Non-Sterile Liquids and Suspensions Market Size and Forecast 2025 to 2034

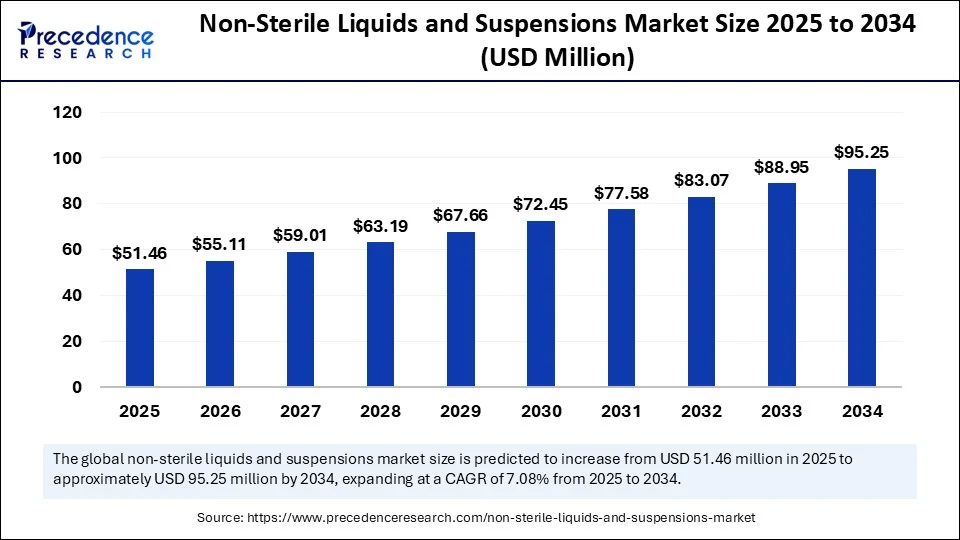

The global non-sterile liquids and suspensions market size accounted for USD 48.06 million in 2024 and is predicted to increase from USD 51.46 million in 2025 to approximately USD 95.25 million by 2034, expanding at a CAGR of 7.08% from 2025 to 2034. The market for non-sterile liquids and suspensions is driven by rising demand for oral medications, ease of administration, pediatric and geriatric preference, cost-effectiveness, expanding pharmaceutical production, and increasing prevalence of chronic diseases.

Non-Sterile Liquids and Suspensions Market Key Takeaways

- In terms of revenue, the global non-sterile liquids and suspensions market was valued at USD 48.06 million in 2024.

- It is projected to reach USD 95.25 million by 2034.

- The market is expected to grow at a CAGR of 7.08% from 2025 to 2034.

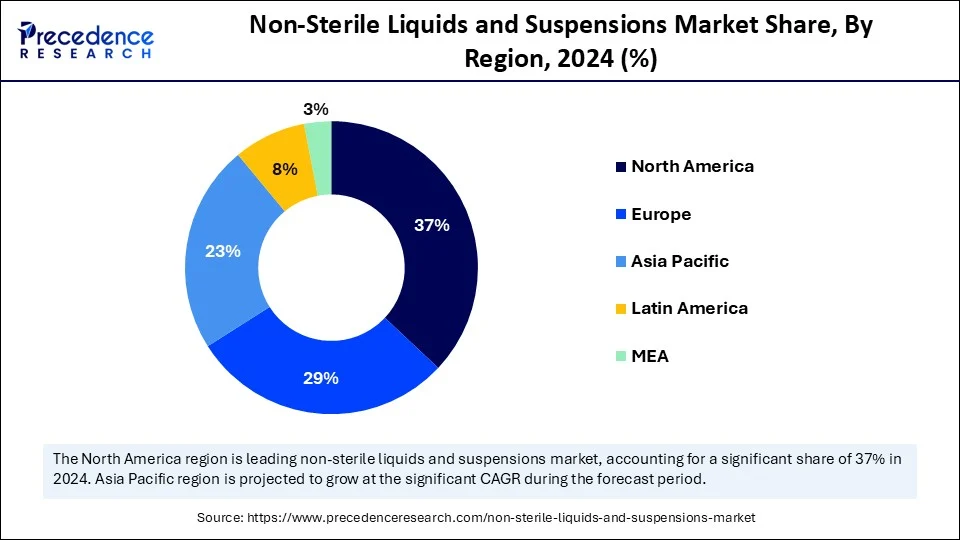

- Asia Pacific dominated the global non-sterile liquids and suspensions market with the largest market share of 37% in 2024.

- North America is anticipated to witness the fastest growth during the forecasted years.

- By dosage form/product type, the oral suspensions segment captured the biggest market share of 35% in 2024.

- By dosage form/product type, the topical non-sterile liquids segment is anticipated to show considerable growth over the forecast period.

- By therapeutic area, the anti-infectives segment contributed the highest market share of 30% in 2024.

- By therapeutic area, the respiratory segment is anticipated to show considerable growth over the forecast period.

- By user/end market, the prescription pharmaceuticals segment generated the major market share of 50% in 2024.

- By user/end market, the OTC/consumer health liquids segment is anticipated to show considerable growth over the forecast period.

- By sales/distribution channel, the retail pharmacies & drugstores segment held the largest market share of 55% in 2024.

- By sales/distribution channel, the e-commerce and direct-to-consumer segment is anticipated to show considerable growth over the forecast period.

How Is AI Integration Transforming the Non-sterile Liquids and Suspensions Market?

Artificial intelligence has gained popularity in the non-sterile liquids and suspensions market to enable the maintenance of accountable production to enable the development of formulation, the simplification of production, and the uplifting quality assurance. In manufacturing, process automation using AI ensures consistency, reduces errors, and expands the capacity of the application. AI is applied in the design of packaging innovations, including child-resistant yet patient-friendly packaging, and supply chain management to predict future demand in pharmacies, hospitals, and e-commerce networks. With the help of the AI, the pharmaceutical organization will be able to reduce costs, shorten the time-to-market, and develop better patient-centric designs.

U.S. Non-Sterile Liquids and Suspensions Market Size and Growth 2025 to 2034

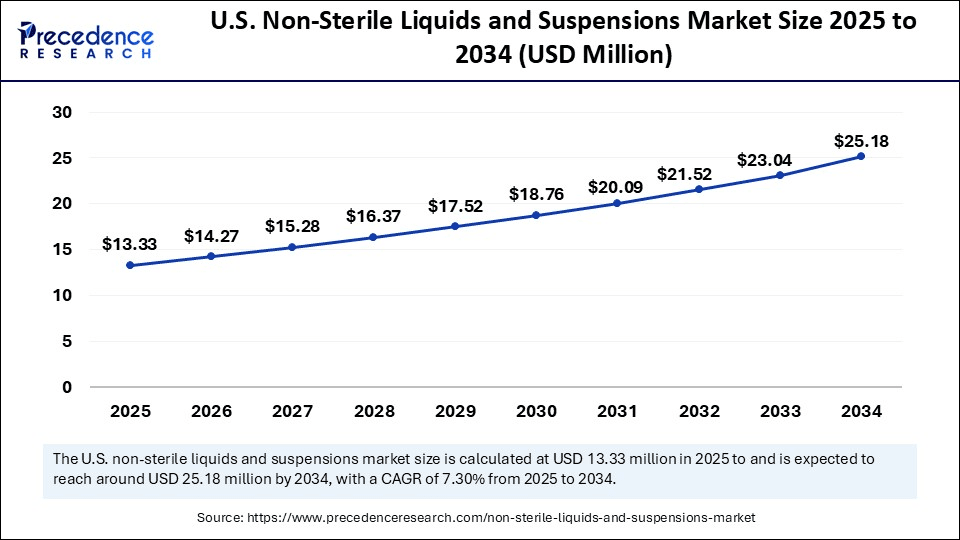

The U.S. non-sterile liquids and suspensions market size is evaluated at USD 12.45 million in 2024 and is projected to be worth around USD 25.18 million by 2034, growing at a CAGR of 7.30% from 2025 to 2034.

Why Did Asia Pacific Dominate the Global Non-sterile Liquids and Suspensions Market in 2024?

Asia Pacific led the global market with the highest market share of 34-38% in 2024, supported by the large population base, an escalating healthcare budget, and a powerful healthcare manufacturing ecosystem. India, Japan, South Korea, and other countries in Southeast Asia have a huge market demand and production of oral suspensions, syrups, topical liquids, and functional drinks. The cost-effective manufacturing, a large number of contract manufacturing organizations, as well as domestic demand that needs generic liquid formulations in pediatric and geriatric populations. Moreover, the fast-growing e-commerce platforms and digital health uptake of the region are increasing the speed and spread of OTC liquid products, particularly in rural or semi-urban regions.

China is a key contributor to the leadership of the Asia Pacific, as it is a highly demanding consumer market and the leading global manufacturing hub of non-sterile liquids and suspensions. Government policies on the promotion of universal healthcare coverage and affordable generics have increased access to liquid dosage forms, especially in the rural and lower-income territories in China. China is increasingly effective in its process of conducting pharmaceutical research and distributing it with the help of artificial intelligence and digital health to make those processes more efficient and patient-centered.

Why Is North America Undergoing the Fastest Growth in the Non-sterile Liquids and Suspensions Market?

North America is estimated to grow at the fastest CAGR during the forecast period, due to the high demand for regulated formulations that are premium and the increasing rate of patient-friendly dosage forms. The area enjoys high-quality pharmaceutical R&D, strong regulatory oversight of the region by the U.S. FDA and Canadian Health, and high healthcare spend, all of which are supportive of innovation and quality in non-sterile liquid commercialization. The increased adoption of personalized medicine and tailor-made suspensions prepared in compounding pharmacies is opening up new opportunities in therapeutic fields. The increasing population of geriatrics and the prevalence of chronic diseases are resulting in the region experiencing increased growth at a rapid rate.

North America is experiencing a high rate of growth driven mainly by the U.S., which holds most of the markets in the region. The U.S. has a favorable market due to a robust healthcare infrastructure with high spending per capita on medicine and sizable insurance penetration. There is a greater use of pediatric antibiotic formulations in oral suspension, and the acceptance of liquid therapies in respiratory, gastrointestinal, and cardiovascular disorders in the country.

Market Overview

Non-sterile liquids and suspensions include their wide array of products, including oral solutions, syrups, elixirs, emulsions, and reconstitutable powders or topical lotions or creams, based on their categorization. The preparations are intended mostly for non-parenteral routes such as oral, topical, otic, nasal, and oral rinses. Their usage has been popular due to their administrability, particularly in the pediatric and geriatric groups. The market structure will include the development of formulations, contract manufacturing (CMO/CDMO), excipients such as preservatives and flavorings, special packaging solutions, stability and quality testing, and various distribution channels such as retail pharmacies, hospital pharmacies, and e-pharmacies.

The increase in the prevalence of chronic conditions, such as respiratory diseases, gastrointestinal and dermatological problems globally, has contributed to steady demand in the non-sterile liquids and suspensions market. Patient compliance is more likely to happen with the flavored syrups and suspensions, especially with children and elderly patients. Innovation in product design is being enabled by advances in excipients, preservatives, and stabilizers that are increasing the shelf-life and efficacy of formulations. E-commerce and online pharmacy further propagate the availability of non-sterile formulations, which also increases their consumers.

What Factors Are Fueling the Rapid Expansion of the Non-sterile Liquids and Suspensions Market?

- Surge in Chronic Diseases: The rising cases of respiratory, gastrointestinal, and dermatological ailments favor liquid formulations offered in oral and topical form that can be easily consumed. The long-term patients of treatment would prefer to be with suspensions and solutions to remain with their drugs, particularly those in pediatrics and geriatrics.

- Pediatric and Geriatric preference: Elderly patients and children find it difficult to swallow tablet forms, and liquids are the favored dosage form. Improved palatability with flavor, allowing flexible amounts to be administered, and easier intake also improves acceptance.

- Innovation in excipients and formulation technologies: Excipients and formulation technology can be employed to develop innovation in non-sterile liquids and suspensions, with greater product stability, flavor, and bioavailability enabled by intriguing excipients and preservatives, and suspending agents. The new formulations are more stable, prolong shelf life, and are more effective as therapeutics.

- The rise of Contract Manufacturing: The current popularity of outsourcing to Contract Manufacturing organizations is allowing pharmaceutical firms to generate cost savings in production, increase capacity, and time-to-market of non-sterile liquids and suspensions. This move promotes outsourcing in the trade to ensure product availability and non-sterile liquids and suspensions market coverage at low cost and investment by drug manufacturers.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 95.25 Million |

| Market Size in 2025 | USD 51.46 Million |

| Market Size in 2024 | USD 48.06 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.08% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Dosage Form / Product Type, Therapeutic Area / Indication, User / End Market, Sales / Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Chronic Diseases

The world is facing the burden of chronic illnesses like diabetes, asthma, cardiovascular diseases, and gastrointestinal diseases, and this boom is spurring the demand for more patient-friendly pharmaceutical dosage forms. Non-sterile liquid and suspension forms have become the latest option in the management of long-term therapies in terms of ease of dosage, more rapid absorption rates, and the ability to dose these liquids to the different groups of patients. The diabetic and cardiovascular patients need regular adjustments in medication and can receive it more conveniently in liquid forms than in rigid solid dosages. The ease of titrating the doses using liquids or reconstitutable suspensions increases compliance and efficacy of therapy. Also, other demographic groups, such as the pediatric and geriatric populations, who also show the highest incidences of chronic conditions, also contribute to the need that enhances the demand in the non-sterile liquids and suspensions market. As the number of chronic diseases is expected to increase worldwide, non-sterile liquids and suspensions present a critical aspect of therapeutic solutions, resulting in massive market growth in prescriptions and over-the-counter markets.

Ease of Administration for Vulnerable Populations

Tablets and capsules tend to be difficult with regard to swallowing and correct dosage, but liquid formulations are flexible, with a better flavour and easier administration. Syrups and flavored suspensions are particularly suitable in medicines used by pediatric patients, need to be effective, but their tolerance of medicine preferences also matters in terms of taste and appearance. In geriatric populations who will potentially have trouble swallowing solid oral doses, liquids offer an easier route of administration and a quicker time to effect. This reduced complexity of management also helps with greater patient treatment adherence and decreased treatment failures. As the world's healthcare turns towards patient-centered healthcare and home-based treatments, liquid and suspension formulations are getting more important.

Restraints

Stringent Regulatory Requirements

The regulatory barriers impede the non-sterile liquids and suspensions market to a great extent because strict laws regulate the creation, fabrication, and marketing of the products across the globe. Strict regulatory requirements, such as the product quality requirements set by agencies like the U.S. FDA, EMA, and other national health-related organizations, as well as the microbial contaminant limits or the accuracy of labeling, stability testing requirements, are a strict requirement of regulatory agencies. Paying attention to compliance may require a big investment in modern manufacturing facilities, specific quality control mechanisms, and a highly qualified workforce. Additional impediments could include high costs of compliance and scarcity of resources in the case of small pharmaceutical firms and startups. The extent of regulatory controls as safety measures is to the patient and the efficacy of the products; however, as a significant roadblock, regulation creates delays in development pipelines and time-to-market non-sterile liquid and suspension products.

Opportunity

Growing Demand for Pediatric and Geriatric Medicines

The growth in pediatrics and geriatrics medications is one of the most promising opportunities in the non-sterile liquids and suspensions market. Tablets and capsules can be difficult to swallow; hence, the use of liquid formulations among children and elderly patients is more effective in increasing medication adherence and the effectiveness of the delivery. Flavoured syrups, suspensions, and reconstitutable powders, in pediatrics, enhance palatability and make the dose flexible according to body weight and age. Liquid formulations are easily administered, quick-acting, and allow variable dosing, which is especially useful when the patient requires medication to treat multiple chronically occurring conditions. Also, the increase in home healthcare and telemedicine is another reason that can escalate the use of these convenient dosage forms. The opportunity in formulation technologies, excipients, and packaging is specifically adapted to the requirements of pediatric and geriatric care.

Dosage Form / Product Type Insights

Why Did the Oral Suspensions Segment Lead the Non-sterile Liquids and Suspensions Market in 2024?

The oral suspensions segment led the market while holding a 35% share in 2024. Oral suspensions are liquid preparations where drugs are suspended in a specific vehicle, and therefore, these kinds of suspensions are preferred by patients who have a hard time consuming pills or capsules. In this dosage form, ready-to-use suspensions and reconstitutable powders are included, especially in pediatric antibiotics and various over-the-counter medications by formulation as antacids, analgesics, as well as food supplements. The freedom of dosing, the ability to easily administer it, and enhanced palatability through the use of flavoring agents also play a role in ensuring patient adherence to therapy, as well as therapeutic efficacy. Moreover, the growing volume of infections and chronic illnesses where drugs have to be taken long-term also boosted the demand for oral suspensions.

The topical non-sterile liquids (lotions, liniments) segment is expected to grow at a significant CAGR over the forecast period, driven by an increase in the demand for dermatological and localised treatments. These preparations are intended to be applied topically to the skin or mucous membranes, providing localized therapy of diseases like infections, inflammations, pain, or skin irritation. There are lotions affording a cooling, refreshing effect, and commonly used in dermatology, and liniments, which are used more frequently in the relief of musculoskeletal ailments such as joint pain and muscle stiffness. Their non-invasive mode of administration, convenience of self-administering, and wide accessibility in prescription and OTC are factors that make them extremely popular. Increasing lifestyle-related skin conditions, greater awareness of skin and personal care products, and the growing number of aging populations may necessitate topical care in managing chronic skin disorders, contributing to this growth.

Therapeutic Area Insights

Why Did the Anti-infectives Segment Lead the Non-sterile Liquids and Suspensions Market in 2024?

The anti-infectives segment held a 30% market share in 2024. They constitute a staple in the treatment of bacterial infections like otitis media, upper and lower respiratory infections, and gastrointestinal illness, and children are a major case load in such diseases. Compared to suspensions and reconstitutable powders, which can be dosed correctly based on weight. Also, they are more palatable due to the addition of flavouring agents, which enhances compliance, a relevant element in the enjoyment of an antibiotic. The ever-increasing cost of combating antimicrobial resistance has also prompted manufacturers to become more creative due to the need to ensure stabilized formulation and newer combinations. As the infection rate continues to grow in the developing world and the world continues to consume antibiotics heavily, this segment is likely to continue as a pillar of the market.

The respiratory segment is expected to grow substantially in the non-sterile liquids and suspensions market, backed by increased incidences of asthma, chronic obstructive pulmonary disease (COPD), seasonal allergies, and viral respiratory infections. Respiratory farings consisting of over-the-counter respiratory relief liquids (e.g., cough syrups, expectorants, decongestant suspensions) have strong consumer demand and are widely used by pediatric and adult populations. The rising interest in nutritional and functional drinks, which commonly provide vitamins, immune-boosting substances, and extracts, which are aligned with the growth of preventive health trends. The further growth in OTC-respiratory products is due to the emphasis on consumer care and self-care, as well as the ease of access achieved through the use of e-commerce.

User / End Market Insights

Why Did the Prescription Pharmaceuticals Segment Lead the Non-sterile Liquids and Suspensions Market in 2024?

The prescription pharmaceuticals (Rx oral suspensions & solutions) segment led the market while holding a 50% share in 2024. Such dominance has been traced in this leadership to the high consumption of prescription-based oral suspensions and solutions in chronic and acute diseases like infections, cardiovascular diseases, diabetes, as well as respiratory disorders. Oral suspensions, especially antibiotics and geriatric-friendly formulations, continue to have a significant role to play in prescriptions because of the flexibility of dose, palatability, and ease of administration. Prescription solutions are popularly adopted in drug therapies that demand dosing accuracy and swifter absorption; hence, it has been useful in the treatment of long-term ailments. Moreover, robust regulatory control of prescription oral liquids provides patient safety and efficacy, resulting in patient confidence and long-term adoption. The investments that pharmaceutical companies have continued to make in enhanced excipients, preservative systems, and flavor boosts further promote the growth prospects.

The OTC/consumer health liquids segment is expected to grow at a significant CAGR over the forecast period, driven by the increased need for self-care and preventative healthcare services. The cough syrups, digestive agents, multivitamin juices, herbal supplements, and functional beverages are very popular among children and youth with diverse groups of the population due to their convenience and accessibility. Expansion in health consciousness, and growing purchasing power of the sugar-free, herbal, and flavored products is improving acceptance and re-purchase. The booming growth of e-commerce and digital health platforms also expanded the accessibility of OTC liquid formulations to consumers. The OTC/consumer health liquids segment also provides a good potential for future innovation and market expansion with the increasing trend toward a preventive care model and health conditions management based on a lifestyle approach.

Sales / Distribution Channel Insights

Why Did Retail Pharmacies & Drugstores Hold the Largest Share in the Non-sterile Liquids and Suspensions Market?

The retail pharmacies & drugstores segment held a 55% share in the market in 2024. The retail pharmacies & drugstores continue to be the main point of contact when a patient needs prescription and non-prescription liquid form of medicines such as pediatrics, cough syrups, gastrointestinal solutions, and nutritional supplements. The retail pharmacies & drugstores are the link between pharmaceutical manufacturers and retail channels, thus guaranteeing the expansion of the products and lower costs to consumers. Pharmacies associated with the hospital play an important role, especially in the management of chronic diseases, where prescription liquids are sold. As the burden of chronic and infectious diseases increases and the need for conveniently-delivered formulations persists, both retail pharmacies and drugstores will remain sales-dedicated in developed and developing markets.

The e-commerce and direct-to-consumer segment is expected to grow substantially in the non-sterile liquids and suspensions market. The growth in digital adoption, the desire of the market towards convenience, and easy accessibility of OTC non-sterile liquid products online are some of the factors promoting this industry. Cough syrup, immunity-strength tonic, functional drinks, and herbal supplements are increasingly marketed through online drugstores and specialized direct-to-consumer websites. Pediatric drug prescriptions and chronic illness interventions with subscription models are also gaining popularity, and guarantee an uninterrupted supply of high-commodity medication. E-commerce and D2C will emerge as major growth drivers with better logistics, digital health integration, and improved regulatory favourability to the sale of drugs online.

Non-sterile Liquids and Suspensions Market-Value Chain Analysis

- Formulation and Final Dosage Preparation: This is the crucial step to obtain the active pharmaceutical ingredients (APIs) combined to form stable, bioavailable liquid suspensions. Highly sophisticated formulation technologies are employed to address the various therapeutic needs and still achieve safety and regulatory requirements.

Key Players: Catalent Pharma Solutions, Thermo Fisher Scientific (Patheon), Recipharm

- Packaging and Serialization: Good packaging helps maintain product integrity and increases the shelf life. Serialization also includes unique marking codes, which can aid in resisting counterfeiting and make the chain traceable in the supply chain.

Key Players: PCI Pharma Services, Almac Group, Fareva

- Distribution to Hospitals, Pharmacies: Safe distribution would provide the non-sterile liquid medicines to the healthcare providers without altering their quality. Quality transportation partners also observe the best storage conditions and regulatory paperwork to make sure that there is no interruption in the supply of vital medications.

Key Players: Pfizer Inc., Dr. Reddy's Laboratories, Sun Pharmaceutical Industries

Non-sterile Liquids and Suspensions Market Companies

- Catalent Pharma Solutions

- Thermo Fisher Scientific (Patheon)

- Recipharm

- PCI Pharma Services

- Fareva

- Piramal Pharma Solutions

- Aenova Group

- Almac Group

- Jubilant Pharmova (Jubilant Life Sciences)

- SB Pharmco (SB Pharmco Puerto Rico / S. B. Pharma)

- Kindeva Drug Delivery

- Glenmark Pharmaceuticals

- Sun Pharmaceutical Industries

- Dr. Reddy's Laboratories

- Cipla Ltd.

- Aurobindo Pharma

- Teva Pharmaceutical Industries

- Viatris (Mylan legacy)

- Novartis (Sandoz division)

- Pfizer Inc.

Recent Developments

- In March 2025, the FDA approved LIKMEZ (Saptalis Pharmaceuticals), which is a brand of metronidazole which is ready-to-use bicarbonate-free metronidazole oral suspension (500 mg/5 mL) in strawberry-peppermint flavour. Under license, designed and manufactured by Appili Therapeutics and in partnership to market through Kesin Pharma, the formulation will improve patient compliance and reduce risks of compounding, versus the use of tablets.

(Source: https://www.biospace.com) - In February 2025, Jabil Inc. acquired Pharmaceutics International Inc. (Pii), which is a CDMO focusing on oral solid dosage services and aseptic filling services. The acquisition enables Jabil to tighten its biological and pharmaceutical solutions and may determine a redundant zone of liquid dose manufacturing and promote Jabil's competitive status in multifaceted drug development.(Source: http://www.jabil.com)

- In August 2024, VION Biosciences acquired Echelon Biosciences, a global provider of lipid-based excipients. Given that excipients play an important role in liquid dosage forms, e.g., suspensions and emulsions, this acquisition will increase VION's presence in critical formulation products, advance drug delivery systems, and specialty pharmaceutical markets.(Source: https://www.contractpharma.com)

Segments Covered in the Report

By Dosage Form / Product Type

- Oral solutions (clear solutions, syrups, elixirs)

- Oral suspensions (reconstitutable powders / ready-to-use suspensions)

- Topical non-sterile liquids (lotions, liniments)

- Emulsions (oil-in-water, water-in-oil)

- Ophthalmic/otic non-sterile rinses (OTC ear/nasal washes — non-sterile where applicable)

- Mouthwashes / oral rinses (therapeutic and OTC)

By Therapeutic Area / Indication

- Respiratory (cough syrups, pediatric antibiotics)

- CNS & pain (liquid analgesics, antiepileptics)

- Anti-infectives (oral antibiotic suspensions)

- Gastrointestinal (antacids, oral rehydration solutions)

- Dermatological (topical lotions/liniments)

- Nutraceuticals & pediatric nutritional liquids

By User / End Market

- Prescription pharmaceuticals (Rx oral suspensions & solutions)

- OTC/consumer health liquids (cough syrups, OTC analgesic liquids)

- Hospital formularies (bulk/ward-use non-sterile liquids)

- Compounding pharmacies (custom non-sterile preparations)

By Sales / Distribution Channel

- Retail pharmacies & drugstores

- Hospital / institutional procurement

- e-commerce & direct-to-consumer (OTC liquids)

- Wholesalers/specialty distributors

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting