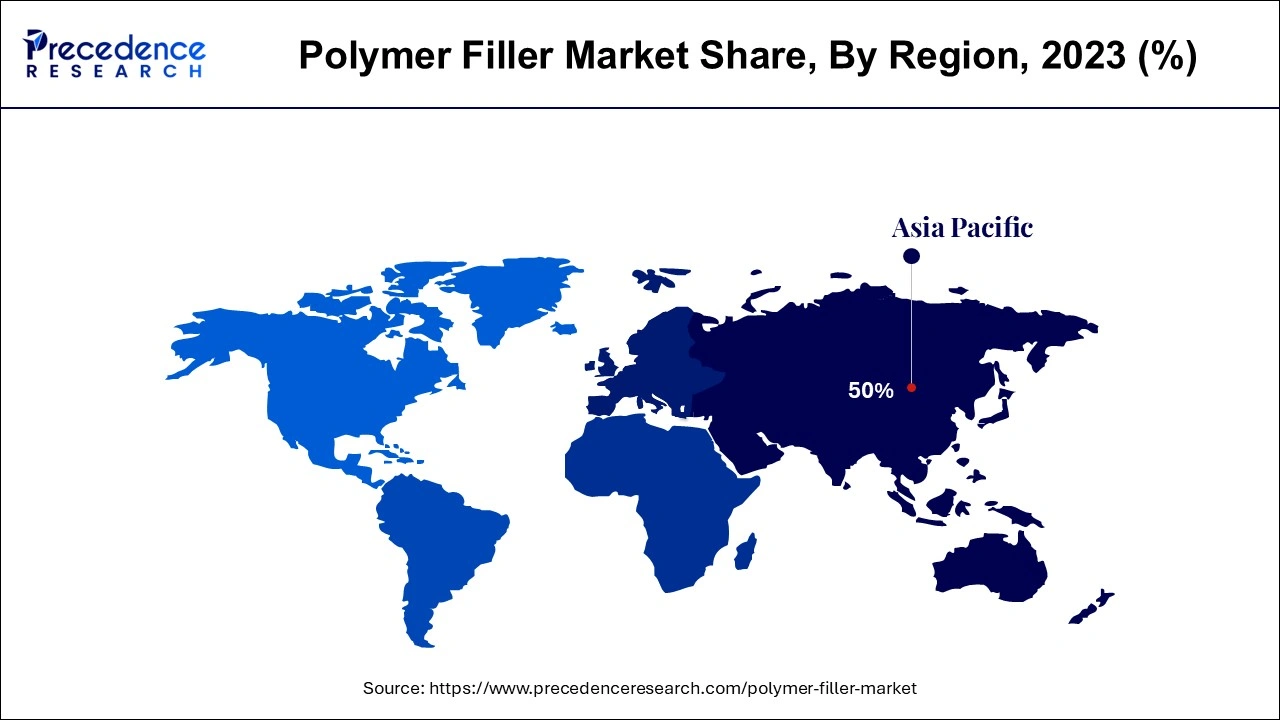

- Asia Pacific dominated the polymer filler market and contributed the biggest market share of 50% in 2024.

- North America is expected to witness significant growth over the forecast period.

- By product, the inorganic segment generated more than 78% of the market share in 2024.

- By product, the organic segment is anticipated to grow at the fastest CAGR of 5.61% over the forecast period.

- By end use, the automotive segment dominated the polymer filler market in 2024 by holding the largest market share.

- By end use, the packaging segment is anticipated to grow at the fastest rate during the forecast period.

Role of AI in the Polymer Filler Market

AI can help researchers discover and design new polymers with different properties and can process vast amounts of data to draw patterns and predict the characteristics of new polymers. Furthermore, AI can also help researchers predict the physical, chemical, and mechanical features of polymers and can enhance the consistency, efficiency, and quality of polymer production processes. However, the precision of AI predictions relies highly on the quality of the data provided to the algorithms.

- In August 2024, Meraxis collaborates with AI start-up POLYMERIZE. Partnership for a greener, more efficient polymer industry. POLYMERIZEs Software-as-a-Service platform enables producers, converters, and compounders to stimulate their materials development and launch new and more eco-friendly products more rapidly.

Asia Pacific Polymer Filler Market Size and Growth 2025 to 2034

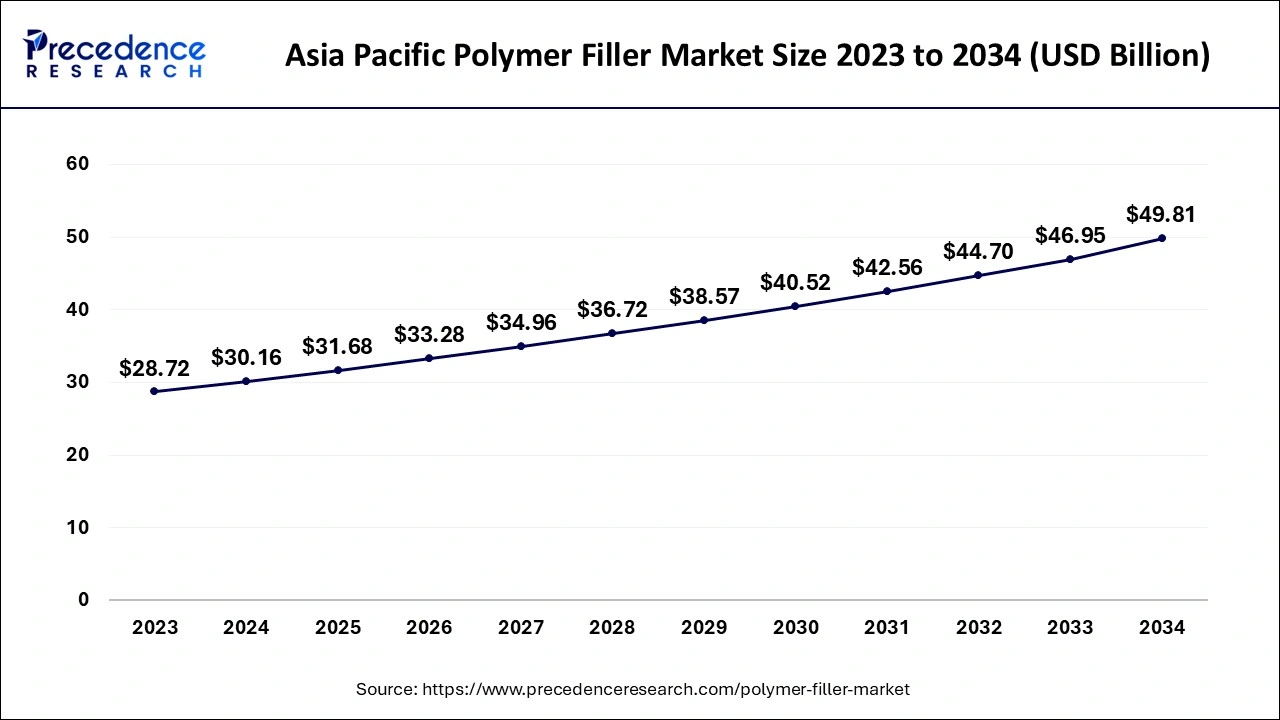

The Asia Pacific polymer filler market size was exhibited at USD 30.16 billion in 2024 and is anticipated to be worth around USD 49.81 billion by 2034, growing at a CAGR of 5.15% from 2025 to 2034.

Asia Pacific dominated the polymer filler market in 2024. The dominance of the segment can be attributed to the rapid industrialization, rising manufacturing activities, and urbanization in the region. India, China, and Japan are witnessing substantial expansions in construction, automotive, and packaging. Furthermore, the increase in infrastructure development also propels the demand for building materials with enhanced properties.

North America is expected to witness significant growth over the forecast period. The growth of the region can be driven by developing infrastructure projects that are creating the demand for polymer fillers to enhance the properties of insulation, concrete, and other building materials. However, the increasing construction and automotive industries in the countries like US are driving the polymer filler market growth in the region.

- In February 2024, Aptar CSP Technologies leader in active material science, partnered with ProAmpac, a provider of material science and flexible packaging, to develop and create ProActive Intelligence Moisture Protect. This platform technology contains Aptar CSP proprietary 3-Phase Activ-Polymer technology.

Market Overview

Polymer filler is an additive that can be added to polymer devising to decrease costs and enhance the chemical and physical properties by replacing costly resins. The filler can be solid, liquid, or gas and is generally used to enhance the stability, moldability, and strength of composites. Polymer filler also possesses material properties like decreased polymerization shrinkage and reduced thermal expansion. It can be organic or inorganic and involves various kinds of organic polymer fillers like carbon fibers, carbon black, and carbon nanotubes.

Top 10 Countries That Produce the Most Plastic Waste (tons) in 2024

| Country | Plastic Consumption (in tons) |

| China | 37.6M |

| United States | 22.9M |

| India | 7.4M |

| Brazil | 4.9M |

| Mexico | 4M |

| Japan | 3.8M |

| German | 3.6M |

| Indonesia | 3.4M |

| Thailand | 3.4M |

| Italy | 3.3M |

Polymer Filler Market Growth Factors

- The surge in penetration of polymer filler in numerous industries such as packaging, electrical, automotive, and electronics is expected to boost polymer filler market growth soon.

- Rising demand for environment-friendly materials in construction building materials can propel market growth further.

- Advancement in product development, along with the new investments from market players, will likely contribute to market expansion shortly.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 98.64 Billion |

| Market Size in 2024 | USD 60.32 Billion |

| Market Size in 2025 | USD 63.36 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.04% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Driver

Increasing demand for polymer fillers in the aerospace industry

There is a growing demand for polymer fillers like graphite, graphene oxide, carbon nanotubes, and nano clay from the aerospace industry, as polymer fillers are chosen structural constituents for airplanes because of their compatible mechanical properties and lightweight nature. Additionally, polycarbonate (PC) is a thermoplastic polymer that possesses high impact resistance, exceptional transparency, and thermal stability, which are preferred over other fillers due to its extensive range of properties.

- In July 2024, Syensqo and Orbex Ink collaborated to develop next-generation space launch systems. The partnership will drive the interaction of specialty polymer materials into launch vehicles along with developments in durability, performance, and the reuse of orbital space launch systems.

Restraint

High processing cost

The processing techniques utilized in the production of these fillers are not financially viable such as electrospinning and solvent processing. However, the cost rate of polymer processing is much higher as it involves a high loading of fillers for property improvements, which leads to hurdles in processing and melt movement because of the high viscosity of the materials filled, which can constrain polymer filler market growth.

Opportunities

Increasing demand for plastic polymer fillers

Plastic fillers offer a more cost-effective and sustainable solution to the polymer industry as compared to conventional polymer fillers. Plastic fillers improve the thermal, mechanical, and flow properties of polymers. They can also enhance the toughness, heat resistance, and tensile strength of the material. There are two main types of plastic fillers: inorganic and organic. Furthermore, PCC and GCC fillers are utilized in polymers like polypropylene, polyethylene, and polyvinyl chloride, which makes plastic parts opaque.

- In October 2024, ExxonMobil declared the launch of Signature Polymers. The innovative approach will allow customers to be more confident in meeting the value chain's complex challenges by reducing complexity and inspiring improved collaboration.

Smart polymer fillers are a new market trend

The utilization of smart polymer fillers is an emerging trend in the polymer filler market. These polymers are in demand in the medical industry. They are used in artificial body parts, biosensors, etc. In addition, they are utilized on a wide scale due to their flexibility and strength. The biocompatible property of smart polymers will fuel the overall market growth soon. Apart from this, producers of polymers have started to use enhanced technology in chemical and mechanical procedures. The main benefit of f polymer recycling is that it cuts the overall production cost by reducing the utilization of fresh or new raw materials. Later, it will help maintain a more sustainable environment.

- In December 2023, Sulzer launched a new end-to-end licensed technology, CAPSUL, for the continuous production of polycaprolactone (PCL), a biodegradable polyester often utilized in the textile, packaging, agricultural, and horticultural industries.

- In December 2023, Washington State University developed a single strand of fiber that has the flexibility of cotton and the electric conductivity of a polymer called polyaniline. The newly crafted material showed good potential for wearable e-textiles.

Product Insights

The inorganic segment led the polymer filler market in 2024. The dominance of the segment can be attributed to the more cost-effective solutions provided by inorganic polymers over organic ones. The inorganic segment is further divided into salts, silicates, oxides, hydro-oxides, and metals. Additionally, the utilization of inorganic fillers, including talc, calcium, gypsum, and others, improves the material's mechanical properties, such as strength, elasticity, impact resistance, etc.

- In November 2022, Lummus Technology, a global leader in process technologies and value-driven energy options, declared its new product, Novolen PPure polypropylene (PP) technology. The new range of polymer-based products is aimed at healthcare, automotive, components, and food packaging materials.

The organic segment is anticipated to grow at the fastest rate in the polymer filler market over the forecast period. The growth of the segment can be linked to the increasing demand for ultraviolet resistance. Organic fillers like natural fibers, cellulose, and starch-based materials provide numerous benefits like biodegradability, lightweight properties, and enhanced mechanical functions of polymers. Moreover, the increasing focus on sustainability and decreasing environmental effects will also impact product demand as they are obtained from renewable resources.

End Use Insights

The automotive segment dominated the polymer filler market in 2024 by holding the largest market share. The dominance of the segment can be credited to the increasing demand for high-strength, low-weight materials is boosting the sales of polymer fillers in the automotive industry. The plastic utilized in automobiles is derived from polymers like polyamides and PVC. Furthermore, Fillers are added to enhance the characteristics of these plastics, decreasing the price of the vehicle and enhancing fuel efficiency and overall strength.

- In July 2024, LyondellBasell, a key leader in the chemical industry, declared the launch of its new Schulamid ET100 product line, a transforming polyamide-based compound product. Created for automotive interior structural solutions, such as door window frames, this new technology highlights LYB's advanced capabilities in Engineered Polymers.

The packaging segment is anticipated to grow at the fastest rate in the polymer filler market during the forecast period. The growth of the segment can be driven by the increasing use of polymer fillers in packaging materials because these fillers are easy to seal and allow the material to remain fresh for a longer duration of time. Also, lower weight in packaging optimizes for raised product capacity, which results in lesser environmental impact and lower logistics expenses, leading to segment growth during the forecast period.

- In March 2024, INEOS & partners launch an upgraded film packaging with 50% recycled plastic. The new packaging solutions were launched by PepsiCo for the well-known snack brands in the UK and Ireland. This is done by utilizing an innovative recycling process.

Polymer Filler Market Companies

- 3M

- Dow

- Lanxess

- Momentive Performance Materials

- Rogers Corporation

- Saint-Gobain Performance Plastics

- Trelleborg AB

- Solvay

- Shin-Etsu Chemical Co. Ltd.

- PolyMod Technologies, Inc.

- Holland Shielding Systems

Recent Developments

- In May 2022, for its range of superior performance fibers, DOMO Chemica introduced a new brand, NYLEO. NYLEO combines innovative new technologies with proven performance fibers in an appealing way. The flooring, flock, textile, and abrasive sectors all use NYLEO substantially.

- In May 2022, the expansion of its MevopurTM bio-based medical-grade polymer solution line was announced by Avient Corporation, a producer of sustainable and catered material solutions and services.

Segments Covered in the Report

By Product

- Organic

- Natural

- Carbon

- Others

- Inorganic

- Oxides

- Hydro-oxides

- Salts

- Silicates

- Metals

By End Use

- Automotive

- Building & Construction

- Electrical & Electronics

- Industrial Products

- Packaging

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting