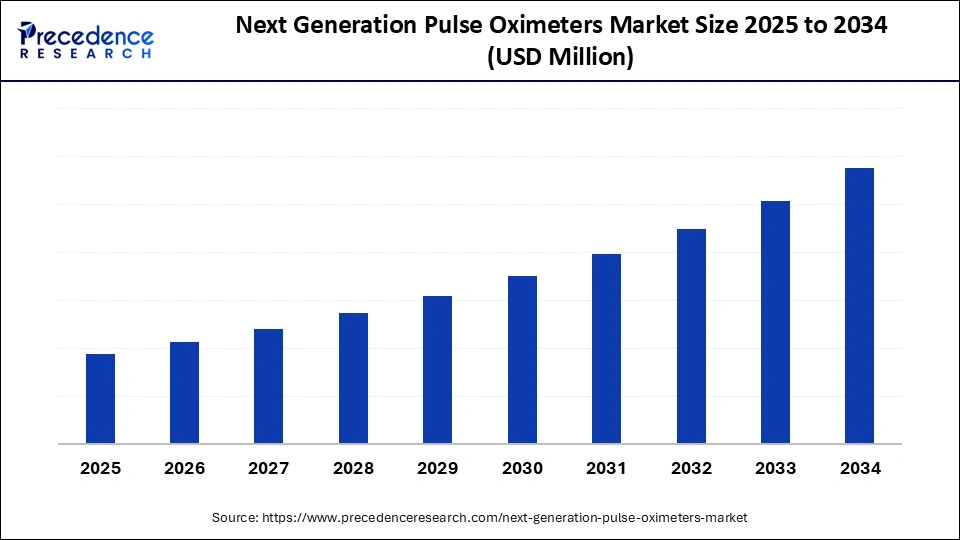

Next Generation Pulse Oximeters Market Size and Forecast 2025 to 2034

The global next generation pulse oximeters market is expanding as healthcare systems focus on preventive care and telemedicine. Next-gen devices improve outcomes for chronic and acute conditions alike. The market has experienced significant growth in recent years, reflecting the increasing reliance on digital platforms for freelance and gig-based work. The next generation pulse oximeters market is emerging as a transformative segment in patient monitoring, driven by the rising need for accurate, real-time data in both hospital and home care settings.

Next Generation Pulse Oximeters Market Key Takeaways

- North America dominated the next generation pulse oximeters market in 2024.

- By region, Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By technology type, the wireless & Bluetooth-enabled segment held a biggest market share in 2024 and is expected to grow at the fastest rate during the forecast period of 2025 to 2034.

- By product type, the wireless fingertip oximeters segment accounted for a considerable share in 2024.

- By product type, the wearable ring & watch oximeters segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By application area type, the home healthcare & remote monitoring segment contributed the highest market share in 2024.

- By application area type, the sleep disorder studies & fitness tracking segment is set to experience the fastest CAGR from 2025 to 2034.

- By development stage type, the clinical supply segment captured the maximum market share in 2024.

- By development stage type, the IND/CTA enabling services for advanced modalities are the fastest growing from 2025 to 2034.

- By end-user industry type, the home healthcare providers segment held the largest market share in 2024.

- By end-user industry type, the telehealth & consumer healthcare market is experiencing rapid deployment. They are the fastest-growing in the next generation pulse oximeters market, from 2025 to 2034.

- By connectivity features type, the mobile app integration segment led the market in 2024.

- By connectivity features type, the AI-Powered analytics & EHR integration is the fastest growing from 2025 to 2034.

- By patient demographics, the adult population segment generated the major market share in 2024.

- By patient demographics, the geriatric & chronic disease patients are the fastest growing in the market, from 2025 to 2034.

Market Overview

The next generation pulse oximeters market refers to the advanced segment of the global medical devices industry focused on innovative pulse oximetry technologies that go beyond traditional fingertip and tabletop oximeters. This market encompasses wireless pulse oximeters, continuous monitoring devices, wearable oximeters, smartphone-integrated solutions, multi-parameter monitoring systems, AI-powered analytics platforms, and remote patient monitoring solutions. These devices offer enhanced accuracy, improved connectivity capabilities, real-time data transmission, seamless cloud integration, and advanced algorithms, all designed to deliver better patient care. The market is driven by the increasing prevalence of respiratory diseases, growing demand for home healthcare, COVID-19 impact, telemedicine adoption, and technological advancements in sensor technology and wireless communications.

The next generation pulse oximeters market is witnessing robust growth as pulse oximeters evolve from basic diagnostic tools into intelligent, connected health devices. Industry players are focusing on improving accuracy across diverse patient demographics, including pediatrics and individuals with darker skin tones, addressing past limitations. The integration of wireless connectivity and compatibility with smartphones and wearables has expanded their reach beyond traditional healthcare environments. Increasing investments in miniaturized sensors and ergonomic designs are making devices more user-friendly and accessible. Governments and healthcare systems are recognizing the importance of monitoring chronic illnesses and emergency preparedness. Collectively, these factors are driving significant expansion in the global market.

AI Impact- Smart Algorithms for Smarter Care

Artificial intelligence has profoundly reshaped the next generation pulse oximeters market, enabling devices to deliver enhanced precision and predictive insights. AI-driven algorithms filter out motion artifacts, skin pigmentation biases, and ambient light interference, producing more reliable readings. These technologies are also enhancing clinical decision support by detecting early signs of hypoxemia or sleep apnea. Integration with AI-based cloud platforms allows continuous monitoring and real-time alerts for clinicians, caregivers, and patients. The ability to aggregate and analyse vast amounts of health data further empowers personalized healthcare interventions. Thus, AI is turning pulse oximeters into proactive tools rather than passive diagnostic instruments.

Market Key Trends

- Growing adoption of wearable and fingertip oximeters integrated into fitness ecosystems.

- Development of multi-parameter monitoring devices combining oxygen saturation, heart rate, and respiratory metrics.

- Rising demand for paediatric- and neonatal-specific devices with enhanced sensitivity.

- Increased integration of telemedicine platforms with pulse oximeters for remote diagnostics.

- Expansion of home care monitoring as consumers embrace preventive health technologies.

- Focus on design innovations, including wireless, portable, and energy-efficient devices.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology Type, Product Type, Application Area, End-User Type, Connectivity & Features, Patient Demographics, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Powering the Pulse

The primary driver of the next generation pulse oximeters market is the rising incidence of respiratory and cardiovascular diseases globally. Increased awareness of the importance of oxygen monitoring, especially after the COVID-19 pandemic, has accelerated adoption. Home healthcare demand is rising as patients seek convenient and affordable monitoring outside hospitals. Advances in wireless connectivity and integration with smartphones are broadening the devices' appeal. Strong investments from medical device manufacturers and startups alike are fostering innovation. Together, these dynamics are creating a powerful momentum for next generation pulse oximeters.

Restraints

Barriers in the Flow

Despite strong growth, the next generation pulse oximeters market faces limitations that hinder faster adoption. High device costs remain a challenge in developing regions, restricting widespread accessibility. Data privacy concerns related to connected health devices pose risks for both patients and providers. Accuracy issues, though improved, persist in certain patient populations and environments. Regulatory complexities also slow down the introduction of newer models in critical care markets. These restraints underline the need for balanced innovation and affordability.

Opportunity

Breathing Room for Growth

The future holds immense opportunities for next-generation pulse oximeters as healthcare shifts toward personalized and preventive models. Integration with broader digital health ecosystems creates possibilities for predictive and continuous care. Emerging markets with growing healthcare infrastructure represent untapped avenues for expansion. Partnerships with tech companies for AI-driven analytics and cloud-based monitoring open new revenue streams. Rising consumer focus on wellness and fitness devices also expands the market beyond clinical use. Altogether, the sector stands at the crossroads of medical necessity and lifestyle demand.

Technology Type Insights

Why Are Wireless & Bluetooth-Enabled Pulse Oximeters Dominating the Next Generation Pulse Oximeters Market?

Wireless and Bluetooth-enabled oximeters dominate the next generation pulse oximeters market because they offer seamless data transfer, allowing patients and clinicians to access real-time information with minimal effort. Their compatibility with smartphones and tablets has made them a go-to choice for both clinical and consumer healthcare environments. Hospitals and home care providers prefer these devices for their convenience, accuracy, and portability. They also integrate easily with telehealth platforms, enabling continuous monitoring and immediate response to abnormalities. Manufacturers have heavily invested in these models, leading to a wide range of affordable and advanced options. This has made wireless and Bluetooth-enabled oximeters the foundation of the next generation market.

The dominance is further reinforced by their proven reliability in diverse patient settings, from critical care to personal wellness tracking. They provide stable performance even in motion-heavy or low-light environments, which has built trust among healthcare professionals. Regulatory approvals have been more streamlined for wireless devices, encouraging their widespread adoption. Healthcare systems benefit from reduced infrastructure costs since Bluetooth connectivity eliminates the need for complex wired setups. Moreover, their integration with cloud-based dashboards facilitates easy data sharing across care teams. This comprehensive ecosystem ensures that wireless and Bluetooth-enabled oximeters will remain market leaders in the foreseeable future.

Wearable and patch-based oximeters are emerging as the fastest growing category due to their discreet, continuous monitoring capabilities. These devices appeal to patients who require long-term tracking but prefer comfort and mobility over bulky equipment. The rising popularity of preventive health and fitness monitoring has also accelerated demand, as consumers adopt wearables for both medical and lifestyle purposes. Patch-based models are increasingly being used in clinical trials and sleep studies, where extended, non-invasive monitoring is critical. They also serve paediatric and geriatric populations well by eliminating the need for repetitive manual measurements. This combination of convenience and advanced monitoring is fuelling their rapid market expansion.

The growth of this segment is also driven by the booming digital health ecosystem, where data integration with mobile apps and cloud platforms enhances user experience. Wearables can easily complement existing health devices like smartwatches, creating a seamless ecosystem of continuous health monitoring. Companies are leveraging AI algorithms within these devices to provide predictive health insights, increasing their perceived value. Venture capital and strategic partnerships are pouring into this space, fuelling R&D and commercialization. Governments and insurers are beginning to acknowledge their potential for preventive care, which could accelerate reimbursement policies. As a result, wearable and patch-based oximeters are positioned as the most dynamic growth engine in the market.

Product Type Insights

Why Are Wireless Fingerprint Oximeters Dominating the Next Generation Pulse Oximeters Market?

Wireless fingerprint oximeters dominate the next generation pulse oximeters market because of their simplicity, compactness, and accuracy in delivering quick oxygen saturation readings. These devices are highly popular in both hospitals and home care settings for their user-friendly design and reliability. They have become the most widely recognized form of pulse oximetry due to their affordability and ease of distribution. Consumers value their portability, making them suitable for travel, sports, and emergency use. Manufacturers continue to refine their accuracy with improved sensors and Bluetooth-enabled data sharing. This accessibility and reliability ensure their commanding position in the market.

Their dominance also stems from the familiarity and trust built during the COVID-19 pandemic, when fingerprint oximeters became household necessities. Healthcare providers also prefer them for spot-check monitoring, where speed and accuracy are paramount. Their design requires little training, which enhances adoption among elderly users and caregivers. The competitive market landscape has driven down prices, further cementing their appeal in emerging economies. These devices also meet the regulatory standards more readily compared to newer wearable technologies. Collectively, these factors sustain their dominance in the global pulse oximeter market.

Wearable ring and watch oximeters are experiencing the fastest growth due to their dual appeal as lifestyle gadgets and medical devices. Consumers are increasingly adopting them as part of fitness and wellness ecosystems, tracking oxygen saturation alongside heart rate and sleep quality. These devices also provide continuous monitoring, which is particularly beneficial for patients with chronic respiratory issues. Their discreet design allows users to track health metrics without disrupting daily activities. Major technology companies are integrating pulse oximetry features into smartwatches, expanding awareness and adoption. This convergence of consumer tech and healthcare is driving rapid growth.

The expansion of this category is also fueled by the broader wearables boom, where users are willing to invest in multifunctional devices. Partnerships between medical device companies and consumer tech giants are further legitimizing their use in healthcare. Continuous software updates and AI-enabled insights enhance the long-term value of these devices. Insurance companies are starting to consider wearable data for wellness incentives, which could increase adoption further. The appeal of having medical-grade features in stylish, everyday devices is especially strong among younger demographics. Altogether, wearable rings and watches are reshaping the perception of oximeters from clinical tools to lifestyle essentials.

Application Area Insights

Why Are Home Healthcare & Remote Monitoring Services Dominating the Next Generation Pulse Oximeters Market?

Home healthcare and remote monitoring applications dominate the next generation pulse oximeters market due to the growing trend of decentralizing patient care from hospitals to homes. Chronic disease patients, particularly those with respiratory or cardiac conditions, benefit from continuous monitoring without frequent hospital visits. Remote monitoring solutions also reduce healthcare costs while improving patient outcomes. Governments and health providers encourage home-based care as part of long-term care strategies. Consumers, too, prefer the comfort and convenience of managing their health at home. This has positioned home care and remote monitoring as the leading application area.

The dominance is also strengthened by the integration of oximeters into telemedicine platforms. Clinicians can access patient data in real time, enabling timely interventions and reducing hospital readmissions. COVID-19 significantly boosted the adoption of home monitoring devices, creating lasting behavioral shifts among patients. Device makers are now designing user-friendly models with simplified interfaces for non-clinical users. Regulatory bodies are supporting this trend through reimbursement policies for remote monitoring services. As healthcare continues to move toward patient-centric models, this segment will remain the primary application area.

Sleep disorder studies and fitness tracking are rapidly emerging as the fastest-growing application areas for next generation pulse oximeters. Growing awareness of sleep apnea, insomnia, and related disorders has increased the demand for continuous overnight monitoring. Fitness enthusiasts are also adopting oximeters to track oxygen levels during high-intensity workouts, sports, and altitude training. The rise of wearable technologies makes it easier to integrate pulse oximetry into lifestyle routines. These devices not only provide medical insights but also enhance overall wellness monitoring. This dual appeal is driving accelerated growth in this segment.

Further expansion comes from the rise of consumer-focused digital health ecosystems. Apps linked with wearable oximeters can track long-term trends in sleep quality and fitness performance. Clinical researchers are increasingly using these devices in large-scale sleep disorder studies, fueling credibility and adoption. Tech companies are also embedding oximetry features into multipurpose fitness trackers, boosting accessibility. Younger populations are embracing these devices as lifestyle tools, while older populations see them as preventive care aids. With the convergence of health and wellness, this application area is set to expand rapidly.

End-User Type Insights

Why Are Home Healthcare Providers Dominating the Next Generation Pulse Oximeters Market?

Home healthcare providers dominate the end-user segment because of the increasing emphasis on cost-effective, patient-centred care. Providers rely on pulse oximeters to monitor patients with respiratory, cardiac, and post-surgical conditions. The devices allow caregivers to ensure safety while reducing unnecessary hospital visits. Wireless integration also makes it easier for providers to share patient data with physicians remotely. These advantages have made home healthcare providers the largest consumers of next generation oximeters. Their central role in chronic disease management sustains their dominance in this market.

Their dominance is also rooted in demographic trends, with aging populations increasing demand for long-term home care. Insurance support and government incentives for home-based care models further strengthen their position. Providers prefer oximeters with user-friendly features, ensuring compliance among patients of all ages. The ability to monitor patients in real time improves efficiency and reduces workload for healthcare professionals. Device makers have also developed tailored solutions for home care providers, reinforcing this alignment. Altogether, the home healthcare provider segment will continue to dominate due to structural healthcare shifts.

The telehealth and consumer healthcare market is the fastest-growing end-user segment in the next generation pulse oximeters market, fuelled by the global boom in digital healthcare services. Patients are increasingly engaging with telemedicine platforms that rely on accurate remote monitoring devices like pulse oximeters. Consumers also view these devices as essential tools for proactive health and wellness tracking. The affordability of smartphone-linked oximeters has made them accessible to wide populations. Digital-first health startups are further driving adoption by integrating these devices into virtual care packages. These dynamics make telehealth and consumer healthcare the fastest growth driver.

This growth is amplified by the convenience and flexibility that telehealth brings to modern lifestyles. Patients can consult doctors without leaving their homes, with oximeter data serving as a reliable clinical reference. Consumer demand for preventive health monitoring aligns with the broader adoption of wearable oximeters. The pandemic accelerated digital healthcare, and the trend continues even in the post-pandemic era. Partnerships between telehealth platforms and device manufacturers are creating bundled solutions for patients. With healthcare shifting toward hybrid and virtual models, this segment's growth trajectory is unmatched.

Connectivity Features Insights

Why Mobile App Integration Is Dominating the Next Generation Pulse Oximeters Market?

Mobile app integration dominates the connectivity feature segment due to the widespread adoption of smartphones worldwide. Patients and caregivers value the ability to track and analyze health metrics directly on mobile devices. Apps allow easy sharing of oxygen data with clinicians, family members, and cloud platforms. Mobile integration has also expanded the utility of oximeters into fitness and wellness tracking. Manufacturers design user-friendly apps with dashboards and alerts, making them appealing to both medical and non-medical users. These capabilities ensure mobile app integration remains the most dominant feature.

AI-powered analytics and EHR integration are the fastest-growing features, redefining how oximetry data is utilized in clinical and consumer settings. Advanced algorithms can predict deteriorations in respiratory health before they become critical. Integration with electronic health records ensures seamless documentation and continuity of care. These capabilities are particularly valuable in hospitals managing large patient volumes. They also empower providers to personalize care through predictive insights. This transformative impact is propelling rapid growth in this segment.

Patient Demographics Insights

Why Are Geriatric & Chronic Disease Patients Dominating the Market?

Geriatric and chronic disease patients dominate the next generation pulse oximeters market because they represent the largest group requiring continuous oxygen monitoring. Aging populations worldwide face higher incidences of respiratory disorders, cardiovascular conditions, and sleep-related breathing problems. Pulse oximeters provide a non-invasive, reliable solution to manage these risks and reduce hospital visits. Healthcare providers prioritize these patients for remote monitoring programs, ensuring safety while lowering costs. The adoption is further reinforced by government initiatives supporting home care for elderly and chronically ill individuals. As a result, these demographic forms the backbone of demand for advanced oximetry solutions.

The adult population is emerging as the fastest-growing segment due to rising health awareness and lifestyle-related risks. Younger and middle-aged adults are increasingly adopting oximeters for fitness tracking, high-altitude activities, and preventive health monitoring. The rising prevalence of asthma, obesity-related respiratory problems, and stress-driven cardiac conditions also fuels adoption. Adults prefer wearable and app-integrated devices that seamlessly fit into their digital lifestyles. Tech-savvy consumers are driving the demand for smartwatches and rings with built-in oximetry features. This convergence of wellness, fitness, and preventive health monitoring is accelerating market growth in this demographic.

Regional Insight

How is North America Leading with Innovation?

North America dominates the next generation pulse oximeters market due to its advanced healthcare infrastructure and strong adoption of digital health technologies. The region's high prevalence of chronic respiratory and cardiac conditions drives sustained demand. Government initiatives supporting telemedicine and home care monitoring further boost the market. Leading companies in the U.S. and Canada are actively investing in product innovation and AI integration. Consumers in the region are also more receptive to wearable health technologies, fuelling adoption in non-clinical environments. This blend of innovation, awareness, and infrastructure cements North America's dominance.

North America's dominance is further strengthened by its robust regulatory frameworks that balance innovation with safety. The region is witnessing strong collaborations between healthcare providers, tech companies, and device manufacturers. Insurance coverage and reimbursement models are also evolving to support remote monitoring solutions. The rise of personalized medicine and precision healthcare aligns perfectly with the capabilities of next-gen pulse oximeters. Large-scale clinical research and pilot programs continue to validate their effectiveness in improving outcomes. Thus, North America is likely to remain the benchmark for global market growth.

How is Asia Pacific Breathing Fastest into the Future?

Asia Pacific represents the fastest-growing region in the next generation pulse oximeters market, driven by expanding healthcare infrastructure and rising disease burden. Countries such as China, India, and Japan are witnessing increased adoption of digital health devices in both urban and rural settings. Economic growth has fuelled healthcare investments, making advanced monitoring technologies more accessible. The region's large population base creates enormous demand for affordable yet advanced pulse oximeters. Consumer acceptance of wearable health devices is growing rapidly, particularly among younger demographics. These dynamics collectively propel Asia Pacific a the most vibrant growth engine.

In addition, the Asia Pacific is becoming a hub for cost-effective manufacturing of medical devices. Local startups are collaborating with global firms to deliver innovative and affordable solutions tailored to the region. Governments are actively promoting telehealth and digital health ecosystems, further encouraging adoption. Increasing internet penetration and smartphone usage also facilitate widespread integration of connected monitoring devices. Awareness campaigns about preventive healthcare are reshaping patient behaviours and driving demand. With these trends converging, the Asia Pacific is set to outpace other regions in its growing trajectory.

Next Generation Pulse Oximeters Market Companies

- Masimo Corporation

- Medtronic PLC

- Nonin Medical Inc.

- Nihon Kohden Corporation

- Philips Healthcare

- GE Healthcare

- Smiths Medical

- Contec Medical Systems

- Oximax Medical Technologies

- Oxitone Medical Ltd.

- Apple Inc. (Apple Watch)

- Fitbit (Google Health)

- Garmin Ltd.

- Samsung Electronics

- Withings (Nokia Health)

- Beurer GmbH & Co. KG

- ChoiceMMed

- Fingertip Pulse Oximeter Co.

- Innovo Medical

- Zacurate

Recent developments

- In October 2024, the patient, a man in his sixties with emphysema, was Africa America. When a fingertip oximeter was used, it recorded oxygen saturation levels well above the critical 88% threshold that typically signals imminent risk of organ failure or death. However, his physician, Dr. Noha Aboelata, suspected the reading was misleading and that his condition was more severe than the device indicated. To verify her concern, she ordered a laboratory test, which confirmed that the patient required supplemental oxygen therapy at home. (Source: https://www.cbsnews.com)

Segment Covered in the Report

By Technology Type

- Wireless & Bluetooth-Enabled Oximeters

- Continuous Monitoring Systems

- Wearable & Patch-Based Oximeters

- Smartphone-Integrated Solutions

- AI & Machine Learning-Enhanced Devices

- Multi-Parameter Monitoring Systems

- Cloud-Connected Platforms

- Reflectance-Based Technology

- Transmission-Based Technology

- Near-Infrared Spectroscopy (NIRS)

By Product Type

- Wireless Fingertip Oximeters

- Wearable Ring & Watch Oximeters

- Patch & Adhesive Oximeters

- Smart Sensor Arrays

- Pediatric & Neonatal Specialized Devices

- Tabletop Connected Systems

- Handheld Wireless Units

- Ear Clip & Forehead Sensors

- Continuous Monitoring Bands

- Implantable Monitoring Systems

By Application Area

- Chronic Respiratory Disease Monitoring

- Sleep Apnea & Sleep Disorder Studies

- Post-Surgical & ICU Monitoring

- Home Healthcare & Remote Monitoring

- Sports Performance & Fitness Tracking

- Elderly Care & Assisted Living

- Pediatric & Neonatal Care

- Emergency & Ambulatory Care

- Rehabilitation & Physical Therapy

- Clinical Research & Drug Trials

By End-User Type

- Hospitals & Critical Care Units

- Home Healthcare Providers

- Ambulatory Surgical Centers

- Long-Term Care Facilities

- Sports & Fitness Centers

- Rehabilitation Centers

- Emergency Medical Services

- Telehealth & Remote Monitoring Companies

- Consumer Healthcare Market

- Clinical Research Organizations

By Connectivity & Features

- Bluetooth & Wi-Fi Connectivity

- Cloud-Based Data Storage

- Mobile App Integration

- Real-Time Alerts & Notifications

- Electronic Health Record (EHR) Integration

- Telemedicine Platform Compatibility

- AI-Powered Analytics & Insights

- Multi-Device Synchronization

- Remote Monitoring Capabilities

- Data Sharing & Collaboration Tools

By Patient Demographics

- Adult Population (18-65 years)

- Geriatric Population (65+ years)

- Pediatric Population (2-18 years)

- Neonatal & Infant Population

- Chronic Disease Patients

- Post-Surgical Patients

- Athletes & Fitness Enthusiasts

- High-Risk Patient Groups

- Geriatric & Chronic Disease Patients

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting