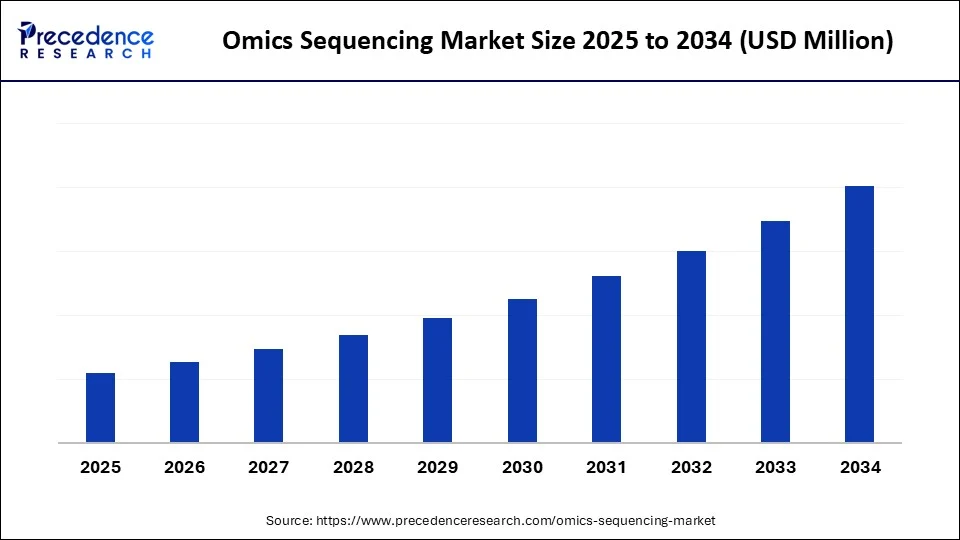

Omics Sequencing Market Size and Forecast 2025 to 2034

The omics sequencing market continues to expand with government funding, biopharma adoption, and innovations in next-generation sequencing platforms. The market is rapidly expanding, driven by advancements in genomics, proteomics, and transcriptomics, enabling precision medicine, drug discovery, and personalized healthcare solutions across diverse clinical and research applications worldwide.

Omics Sequencing Market Key Takeaways

- North America dominated the global market with the largest market share of around 42% in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By technology, the next-generation sequencing segment captured the biggest market share of 55% in 2024.

- By technology, the single-cell sequencing segment is anticipated to show considerable growth over the forecast period.

- By component, the reagents and consumables segment contributed the highest market share of 45% in 2024.

- By component, the software and bioinformatics tools segment is anticipated to show considerable growth over the forecast period.

- By application, the clinical diagnostics segment held the largest market share of 40% in 2024.

- By application, the precision medicine and personalized healthcare segment is anticipated to show considerable growth over the forecast period.

- By end-user, the academic and research institutions segment generated the major market share of 35% in 2024.

- By end-user, the hospitals and clinical laboratories segment is anticipated to show considerable growth over the forecast period.

- By distribution model, the direct sales segment accounted for the significant market share of 50% in 2024.

- By distribution model, the sequencing-as-a-service segment is anticipated to show considerable growth over the forecast period.

How is AI Integration Transforming the Omics Sequencing Market?

The use of artificial intelligence in interpreting and using omics sequencing is changing the way biological data is being interpreted and utilized by fields such as healthcare and life sciences. The synergy enables an international approach to the knowledge of complex biological systems, and this results in breakthroughs in the diagnosis of diseases, in drug discovery, and in the development of therapies. AI promotes more accuracy and faster analysis of huge amounts of sequencing data to allow researchers to switch the descriptive to predictive and prescriptive models of medicine. AI-assisted omics sequencing in the medical field facilitates the use of personalized, predictive, and preventive medicine, which replaces reactive interventions in the treatment process with preventive and proactive health care services.

Market Overview

The omics sequencing market is a high-energy and evolving industry that combines various omics disciplines such as genomics, transcriptomics, proteomics, metabolomics, and epigenomics to offer a full picture of biological systems at the molecular scale. The technologies facilitate a wide range of applications, including precision medicine and biomarker discovery and agriculture, microbiome research, and environmental studies. Declining sequencing prices and increased precision and scalability, omics instruments are becoming more affordable, which is spurring their use in universities, drug development, and healthcare.

The market scope continues to expand rapidly with the rate at which sequencing platforms and ancillary technologies, such as single-cell RNA sequencing (scRNA-seq) and spatial transcriptomics, deliver new insights into gene and tissue biology expression. The use of artificial intelligence and machine learning on big and complicated omics data has significantly enhanced the ability to analyze and interpret omics data, making drug development and precision healthcare findings much faster. Further, a growing government investment and private investments in life sciences research and development, combined with the increased demand for personalized medicine, are driving the market growth.

What Factors Are Fueling the Rapid Expansion of the Omics Sequencing Market?

- New Sequencing Technologies: Single-cell, spatial transcriptomics, and long-read sequencing are shaking up the research frontier of biology. These technologies, cellular heterogeneity, gene regulation, and tissue-specific functions can be researched further.

- AI and Bioinformatics Integration: These capabilities allow processing large and complex sequencing data in an accelerated and more precise way. The AI-powered analytics disclose the hidden trends and biological understandings to enhance the applications in precision medicine, clinical decision support, and therapeutic discovery, which are driving swift adoption and market development.

- Increased Demand in Personalized Medicine:Omics allows treating patients individually by offering specifics on a molecular level and enhancing treatment results, and reducing side effects. Adoption is being propelled by applications in oncology, rare disease, and pharmacogenomics, making personalized medicine one of the primary growth engines of the omics sequencing market.

Market Scope

| Report Coverage | Details |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Component, Application, End-User, Distribution Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Personalized Medicine

One of the primary drivers for the omics sequencing market expansion and particularly in such areas as oncology, rare diseases, and inherited disorders, is the increasing demand for custom medicine. Omics sequencing is the full examination of the genetic, proteomic, and transcriptomic portrait of an individual, as a result of which it is possible to create therapies according to the biological specificity of a person. Personalized medicine increases the effectiveness of treatment, minimizes the adverse drug reaction, as well as improves patient outcomes by tailoring treatment to definite genetic markers and molecular pathways. Omics sequencing is critical in oncology to determine tumor-specific mutations and to identify the most effective targeted therapies. With the move towards precision-based care models in healthcare systems that are progressively taking place across the globe, the need to use omics sequencing as the basis of personalized medicine continues to grow exponentially.

Restraint

High Costs

One of the biggest constraints of the omics sequencing market is the high cost of the technologies and infrastructure of omics sequencing. Omics sequencing requires certain equipment, reagents, consumables, and advanced computational systems to store and process data, which are highly expensive to run. Such an expense barrier restricts the availability of omics sequencing technologies, especially to smaller research institutions, startups, and health systems in developing countries. Also, the fact that sequencing systems and the need to operate them as well as analyze the resulting large datasets require skilled professionals increases the total cost. Such challenges make the omics sequencing more difficult to be universal, which slows its application in clinical practice and reduces its possible usefulness to personalized medicine and translational research despite its disruptive potential.

Opportunity

Technological Advancements

Technological advancements that have made the omics sequencing market enormously efficient, less expensive, and more broadly applicable have immense growth potential. The accessibility of breakthroughs in high-throughput systems, in particular, the NGS and long-read sequencing, has redefined the possibility of generating massive amounts of genomic and transcriptomic data with greater accuracy and speed. New technologies such as single-cell omics and spatial omics are other technologies that are transforming the landscape by providing highly detailed information regarding cellular heterogeneity, tissue-specific interaction, and disease progression at a molecular scale. As the adoption rate increases with higher scalability and lower costs of sequencing, technological innovation will become a significant opportunity driver in the global omics sequencing landscape.

Technology Insights

Which Technology Dominated the Omics Sequencing Market in 2024?

The next-generation sequencing segment led the market in 2024. The NGS technology changed the landscape of biological research in the sense that it enables the sequencing of millions of fragments of DNA or RNA in parallel, providing deep insights into genomes, transcriptomes, epigenomes, and metagenomes. NGS has emerged as a foundation in precision medicine and especially in the fields of oncology and the study of rare genetic disorders, by allowing the discovery of genetic variations and molecular processes more rapidly. The adoption of sequencing in academic institutions, clinical laboratories, and pharmaceutical companies is further stimulated by continuous advances in the accuracy of sequencing, the length of reads, and affordability. With robust genomics investments and healthcare innovation, NGS still reigns at the top of the sequencing technology as the most utilized and revolutionary.

The single-cell sequencing segment is expected to grow at a significant CAGR over the forecast period, due to its ability to provide molecular information on the single-cell level. The technology enables the simultaneous analysis of the genome, transcriptome, and proteome of a cell to generate single-cell multimodal omics to provide a more holistic view of cellular functions and interactions. It was particularly used in cancer, immunology, and neuroscience research where cellular diversity constitutes a major component of disease processes and reaction to therapy. Single-cell sequencing promotes the breakthroughs of personalized medicine and targeted therapies by identifying the rare cell types and tracing the evolution of cells.

Component Insights

Why Did the Reagents and Consumables Segment Dominate the Omics Sequencing Market?

The reagents and consumables segment held a 45% share in the market in 2024, because of its vital position in the sequencing workflow. Omics sequencing uses a wide range of consumables, which are needed at every stage, including library preparation kits, enzymes, primers, buffers, and sequencing chips, and includes data output. The accuracy, reproducibility, and throughput of sequencing experiments in genomics, transcriptomics, epigenomics, and metagenomics depend directly on these factors. The demands to acquire high-quality reagents are only growing with the broader application of omics sequencing to precision medicine, to drug discovery, and microbiome studies. Also, reagent chemistry and kit development innovations are enhancing workflow performance and minimizing sequencing error, further consolidating the market leadership of this segment.

The software and bioinformatics tools segment is expected to grow substantially in the omics sequencing market. Multi-layered biological data being produced by omics sequencing is complex data demanding advanced computational solutions to integrate, visualize, and interpret. The bioinformatics tools assist researchers in mapping genes, discovering regulatory networks, and understanding disease mechanisms with a higher degree of accuracy. This growing use of artificial intelligence and machine learning further expands this segment, making it possible to predict by modeling and discover biomarkers, and integrate multi-omics to obtain further biological understanding. As the role of big data analytics in health care and life science continues to increase, software and bioinformatics products are emerging as essential.

Application Insights

Why does the Clinical Diagnostics Segment Dominate the Omics Sequencing Market?

The clinical diagnostics segment led the market in 2024, due to its transformative service in disease diagnosis, surveillance, and treatment strategy. Omics sequencing is, unlike traditional diagnostics, a comprehensive way to get multiple layers of molecular-level insight, as it can be used to analyze several different layers of omics, including genomics, transcriptomics, proteomics, and metabolomics. The technique enables clinicians to identify the mechanisms of diseases, genetic mutations, and biomarkers more precisely and more accurately. It has been applied to oncology, rare genetic diseases, diagnostics of infectious diseases, and chronic diseases, where omics sequencing can help in earlier diagnosis and a more successful response to treatment. The use of omics-based tests in the healthcare sector has been further promoted by the increasing use of next-generation sequencing systems in clinical labs, coupled with regulatory approvals to use such systems in healthcare.

The precision medicine and personalized healthcare segment is expected to grow at a significant CAGR over the forecast period, influenced by the rising demand for customized medical solutions. Omics sequencing combined with multi-omics integration enables in-depth mapping of the molecular composition of an individual, offering practical insight into the predisposition to disease, drug response, and the best treatment methods. Such a tailored strategy is especially effective in cancer care, where tumor-specific mutations are being used to generate targeted therapies that are enhancing patient outcomes and survival. The integration of omics data with bioinformatics, artificial intelligence, and clinical records further enhances predictive modeling and treatment personalization. It is the fastest-growing use in the omics sequencing market due to its potential to revolutionize the care of patients and increase the effectiveness of treatment.

End-User Insights

Why does the Academic and Research Institutions Segment Lead the Omics Sequencing Market?

The academic and research institutions segment held around a 35% share in the market in 2024. These centers are essential in the development of basic findings in the fields of genomics, transcriptomics, proteomics, and metabolomics. They are not clinical or pharmaceutical users, but rather interested in the exploration of new scientific questions, new sequencing technologies, and the multi-omics integration of the data to understand biological complexity. Higher education institutions tend to be at the frontline of the new research, with Governmental and other funding that enhances the advancement in technology and the spread of applications. They also produce the large data sets necessary to optimize bioinformatics software and AI systems that run sequencing analysis.

The hospitals and clinical laboratories segment is expected to grow substantially in the omics sequencing market, due to the increasing need for tailored healthcare solutions, as well as better diagnostics. Omics sequencing provides these end-users with a comprehensive understanding of the molecules and allows the detection of the disease, prognosis, and treatment strategies to be specific. Its implication is especially revolutionary in oncology, rare genetic diseases, as well as infectious diseases, where early and correct diagnosis is important. The integration of genomics, proteomics, and metabolomics findings has made clinical laboratories stop being confined to standard diagnostics and transition to multi-omics analysis that may illuminate complex disease mechanisms. This growing clinical utility and direct effect on patient outcomes make hospitals and clinical laboratories the fastest-growing end-user segment of the market.

Distribution Model Insights

Why Did the Direct Sales Segment Lead the Omics Sequencing Market in 2024?

The direct sales segment led the market in 2024, due to its ability to provide manufacturers with direct access to end-users, such as research institutions, pharmaceutical companies, and diagnostic labs, as well as enabling it to build long-term relationships. This model allows closer management of the pricing, branding, and customer support, which is extremely important in a highly specialized market where trust, technical advice, and product personalization are extremely important factors. Close contact also enables the manufacturers to have real-time knowledge about the customer needs and emerging trends that will assist them in designing solutions and promoting innovation. The direct sales model will continue to play a central role in the development of credibility, entry into long-term contracts, and adoption of sequencing technologies, hence ensuring its dominant market share.

The sequencing-as-a-service segment is expected to grow at a significant CAGR over the forecast period, due to the demand to have cost-effective, easy, and scalable sequencing products. Out of the expectation to spend a lot of money on buying equipment, reagents, and highly skilled personnel, the institutions can outsource their sequencing workflows to service providers that have advanced infrastructure. This business model is especially attractive to small laboratories, hospitals, and start-ups with budget limitations but with research and clinical sequencing needs based on the state of the art. Centralization of resources and expertise provides Seq-as-a-Service with reduced barriers to entry, with access to high-throughput sequencing and bioinformatics. This model is the most rapidly expanding mode of distribution as it is scalable, can reduce initial expenditure, and is flexible, and it is transforming how organizations use and obtain omics sequencing technologies.

Region Insights

Why Did North America Lead the Global Omics Sequencing Market?

North America led the global market with the highest share of 42% in 2024, due to the extensive funding in the life sciences, the presence of a well-developed research infrastructure, and the suitable policy environment. The region has a strong biotechnology ecosystem that consists of the top academic institutions, research organizations, and internationally known pharmaceutical and biotech enterprises. Additionally, adoption has been reinforced through government-led programs like large-scale funding programs, research grants, and national-level precision medicine projects. The presence of collaborations between academia, hospitals, and private players also contributes to the leadership status of the region.

The U.S. leads the omics sequencing market by virtue of its supreme R&D spending, ecosystem, robust regulatory environment, and funding. The well-established healthcare infrastructure also allows a quick clinical integration of omics sequencing in diagnostic and treatment plan testing, in the fields of oncology, infectious diseases, and inherited diseases. Existing robust venture capital financing, strategic collaborations between biotech companies and academic establishments, and a culture of innovation all keep the U.S. on top of global omics sequencing developments.

Why is Asia Pacific undergoing the Fastest Growth in the Omics Sequencing Market?

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period, which is supported by the increase in the need for precision medicine, the rising rate of chronic diseases, coupled with intense efforts by government policies to enhance genomic research. Next-generation sequencing, single-cell multi-omics, and spatial omics technologies are rapidly being adopted in the region in healthcare, agriculture, and environmental research. Japan, India, South Korea, and Australia are investing in infrastructure and research to support omics, and are also developing academic-industry partnerships to hasten innovation. Moreover, the genomics-friendly startups and expanding sequencing service providers are increasing in the region, which is also contributing to the robust ecosystem.

China plays a central role in the market of the omics sequencing of the Asia Pacific, which is explained by the massive government programs, great investment in genomics, and its intentions to become a global leader in life sciences. New programs like the China precision medicine initiative and extensive investments in national sequencing projects are speeding up the discovery of new uses of cancer genomics, population genetics, and infectious disease surveillance. Also, the increasing healthcare reforms in China are driving clinical uptake of oncology, reproductive, and rare disease omics sequencing in hospitals and diagnostic centers.

Value Chain Analysis

- Research and Development (R&D)

Omics sequencing is at the forefront of R&D early-stage development, allowing the discovery of genes, the molecular profiling of samples, and the identification of new biomarkers. It hastens the discovery of disease pathways and aids in the creation of precision medicine.

Key Players: 10x Genomics, Illumina, PacBio, Oxford Nanopore, Agilent, Bio-Rad, Bruker, NEB, Takara Bio, Promega

- Packaging and Serialization

Omics sequencing has an indirect effect on packaging with verified diagnostic kits and panels. Meeting the requirements of global serialization standards makes sequencing-based products processed safely to facilitate integrity and traceability in clinical usage.

Key Players: QIAGEN, Thermo Fisher Scientific, Roche Diagnostics

- Distribution to Hospitals and Pharmacies

Sequencing platforms, consumables, and diagnostic panels are sold all over the world to hospitals, clinical labs, and research institutes. This means that there is timely delivery of omics technologies to diagnostics, drug development, and patient treatment.

Key Players: Illumina, Thermo Fisher Scientific, QIAGEN, Roche, BGI Group

- Patient Support and Service

Omics sequencing assists the patients with the help of specific diagnostics, oncology analyses, and individual treatment routes. It allows constant observation of patients, therapy optimization, and incorporation in clinical decision-making.

Key Players: Roche, QIAGEN, Illumina, Oxford Nanopore, Eurofins, Novogene

Omics Sequencing Market Companies

- 10x Genomics

- Agilent Technologies

- BGI Group/MGI Tech Co.

- Bio-Rad Laboratories

- Bruker

- Danaher Corporation

- Eurofins Scientific

- F. Hoffmann-La Roche Ltd.

- Illumina

- LGC Limited

- Merck KGaA

- New England Biolabs

- Novogene Co., Ltd.

- Oxford Nanopore Technologies plc

- Pacific Biosciences (PacBio)

- PerkinElmer

- Promega Corporation

- QIAGEN

- Takara Bio Inc.

- Thermo Fisher Scientific

Recent Developments

- In June 2025, BioAro introduced PanOmiQ Research, an AI-based multi-omics platform with a combination of genomics, proteomics, and transcriptomics, used in drug discovery. With multilingual clinical reporting and a beta deep drug discovery module, it is the first global, large-scale, omics-to-therapeutics system, which speeds up personalized medicine and predictive health care applications.(Source: https://firstwordpharma.com)

- In April 2025, Singapore released the Singapore Nanopore Expression (SG-NEx) dataset, which is one of the largest long-read RNA sequencing datasets, consisting of more than 750 million RNA reads in 14 human cell types. This breakthrough solves bottlenecks of RNA complexity, which is now able to provide more specific disease research, next-generation diagnostics, and innovative therapeutic development. (Source: https://www.a-star.edu.sg)

- In February 2025, Illumina, Inc. unveiled its largest suite of omics offerings, including genomics, spatial transcriptomics, single-cell analysis, CRISPR, epigenetics, and enhanced data analytics software. These inventions are a well-developed sequencing platform of Illumina, outperforming the industry in terms of accuracy, magnitude, and dependability, enabling researchers to discover the processes of diseases and speed up the creation of drugs.(Source: https://investor.illumina.com)

Segment Covered in the Report

By Technology

- Next-Generation Sequencing (NGS)

- Whole Genome Sequencing (WGS)

- Whole Exome Sequencing (WES)

- RNA Sequencing (Transcriptomics)

- Single-Cell Sequencing

- Epigenomic Sequencing

- Proteomics and Metabolomics Sequencing

- Sanger Sequencing (legacy use)

By Component

- Instruments and Sequencing Platforms

- Reagents and Consumables

- Software and Bioinformatics Tools

- Sequencing Services

By Application

- Clinical Diagnostics (cancer, rare diseases, infectious diseases)

- Drug Discovery and Development

- Precision Medicine and Personalized Healthcare

- Agricultural and Plant Genomics

- Microbiome and Metagenomics

- Forensics and Veterinary Genomics

- Academic and Research Studies

By End-User

- Academic and Research Institutions

- Hospitals and Clinical Laboratories

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations (CROs)

- Agriculture and Environmental Research Centers

By Distribution Model

- Direct Sales (manufacturers to labs and institutions)

- Distributors and Value-Added Resellers

- Sequencing-as-a-Service (outsourced labs and genomics service providers)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting