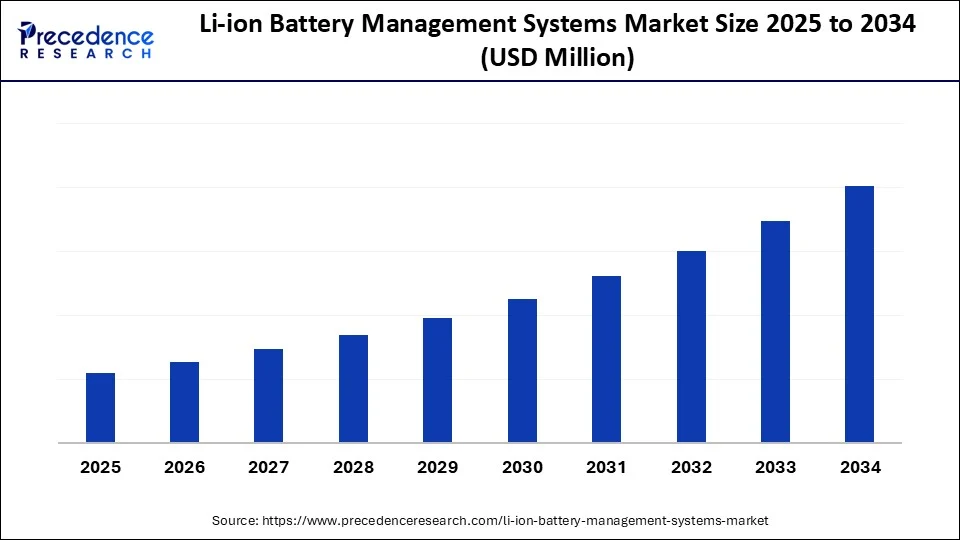

Li-ion Battery Management Systems Market Size and Forecast 2025 to 2034

The Li-ion battery management systems market continues to grow as renewable energy integration and EV penetration rise globally. By ensuring safety, balancing cells, and optimizing power, BMS is becoming the backbone of modern energy solutions. The growing focus on sustainability, increasing demand for electric vehicles (EVs), and increasing safety concerns surrounding lithium-ion batteries. The rising integration of renewable energy sources is expected to propel the growth of the global Li-ion battery management systems market over the forecast period. Additionally, the market is rapidly expanding in various developing and developed regions, particularly the Asia Pacific, fuelled by an increasing adoption of renewable energy sources, a supportive regulatory environment, and the wide adoption of electric vehicles (EVs).

Li-Ion Battery Management Systems Market Key Takeaways

- Asia Pacific dominated the Li-ion battery management systems market with the largest market share of 52% in 2024.

- North America is anticipated to grow at the fastest CAGR during the forecast period.

- By topology, the modular segment captured the biggest market share of 48% in 2024.

- By topology, the distributed segment is expected to witness a significant share during the forecast period.

- By component, the hardware segment held the largest market share of62% in 2024.

- By component, the software & analytics segment accounted for considerable growth over the forecast period.

- By application, the automotive passenger BEV segment contributed the highest market share of 28% in 2024.

- By application, the stationary storage (utility-scale) segment is expected to grow significantly during the forecast period.

- By sales channel, the OEM segment generated the major market share of 88% in 2024.

- By sales channel, the aftermarket/retrofit segment is expected to witness remarkable growth during the forecast period.

How Does Artificial Intelligence Integration Improve the Li-Ion Battery Management Systems Market?

As technology continues to evolve, artificial intelligence emerges as a game-changer and holds potential for growth and innovation in the Li-ion battery management systems market by offering predictive analytics, optimizing performance & longevity, improving manufacturing efficiency, and enhancing safety features. AI-powered algorithms assist in effectively analyzing vast datasets from battery cells in real-time to predict any potential battery failures or detect anomalies, which allows for proactive maintenance and enhances uptime. The lithium-ion battery performance can be optimized through AI by adjusting parameters based on real-time conditions, which leads to increased efficiency and longevity. By harnessing the power of AI, it assists in providing more accurate real-time diagnostics of battery health (SoH) and remaining charge (SoC), which was often difficult to determine with conventional methods.

Market Overview

The Li-ion battery management systems market includes hardware and software systems that monitor, protect, balance, and control lithium-ion battery packs/cells at cell, module, pack, and rack levels across mobility, stationary storage, and industrial devices, ensuring safety, performance, and lifecycle optimization. Lithium-ion technology is increasingly becoming a leading choice, powering a wide range of devices from laptops and smartphones to electric vehicles and renewable energy storage systems.

What Are the Latest Trends in the Li-Ion Battery Management Systems Market?

- The increasing adoption of portable electronic devices and consumer electronics is expected to significantly contribute to the overall growth of the Li-ion battery management systems market during the forecast period. Li-ion battery management systems ensure optimal battery performance, extending battery life, and maintaining safety in devices.

- The favourable government incentives and supportive policies for cleaner fuel alternatives are expected to promote the growth of the Li-ion battery management systems market during the forecast period.

- The rising partnerships among key players to develop more intelligent Li-ion battery management solutions, which can enhance safety features, provide better thermal management, and significantly improve battery life prediction capabilities, are propelling the expansion of the Li-ion battery management systems market in the coming years.

- The rapid technological advancement is anticipated to contribute to the overall growth of the Li-ion battery management systems market. The continuous advancements in lithium-ion battery technology have led to improved performance, lower costs, and longer lifespan, making them more attractive for a wider range of applications.

- The introduction of cloud-based BMS offers real-time monitoring and remote diagnostics, enhancing the performance and safety of vehicles, driving the market expansion during the forecast period.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Topology, Component, Application, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Rising Demand for Electric Vehicles (EVs) Impacting the Market's Growth?

The increasing demand for electric vehicles (EVs), supported by the rising environmental concerns and supportive government policies, is expected to boost the growth of the Li-ion battery management systems market during the forecast period. As the future of transportation is moving toward electric vehicles (EVs), Li-ion-based batteries are widely used in consumer electric vehicles owing to their high energy and power density, which is crucial for optimal performance and efficiency. Li-ion battery management system (BMS) is a vital technology that monitors and manages the health and safety of lithium-ion batteries in electric vehicles and ensures the safe and optimal battery performance by effectively monitoring various parameters such as current, voltage, temperature, and state of charge (SOC).

Battery management systems assist in protecting the battery and preventing hazards such as over-discharging, overcharging, and overheating, which in turn improve the vehicle's overall safety, efficiency, and longer lifespan of batteries. According to the Global EV Outlook 2025 published by the International Energy Agency (IEA), A total of 17.3 million electric cars were produced worldwide in 2024, nearly one-quarter more than in 2023, largely as a result of increased production in China, which reached 12.4 million electric cars. China remains the world's electric car manufacturing hub, accounting for more than 70% of global production in 2024. In 2024, Chinese OEMs accounted for more than 80% of domestic production, up from roughly two-thirds in 2021. (Source: https://www.iea.org)

Restraint

High Implementation Costs

The high implementation cost is anticipated to hamper the market's growth. A high upfront capital investment is required for investment in advanced sensors and sophisticated monitoring hardware, especially in large-scale applications such as electric vehicles and energy storage systems. Li-ion battery management systems require advanced sensors to accurately monitor individual cell voltage, current, and temperature. Such factors are likely to limit the expansion of the Li-ion battery management systems market in price-sensitive regions or sectors.

Opportunity

Rapid Expansion of Renewable Energy Storage Systems

The rising expansion of renewable energy storage systems is projected to offer lucrative growth opportunities to the Li-ion battery management systems market during the forecast period. The market is experiencing large-scale integration of renewable energy sources, such as wind and solar power, which requires energy storage systems (ESS) to stabilize the grid. Li-ion battery management systems play a critical role in managing these large battery packs in the storage facilities, ensuring optimum performance and safety for a reliable power supply. Li-ion batteries are increasingly preferred in utility-scale and residential energy storage systems for storing intermittent wind and solar energy. Several countries are increasingly focusing on transitioning to cleaner energy sources, which necessitates energy storage solutions like lithium-ion batteries to efficiently manage the renewable energy output. The renewable technologies generate energy during sunlight hours or windy periods, which creates the need for effective energy storage solutions for capturing the excessive energy produced. The stored energy is released during peak periods of high demand or during unfavourable climatic conditions. Governments across the globe are heavily investing in renewable energy projects and are implementing favorable policies to incentivize the installation of renewable energy sources.

For instance, according to the article published by the Press Information Bureau (PIB), India is poised to significantly lead the global energy storage revolution. Union Minister for New and Renewable Energy inaugurated Battery Energy Storage Systems (BESS) manufacturing facility in Bidadi Industrial Area, Bengaluru. India's renewable capacity is growing fast as they are adding 25–30 GW every year. Between 2022 and 2032, India plans to add over 47 GW of battery storage capacity, with a total investment of around ₹3.5 lakh crore. The minister stated that the launch of a factory is a promise for cleaner energy, greater grid resilience, and India's leadership in the global energy storage market. According to the India Energy Storage Alliance, the country's energy storage sector is likely to attract ₹4.79 lakh crore investment by 2032. The CEA estimates a project requirement of 411.4 GWh (175.18 GWh from PSP and 236.22 GWh from BESS) of energy storage systems by 2032.

Topology Insights

Which Segment Is Leading the Market by Topology in the Li-Ion Battery Management Systems Market?

The modular segment led the global Li-ion battery management systems market in 2024. The demand for modular lithium-ion battery management systems (BMS) is mainly driven by the increasing application in electric vehicles (EVs), marine & defense, and energy storage systems (ESS). Modular systems offer robust reliability, reduced weight, scalability, and simplified maintenance compared to traditional centralized designs, which makes them ideal for large & complex battery packs. On the other hand, the distributed segment is expected to witness remarkable growth during the forecast period, owing to its superior flexibility, scalability, and safety features. Distributed battery management systems widely use multiple monitoring units placed directly on or near individual battery cells or modules. The growth of the distributed lithium-ion battery management systems (BMS) is driven by the growing need for high-capacity battery packs in electric vehicles (EVs) and renewable energy storage systems.

Component Insights

What Has Caused the Hardware to Dominate the Li-Ion Battery Management Systems Market?

The hardware segment dominates the hardware segment of the global Li-ion battery management systems market in 2024. The hardware segment includes CMU, BCU, wiring harness, contactors, sensors, and power electronics. Hardware enables Li-ion battery management systems to effectively monitor and manage battery performance. These hardware solutions are rapidly evolving to meet the increasing demands of advanced and high-power battery packs. On the other hand, the software & analytics segment is anticipated to grow at a CAGR during the forecast period. The software & analytics include embedded firmware, diagnostics, SOC/SOH/SOHF algorithms, and cloud/edge analytics. The software and analytics are becoming increasingly advanced through the integration of machine learning (ML), artificial intelligence (AI), and cloud computing. Li-ion battery management systems software monitors several key parameters like temperature, voltage, and state of charge, and offers real-time data for effective control and optimization. Analytics provide valuable insights into battery health, predict potential failures, and improve charging or discharging cycles for a longer lifespan.

Sales Channel Insights

What Causes the OEM to Dominate the Li-Ion Battery Management Systems Market?

The OEM held a dominant presence in the Li-ion battery management systems market in 2024. Original Equipment Manufacturers (OEMs) in the BMS market play a crucial role as a significant sales channel in the market by integrating battery management systems (BMS) into their final products, like electric vehicles, consumer electronics, and other portable devices, and selling the complete product to end-users. BMS manufacturers to get wide access to a broad market through the OEM's established sales and distribution networks. The OEMs are increasingly focusing on performing rigorous testing to ensure the battery management systems (BMS) function efficiently and meet the safety standards and performance requirements for their product. In Automotive OEMs, several EV manufacturers as BYD, Tesla, and General Motors, develop or procure battery management systems (BMS) tailored to their specific battery and vehicle architectures. On the other hand, the aftermarket/retrofit segment is expected to grow at a notable rate.

Aftermarket/retrofit plays an integral role as a Li-ion battery management system (BMS) in the market by offering cost-effective and efficient solutions for electrifying existing equipment and fleets, especially in sectors such as two-wheelers or three-wheelers, and where they enhance battery life, improve safety, and optimize performance.

Application Insights

How Did the Automotive Passenger BEV Segment Dominate the Market in 2024?

The automotive passenger BEV segment held the majority of the market share in 2024, owing to the widespread adoption of electric vehicles (EVs) and the increasing need for improved battery safety and performance. The escalating demand for electric vehicles, including passenger BEVs, has led to an increasing need for intelligent Li-ion BMS solutions to ensure battery safety, energy efficiency, thermal stability, and reliability. Additionally, the rising innovations, including modular designs, wireless communication, and specialized sensor technologies, are significantly improving Li-ion battery management systems (BMS) functionality and making them more efficient.

- In December 2024, at the 2024 CTI Symposium in Berlin, Marelli announces a new pioneering advancement in Battery Management Systems (BMS) for automotive applications, with a BMS based on Electrochemical Impedance Spectroscopy. This development is set to elevate the standard for battery cell management by ensuring optimal operation and enhanced performance of the battery pack.(Source: https://www.marelli.com)

On the other hand, the stationary storage (utility-scale) segment is projected to grow at a CAGR between 2025 and 2034, owing to the rising renewable energy integration and rising efforts in grid modernization. Lithium-ion batteries are the leading technology in the stationary storage (utility-scale), as they provide longer cycle life and increased durability. Moreover, rapid technological Innovations revolving around lithium-ion batteries aim to enhance their safety, performance, and life expectancy, which in turn makes them reliable solutions for stationary applications.

Regional Insights

Asia Pacific Is Dominating the Market With the Majority of the Market Share

Asia Pacific held the dominant share of the Li-ion battery management systems market in 2024. The region's rapid growth is driven by the rising decarbonization efforts, robust domestic battery manufacturing ecosystem, significant adoption of renewable energy sources, and supportive government initiatives. The market for Li-ion battery management systems is propelled by the increasing global demand for consumer gadgets, portable electronics, and electric vehicles. Battery management systems (BMS) ensure safety, efficiency, and extended battery life. Asia-Pacific countries such as China, India, Japan, Singapore, and South Korea are heavily investing in renewable energy projects to reduce their reliance on fossil fuels, which creates the need for efficient energy storage solutions. Li-ion batteries are widely adopted in utility-scale and residential energy storage systems for storing intermittent solar and wind energy. Moreover, government incentives and stringent emissions targets are expected to accelerate the adoption of electric vehicles (EVs), driving the expansion of the market in the coming years.

Li-Ion Battery Management Systems Market Trends in China and India

China and India accounted for the majority of the Li-ion battery management systems market trends in China and India revenue share in 2024, fuelled by rising production of electric vehicles (EVs), supportive government policies, and rising environmental concerns. China leads the regional market's growth owing to its large-scale EV production and rising investment in renewable energy projects. Moreover, the surge in emissions targets and the expansion of renewable energy infrastructure are anticipated to propel the market's expansion in these countries.

- According to the article published by the IBEF in February 2025 on the Electric Vehicle Industry Report, the sales of electric vehicles (EVs) in India saw an exponential rise in January 2025, with a 19.4% month-over-month (MoM) and 17.1% year-over-year (YOY) growth, reaching 1,69,931 units. In 2023, electric vehicle sales in India saw a significant increase of 49.25%, reaching 1.52 million units. Indian automakers are likely to launch nearly a dozen new EVs in 2025, focusing on premium models, as India's EV sales rose 20%, with a 30% target by 2030.

- According to the China Association of Automobile Manufacturers (CAAM) in May 2025, in April, vehicle production and sales volumes totaled 2.619 million units and 2.59 million units, up 8.9% y/y and 9.8.% y/y, respectively.

North America Is Expected to Grow at the Fastest Rate in the Market

North America is expected to grow at the fastest rate in the market during the forecast period. The fastest growth of the region is mainly fuelled by the strong presence of key industry players and research institutions, shifts toward sustainable transportation, growing demand for high-performance EV batteries, rising adoption of consumer electronics, growing demand for sustainability, increasing renewable energy investments, and advancements in battery technology. The rising deployment of renewable energy sources has significantly increased the ESS installations, necessitating demand for Lithium-ion battery management systems in the region. Additionally, Governments in the region are implementing favorable policies to promote clean energy and incentivize the adoption of renewable energy and electric vehicles (EVs), including tax benefits, subsidies, and grants for battery energy storage systems.

Li-Ion Battery Management Systems Market Companies

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Hitachi Astemo, Ltd.

- Contemporary Amperex Technology Co., Ltd.

- BYD Company Limited

- LG Energy Solution

- Panasonic Energy Co., Ltd.

- Samsung SDI Co., Ltd.

- Sensata Technologies

- Nuvation Energy

- Eberspächer

- Ewert Energy Systems

- Elithion, Inc.

- LION Smart GmbH

- Marelli

- Aptiv PLC

- Shenzhen Jiabaida (JBD)

- Daly Electronics Co., Ltd.

- Hangzhou Bestech Power Co., Ltd.

Recent Developments

- In May 2025, KULR Technology Group partnered with AstroForge, an asteroid-mining start-up, to develop a custom 500Wh lithium-ion battery pack for space missions. The new pack is expected to be based on the KULR ONE Space (K1S) technology and include KULR's established modules and NASA JSC 20793-compliant architectures. This partnership highlights the growing demand for high-performance battery systems for space-ready applications.

(Source: https://www.bestmag.co.uk) - In March 2025, Renesas Electronics Corporation, a premier supplier of advanced semiconductor solutions, today introduced all-in-one solutions for managing lithium-ion battery packs in a wide range of battery-powered consumer products, such as e-bikes, vacuum cleaners, robotics, and drones. With pre-validated firmware provided, the R-BMS F (Ready Battery Management System with Fixed Firmware) will significantly reduce the learning curve for developers, enabling rapid designs of safe, power-efficient battery management systems.(Source: https://www.renesas.com)

Segmentation Covered in the Report

By Topology

- Centralized

- Modular

- Distributed

By Component

- Hardware

- Software & Analytics

- Services

By Application

- Automotive Passenger BEV

- Automotive PHEV/HEV

- Commercial Vehicles (LCV/Bus/Truck)

- Micro-Mobility (e-bike/e-scooter)

- Consumer Electronics (laptops/tablets/handhelds)

- Power Tools & Garden Equipment

- Stationary Storage (Residential)

- Stationary Storage (C&I)

- Stationary Storage (Utility-Scale)

- Marine & Rail

- Medical & Specialty Industrial

By Sales Channel

- OEM

- Aftermarket/Retrofit

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting