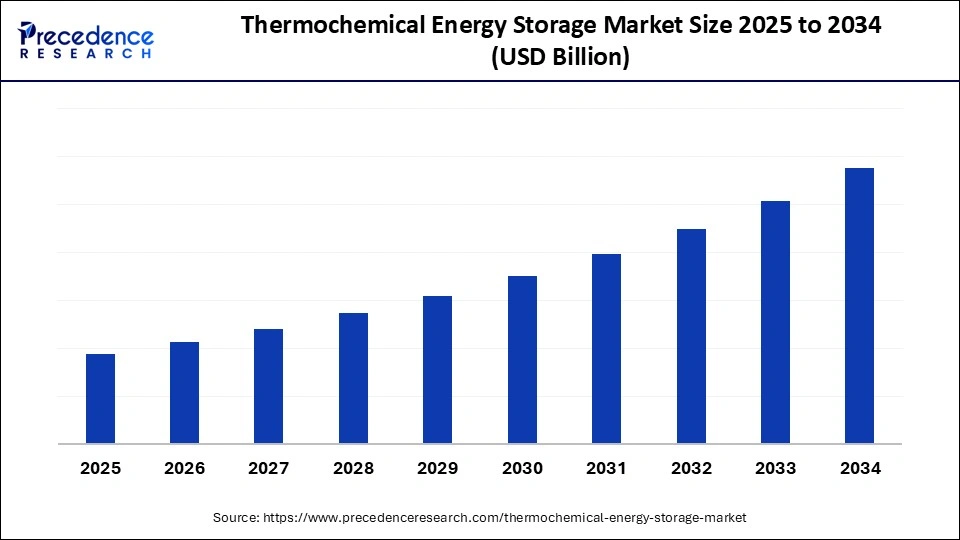

Thermochemical Energy Storage Market Size and Forecast 2025 to 2034

The thermochemical energy storage market is expanding as industries and utilities seek sustainable storage solutions. It provides cost-effective, long-lasting energy retention for peak demand. The global market is experiencing significant growth due to increased demand for grid stability, with intermittent renewable energy sources. The rising use of solar and wind power is driving the need for highly scalable and reliable energy storage solutions, including thermochemical energy storage systems.

Thermochemical Energy Storage Market Key Takeaways

- North America dominated the global thermochemical energy storage market with the largest share of 37% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By material/reaction system, the metal oxides segment contributed the biggest market share of 35% in 2024.

- By material/reaction system, the ammonia-based systems segment is expected to grow at a notable rate at a CAGR between 2025 and 2034.

- By reactor technology, the fixed bed reactors segment captured the highest market share of 30% in 2024.

- By reactor technology, the fluidized bed reactors segment will grow at a CAGR between 2025 and 2034.

- By temperature range, the high temperature (>800°C) segment held the maximum market share of 40% in 2024.

- By temperature range, the medium temperature (400–800°C) segment will grow at a CAGR between 2025 and 2034.

- By storage capacity/scale, the large scale (utility & industrial) segment accounted for the significant market share of 45% in 2024.

- By storage capacity/scale, the medium scale (commercial & district heating) segment will grow at a CAGR between 2025 and 2034.

- By application, the power generation (renewable integration, peak shaving) segment generated the major market share of 38% in 2024.

- By application, the seasonal / long-duration Storage segment will grow at a CAGR between 2025 and 2034.

AI Influence on Thermochemical Energy Storage Solutions?

AI is playing a transformative role in thermochemical energy storage solutions in ways of optimizing energy storage systems, predictive maintenance, smart energy management, system design and optimization, and material selection and development. Several potential AI applications have integrated with thermochemical energy storage, such as industrial energy storage, grid stability, and solar thermochemical energy storage systems (STESS). AI is being surged as a crucial tool in thermochemical energy storage for enhancing its sustainability, efficiency, and reliability of energy systems. AI prediction and optimization of phase change materials (PCM) parameters for heat storage and transport systems is an emerging innovative factor, leveraging AI acknowledgments for thermochemical energy storage solutions.

- For instance, in July 2025, a study titled “A review of artificial intelligence to thermal energy storage and phase change materials” explored the AI applications, including machine learning for prediction and optimization of material properties and system performance in phase change material (PCM)-based heat storage and transfer systems. This study was reviewed by Zhang et al. and published in Sustainable Materials and Technologies. (Source: https://www.sciencedirect.com)

Market Overview

The thermochemical energy storage (TCES) market refers to the industry focused on storing thermal energy using reversible chemical reactions, enabling long-duration, high-density energy storage for applications in power generation, industrial heating, and renewable integration. Unlike sensible or latent heat storage, TCES provides significantly higher energy density and negligible losses over time, making it highly suitable for balancing intermittent renewable sources like solar and wind, supporting decarbonization goals, and enabling efficient energy transport and seasonal storage.

The growing renewable energy solutions and energy efficiency needs are fostering market expansions. Several key factors, like the deployment of renewable energy sources like solar and wind power, demand for grid stability, advancements in thermochemical energy storage technologies, and government initiatives and investments in energy storage infrastructure, contribute to this growth. Technologies, including thermochemical storage, sensible heat storage, and latent heat storage, are gaining significant traction in the global market.

What are the Key Trends of the Thermochemical Energy Storage Market?

- Demand for Renewable Energy Sources: The demand for renewable energy sources like solar and wind power has increased, driving the need for thermochemical energy storage systems for high energy density and long-duration storage capabilities.

- Volatility in Natural Gases: The increased volatility and prices of natural gases and the emergence of a surge for reducing their reliability are driving the need for efficient energy storage solutions, including thermochemical energy storage systems.

- Government Support: The supportive government policies and incentives, such as investments in energy storage infrastructure, aim to improve grid resilience, meet climate targets, and reduce reliance on fossil fuels, driving innovations, developments, and the adoption of thermochemical energy storage solutions.

- Smart Building Expansion: The rapid industrialization and increasing use of energy in smart buildings drive the necessity for the adoption of thermochemical energy storage systems to attain sustainability targets.

- Growing Use in Electric Vehicle (EV) Charging Infrastructure: The adoption of electric vehicles (EVs) has increased across the world, driven by various factors contributing to increasing demand for thermal chemical energy storage solutions.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material / Reaction System, Reactor Technology, Temperature Range, Storage Capacity / Scale, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Industrial Decarbonization and Energy Efficiency Focus

Industries like chemicals, steel, glass, and cement are the major energy consumers and greenhouse gas emitters. This industrial manufacturing needs constant high-temperature processes that drive a robust demand for thermochemical energy storage (TCES) systems to offer reliable heat and efficiency. Industrials' surge for lowering greenhouse gas emissions and meeting global climate targets is necessitating thermal energy storage system adoption.

The thermochemical energy storage enables this industry to capture waste heat and store it efficiently, and reuse it for various applications and processes, which leads to reduced energy consumption and supports cleaner energy transitions. This solution enables low-carbon solutions for heating processes in industrial manufacturing and helps industries to comply with emission control targets and reduce costs.

Restraint

High Initial Cost

The high upfront cost of technology, materials, and installations is the major restraint for the global market. Purchasing, installation, and integration of TES systems require high initial cost and specialized expertise, making them major barriers, particularly for budget-conscious industries and organizations. Additionally, the adoption of advanced materials like phase change material and molten salt, infrastructure, and specialized components further adds to cost, hindering its market across price-sensitive areas and limiting the mass production of proprietary technologies.

Opportunity

Technological Advancements

The ongoing advancements in technologies like Phase change materials (PCMs) are the major factor bringing innovative approaches to the emerging market. Similarly, the advancements in molten salts to enhance high-temperature thermal storage efficiency, especially in solar thermal power plants, are leveraging significant incentives. These two technological advancements are enabling enhanced storage density and efficiency. Additionally, the upcoming innovations in concentrated solar power (CSP) systems, like enhanced parabolic trough and tower designs, further add efficient heat absorption and storage capacities. The advancements in system designs and the reduction of the cost of key storage materials are enabling the adoption of cutting-edge thermochemical energy storage systems by diverse industries and organizations.

Lates Technological Advancements Unveiled in Thermochemical Energy Storage Sector

In July 2025, novel energy storage research from NREL modeling, a U.S. Department of Energy national laboratory, showcased geothermal and borehole thermal energy storage for reliable heat buildings in extremely cold environments through a feasibility study test of 20 years in borehole thermal energy storage (BTES). This demonstration focuses on offering toarfe and reusing heat solutions to meet with rising demand for cold regions like Alaska. (Source: https://www.nrel.gov)

- In January 2025, thermal energy storage solutions were showcased by ASTEP at the Energy Storage 2025 event held in Barcelona. ASTP demonstrator poster titled “A fast response thermal energy store for solar heat and industrial process - construction and testing in H2020 ASTEP project, represented by Juan P. Solano from the Universidad Politécnica de Cartagena (UPCT) ASTEP. (Source: https://astepproject.eu)

Material/Reaction System Insights

What Made Metal Oxides Lead the Thermochemical Energy Storage Market in 2024?

In 2024, the metal oxides segment led the market due to its high energy density. The metal oxides offer a simple gas-solid reaction process and use air as a reactant, making it sustainable for high-temperature applications such as solar thermal plants. Cobalt oxide, iron oxide, and manganese oxides are the key metal oxides used for better reaction stability and spectacular oxygen-evolution capacity. The metal oxides are suitable for storing and releasing thermal energy through reversible chemical reactions.

The ammonia-based systems segment is the second-largest segment, leading the market due to its high energy density and cost-effectiveness. Ammonia-based systems have a carbon-free nature than hydrogen, which fuels its use for large-scale and long-term energy storage in applications of solar and wind power integration. The widespread use of ammonia-based systems in industrial energy security and remote power generation contributes to segment growth. Additionally, its robust infrastructure for production, handling, and distribution adds to its wide availability and accessibility.

Reactor Technology Insights

Which Reactor Technology Segment Dominates the Thermochemical Energy Storage Market?

The fixed bed reactors segment dominated the market in 2024, due to its simplicity and cost-effectiveness. Fixed-bed reactors enable the storage of energy in a porous medium with minimal mechanical components. The fixed bed reactors are ideal for various TES systems due to their efficiency, prevalence, and feasibility for both low and high-temperature applications. The strict designs of fixed-bed reactors make them ideal for heat and mass transfer.

The fluidized bed reactors segment is expected to grow fastest over the forecast period, driven by its improved heat and mass transfer. The fluidized bed reactors have high mixing rates and uniform temperature distribution, enabling superior efficiency for solid-gas reactions than fixed or moving bed reactors. High-temperature applications like concentrating solar power (CSP) plants and domestic-scale heat storage are major adopters of fluidized bed reactors. Fluidized bed reactors improve power outputs and overall performance of thermochemical energy storage (TCES) systems by reducing hotspots and facilitating effective particle interaction.

Temperature Range Insights

How High Temperature (>800°C) Segment Dominates the Thermochemical Energy Storage Market in 2024?

The high temperature (>800°C) segment dominated the market in 2024, due to its wide range of temperatures, simplicity, and cost-effectiveness. The high-temperature TES uses high high-temperature (>800°C) range for sensible heat storage with materials like steel, rocks, or concrete for energy storage. These materials help to store heat at temperatures of more than 565°C. The advanced applications with materials like ceramic balls or solid particles also use this temperature range to gain even higher temperatures. Companies are using materials with a high temperature (>800°C) range for developing thermochemical energy storage systems.

The medium temperature (400–800°C) segment is the second-largest segment, leading the market due to its high energy storage density and compatibility. Metal oxides and perovskites are major materials used for their high compatibility in operational temperatures of concentrated solar power (CSP) plants. This temperature range enables high energy storage density and theoretically unlimited storage periods, making it ideal for a thermochemical energy storage system.

Storage Capacity/Scale Insights

Why Large-Scale Storage Capacity/Scale Segment Dominates the Thermochemical Energy Storage Market in 2024?

In 2024, the large-scale (utility & industrial) segment dominated the market, due to increased demand for grid stabilization. The growing focus on renewable energy integration and reducing operation costs in power generation drives the need for efficient energy storage solutions like a thermochemical energy storage system. The rapid industrial power processes have boosted the use of thermochemical energy storage for storing and dispatching energy to meet peak demands and balance intermittent renewable energy sources. Expanding thermal infrastructure for applications involving process heat, HVAC, and hot water, adding in need for a thermochemical energy storage system.

The medium-scale (commercial & district heating) segment is expected to grow fastest over the forecast period, driven by increased demand for efficient heating & cooling solutions. The rapid urbanization and strict environmental regulations for energy use are driving a shift towards energy-efficient solutions, including thermochemical energy storage systems. The medium-scale storage capabilities enable optimal utilization of renewable energy sources, stabilize energy supply, and reduce operational expenses. Additionally, the growing demand for centralized solutions is contributing to the rising adoption of thermochemical energy storage systems.

Application Insights

Which Application Dominates the Thermochemical Energy Storage Market?

In 2024, the power generation (renewable integration, peak shaving) segment dominated the market, due to growing focus on renewable integration, grid stability, and dispatchability. Thermochemical energy storage systems enable the intermittent nature of renewable energy sources like solar and wind power. This solution provides grid stability through peak shaving and load balancing. The demand for high-temperature thermal storage systems is wide for storing large amounts of energy efficiently to meet with generated electricity on demand.

The seasonal / long-duration Storage segment is expected to grow fastest over the forecast period, due to increased requirements of grid resilience and the integration of intermittent renewables. The growing decarbonization goals across industries are further adding to this growth. The ability of seasonal / long-duration Storage to offer a balancing energy supply solution and demand for long-period storage ability increases the adoption of thermochemical energy storage systems. The demand for thermochemical energy storage is rising due to climate change, aging infrastructure, and government initiatives.

Regional Insights

North America Thermochemical Energy Storage Market Trends

North America dominates the global market due to strong regional use for grid stability and robust government support. Strong surge in renewable energy integration and reducing greenhouse gas emission targets are leveraging this growth. Initially, the presence of key market players and their focus on technological advancements and the adoption of eco-friendly materials are key regional market trends. Rapid growth in hybrid storage systems and growing renewable energy storage demands for both commercial and industrial sectors are increasing focus and investments in thermochemical energy storage solutions.

U.S. Thermochemical Energy Storage Market Trends

The U.S. is a major player in the regional market, contributing to growth due to supportive government and the existence of favorable regulations and initiatives, including the U.S. Inflation Reduction Act. This act enables heavy investments in renewable energy and storage technologies, including thermochemical energy storage solutions. The investments in efficient energy storage solutions have increased from the federal government, leading to a boost U.S. market.

Asia Pacific Thermochemical Energy Storage Market Trends:

Asia Pacific is the fastest-growing region in the global market, growth driven by countries' cutting-edge energy storage infrastructure with a strong focus on thermal energy storage applications. Government initiatives and investments in clean energy and rising renewable energy adoptions are fostering this growth. Additionally, the growing demand for heating and cooling solutions in countries like China, India, and Southeast Asia, driven by an increased middle-class population, disposable income, and growing industrialization, is driving the market. Moreover, the growing global interest from key players and government researchers to fuel regional sustainable energy areas is bringing significant innovations in the emerging market.

- For instance, in July 2025, the energy storage division of global solar leader Trinasolar, Trian Storage, reached over 2.4 GWh of utility-scale storage capacity under execution across the Asia-Pacific region. The company spans Australia, Japan, and Southeast Asia, with deployments representative of sustainable contribution to 16 GWh of novel battery energy storage system (BESS) capacity expected to be added in APAC in 2025. (Source: https://www.prnewswire.com)

China is a major player in the regional market, contributing to growth due to the country's strong government initiatives and robust manufacturing base for energy storage technologies. China's “14th five-year plan” is leveraging developments in large-scale energy storage to support renewable energy integration. Strong focus on achieving carbon neutrality goals is fostering market expansion.

India is the fastest-growing country in the regional market, driven by large demand for renewable energy sources, growing focus on energy efficiency, and government policies and initiatives. With the first regulatory-approved battery energy storage systems (BESS) deployment in Delhi in May 2025, the industry is shifting toward upgrading urban grids and improving sustainable energy distribution across the country.

Thermochemical Energy Storage Market – Value Chain Analysis

- Resource Extraction

Sourcing thermochemical energy sources, including chemical components from naturally abundant mineral deposits and industrial byproducts. These resources depend on various temperature ranges of the TCES system, including low, medium, and high temperatures.

Key Players: SaltX Technology, RedoxBlox, Kraftblock, and Rondo Energy.

- Distribution Network Management

Distribution network management of thermochemical energy storage is a primary area of research and development, with thermal grids and not electrical distribution networks. This network manages the transport of thermal energy through transfer fluids and stored chemical products through a network of pipes.

Key Players: Siemens, Abengoa, Antora Energy, and CALMAC.

- Regulatory Compliance and Energy Trading

Thermochemical energy storage involves regulatory compliance such as environmental & hazard mitigation, material & reactor-specific rules, and intention standards. Similarly, the energy trading is energy arbitrage, ancillary services, renewable energy integration, and capacity markets.

Key Players: Malta Inc., EnergyNest, Kraftblock, and Antora Energy.

Thermochemical Energy Storage Market Companies

- Siemens Energy

- EnergyNest

- Linde plc

- ENGIE

- MAN Energy Solutions

- Echogen Power Systems

- HyGear

- Malta Inc.

- Mitsubishi Heavy Industries (MHI)

- Sumitomo SHI FW

- Kraftanlagen München

- Brenmiller Energy

- StorTera

- Abengoa Energía

- Air Liquide

- Johnson Matthey

- Synhelion

- CEA (French Alternative Energies and Atomic Energy Commission)

- BASF SE

- Azelio AB

Recent Developments

- In July 2025, a part of Mitsubishi Heavy Industries (MHI) Group, Mitsubishi Heavy Industries Thermal System, Ltd., began its field testing of a “Surplus Renewable Energy Absorption and Release System” by using the Aquifer Thermal Energy Storage (ATES) systems. This system is developed in collaboration with Osaka Metropolitan University and other partners with a focus on novel energy absorption and release systems to respond challenges of renewable energy use. (Source: https://www.mhi.com)

- In June 2025, a novel CEN-CENELEC workshop on ‘thermal energy storage (TES) systems' was planned to complement the EU research project HYSTORE (hybrid services from advanced thermal energy storage systems) activities. This project developed and validated the innovations according to a combination of advanced technology components. (Source: https://www.cencenelec.eu)

Segment Covered in the Report

By Material / Reaction System

- Metal Oxides

- Carbonates

- Ammonia-based Systems

- Hydroxides

- Sulfates

- Silicates

- Others

By Reactor Technology

- Fixed Bed Reactors

- Fluidized Bed Reactors

- Moving Bed Reactors

- Thermochemical Heat Pumps

- Hybrid Reactors

- Others

By Temperature Range

- Low Temperature (<400°C)

- Medium Temperature (400–800°C)

- High Temperature (>800°C)

By Storage Capacity / Scale

- Small Scale (Residential & Small Commercial)

- Medium Scale (Commercial & District Heating)

- Large Scale (Utility & Industrial)

By Application

- Power Generation (Renewable Integration, Peak Shaving)

- Industrial Heating & Cooling

- Combined Heat & Power (CHP)

- Seasonal / Long-duration Storage

- Hydrogen / Fuel Production Support

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting