Healthcare Payer Network Management Market Size and Forecast 2025 to 2034

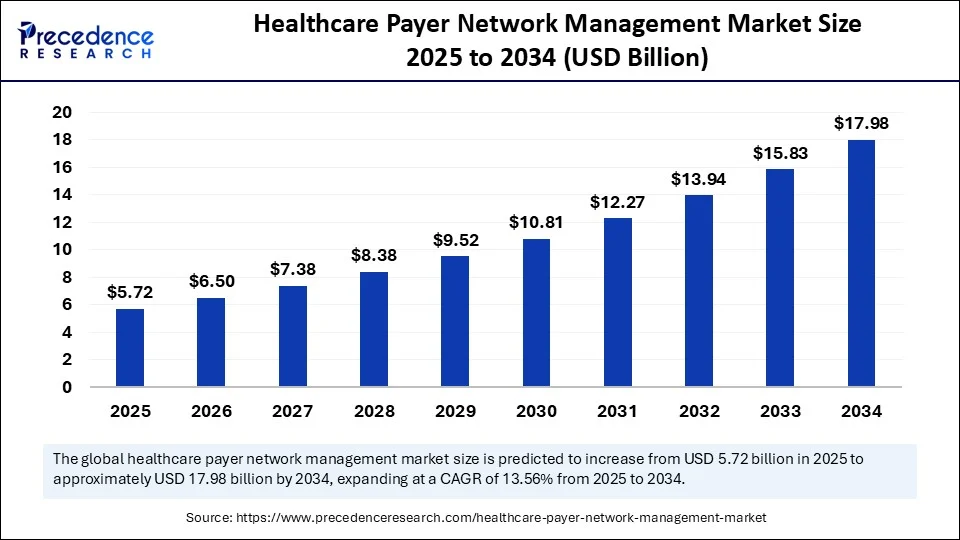

The global healthcare payer network management market size accounted for USD 5.04 billion in 2024 and is predicted to increase from USD 5.72 billion in 2025 to approximately USD 17.98 billion by 2034, expanding at a CAGR of 13.56% from 2025 to 2034. The market growth is attributed to rising digital health adoption, government-driven interoperability mandates, and increasing investments in advanced payer IT infrastructure.

Healthcare Payer Network Management Market Key Takeaways

- In terms of revenue, the global healthcare payer network management market was valued at USD 5.04 billion in 2024.

- It is projected to reach USD 17.98 billion by 2034.

- The market is expected to grow at a CAGR of 13.56% from 2025 to 2034.

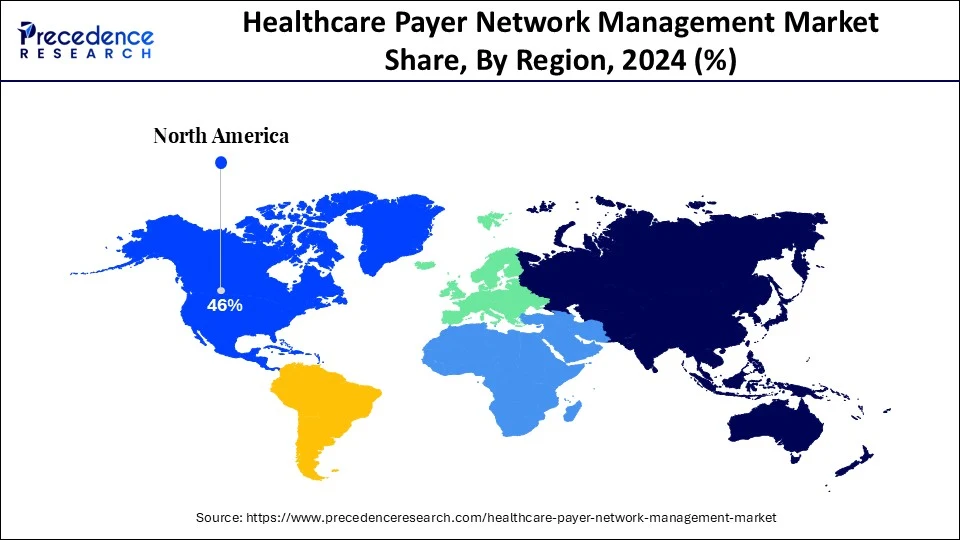

- North America dominated the global market with the largest share of 46% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By component, the software platforms segment held the major market share of 62% in 2024.

- By component, the services segment is projected to grow at a CAGR between 2025 and 2034.

- By deployment mode, the cloud-based segment held the largest revenue share of 57% in 202.

- By functionality, the claims management segment contributed the highest market share of 28% in 2024.

- By functionality, the provider data management segment is expected to grow at a significant CAGR over the projected period.

- By end user, private payers/insurers segment generated the major market share of 49% in 2024.

- By end user, the managed care organizations segment is expected to grow at a notable CAGR from 2025 to 2034.

Impact of Artificial Intelligence on the Healthcare Payer Network Management Market

Artificial intelligence (AI) is transforming the management of healthcare payer networks. They provide insurers with a more powerful suite of tools to control provider contracts, claims, and member engagement more efficiently and effectively. Predictive algorithms enable payers to utilize historical claims data to identify drivers of costs and potential fraud before it gets out of control. Furthermore, natural language processing will advance pre-authorization and pre-eligibility assessments, eliminating the administrative delays that are likely to irritate patients and healthcare providers.

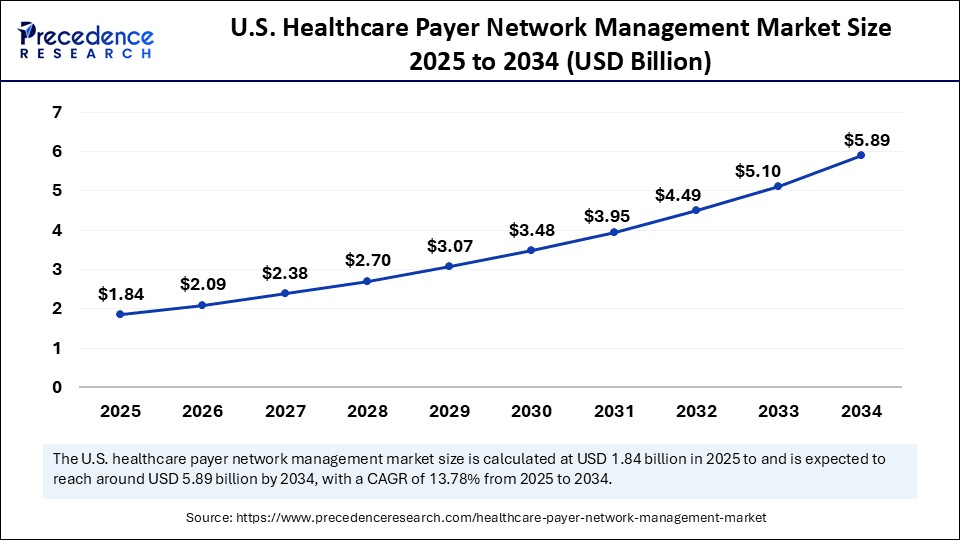

U.S. Healthcare Payer Network Management Market Size and Growth 2025 to 2034

The U.S. healthcare payer network management market size was exhibited at USD 1.62 billion in 2024 and is projected to be worth around USD 5.89 billion by 2034, growing at a CAGR of 13.78% from 2025 to 2034.

How Did North America Secure a ~46% Share in the Healthcare Payer Network Management Market?

North America led the healthcare payer network management market, capturing the largest revenue share in 2024, accounting for 46% of the market share, due to high healthcare expenditures, payer consolidation, and fast uptake of sophisticated IT solutions. The Centers for Medicare & Medicaid Services (CMS) notes that U.S. national health expenditure stood at 4.8 trillion in 2024, representing 18% of the GDP, among the highest in the world. Such a significant cost burden has compelled payers to prioritize network optimization and claims efficiency, thereby increasing the popularity of healthcare payers' network management technology. (Source:https://www.cms.gov)

According to the Office of the National Coordinator for Health IT (ONC), by 2024, more than 95% of hospitals in the United States had adopted certified EHR technology. This has formed a massive ecosystem and relies on strong payer-provider connections. Increased enrollment in government-supported programmes also increased the demand for network management. Additionally, the interest in optimizing payer networks to handle increased chronic disease burdens has been growing, further boosting the market in this region.(Source:https://www.healthit.gov)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, as a result of universal health coverage plans, digital health reforms, and rapid penetration of insurers. The World Health Organization (WHO) says that healthcare spending in the Asia Pacific economies increased at an average of 7-8% per year between 2020 and 2024, surpassing most developed markets.

In China, the National Healthcare Security Administration (NHSA) covered approximately 1.32 billion individuals in public health insurance as of 2024. It is the country with the largest population under public health insurance in the world. This scale is likely to create long-term demand for advanced network and claims management platforms. The Ayushman Bharat Digital Mission provided more than 400 million beneficiaries in India by late 2024, and drives interoperability needs amid fragmented payer systems. Furthermore, positive government policies, such as the National Health Stack in India and the "Healthy China 2030" plan in China, are expected to propel the market in the coming years.

(Source: https://www.healthsystemtracker.org)

(Source: http://english.scio.gov.cn)

(Source: https://www.tandfonline.com)

Market Overview

The healthcare payer network management market is growing due to the rising usage of digital health technologies. Payers incorporate FHIR-based APIs, with the acceleration provided by the 2024 CMS Interoperability and Prior Authorization Final Rule. This optimizes prior authorizations and enhances data exchange, which the rule predicts will result in approximately $ 15 billion in savings over a decade. Mandates under the governmental regulation require payers to address urgent authorization requests within 72 hours and standard ones within seven days, increasing administrative efficiency in all payer-provider interactions.

According to OECD reports, the computerization of health systems significantly enhances effectiveness during financial strain, thereby strengthening payer investments in interoperable infrastructure. Payers introduce AI-enhanced automation to decrease the number of people working on claim and authorization processing, decreasing the staff and speeding up the delivery of care.

They use dynamically managed provider networks that apply real-time analytics to dynamically manage resources and enhance quality control. Furthermore, the increasing attention to value-based models continues to drive the need to support outcome-linked contracting and predictive care coordination with network solutions.(Source: https://www.urotoday.com/)

Healthcare Payer Network Management Market Growth Factors

- Expanding Role of Telehealth Integration: The rising adoption of virtual care services is fueling demand for payer platforms that ensure seamless provider reimbursement and network alignment.

- Boosting Adoption of Interoperability Standards: Growing enforcement of HL7 FHIR and other global data exchange frameworks is driving streamlined payer–provider collaboration.

- Propelling Shift Toward Preventive Care Models: The increasing focus on preventive health management is driving the need for network tools that effectively monitor outcomes and manage population risk.

- Fueling Growth of AI-Powered Fraud Detection: The rising risks of healthcare fraud are driving investments in AI-driven network analytics that enhance claims integrity and payment accuracy.

- Driving Patient-Centric Digital Engagement: Growing demand for personalized member experiences is propelling the adoption of payer solutions with mobile health and self-service capabilities.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 17.98 Billion |

| Market Size in 2025 | USD 5.72 Billion |

| Market Size in 2024 | USD 5.04 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.56% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Mode, Functionality, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Increasing Adoption of Digital Health Technologies Driving Growth in the Healthcare Payer Network Management Market?

Increasing adoption of digital health technologies is expected to drive market growth. The rise of digital health technology is increasing the payer network activity as more insurers incorporate electronic health records, telehealth, and real-time data exchange tools. This facilitates the claims processing process and enhances coordination with their providers. Patient-engagement capabilities have increased in recent years, as reported by health systems and payers, who use them to trim administrative friction and expedite eligibility checks. Telemedicine gained momentum. During the COVID-19 period, with physician use increasing from 15.4% in 2019 to 86.5% in 2021, and the latter changes in utilization observed in 2021-2022 redefined payer priorities in virtual care routing and reimbursement policies.

- In 2024, the intensity of interoperability requirements was increased by federal and regulatory actions as the Centers for Medicare and Medicaid Services published the Interoperability and Prior Authorization Final Rule. That compels standardized data exchange and accelerates prior-authorization processes across Medicare and Medicaid programs, which further spurs payer investments in API-based network tools. Digital transformation is a central health agenda for international policy agencies, driving payers to implement analytics and standardized data models to compare provider performance across jurisdictions. Additionally, the surging prevalence of chronic diseases is projected to increase reliance on payer-driven solutions in the coming years.

(Source: https://pubmed.ncbi.nlm.nih.gov)

(Source: https://www.zeomega.com)

Restraint

High Implementation Costs Limiting Adoption

Innovation through data security and privacy risks, which are expected to limit trust in digital platforms, is expected to hamper the market. Healthcare payers are sensitive to both financial and clinical data, which must be highly protected. Current infrastructures are prone to cyberattacks, as the number of cyberattacks on insurers and hospital systems has increased over the past several years. Furthermore, the high implementation costs, which are expected to limit adoption further, hamper the market growth.

Opportunity

How Are High Investments in Healthcare IT Infrastructure Supporting the Expansion of the Healthcare Payer Network Management Market?

High investments in healthcare IT infrastructure are estimated to support market expansion, further creating immense opportunities for the market. Governments and insurance companies invest substantial resources in cloud computing, cybersecurity solutions, and big data analytics tailored to payer ecosystems. This investment enables insurers to upgrade their existing systems, make them interoperable, and make informed decisions in real-time. Well-established IT bases also enable the adoption of superior technologies, including predictive analytics and automation by AI.

In 2024, the Department of Health and Human Services announced additional grants to programs aimed at supporting health IT modernization. This enhances interoperability and cybersecurity across payer-provider systems, a federal priority aimed at minimizing administrative complexity.

In 2024, the Centers for Medicare & Medicaid Services further strengthened its electronic data exchange requirements. But it includes a standards API that requires payers to speed up claims processing and prior authorization. Furthermore, such advancements are driving payers to deploy next-generation IT systems that can both secure sensitive health information and enhance network management strategies.(Source:https://www.healthit.gov)

Component Insights

Why Did Software Platforms Dominate the Healthcare Payer Network Management Market in 2024?

The software platforms segment dominated the healthcare payer network management market in 2024, accounting for an estimated 62% market share, as they are speeding up digital transformation and implementing integrated platform architecture. Furthermore, invest in strong layers of cybersecurity, and deploy modular platforms that incorporate third-party analytics that making software platforms the operational backbone of ongoing network modernization.

The service segment is expected to grow at the fastest rate in the coming years, driven by the flexibility in operations required by payers and the external knowledge needed to manage complex IT estates and navigate regulatory changes. Organizations are starting to delegate more operations, including provider data governance, managed security, and analytics operations, to decrease internal overhead and expedite the response to rules added in 2024. Additionally, the managed-service providers to provide cloud migration, ongoing monitoring, and practical assistance to interoperability projects, further facilitating the segment growth in the coming years.

Deployment Mode Insights

How Did Cloud-Based Solutions Capture 57% Share and Lead the Healthcare Payer Network Management Market?

The cloud-based segment held the largest revenue share in the healthcare payer network management market in 2024, accounting for 57% of the market share, and is expected to sustain this position in the coming years as payers accelerate their migration away from legacy on-premises systems.Cloud modernization became a priority of federal agencies by 2024, and CMS declared several initiatives that expand cloud services and underlying digital infrastructure, which spurred large payers to move to cloud-first architecture to achieve scalability and resiliency.

To satisfy interoperability deadlines and reduce the time spent in prior-authorization cycles, health plans developed FHIR-enabled API strategies on cloud platforms, and regulators reinforced those timelines in the 2024 rulemaking. Furthermore, the presence of strong cloud security controls and ongoing compliance monitoring on vendor platforms enabled payer confidence, and it is expected that such capabilities facilitate the ongoing platform consolidation in the clouds.

(Source: https://www.digitalhealthnews.com)

Functionality Insights

What Made Claims Management the Largest Functional Segment in the Healthcare Payer Network Management Market With ~28% Share?

The claims management segment dominated the healthcare payer network management market in 2024 that holding a market share of about 28%, due to the growing claims processing load continues to be massive across both public and private payers. In 2024, the U.S. Centers for Medicare & Medicaid Services (CMS) paid out over $ 1.14 billion in claims through its fee-for-service program. (Source: https://www.cms.gov)

The private insurance sector as a whole paid out over 2 billion medical claims, according to the National Association of Insurance Commissioners (NAIC). Inappropriate payment monitoring also continued to be a federal priority, with CMS identifying an improper payment rate of 7.66% across Medicare programs, which constitutes almost 31.70 billion in improper payments. Furthermore, these pressures increased payer investment in AI-based claims adjudication tools that detect fraud in real-time, further boosting the segment.(Source:https://content.naic.org)

The provider data management segment is expected to grow at the fastest CAGR in the coming years, as a result of the increase in regulatory enforcement on issues related to directory accuracy and access to care. The Office of the National Coordinator for Health IT (ONC) also emphasized that in 2024, 1 in 5 patients experienced delays or misplaced referrals due to directory errors.

This led to payer requests for data to be managed automatically and in real-time. Furthermore, other innovations, including blockchain-based credentialing and AI-enabled provider matching, are also expected to enhance compliance and member satisfaction, as provider data management is a key priority investment in the coming years.Source: https://www.healthit.gov)

End-user Insights

Why Did Private Payers and Insurers Account for ~49% of the Healthcare Payer Network Management Market in 2024?

The private payers segment held the largest revenue share in the healthcare payer network management market in 2024, accounting for an estimated 49% market share, primarily due to the significant employer-sponsored membership and rapid adoption of technology. Additionally, the growing demand for AI-based validation and fraud-detection systems to streamline various processes further facilitates the demand for healthcare payers' network management systems in this sector.

The managed care organizations segment is expected to grow at the fastest rate in the coming years, driven by the rapid pace of value-based models and increased public program enrollment. The rapid transition to managed-care structures has seen Medicare Advantage enrolment grow to 2.1 million beneficiaries in 2024, or more than one-half of all Medicare enrollees.

Managed-care penetration of state Medicaid exceeded three-quarters of the national rate, and some states reported rates of 90% or higher, driving interest in real-time monitoring and provider-performance analytics. The OECD stated that U.S. spending on healthcare was over USD 12,555 per capita in 2024, fueling payer pressure to find the golden mean between cost and quality. Additionally, the greater care coordination and chronic illness care are expected to fuel the growing adoption of these technologies in managed care organizations.(Source: https://www.kff.org)

Healthcare Payer Network Management Market Companies

- Accenture Plc

- Aetna (CVS Health)

- Availity LLC

- Change Healthcare (Optum Insight)

- Cognizant Technology Solutions

- Genpact Limited

- HealthEdge Software Inc.

- IBM Corporation

- Infosys Limited

- Inovalon Holdings Inc.

- McKesson Corporation

- Medversant Technologies

- Optum (UnitedHealth Group)

- Oracle Corporation

- SAS Institute Inc.

- Tata Consultancy Services (TCS)

- TriZetto Healthcare Products (Cognizant)

- Verisk Analytics Inc.

- Wipro Limited

- ZeOmega Inc.

Recent Developments

- In April 2025, HealthEdge, a provider of next-generation core administrative processing systems, payment integrity, and care management solutions, introduced its new HealthEdge Provider Data Management platform. The solution enables health payers to automate the critical process of maintaining accurate and updated provider information. HealthEdge also confirmed the first deployment of the platform with PEHP Health & Benefits, a division of the Utah Retirement Systems that offers medical, dental, life, and long-term disability insurance plans to public employees. (Source: https://healthedge.com)

- In May 2025, Smarter Technologies, a platform focused on healthcare efficiency through automation and insights, announced the release of the industry's first AI-powered revenue management platform. This innovation combines the strengths of Access Healthcare, SmarterDx, and Thoughtful.ai. These three companies have recently received strategic growth investments from New Mountain Capital, a firm with over $55 billion in assets under management. The platform aims to optimize administrative workflows, improve revenue integrity, and strengthen the financial performance of hospitals and health systems. (Source: https://www.accesshealthcare.com)

- In October 2024, Inovalon, a provider of cloud-based software solutions for data-driven healthcare, introduced a suite of new products and features at its annual Empower 2024 summit. Leveraging its vast data assets and integrated ecosystem across providers, payers, pharmacies, and life sciences, Inovalon seeks to improve clinical outcomes, streamline operations, and deliver more connected healthcare experiences. (Source: https://www.inovalon.com)

- In April 2024, Innovaccer announced the launch of the Healthcare Experience Platform (HXP) following its acquisition of Cured. The new platform, powered by AI, is designed to enhance patient engagement and drive revenue growth for healthcare organizations. This collaboration reflects Innovaccer's strategy to accelerate innovation in patient experience and outcomes through advanced digital solutions.(Source:https://innovaccer.com)

Segments Covered in the Report

By Component

- Software Platforms

- Credentialing Management Systems

- Provider Directory Management

- Contract Lifecycle Management

- Claims Management & Adjudication Software

- Analytics & Reporting Tools

- Services

- Implementation & Integration Services

- Consulting Services

- Maintenance & Support Services

- Outsourcing/Managed Services

By Deployment Mode

- On-premise

- Cloud-based

By Functionality

- Provider Onboarding & Credentialing

- Provider Contracting & Compliance

- Provider Data Management

- Claims Management

- Network Design & Optimization

- Patient Access & Engagement

By End User

- Private Payers / Insurance Companies

- Public/Government Payers

- Managed Care Organizations (MCOs)

- Third-Party Administrators (TPAs)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East &Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting