5G Edge Computing Market Size and Forecast 2025 to 2034

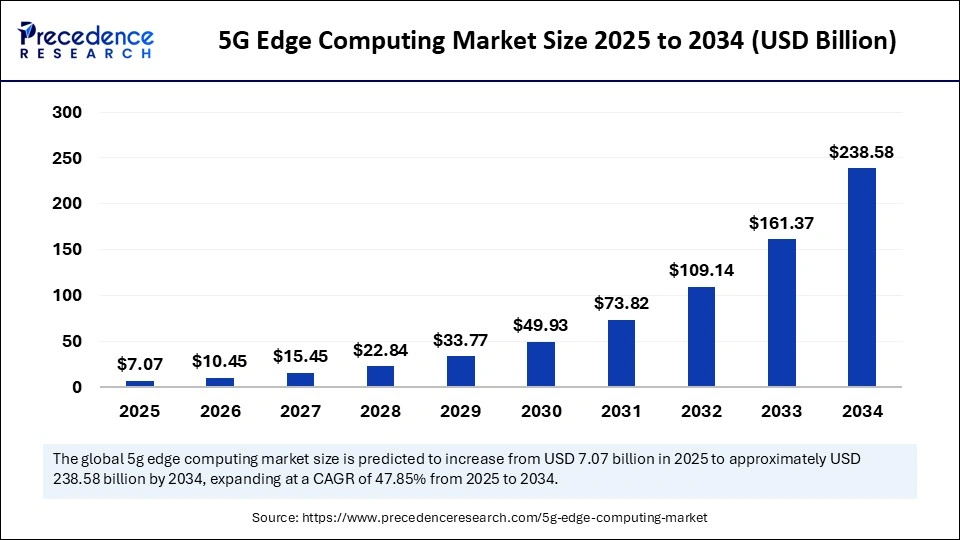

The global 5G edge computing market size accounted for USD 4.78 billion in 2024 and is predicted to increase from USD 7.07 billion in 2025 to approximately USD 238.58 billion by 2034, expanding at a CAGR of 47.85% from 2025 to 2034. The market is growing due to the rising demand for ultra-low-latency, real-time data processing, and scalable network infrastructure across industries.

5G Edge Computing Market Key Takeaways

- In terms of revenue, the global AA market was valued at USD 4.78 billion in 2024.

- It is projected to reach USD 238.58billion by 2034.

- The market is expected to grow at a CAGR of 47.85% from 2025 to 2034.

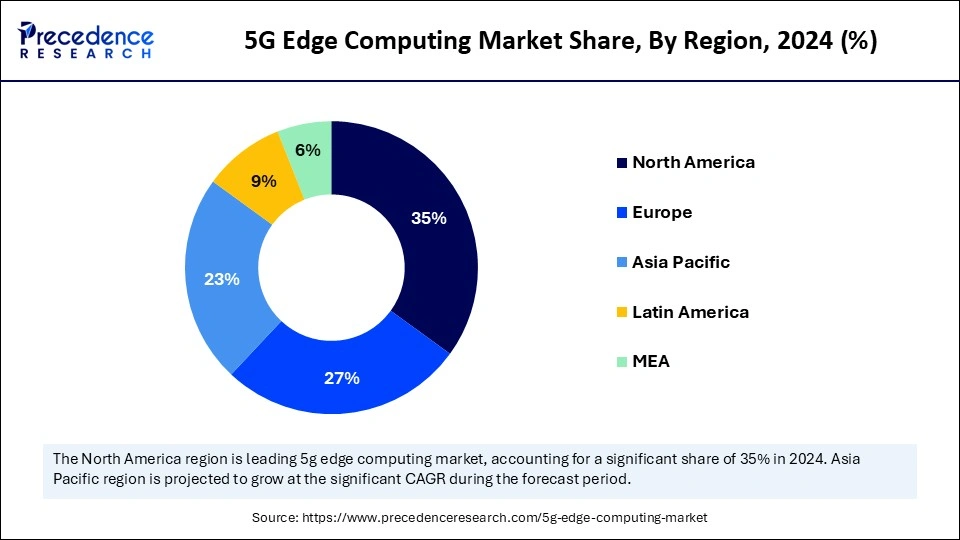

- North America dominated the 5G edge computing market with the largest market share of 35% in 2024.

- Asia Pacific is expected to grow at a notable CAGR during the forecast period.

- By component, the hardware segment held the biggest market share of 45% in 2024.

- By component, the software segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the smart cities segment captured the highest market share of 30% in 2024.

- By application, the industrial automation segment is expected to grow at the fastest CAGR during the forecast period.

- By network technology, the 5G segment contributed the maximum market share of 60% in 2024.

- By network technology, the non-5G networks segment is expected to grow at the fastest CAGR during the forecast period.

- By deployment type, the cloud-based segment generated the major market share of 35% in 2024.

- By deployment type, the on-premise segment is expected to grow at the fastest CAGR during the forecast period.

Market Overview

How Does the 5G Edge Computing Market Benefit Enterprises?

Businesses can benefit greatly from the 5G edge computing, low-latency processing, improved data privacy, and increased bandwidth efficiency, which makes it perfect for on-site mission-critical operations, real-time analytics, and AI inference. By placing compute closer to the point of data generation and combining it with the fast 5G connectivity, companies can enhance operational security, reduce dependency on centralized cloud infrastructure, expedite response times, and lower costs associated with data transmission. For industries that require real-time decision making, like manufacturing, healthcare, utilities, and autonomous systems, this architecture is especially revolutionary.

- In July 2025, Three Ireland and Ericsson announced the launch of 3Business Broadband Pro, a managed 5G service for enterprise offering improved reliability, scalability, and secure high-speed connectivity via Ericsson's Cradlepoint X10 Router and NetCloud management platform.

(Source: https://www.itpro.com)

What Role Does AI Play in Enhancing Security and Efficiency in the 5G Edge Computing Market?

AI makes proactive threat detection, dynamic resource optimization, and real-time response capabilities possible right at the network edge. It is essential to enhance security and increase efficiency in the 5G edge computing market. Predictive analytics and intelligent orchestration optimize network performance by automating the allocation of latency, bandwidth, and workload. Meanwhile, AI-driven monitoring identifies anomalous patterns, such as additional data transfers or access attempts, before they develop into breaches. The combination of edge computing and artificial intelligence guarantees the protection of sensitive data while enabling businesses to use faster, more adaptable, and resilient infrastructure.

- In December 2024, Verizon and NVIDIA announced the launch of a 5G Private Network solution with Mobile Edge Compute designed to run time AI workloads at the edge, offering enterprises ultra-low latency, enhanced security, and scalable AI-powered connectivity.(Source: https://www.globenewswire.com)

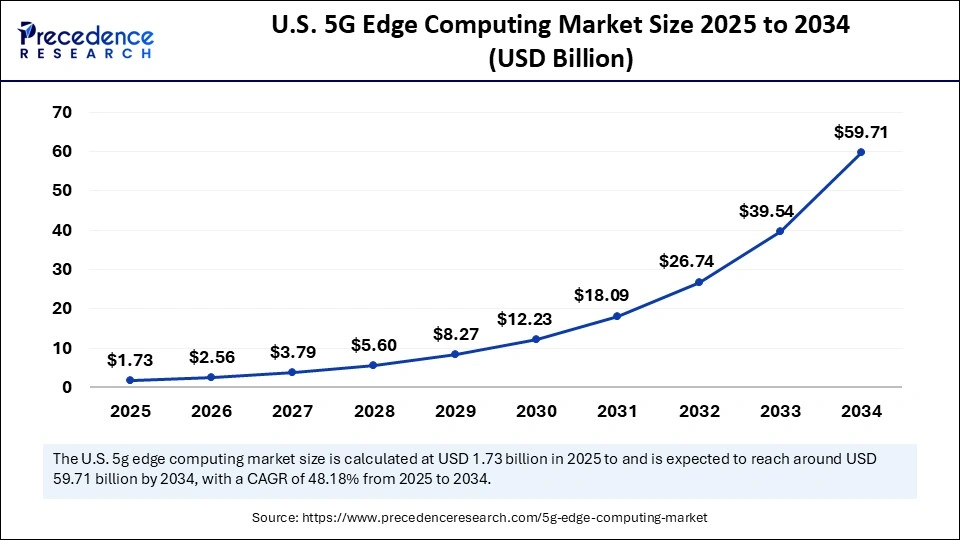

U.S. 5G Edge Computing Market Size and Growth 2025 to 2034

The U.S. 5G edge computing market size was exhibited at USD 1.17 billion in 2024 and is projected to be worth around USD 59.71 billion by 2034, growing at a CAGR of 48.18% from 2025 to 2034.

What Made North America Dominate the 5G Edge Computing Market in 2024?

North America dominates the 5G edge computing market, supported by robust 5G adoption, sophisticated telecom infrastructure, and significant investments in industrial automation and smart city initiatives. The region is dominated in part because of the presence of top technology providers and the early adoption of edge computing solutions. North America's market dominance was further reinforced by high R&D investment and a strong emphasis on innovation in low-latency applications. Edge computing solutions are continuously in demand in the region due to established regulatory frameworks and early enterprise adoption of emerging technologies.

The Asia Pacific region is growing rapidly, driven by the increasing adoption of low-latency apps, AI-driven analytics, and cloud-based edge platforms. The deployment of 5G is being accelerated across various industries due to rising investments in connected devices and infrastructure. The region's businesses and industrial facilities are rapidly adopting edge computing solutions due to the increasing demand for real-time data processing and increased operational efficiency.

5G Edge Computing Market Growth Factors

- Rising IoT and connected devices adoption is fueling demand for faster, more efficient edge computing to process massive data volumes in real time.

- Ultra-low latency requirements in applications such as autonomous vehicles, AR/VR, and smart manufacturing are accelerating deployment.

- Expansion of 5G networks globally is providing the backbone needed for scalable and reliable edge infrastructure.

- Cloud-to-edge migration by enterprises is driving investment in distributed computing models for better efficiency and cost optimization.

- The growth of smart cities and industrial automation is boosting the need for localized processing to enable real-time decision-making.

- Increased demand for video analytics, content delivery, and immersive technologies is pushing the adoption of edge solutions to handle high bandwidth usage.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 238.58 Billion |

| Market Size in 2025 | USD 7.07 Billion |

| Market Size in 2024 | USD 4.78 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 47.85% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Application, Network Technology, Deployment Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growth of Data Intensive Applications

Applications that demand blazing-fast connections and constant data flow include augmented reality (AR), virtual reality (VR), immersive gaming, and 4K/8K video streaming. The 5G edge computing market technologies enhance user experiences by making them more fluid and engaging, while lowering latency and optimizing bandwidth usage. This trend is fueling adoption in the fields of entertainment education and corporate training. More companies will utilize AR and VR for remote training and collaboration, making dependable, edge-enabled 5G a necessity. The increasing desire for immersive experiences guarantees that there will always be a need for cutting-edge solutions in these industries.

- In June 2024, Ericsson and Deutsche Telecom launched an edge cloud gaming trial to demonstrate lag-free VR/AR and gaming experiences powered by 5G edge infrastructure.(Source: https://www.telekom.com)

Scalability of Next Gen Infrastructure

Enterprises are increasingly adopting hybrid architectures that combine public cloud, private edge, and AI-driven orchestration. This approach improves scalability while lowering operational costs, as workloads can be balanced between the cloud and the edge. Businesses benefit from enhanced flexibility, ensuring smooth adaptation to growing data volumes and dynamic user demands. Scalability also provides enterprises with the ability to innovate without being constrained by traditional infrastructure limits. It enables the seamless expansion of service across geographies while maintaining performance consistency.

Restraints

High Infrastructure and Deployment Costs

A primary barrier to the 5G edge computing market is the substantial financial investment required to construct new infrastructure, including edge data centers, network hardware, and spectrum licensing. Deployment costs are further increased by integrating cutting-edge technologies such as edge servers, AI, and IoT. Large-scale adoption may be slowed down by the inability of smaller businesses to afford such investments. Furthermore, finding a way to balance the expense of innovation with reasonably priced services for end users is still difficult.

- In June 2023, Verizon announced a $100 million investment in edge infrastructure expansion, but highlighted that high deployment costs remain a concern for smaller operators.(Source: https://www.verizon.com)

Interoperability and Standardization Issues

Integration is made more difficult by the incompatibility of various 5G and edge platforms. Because vendors frequently create proprietary solutions, businesses often struggle to implement multi-vendor ecosystems, resulting in implementation delays and increased integration costs, particularly for multinational corporations. Ensuring seamless connectivity across particularly for multinational corporations. Ensuring seamless connectivity across diverse applications and networks is critical but still underdeveloped. This fragmentation hampers scalability, and the adoption of innovations is slowed in the 5G edge computing market.

Opportunities

Rising Demand in Autonomous Vehicles and Smart Transportation

The 5G edge computing market has a lot of potential since the development of driverless cars and intelligent transportation systems mainly depends on ultra-low latency and real-time data processing. Edge computing has the potential to enhance autonomous driving systems, road safety, and traffic management by facilitating vehicle-to-everything (2=V2X) communication. Smart mobility is receiving significant investment from both the public and private sectors, and 5G edge computing will be essential to bringing this vision to fruition. It is anticipated that this industry will embrace edge solutions at one of the quickest rates.

Growth in Cloud Edge Hybrid Solutions

The increasing convergence of cloud and edge computing provides a unique growth opportunity for enterprises. Hybrid models allow organizations to use cloud scalability alongside edge real-time data processing capabilities. This hybrid approach is especially beneficial for sectors that require both global cloud reach and localized edge insights. Cloud providers are increasingly partnering with telecoms to expand their edge footprint, creating new opportunities in the 5G edge ecosystem.

Component Insights

Why Did the Hardware Segment Dominate the 5G Edge Computing Market in 2024?

The hardware segment dominated the 5G edge computing market, driven by the installation of specialized edge devices, servers, routers, and gateways. Low-latency processing and effective data management at network edges are made possible by hardware that serves as the foundation of edge infrastructure. Strong demand for dependable and scalable edge hardware solutions from cloud service providers, telecom operators, and businesses strengthened its position as the industry leader.

The software segment is expected to be the fastest-growing as AI, orchestration platforms, and virtualization software become essential for managing distributed edge resources. Software solutions facilitate workload optimization, resource allocation, and real-time analytics, enhancing the efficiency of edge computing deployments. Increasing adoption of AI-driven management and automation tools is driving rapid growth in software investments across edge networks.

Application Insights

Why Did the Smart Cities Segment Lead the 5G Edge Computing Market in 2024?

The smart cities segment is dominating the market due to the need for low-latency processing of large amounts of data generated by connected transportation systems, public services, and Internet of Things (IoT) devices. Because edge computing facilitates effective network use and real-time decision-making, it is essential for smart city projects. Investments in energy optimization, traffic control, and surveillance software further increased the market share of this sector.

Industrial automation is growing rapidly, fueled by the use of edge computing in robotics, manufacturing, and industrial processes made possible by the Internet of Things. Real-time monitoring, predictive maintenance, and production optimization are all aided by low-latency data processing. There is a high demand for edge computing solutions in industrial settings due to the growing adoption of Industry 4.0 initiatives.

Network Technology Insights

Why Did the 5G Segment Hold the Largest Share in the 5G Edge Computing Market in 2024?

The 5G segment held the largest share in 2024 as ultra-high-speed, low-latency connectivity is essential for edge computing applications. 5G networks support massive data throughput and enable real-time processing at the network edge, driving investments from telecom providers and enterprises. Its integration with edge computing facilitates innovative applications such as autonomous vehicles, smart grids, and remote healthcare.

Non-5G networks, including private LTE and hybrid wireless solutions, are the fastest-growing segment. These networks are increasingly used in enterprise campuses, factories, and localized deployments where 5G rollout is limited. Their adoption is driven by cost efficiency, reliability, and tailored coverage for specific industrial and commercial applications.

Deployment Type Insights

Why Did Cloud-Based Segments Dominate the Market for 5G Edge Computing in 2024?

Cloud-based segment is dominating the market because of its affordability, centralized administration, and scalability. Cloud platforms enable the orchestration of edge resources across multiple locations, simplifying on-site infrastructure maintenance. Because cloud-based deployments offer remote monitoring and faster rollouts, telecom operators and service providers prefer them.

On-premises segment is growing rapidly because businesses that need to operate quickly or handle sensitive data prefer localized control. On-premises edge computing is being used by sectors like healthcare, finance, and defense to protect data privacy and guarantee continuous operation. On-premises deployment is expanding more quickly due to the growing need for specialized, highly secure solutions.

5G Edge Computing Market Companies

- Ericsson

- Nokia

- Huawei Technologies

- Intel Corporation

- Cisco Systems

- Dell Technologies

- Hewlett-Packard Enterprise (HPE)

- IBM Corporation

- Microsoft

- Amazon Web Services (AWS)

- Qualcomm Technologies

- ZTE Corporation

- Samsung Electronics

- Juniper Networks

- Vodafone Group

- NTT Communications

- Rockwell Automation

- Siemens AG

- ADLINK Technology

- Keysight Technologies

Recent Developments

- In September 2025, Nokia and Global Data revealed that 87% of industrial companies adopting on-premises edge computing and private 5G networks recorded ROI within one year, underscoring the value of edge infrastructure in enhancing industrial AI, security, productivity, and cost savings.

(Source: https://www.telecomstechnews.com) - In August 2025, Dell'Oro Group reported a surge in 5G Standalone (SA) and Multi-access Edge Computing adoption, with manufacturing revenues growing 31% year over year and 71 mobile network operators launching 5G SA enhanced mobile broadband services.(Source: https://www.delloro.com)

Segments Covered in the Report

By Component

- Hardware

- Edge Devices

- Edge Servers

- Routers and Gateways

- Storage Devices

- Communication Infrastructure

- Software

- Edge Computing Platform

- Edge Management Software

- Data Analytics Software

- Security Software

- Services

- Consulting Services

- System Integration Services

- Managed Services

By Application

- Autonomous Vehicles

- Smart Cities

- Industrial Automation

- Healthcare

- Retail

- Energy and Utilities

- Agriculture

- Entertainment & Media

- Telecom & IT

By Network Technology

- 5G

- Private 5G Network

- Public 5G Network

- Non-5G Networks

- LTE

- Wi-Fi

- Satellite

By Deployment Type

- On-Premise

- Cloud-Based

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting