What is the U.S. Cellulose Acetate Market Size?

The U.S. cellulose acetate market size accounted for USD 1.76 billion in 2025 and is predicted to increase from USD 1.84 billion in 2026 to approximately USD 2.79 billion by 2035, expanding at a CAGR of 4.72% from 2026 to 2035. The U.S. cellulose acetate market is driven by rising demand for sustainable, biodegradable materials across consumer and industrial applications.

Market Highlights

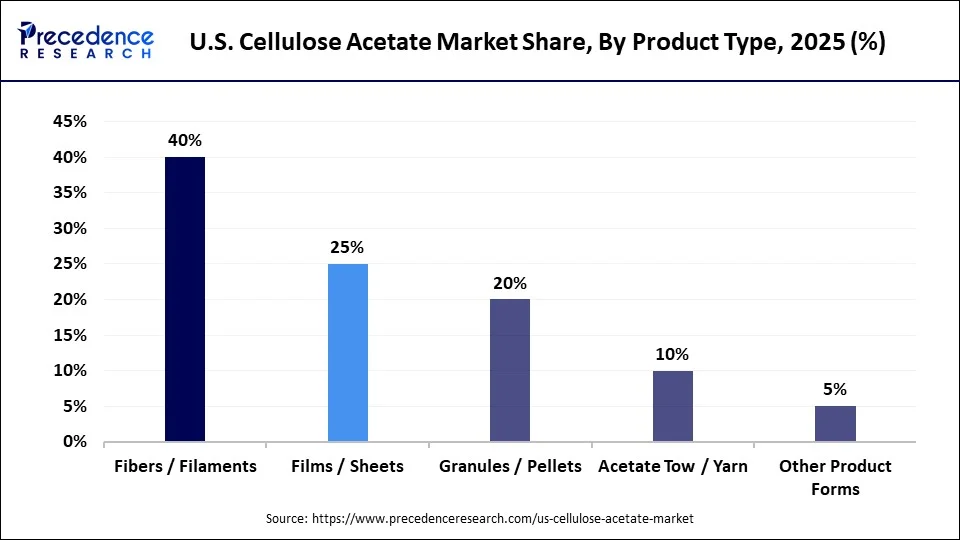

- By product type, the fibers/filaments segment held the largest market share of 40% in 2025.

- By product type, the films/sheets segment is expected to grow at a remarkable CAGR between 2026 and 2035.

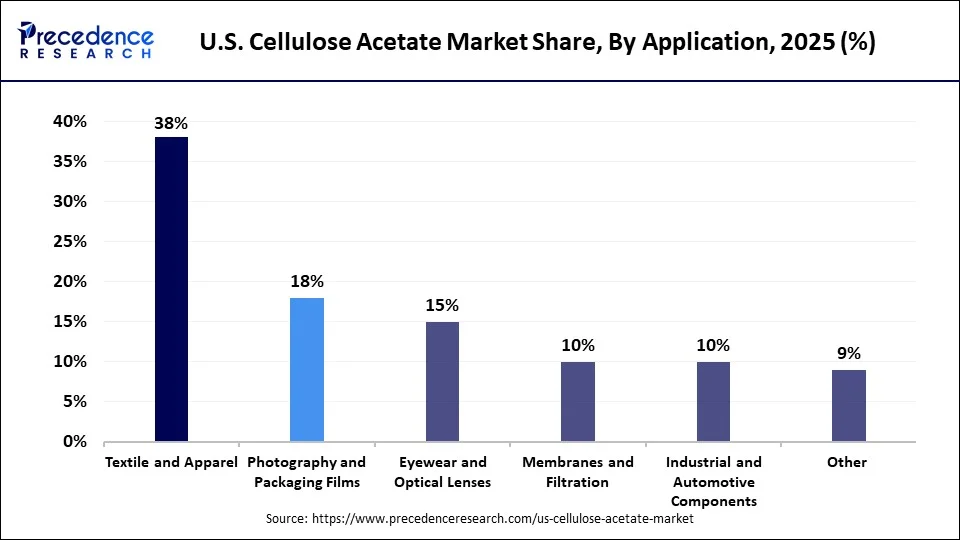

- By application, the textile and apparel segment contributed the biggest market share of 38% in 2025.

- By application, the eyewear & optical lenses segment is growing at the fastest CAGR between 2026 and 2035.

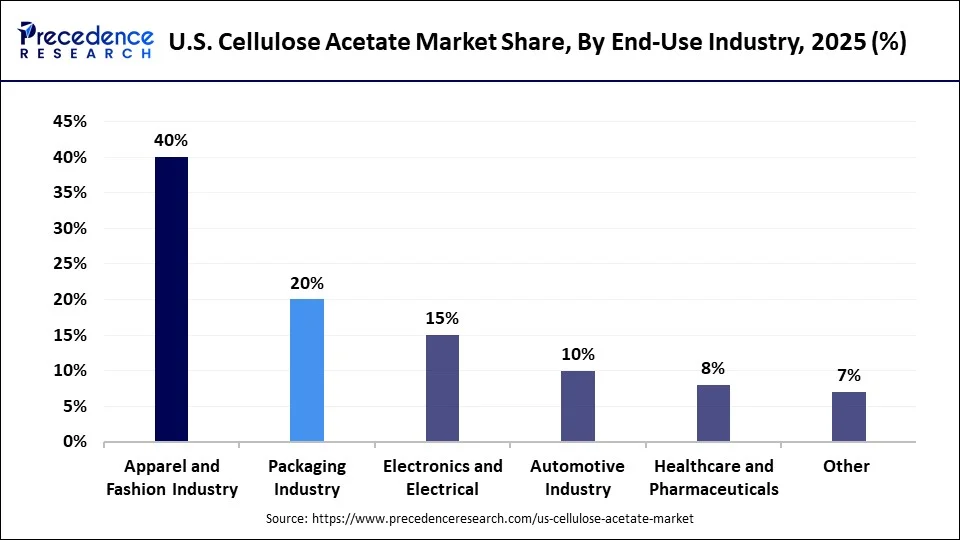

- By end-use industry, the apparel and fashion industry segment accounted for the highest market share of 40% in 2025.

- By end-use industry, the electronics & electrical segment is projected to grow at a solid CAGR between 2026 and 2035.

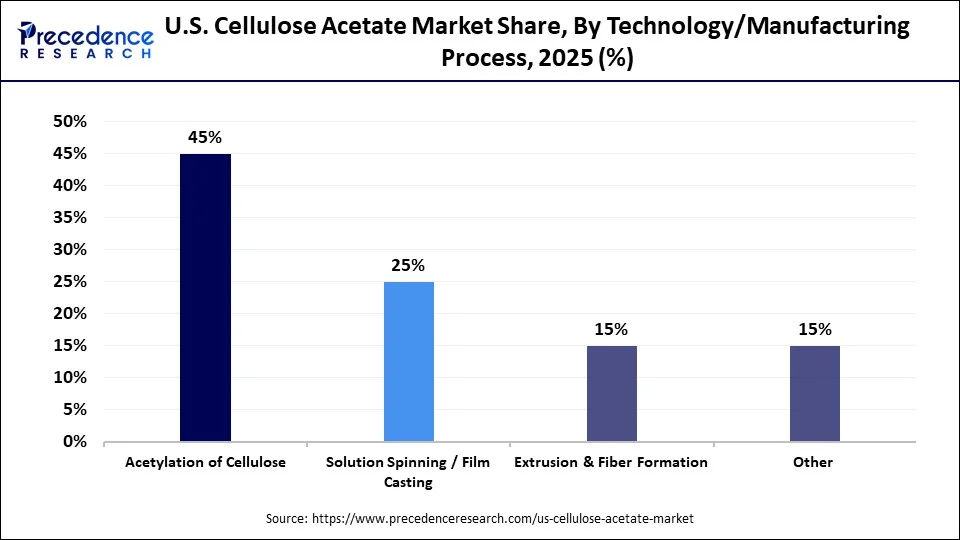

- By technology/manufacturing process, the acetylation of cellulose segment captured the major market share of 45% in 2025.

- By technology/manufacturing process, the solution spinning / film casting segment is set to grow at a notable CAGR between 2026 and 2035.

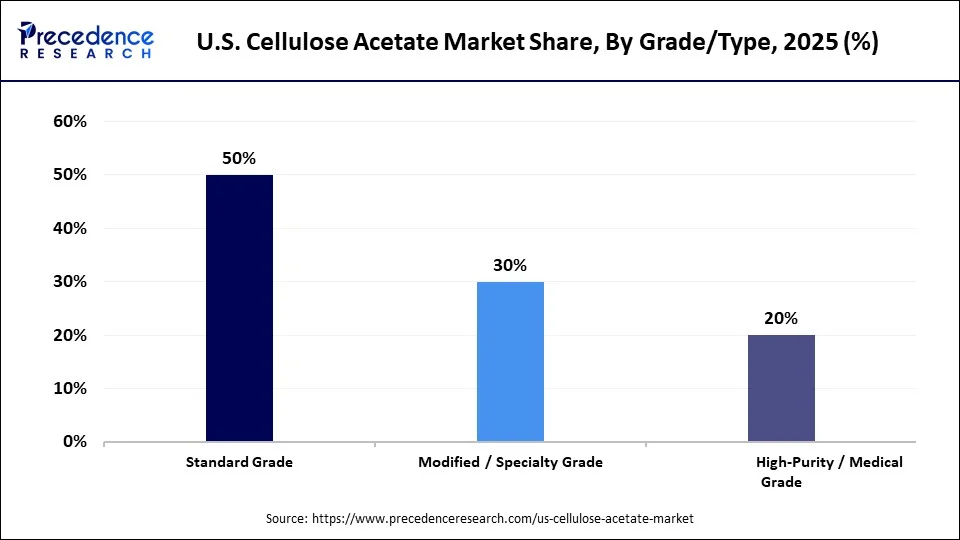

- By grade/type, the standard grade segment generated 50% of market share in 2025.

- By grade/type, the modified / specialty grade segment is expected to expand at a strong CAGR between 2026 and 2035.

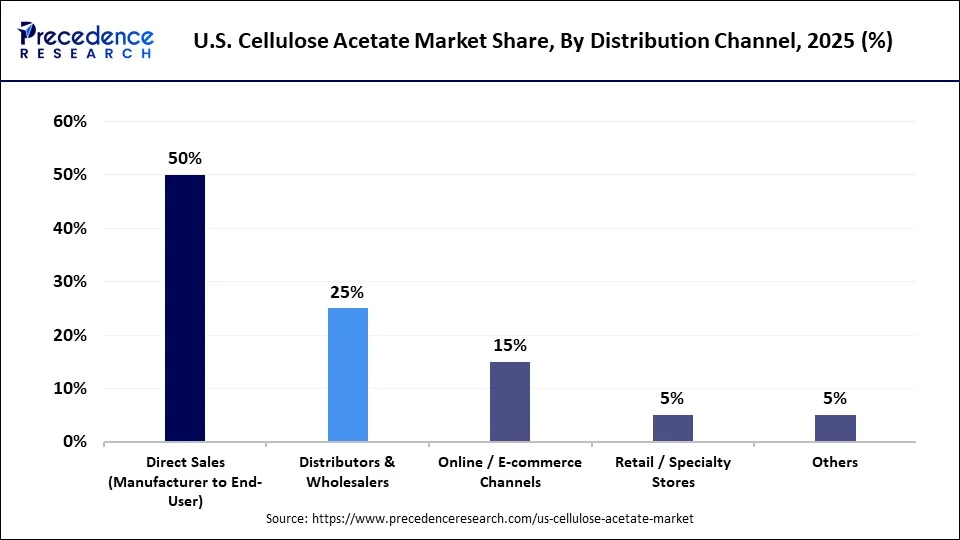

- By distribution channel, the direct sales segment contributed the highest market share of 50% in 2025.

- By distribution channel, the online / e-commerce channels segment is set to grow at a remarkable CAGR between 2026 and 2035.

Redefining Performance & Sustainability: How Innovation Is Transforming the U.S. Cellulose Acetate Market

The U.S. cellulose acetate market is one of the rapidly evolving segments of the polymer and specialty materials sector, focusing on the development of biodegradable, semi-synthetic plastics derived from natural cellulose and their applications. Cellulose acetate, known for its clarity, durability, and excellent film-forming qualities, has become a key component in textiles, packaging films, cigarette filters, coatings, medical equipment, and consumer products. Demand in the U.S. market is increasing as manufacturers shift toward using eco-friendly materials that are less damaging to the environment. Its biodegradability, compatibility with advanced processing technologies, and suitability for high-value engineered applications have further expanded its use across various industries.

The market is expanding due to increasing interest in alternative materials to petroleum-based plastics and biodegradable options, along with a regulatory environment favoring biodegradable products, which are the most important. New technologies in acetate tow, specialty membranes, optical film, and high-purity derivatives are creating new applications in electronics, filtration, bioplastics, and medicine. Additionally, the rising popularity of eco-friendly packaging among consumers, the growth of the textile sector, and improvements in cellulose acetate's mechanical strength are also boosting its market penetration.

AI Integration in the U.S. Cellulose Acetate Market

AI is transforming the U.S. cellulose acetate market by improving efficiency, fostering innovation, and promoting sustainability in the supply chain. AI-powered material optimization tools help manufacturers develop cellulose acetate grades that are stronger, clearer, and biodegradable, while also reducing development time. AI-driven quality control systems can detect micro-defects in films, fibers, and membranes with high precision, ensuring consistent performance in packaging, textiles, and filtration. On the demand side, predictive analytics support market forecasting, enabling companies to adjust supply based on trends in bioplastics, electronics, and consumer products. Additionally, AI speeds up research into advanced cellulose acetate derivatives used in medical devices, optical films, and high-performance composites.

U.S. Cellulose Acetate Market Outlook

- Industry Growth Overview: The market is expected to grow rapidly from 2026 to 2035 due to the necessity to eliminate the usage of traditional non-biodegradable petrochemical plastics, which boosts demand for biodegradable and semi-synthetic polymers. Specialty grades of cellulose acetate are being developed, enabling its use in electronics, medical devices, and high-performance consumer goods.

- Major Investors: Top companies include Eastman Chemical Company, Celanese Corporation, Daicel Corporation, Solvay, and Mitsubishi Chemical. These players are investing in high-purity acetate, sustainable processing technology, and high-product lines.

- Startup Ecosystem: Startups like Sulfatex, Greenyarn, and Bioworks are researching cellulose-based biopolymers and textile innovations. These startups are focusing on biodegradable solutions, filtration membranes, and cellulose acetate-based environmentally friendly packaging materials.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.76 Billion |

| Market Size in 2026 | USD 1.84 Billion |

| Market Size by 2035 | USD 2.79 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.72% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application, End-Use Industry, Technology/Manufacturing Process, Grade/Type, and Distribution Channel |

Segment Insights

Product Type Insights

Why Did the Fibers / Filaments Segment Dominate the Market in 2025?

In 2025, the fibers / filaments segment dominated the U.S. cellulose acetate market with the largest share due to its widespread use in the textile industry, cigarette filters, and specialized industrial applications. Cellulose acetate fibers, especially staple fibers and continuous filaments, are in demand because of their biodegradability, moisture absorption, silky feel, and dye affinity, making them well-suited for apparel, home textiles, and fashion accessories. In fabrics like luxury textiles, linings, and performance clothing, softness, drape, and breathability are important, so filaments are highly valued. Growing regulatory focus on replacing non-biodegradable materials has also driven the adoption of eco-friendly textiles and filter products.

The films / sheets segment is expected to grow at the fastest CAGR during the projection period, driven by the high demand for sustainable packaging, optical, and specialty coatings. Clear cellulose acetate films are popular for food packaging, blister packs, and protective coatings because they are shiny, strong, and completely biodegradable; thus, they are preferred over petroleum-based plastic films. Specialty and coated films have gained popularity in electronics, labeling, laminates, and photography, where high clarity, dimensional stability, and chemical resistance are essential. Technologies like solvent-free coating and bio-based formulations have also accelerated their use in high-end packaging and greener consumer goods. Additionally, the rise of compostable packaging options in retail, cosmetics, and food sectors has further boosted the segment's momentum.

Application Insights

Why Did the Textile & Apparel Segment Lead the Market in 2025?

The textile & apparel segment led the U.S. cellulose acetate market in 2025 due to strong demand for cellulose acetate fibers and filaments in fashion, luxury, lining, and home textile sectors. The fabric, which resembles silk but is soft, offers high comfort, breathability, and excellent dyeability, making it ideal for premium clothing and beauty textiles. Consumers' preference for sustainable and biodegradable fabrics has increased the popularity of acetate-based materials as alternatives to polyester and synthetic blends. Additionally, brands focusing on greener materials to meet regulatory and environmental standards have driven up demand for cellulose acetate in both standard and high-end apparel collections. Acetate fibers are versatile for blending, moisture management, and comfort, which allows for their use in a wide range of fabric types.

The eyewear & optical lenses segment is expected to grow rapidly in the coming years because cellulose acetate remains popular as a high-quality, durable, and highly adaptable material used in eyeglass frame construction. This material is favored for its flexibility, lightness, gloss, and ability to hold vibrant colors. Consumers' preference for biodegradable frames and the expansion of premium product lines from brands have significantly contributed to the segment's growth.

End-Use Industry Insights

How Does the Apparel & Fashion Industry Lead the U.S. Cellulose Acetate Market in 2025?

The apparel & fashion industry segment led the market with a significant revenue share in 2025 because it uses acetate fibers to produce high-quality, sustainable, and attractive textiles. As the fashion industry shifts toward eco-friendly fabrics, cellulose acetate has gained more acceptance due to its biodegradability, soft touch, and dyeability. It has become a preferred fabric for dresses, linings, scarves, and high-end wear when comfort and appearance are top priorities for designers and brands. Additionally, there was a surge in demand for breathable and lightweight clothing as consumer trends moved toward comfort-based fashion. Further increasing the use of cellulose acetate was the growing industry interest in circularity and reducing reliance on plastic-based textiles.

The electronics & electrical segment is projected to grow at the fastest CAGR in the upcoming period due to the increased use of cellulose acetate films in electronic components, insulation, optical products, and flexible displays. Its superior dielectric properties, transparency, and dimensional stability make it valuable for capacitors, protective films, and wiring insulation. The adoption has also risen due to the growing need for flexible and lightweight materials in next-generation electronics such as wearables, sensors, and smart devices. Additionally, the ability of cellulose acetate to interact with specialty coatings enables its use in optical films for screens, LED lights, and display technologies. Further investment in bio-based electronic materials and high-tech polymer films positions the segment well to gain momentum in the forecast period.

Technology/Manufacturing Process Insights

Why Did the Acetylation of Cellulose Segment Dominate the Market in 2025?

The acetylation of cellulose segment dominated the U.S. cellulose acetate market in 2025 because it is the primary manufacturing process used to produce cellulose acetate with consistent quality, purity, and performance properties. The differentiation between standard and high-performance acetate grades offers manufacturing flexibility regarding the degree of acetate content and the desired properties. The process enables manufacturers to achieve the transparency, mechanical strength, and biodegradability needed for textiles, films, coatings, and filtration applications. The segment also grew due to technological innovations that enhanced acetylation performance, reduced emissions, and boosted sustainability.

The solution spinning / film casting segment is expected to grow the fastest due to increasing demand for high-quality acetate films, membranes, and specialty fibers. These processes enable the creation of transparent, uniform films used in packaging, electronics, optics, and protective coatings. Film casting allows for customization of thickness, clarity, and surface properties, making it ideal for advanced packaging and display technologies. Solution spinning also provides precise control over the fiber morphology needed in technical textiles and filtration media. Additionally, there is a rising focus on producing cellulose acetate films, driven by the growing trend toward eco-friendly packaging and biodegradable films.

Grade / Type Insights

What Made Standard Grade the Leading Segment in the U.S. Cellulose Acetate Market?

The standard grade segment led the market in 2025, holding a major share, as it is widely used in mainstream applications such as textiles, cigarette filters, films, and consumer goods. Cellulose acetate of standard grade offers balanced performance, affordability, and is suitable for large-scale industrial production. Its strong mechanical properties, ease of processing, and well-developed supply chain make it the preferred choice among manufacturers of reliable, scalable materials. Standard grades remained important in mass-market applications that do not require complex modification as demand for biodegradable and semi-synthetic polymers grew. The segment also saw significant use of acetate tow in filtration, which could not be achieved without standard-grade formulations.

The modified / specialty grade segment is expected to grow at a significant CAGR during the forecast period. Designed to offer superior optical clarity, chemical resistance, biodegradation rate, or functional coatings, specialty grades are gaining a niche in electronics, medical devices, membrane filtration, and premium packaging. As industries seek high-end polymers that outperform standard materials, modified cellulose acetate provides custom solutions. The adoption is further driven by the tendency to develop bioplastics and other high-value specialty films. Additionally, cellulose acetate and functionalized derivatives have advanced in research and are now finding applications in aerospace, automotive interiors, and next-generation electronics.

Distribution Channel Insights

Why Did the Direct Sales Segment Dominate the Market in 2025?

The direct sales segment led the market in 2025 because cellulose acetate products, including fibers, films, tow, and specialty grades, are typically sold through long-term, business-to-business (B2B) contracts. Manufacturers prefer to work directly with industrial customers to customize specifications, set pricing based on quantities, ensure consistent supply, and receive technical support. Direct channels enable lean logistics and foster more effective collaboration in product development, especially with high-volume customers in textiles, packaging, and filtration. Direct procurement helps deliver uniform quality and reduce waste in the production process, as industrial applications are complex and large-scale.

The online/e-commerce channels segment is expected to grow rapidly during the projection period because digital platforms are making procurement easier for small to medium-sized manufacturers, research institutions, and specialty buyers. E-commerce sites improve price transparency, enable quick and easily comparable deals, and support low-volume purchases that might not otherwise be feasible, pursuing direct B2B contracts. Digital marketplaces have contributed to the expansion of online chemical distribution networks. As the digital transformation of industries continues to accelerate, internet channels are becoming more accessible and efficient compared to traditional procurement methods.

Top Companies in the U.S. Cellulose Acetate Market & Their Offerings

- Eastman Chemical Company: The company sells cellulose acetate flakes, tow, fibers, films, and specialty acetate polymers to the textile, filtration, and packaging industries.

- Celanese Corporation: Supply cellulose acetate tow, flake, and engineered acetate filter materials, films, and textile materials.

- Daicel Corporation: It is a supplier of high-purity cellulose acetate, acetate tow, specialty fibers, and advanced acetate compounds to industries and consumers.

- Rayonier Advanced Materials (RYAM): Manufactures cellulose acetate and acetate flake filters, films, and coatings that are high-performance, produced with specialty cellulose.

- Rotuba Extruders, Inc.: Cellulose acetate sheets, rods, and custom cellulose acetate extruders of eyewear, consumer products, and industrial components.

Other Major Companies

Recent Developments

- In June 2024, Eastman Chemical Company introduced Naiatm Renew, a cellulosic acetate fiber made with 60% sustainably sourced wood pulp and 40 percent certified recycled content, along with denim and other sustainable textiles.(Source: https://www.eastman.com)

- In March 2024, Eastman increased North American pricing for its plasticizer product lines used in acetate tow and other related products due to changes in the supply chain and raw-material prices.(Source: https://www.eastman.com)

Segments Covered in the Report

By Product Type

- Fibers/Filaments

- Staple fibers

- Filaments

- Films/Sheets

- Transparent films

- Coated/specialty films

- Granules/Pellets

- Standard granules

- Modified granules

- Acetate Tow/Yarn

- Textile yarns

- Industrial tow

- Other Product Forms

By Application

- Textile & Apparel

- Photography & Packaging Films

- Eyewear & Optical Lenses

- Membranes & Filtration

- Industrial & Automotive Components

- Other Applications

By End-Use Industry

- Apparel & Fashion Industry

- Packaging Industry

- Electronics & Electrical

- Automotive Industry

- Healthcare & Pharmaceuticals

- Other End-Use Industries

By Technology/Manufacturing Process

- Acetylation of Cellulose

- Solution Spinning/Film Casting

- Extrusion & Fiber Formation

- Other Processes

By Grade/Type

- Standard Grade

- Modified/Specialty Grade

- High-Purity/Medical Grade

By Distribution Channel

- Direct Sales

- Distributors & Wholesalers

- Online/E-commerce Channels

- Retail/Specialty Stores

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting