AgPd Powder Market Size and Forecast 2025 to 2034

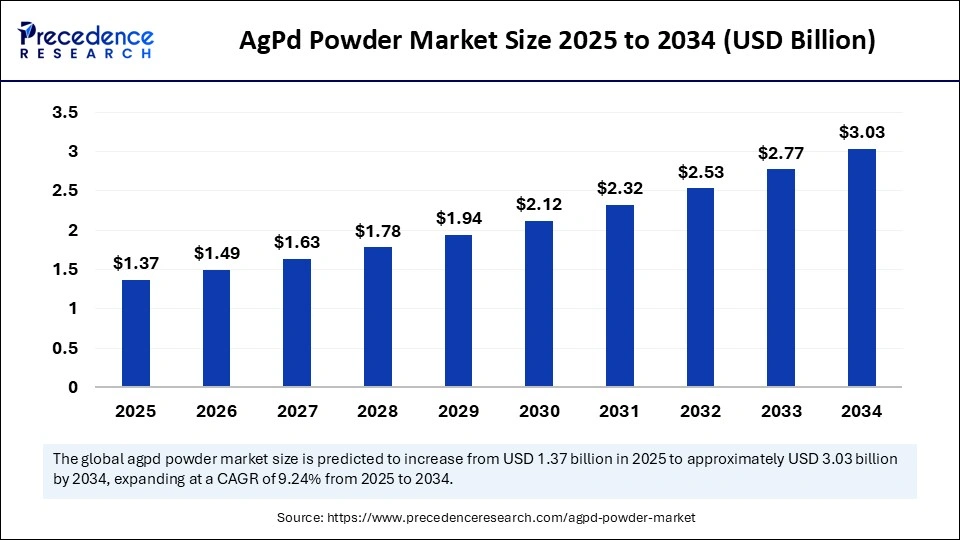

The global AgPd powder market size was estimated at USD 1.25 billion in 2024 and is predicted to increase from USD 1.37 billion in 2025 to approximately USD 3.03 billion by 2034, expanding at a CAGR of 9.24% from 2025 to 2034. The growth of the AgPd powder market is driven by increasing demand for high-performance conductive materials in electronics, automotive sensors, and multilayer ceramic capacitors.

AgPd Powder Market Key Takeaways

- In terms of revenue, the global AgPd powder market was valued at USD 1.25 billion in 2024.

- It is projected to reach USD 3.03 billion by 2034.

- The market is expected to grow at a CAGR of 9.24% from 2025 to 2034.

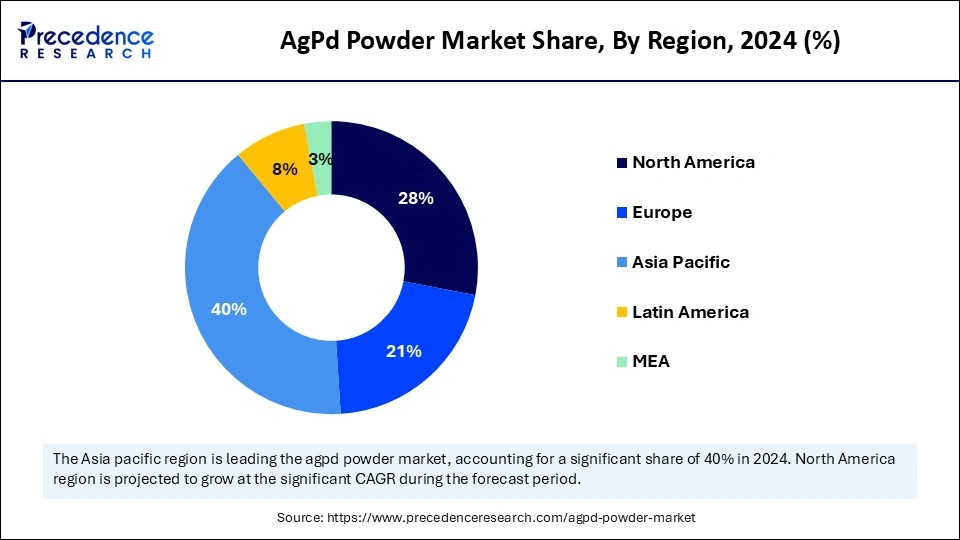

- Asia Pacific dominated the global AgPd powder market with the largest market share of 40% in 2024.

- North America is anticipated to witness the fastest growth during the forecasted years.

- By application, the automotive segment captured the biggest market share of 40% share in 2024.

- By application, the electronics and electrical contacts segment is expected to grow at the fastest CAGR over the forecast period.

- By form, the powder form segment contributed the highest market share of 60% in 2024.

- By form, the paste form segment is anticipated to show considerable growth over the forecast period.

- By end-use industry, the automotive industry segment generated the major market share of 45% share in 2024.

- By end-use industry, the electronics industry segment is anticipated to expand at the highest CAGR over the forecast period.

- By type of alloy composition, the high silver content (Ag >75%) segment held the largest market share of 50% in 2024.

- By type of alloy composition, the balanced silver-palladium alloys (50% Ag, 50% Pd) segment is expected to grow at the fastest CAGR in the upcoming period.

- By distribution channel, the direct sales segment accounted for the significant market share of 55% in 2024.

- By distribution channel, the online sales segment is expected to grow at a significant CAGR over the forecast period.

How is AI Transforming the AgPd Powder Market?

AI-based tools in material research are accelerating innovation and reducing the cost of AgPd alloy research by simulating and predicting behavior under different conditions. The use of artificial intelligence (AI) and IoT in manufacturing allows for real-time tracking of powder properties, the production process, and quality, ensuring steady output and minimizing waste. Machine learning algorithms assist in predictive maintenance, reducing downtime and maximizing productivity. AI also plays a crucial role in predicting market demand and analyzing customer behavior, enabling manufacturers to optimize their production strategies.

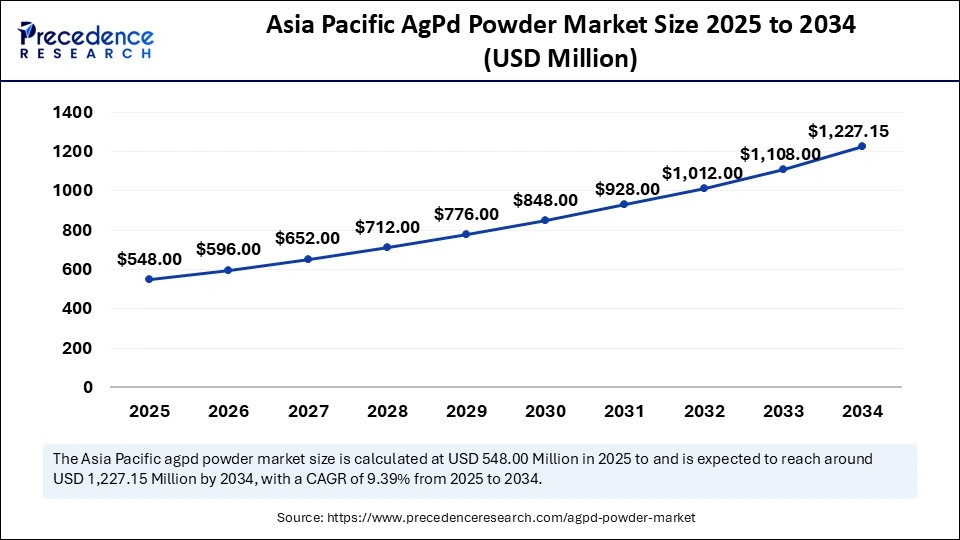

Asia Pacific AgPd Powder Market Size and Growth 2025 to 2034

The Asia Pacific AgPd powder market size is evaluated at USD 548.00 million in 2024 and is projected to be worth around USD 1,227.15 million by 2034, growing at a CAGR of 9.39% from 2025 to 2034.

What Made Asia Pacific the Dominant Region in the AgPd Powder Market in 2024?

Asia Pacific dominated the market with the highest market share of 40% in 2024. Asia Pacific's leading position in the market is attributed to its strong electronics and automotive manufacturing sectors, especially in countries like Japan, South Korea, Taiwan, and India, generated significant demand. AgPd powder is vital for producing components like multilayer ceramic capacitors and sensors, essential for these industries. Rapid industrialization and government support have accelerated market growth. Technological advancements within the region have also played a crucial role. This combination of factors has propelled Asia Pacific to the forefront of both the production and consumption of AgPd powder. The region is expected to maintain its dominance as advancements in 5G, renewable energy, and automation continue to drive demand.

China is a major contributor to the market in Asia Pacific, boasting a large end-user base and silver-palladium alloy producers. The country's dominance in electronics manufacturing, particularly in smartphones, semiconductors, and automotive electronics, fuels substantial demand for AgPd powder. Massive government and infrastructure investments, coupled with incentives for the electric vehicle transition in China, have dramatically increased the application of AgPd alloys in electric vehicle component development, including connectors, relays, and battery management systems.

Why is North America Experiencing the Fastest Growth in the AgPd Powder Market?

North America is expected to grow at the fastest CAGR during the forecast period due to several key factors. High technological development rates, particularly in electronics and automotive sectors, drive demand for AgPd alloys. The increasing adoption of electric vehicles necessitates these materials for various components. Substantial investments in sectors like aerospace, defense, and healthcare further boost market expansion. A growing focus on clean energy and electrification encourages the use of high-conductivity, anti-corrosive alloys like AgPd. These combined factors position North America for significant growth in the market.

The U.S. plays a major role in the market due to high demand for AgPd powder from well-developed industries such as automotive, aerospace, electronics, and medical device manufacturing. Its leadership in aerospace and defense applications, which require durable and reliable materials, further fuels market expansion. Government investment in material science research and innovation plays a crucial role. The presence of major players in the specialty alloy industry also supports this growth.

What are the Major Factors Boosting the Growth of the AgPd Powder Market in Europe?

The market in Europe is expected to grow at a notable rate, driven by a robust industrial base, particularly in the automotive, aerospace, and electronics sectors, creating substantial demand for these alloys. Technological advancements and high-quality standards within these sectors further boost market expansion. The rising adoption of green technologies and sustainable transport solutions, including electric vehicles, increases the use of AgPd powders in electronic components. Stringent quality control and environmental responsibility measures by European manufacturers also contribute to market growth. Furthermore, the integration of new, low-emission alloy processes supports sustainable market development. These combined factors foster a favorable environment for the market.

The UK plays a strategic role in the European AgPd powder market, excelling in material science, automotive engineering, and medical device manufacturing. A strong R&D sector, including academic institutions and research centers, fosters innovation in metal alloys and powders designed for high-performance applications. The growth of the electric vehicle industry and efforts to strengthen the domestic semiconductor market provide a favorable environment for AgPd-based components. The UK's commitment to quality and technological advancement further supports its position in this specialized market.

Market Overview

The AgPd (silver palladium) powder market refers to the global market for fine powders made from the alloy of silver (Ag) and palladium (Pd). These powders are utilized in a range of industrial applications due to their unique properties, such as high thermal and electrical conductivity, corrosion resistance, and catalytic activity. AgPd powders are primarily used in electronics, automotive, dental alloys, and other specialized applications requiring high-performance materials.

The AgPd powder market is rapidly growing due to increased applications in high-precision electronics, multilayer ceramic capacitors (MLCCs), and dental uses. The alloy's outstanding electrical conductivity and corrosion resistance make it ideal for conductive pastes and microelectronic components. Moreover, its biocompatibility stimulates its use in dental restoration and medical appliances. The miniaturization trend in electronic equipment, coupled with the growth of electric vehicles, has further increased the demand for high-performance materials like AgPd.

What Factors are Fueling the Growth of the AgPd Powder Market?

- Rising Demand from the Electronics Industry: The growth of consumer electronics and miniature devices has led to a rise in the application of AgPd powder in conductive pastes for printed circuit boards, as well as multilayer ceramic capacitors.

- Growth of Automobile Electronics: The rising production of electric cars and hybrid cars is leading to the heightened use of AgPd powder in sensors and control units, which is a factor driving market growth.

- Increasing R&D Investments: Ongoing research activities into material science lead to expanding applications of AgPd alloys beyond traditional domains, opening up new growth avenues.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.03 Billion |

| Market Size in 2025 | USD 1.37 Billion |

| Market Size in 2024 | USD 1.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.24% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Form, End-User Industry, Type of Alloy Composition, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Lightweight and Durable Materials

One of the major factors driving the growth of the AgPd powder market is the increasing demand for lightweight, high-performing, and corrosion-resistant materials from the automotive industry. Modern vehicles, particularly electric and hybrid models, necessitate compact and dependable electronic systems, where AgPd alloys are essential in sensors, connections, and contact materials. These alloys excel as electrical conductors, offer robust strength, and demonstrate high resistance to environmental factors, making them perfectly suited for automotive electronics. These applications demand high electrical conductivity, mechanical durability, and resilience against extreme environmental conditions, including high temperatures and vibrations.

Furthermore, the automotive industry's move toward sustainability and fuel efficiency has driven increased demand for materials that reduce weight without sacrificing performance. This trend is amplified by the global rise in EV production and the enforcement of stringent emission standards.

Restraint

Fluctuating Raw Material Prices

A major factor restraining the growth of the AgPd powder market is the volatility in the prices of raw materials, particularly silver and palladium. Both metals are valuable, and their prices are heavily influenced by global economic trends, mining output, geopolitical factors, and supply-demand imbalances. The reliance on global suppliers of these materials also creates vulnerabilities in the supply chain. This makes raw material costs highly unpredictable, significantly limiting the market's scale and profitability, particularly in price-sensitive industries.

Opportunity

Continued Innovation and R&D Advancements

The AgPd powder market's greatest potential lies in innovation and dedicated research and development aimed at improving alloy performance. New materials offer opportunities in emerging fields like renewable energy, high-frequency electronics, and aerospace engineering, where materials must withstand extreme temperatures. Furthermore, advancements in powder metallurgy and nanostructuring are helping to refine AgPd powder grains, reducing their size and homogenizing them, which unlocks unique properties. These enhancements will increase the material's application in fabrication and precision components. Improved material qualities promote longer product lifecycles and reduced energy consumption, aligning with global sustainability goals.

Application Insights

Why Did the Automotive Segment Lead the AgPd Powder Market in 2024?

The automotive segment led the market while holding a 40% share in 2024. This is mainly due to the increased integration of electronic technology and the need for high-performance materials in modern vehicles. AgPd alloys are crucial in connectors, relays, and sensors, where electrical conductivity, high-temperature resistance, and corrosion resistance are essential.

The increased adoption of electric and hybrid vehicles has also boosted the demand for AgPd powder, as these vehicles require advanced electrical systems for battery management, charging infrastructure, and autonomous driving features. As the automotive industry embraces electrification and smart mobility, the demand for sophisticated materials like AgPd powder is expected to rise, solidifying the segment's position in the market.

The electronics and electrical contacts segment is expected to grow at a significant CAGR over the forecast period. AgPd is widely used in conductive pastes and contact materials due to its high electrical conductivity, oxidation resistance, and high-temperature performance. Electronic devices are becoming more compact and sophisticated across consumer electronics, telecommunications, and data infrastructure. The expansion of 5G networks, the Internet of Things, and smart home devices is driving the use of AgPd components. As electronic product manufacturing continues to advance, creating more energy-efficient and durable products gains global popularity.

Form Insights

How Does the Powder Form Segment Dominate the Market 2024?

The powder form segment dominated the AgPd powder market while capturing a 60% share in 2024. This dominance is due to the widespread use of AgPd alloy powder in high-precision manufacturing, particularly in the electrical, automotive, and dental industries. Powdered AgPd is favored for its versatility, ease of handling, and suitability for various processes like sintering, pressing, and additive manufacturing. Furthermore, the alloy's excellent corrosion and wear resistance makes it durable and reliable in harsh environments, such as automotive sensors and contact materials. Powdered AgPd is also utilized in metal injection molding and 3D printing, enabling intricate shapes and scaled-down designs.

The paste form segment is expected to grow at a significant CAGR in the coming years. AgPd conductive pastes are used in manufacturing printed circuit boards (PCBs), thick film circuits, and hybrid micro-electronic assemblies. With the expansion of consumer electronics, IoT devices, and 5G infrastructure, manufacturers require high-precision, stable pastes to facilitate miniaturization and enhance performance. Furthermore, the paste form offers advantages such as efficient material deposition, reduced waste, and improved scalability in automated production. As industries shift toward more compact and energy-efficient technologies, the paste form segment is expected to experience steady and robust growth during the forecast period.

End-Use Insights

What Made the Automotive Industry the Dominant Segment in the AgPd Powder Market in 2024?

The automotive industry segment dominated the market, holding a 45% share in 2024. This dominance is fueled by the increasing reliance on sophisticated electronic systems and sustainable mobility approaches within the sector. The rise of electric vehicles and autonomous driving necessitates materials with superior tensile strength, electrical conductivity, and robust resistance to corrosion and high temperatures.

AgPd alloy powder plays a crucial role in the production of essential automotive parts, including sensors, connectors, and control systems, thereby enhancing the safety, efficiency, and overall performance of vehicles. As the infrastructure for EVs continues to develop, vehicle-to-everything (V2X) technologies gain wider adoption, and interest in intelligent transport systems expands, the automotive industry is poised to remain a key driver of the market's growth in the years ahead.

The electronics industry segment is expected to grow at the highest CAGR in the coming years, driven by the increasing complexity of modern electronic devices. As demand grows for higher-performance components in smartphones, laptops, servers, and communication systems, manufacturers are increasingly turning to advanced materials like AgPd alloy due to their superior electrical and thermal conductivity. The shift toward renewable energy systems and the expansion of electrical infrastructures, both of which depend on the efficient use of electronic control units, further broaden the application of AgPd-based components. With ongoing innovation in electronics manufacturing, the AgPd powder market is expected to benefit significantly from the evolving material demands within the industry.

Type of Alloy Composition Insights

What Factors Led the High Silver Content (Ag >75%) Segment in 2024?

The high silver content (Ag >75%) segment led the AgPd powder market with a 55% share in 2024. The dominance of the segment stems from the high adoption of silver due to its superior electrical and thermal conductivity. These alloys are particularly well-suited for use in electronics, automotive sensors, and electrical contact materials. These formulations enable efficient signal transmission and sustained performance in autonomous and industrial applications. Furthermore, dental applications favor high-silver compositions due to their biocompatibility and aesthetic qualities. As the development of miniaturized, energy-efficient products continues, and electrification initiatives gain momentum globally, their established versatility and multi-functionality solidify their position as a cornerstone of the market across various high-tech sectors.

The balanced silver-palladium alloys (50% Ag, 50% Pd) segment is expected to grow at the fastest rate in the upcoming period. This specific alloy ratio achieves a balanced combination of the strengths of silver and palladium, making it highly valuable in specialized applications where enhanced mechanical stability is desired, along with predictably stable electrical characteristics. The increasing use of high-tech sensing and communication systems in electric vehicles, the expanding implementation of smart grids, and advanced power management systems are driving the demand for materials that can perform reliably under varying thermal and electrical loads. The demand for balanced AgPd alloys will accelerate as industries prioritize materials that extend component lifespan and maintain cost-effectiveness.

Distribution Channel Insights

Why Did the Direct Sales Segment Dominate the AgPd Powder Market in 2024?

The direct sales segment led the market while holding a 55% share in 2024. This dominance stems from the critical applications of AgPd powders across various industrial sectors, including aerospace, automotive, medical, and electronics, where precision, traceability, and performance are paramount. Direct sales enable manufacturers to establish close relationships with their key clients, allowing them to provide highly customized solutions that meet the most stringent technical and regulatory requirements. This distribution method fosters long-term relationships, builds trust, and facilitates real-time technical support, which is essential in a high-value business that demands material quality assurance and prompt product delivery. Customers prefer direct engagement with suppliers due to the high value and technical complexity of AgPd powders.

The online sales segment is expected to grow at a significant CAGR over the forecast period, driven by digitalization and evolving consumer preferences. The advantages of online purchasing platforms for businesses are becoming increasingly appealing, with efforts focused on providing product specifications, facilitating price comparisons, and enabling real-time order placement. As e-commerce expands and evolves, new and improved features are emerging, such as real-time inventory availability, smart recommendations, and automated purchasing systems. These innovations are making the purchasing process more efficient and expanding the availability of specialized materials, including AgPd powder. Moreover, online platforms enhance reach to a broader consumer base, contributing to market growth.

AgPd Powder Market Companies

- Umicore

- Johnson Matthey

- Ferro Corporation

- Daiichi Kigenso Kagaku Kogyo Co., Ltd.

- BASF

- Palladium Metals Ltd.

- The Materials Company

- Evonik Industries AG

- Advanced Technology & Materials Co., Ltd.

- Metalor Technologies

- Sumitomo Metal Mining Co., Ltd.

- Giga-Mach Corp.

- Tateho Chemical Industries Co., Ltd.

- VICI Metronics Inc.

- Shaanxi Kaida Powder Metallurgy Co., Ltd.

- Tanaka Precious Metals

- Heraeus Precious Metals

- AGC Inc.

- Orbel Corporation

- Mitsubishi Materials Corporation

Recent Developments

- In April 2024, Heraeus Precious Metals introduced a product line under the brand name Circlear made with 100% recycled content precious metals. Circlear products are available for seven types of metal: gold, silver, platinum, palladium, rhodium, ruthenium and iridium. The wide portfolio of Circlear products means Heraeus can cater to diverse industrial applications, such as chemical products, catalytic gauzes, electrical contacts and pharmaceutical ingredients, the company says. (Source: https://www.recyclingtoday.com)

- In February 2024, Kymera International bought the assets of Royal Metal Powders with operations in copper, nickel/silver, bronze, and tin powder, which closed the Royal plant in Tennessee, expanding shop inventory and source of supply to the U.S., Germany, and North Carolina plants. (Source:https://www.prnewswire.com)

Segments Covered in the Report

By Application

- Electronics and Electrical Contacts

- Semiconductor manufacturing

- High-frequency and low-loss components

- Automotive

- Catalysts for emission control systems

- Electrical components for ignition systems

- Dental Alloys

- Temporary crowns

- Permanent crowns

- Jewelry and Watches

- Watches

- Rings and Necklaces

- Fuel Cell Technologies

- Hydrogen storage applications

- PEM fuel cells for automotive

- Other Industrial Applications

- Thermocouples

- Catalyst applications in chemical processes

By Form

- Powder Form

- Paste Form

- Granules Form

- Coated Forms

By End-User Industry

- Electronics Industry

- Automotive Industry

- Healthcare & Medical

- Jewelry

- Energy & Power

- Chemical Processing

- By Type of Alloy Composition

- High Silver Content (Ag > 75%)

- Balanced Silver-Palladium Alloys (50% Ag, 50% Pd)

- High Palladium Content (Pd > 75%)

By Distribution Channel

- Direct Sales

- Distributors

- Online Sales

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting