Biocatalysis Market Revenue to Attain USD 1,206.02 Mn by 2034

Biocatalysis Market Revenue and Trends 2026 to 2035

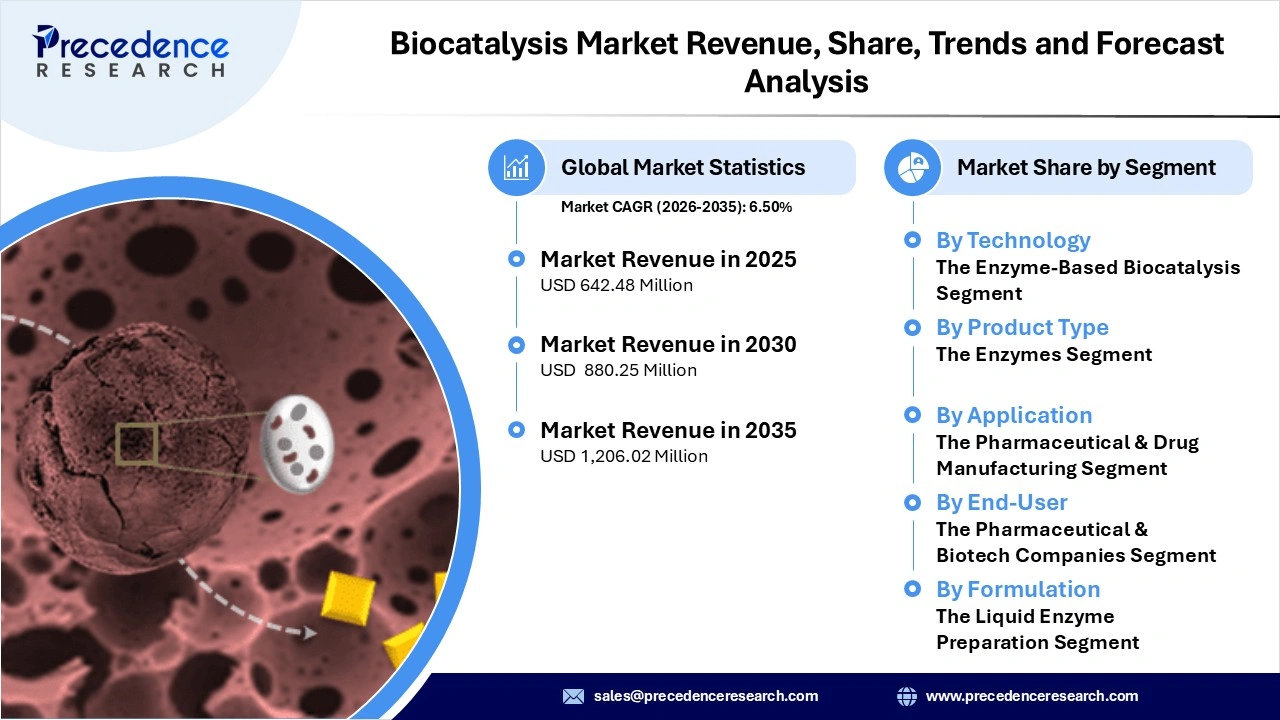

The global biocatalysis market revenue surpassed USD 642.48 million in 2025 and is predicted to attain around USD 1,206.02 million by 2035, growing at a CAGR of 6.50%. This market is rising as more industries embrace biocatalysis as a sustainable, cost-efficient, and high-precision alternative to conventional chemical processes, particularly driven by demand for clean manufacturing and eco-friendly chemical synthesis.

What Are the Key Factors Enabling the Growth of the Biocatalysis Market?

The rise of the biocatalysis industry is driven substantially by the worldwide movement toward Sustainable Manufacturing. By using enzymes, manufacturers can produce lower levels of toxic by-products and consume less energy than with traditional chemical catalytic methods. The rapid growth of the field has led to improvements in enzyme stability, specificity, and efficiency, driven by advances in both Enzyme Engineering and Protein Design. Therefore, the areas that can now benefit from the use of Enzymes have expanded significantly, including Pharma, Specialty Chemicals, Biofuels, and Bio-Polymer Materials.

As industrial growth in demand for 'Green' and Bio-Based Products continues to be driven by Government Regulations and increased consumer demand, as well as by growing environmental pressure to adhere to Environmental Standards, Biocatalysts have become the preferred method for the production of Fine Chemicals and Medicinal Products. In addition to eliminating the current high-cost factor in the production of Enzymes through the development of Modern Techniques, Modern Technologies have also enabled broader-scale production and use of Enzymes by converting the Enzymes into a Capital Investment Fixture, thereby enabling the production of Cell-Free Enzymatic Systems at a lower cost than Productive Facilities.

Segment Insights

- By Technology, the enzyme-based biocatalysis segment dominated the market in 2024, due to customers preferring isolated enzymes over whole cell methods because of greater control, scalability, and reproducibility.

- By Product Type, the enzymes segment dominated the market for the vast majority of biocatalytic applications in 2024, as enzymes can be used in virtually all industries and easily customized for specific reaction types.

- By Application, the pharmaceutical & drug manufacturing segments are the dominant segment, as pharmaceutical companies are increasingly utilizing biocatalysts for the stereoselective synthesis of active pharmaceutical ingredients (APIs) and other complex compounds.

- By End-User, the pharmaceutical & biotechnology company segments held the largest share of the biocatalysis market in 2024, as demonstrated by the high level of demand for biocatalytic solutions within drug discovery and drug production systems.

- By Formulation, the liquid enzyme preparation segment had the largest share due to the liquid format's ease of use, ability to support multiple downstream processing forms, and its ability to support continuous-flow and high-throughput modalities of industrial manufacture.

Regional Insights

North America dominated the market in 2025 due to substantial government funding for genomic and clinical informatics, sophisticated research infrastructure, and the strong presence of major pharmaceutical and biotechnology companies. The region has a long history of early adoption of digital health technologies, and this culture of rapid modernization has pushed organizations to implement advanced clinical data platforms. The widespread use of AI enabled cloud systems, automated analytics, and compliant digital workflow tools accelerated institutional investment in structured data environments. Strict regulatory expectations from agencies such as the FDA and HHS also encouraged the deployment of high-performing systems designed to ensure audit readiness, traceability, and secure data storage across clinical and research settings.

Asia Pacific was the fastest-growing region because large patient populations, expanding national genomics programs, and rapidly developing biotech ecosystems generated massive volumes of clinical and molecular data. Governments in China, South Korea, Singapore, and India have issued specific policies to support precision medicine, digital health, and AI-enabled research, which increased regional demand for sophisticated data management. Growth was also supported by new infrastructure in sequencing centers, teaching hospitals, and university research networks, which rely heavily on interoperable data platforms to exchange information across borders. Affordable cloud-based systems are in high demand within early-stage biotech firms, particularly those focused on personalized medicine and computational drug development.

Latin America, the Middle East, and Africa recorded emerging. Still, slower adoption as digital health programs gained traction and more clinical sites transitioned toward electronic data capture and cloud-based workflows. Growth was fuelled by the expansion of telemedicine, pharmaceutical manufacturing hubs in countries such as Brazil and Saudi Arabia, and increasing interest in population health analytics. Long-term demand for mobile-integrated and cloud-native platforms is rising as many healthcare facilities move away from paper-based systems and adopt basic digital infrastructure. Market maturity is still progressing gradually because of inconsistent regulatory frameworks, limited digital capacity in rural areas, and variability in national investment levels.

Biocatalysis Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 642.48 Million |

| Market Revenue by 2035 | USD 1,206.02 Million |

| CAGR from 2026 to 2035 | 6.50% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2025 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Recent Developments

- On September 9, 2025, Cascade Bio, a Colorado-based industrial biotechnology company, secured US$6 million in funding (seed and nondilutive), enabling the scale-up of its “Body Armor for Enzymes” platform to deliver highly stable, high-performance enzymes for biomanufacturing across chemicals, food, fragrance, and pharmaceutical industries.(Source: https://www.indianchemicalnews.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/7180

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344