Soybean Oil Pharma Grade Market Size and Forecast 2025 to 2034

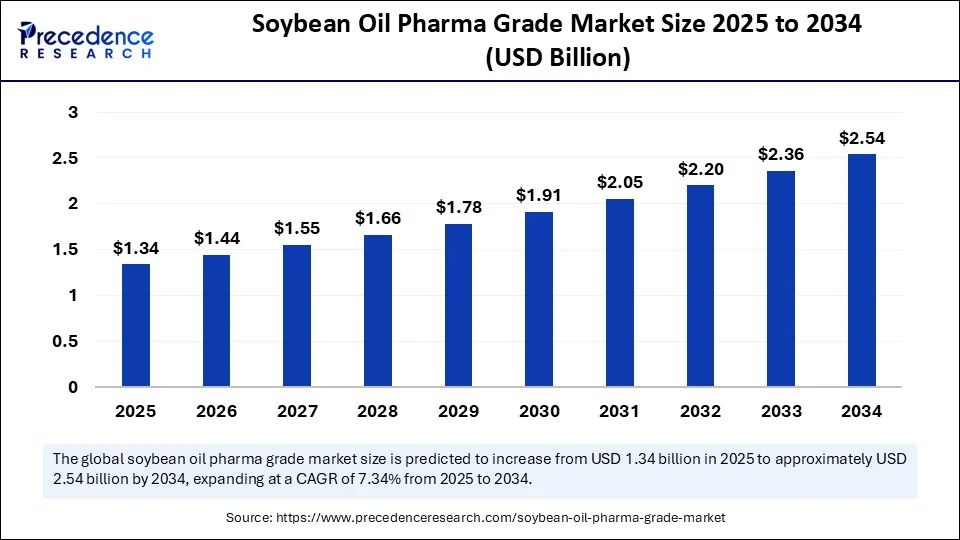

The global soybean oil pharma grade market size accounted for USD 1.25 billion in 2024 and is predicted to increase from USD 1.34 billion in 2025 to approximately USD 2.54 billion by 2034, expanding at a CAGR of 7.34% from 2025 to 2034.The market is driven by rising demand for natural excipients in drug formulations and growing use in nutraceuticals and soft gel capsules.

Soybean Oil Pharma Grade MarketKey Takeaways

- In terms of revenue, the global soybean oil pharma grade market was valued at USD 1.25 billion in 2024.

- It is projected to reach USD 2.54 billion by 2034.

- The market is expected to grow at a CAGR of 7.34% from 2025 to 2034.

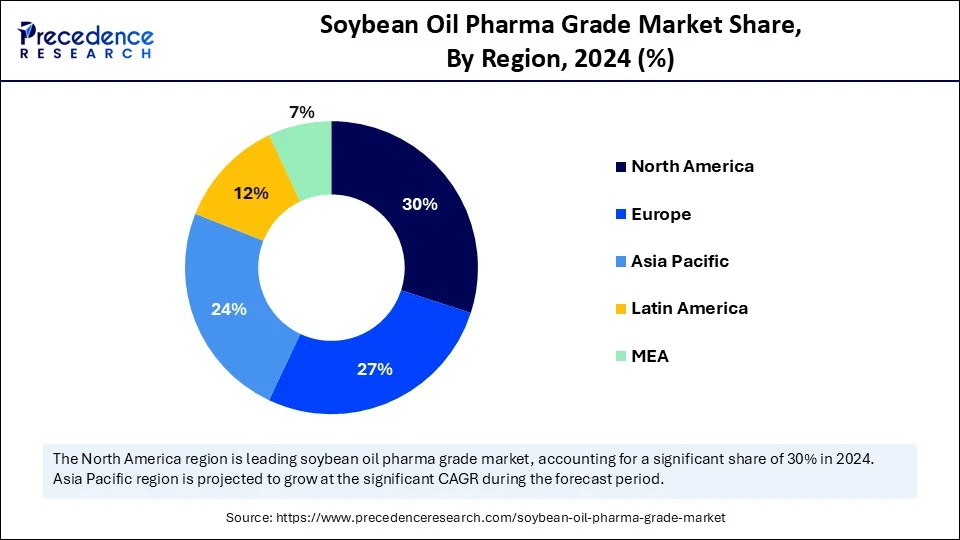

- North America dominated the global soybean oil pharma grade market with the largest market share of 30% in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the foreseeable period.

- By product type, the RBD soybean oil segment captured the biggest market share of 60% in 2024.

- By product type, the fractionated soybean oil segment is anticipated to show considerable growth over the forecast period.

- By application, the carrier oil for injectable formulations segment contributed the highest market share of 35% in 2024.

- By application, the nutraceutical/oil-based supplements segment is anticipated to show considerable growth over the forecast period.

- By form, the liquid form segment led the market generated the major market share of 80% in 2024.

- By form, the semi-solid form (gels/ointments) segment is anticipated to show considerable growth over the forecast period.

- By end-user industry, the pharmaceutical manufacturing segment held the largest market share of 50% in 2024.

- By end-user industry, the nutraceuticals/dietary supplements segment is anticipated to show considerable growth over the forecast period.

- By distribution channel, the direct sales to pharmaceutical companies segment accounted for the significant market share of 50% in 2024.

- By distribution channel, the CMOs segment is anticipated to show considerable growth over the forecast period.

How is AI Integration Transforming the Soybean Oil Pharma Grade Market?

The integration of Artificial Intelligence in the market is changing the industry, which provides product development and process optimization. AI can monitor the processes of refining and ensure it has a stable purity, following pharmaceutical standards. Predictive analytics support manufacturers to forecast the maintenance requirements of their equipment, keep the downtime at a minimum, and lower the cost of production. Moreover, the monitoring of the supply chain with the assistance of AI promotes traceability and conformity with regulatory requirements, as it guarantees a transparent source of raw soybeans. With the incorporation of AI, the manufacturers can be more efficient, product performance will be enhanced, and their market competitiveness will also improve, considering the industry transformation in terms of being sustainable, high-quality, and technologically advanced in the pharmaceutical-grade ingredients.

U.S. Soybean Oil Pharma Grade Market Size and Growth 2025 to 2034

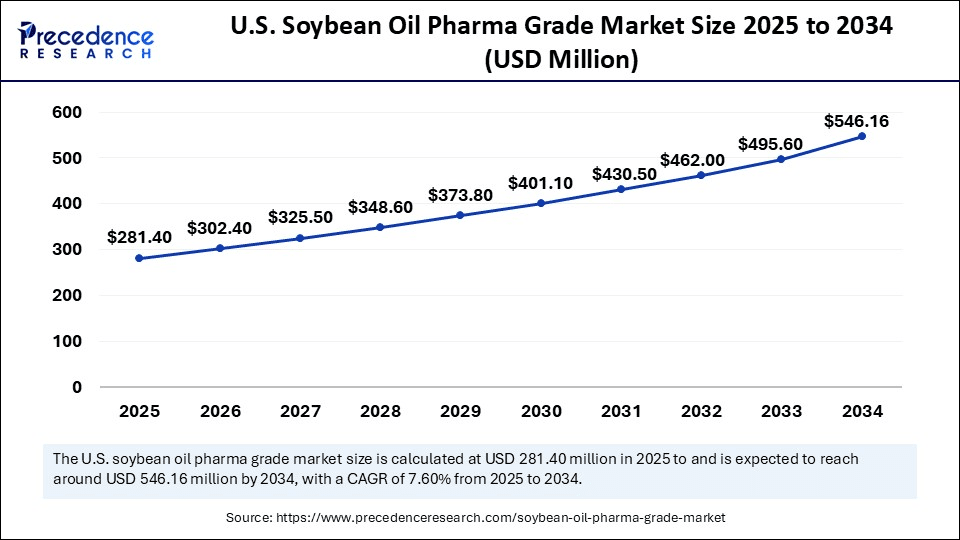

The U.S. soybean oil pharma grade market size was exhibited at USD 262.50 million in 2024 and is projected to be worth around USD 546.16 million by 2034, growing at a CAGR of 7.60% from 2025 to 2034.

Why Did North America Dominate the Global Soybean Oil Pharma Grade Market in 2024?

North America led the global market with the highest share of 30% in 2024, spurred by its highly advanced and well-established pharmaceutical industry, health care infrastructure, as well as strong regulatory system. The expertise of the region in the areas of R&D activities and the emphasis on innovation in drug formulation have enhanced the faster uptake of plant-based excipients like pharma grade soybean oil. Sensitizing consumers about the benefits of plant-based ingredients on health and the increased market size of natural and sustainable products also adds to the development of the market. Moreover, strict quality and safety requirements in the drug and nutraceutical market also lead to the pharma grade soybean oil being a popular ingredient due to its high levels of purity and stability.

In North America, the U.S. industry is the largest consumer of pharma grade soybean oil because it is also a major center of pharmaceutical production in the world. The existence of large pharmaceutical and nutraceutical corporations, large investments in biotechnology, and a dominating rate of advanced drug delivery systems are taking place, boosting the market growth. The U.S. is a stable ground for soybean farming, thus ensuring a constant flow of raw collectibles to be eventually processed into pharma grade oil, advancing cost effectiveness and also benefits associated with domestic sourcing. The growing concern about health among consumers and the popularity of clean-label formulae and plant-based formulae in oral, topical, and injectable products have led to the growth in the demand for soybean oil.

Why is Asia Pacific Undergoing the Fastest Growth in the Soybean Oil Pharma Grade Market?

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period. The increasing demand for natural and plant-based ingredients in healthcare products is increased awareness of better health, better living standards, and the increase in disposable income. The growth of the healthcare system is another contributor to the adoption, and the fact that modern medical treatment is becoming more readily available. Also, the market growth is getting intensified by the favourable government programmes on local production of pharmaceuticals, in addition to foreign investments. The region is likely to be in a better position due to the continuous development of refining technologies and an increasing number of partnerships between local manufacturers and international pharmaceutical corporations.

China plays a significant role in the growth of the Asia Pacific soybean oil pharma grade market, where large pharmaceutical manufacturing presence and a tendency to use natural excipients matter. The expanding middle-class population and the rise in the attention paid to health and wellness in the country have made the consumption of plant-based nutraceuticals and functional foods grow significantly. Healthcare innovation and the production of APIs in the country are encouraged by government policy initiatives and the establishment of a positive environment in favor of local manufacturers. As the country is increasing the budget allocation on R&D and the construction of sophisticated manufacturing plants, as well as making critical strategic alliances with global corporations, this will continue to be a growth within the Asia Pacific market.

What Factors Are Fueling the Rapid Expansion of the Soybean Oil Pharma Grade Market?

- Rising Demand for Plant-Based Ingredients: The health considerations, the sustainability, and safety aspects of the pharmaceutical and nutraceutical products are turning their attention to natural and plant-based ingredients. The stability, non-toxicity, and biocompatibility properties of soybean oil are interesting to consider it an interesting choice to use in the area of clean-label drug products and its utilization as an excipient that can be used to develop medications.

- Rise in Pharmaceutical and Nutraceutical Market: As the pharmaceutical and nutraceutical markets take off, pharma grade soybean oil is on the rise, exponentially raising the demand. It has applications in soft gel capsules, topicals, and emulsions, which are in line with the trend of wellness and prevention.

- Improved Techniques of Refining and Extraction:The process of production of pharma grade soybean oil has technological advancements in its oil refining and extraction, thus making the oil and products of oil of a high degree of purity, oxidative stability, and functionality.

Market Overview

Specialty grade soybean oil refers to a very refined grade of soybean oils that conform to extremely high standards of a pharmaceutical-grade concerning extremely high purity, extremely minor levels of peroxide, and extremely low quantities of residue of the solvents deployed in the refinery procedure, as well as observance of microbiologically purported safety regulations. This type of soybean oil is robustly applicable in the fields of pharmaceutical, nutraceutical, and medical preparations due to its high stability, biocompatibility, and formulation degrees. The functional properties that contribute to the demand for pharma grade soybean oil are its safer usage as a carrier of lipophilic active pharmaceutical ingredients (API), safe usage as an excipient, and provision of oxidative stability to easily oxidizable formulations.

The soybean oil pharma grade market is highly anticipated to grow due to high global health consciousness, largely due to the increasing demand through the pharmaceutical and nutraceutical markets. The trend is also observed in the pharmaceutical industry, such that excipients and active ingredients produced in plants are increasing about their safety status and capacity to interact with diverse formulations. The efficacy and quality of pharma grade soybean oil are on the rise is also attributed to improved extraction, refining, and purification methods of the products.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.54 Billion |

| Market Size in 2025 | USD 1.34 Billion |

| Market Size in 2024 | USD 1.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.34% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Form, End-User Industry, Application,Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Plant-Based Ingredients

The soybean oil pharma grade market is experiencing development, which is primarily caused by the increasing demand for plant ingredients in the sphere of pharmaceutics, nutraceutics, and cosmetics. The emergence of consumers' need to consume natural, organic, and clean-label products has motivated manufacturers to start adopting the usage of plant-related ingredients in formulations, including soybean oil, as a means of meeting the escalating needs of consumers. Pharma-grade soybean oil can be a food safety excipient or lipid-soluble active ingredient carrier in the pharmaceutical and nutraceutical sectors to have better shelf-life and bioavailability. It is non-toxic, biocompatible, and this aspect is compatible with the changing regulatory and consumer requirements. With this increased uptake and the flexibility of different dosage forms, pharma grade soybean oil has become an active ingredient in the emerging health and wellness sphere with huge market growth opportunities.

Restraint

Volatility in Raw Material Prices and Regulatory Challenges

One of the main market suppressors of pharma grade soybean oil is the fluctuations in prices of raw materials. The main input (soybeans) is very prone to variations that are brought about by changes in weather patterns, yields of the crop worldwide, international supply-demand discontinuities, and international trade regulations. Production costs are also directly affected by such price instability, as shown by the profitability of manufacturers. Further on, the pharmaceutical and nutraceutical application industries also need strict regulatory approval and hence require high-quality, safe usage, and comprehensive documentation. There is also a constant change of standards, which manufacturers are forced to deal with, creating complexity in the operations. These factors have the possibility to exert both financial and operational strain on the industry players, which will inhibit the expansion of the industry.

Opportunity

Expansion of the Nutraceutical and Functional Food Sectors

Increasing nutraceutical and functional food industries provide a lucrative market opportunity to the soybean oil pharma grade market. The main benefit of using soybean oil in such products is due to its nutritional value, which makes it a source of essential fatty acids, vitamin E, and antioxidants. It fits perfectly in capsules, soft gels, enriched foods, and beverages because it can be combined with other formulations and enhance the bioavailability of active ingredients. Global shift towards plant-origin-based ingredients, clean label products, and natural ingredients is also driving adoption. With the realization that soybean oil has health-promoting benefits, the manufacturers have a big chance to innovate and extend its use into the nutraceutical and functional food products, considering the demands by consumers as well as the trend of progressive healthcare solutions held by the industry.

Product Type Insights

Why Did the RBD Soybean Oil Segment Lead the Soybean Oil Pharma Grade Market in 2024?

The refined, bleached, deodorized (RBD) soybean oil segment led the market while holding a 60% share in 2024. Refined and bleached, and deodorized (RBD) soybean oil has undergone a lot of refining to essence all the impurities, color pigments, smell, and free fatty acids, resulting in a high-purity product that fits even the strictest pharmaceutical grade. It is a popular choice due to its high stability and neutral taste, compatibility with active pharmaceutical ingredients, as an excipient in capsules, emulsions, ointments, and creams. Also, its oxidative stability, as well as biocompatibility, adds to the shelf life and safety of pharmaceutical and nutraceutical products. As the emphasis on quality and purity of the pharmaceutical formulation increases, the RBD segment is likely to continue leading the market.

The fractionated soybean oil segment is expected to grow at a significant CAGR over the forecast period. Fractionation is an operation where the oil is divided into various components in terms of melting points to yield fractions with customization, including greater oxidative stability, more purity, and compatibility with certain formulations. This means fractionated soybean oil is very versatile in most of the complicated pharmaceutical and nutraceutical applications to include sustained-release drug distribution and fragile compositions with specific output requirements. It is increasingly finding applications in medical products with high value, including intravenous emulsions and special topical products, and this is increasing market demand. As the investments in refining techniques continue to be integrated and more refinements are made in complex drug formulations, the fractionated soybean oil pharma grade market is set to grow extensively.

Application Insights

Why Did the Carrier Oil for Injectable Formulations Segment Dominate the Soybean Oil Pharma Grade Market in 2024?

The carrier oil used in the injectable formulations segment accounted for a 35% share in the market in 2024 because of its general use as a non-toxic and biocompatible excipient in parenteral pharmaceutical formulations. Pharma-grade soybean oil is refined so that it complies with pharmaceutical standards of sterility, low level of peroxide, and is free of contaminants; thus, it is used as an injectable mixture. It is used to test the effects of a lipid-soluble drug and active pharmaceutical ingredients, increasing solubility, stability, and controlled liberation in the body. Compatibility and oxidative stability of the oil with other constituents of the pharmaceutical products maintain the integrity of the products and extend the shelf life. The proven safety profile of the segment, in combination with the rising need for injectable drugs, as the prevalence of chronic diseases rises.

The nutraceutical/oil-based supplements segment is expected to grow substantially in the soybean oil pharma grade market, due to an increase in lifestyle-related diseases, the growing ageing population, and awareness regarding preventive care. Soybean oil is of high value to the nutraceutical industry due to its cardiovascular, anti-inflammatory, and antioxidant properties, owing to the higher content of omega-3 fatty acids, vitamin E, and other essential nutrients in pharma grade soybean oil. There is general incorporation in dietary supplements, functional foods, and fortified beverages to boost nutrition and improve overall well-being. Rising consumer interest in nutraceuticals, plant-based, and natural health products has opened up a pharma grade soybean oil nutraceutical segmentation as one of the fastest-growing applications.

Form Insights

Why Did the Liquid Form Segment Dominate the Soybean Oil Pharma Grade Market in 2024?

The liquid form segment led the market while holding an 80% share in 2024. Soybean oil is a common liquid excipient used in oral soft gel capsules, emulsions, and injectable dosage forms, or used topically in combination with creams and lotions. It is fluid and it can be dosed accurately, active pharmaceutical ingredients can be dispersed homogenously, and lipid-soluble compounds are subject to increased bioavailability. The liquid form also promotes manufacturing efficiency and minimizes the processing time needed and large-scale production. Also, it has a high level of oxidative stability and interaction with other excipients, which makes products safe and long-lasting. Expanding the market for the drug delivery system based on lipid, as well as the increasing demand for functional foods and liquid supplements, serves as further support to the leadership of the segment.

The semi-solid form segment is expected to grow at a significant CAGR over the forecast period, prompted by the increasing popularity of topical and transdermaldrug delivery devices. Semi-solid preparations of pharma grade soybean oil are characterized by higher emollient activities to facilitate hydration/repair of the skin and absorption of active ingredients within the skin. It becomes biocompatible, natural, and can improve the texture and spreadability of the products; it is being increasingly used in therapeutic creams, medicated ointments, and cosmetic-pharmaceutical cross-overs. The rise of consumer demand in plant-derived, dermatologically secure products and the emergence of formulation science are leading to their more routine usage in the pharmaceutical as well as cosmeceutical spheres.

End-User Industry Insights

Why Did the Pharmaceutical Manufacturing Segment Dominate the Soybean Oil Pharma Grade Market in 2024?

The pharmaceutical manufacturing segment held a 50% share in the market in 2024 due to the wide application of soybean oil as an excipient in different formulations of drugs such as oral capsules, topical creams, and parenteral injection medicines. The desired property is its best oxidative stability, high purity, and solubility in active pharmaceutical ingredients (APIs) used in enhancing the drug solubility, bioavailability, and shelf life. With advances in drug delivery technology, pharma grade soybean oil is being incorporated into other multi-component drug delivery platforms, such as lipid nanoparticle or controlled release formulations. The higher demand for plant-based excipients because of the current trend toward clean-label and sustainable products also stimulates their use. The pharmaceutical firms are also utilizing the safety profile and compliance of soybean oil to deliver high-quality products.

The nutraceuticals/dietary supplements segment is expected to grow substantially in the soybean oil pharma grade market, driven by an increasing health awareness, combined with the worldwide trend towards preventive medicine. Soybean oil is a source of omega-3 fatty acids, vitamin E, and antioxidants, which possess immense cardiovascular protection, anti-inflammatory, and immunoenhancing properties. It is becoming more commonly found in dietary supplements, functional foods, and fortified beverages as a way of adding nutritional content and general well-being. Manufacturers are also coming up with nutraceutical food products which are based on plants and have of clean label to suit changing consumer preferences.

Distribution Channel Insights

Why did the Direct Sales to Pharmaceutical Companies Segment Dominate the Soybean Oil Pharma Grade Market in 2024?

The direct sales to the pharmaceutical companies segment led the market while holding a 50% share in 2024. This was primarily caused by the fact that the pharmaceutical manufacturers favor direct procurement where there is a guarantee that products are authentic, supply is regular, and quality standards are well maintained. Through direct sales, large quantities can be purchased at lower unit prices in an effort to increase cost efficiency. In addition, the channel enables suppliers to establish good long-term relationships with manufacturers, enabling them to forecast demand better and make adjustments in product specifications. Due to the growing focus on the concepts of traceability, compliance, and reliable sourcing in the pharmaceutical industry, direct supplier-manufacturer collaborations are gaining even more importance.

The contract manufacturing organizations (CMOs) segment is expected to grow at a significant CAGR over the forecast period, stimulated by the increasing popularization of the outsourcing of pharmaceutical production. CMOs have the cost and ability to scale solutions in drug formulation, manufacturing, and packaging, hence enabling the pharmaceutical companies to concentrate on R&D and market expansion. The rising relevance of pharma grade soybean oil in drug products that are formulated as soft gel capsules, emulsion products, and topical products has made CMOs more interested in supplying high-quality soybean oil to their customers. CMOs are also in a good position to work with high regulatory standards and customization of formulations to fit the changing demands in the industry. As global pharmaceutical outsourcing has increased over the years, CMOs are likely to further emerge as an even bigger distribution channel of pharma grade soybean oil in the future.

Value Chain Analysis

- Regulatory Compliance and Safety Monitoring

Pharma-grade soybean oil must be manufactured and distributed by following the worldwide and national regulations, such as Good Manufacturing Practices (GMP) and other quality standards of such agencies as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and the national bodies. The use of safety monitoring in the production process has been installed to ensure that the product is safe and effective by identifying potential problems at their earliest stage.

Key Players: Regulatory agencies like the FDA, EMA, and relevant national authorities.

- Chemical Synthesis and Processing:

Manufacture of pharma grade soybean oil begins by removing the oil from the soybean and normally using the solvent extraction process, but commonly hexane extraction. This is to make sure that the oil is kept to the most stringent purity, stability, and safety conditions as it is used in the pharmaceutical application.

Key Players: Archer Daniels Midland Company (ADM), Bunge Limited, and Wilmar International.

- Research and Development (R&D)

The literature advocates the use of pharma grade soybean oil, primarily as an advanced drug delivery and precision medicine. Scientists are examining how its formulation could be optimized to ensure high levels of bioavailability, high-targeted drug distribution, and compatibility with active pharmaceutical ingredients (APIs).

Key Players: ADM, Cargill Incorporated, Wilmar International Limited, Bunge Limited, Louis Dreyfus Company, Nutrien Ltd., AgProcessing Inc., and Solae LLC.

Soybean Oil Pharma Grade Market Companies

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- Bunge Limited

- Wilmar International

- AAK AB

- Louis Dreyfus Company

- IOI Loders Croklaan

- Fuji Oil Holdings, Inc.

- Henry Lamotte Oils GmbH

- Sime Darby Plantation

- AAK Foodservice AB

- Brenntag AG (Oils and Fats division)

- IOI Group (Pharma grade division)

- KLK OLEO (Kuala Lumpur Kepong Berhad)

- Vantage Specialty Commodities Inc.

- Fuji Chemical Industries Co., Ltd.

- Pacific Oleochemicals Sdn Bhd

- KLK OLEO's pharma arm (specific entity)

- Sime Darby Oils (Pharmaceuticals)

- Radha Chemicals/Nutritive Oils (India)

Recent Developments

- In May 2025, Roquette purchased IFF Pharma Solutions as part of its plan to make itself more agile, responsive to customers. The business has a varied portfolio, and this deal will facilitate long-term, sustainable expansion in the field of novel plant-based ingredients, as well as pharmaceutical excipients.

- In January 2025, Canadian authorities allowed Bunge to merge with Viterra, but it would be subject to the sale of six grain elevators and investment of C05 Ub20 billion within five years. The merger brings a new agricultural trading giant with greater worldwide abilities to grow soybeans and canola oil. (Source: https://www.reuters.com)

- In August 2024, ADM and Farmers Business Network (FBN) created a 50/50 joint venture named Gradable to develop more sustainable grain solutions. The project will seek to bridge the gap between the farmers and the buyers in the adoption of technology that aims at making as much money as possible out of environmentally friendly grain growing in the U.S. (Source: https://investors.adm.com)

Segments Coverd in the Report

By Product Type

- Refined, bleached, deodorized (RBD) soybean oil

- Hydrogenated soybean oil

- Fractionated soybean oil

By Application

- Carrier oil for injectable formulations

- Excipient in oral dosage forms (capsules, tablets)

- Base for topical and dermal delivery systems

- Nutraceutical/oil-based supplements

By Form

- Liquid form

- Semi-solid form (e.g., gels, ointment base)

By End-User Industry

- Pharmaceutical manufacturing

- Nutraceuticals/dietary supplements

- Medical device coatings

- Cosmetic/dermatological preparation (pharma grade use)

By Distribution Channel

- Direct sales to pharmaceutical companies

- Through pharmaceutical distributors/wholesalers

- Via contract manufacturing organizations (CMOs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting