What is the Oven-Controlled Crystal Oscillator (OCXO) Market Size?

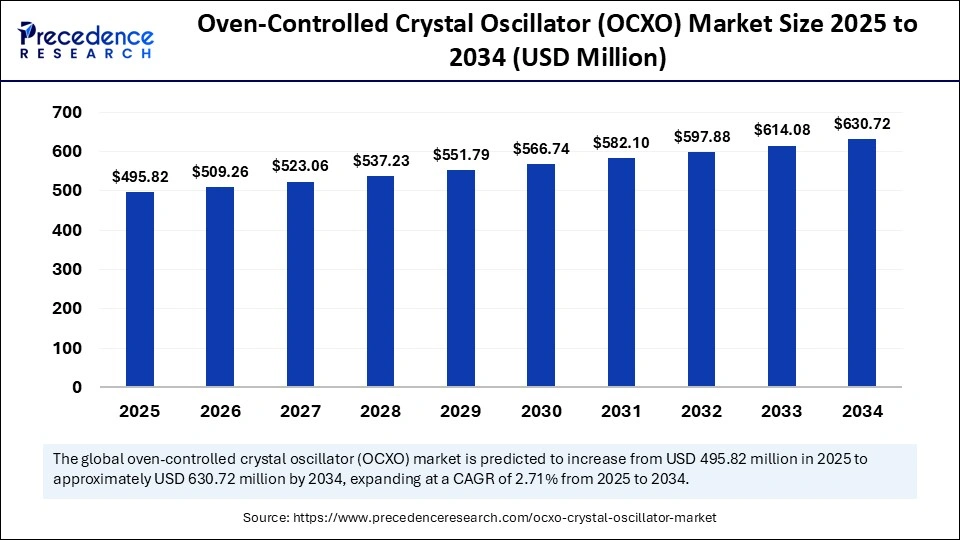

The global oven-controlled crystal oscillator (OCXO) market size is calculated at USD 495.82 million in 2025 and is predicted to increase from USD 509.26 million in 2026 to approximately USD 630.72 million by 2034, expanding at a CAGR of 2.71% from 2025 to 2034. The market is driven by rising demand for precision frequency control in telecom, aerospace, and advanced electronic systems.

Market Highlights

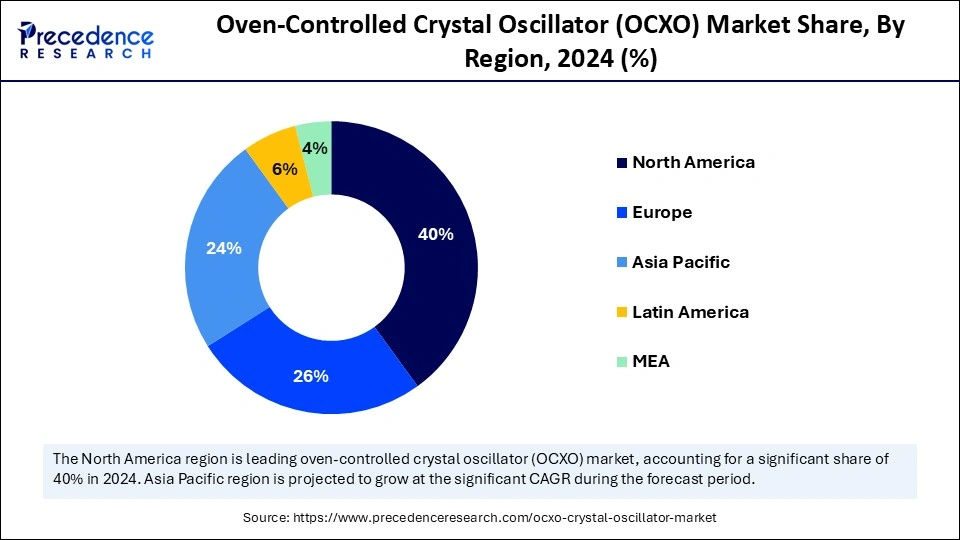

- North America led the global oven-controlled crystal oscillator (OCXO) market with approximate 40% of market share in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

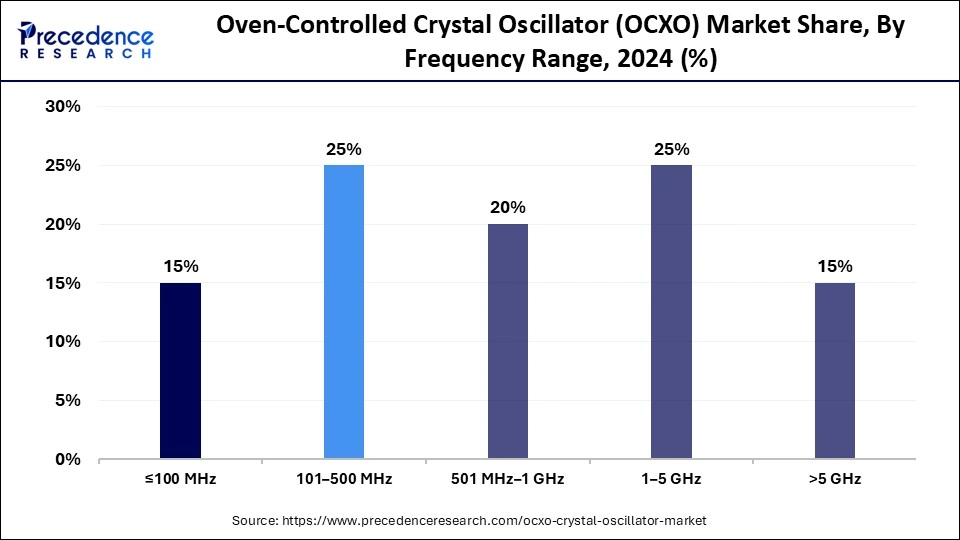

- By frequency range, the 1–5 GHz segment held the major market share of 25% in 2024.

- By frequency range, the >5 GHz segment is expected to grow at a solid CAGR between 2025 and 2034.

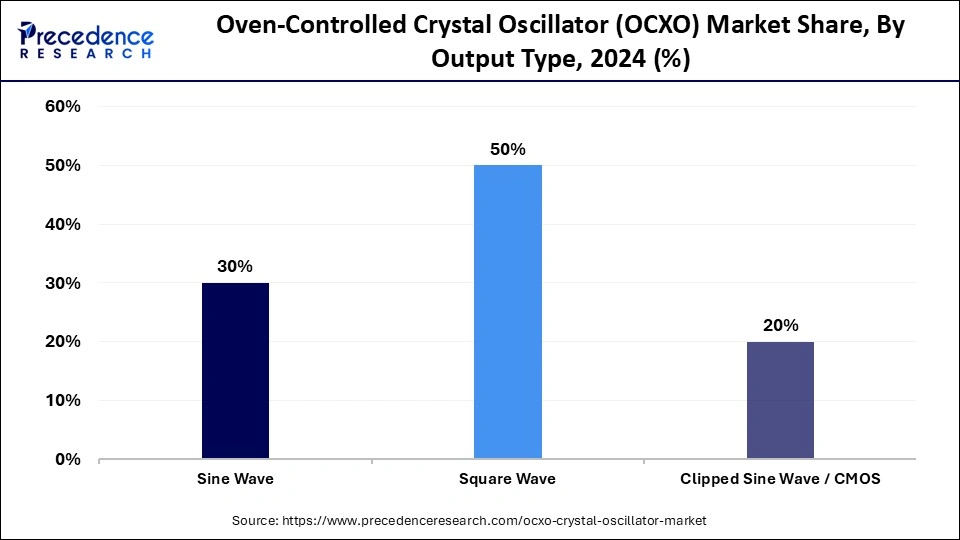

- By output type, the sine wave segment captured more than 30% of market share in 2024.

- By output type, the clipped sine wave / CMOS segment is expanding at a notable CAGR between 2025 and 2034.

- By stability, the ±0.5 ppm segment captured a 25% share of the market in 2024.

- By stability, the ±1 ppm or higher segment is expected to grow at the highest CAGR between 2025 and 2034.

- By application, the telecommunications segment contributed the largest market share of 28% in 2024.

- By application, the industrial and automation segment is growing at the fastest CAGR from 2025 to 2034.

- By end-user / customer, the telecom & network operators segment captured a 35% market share in 2024.

- By end-user / customer, the industrial automation & manufacturing segment is expected to expand at a significant CAGR from 2025 to 2034.

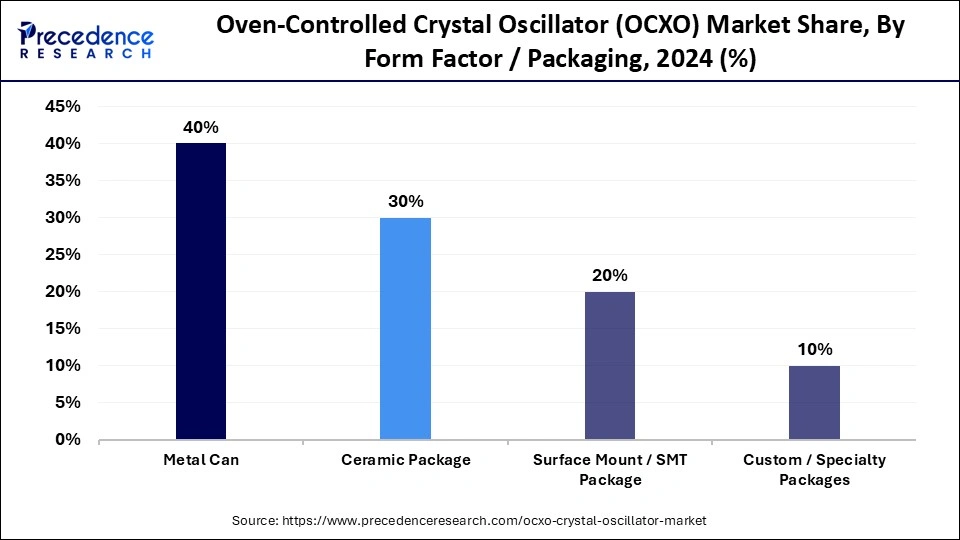

- By form factor / packaging, the metal can segment generated the biggest market share of 40% in 2024.

- By form factor / packaging, the surface mount / SMT package segment is expected to expand at the fastest CAGR from 2025 to 2034.

Emerging Growth Patterns in the Oven-Controlled Crystal Oscillator Industry

The oven-controlled crystal oscillator (OCXO) market is growing due to increased demand for high-frequency stability in telecommunications, military, and aerospace industries. OCXOs, like other crystal oscillators, use a crystal kept in a temperature-controlled oven to stabilize it and maintain a constant frequency under varying environmental conditions. An Oven-Controlled Crystal Oscillator (OCXO) is a high-precision electronic oscillator in which a quartz crystal is kept at a constant elevated temperature inside an internal oven.

The continued growth of the market has been supported by increased deployment of 5G networks and innovations in satellite communications. In various industries, there is also a growing focus on fast, reliable synchronization of timing functions provided by OCXOs, which offer high reliability, low phase noise, and long-term stability.

Key Technological Shifts in the Oven-Controlled Crystal Oscillator (OCXO) Market

- The oven-controlled crystal oscillator (OCXO) market is experiencing a major shift due to advancements in precision electronics and the integration of artificial intelligence (AI). The latest generation of OCXO devices features temperature-compensating algorithms and compact oven designs to enhance frequency stability while reducing power consumption. These improvements allow OCXOs to operate in smaller, more energy-efficient packages, meeting the growing needs and demands in aerospace and communication sectors.

- Through AI integration, the market is being transformed by predictive performance tuning and real-time calibration. Using AI-enabled electronics that offer monitoring, manufacturers can track temperature changes, frequency drift, component wear, and other data to assess and maintain signal accuracy. The combination of AI with performance materials is advancing OCXOs toward smarter, self-correcting technology that will become a key component for future 5G infrastructure, defense electronics, or autonomous systems.

- In January 2025, Epson introduced its new oven-controlled crystal oscillator (OCXO) model "OG7050CAN," offering 56% lower power consumption and 85% smaller size compared to the previous OG1409 series, featuring a redesigned rectangular SC-cut crystal unit and digital temperature control.

Oven-Controlled Crystal Oscillator (OCXO) MarketOutlook

The market for oven-controlled crystal oscillator is experiencing significant growth, driven by rising demand for ultra-high frequency stability in 5G, aerospace, and satellite communications. Continuous R&D in thermal control, resonator materials, and miniaturization is enhancing performance efficiency, unlocking new opportunities across precision timing applications.

Emerging research suggests that maintaining ambient temperature fluctuations below 10 mK is necessary to achieve flicker-noise-limited performance. For instance, a 10 MHz OCXO with such thermal stability achieved an Allan deviation of ~10⻹³ at 100 seconds. As a result, R&D investments are intensifying in areas like thermal control, advanced packaging, resonator materials, and phase-noise optimization.

While direct OCXO-specific investments are rarely disclosed, there is growing investment in frequency-control technologies that underpin synchronization for defense, aerospace, and telecom infrastructure. Notably, design enhancements in 10 MHz ovens have yielded a tenfold performance improvement, signaling future capital inflows toward OCXO-focused innovation.

The escalating demand for high-frequency stability in 5G networks and digital radar systems is a primary growth driver. OCXOs are preferred for their superior phase noise characteristics and reliability under dynamic environmental conditions.

Despite technical advantages, high manufacturing and maintenance costs limit OCXO adoption in cost-sensitive applications. These oscillators require precise temperature control and specialized calibration, which increase production complexity and overall cost of ownership.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 495.82 Million |

| Market Size in 2026 | USD 509.26 Million |

| Market Size by 2034 | USD 630.72 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 2.71% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Frequency Range, Output Type, Stability, Application, End-User / Customer Segment, Form Factor / Packaging, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Oven-Controlled Crystal Oscillator (OCXO) Market Segment Insights

Frequency Range Insights

The 1–5 GHz segment held the largest share of 25% in 2024, primarily because it is extensively used for high-precision communication and navigation systems. This frequency range is preferred over others for advanced radar, satellite communication, and telecom base stations where ultra-low phase noise and high frequency stability are essential. This type of OCXO offers reliable performance across various environmental conditions and is increasingly vital for 5G infrastructure and aerospace applications that depend on high speeds and reliability.

The >5 GHz segment is expected to grow at the fastest rate in the coming years due to increased adoption of next-generation wireless systems and defense. This segment is rapidly expanding because of the rising demand for millimeter-wave technology for the next-generation 5G networks, advanced radar (for imaging), and satellite-based communication systems. The higher frequency OCXO will enhance signal precision and bandwidth efficiency for demanding applications, supporting the needs of upgraded high-speed data collection and sensing for aerospace, defense, and high-frequency testing equipment (e.g., signal generators, communications testing in labs).

Output Type Insights

The sine wave segment held around a 30% market share in 2024. This is primarily because of its high signal purity and low phase noise. Sine wave OCXOs are widely used in telecommunications, aerospace, and precision measurement devices, where a clean and software-controlled frequency output is essential for accurate data transfer and synchronization. The smoothness of the sine wave minimizes harmonic distortion, making it suitable for applications like base stations, radar systems, and advanced testing equipment.

The clipped sine wave / CMOS segment is expected to grow at the fastest CAGR during the forecast period, due to its compatibility with digital systems and low power consumption. OCXOs that output a clipped sine wave or CMOS are increasingly used in compact and portable electronic devices, such as IoT modules, network equipment, and embedded systems. The high performance, small size, and cost-effective manufacturing of these OCXOs create opportunities for modern system designs that need energy-efficient, stable frequency control in smaller, digital-focused applications.

Stability Insights

The ±0.5 ppm segment held about 25% of the market share in 2024 due to its balanced performance in stability and cost. OCXOs in the ±0.5 ppm range are widely used in sectors such as telecom, defense, and test equipment, where maintaining a reliable, stable frequency (or frequency output) under temperature changes and varying environmental conditions is necessary. This guarantees repeatable accuracy for applications like network timing, radar, and GPS, where precision is essential.

The ±1 ppm or higher segment is expected to grow at the fastest rate in the upcoming period. This is mainly driven by demand for affordable yet reliable oscillators in emerging industrial and automation sectors. In these applications, the ±1 ppm or higher stable output OCXO will deliver sufficient performance for non-critical or medium-precision uses, while also offering efficiency and cost advantages. The increasing use of OCXOs in IoT infrastructure, smart manufacturing, and portable instruments is significantly boosting wide-scale OCXO adoption across many cost-sensitive electronic designs.

Application Insights

The telecommunications segment led the oven-controlled crystal oscillator (OCXO) market with a 28% share in 2024, as OCXOs are essential for providing frequency stability and synchronization in networks. OCXOs are commonly used in base stations, repeaters, and satellite communication systems for timing and signal integrity. The global expansion of 5G networks and fiber-optic communications has further increased demand for high-stability oscillators to transmit data quickly and accurately without drifting in telecommunications infrastructure.

The industrial & automation segment is expected to grow the fastest during the projection period due to increased use of robotics, process automation, and smart manufacturing. OCXOs are being increasingly used in industrial control systems, robotics, and monitoring equipment to ensure reliable frequency control, even in changing environmental conditions. Additionally, the rise of Industry 4.0 and connected factory systems is driving demand for durable, compact oscillators that can maintain their accuracy and support operational performance in complex automated systems.

End-User Insights

The telecom & network operators segment held a 35% market share in 2024. This growth is mainly driven by the increasing demand for OCXOs, primarily due to ongoing operational support for network synchronization and signal integrity. OCXOs are widely used across mobile and broadband infrastructures such as 4G and 5G-TDD base stations, repeaters, and optical networks. Reliable frequency stability ensures power outage prevention and guarantees uninterrupted, high-quality communications, high-speed data transfer, low latency without drops, and reduced jitter, allowing broadband internet service providers (ISPs) to deliver consistent, high-quality network performance.

The industrial automation & manufacturing sector is projected to grow at the fastest rate during the forecast period. Increasing adoption of robotics, smart factories, and industrial control systems has driven this growth. OCXOs will offer a stable frequency reference for precision machinery, industrial monitoring systems, and automated production lines. As industries embrace IoT and real-time control technologies, the accuracy and reliability of oscillators enhance efficiency, reduce downtime, and improve process control in increasingly fast-paced manufacturing environments.

Form Factor / Packaging Insights

The metal can segment dominated the market with a 40% share in 2024 due to its superior thermal stability, durability, and shielding capabilities against electromagnetic interference. Metal enclosures provide an ideal environment for maintaining precise temperature control, which is crucial for achieving high frequency stability in precision timing applications. Additionally, their robustness and reliability make them the preferred choice across aerospace, defense, and telecommunications sectors, where performance consistency is critical.

The surface mount / SMT packages segment is expected to grow at a significant CAGR in the coming years due to its compact form factor, ease of integration, and suitability for automated manufacturing processes. SMT packages enable high-density circuit designs and efficient thermal management, meeting the growing demand for miniaturized, power-efficient electronic systems. Their adaptability to modern PCB layouts and reliability under harsh environmental conditions make them ideal for telecom, aerospace, and precision instrumentation applications.

Oven-Controlled Crystal Oscillator (OCXO) MarketRegional Insights

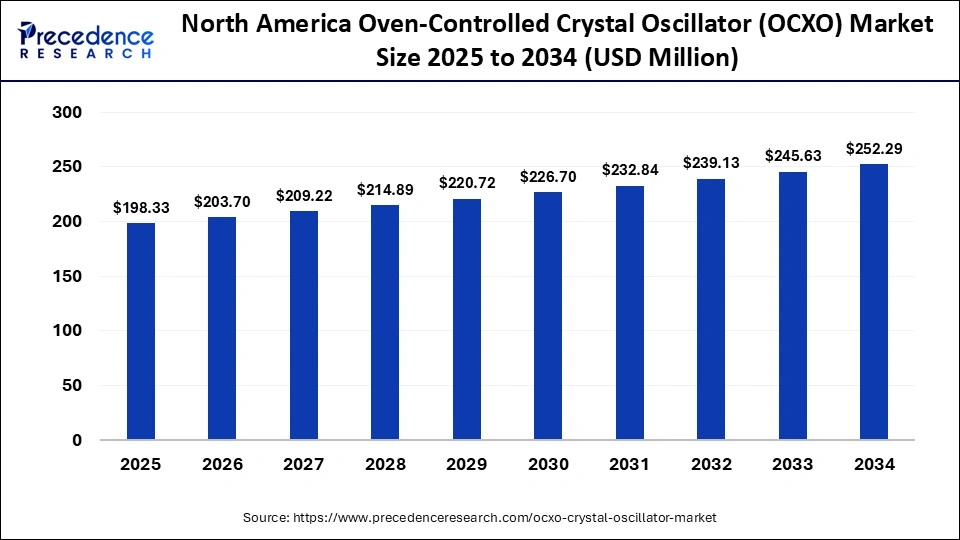

The North America oven-controlled crystal oscillator (ocxo) market size is estimated at USD 198.33 million in 2025 and is projected to reach approximately USD 252.29 million by 2034, with a 2.71% CAGR from 2025 to 2034.

What Made North America a Leading Force in the Oven-Controlled Crystal Oscillator (OCXO) Market?

North America dominated the market with the largest share of 40% in 2024. This is mainly due to a strong demand for OCXOs in the region, driven by significant hyperscale data center investments, advanced telecom timing requirements, and robust defense and aerospace programs that demand highly stable and rugged oscillators. The expansion of hyperscalers into AI and cloud infrastructure is further accelerating the need for reliable timing and holdover solutions at scale. Additionally, telecom and cloud operators are increasingly adopting high-stability local oscillators to ensure service reliability and resilience against GNSS signal disruptions.

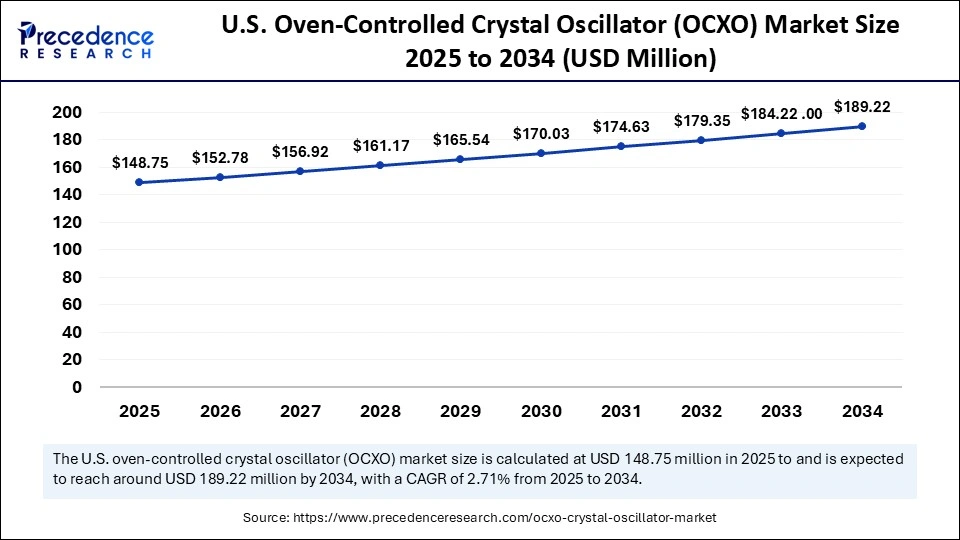

The U.S. oven-controlled crystal oscillator (ocxo) market size is calculated at USD 148.75 million in 2025 and is expected to reach nearly USD 189.22 million in 2034, accelerating at a strong CAGR of 2.71% between 2025 and 2034.

U.S. Market Trends

The U.S. remains the core hub for hyperscale data center expansion, advanced telecom upgrades, and substantial defense R&D investment, all of which drive demand for OCXOs. The surge in data center construction and hyperscale investment has triggered a new procurement cycle focused on resilient, high-precision timing solutions for both edge and core applications. Concurrently, U.S. defense SBIR programs and procurement initiatives are emphasizing next-generation quartz and OCXO technologies, driving demand for qualified domestic supply partners. The presence of a robust local supply chain, including leading timing component manufacturers and distributors, further accelerates product qualification and customization for aerospace, telecom, and data center applications.

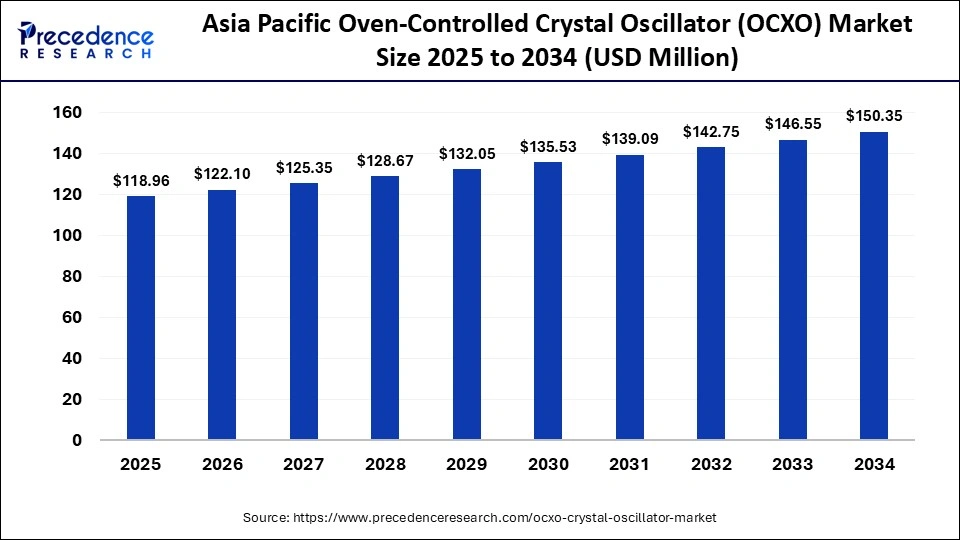

The Asia Pacific oven-controlled crystal oscillator (ocxo) market size is expected to be worth USD 150.35 million by 2034, increasing from USD 118.96 million by 2025, growing at a CAGR of 2.64% from 2025 to 2034.

Why is Asia Pacific Considered the Fastest-Growing Area in the Oven-Controlled Crystal Oscillator (OCXO) Market?

Asia Pacific is expected to experience the fastest growth in the upcoming period, driven by rapid telecommunications expansion, aggressive 5G and 5G-Advanced deployments, and a strong local electronics manufacturing base. Extensive operator network buildouts are increasing the number of base stations and edge nodes requiring high-precision holdover oscillators, while demand from satellite, transport, and industrial automation sectors is fueling adjacent market growth. Simultaneously, APAC foundries and component manufacturers are advancing miniaturization and power optimization of OCXOs, enabling integration into power-constrained radio and IoT devices, a key accelerant for regional market expansion.

China Oven-Controlled Crystal Oscillator (OCXO) Market Analysis

China's extensive network expansion, encompassing millions of 5G sites and aggressive 5G-Advanced pilots, is driving immediate, large-volume demand for holdover and disciplined oscillators across radio and edge infrastructure. Government initiatives and operator capital expenditures (as outlined in MIIT updates and carrier roadmaps) are accelerating both coverage and densification, thereby boosting procurement of compact, low-power OCXOs for remote sites and backhaul systems. Furthermore, local OEMs and module suppliers are increasingly integrating new low-power OCXO form factors aligned with national carrier specifications, which in turn reduces lead times and unit costs for regionally sourced deployments.

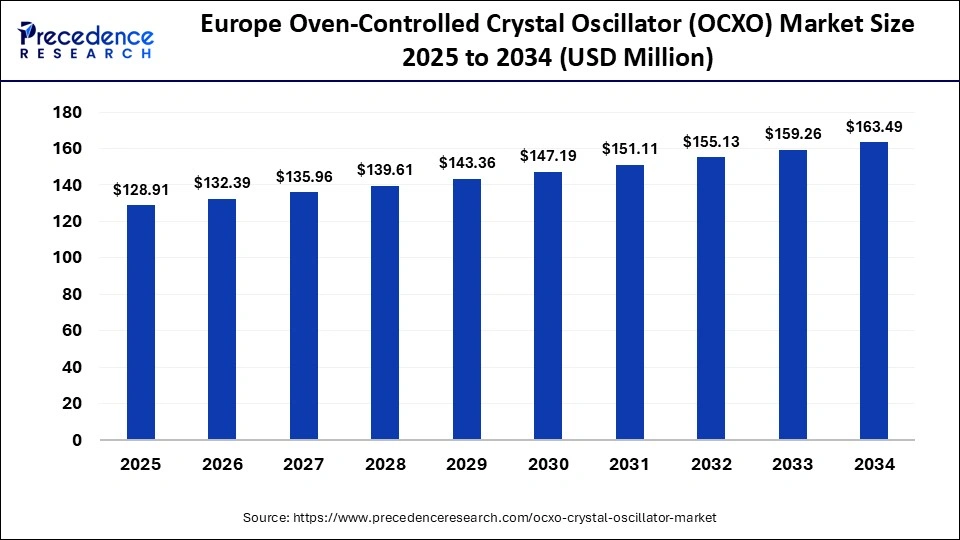

The Europe oven-controlled crystal oscillator (ocxo) market size has grown strongly in recent years. It will grow from USD 128.91 million in 2025 to USD 163.49 million in 2034, expanding at a compound annual growth rate (CAGR) of 2.68% between 2025 and 2034.

What Drives the Growth of the Oven-Controlled Crystal Oscillator (OCXO) Market in Europe?

The market in Europe is growing at a notable rate due to the modernization of telecom infrastructure, advancements in satellite navigation, and the rising integration of precision timing in industrial automation. The region's focus on secure and synchronized communication systems for aerospace and defense applications continues to sustain steady OCXO demand. Moreover, EU-backed initiatives promoting energy-efficient and smart manufacturing are accelerating the adoption of compact, temperature-stable oscillators in complex industrial control and monitoring systems, ensuring highly reliable timing performance across modern European industries.

Germany Oven-Controlled Crystal Oscillator (OCXO) Market Trends

Germany continues to lead the European oven-controlled crystal oscillator (OCXO) market, driven by its strong foundation in industrial automation, automotive electronics, and advanced communication technologies. The country's aerospace and defense programs are further propelling demand for OCXO devices that require exceptional frequency stability and environmental resilience. In addition, significant investments in 5G infrastructure and collaborations between regional manufacturers and research institutions are reinforcing Germany's position as a hub for OCXO development and deployment across high-performance applications.

The Middle East saw notable growth in the oven-controlled crystal oscillator (OCXO) market in 2024, supported by major advancements in telecommunications, aerospace, and industrial technology. The region's aggressive expansion of 5G and exploration of 6G connectivity has significantly increased demand for ultra-stable timing components, such as OCXOs. For instance, in 2024, the UAE conducted the Middle East's first 6G trial, reaching record data transmission speeds, according to the Times of India. Such developments require highly precise frequency control technologies to ensure reliable synchronization in next-generation communication networks.

Regional investments in space technology have expanded rapidly, with the UAE Space Agency announcing progress in 2025 on the Arab Satellite 813 program, a cooperative satellite initiative aimed at enhancing earth observation capabilities. These advancements, combined with broader initiatives to modernize oil and gas monitoring systems and industrial automation infrastructure, have accelerated the use of OCXOs for their temperature stability, reliability, and precision across critical applications.

U.A.E. Market Analysis

In the United Arab Emirates, demand for oven-controlled crystal oscillators continued to grow in 2024 as the nation strengthened its position as a regional hub for high-tech innovation, telecommunications, and aerospace. The UAE government's push for digital transformation and smart-city integration has driven significant investment in precision timing systems for communication networks, autonomous technologies, and defense applications. In 2025, Khaleej Times reported that the UAE launched its first official national time-reference clock based on atomic standards, highlighting the country's commitment to time accuracy and synchronization across digital infrastructure.

The UAE's growing satellite and space manufacturing capabilities, illustrated by Space42's announcement in 2025 to build a synthetic aperture radar (SAR) satellite facility, have boosted demand for ruggedized OCXOs suited to aerospace environments. With continued emphasis on cutting-edge telecommunications, aerospace, and industrial automation projects, the UAE has become one of the most technologically progressive markets for precision oscillator systems in the Middle East.

Oven-Controlled Crystal Oscillator (OCXO) Market Value Chain

Suppliers provide essential inputs such as quartz crystal blanks, ceramic packages, temperature sensors, capacitors, and high-stability, low-noise ICs. These materials are quality-verified, traceable, and often sampled before procurement to ensure reliability. Component costs directly influence overall product pricing and margins.

Manufacturers focus on precision oven designs, crystal cuts, and control firmware, developing and testing R&D processes to minimize phase noise and frequency drift while optimizing yield. This stage enables product differentiation through superior performance and reliability.

The fabrication process involves precise construction of the oven or chamber, crystal trimming, assembly, and sealing within controlled clean-room environments. Rigorous process control ensures consistent product performance, yield, and compliance with military or telecom specifications.

Completed units undergo environmental, vibration, accelerated-aging, and phase-noise testing to validate performance. Certifications and detailed test reports serve as key differentiators, instilling customer confidence, though they may increase costs and delivery lead times.

Distributors supply aerospace, defense, and telecommunications markets with specialized OCXO products. Value-added services such as repair, calibration, and technical support enhance product lifespan and reliability, further distinguishing manufacturers in high-reliability segments.

Oven-Controlled Crystal Oscillator (OCXO) Market Companies

Corporate Information

- Headquarters: Chandler, Arizona, United States

- Year Founded: 1989

- Ownership Type: Publicly Traded (NASDAQ: MCHP)

History and Background

Microchip Technology Inc. was established in 1989 following a spinoff from General Instrument’s microelectronics division. The company has evolved into a leading provider of microcontroller, analog, mixed-signal, and timing semiconductor solutions. Over the past three decades, Microchip has grown through both organic development and a series of strategic acquisitions, including Microsemi, Atmel, and Supertex, expanding its product portfolio and global reach.

Microchip’s timing and synchronization business has become a key segment, supplying oscillators, clock generators, and precision timing solutions for aerospace, communications, industrial, and data center applications.

Key Milestones / Timeline

- 1989: Founded as a spin-off from General Instrument’s microelectronics operations

- 1993: Initial public offering on NASDAQ (Ticker: MCHP)

- 2016: Acquisition of Atmel Corporation, strengthening microcontroller and analog offerings

- 2018: Acquisition of Microsemi Corporation, expanding timing, power, and communications portfolios

- 2023: Introduction of next-generation MEMS and atomic clock timing products

- 2025: Expansion of global semiconductor manufacturing and design centers for advanced timing and embedded systems

Business Overview

Microchip Technology is a global semiconductor company specializing in embedded control solutions, serving industrial, automotive, aerospace, communications, and consumer markets. The company’s products support critical infrastructure and advanced electronic systems worldwide.

Its Timing and Synchronization division offers a broad range of frequency control products, including quartz and MEMS oscillators, clock ICs, and synchronization systems, many of which trace their heritage to Microsemi and Vectron International.

Business Segments / Divisions

- Microcontrollers and Embedded Solutions

- Analog and Mixed-Signal Products

- Timing and Synchronization Systems

- Power and Connectivity Solutions

Geographic Presence

Operations in more than 100 countries with major design, R&D, and manufacturing facilities in the United States, Europe, and Asia (including Thailand, the Philippines, and India).

Key Offerings

- Microcontrollers (8-bit, 16-bit, 32-bit)

- Analog and power management ICs

- MEMS and quartz oscillators, OCXOs, and atomic clocks

- Clock generation and distribution ICs

- Security, connectivity, and embedded software tools

Financial Overview

Microchip Technology reports annual revenues of approximately $8–9 million USD. The company has maintained strong profitability through diversified end markets, a fab-light manufacturing model, and consistent operating margins. Growth in timing, power, and embedded AI applications continues to support long-term performance.

Key Developments and Strategic Initiatives

- April 2023: Expanded AI-driven timing solutions integrating precision clocks with edge microcontrollers

- September 2023: Partnership with GlobalFoundries to enhance semiconductor supply chain resilience

- January 2024: Introduction of next-generation MEMS oscillator platforms for automotive and data center use

- June 2025: Announcement of hybrid atomic clock systems for advanced timing and synchronization in communications infrastructure.

Partnerships & Collaborations

- Collaborations with aerospace and defense contractors for mission-critical timing systems

- Partnerships with foundry and semiconductor manufacturing partners for production scalability

- Industry collaborations with standards organizations for timing and synchronization protocols

Product Launches / Innovations

- MEMS-based precision timing devices with enhanced shock and vibration resistance (2024)

- Ultra-low-power oscillators for IoT and wearables (2023)

- Next-generation atomic clock modules for telecom and satellite systems (2025)

Technological Capabilities / R&D Focus

- Core technologies: Microcontrollers, mixed-signal ICs, MEMS timing, precision oscillators, secure connectivity

- Research Infrastructure: Global R&D network across the United States, Europe, India, and the Philippines

- Innovation focus: Precision timing, embedded AI, energy-efficient semiconductors, and secure IoT connectivity

Competitive Positioning

- Strengths: Diversified product portfolio, strong timing and microcontroller expertise, global scale

- Differentiators: Integration of embedded control, timing, and power management in a single ecosystem

SWOT Analysis

- Strengths: Broad product range, acquisition-driven growth, high reliability in mission-critical markets

- Weaknesses: Exposure to cyclical semiconductor demand

- Opportunities: Expansion of MEMS and atomic timing technologies, automotive and IoT growth

- Threats: Intense competition from major semiconductor manufacturers and pricing pressures

Recent News and Updates

- May 2024: Announced new high-stability MEMS oscillator line for industrial automation

- December 2024: Opened new R&D facility in Chandler focused on precision timing and embedded AI

- August 2025: Introduced hybrid atomic oscillator platform targeting telecom synchronization markets

Other Companies in the Market

- Seiko Epson: Seiko Epson is a global leader in crystal devices, offering quartz crystals, oscillators, and real-time clock (RTC) modules with exceptional precision and reliability. The company's frequency control products serve diverse industries including telecommunications, automotive, and consumer electronics. Epson's innovation in MEMS timing solutions and miniaturized oscillators supports next-generation IoT and 5G applications.

- Vectron International: Vectron International designs and manufactures precision frequency control, sensor, and hybrid timing solutions. Its portfolio includes crystal oscillators, TCXOs, VCXOs, and OCXOs used in aerospace, defense, and industrial systems. Known for high stability and rugged performance, Vectron's advanced frequency management technologies ensure reliable operation in critical environments.

- Rakon Limited: Rakon is a major supplier of high-performance frequency control products, including quartz crystals, oscillators, and resonators. The company's expertise in ultra-stable frequency generation supports satellite navigation, telecommunications, and aerospace applications. Rakon's precision-engineered components are key enablers in high-frequency 5G networks and GPS systems.

- SiTime Corporation: SiTime is a pioneer in MEMS-based timing solutions, offering high-performance oscillators and resonators that outperform traditional quartz devices. Its MEMS technology provides superior shock resistance, miniaturization, and programmability, making it ideal for automotive, networking, and IoT applications. SiTime's configurable timing solutions are transforming the global frequency control market.

- TXC Corporation: TXC Corporation manufactures a wide range of quartz frequency control products including crystals, oscillators, and resonators. Its products are used in telecommunications, consumer electronics, and computing applications. TXC's focus on reliability and miniaturization ensures precise synchronization for advanced communication systems.

- IQD Frequency Products: IQD Frequency Products offers crystals, oscillators, and timing modules serving communications, medical, and industrial markets. The company is recognized for its customized and high-reliability timing solutions across global OEM networks.

- Bliley Technologies: Bliley Technologies specializes in ultra-low phase noise oscillators and high-stability frequency control products. Its precision solutions are widely used in radar, satellite, and defense systems.

- MTI-Milliren Technologies: MTI-Milliren Technologies designs high-performance oscillators and frequency synthesizers. Its ruggedized products are tailored for aerospace, defense, and timing-critical applications.

- Connor-Winfield: Connor-Winfield manufactures crystal oscillators and timing modules for communications and industrial automation. The company's products are known for long-term stability and design flexibility.

- Raltron Electronics: Raltron Electronics produces a comprehensive range of frequency control components, including crystals, filters, and oscillators. Its solutions serve telecommunications, IoT, and consumer electronics applications.

- Taitien: Taitien develops advanced frequency control components such as quartz oscillators, MEMS oscillators, and frequency synthesizers. Its products deliver high accuracy and performance in automotive, industrial, and networking systems.

Recent Developments

- In October 2024, Seiko Epson Corporation developed a new oven-controlled crystal oscillator (OCXO) model, OG7050CAN, that consumes 56% less power and is 85% smaller than its predecessor, tailored for next-gen communications infrastructure. (Source: https://corporate.epson)

- In January 2024, SiTime Corporation introduced its Endura Epoch PNT platform, featuring rugged MEMS OCXOs designed for deployment in defense systems to improve resilience of positioning, navigation, and timing against jamming and spoofing. )Source: https://www.gpsworld.com)

- In August 2025, Microchip Technology Inc. introduced a range of GNSS-disciplined oscillator (GNSSDO) modules for aerospace and defense applications, incorporating atomic clocks and oscillators to provide accurate timing and hold-over performance in GNSS-denied environments. (Source: https://www.quiverquant.com)

Exclusive Analysis

The global oven-controlled crystal oscillator (OCXO) market is witnessing accelerated adoption, driven by the convergence of hyperscale data center expansion, 5G/5G-Advanced telecom deployments, and AI-enabled cloud infrastructures that demand ultra-stable frequency references. High-precision oscillators are increasingly critical in mitigating GNSS outages, ensuring synchronized communication networks, and supporting edge and core network resiliency. Consequently, there is a pronounced shift toward low-noise, high-stability OCXO solutions with compact footprints, offering manufacturers a compelling avenue for product differentiation and revenue expansion.

Technological innovation is further enhancing market potential, with advancements in miniaturization, low-power consumption, and enhanced thermal stability enabling OCXOs to penetrate emerging applications such as industrial automation, IoT, and satellite communication. The Asia-Pacific region, led by China, Taiwan, and South Korea, is emerging as a strategic growth hub due to aggressive telecom infrastructure rollouts, local electronics manufacturing scale-up, and favorable government initiatives incentivizing precision timing solutions. This provides a dual growth lever for OCXO providers: high-volume deployment opportunities alongside incremental value from premium, high-performance products.

From a strategic investment perspective, market dynamics are increasingly favoring vertically integrated and technologically advanced players capable of delivering bespoke solutions for aerospace, defense, and industrial sectors. Strong demand for high-reliability, long-lifecycle OCXOs positions the market for elevated margins, while regulatory compliance, precision manufacturing, and strategic alliances with telecom and defense OEMs offer barriers to entry that consolidate market potential among a select cohort of capable suppliers.

Oven-Controlled Crystal Oscillator (OCXO) MarketSegments Covered in the Report

By Frequency Range

- ≤100 MHz

- 101–500 MHz

- 501 MHz–1 GHz

- 1–5 GHz: 25%

- >5 GHz: 15%

By Output Type

- Sine Wave

- Square Wave

- Clipped Sine Wave / CMOS

By Stability

- ±0.05 ppm

- ±0.1 ppm

- ±0.25 ppm

- ±0.5 ppm

- ±1 ppm or higher

By Application

- Telecommunications

- Base stations & repeaters

- Satellite communications

- Defense & Aerospace

- Military radars & communication systems

- Avionics & navigation systems

- Instrumentation & Test Equipment

- Lab & measurement instruments

- Oscilloscopes / signal generators

- Industrial & Automation

- Robotics & automation control

- Industrial monitoring systems

- Broadcasting & Media

- TV & radio transmission systems

- Other Applications

- Medical devices

- Semiconductor equipment

By End-User / Customer Segment

- Telecom & Network Operators

- Defense & Aerospace Organizations

- Industrial Automation & Manufacturing

- Test & Measurement Equipment Manufacturers

- Broadcasting Companies

- Other End Users

By Form Factor / Packaging

- Metal Can

- Ceramic Package

- Surface Mount / SMT Package

- Custom / Specialty Packages

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting