What is the Energy Analytics Platforms Market Size?

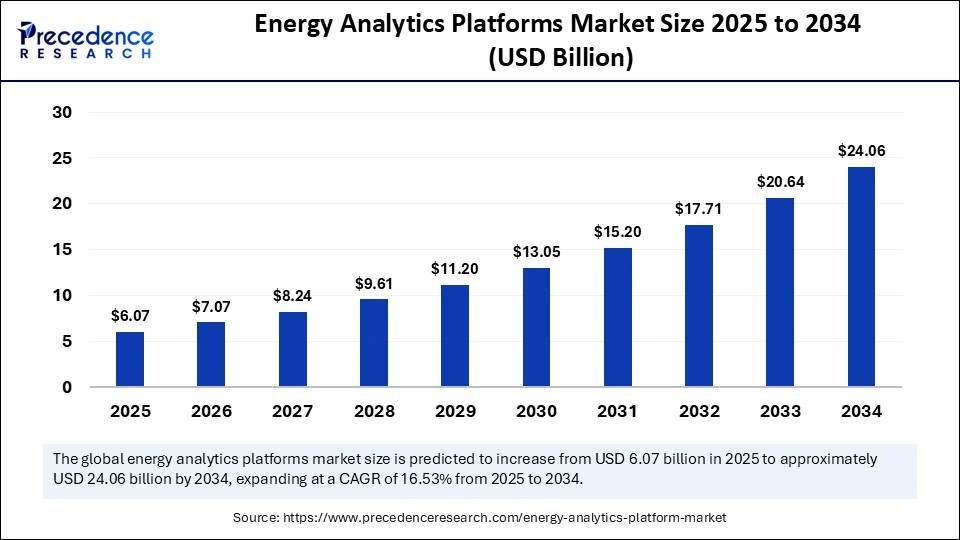

The global energy analytics platforms market size is calculated at USD 6.07 billion in 2025 and is predicted to increase from USD 7.07 billion in 2026 to approximately USD 24.06 billion by 2034, expanding at a CAGR of 16.53% from 2025 to 2034. The market for energy analytics platforms is driven by rising adoption of smart grids, data-driven energy management, and increasing focus on sustainability and efficiency.

Market Highlights

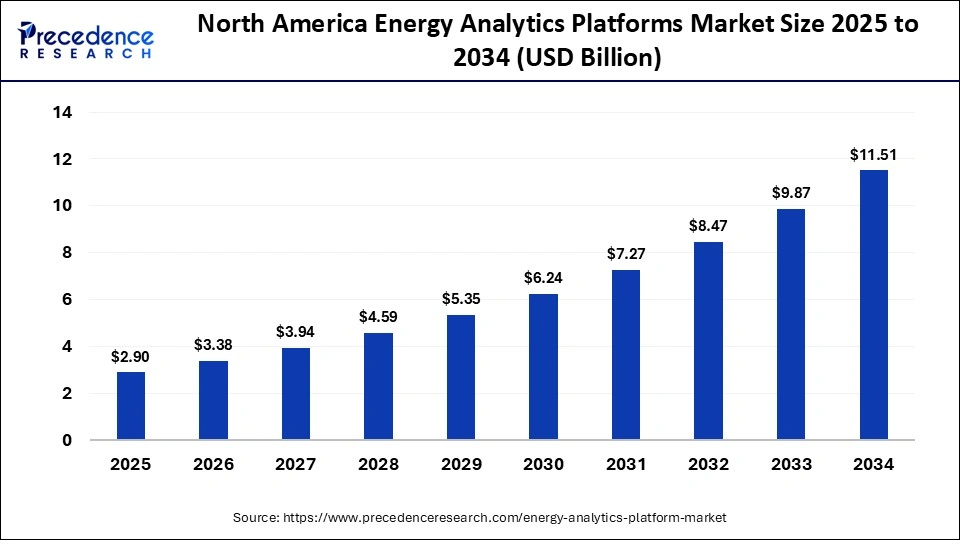

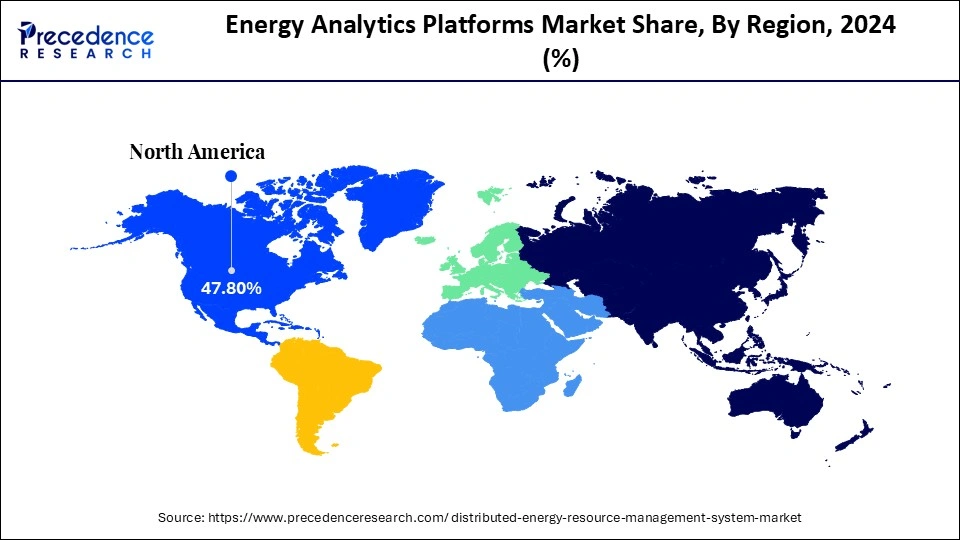

- North America led the energy analytics platforms market with around 47.8% of the share in in 2024.

- Asia Pacific is estimated to expand the fastest CAGR of 15.5% between 2025 and 2034.

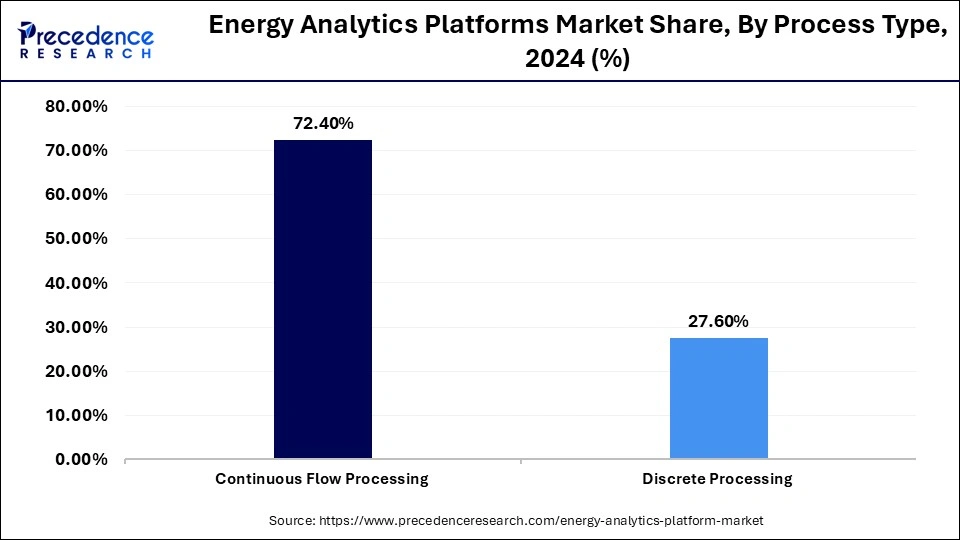

- By process type, the flow processing segment captured the highest market share of 72.4% in 2024.

- By process type, the discrete processing segment is growing at a strong CAGR of 13.8% from 2025 to 2034.

- By application, the drug discovery and development segment held the major market share of 46.8% in 2024.

- By application, the clinical diagnostic segment is expanding at a double-digit CAGR of 14.3% between 2025 to 2034.

- By automation/solution type, the modular automation systems segment contributed the highest market share of 45.6% in 2024.

- By automation/solution type, the total lab automation systems segment is projecetd to grow at a notable CAGR of 14% between 2025 and 2034.

- By end-user, the pharmaceutical & biotechnology companies segment captured approximately 48.6% of market share in 2024.

- By end-user, the contract research organisations (CROs) / CDMOs segment is expected to expand at 14.2% CAGR over the projected period.

The Energy Analytics Platforms: A Market Perspective

Organizations responding to rising energy prices and increasing sustainability priorities are turning to advanced analytics to identify opportunities for improved energy efficiency. Energy analytics solutions are able to process, evaluate and predict energy use patterns in real time, identify energy waste and inefficiencies, and help organizations embrace a predictive maintenance strategy for energy systems to deliver cost savings and operational sustainability.

These solutions typically deploy IoT sensor technology, AI algorithms, and cloud computing to measure, monitor, analyse and forecast energy utilization across industrial, commercial, and utility sectors. The market is being rapidly embraced by organizations seeking to employ data-driven strategies for energy resource management, while simultaneously delivering operational performance and acting responsibly and sustainably towards the environment.

AI Enhancing Energy Analytics Platforms Across the Globe

The adoption of artificial intelligence (AI) in energy analytics platforms for utilities and grid operators is growing substantially. With machine learning built into these platforms, the ability to collect and analyze data from smart meters, sensors, and other endpoints enables utilities to provide real-time load forecasts, detect anomalies, and implement predictive asset maintenance. In addition, these analytics platforms support the integration of renewables, optimize demand-side management, and enhance grid resilience.

Most recently, in October 2025, the Maharashtra State Electricity Distribution Company Ltd (MSEDCL) signed a Statement of Intent with the Global Energy Alliance for People and Planet (GEAPP) to modernize its power-distribution network with AI and analytics. The focus is on real-time asset monitoring, load-flow analysis, demand forecasting, and deployment of battery storage to aid in managing peak loads and effectively integrating renewables.

- In September 2025, UK-based Octopus Energy announced the spin-off of its AI-enabled utility software business, Kraken Technologies, as an independent company. Kraken manages more than 70 million accounts globally with billions of data points daily and provides scalable analytics capabilities to utilities globally.

Analytics-enabled platforms are beginning to transition energy operations from reactive to proactive utilities and contribute to smarter grids, improved efficiency, and lower carbon energy systems.

Energy Analytics Platforms Market Outlook

Investment in grid digitalisation for the energy sector is increasing rapidly, having escalated by over 50%. Emphasis on real-time monitoring, predictive analytics, and optimization of energy flows demonstrates a redefinition of analytics platforms, central to operations.

Analytics platforms are rapidly expanding their footprint in regions rolling out renewable energy at scale, most notably, Asia-Pacific and Latin America, which require advanced data solutions to integrate variable energy sources into reliable and efficient grid management.

As platforms are invested in and actioned, R&D in AI, machine learning, digital twins, and edge analytics will enable next-generation energy platforms, increasing efficient capacity of the grid, upholding asset performance without additional critical infrastructure, operational performance, and more intelligent energy solutions.

Sustainability and regulatory pressures have driven adoption fast, as analytics platforms give advanced performance forecasting on energy demand, energy supply, and emissions, promoting compliance and delivering the dual benefits of lowering operational costs and environmental footprint.

Data infrastructure is limited and low concentrations of AI talent and a lack of interoperability between platforms are considerable constraints to immediate deployment of analytics platforms, thus deepening implementation complexity, risk, and need to develop specific integrations or training initiatives, etc.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.07 Billion |

| Market Size in 2026 | USD 7.07 Billion |

| Market Size by 2034 | USD 24.06 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Process Type, Application, Automation Type/Solution Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Energy Analytics Platforms MarketSegment Insights

Process Type Insights

Continuous Flow Processing accounts for 72.4% of the energy analytics platforms market share by facilitating ongoing, real-time energy monitoring. It enables an industrial system to monitor its overall energy consumption in real time, thus helping identify efficiency, optimize performance, and reduce energy waste. Continuous flow processing is particularly advantageous for larger operations that require periodic integration of data systems from sources such as smart meters, IoT or other smaller smart devices, and predictive maintenance systems.

Discrete Processing has the fastest-growing subsegment, with a 13.8% CAGR, ideal for batch operations or facilities that require periodic energy monitoring of operational energy use. Like continuous flow processing, discrete processing offers a stepwise or periodic data-collection benefit, enabling energy optimization of period consumption in smaller-scale or proprietary parts of an industrial operation.

Application Insights

Genomics is the leading segment in the bioinformatics services market, with 56.4% market share. This segments growth is supported by increasing genomic sequencing activities and initiatives in personalized medicine and population-based genetics. The integration of computational and artificial intelligence (AI) tools for genome interpretation and disease prediction, coupled with advancements in precision medicine and clinical research, has reinforced the role of genomics.

The clinical diagnostics segment is set to be the fastest-growing, with a 14.3% CAGR, driven by increased emphasis on protein characterization, biomarker discovery, and understanding disease mechanisms. The increasing incorporation of bioinformatics in the mapping of proteomes and structural proteomic analysis supports drug discovery, allowing researchers to identify targets and explore protein-based strategies to treat disease in many different therapeutic areas.

Quality control labs are seeing notable growth in the energy analytics platforms market as energy systems become more complex and require precise testing, verification, and performance monitoring. With the rapid adoption of distributed energy resources, grid-scale storage, and advanced inverters, laboratories rely on analytics platforms to validate equipment behavior, assess efficiency, and ensure compliance with national standards. Stricter regulatory requirements, increased certification needs, and the rise of field data integration have also encouraged QC labs to adopt advanced analytics tools that improve accuracy, reduce testing time, and support safer grid operations.

Automation Type / Solution Type Insights

Modular Automation Systems is the prevalent solution type, accounting for 45.6% of energy analytics platforms that support existing modular energy monitoring environments in laboratories and industrial facilities. These systems represent scalable solutions for monitoring energy consumption, negotiating workflows, and reducing operational costs without reconstructing necessary infrastructures; therefore, they are attractive to an established facility.

The total lab automation systems segment is set to grow at the highest CAGR of 14%, as these systems represent the fastest-growing solution type, enabling end-to-end integration of energy analytics across an entire laboratory or industrial process. These solutions enable full energy management across all laboratory functioning processes, without getting too specific, all the way from input to output (e.g., the energy use is predicted, or monitoring might be automatically conducted), and provide improved sustainability measures, which may also have very rapid adoptio,n accompaniment of energy analytics in modern configuration, and increased lab throughput of operations.

Hardware equipment (i.e., incl. robotics and/or liquid handlers) integrates energy analytics to determine individual instrument energy utilization. These platforms do allow the user to obtain very specific details on energy consumption at the equipment level, thereby providing the possibility of optimizing individual hardware with respect to costs and efficiencies, especially in laboratories and production environments with a range of instruments that have previously been difficult to monitor.

End User Insights

The pharmaceutical & biotechnology companies are the dominant end user with 48.6% share due to the high-energy-intensive research, production, and testing processes. Energy analytics platforms help mitigate operating expenses, support energy compliance, and facilitate sustainability, while allowing the integrity, quality, and output of those processes in stringent regulatory environments.

CROs/CDMOs are the fastest-growing end-user segment, with a 14.2% CAGR, as outsourced research and manufacturing organizations increasingly turn to energy analytics platforms to optimize energy performance through real-time monitoring across multiple client projects. Energy analytics platforms are intended to provide predictive monitoring, automated energy allocations, and energy efficiency upgrades through multi-project and shared projects.

Academic & Research Institutes and Clinical/Diagnostic Laboratories utilize energy analytics platforms to improve energy efficiency in energy-consuming operations. In academic & research institute settings, end-users can monitor energy use at the lab or department level, enabling them to maximize equipment utilization, limit waste, and develop energy-saving protocols, sharply reducing energy use and expense while safeguarding the precision of research or diagnostic outputs.

Energy Analytics Platforms Market Regional Insights

The North America energy analytics platforms market size is estimated at USD 2.90 billion in 2025 and is projected to reach approximately USD 11.51 billion by 2034, with a 16.54% CAGR from 2025 to 2034.

Why North America Dominates the Energy Analytics Platforms Market?

North America is dominant in the energy analytics platforms market with a 47.8% share because utilities and regulators have invested in grid modernization, large-scale smart meter deployment, and support for distributed energy resource (DER) integration, all viable areas for analytics platforms. The U.S. DOEs Grid Modernization initiatives and state micro-grid and resilience programs establish procurement and pilot pipelines for analyticssoftware with forecasting, asset analytics, and market participation functions. High levels of smart meter penetration and utility modernization investments create volume and quality data sources (AMI, SCADA, DER telemetry) that permit efficient adoption of analytics. Additionally, commercial customers (data centers, campuses) invest in energy optimization and resilience services, providing repeatable enterprise use cases to analytics platform vendors.

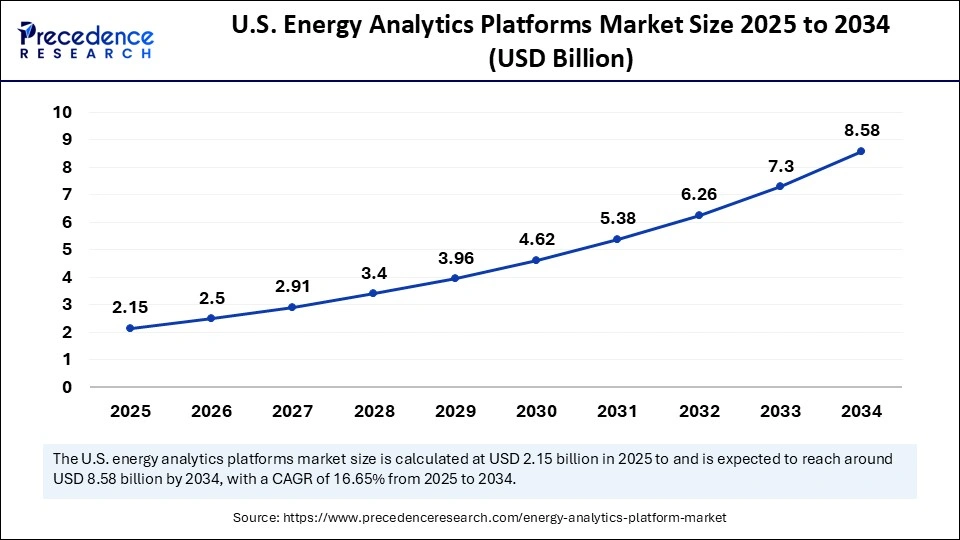

The U.S. energy analytics platforms market size is calculated at USD 2.15 billion in 2025 and is expected to reach nearly USD 8.58 billion in 2034, accelerating at a strong CAGR of 16.65% between 2025 and 2034.

U.S. Energy Analytics Platforms Market Trend

The United States is leading because federal R&D, state incentive programs, and the sheer scale of grid investment make it the largest addressable market for analytics pilots and rollouts. This mix of national funding, strong regulatory support, and high utility spending allows companies to test, validate, and scale digital tools more rapidly than in most other regions. Utilities and technology vendors co-develop solutions across the transmission, distribution, and behind-the-meter segments and are successfully deploying mature commercial solutions and case studies to support vendor selection across the country. These deployments create a growing body of proven results, further accelerating adoption and encouraging additional investment in advanced energy analytics.

The Asia Pacific region is experiencing the fastest growth of the energy analytics platforms market in the world. This is primarily due to the rapid modernization of the grid, rising grid-scale renewable generation, and the increasing demand for power associated with industrial and urban development. Utilities in the region major economies have begun adopting analytics that leverage artificial intelligence (AI) to better manage variable renewable generation and improve operational efficiency. Governments are also initiating digital transformation programs and developing regulatory and governance regimes that support the deployment of innovative energy partnerships among utilities, analytics providers, and cloud providers, establishing the Asia Pacific region as the home of next-generation intelligence in energy data.

China Energy Analytics Platforms Market Trend

China is the leading country in the region primarily because of its extensive deployment of renewables, and its home to the world largest smart grid expansion under the State Grid Corporation of China. The 14th Five-Year Plan by the Chinese government sets out policies to advance the digitalization of the grid and requires the integration of real-time conditional analytics systems across the grid to manage the variability of both solar and wind energy. The Chinese government continues to invest in IoT-based grid sensors and cloud-based grid analytics, positioning the country as a leader in large-scale, data-driven energy management in the Asia-Pacific region.

Europe is a rapidly emerging region driven by its decarbonization goals and strong regulatory programs supporting grid modernization. European utilities are adopting analytics platforms to address renewable energy intermittency, the proliferation of electric vehicles, and the enablement of flexibility markets across distributed grids. Additionally, the growth of smart meters and the Digitalization of Energy Action Plan are increasing the availability of data, in turn enabling AI and advanced analytics. There continues to be a focus on cybersecurity and interoperability standards and data-sharing frameworks that are stimulating technology providers to supply innovative and compliant analytical solutions to assist with compliance across transmission and distribution domains.

Germany Energy Analytics Platforms Market Trend

Germany is leading the regional market, with high penetration of grid-connected renewable energy generation and ongoing investments in grid modernization. Programs that provide funding to support Digitale Energiewende and the introduction of smart meters by the Federal Network Agency are strengthening data-driven energy operations. Therefore, German utilities and technology providers are developing pilot programs that use predictive analytics for grid stability, renewable integration, and market forecasting as a standard for energy intelligence in Europe.

Energy Analytics Platforms Market Companies

Provides advanced data platforms and analytical software that help energy and industrial users optimize laboratory testing, environmental monitoring, and operational efficiency through integrated instrumentation data.

Offers digital analytics tools through its operating companies to support process optimization, environmental quality monitoring, and predictive analytics for energy and industrial workflows.

Delivers analytical software, environmental monitoring systems, and data platforms that support energy companies in emissions tracking, resource analysis, and performance monitoring.

Provides analytical data systems and software platforms that support energy-sector testing, chemical analysis, and real-time process monitoring for performance and compliance.

Through Siemens technology ecosystem, offers digital analytics infrastructure, industrial data platforms, and IoT integrations that support energy system monitoring and efficiency insights.

Supplies laboratory automation and digital data solutions used in bioenergy research, materials testing, and analytics workflows relevant to renewable energy R&D.

Provides automation platforms and software that help streamline analytical workflows for energy research labs, materials development, and environmental testing.

Offers digital tools and analytical systems used in environmental microbiology and bioenergy applications where data-driven monitoring is required.

Develops automated systems and data software used in analytical laboratories within energy research, supporting high-throughput testing and process optimization.

Provides automated liquid handling and laboratory data platforms supporting analytical workflows used in renewable energy, materials research, and emissions testing.

Supplies bioinformatics and analytical software used in biofuel R&D, environmental sample analysis, and energy-related biological monitoring.

Offers analytical instruments and data systems used for chemical, water quality, and materials testing critical in petroleum, bioenergy, and environmental sectors.

Develops microplate readers and analytics software supporting high-throughput testing in energy-related biological and chemical research labs.

Provides digital lab management and data integration platforms that support energy analytics workflows, R&D data traceability, and lab automation.

Recent Developments

- In April 2024, Databricks launched its Data Intelligence Platform for Energy to enable energy companies to utilise generative AI on large-scale streams of asset, operations and customer data, helping optimise grid reliability and reduce transmission losses.(Source: https://www.databricks.com)

- In April 2024, ABB India introduced two new motor ranges IE4 cast-iron super-premium-efficiency motors and IE3 aluminium motors manufactured in India under its Make in India drive, aimed at cost reduction, energy savings and lower emissions in industrial applications.(Source: https://new.abb.com)

- In October 2024, IBM acquired Prescinto, an Indian SaaS firm for renewable-energy asset performance management, to bolster its Maximo Application Suite with AI-enabled diagnostics for wind, solar, and storage assets, supporting its energy and utility market ambitions.(Source: https://www.business-standard.com)

Energy Analytics Platforms MarketSegments Covered in the Report

By Process Type

- Continuous Flow Processing

- Discrete Processing

By Application

- Drug Discovery & Development

- Clinical Diagnostics

- Genomics & Proteomics

- Quality Control / QC Labs

- Others (e.g., Food & Environmental Testing)

By Automation Type / Solution Type

- Modular Automation Systems

- Total Lab Automation Systems (End-to-End)

- Hardware Equipment (robotics, liquid handlers)

- Software & Platforms (AI algorithms, workflow orchestration)

By End User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organisations (CROs) / CDMOs

- Clinical / Diagnostic Laboratories & Hospitals

- Academic & Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting