Friction Stir Welding Market Size and Forecast 2025 to 2034

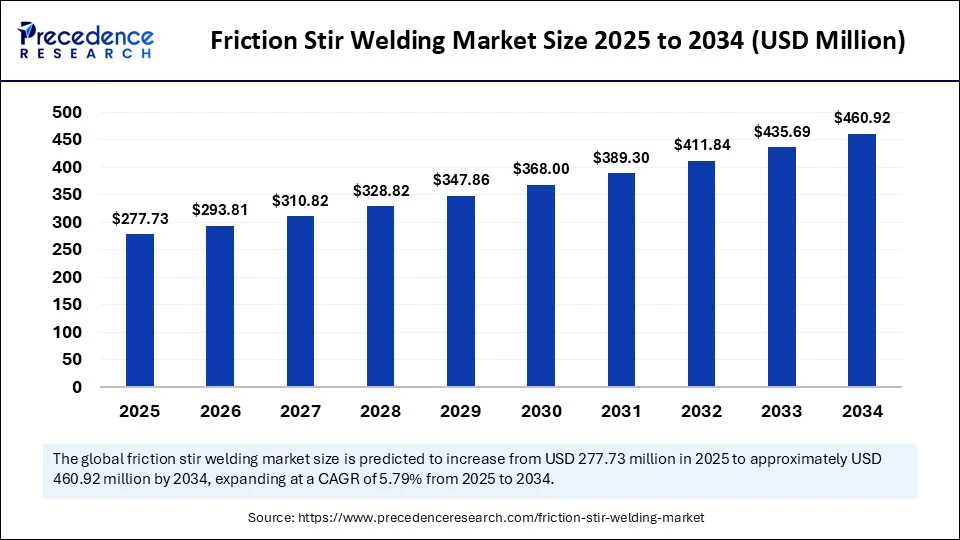

The global friction stir welding market size accounted for USD 262.53 million in 2024 and is predicted to increase from USD 277.73 million in 2025 to approximately USD 460.92 million by 2034, expanding at a CAGR of 5.79% from 2025 to 2034. The market growth is attributed to the rising demand for defect-free, high-strength joints in lightweight materials across automotive, aerospace, and electric vehicle manufacturing.

Friction Stir Welding Market Key Takeaways

- In terms of revenue, the global friction stir welding market was valued at USD 262.53 million in 2024.

- It is projected to reach USD 460.92 million by 2034.

- The market is expected to grow at a CAGR of 5.79% from 2025 to 2034.

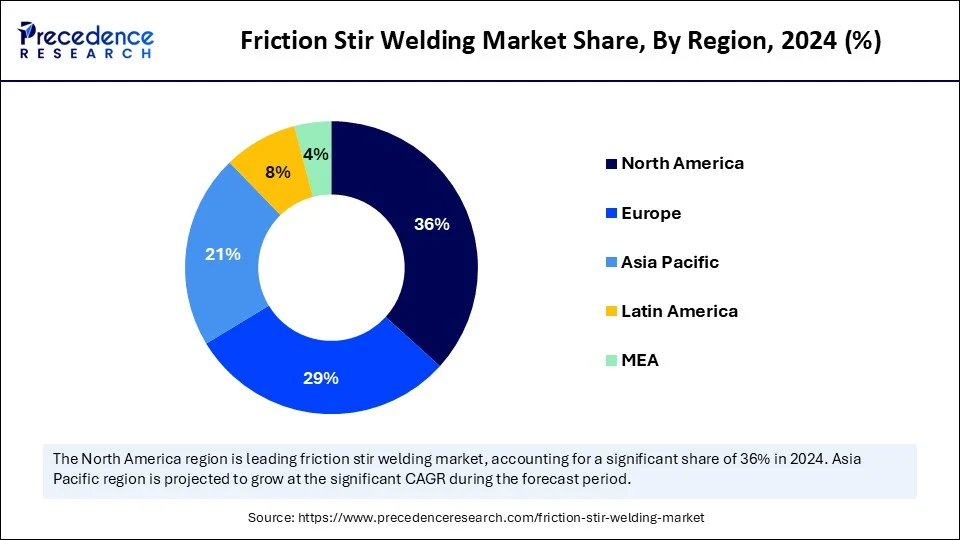

- North America dominated the global friction stir welding market with the largest share of 36% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By equipment type, the fixed FSW equipment segment held the major market share of 41% in 2024.

- By equipment type, the portable FSW equipment segment is projected to grow at a CAGR between 2025 and 2034.

- By material type, the aluminium alloy segment contributed the biggest market share of 53% in 2024.

- By material type, the steel & stainless steel segment is expanding at a significant CAGR between 2025 and 2034.

- By end use industry, the automotive & transportation segment captured the highest market share of 32% in 2024.

- By end use industry, the aerospace & defense segment is expected to grow at a significant CAGR over the projected period.

- By technology/ tool type, conventional FSW tools segment led the market in 2024.

- By technology/tool type, the advanced tool materials segment is expected to grow at a notable CAGR from 2025 to 2034.

- By automation level, fully automated & CNC-integrated systems dominated the global market in 2024, and is expected to sustain the growth in the coming years.

Impact of Artificial Intelligence on the Friction Stir Welding Market

Manufacturers currently also utilize AI-enabled applications to process live data of the welding process data including tool position, heat input, and flow of material. That maintains the effective and consistent state of the weld quality and has less dependence on manual work. Furthermore, the machine learning models allow the companies to identify anomalies when the welding occurs and take corrective measures in real-time and thus reducing the rework and improving the reliability of the products.

U.S. Friction Stir Welding Market Size and Growth 2025 to 2034

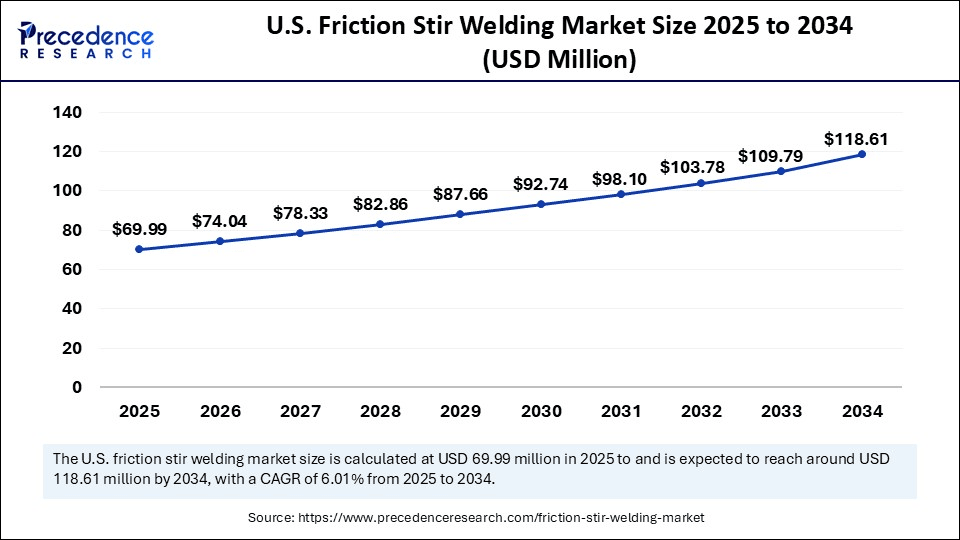

The U.S. friction stir welding market size was exhibited at USD 66.16 million in 2024 and is projected to be worth around USD 118.61 million by 2034, growing at a CAGR of 6.01% from 2025 to 2034.

What Positioned North America as the Leading Regional Market for Friction Stir Welding in 2024?

North America led the friction stir welding market, capturing the largest revenue share in 2024 accounting for an estimated 36% market share, due to energetic investments put in aerospace manufacturing, automotive manufacturing, and defense manufacturing options. The region was associated with well-developed infrastructure, adoption of early technologies, and excellent institutional backing by agencies, such as the U.S. Department of Energy (DOE) and NASA. They are aggressively funding R&D activities on high-integrity welding of space systems, hypersonic vehicles, and electric mobility platforms.

The American Welding Society (AWS) and National Institute of Standards and Technology (NIST) state that more than 70% of aerospace manufacturers in the United States used FSW to fabricate structural components in 2024. Other industry leaders, such as Lockheed Martin, Boeing, and General Motors, placed automated FSW units in more production lines to make the process more reliable. Additionally, growing demand for electric vehicles in North America promoted the use of aluminum-intensive designs, strengthening the demand for friction stir welding, thus boosting the market in this region.

- According to the International Energy Agency (IEA), electric car sales in the United States rose to 1.6 million units in 2024, with their share of total vehicle sales expanding to over 10% for the year.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the increase in industrialization, development of modern infrastructure, and a corresponding growth of manufacturing ecosystems in China, India, South Korea, and Japan. Massive implementation of FSW technologies in the manufacturing of electric vehicles, shipbuilding, and rail modernization is expected by the government-backed programs of countries, such as Made in China 2025, GMI, and Green Mobility Plan.

Chinese aerospace companies such as AVIC and COMAC massively increased the application of CNC-combined FSW machines in constructing fuselages and bulkheads with 2000 series and 7000 series aluminum. Additionally, the development of a localized supply of robotic welding equipment on upcoming EV platforms of battery production further facilitates the market in the coming years.

Market Overview

The Friction Stir Welding (FSW) market involves the use of a solid-state joining process in which materials are fused without melting, by applying frictional heat and mechanical stirring using a non-consumable rotating tool. FSW is widely used for aluminum alloys, magnesium, copper, and dissimilar material joints, offering benefits such as low distortion, high weld strength, no filler requirement, and eco-friendly operation. It is gaining traction in aerospace, automotive, shipbuilding, railways, defense, and electronics sectors, driven by the demand for lightweight, high-strength structures and advanced joining solutions for modern engineering challenges.

The demand for lighter-weight material in the automotive and aerospace industries keeps on augmenting the development of the friction stir welding (FSW) market. In 2024, the U.S DOE highlighted the necessity of lightweight structural materials that be used to achieve national fuel economy regulations and clean transportation objectives.

Friction stir welding aids such efforts, which are currently made with high-integrity welds in the enclosures of electric vehicle batteries, aerospace fuselages, and the construction of high-speed rail. Furthermore, the increased attention on high-value energy-efficient and emission-reducing manufacturing systems is likely to contribute even further to the use of friction stir welding in the progressive industrial segments.

Friction Stir Welding Market Growth Factors

- Rising Demand for High-Speed Rail Infrastructure: Increasing global investments in lightweight, durable transportation systems are driving the adoption of friction stir welding in railcar manufacturing.

- Boosting Use of Aluminum in Shipbuilding: Naval architects are turning to FSW for creating strong, corrosion-resistant joints in aluminum hulls, fuelling technology expansion in marine applications.

- Growing Adoption in Cryogenic Tank Fabrication: The need for defect-free, high-integrity welds in LNG and hydrogen storage tanks is propelling FSW usage in energy storage infrastructure.

- Expanding Use in Spacecraft Component Assembly: Space agencies like NASA and ESA are driving advanced manufacturing adoption by integrating friction stir welding into satellite and launch vehicle fabrication.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 460.92 Million |

| Market Size in 2025 | USD 277.73 Million |

| Market Size in 2024 | USD 262.53 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.79% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Equipment Type, Material Type, End Use Industry, Technology / Tool Type, Automation Level, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is the growing preference for lightweight materials in the automotive and aerospace sectors accelerating the adoption of friction stir welding technology?

Increasing demand for lightweight materials in the automotive and aerospace industries is expected to drive the market. Solid-state welding is supplanting traditional joining techniques in the manufacture of aluminum and other lightweight alloys by bonding but not melting the base material. It provides high mechanical strength, better fatigue life, and little distortion, and as such is useful in controlling structural parts. Automotive organizations are spending their resources on weight-saving efforts to increase fuel efficiency and meet emission standards, whereas the aerospace OEMs work on payload capacity and efficiency.

Friction stir welding helps to achieve these objectives in that it makes seam-free connections on large panels and complicated assemblies. In 2024, the U.S. Department of Energy (DOE) cited aluminum alloys as one of the main enablers of mass reduction in vehicles through its lightweight materials strategy to sustainable transportation.

- In 2024, the American Welding Society (AWS) reported that solid-state welding techniques have been adopted by automotive OEMs in North America for improved quality of welds and cost-saving benefits. Furthermore, the transition of the industry toward precision-focused joining in the effort of structural optimization in lightweight manufacturing further fuels the demand for the friction stir welding market.

Restraint

Limited Material Compatibility Restrains Broader Industrial Application

Limited material compatibility is anticipated to restrict the market. Fraction stir welding is best applied to the soft, non-ferrous materials such as aluminum and magnesium alloys. Despite efforts by research institutions to develop tool materials to harder metals such as the Fraunhofer Institute, the material is yet to find a commercial level scalability. Moreover, the high initial setup costs for specialized equipment are expected to limit adoption among small and mid-sized manufacturers, thus further hindering the market.

Opportunity

Why is the demand for durable, thermally stable joints in EV battery assemblies boosting the use of friction stir welding?

Spurring demand for high-strength joints in electric vehicle battery enclosures is likely to influence market growth and further creating immense opportunities for market. Ev manufacturers need joints that are safe, thermally stable, battery trays, housings and structures. These results are attained by friction stir welding which produces perfect connections in aluminum and other conductive metals without electrical degradation. It is also a method of minimizing the heat affected zones, essential in a sensitive thermal environment.The top European, Chinese, and American manufacturers of EVs are expanding their adoption of FSW to increase production and the manufacturing of batteries that are unsusceptible.

- According to the 2024 IEA report, global demand for EV batteries exceeded 750 GWh in 2023, marking a 40% increase compared to 2022. Although this reflects robust expansion, the annual growth rate moderated slightly from the rapid pace observed during 2021–2022. Notably, electric cars contributed approximately 95% of this surge in battery demand.Furthermore, the growing investments in defense and military aircraft production are anticipated to accelerate the technology utilization of friction stir welding technology facilitating the market.

Equipment Type Insight

Why Did Stationary FSW Machines Dominate the Friction Stir Welding Market in 2024?

Fixed FSW Equipment (Stationary Machines) segment dominated the friction stir welding market in 2024, accounting for 42% market share, due to their capability to perform high-volume-precision-essential welding. Stationary machines were in use by manufacturers of aerospace, automotive, shipbuilding, and defense industries. These have the advantage of consistency of process control, great mechanical accuracy, and are compatible with automation and robotic arms. Furthermore, the fixed equipment was the most favourable in a production environment where multi-axis control was required and real-time data monitoring.

The portable FSW equipment segment is expected to grow at the fastest CAGR in the coming years, owing to the increase in demand for flexibility, gear that can be used in a field, and economical fabrication. These small units enable the operators to execute high-integrity welds with direct mounting on any large or stationary structure. This includes pipelines, marine structures, bridges, and aerospace components, during each repair or on-site assembly.

- In 2024, KUKA AG and ESAB Corporation invested in the development of modular robotic FSW heads to be retrofitted in mobile robotic systems used, amongst others, in on-site infrastructure welding. Offshore wind energy, big infrastructure projects, and rail transport also add to the attraction of portable systems. Furthermore, the portability combined with automation and adaptive control is expected to increase the demand further, facilitating the segment's growth.

Material Type Insights

How Did Aluminum Alloys Maintain Dominance in the Friction Stir Welding Market in 2024?

Aluminum alloys segment held the largest revenue share in the friction stir welding market in 2024 that held a market share of about 53%, as they gained widespread use in the automotive, aerospace, marine, and railway industries, where manufacturers are focusing on the lightweight structures of high strength-to-mass ratio.

Friction stir welding is a better alternative that be used to perform welding on aluminum. This technique does not have the problems of porosity, distortion, and cracking that the fusion-based welding processes face. Moreover, this type of welding facilitates high-volume production, further making it popular and fuelling the segment's growth.

Steel & stainless steel segment is expected to grow at the fastest rate in the coming years, owing to the increased demand in the fields of shipbuilding, defense, energy, and infrastructure. These materials are highly strong and resistant to corrosion, as they are paramount in structural works that are subjected to unfavorable external conditions. Furthermore, the very high rate as industries attempt to switch over to more time-efficient methods of joining, which results in high performance for steels, further fuels the market growth.

End Use Industry Insights

What Enabled the Automotive & Transportation Sector to Lead the Friction Stir Welding Market in 2024?

Automotive & transportation segment dominated the friction stir welding market in 2024, accounting for an estimated 32% market share, due to the widespread implementation of FSW by automakers has been to join aluminum and other lightweight materials in vehicle chassis and body structures.

In 2024, the automobile industry players are shifting towards friction stir welding on the electric vehicle platforms. They are utilizing this technology to strengthen these vehicles so that they can be made lighter and thinner in a manner that does not compromise the safety of such vehicles. Additionally, the use of FSW as the next generation of EVs that are to be designed to enhance lightweighting strategies to meet the CAF, thus further driving the market growth in this sector.

Aerospace & defense segment is expected to grow at the fastest CAGR in the coming years, owing to the rapidly growing end-use sector of friction stir welding technologies for increasing mission-critical parts demands. Fuselages, wings, and tank fuel structures that make use of aluminum and other advanced alloys are also joined with FSW in aircraft and defense systems. Furthermore, the increased spending to modernize its defense and upgrade its aerospace manufacturing sector is expected to drive further growth within this segment in the coming years.

Technology/Tool Type Insights

What Factors Contributed to the Dominance of Conventional FSW Tools in 2024?

Conventional FSW tools segment held the largest revenue share in the friction stir welding market in 2024, as they are consumed by the broad application of forming bonds between such low to medium-melting-point materials. This equipment finds wide application in various industries for its cost, availability, and compatibility with most standard rotary FSW machines. Additionally, the high level of utilization within cost-sensitive and volume-centered industries in the medium term further propels the segment.

Advanced tool materials segment is expected to grow at the fastest CAGR in the coming years, owing to the increased demand for welding high-temperature and difficult-to-stir materials, such as titanium, steel, and nickel-based alloys. These new high-tech tools are made of polycrystalline cubic boron nitride (PCBN), tungsten-rhenium, and silicon nitride and were developed to extend tool life under heavy process temperature conditions. Furthermore, the utilization of advanced stir welding offers better weld penetration and improved fatigue strength than using conventional tools, further boosting the market in the coming years.

Automation Level Insight

How Did Fully Automated & CNC-Integrated Systems Become Both the Leading and Fastest Growing Automation Level in the FSW Market?

Fully automated & CNC-integrated systems segment dominated the global market in 2024, and is expected to sustain the growth in the coming years, due to the rapidly growing component in the foreseeable future. Producers in industries such as aerospace, automotive, shipbuilding, and rail continually turned to these systems for critical manufacturing conditions. A study carried out in 2024 by the International Institute of Welding (IIW Global) and TWI Ltd. discovered that almost 60% of the on-demand lines built within the industrial sector were fully automated. This represents the need to have unwinationally programmable procedures occurring at the same time with the ability to control quality costs.

Firms like Airbus, Tesla, and GKN Aerospace have increased the use of robotic FSW cells combined with CNC controls and in-process monitoring systems to add complex geometries and lessen the cycle. The further sustenance of this segment is projected owing to the increasing demand for digital manufacturing incorporation and Industry 4.0 conformance. Additionally, the growing demand for consistency of welds and tight geometric tolerances further propels the market in the coming years.(Source:https://iiwelding.org)

Friction Stir Welding Market Companies

- Achi Industries Co., Ltd.

- Beijing FSW Technology Co., Ltd.

- Bharat Heavy Electricals Limited (BHEL, India)

- ESAB (Colfax Corporation)

- ETA Technology Pvt. Ltd. (India)

- Fronius International GmbH

- Gatwick Technologies

- General Tool Company

- Grenzebach Maschinenbau GmbH

- HFW Solutions

- Hitachi High-Tech Corporation

- IWES GmbH

- KUKA Systems GmbH

- Mazak Corporation

- MTI (Manufacturing Technology Inc.)

- PaR Systems, LLC

- Stirtec GmbH

- Thyssenkrupp AG

- TWI Ltd (The Welding Institute, UK)

- VBC Group (UK)

Recent Developments

- In October 2024, TWI Ltd and Stirweld announced a collaborative event to showcase advanced tank welding capabilities using Stirweld's retractable pin Friction Stir Welding (FSW) head technology. Supported by the UK Aerospace Technology Institute (ATI) MASTER project, the event is scheduled for March 11, 2025, at TWI Ltd's Cambridge facility. Live welding demonstrations and expert talks from key stakeholders, including GKN Aerospace, will highlight innovations in manufacturing aluminium hydrogen storage tanks for aerospace applications.

- In April 2025, Bodor officially launched its ECO Series handheld laser welding machine, offering full-rated power and higher welding speeds. The system is designed to reduce labor costs by up to 50%, while delivering smart, automation-ready performance for next-generation manufacturing environments. (Source:https://www.bodor.com)

- In May 2024, IPG Photonics Corporation (NASDAQ: IPGP), a global leader in fiber laser solutions, introduced an automated cobot laser welding and cleaning system tailored for fabrication and manufacturing sectors. The system supports streamlined, high-precision operations, reinforcing IPG's position at the forefront of advanced welding automation.

Segments Covered in the Report

By Equipment Type

- Fixed FSW Equipment (Stationary Machines)

- Vertical milling machines

- CNC-based welders

- Portable FSW Equipment

- In-field/on-site applications

- Shipbuilding and aerospace maintenance

- Robotic FSW Systems

- Gantry/Track-Based Systems

- Retrofit Kits for Conventional CNC Machines

By Material Type

- Aluminum Alloys

- Aerospace-grade, automotive-grade aluminum

- Magnesium Alloys

- Copper & Copper Alloys

- Steel & Stainless Steel

- Titanium Alloys

- Dissimilar Material Combinations (e.g., Al-Cu, Al-Mg)

By End Use Industry

- Automotive & Transportation

- EV battery trays, chassis, aluminum body frames

- Aerospace & Defense

- Aircraft fuselage, rocket fuel tanks, satellite structures

- Shipbuilding

- Panels, decks, hulls

- Railway

- Construction & Infrastructure

- Energy (e.g., solar panel frames, LNG tanks)

- Electronics (e.g., heat sinks, casings)

By Technology / Tool Type

- Conventional FSW Tools

- Cylindrical, threaded pin, shoulder tools

- Advanced Tool Materials

- PCBN (Polycrystalline Cubic Boron Nitride)

- Tungsten-based alloys

- Self-reacting and Dual-rotational Tools

- Adjustable Pin Tools for Complex Joints

By Automation Level

- Manual / Semi-Automated FSW Machines

- Fully Automated & CNC-Integrated Systems

- Integration with Industry 4.0 & digital twin technology

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting