Laser-Based 3D Bioprinting Market Size and Forecast 2025 to 2034

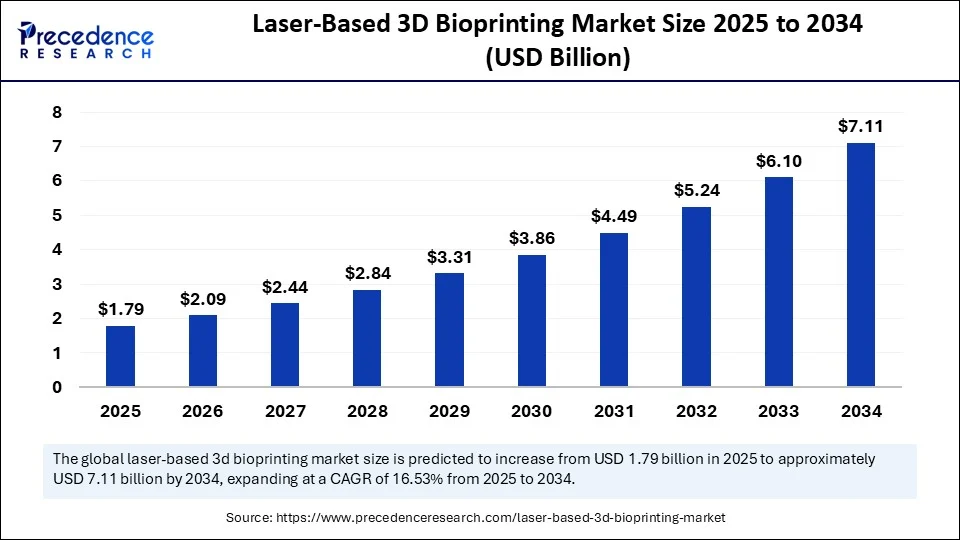

The global laser-based 3D bioprinting market size was calculated at USD 1.54 billion in 2024 and is predicted to increase from USD 1.79 billion in 2025 to approximately USD 7.11 billion by 2034, expanding at a CAGR of 16.53% from 2025 to 2034. The rapid growth of the laser-based 3D bioprinting market is driven by growing need for organ and tissue regeneration, pharmaceutical drug testing, and ongoing improvements in laser precision and biocompatible materials.

Laser-Based 3D Bioprinting Market Key Takeaways

- In terms of revenue, the global laser-based 3D bioprinting market was valued at USD 1.54 billion in 2024.

- It is projected to reach USD 7.11 billion by 2034.

- The market is expected to grow at a CAGR of 16.53% from 2025 to 2034.

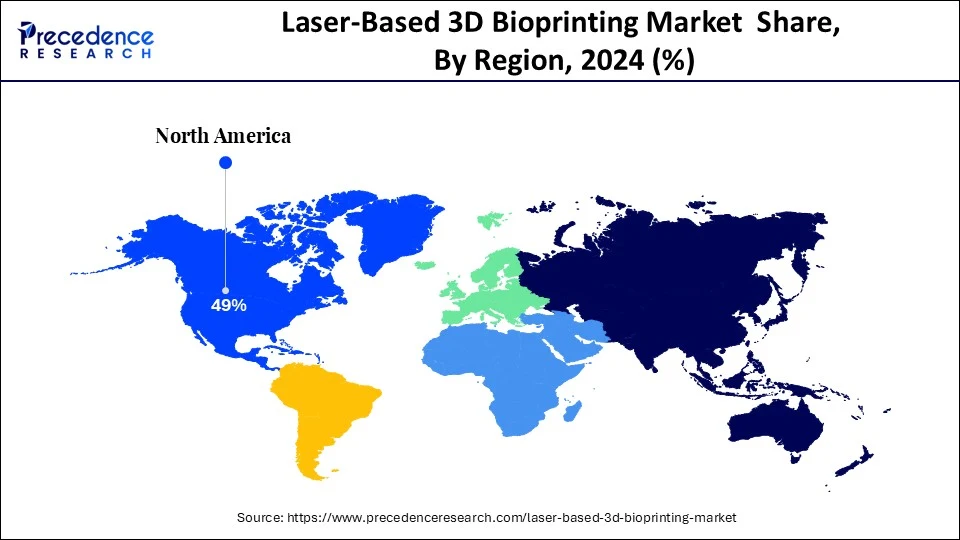

- North America dominated the laser-based 3D bioprinting market with the largest market share of 49% in 2024.

- Asia Pacific is estimated to expand the fastest CAGR in the market between 2025 and 2034.

- By technology / printing method, the LIFT / laser-induced forward transfer segment held the biggest market share of 45% in 2024.

- By technology / printing method, the holographic / volumetric laser printing (high-throughput, high-resolution) segment is anticipated to grow at a fastest CAGR between 2025 and 2034.

- By product offering, the printing equipment / laser bioprinters (research benchtop) segment captured the highest market share of 50% in 2024.

- By product offering, the consumables & application services (bioinks, substrates, cdmo printing) segment is expected to expand at a notable CAGR over the projected period.

- By component / subsystem, the laser sources & optics (uv/near-ir pulsed systems) segment contributed the maximum market share of 40% in 2024.

- By component / subsystem, the integrated donor substrate modules & automated handling (to scale throughput) segment is expected to expand at a notable CAGR over the projected period.

- By application / end-use, the research & academic R&D segment generated the major market share of 38% in 2024.

- By application / end-use, the tissue engineering for regenerative medicine (preclinical -> clinical translation) segment is expected to expand at a notable CAGR over the projected period.

- By end-user / customer segment, the academic & government research institutes segment accounted for the significant market share of 52% in 2024.

- By end-user / customer segment, the pharmaceutical & biotech (drug screening + cdmo partnerships) segment is expected to expand at a notable CAGR over the projected period.

How AI is Driving Innovations in Laser-Based 3D Bioprinting?

By improving precision, process control, and predictive accuracy, artificial intelligence is quickly advancing laser-based 3D bioprinting. AI-driven frameworks are being used to optimise laser energy deposition, lowering errors brought on by overheating or uneven material distribution, according to recent developments. The use of machine learning models to predict intricate bioink behaviour is growing in popularity as a way to increase tissue construction fidelity and reduce cell damage. Researchers are now attaining consistent structural stability and reproducibility thanks to AI's ability to enable real-time monitoring and adaptive control. Bioprinting's future is being redefined by this integration, which is bringing the technology closer to uses in clinical and regenerative medicine.

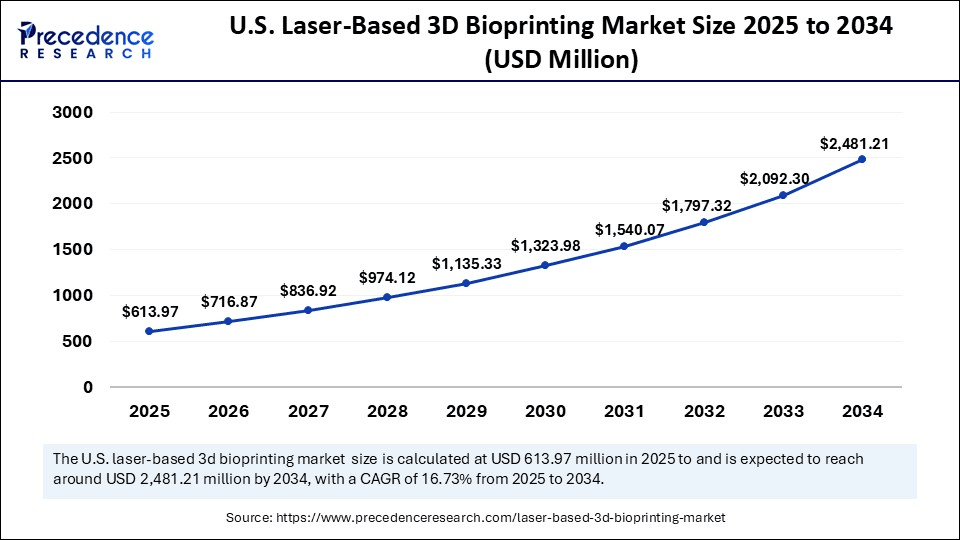

U.S. Laser-Based 3D Bioprinting Market Size and Growth 2025 to 2034

The U.S. laser-based 3D bioprinting market size was exhibited at USD 528.22 million in 2024 and is projected to be worth around USD 2,481.21 million by 2034, growing at a CAGR of 16.73% from 2025 to 2034.

North America Laser-based 3D Bioprinting Market Trends

North America leads in funding, clear regulations, and a strong ecosystem. ARPA-H's PRINT program focuses on making bioprinted organs on-demand. It brings together hospitals, universities, and startups in milestone-driven projects. Meanwhile, the NIH runs bioprinting and tissue-model initiatives that support early research. The FDA provides guidance on 3D-printing devices and engages with the community, reducing uncertainty about quality and validation. This is helpful for labs using LIFT and other laser methods in skin, vascular, and organ models. Together, these efforts shorten the path from research to regulated use in trials and at point-of-care.

The U.S. supports the region with major awards, such as Stanford's ARPA-H heart-bioprinting program. It also features NIH-supported organ-on-chip and bioprinted-skin platforms for screening. Additionally, multi-center collaborations are building vascularized tissues. These applications demonstrate laser precision at cell-friendly energy levels. These resources create consistent processes for procurement and validation for hospitals and CROs. This strengthens leadership across devices, bioinks, and workflows.

Asia Pacific Laser-based 3D Bioprinting Market Trends

Asia Pacific is expected to be the fastest growing region for the market. The region is experiencing rapid growth in laser-based 3D bioprinting. This surge is due to increased investment in regenerative medicine, government-supported healthcare innovation policies, and more collaboration between academic institutions and biotechnology companies. Demand in the region is driven by the need for better solutions in tissue repair, drug testing, and personalized medicine, where laser precision offers high-resolution benefits. More clinical trials, favorable regulatory frameworks, and increased funding are making APAC an appealing area for technology providers and bioink developers, leading to strong use in healthcare and research environments.

China is the leading country. China is quickly becoming a leader through government-backed research programs and partnerships between universities and industries focused on high-resolution tissue engineering and organ reconstruction. Meanwhile, local biotech startups are developing bioinks designed for clinical use. These initiatives, backed by strong government funding and commercialization support, position China as a key player in APAC's bioprinting scene.

Market Overview

Laser-based 3D bioprinting, or laser-assisted bioprinting, is a modern additive manufacturing method that uses laser energy to accurately deposit or cure bioinks and has various methods, including LIFT (laser induced forward transfer), stereolithography and holographic patterning. This method allows for sub-micron accuracy, high cell viability and performance, and even the fabrication of complicated multi-material constructs

The market is developing because of the increased flexibility for regenerative medicine, tissue engineering, and drug development, as well as advancements in stem cell research and new innovative biomaterials. The cooperative response between biotech companies, academic institutions, and health delivery institutions indicate an increase to innovation, although some key barriers to broader adoption and commercialization are still present, including high costs for equipment, products and deficiencies in scalability.

Laser-Based 3D Bioprinting Market Growth Factors

- Advancements in Regenerative Medicine: The increasing emphasis on producing functional tissues and organs for transplantation is a clear driver for adoption. 3D bioprinting with lasers provides precise control without compromising cell viability in a single step, which is crucial for next-generation regenerative therapies.

- Drug Discovery Applications: Pharma companies are leveraging bioprinted tissues in preclinical drug testing and reducing reliance on animal models. Laser-assisted bioprinting allows for a real human-like model system, which can result in more efficient drug screening and reduced development costs.

- A development in Stem Cell and Biomaterials Research: Continued evolution in stem cell biology and biomaterials, from the applications coming from multiple research disciplines, improves the compatibility with laser bioprinting. This progress has helped enable scientists to now fabricate more complex multicellular structures that can carry out higher functioning particularly in comparison to simpler models enabling higher levels of sophistication in the adoption of 3D bioprinting across biomedical research.

- Increased Collaborations: Collaborative networks of universities, research labs, and biotech companies are changing the timeline to bring refined technologies closer to application. It is easier to innovate, access funding, apply results clinically, and turn laser-assisted bioprinting technologies into scalable biomedical and therapeutic applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 7.11 Billion |

| Market Size in 2025 | USD 1.79 Billion |

| Market Size in 2024 | USD 1.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology / Printing Method, Product Offering, Component / Subsystem, Application / End-Use, End-User / Customer Segment, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Is Organ Shortage Driving the Demand for Laser-Based 3D Bioprinting?

Organ shortage is one of the biggest driving element for the laser-based 3D bioprinting market. Currently, according to the Health Resources and Services Administration (HRSA), there are over 103,223 men, women, and children on the national transplant waiting list, and approximately 13 people die each day waiting for a suitable organ donor. This is a sobering fact that highlights the need for alternatives such as laser-based bioprinting, which enables unprecedented precision in the spatial arrangement of cells to fabricate complex tissues and organs.

Recent advancements in laser technology have enabled higher bioprinting speeds and improved accuracy and cell viability, facilitating the creation of transplant-ready tissues. With demand far exceeding supply, the need for organs is driving the demand for laser-based 3D bioprinting as a life-saving solution, with the potential to revolutionize the regenerative medicine field.

Restraint

Could High Cost and Technical Complexity Be Holding Back Laser-Based 3D Bioprinting?

Laser-based 3D bioprinting promises exceptional precision and high-resolution tissue constructs, but it faces a major obstacle, the high cost and complicated technical requirements of its equipment. Recent reports show that advanced laser systems remain very expensive and complex, limiting use to well-funded research centers.

Additionally, current laser-based methods are slow and mostly focused on producing only small structures, making them unsuitable for larger-scale or commercial medical applications. Also laser-assisted bioprinting results in lower cell viability and slower output compared to other methods, which further limits its ability to create viable, functional tissues. These factors high initial investment, complex operation, low output, and poor cell viability together create a significant barrier for the laser-based 3D bioprinting market.

Opportunity

Could In-Situ and Multi-Material Printing Pave the Way for the Next Major Opportunity for the Laser-based 3D Bioprinting Industry?

A major opportunity exists for the laser-based 3D bioprinting market with the combination of in-situ bioprinting and multi-material printing capabilities. In-situ bioprinting involves the direct placement of living cells and or biomaterials directly onto or into the patient's body, allowing for real time tissue repair and personalized regenerative treatments, all without the extensive ex-vivo cultivation time. At the same time, new sophisticated laser platforms offers multi-material and multi-cellular printing capabilities, allowing for tissue engineered heterogeneous constructs more like natural tissue or organ structures.

This combined innovation will not only hasten surgical applications like wound treatments or organ patching, but also impact the development of organoids for research, drug testing and precision medicine. These capabilities offer hierarchical, functional tissue architectures, and position laser-assisted bioprinting as a disruptive technology for cross-linking clinical and research problems.

Technology/Printing Method Insights

Laser-induced forward transfer (LIFT) technology is the most prevalent subsegment of the laser-based 3D bioprinting market because of accuracy, high cell viability and the types of biomaterials that can be printed. LIFT is preferred by researchers and institutions due to its ability to produce highly complex structures with limited cell damage potential. This means LIFT has become the gold standard for academic and early-stage research bioprinting; and given LIFT's ability to be scaled up, and be consistent, its become the default technology for most laser-based bioprinting work.

Holographic and volumetric laser printing is the fastest growing subsegment due to the product demand for increased throughput and speed of prototyping, as well as more complex tissue constructs. Holographic lasers allow for entire 3D volumes to be printed simultaneously instead of layer by layer and therefore lend itself to much faster processing which make it the most intriguing subsegment of the future in terms of market growth.

Product Offering Insights

Centralized manufacturing remains prevalent because it is able to provide consistency, quality assurance, and adherence to strict regulatory oversight. Centralized manufacturing also provides scale and minimizes variability, especially for therapies like CAR-T that require specific controllable conditions. Centralized manufacturing also benefits from commonality of training workers, facility phases, and part tracking.

Decentralized or point-of-care (PoC) manufacturing is growing the fastest as timeframe from treatment initiation in one location to treatment in another can be reduced, risks from transporting the product are reduced and a patient specific project can be completed in real time. It is interesting to note that unless you are a manufacturing engineer, PoC is in the jurisdiction of hospitals and transplant centers, which continue to purchase and install PoC infrastructure given the technologies associated with modular cleanroom systems and digital orchestration platforms.

Component/ Subsystem Insights

The laser source and optics (especially UV and near-infrared pulsed systems), is the largest subsystem. The laser subsystem is most important subsystem of a laser bioprinting system because it ensures positioning accuracy, stability, and reproducibility of bioprinting. There have been continuing enhancements with small, high energy, and cost effective laser modules, which has made them a common choice for most laser bioprinting systems today.

The integrated donor substrate module and automated handling systems are the fastest growing subsegment in the laser-based 3D bioprinting market, as a response to the need to scale throughput and reduce manual handling by users. These integrated systems streamline workflow by enabling efficient cell deposition on the donor substrate, accurate alignment of the donor substrate, and seamless high throughput bioprinting. With research moving toward translational and preclinical applications, automated handling and integrated modules are becoming more value, as they allow for consistent, reproducible, and scalable outputs across multiple complex tissue engineering projects.

Application/End-use Insights

Research and academic R&D continue to be the leading application sector, as universities and research institutes support the adoption of laser bioprinting by researchers exploring cell biology, tissue architecture, and disease modelling. Academic projects are often a pipeline to commercial translation, which explains why research-based adoption continues to command the highest usage of laser 3D bioprinting, with strong collaborations, grants, and an increase in publication count in respect to analysis bioprinting science.

Tissue engineering for regenerative medicine is by far the fastest-growing application sector, due to the potential to manufacture functional tissues and functional organs for transplantation. Overall this subsegment will increasingly transition from preclinical validation to commercial translation, where there is growing interest to expedite the concept of repairing functional tissues based upon polymer integrated scaffolds that match the unique biochemical and mechanical functionality of cartilage, skin, and vascular tissues. The innovative aspect of healthcare, paired with the onset of well-established partnerships between research laboratories and biotech, is an ongoing push to find bioprinting solutions that meet the mixed requirements of quality safety medicine.

End User/ Customer Insights

Academics and government research institutes dominate the end-user segment based on their important contributions to foundational investigation, prototyping, and early validation of laser bioprinting applications. Because they are investigating various bioprinting applications in regenerative medicine, drug discovery, and fundamental cell biology research, their focus on early investigations puts them in a dominant position as the primary market activity contributor.

The fastest-growing customer segment, pharmaceutical and biotechnology companies, are seeing more interest in integrating laser bioprinting into drug discovery pathways, preclinical testing, and contract development service organizations, and academia. Their demand is driven because they require accurate human-relevant tissue models to reduce drug failure rates and speed up development processes. The growth of partnerships between pharma, biotech, and bioprinting service providers is further illustrating high adoption rates that are essential for the business-to-business and business-to-consumer translational and commercial applications of laser-based 3D-bioprinting.

Laser-based 3D Bioprinting Market Companies

- Poietis

- Prellis Biologics

- Precise Bio / Precise Bio 3D

- BICO / CELLINK (BICO group)

- RegenHU

- 3D Bioprinting Solutions

- 3DBio Therapeutics

- Organovo Holdings, Inc.

- EnvisionTEC / Desktop Metal

- CollPlant Ltd.

- Photon Jet Ltd.

- Orbotech (KLA)

- Mycronic AB

- Precise Bio Inc.

- Cyfuse Biomedical

- nScrypt

- TeVido BioDevices

- Vivax Bio / 3D Bio Corp

- Regenova

- Various contract / CDMO bioprinting service providers

Recent Developments

- In June 2024, Researchers at Karlsruhe Institute of Technology (KIT), in collaboration with Carl Zeiss Meditec and Evonik Healthcare, developed a laser-based 3D bioprinting method using personalized bioink from the patient's stem cells and collagen to print corneas during surgery, reducing rejection risk and advancing personalized vision restoration.(Source: https://www.news-medical.net)

- In May 2024, Bioink firm BIO INX teamed up with Readily3D to launch READYGEL INX, a sterile, “plug-and-print” Gel-MA based ink optimized for volumetric 3D bioprinting enabling rapid, reproducible, and clinically applicable structures in seconds.(Source: https://www.tctmagazine.com)

Segments Covered in the Report

By Technology / Printing Method

- Laser-Induced Forward Transfer (LIFT) / Laser-assisted droplet transfer

- Laser stereolithography / Digital Light Processing (DLP) for bioprinting (photocrosslinking)

- Holographic / volumetric laser printing (holographic light patterning)

- Hybrid systems (laser + extrusion / laser + inkjet combinations)

By Product Offering

- Printing equipment / laser bioprinters (research benchtop)

- Bioinks & biomaterials formulated for laser methods (photocurable, absorptive layers)

- Consumables (donor substrates, coatings, cell-carriers)

- Software & process control (path planning, laser/energy control)

- Services (custom printing, contract biofabrication, validation)

By Component / Subsystem

- Laser sources & optics (UV, near-IR pulsed lasers, beam shaping)

- Donor/acceptor substrate modules (coated films/carriers)

- Photo-initiators, photocurable hydrogels & crosslinkers

- Precision stages & motion control

- Bioreactors / maturation modules (post-print culture)

By Application / End-Use

- Tissue engineering & regenerative medicine (scaffolded tissues, grafts)

- Drug discovery & in-vitro models (organoids, tumor models)

- Personalized medicine / patient-specific implants (skin, cartilage)

- Research & academic R&D (method development)

- Pre-clinical testing & contract research services

By End-User / Customer Segment

- Academic & government research institutes

- Pharmaceutical & biotech companies (drug screening)

- Contract research / contract development and manufacturing orgs (CROs/CDMOs)

- Hospitals & translational research centers (clinical-grade R&D)

- OEMs and instrument integrators

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting